What injury is considered work-related?

According to existing labor legislation, an industrial injury is any event that causes harm to an employee’s health, occurring during the performance of work duties, while performing any actions performed for the benefit of the employer. In particular, these include injuries received independently and inflicted by another person, animal bites, lightning strikes and other events associated with industrial and natural factors. Such injuries will be considered industrial if:

- the employee was at the workplace specified in the employment contract or on a break;

- a company vehicle was used;

- the employee was on a business trip or en route to its destination.

The question of whether a work-related injury occurs when an injury occurs as a result of an accident on personal or public transport is decided depending on the purpose for which the transport was used. An injury is recognized as a work-related injury if the employee was using such transport to carry out instructions from the manager. It is worth remembering that one of the main criteria for qualifying injuries as work-related is the presence of an order from the manager, his financial interest in the employee performing certain actions.

What accidents are considered non-work related?

Accidents involving workers come in different forms. But not every one of them can be associated with production: be it a minor injury or a serious injury. How to avoid making a mistake in classifying an accident and filing it correctly? Let's figure it out.

The employer must investigate and account for accidents

, if they:

- happened to employees during the performance of work duties or other instructions of the employer (part one of Article 227 of the Labor Code of the Russian Federation);

- led to the need to transfer the employee to another job, to the employee’s loss of ability to work or to his death (part three of Article 227 of the Labor Code of the Russian Federation).

Not related to production

The following accidents are considered to be:

- death of an employee due to a general illness or as a result of suicide confirmed by a medical institution and investigative authorities;

- death or health damage that an employee received while under the influence of alcohol, drugs or other toxic substances (unless this is associated with a violation of the technological process in which industrial alcohols, aromatic, narcotic or toxic substances are used);

- incidents that occurred with the employee during his illegal actions (for example, the employee was injured when, on the instructions of the employer, he was digging up a copper electrical cable on the territory of someone else’s organization).

Work injury: payments and compensation 2021

In Art. 184 of the Labor Code of the Russian Federation states what an employee has the right to claim in the event of an injury at work:

- to receive earnings that were lost due to injury (100% temporary disability benefit);

- for reimbursement of expenses incurred for the purpose of professional, social or medical rehabilitation.

In addition, a citizen receives insurance transfers in accordance with the accident insurance law FZ-125 of July 24, 1998, and has the right to count on compensation for moral damage caused by the employer.

In addition to the accident report, the basis for receiving funds is sick leave. In the column “Cause of disability” the code “04” is indicated. It stands for industrial accident or its consequences.

The amount and procedure for paying benefits and compensation for injuries is regulated by Article 184 of the Labor Code of the Russian Federation. The benefit is calculated on the basis of all payments received by the employee during the pay period, from which the injury contribution has been paid. The answer to the question: how much temporary disability benefits are paid in case of accidents at work is contained in Art. 9 FZ-125 - a citizen receives benefits in the amount of 100% of his average earnings. The benefit does not depend on the employee’s length of service, so it is calculated based on the average monthly daily wage.

Federal Law No. 125 dated July 24, 1998 indicates what payments are due for an industrial injury, except for sick leave, under social insurance:

- one-time insurance payment;

- monthly insurance payment in case of loss of professional ability to work.

According to current legislation, the victim is entitled to a one-time insurance payment. The procedure for its payment (including calculation principles and amounts) is in 125-FZ. It is paid once - upon receipt of injury. In 2021 (from February 1), its size is 108,600.52 rubles. Its size is established in Art. 11 125-ФЗ and is indexed annually (in 2021 indexed on the basis of Decree of the Government of the Russian Federation No. 73 of January 28, 2021).

The law provides for a monthly insurance payment. Its size depends on the degree of disability, if any, as determined by the results of the incident. This year, the maximum amount is 83,502.89 rubles, in accordance with the Federal Law on the FSS Budget FZ-384 dated 12/02/2019 and Art. 12 125-FZ. The indexation coefficient in 2021 is established by Decree of the Government of the Russian Federation No. 73 dated January 28, 2021.

In addition, the employer has the right, at his own expense, to pay the injured employee additional funds allocated for treatment and rehabilitation, if they are specified in the collective agreement or employment agreement.

ConsultantPlus experts looked at how an employee can receive benefits in the event of an accident at work. Use these instructions for free.

The most necessary regulations

| Document | Will help you |

| Article 227 of the Labor Code of the Russian Federation | Clarify which accidents can be classified as industrial |

| Article 108 of the Labor Code of the Russian Federation | Study how the time and duration of work breaks are set |

| Article 229.2 of the Labor Code of the Russian Federation | Understand which accidents may be classified as non-work related |

| Article 230.1 of the Labor Code of the Russian Federation | Understand the procedure for registering accidents |

| Article 5.27 of the Code of Administrative Offenses of the Russian Federation | Clarify the extent of liability for an accident at work |

| Article 15.34 of the Code of Administrative Offenses of the Russian Federation | Understand what punishment will follow for concealing an accident |

| Article 14 of the Federal Law of July 24, 1998 No. 125-FZ | Understand how the degree of employee guilt affects the amount of insurance payments for an accident |

| Resolution of the Ministry of Labor of Russia of October 24, 2002 No. 73 | Familiarize yourself with the documents needed to investigate and record industrial accidents |

| Order of the Ministry of Health and Social Development of Russia dated April 15, 2005 No. 275 | Clarify what documents are needed to investigate an industrial accident |

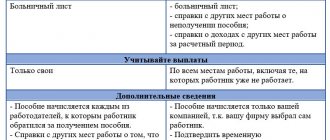

Types of payments

An employee has the right to claim the following payments and compensation in case of an industrial injury:

- benefit due to temporary disability: it is paid in the amount of 100% of average earnings, length of service is not taken into account;

- insurance payment made at a time;

- monthly insurance payments;

- compensation for moral damage caused. Carried out by the employer on a voluntary basis, the employee has the right to seek protection of his rights to receive it in court;

- material assistance if such a clause is contained in a collective agreement or other local regulatory act, and in the amounts established by this document;

- payment for further restoration of health after leaving the hospital, if it is not covered by compulsory medical insurance or other benefits (Article 8 125-FZ).

If an employee dies as a result of an accident, payments are made to his relatives.

Injury on the way to or from work

If an accident occurred when an employee was going to work or home on corporate transport, then it is recognized as related to production (Article 227 of the Labor Code of the Russian Federation). The situation becomes more complicated when an employee, for example, is injured in an accident on the way to work in a personal vehicle. The injury will be considered not work-related if it is impossible to confirm the fact that the car was used for business purposes. The following documents will be required for confirmation:

- an employment contract that stipulates the condition for using a personal car for business purposes;

- relevant order of the head or local regulatory act;

- waybills or other documents accounting for the employee’s business trips.

If the employee traveled to his place of work by public transport or walked, then the accident with him will also be considered non-productive.

Example No. 1

At the end of the working day, the accountant went to submit reports on behalf of the employer. After that, he immediately went home without stopping at the office. The bus in which the accountant was traveling was involved in an accident, and the employee suffered a concussion. The injury will not be considered work-related because the incident occurred after the accountant was performing his work duties.

Example No. 2

The head of the HR department walked to work. Upon entering the enterprise territory through the gate, the employee slipped on the ice and broke her arm. The injury was recognized as work-related, since it was received within the organization, and the employer did not properly care for the territory belonging to him.

Example No. 3

The head of a department in a company specializing in the sale of elite alcohol was at a wine presentation during working hours, where he participated in the tasting of a new product. After the event, the man went to the office by taxi and got into an accident, as a result of which he received a serious leg injury. Despite the fact that the employee was intoxicated, the accident was recognized as work-related: the head of the department participated in a presentation on the instructions of the director, and the commission did not find a cause-and-effect relationship between the injury and the employee’s intoxication.

Separately, it is worth mentioning accidents with employees on the way to a business trip

. A business trip begins from the moment an employee departs, for example, to the airport or train. If an accident occurs during this time, it can be classified as industrial, taking into account all the circumstances.

Procedure for assigning payments

They are designed to compensate an injured worker for lost earnings because he is unable to work (or work at full capacity) for a certain period of time. If a person dies, financial assistance is provided to his relatives, who have the right to receive it in accordance with the law.

A one-time payment is made no later than a month from the date of its appointment, and to the relatives of the deceased - no later than two weeks from the moment the entire set of documents is provided. The injured specialist will need to provide the Social Insurance Fund with a medical and social examination report, and the relatives of the deceased will need to provide documentary evidence of the occurrence of death and the acquisition of the right to financial assistance.

In accordance with Art. 7 125-FZ, the following relatives of the deceased acquire the right to receive funds:

- recognized as dependents entitled to receive maintenance from the deceased on the day of his death;

- children of the deceased employee born after his death;

- dependents of an employee who have lost the ability to work within five years from the date of death of this citizen;

- non-working family members caring for young or disabled children of the deceased.

Transfers are made according to the general principle until the moment of restoration or acquisition of working capacity, if this is not possible - for life.

Who pays

The legislation establishes who and how much must pay for an industrial injury: the Social Insurance Fund and the employer in the amount established by law, taking into account regional coefficients, but not more than legal limits. Sick leave is paid 100%.

Payments are made by both the employer and the Social Insurance Fund. For example, compensation for moral damage caused, quite logically, is paid by the administration of the enterprise, and insurance payments, both monthly and one-time, are made by the Social Insurance Fund. In addition, sick leave is paid at the expense of the Fund, and the employer makes payments stipulated by the labor or collective agreement (material assistance, for example).

The Social Insurance Fund is obliged to bear the financial costs of the citizen for further rehabilitation (in the case of undergoing treatment and restoring health in sanatoriums, purchasing medicines). Such expenses will be reimbursed only after the provision of payment documents confirming the costs incurred.

Injury during non-working hours

It would seem clear: injuries received during non-working hours are not related to production. But not everything is so simple, because an employee can act in the interests of the employer at any time.

Example No. 1

At the end of the working day, the employee went to dinner with business partners, where he planned to discuss the upcoming deal. The employer provided money for the meeting. During dinner, a fire started in the restaurant. The worker suffered carbon monoxide poisoning and was taken to the hospital. The incident was ruled an industrial accident because the employee was in the restaurant on behalf of the employer.

Regarding accidents during corporate events

, then they cannot be classified as production.

Example No. 2

During a corporate New Year's celebration, employees decided to set off fireworks. The fireworks were not secured securely, and one of the volleys hit the crowd. Several workers suffered burns. The accident was not related to production, because it did not occur during working hours and not while the employees were performing their job duties.

Principles of calculation

The amounts of compensation for industrial injuries are established in 125-FZ, but are revised annually. In Art. 11 of the law indicates the maximum amount of 94,018 rubles, but it is subject to indexation annually in accordance with Part 1.1 of the same article. In 2021, the indexation coefficient is established by Decree of the Government of the Russian Federation No. 73 dated January 28, 2021. The amount of compensation depends on the degree of loss of professional ability after injury. In the event of the death of a citizen, it is one million rubles. Regional coefficients are also taken into account when calculating.

Compensation for moral damage

The amount of compensation is determined by the court. You can file a claim in court at any time after registration of the N-1 act. If the court decides the case in favor of the victim, the person responsible for the accident will pay compensation.

I filed a claim against the driver who caused the accident for compensation for moral damage as part of a criminal case. Since my health was seriously harmed, the court by default considers that I also suffered moral harm.

If the medical examiner determines moderate or minor injury, the court may require evidence of emotional distress, such as receipts for post-injury visits to a psychologist.

Payment calculation

When paying for sick leave, the calculation procedure includes the following steps:

- determination of average earnings, income for two years before going on sick leave is divided by 730 (the number of days of the specified period);

- the employee’s income is included in the calculation in full, without observing the maximum amount of earnings;

- the resulting value is multiplied by the number of days of sick leave;

- if the average earnings are below the minimum wage, the minimum wage is used in the calculations;

- Personal income tax is withheld from the benefit, this follows from Art. 217 of the Tax Code of the Russian Federation (about this in the Letter of the Ministry of Finance of Russia No. 03-04-05-01/42 dated 02.22.2008).

In 2021, there are changes to the payment procedure. Now the answer to the question: how is sick leave paid for a work-related injury in 2021? The calculation and payment are handled directly by the Social Insurance Fund; the employer’s responsibility is to obtain documents from the employee and transfer them to the Fund. Personal income tax is retained by the Social Insurance Fund.

Mandatory actions of the employer

The employer's responsibilities in the event of an accident are stipulated in Article 228 of the Labor Code of the Russian Federation. Taking into account this standard, step-by-step instructions for work-related injuries are determined:

- Take measures to organize first aid to the victim.

- Prevent further development of the emergency situation.

- If possible, keep the scene of the incident intact.

- Interview witnesses.

- Conduct an investigation into the circumstances of the incident, for which purpose form a commission, and based on the results of the investigation, draw up a report on the industrial accident (the report is drawn up according to the number of victims).

- If the accident was a group accident (two or more people were injured) or serious (resulting in the death of a person), the employer is obliged to report it within 24 hours to the prosecutor's office, the labor inspectorate, and the regional government by sending a notice. It is imperative to report any accident to the Social Insurance Fund, since the Social Insurance Fund makes payments to the injured citizen.

- Fulfill your legal obligations to compensate the victim.

This is exactly the sequence of actions of the employer in the event of an accident at work in 2021: first prevent the accident from developing, provide assistance on the spot, and then conduct an investigation and pay compensation.

Controversial issues

Concealing the fact of a work injury

The employer is required to report any injury. The Code of Administrative Offenses provides for the employer's liability for concealing the fact of an industrial injury at the enterprise.

Article 15.34 defines the following responsibilities:

- Fine for citizens - 300-500 rubles;

- Fine for an official - 500-1000 rubles;

- The fine for organizing is 5-10 thousand rubles.

Also, at the same time, penalties may be imposed for non-compliance with labor law requirements.

Article 5.27 defines the following penalties:

- For an official 1-5 thousand rubles;

- For an entrepreneur 1-5 thousand rubles or suspension of activities for 90 days;

- 30-50 thousand rubles per company or suspension of activities for 90 days.

Important! In cases where the injury received was considered severe or resulted in the death of the employee, this action may be considered under Art. 143 of the Criminal Code of the Russian Federation, which may result in a maximum sentence of up to 4 years in prison with deprivation of the right to occupy leadership positions.

The employer forces the injury to be registered as non-work-related

The organization may ask you to register the injury as a domestic injury. This step will save him from the close attention of regulatory authorities, who will have to investigate the causes of this incident.

In this case, the employee also receives sick leave, but payments are made on other terms - payment is made based on length of service, and not 100%; in addition, the right to various additional payments is excluded, including compensation for money spent on medicines and treatment .

Thus, the fact that the injury is reclassified as a domestic injury is not beneficial for the employee. However, if you plan to work in this place for a long time and do not want to quarrel with the employer, you can negotiate.

Attention! For example, agree that the company administration will still pay all the necessary injuries in case of injury, but not officially. If, by reclassifying the injury, the employer wants to benefit only for himself, it is better not to agree to the request.

What should an employee do if injured at work?

When injured at work, an employee must take care not only to restore his health, but also to ensure that during treatment and rehabilitation he receives compensation, that is, compensation for lost wages. In accordance with Article 184 of the Labor Code of the Russian Federation, the employer is obliged to compensate for the earnings that the employee did not receive during treatment. Law No. 125-FZ of July 24, 1998 speaks about this. Such compensation is recognized as temporary disability benefits.

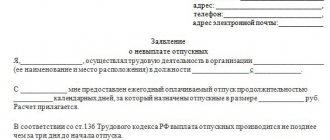

An employee who has been injured at work should remember: in order to receive all the benefits due, you must provide:

- sick leave;

- documents confirming expenses for treatment and rehabilitation;

- an application requesting reimbursement of the amounts specified in the documents provided (application for a one-time or monthly payment for a work-related injury).

Injury during a scheduled break

The time of breaks and their duration are established by internal labor regulations or by agreement between the employee and the employer (part two of Article 108 of the Labor Code of the Russian Federation). Accident during a scheduled break

may be recognized as production under certain circumstances.

Example No. 1

At the appointed time, the employee went for lunch to a nearby cafe. When entering the establishment, part of the roof fell on him, and the employee suffered a fractured forearm. Despite the fact that the accident occurred outside the organization's territory, it was recognized as production-related. The employee’s employment contract stipulated the conditions for his meals, which the employer undertook to organize in the ill-fated cafe.

With unspecified breaks

the situation is different. An accident that occurs during this time is unlikely to be associated with production.

Example No. 2

During working hours, the secretary went out to smoke in the park next to the office. There she was attacked by an unknown person and took away her mobile phone. The employee suffered a dislocated wrist joint. The accident was not classified as an industrial accident, since the company’s corporate policy prohibits smoking, and internal regulations do not provide for time for smoking breaks.

Who makes the payments

Part of the payments for a work injury is made at the expense of the Social Insurance Fund:

- disability benefits;

- monthly allowance;

- compensation for expenses incurred by the employee during rehabilitation in sanatoriums and the purchase of medicines.

As for payments made by the employer upon the occurrence of a work-related injury, some managers try to evade this obligation. In this case, it is necessary to file a complaint with the labor inspectorate and then with the court.

ConsultantPlus experts examined whether payment of additional leave to an employee during the period of treatment due to an injury at work is subject to personal income tax and insurance contributions. Use these instructions for free.