A series of articles about inheritance, debts and bankruptcy

In this article we will tell you how a creditor can collect a debt if the debtor has died.

From it you will learn how to collect debt:

1) through transfer of debt to the heir

or

2) bankruptcy of the deceased.

As a result, you will decide which method is right for you, taking into account potential costs and pitfalls.

But we'll start with a little tediousness.

How to find out that a debtor has died

So, we have dear Vasya, and his “Creditor”. And if Vasya is not a wife, relative or best friend, then the Creditor may not find out about the death of his debtor very soon. Moreover, the state does not make this task any easier.

The fact is that in the event of death, state registration of this fact must occur through the registry office. This happens on the basis of a medical certificate. institutions or by court decision if a person is declared dead.

But here’s the problem: information about a person’s death is classified as personal data. This means that you can just go to the registry office and ask, “Is my Vasily alive there?” will not work.

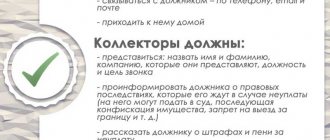

As a result, the creditor can find out about the death of the debtor from:

- bailiff during enforcement proceedings;

- arbitration manager during the bankruptcy procedure of a deceased citizen;

- relatives, colleagues, friends - in general, from the debtor’s circle;

- during debt collection proceedings. For example, in connection with a court request to the Federal Migration Service or from an official of the Ministry of Internal Affairs. But these are special cases.

Now let’s skip the chamomile fortune-telling with “dead or not dead,” and move on to the moment when the creditor knows for sure that Vasya is no longer there.

At the time of writing this article, a creditor has only 2 tools for collecting debt from a deceased person:

- Transfer the debt to his heirs by court decision or

- Bankrupt the deceased and pay off your debt from his personal property.

Let's start with the first method - transferring the debt to the heirs. To implement it, let's first understand how inheritance works.

Order of succession

The deceased distributes his property according to a will, testamentary disposition, inheritance agreement - in general, according to documents. If there are no documents, inheritance occurs according to the law according to the established order.

To accept an inheritance, you need to either contact a notary to open an inheritance case, or start actually using the property.

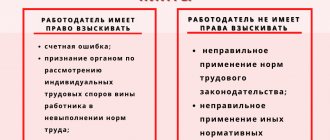

As for creditors, fortunately for them, the heirs are obliged to pay the debt of the deceased. But with a caveat: debts are transferred to them in proportion to the inherited share. This means that if your daughter inherited 1 million from Vasya, and he had 20 more debts than 1 million, it will not be possible to take it from your daughter. Even if she is a rich woman and could easily pay off the debt in full, she will only return a million.

There are 2 problems left to solve:

- Identify the circle of these same heirs. At the same time, you need to understand that the heirs can simply continue to use the property of their deceased relative without advertising it anywhere - this is called actual acceptance of the inheritance.

- Transfer the debt to them officially. By official procedure I mean a judicial process followed by the issuance of a judicial act to collect the exact amount of debt from each of the heirs who participated in dividing the pie, and with the issuance of the corresponding writ of execution.

What happens to the mortgaged property after the death of the borrower?

Article 1175 of the Civil Code of the Russian Federation determines that the debt on a mortgage loan is subject to mandatory payment to the lender. After the death of the debtor, all his debts are transferred to his heirs. However, a mortgage has a number of features.

The fate of the mortgage and the collateral will depend on the following factors:

- whether there are guarantors or co-borrowers on the mortgage;

- whether the client’s life and health insurance agreement was concluded;

- are there any heirs?

If the deceased mortgage borrower's inheritance was successfully distributed among the heirs, then the debt must be repaid by them. Here the bank may request urgent closure of the loan agreement or meet halfway and restructure the mortgage. In this case, the heirs have the right to refuse the inheritance by drawing up an official document. The apartment will then be sold at auction, and the proceeds will be used to pay off the debt.

Co-borrowers and guarantors who signed the agreement bear joint and several liability with the borrower for the executed obligations. This means that after the death of the borrower, servicing of the loan passes to them. If it is impossible to pay the mortgage, the co-borrower or guarantor will be liable in accordance with current legislation and the terms of the loan agreement.

In a situation where the mortgage borrower has insured himself against potential death and loss of health, the bank will receive an insured amount for the occurrence of an insured event, with which it will pay off the debt. The property itself will become the property of the immediate family.

Identification of heirs transfer of debt

In general, both of these issues are resolved using the following algorithm:

Step 1. The creditor files a claim against the estate of the deceased debtor in a court of general jurisdiction.

Step 2. The court is convinced that the debtor has died by obtaining the relevant information from the registry office and requests information from the notary chamber about the inheritance case. If this is discovered, the trial is suspended until the deadline for identifying all heirs has expired.

After this, the court resumes the proceedings and determines the amount of debt to be recovered from each of their heirs in proportion to the amount of property received by them. At the same time, the heir will repay the debt in all possible ways (with his property, from his salary, etc.), and not just with what he inherited. The court case ends with the issuance of a writ of execution.

Step 3. If the inheritance case has not been opened or the heirs have not expressed a desire to participate in it, then, at the request of the Creditor, the court will request information from government agencies about the availability of movable and immovable property of the debtor, which can be used to repay the debt.

In general, information is requested from Rosreestr and the State Traffic Safety Inspectorate, but you can search for yachts in the Inspectorate for Small Boats, bank accounts and shares in businesses in the Federal Tax Service, shares in depositories, intellectual property in Rospatent, etc. Everything that the debtor left in Russia can be found more or less easily, but there will be problems with undeclared foreign assets.

Step 4. If at least some property is found, the court considers the issue of satisfying the creditor’s claims at its expense. As a result, a writ of execution is issued, with which the Creditor applies to the FSSP for subsequent collection.

Step 5. If the debtor has neither one nor the other: no heirs, no property - he is naked as a falcon - then a very interesting and very piquant moment arises: the proceedings in the court case must be terminated, because the debtor himself cannot be responsible for his obligations in connection with death, and there is no one to accept his debts.

At the last step, it becomes especially bitter for those creditors who know 100% that “4 days before the terrible accident that took the life of Vasily, he gave his daughter an apartment in the center of Moscow worth 120 million, through which all debts could now be repaid " They could... But in fact, Vasily now has neither heirs nor property, which means the case must be terminated.

Thank you everyone, everyone is free, let's get out of the courtroom!

The described problem is not the only pitfall in the scheme of transferring debt to heirs, but now we have consciously avoided diving into small details - we will return to them a little later.

Collection of debts of the testator from the heir

Which of the heirs will repay the debt that the citizen incurred at the time of his death, in what amount, whether the creditor’s claims are legal, whether there are grounds for not paying - only a competent lawyer can understand all the nuances. Do not delay seeking legal assistance, consult with a lawyer before accepting the inheritance! Contact us for a consultation - (831) 410-22-66 |

| Lawyer stories |

| The plaintiff (creditor) filed a lawsuit against the heirs - minor children, indicating that the deceased grandmother of the children had a debt to the plaintiff, which could not be collected due to her death. The fact that the legal representative of the minors approached the notary with an application to accept the inheritance was confirmed by the case materials. The court sided with the plaintiff, collecting the debt from the minor children. The appeal ruling left the first instance decision unchanged. The children's father, as their legal representative, appealed the court decisions to the Supreme Court, where both verdicts were overturned. Having studied the case, the Supreme Court indicated that the courts did not take into account that the notary refused to issue a certificate of inheritance to minors due to the absence of any inherited property. And since there was no property at the expense of which minors could be liable for the debts of the deceased, they are not obliged to answer for the debts of the deceased grandmother. |

Can heirs refuse debts when entering into an inheritance?

During inheritance, the property of the deceased passes to other persons in accordance with the procedure of universal succession. This means that the heirs, having accepted the property of the deceased, cannot refuse his debts. Either the heirs renounce all property, including debts, or they inherit both property and debts.

Which heir is responsible for the debts of the testator?

Responsibility for debts lies with the heirs by law and by will who accepted the inheritance. Heirs who did not accept the inheritance are not liable for the debts of the testator.

It must be remembered that there are two ways to accept an inheritance: by submitting an application to the notary for acceptance of the inheritance, or by taking actions indicating the actual acceptance of the inheritance.

Should heirs be liable for the debts of the deceased with their property if the inheritance is not enough to pay them off?

The heirs who accepted the inheritance are liable for the debts of the deceased to the extent of the value of the inherited property transferred to them. If it is absent or insufficient, the claims of creditors at the expense of the personal property of the heirs are not satisfied.

In practice, frankly illegal actions of credit institutions are common - attempts not only to force them to pay, but also to collect additional fines from relatives who are not obligated to pay off other people’s debts. To find out about your rights, seek qualified legal assistance. Call |

How to determine the value of inherited property?

You can determine it with the help of a professional appraiser. The value of the property transferred to the heirs, the limits of which their liability for the debts of the deceased is limited, is determined by its market value at the time of opening of the inheritance (the day of death of the testator), regardless of its subsequent change.

What if the heir considers the loan agreement to be fake?

In this case, the heir can challenge the deal in court. The statement of claim will need to indicate the grounds for challenging the transaction, as well as what rights and interests of the heirs it affects.

Is the obligation to pay alimony inherited?

The obligation to pay alimony is not inherited, because It is considered that this obligation is inextricably linked with the personality of the testator.

At the same time, the alimony debt existing at the time of the testator’s death is a debt not related to the person, and therefore the obligation to pay it passes to the heir of the debtor.

What if the debt is already outstanding?

If the debt is settled and Vasily died when, for example, enforcement proceedings were already underway against him, then in principle nothing changes - it’s just that all the same actions from the above algorithm are performed by the bailiff, and not by our creditor. And there will be some minor amendments:

- The bailiff must himself determine the circle of heirs and the value of the inherited property. To do this, he requests information from the notary in charge of the inheritance case and evaluates the assets,

- then the bailiff goes to court with a demand to change the defendant: from the deceased to the heirs,

- after replacing the sides in use. production, the bailiff collects the debt in proportion to the inherited share. If there are more assets than debts, the creditor is lucky, there is a high probability of receiving the entire amount of the debt. If it’s less, you’ll have to be content with what you have.

In what situations will the insurance company be obliged to close the mortgage, and in what situations will it refuse?

Interaction with an insurance company is often accompanied by difficulties when an insured event occurs. The contract specifies cases that under no circumstances will be considered insurable. In particular, if a person had chronic diseases, was involved in extreme sports, consumed alcohol or drugs, and the death of the borrower occurred for such reasons, then there is a very high probability that the event will be considered non-insurable.

An example is the situation of a borrower dying from a heart attack while playing sports. If in court the insurance company proves the extreme nature of such an activity (especially for a person of advanced age), which implies a real danger to life, then no payments on the loan will follow.

Each insurer has its own list of insured events. In a generalized form, death is not included in it:

- from STDs;

- from drinking alcohol or drugs;

- from chronic diseases;

- from an accident while doing extreme sports.

If the medical report indicates an unknown cause of death, then the insurance company will have many options to prove the fact that the event was not insured.

IMPORTANT! If the borrower's death was caused by alcohol use, then in most cases there will be a refusal to repay the mortgage. It is also worth noting that if at the time of concluding the contract a person could not be insured (chronic illnesses, disability, etc.), then the contract will be declared invalid and payment will be refused.

Transfer of debt to heirs

So, we are done with method 1 - transferring the debt to the heirs. Let's summarize briefly:

pros

- Cheap. You will only need to pay court costs and government fees. duty. Well, hire a lawyer who will go to court for you in the next year or two. An alternative option: if the debt has already been settled, the lawyer will kick the bailiff so that he at least somehow moves.

Minuses

- Energy-intensive. With all due respect to the servants of the law, in order for the bailiff to do something, he needs to be reminded of it. Better yet, pester him specifically. At least if you want to return the money.

- Low efficiency. The powers of the bailiff are limited. If a couple of days before death the debtor transferred all the property to the spouse, it will be almost impossible for the bailiff to return this property. Such transactions, of course, are contested on general civil grounds, but the practice there is very varied and it is not a fact that you will be lucky.

- A bunch of pitfalls. Starting with how to find the debtor’s property and ending with the fact that heirs can actively resist the loss of received assets - but we’ll talk about this below. Now something else is important: you will have practically no mechanisms for quick and effective counteraction - you will have to defend yourself either through court petitions or by obliging bailiffs, and they are not very eager to take on additional burdens.

- Loss of value. Until the heirs are announced and all the trials are completed, it will take from a year to 3 years. During this time, anything can happen to the debtor's former assets.

Now let's talk about the second way to return debt from a deceased person - through bankruptcy of an individual.

Bankruptcy of a deceased citizen

Considering how many articles we have written about bankruptcy, we can at least conclude that this story is more labor-intensive. And complex. And darling.

But the chances of getting yours are much higher. Precisely due to the ability to challenge transactions, the running of the statute of limitations and, most importantly, the powers of the financial manager.

So, the algorithm for bankruptcy of the deceased is as follows:

Step 1. Argue your claims against the debtor in a court of general jurisdiction. The presence of a court decision that has entered into legal force on the collection of a debt in the amount of more than 500,000 rubles is a mandatory requirement for introducing bankruptcy in relation to an individual. An exception is made only for banks and for alimony - these creditors can do without a common fund.

Step 2. Next, the situation can develop in different ways - depending on how Vasily feels. If the debtor has already left this mortal coil, then we follow algorithm No. 1 (claim against inherited property) with all the ensuing problems. To the point that if Vasily does not have heirs and property, then the case of debt collection will be terminated. In practice, this means that the creditor can forget about both bankruptcy and his money.

If our creditor managed to receive the court decision before Vasily died, then we immediately move on to the next step.

Step 3. After receiving the court decision, we file an application for bankruptcy of an individual to the Arbitration Court. The application must indicate that the debtor has died - this is important. And be sure to nominate a reliable, professional and highly paid financial manager, who will now work instead of you and for your benefit. And of course, for your money.

Step 4. The court introduces bankruptcy proceedings. The financial manager collects information about the debtor’s property, transactions involving the withdrawal of his assets over the past 10 years, and open inheritance cases.

Step 5. If the inheritance case has not yet been closed, then the FU waits for the formation of the final list of heirs. At the same time, transactions “donating apartments worth 120 million to daughters 4 days before death” are being disputed, requests are being sent to depositories and other property of the Debtor is being sought.

Step 6. After all the property is collected in one pile, the heirs are invited to participate in the bankruptcy case as a third party. In practice, this means that they can watch from afar as assets that should belong to them are sold off, and the proceeds from the sale are transferred to the hands of creditors. This is usually a very sad picture.

Step 7. If, at the end of the auction, all creditors’ claims are satisfied, the remaining money will be distributed among the heirs. But we have not yet seen such a miracle.

As you can see, the key point for bankruptcy is the settlement of the creditor’s initial claims against the debtor. If you delay with this matter, there is a high chance of being left in the dark. If it later turns out that the debtor withdrew all assets during his lifetime, then the claim will be dismissed, because no inherited property. And there is no inheritance, which means there is no one to accept the debts.

pros

- Probability of success. Considering that in the event of bankruptcy, all the debtor’s property is included in the bankruptcy estate, the likelihood of satisfying the creditors’ claims is much higher.

- More possibilities. In the bankruptcy procedure, the terms are different, and transactions can be challenged on special (bankruptcy) grounds, and “friendly” creditors can be knocked out of the register.

- Control over the procedure . The entire procedure takes place in one case in the Arbitration Court. This means that instead of running to 10 different courts, you will need to contact one. Another bonus - whoever initiates the bankruptcy procedure will be able to appoint an arbitrator.

Minuses

- Expensive. Payment for the procedure, lawyers who will handle the case. Don’t forget about the financial manager and going to the meetings themselves - in general, this is not the most budget-friendly idea. Considering that on average a similar project takes plus or minus a couple of years, it makes sense to start if the debt starts at least 5 million.

- Ambiguous . The bankruptcy law has a lot of ambiguous points that each party can interpret as they wish. And here bankruptcy legislation intersects with family legislation, which is generally far from ideal. Accordingly, the final result largely depends on the qualifications of the lawyers of the opposing parties and their ability to convey to the court their interpretation of the law.

One example of how we do this is described in the article “Limitation period for subsidiary liability.”

What ambushes?

Above we wrote everything well and smoothly. In fact, there are a lot of problems with collecting debt from a deceased person. Here are the main ones:

The debtor withdrew the property

Vasya knew that he did not have long left and before his death he scattered his property among his family and friends. Here is the topic of our article: “How to easily find the debtor’s property.”

There would be no problems if bankruptcy had already been filed, or the debt had at least been settled. The transactions would be contested and the property would be returned to the bankruptcy estate. But in our situation there is no debtor, there is no property, and therefore there are no heirs - therefore there is no one to transfer the debts to. The debt collection case is terminated.

What to do? In this case, you need to go to a court of general jurisdiction again and, referring to precious Art. 10 and 168 of the Civil Code, try to challenge property disposal transactions: it will take a year or two, it will require a lot of nerves and money for lawyers, and the chances of winning will be around 20-30%.

The second option: come to Igumnov Group and we will close this issue in 6-9 months with a 90% guarantee, provided that no more than six months have passed since the death of the debtor. We know how to solve such problems because we know how to find holes in the law. And they are here. So, for anyone interested in settling the debt of a deceased person who has nothing, contact us here. Our services are not cheap, but when more than one million is at stake, the costs will be worth it.

Heirs

Let's imagine that the creditor received satisfaction of his claims at the expense of the inheritance. And then one day, the heirs of the first stage showed up, who did not know about the death of the testator. Or heirs who have the right to an obligatory share in the inheritance. Or, on the contrary, someone was recognized as “unworthy heirs.” In general, you get the point - the story can drag on forever.

What to do? The solution to the problem is still the bankruptcy of the deceased citizen. Unlike a court of general jurisdiction, in the event of bankruptcy, all cases will be considered within the framework of the bankruptcy case and according to the provisions of the bankruptcy law. And as we wrote above, there are more ways to maneuver. In addition, between you and the heirs there will be a buffer in the form of a financial manager - if anything goes wrong, this will be his area of responsibility.

The only housing

It so happens that the only property left after the debtor is housing. But housing can be a one-room apartment near Murmansk or a mansion in Sochi. In this case, what this housing means to the heir will play an important role. If during the life of the debtor this was not his only home, but for the heir it will become so, it will not be possible to claim it - it is not allowed.

What to do? But it is necessary to require the heirs to pay the debt in cash within the inherited share. If the debt is 50 million, and the housing cost 20, then you can demand to pay 20. Another thing is that the heir is not guaranteed to have that kind of money. But no one is stopping the heir from going bankrupt.

Heir's creditors

So, our Vasya died, but the creditor is calm. Vasya had property, which means he was definitely not in trouble. But here’s the problem - the only heir is himself in bankruptcy and accepts the inheritance. Because he has no other option.

We examined this question in more detail in our monthly column “Answer to a Reader’s Question.”

We have already sent subscribers to our newsletter an analysis on the topic “should a bankrupt person accept an inheritance?” In order not to procrastinate on the topic of the 10th circle, leave your email below and we will duplicate the letter for you:

In short: the refusal of a bankrupt heir to enter into an inheritance will be considered an infringement of the rights of his creditors. As a result, the refusal of the inheritance will be challenged, and the testator’s property will be included in the heir’s bankruptcy estate. Therefore, the bankrupt heir will have to accept the property in any case.

Now the picture from the creditor’s side: let’s imagine that Vasya’s debtor has 5 million worth of debts and 30 million worth of property. The picture is excellent: while the creditor is guaranteed to get what he deserves, and what’s more, it remains for the heir.

But only the sole heir files for personal bankruptcy. And he has debts worth 70 million, and property worth 2. When he accepts the inheritance, the picture will be as follows:

- property: 30 2=32 million

- debts: 5 70=75 million

As a result, Vasya’s creditor with his 5 million debt is included in the register of the heir’s claims and shares his property with all other creditors. It will be lucky if in the end he returns at least 50% of the debt amount.

And if you imagine that the heir’s creditors are also “friendly”. Then, with a greater degree of probability, Vasya’s creditor will be left to suck his paw.

What to do? As we wrote above, the best option for the creditor is to bankrupt the deceased debtor. In this case, the debts of our creditor will be repaid first, and the rest will be thrown to the mercy of the heir and his creditors.

Statute of limitations

Let’s imagine a situation where a creditor delayed filing an application with the court until the last minute. The logic is clear - you don’t remind the debtor about the debt for a couple of years and wait until he has money.

The debtor calms down, thinks that he has been forgotten and lives his prosperous life. And then the execution lands on him. production, seizure of accounts, and all this in the company of a bailiff - in general, drawn-out revenge. By the way, banks like to use this method to address malicious defaulters.

Now let's count.

Our lender also decided to delay. He went to court to collect the debt in court exactly by the end of the 3-year period. And then it turns out that the debtor just recently died.

By delaying filing a claim in court until the final days, you may miss the 3-year statute of limitations. Because the death of the borrower does not suspend or interrupt the course of the term. And if he died before you submitted your application, then by the time you figure out who the heir is and who you need to ask, 3 years will easily pass. That's how we made it through.

What to do? First we run to the common fund, in an attempt to judge the inherited property. If the deadlines fly by, we try to restore them. By the way, our team has a master at juggling the statute of limitations. You to her.

How to collect a debt from an heir

Lawyer Antonov A.P.

Contact possible heirs known to you, in particular the spouse, parents, and children of the debtor. They can voluntarily pay off the debt in order to thus accept the inheritance. If the heirs do not satisfy your demands, you will have to go to court. A claim against the heirs can be filed only after they accept the inheritance. This must be done within the limitation period for your claim against the deceased debtor. If you want to file a claim before accepting the inheritance, then you need to file it not against the heirs, but against the inherited property (clause 3 of Article 1175 of the Civil Code of the Russian Federation). Sometimes, even if the potential heirs are known to you, it is better to file a claim against the inherited property without waiting for them to enter into the inheritance, otherwise the statute of limitations may expire by that time.

1. How to make a claim to the heirs of the debtor If you know the potential heirs of the deceased, you can contact them with a claim for repayment of the debt, including before they accepted the inheritance. Sometimes the heirs pay off the debts of the deceased voluntarily, since such an action indicates the actual acceptance of the inheritance (clause 2 of Article 1153 of the Civil Code of the Russian Federation). In practice, in most cases, the deceased is inherited by first-degree heirs: children, parents and spouse (Clause 1 of Article 1142 of the Civil Code of the Russian Federation). Therefore, we recommend that you contact them first.

1.1. How to file a claim Indicate in the claim: the circumstances of the debt and the conditions under which the debtor undertook to repay it, including the terms of repayment; the required amount. If necessary, explain how you calculated it; ways in which heirs can repay the debt, and the information necessary for this. This could be, for example, your account details for transferring debt by bank transfer, or the address to which you can transfer cash or other things. With reference to Art. Art. 1175 and 1153 of the Civil Code of the Russian Federation, explain that the heirs are responsible for the debts of the testator and can accept the inheritance if they pay off his debts. We recommend formulating the text not as a requirement, but as a proposal. This is due to the fact that before accepting the inheritance, the heirs are not obliged to answer for the debts of the deceased (clause 1 of Article 1175 of the Civil Code of the Russian Federation). Attach copies of documents confirming the debt to the claim: agreement, receipt, etc.

1.2. How to submit a claim Receipt of a claim by heirs who have not accepted the inheritance does not give rise to any rights or obligations for them. In this regard, your claim cannot be considered a legally significant message (clause 1 of Article 165.1 of the Civil Code of the Russian Federation). Therefore, you are not required to comply with the rules set forth for such communications. Since your goal at this stage is to notify the heirs and convince them to pay the debt, we recommend sending messages to the addresses of the heirs known to you, as well as to the address of the debtor’s last place of residence. If the details of the heirs are unknown to you, send a written complaint to the notary who is in charge of the inheritance file of your debtor (Article 63 of the Fundamentals of the Legislation of the Russian Federation on Notaries). You can find out which notary is handling the inheritance case on the website of the Federal Notary Chamber https://notariat.ru/ru-ru/help/probate-cases/. To search, it is enough to know the full name of the testator (deceased debtor).

2. When you need to file a claim against the heirs A claim against the heirs can be filed only after they have accepted the inheritance (clause 3 of Article 1175 of the Civil Code of the Russian Federation). The fact that the heir accepted the inheritance is indicated, in particular, by the fact that he (Article 1153 of the Civil Code of the Russian Federation, paragraph 36 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 N 9): submitted an application for its acceptance to the notary at the place of opening of the inheritance ; incurred expenses for maintaining the inherited property; paid part of the testator’s debts to you or another creditor; moved into the housing that belonged to the testator or lived in it on the day the inheritance was opened (including without registering at the place of residence).

2.1. What is the statute of limitations for the creditor's claims in the event of the debtor's death? You must make a claim to the heirs or inherited property within the same time frame as you would to the debtor himself if he were alive. This is explained by the fact that the opening of an inheritance does not interrupt, stop or suspend the running of the limitation period. Please note that you cannot make a claim for those debts whose repayment period has not yet arrived, since the death of the debtor does not entail early fulfillment of his obligations by the heirs (clause 3 of Article 1175 of the Civil Code of the Russian Federation, clause 59 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29. 2012 N 9). Let's consider the following situation as an example. You entered into a loan agreement, under which the debtor agreed to repay the loan amount in two installments - on February 15 and April 15, 2021. The debtor died on January 8, 2021. The general statute of limitations for your claim is 3 years after the end of the period when the debtor had to fulfill the obligation (clause 1 of article 196, clause 2 of article 200 of the Civil Code of the Russian Federation). Thus, you must submit a demand for repayment of the debt: for the first payment - in the period from February 16, 2021 to February 15, 2024 inclusive; for the second payment - from April 16, 2021 to April 15, 2024 inclusive.

3. How to draw up and submit a claim to the heirs Follow the general rules for drawing up and filing a claim in a court of general jurisdiction. The only specific features for you are the following: 1) in which court to file the claim. Disputes about the debts of the testator are heard by district courts of general jurisdiction. File a claim against a specific heir who accepted the inheritance to the court at his place of residence, and if the heir is an organization, then at its address (Article 28 of the Code of Civil Procedure of the Russian Federation, clauses 2, 3 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 N 9) . If there are several heirs, file a claim at the place of residence (address) of any of them (Part 1, Article 31 of the Code of Civil Procedure of the Russian Federation); 2) who to name as the defendant. You can make a claim both against all heirs who accepted the inheritance, and against any of them. This is due to the fact that those who accepted the inheritance are jointly and severally liable for the debts of the testator (clause 1 of Article 1175, clause 1 of Article 323 of the Civil Code of the Russian Federation). We recommend involving as defendants all heirs known to you who accepted the inheritance - this will increase the chances of collecting the debt; 3) how to calculate the cost of the claim. In general, it is calculated the same as if you were suing the debtor directly. However, interest, which is a measure of liability for the delay of a monetary obligation (for example, interest under Article 395 of the Civil Code of the Russian Federation), cannot be accrued for the period from the date of opening of the inheritance (death of the debtor) until the moment of its acceptance by the heirs (see Position of the Supreme Court of the Russian Federation). At the same time, interest on a loan or credit must be calculated in the usual manner, as if you were suing the debtor himself (Review of judicial practice of the Supreme Court of the Russian Federation No. 2 (2018)). Remember that the heirs are liable to you within the value of the property they inherited; beyond this amount, the court will not satisfy the claim (clause 1 of Article 1175 of the Civil Code of the Russian Federation, clause 60 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of May 29, 2012 N 9). Therefore, we recommend that you find out the amount of the inheritance from the case materials (if the court has not requested this information from the notary, apply for it). If it turns out that the debtor's property is not enough to satisfy your claims, reduce the amount of the claim. This way you will be able to return part of the paid state duty (clause 10, clause 1, article 333.20 of the Tax Code of the Russian Federation).

Sincerely, lawyer Anatoly Antonov, managing partner of the law firm Antonov and Partners.

Still have questions for your lawyer?

Ask them right now here, or call us by phone in Moscow +7 (499) 288-34-32 or in Samara +7 (846) 212-99-71 (24 hours a day), or come to our office for a consultation (by pre-registration)!

Practice analysis

In general, if you have not yet understood why an expensive and managed bankruptcy of a deceased citizen is better than a protracted and almost free transfer of debt to his heirs, then we give a specific example:

Oleg acted as a guarantor for his business loan. The business couldn’t bear the burden and the creditor filed a lawsuit to recover 17 million rubles from Oleg. In general, it is quite possible to fight off a guarantee (see the article “How to avoid paying a loan as a guarantor”), but Oleg did not follow this path.

The writ of execution was sent to the FSSP, but during the execution process it turned out that Oleg had died. And since he died, then the heirs will be responsible for the debts. But let us remind you here that the heirs are liable for the debts of the deceased only in the amount of the inherited property.

As a result, the bailiff suspended the proceedings and went to court to replace the defendant - to name the heirs instead of Oleg. And then it emerged that Oleg had much less property than debts. As a result, instead of 17 million, the court decided to collect the debt from the heirs in the amount of 2.7 million.

The loss, let's say, is tangible. But the creditor did not give up.

Natalya and Maxim came onto the stage and bought the right to claim the debt to Oleg from the creditor. On this basis, they are going to be included in the bankruptcy procedure of the deceased Oleg, which was introduced earlier at the request of his other creditors. And speaking in legal terms, it means bankruptcy of the hereditary estate. Moreover, they are trying to get involved at all 17 and kopecks.

The trial court looked at this case and only included the amount set by the court of general jurisdiction in the amount of 2.7 million. The reason? Oleg died, which means the heirs must answer within the inherited share. The court has already made a decision for 2.7 lemmas, so that’s what you can try to get.

But Oleg’s “new” creditors did not stop there and filed an appeal. And then, lo and behold, the court decides to cancel the ruling of the first instance and includes the entire amount of 17 million. The explanation is as follows: in the bankruptcy case of the deceased, the issue of the amount of liability of the heirs is not resolved. The procedure is aimed at the bankruptcy estate of the deceased, and not against the heirs. Thus, limiting the amount of liability would violate the proportionality of satisfaction of creditors' claims.

What's interesting about this case is that it went all the way to the Top. And there they agreed with the arguments of the appeal.

So, 17 versus 2.7 million. Bonus: the opportunity to challenge Oleg’s transactions to alienate his assets over the past 10 years. Now do you understand the main advantage of bankruptcy?

Who will repay the loan

In order to preserve the collateral after the death of its direct owner and at the same time the borrower under the mortgage agreement, it is recommended to continue current debt payments. There may be four possible payers:

- heirs;

- co-borrower or guarantor;

- Insurance Company;

- the bank itself.

Let's take a closer look at them.

Guarantors and co-borrowers

If the recipient of the loan has died, but the second responsible party under the agreement is a co-borrower or guarantor, then all responsibility will fall on him. It is not possible to abandon your responsibilities.

It is important to understand that in case of non-fulfillment or improper fulfillment of the terms of the loan agreement, the bank has the right to go to court. If a decision is made in favor of the creditor, then in addition to the collateral, the bank may also receive the guarantor’s/co-borrower’s own property. The main task of a credit institution is to return the borrowed funds. The way to solve the problem is not important.

Heirs

The option of repaying the mortgage debt is possible if the borrower did not have a will and guarantors/co-borrowers under the agreement. The procedure for inheriting a person's property and obligations is regulated by the Civil Code of the Russian Federation.

After death, the heirs will be required to service the loan according to the current payment schedule, which indicates the date of the upcoming payment and the minimum amount. If several people have inherited, the payment is distributed among them in accordance with the shares due.

NOTE! After the mortgage borrower has died, any accrual of penalties and fines must cease until the persons responsible for the loan obligations are designated.

If the apartment is not needed, and accordingly, the heir does not want to be liable for the debts of the testator, the law allows for a notarized refusal of the inheritance. After submitting such a document to the bank, all claims against the heir will be dropped.

Insurance

If the insurance company recognizes its obligations to pay the insurance premium, then it will be obliged to repay the remaining debt on the loan within the period specified by the bank. To do this, the required amount is requested, and using the specified details, the money is transferred to the loan account of the deceased borrower. The loan is closed.

After the encumbrance is removed, the property remains the property of the heirs or, in their absence, is transferred to the state.