Who was sick: the employee or his child

If an employee comes back from vacation with a certificate of incapacity for work, you need to see who was sick: himself or his child. If sick leave was received due to a child’s illness, then such leave does not need to be paid. The benefit may be assigned if the employee himself becomes ill or injured during his annual paid leave (Clause 1, Clause 1, Article 9 of Federal Law No. 255-FZ of December 29, 2006).

What if the child has not recovered by the end of parental leave? Then the employee has the right to stay at home even after the end of the vacation period. Accordingly, he returns to work only after the child has fully recovered and the sick leave for care has been completed. In such a situation, the employer is obliged to accrue benefits, but only for those days that fell after the vacation.

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

- Temporary disability benefits may be awarded if an employee falls ill or is injured during his annual paid leave.

- Sick leave for child care received by an employee during his vacation is not paid.

- Vacation days that coincide with a period of illness can be extended or postponed to another time by agreement with the employer. If his child gets sick during the vacation, then there is no opportunity to extend or reschedule part of the vacation.

- Days of incapacity for work that fall on non-working holidays cannot be included in the number of days for which vacation must be extended.

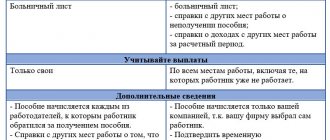

- The sick leave that the employee brought after vacation is subject to payment (if a child was sick, then only for days that did not coincide with the “vacation” period). The benefit is assigned for all calendar days of illness, including weekends and holidays.

However, difficulties may arise here too.

Clause 40 of the Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n states that sick leave for care is not issued while on annual paid leave. At the same time, paragraph 41 of this order states that sick leave for child care is issued (opened) from the day the employee is supposed to go to work.

Often, employees open sick leave to care for a child during their vacation period (when they first contacted the pediatrician about the child’s illness). In essence, there is a violation of the provisions of the above order. Moreover, this may also be due to the employee’s ignorance. The doctor, in turn, being in the dark about the parent’s leave status, issues a sick leave certificate from the moment of the initial application.

And here the employer has a question: is it possible to pay benefits on the basis of such sick leave and reimburse it from social insurance? We believe that it is possible, but sick leave should be accrued only for those days of care that fell during the period after the vacation. The Social Insurance Fund, of course, can refuse compensation, arguing that the sick leave was issued with violations. Therefore, it is worth warning your employee-parents so that in such cases they open a sick leave certificate only after the end of their vacation.

Do I need to include sick days in the billing period?

RF PP No. 922 clarifies whether sick leave days are deducted when calculating vacation time - yes, the period of illness is excluded from the calculations (clause “b”, clause 5 of Regulation No. 922). The accountant must take into account the actual salary and the actual period worked 12 months before the date of annual rest (clause 4 of regulation No. 922).

Let's consider a step-by-step algorithm for how sick leave is taken into account when calculating vacation pay, taking into account the norms of RF Regulation No. 922.

Step 1: Exclude Social Security benefits from your income for the previous 12 months.

Step 2. Calculate vacation based on time worked.

Step 3. Calculate separately the days in each month that were not fully worked.

Step 4. Determine the total number of days to calculate vacation pay.

Step 5. Calculate average earnings.

The final compensation is equal to the product of the SDZ and the days of the next paid vacation.

Example

Let us show whether sick leave and vacation pay are taken into account when calculating vacation pay, using a specific example.

Accountant of Ppt.ru LLC Viktorova V.V. goes on vacation for 14 days - from 01/15/2021 to 01/28/2021. The billing period is from 01/12/2020 to 01/11/2021. Over the previous 12 months, Viktorova V.V. submitted one sick leave certificate. The illness lasted from August 10 to August 17, 2021, these days should be excluded.

Salary in January - July amounted to 25,000 rubles, and in August - 19,000 rubles.

Total payments for 12 months: 25,000 * 11 + 19,000 = 294,000 rubles.

Calendar days for calculating annual rest (in every month except August) - 29.3. In August: (31 -

* 29,3 / 31 = 21,74.

Total number of days: 29.3 * 11 + 21.74 = 344.

SDZ = 294,000 / 344 = 854.65 rubles.

Compensation for 14 days of vacation = 854.65 * 14 = 11,965.10 rubles.

How to fill out sick leave according to the new rules

From December 14, you need to work with sick leave in a new way!

The rules were changed by Order of the Ministry of Health No. 925n dated September 1, 2020. ConsultantPlus experts have prepared an overview of the amendments and new instructions. Use it for free.

Extension of leave due to sick leave

Labor law provisions allow extending or postponing vacation days that coincide with a period of illness (Article 124 of the Labor Code of the Russian Federation). This only applies to cases where the employee himself was sick or injured. If his child gets sick during the vacation, then there is no opportunity to extend or reschedule part of the vacation. The only exception is if the possibility of extension is provided for by the internal regulations of the company (Article 124 of the Labor Code of the Russian Federation, letter of Rostrud dated 06/01/2012 No. PG/4629-6-1).

In the program “1C:ZUP 8” edition 3, how can I extend a vacation interrupted due to illness to an employee?

But there is one “but” here. Obviously, the fact of the child’s illness, as well as the period of his illness, must be confirmed by a document (so that the employer knows for what period to extend the leave). This document is a sick leave certificate for care. But we just wrote that it is better not to open it during the holidays. Otherwise, the company may have problems with compensation for sick leave.

A completely reasonable question arises: what to do in this case?

You can, for example, ask the doctor to write out a certificate that records the time of illness. It is unlikely that he will refuse this, since pediatricians usually have ready-made forms for certificates for kindergartens.

So, the employee who fell ill during the vacation period chose the option of extending the vacation. Is he required to apply for an extension in this case?

No, not required. The vacation is extended automatically (clause 18 of the Rules, approved by Decree of the People's Commissariat of the USSR dated April 30, 1930 No. 169). Therefore, the employee, without going to work on the appointed day, can continue to rest. But he must inform the employer that he was sick on vacation and wants to extend it. This can be done, for example, by telephone.

In this case, an order to extend vacation is also not required, although in practice some companies prefer to draw up one. This will not be considered a violation.

Quite legal tricks

Calculate vacation pay in a few clicks in the Kontur.Accounting web service! Get free access for 14 days

In some cases, an employee may be able to “save” vacation days or earn slightly more vacation pay by taking days off at the beginning and end of the vacation period.

For example, an employee goes on vacation for 3 weeks from July 5 to July 16, 2021. In fact, he rests from July 3 to July 18, since July 3, 4, 17 and 18 are days off.

Attention: Holidays that fall during vacation are not included in the number of calendar days of vacation and are not paid. In such cases, the number of calendar days will be greater than the number of vacation days.

An employee can write an application from July 3 to July 18 (including weekends), or from July 5 to July 16. The rest time will be the same, but in the first case, 16 days of vacation pay will be accrued and there will be another 12 days of vacation left, which can be used later. In the second case, the money will be credited in 12 days, but there will be another 16 days of vacation left.

Both options do not contradict the law. Please note that at least one part of the vacation per year must be at least 14 days (in accordance with Article 125 of the Labor Code of the Russian Federation).

Postponement of vacation due to illness

Another option is to postpone the vacation to another date. Here you need to take into account that this option can be used only if an agreement has been reached with the employer on the timing of the transfer. This follows from the wording of Art. 124 Labor Code of the Russian Federation.

If management is against the transfer or does not agree with the period to which the employee wants to transfer part of the vacation, then the vacation is extended and not postponed. In this regard, it is better for the employee to discuss the possibility of a postponement and the timing with his manager in advance (for example, during a telephone conversation, when he calls to report the fact of his illness). And already on the first day of returning to work after vacation, write a transfer application.

Based on such a statement, you need to draw up an order to postpone the vacation. Since a separate order is issued to postpone the vacation, there is no need to make changes to the originally issued order to grant the vacation.

How can I transfer part of a vacation interrupted by illness in the program “1C:ZUP 8” edition 3?

The vacation fell during the quarantine period or days declared non-working due to coronavirus

If an employee goes on vacation from March 4 to May 7, 2021, then the question arises: is it necessary to extend the vacation for these days and how to pay for it.

In accordance with Decree of the President of the Russian Federation dated April 23, 2021 No. 242, the days from March 4 to May 7 were declared non-working days with pay remaining. According to the rules of Art. 120 of the Labor Code of the Russian Federation, weekends are included in the number of calendar days of vacation and are paid, and non-working holidays are not included in the calculation of vacation and are not paid. The Ministry of Labor, in letter No. 14-2/B-393 dated 04/09/2020, recommended paying for such days as regular days of annual leave and not extending leave for them.

The online service Kontur.Accounting will help you easily calculate vacation pay. The service has many convenient tools that make the work of an accountant easier. Get acquainted with the capabilities of the service for free for 14 days: keep records, calculate salaries and send reports via the Internet.

Try for free

Sick leave pay during vacation

The sick leave that the employee brought after vacation must be paid in any case (if a child was sick, then only for days that did not coincide with the “vacation” period). Moreover, the benefit is assigned for all calendar days of illness, including weekends and holidays (clause 8, article 6, clause 1, clause 1, article 9 of the Federal Law of December 29, 2006 No. 255-FZ).

As for vacation pay, they need to be recalculated only if the employee decides to postpone his vacation due to illness. After all, in this case, it is considered that he did not use part of the declared vacation (the part that fell on the days of illness) as planned, and has already received payment for it. This means that we can say that the company overpaid him, and the employee is obliged to return part of the vacation pay he received earlier.

Usually no money is deposited, and the organization simply reduces the following amounts due to the employee (for example, from the amount of the next salary). In this case, it is better to obtain written consent from the employee for such a reduction. By the way, it can be included in the application for transferring vacation days.

When the employee completes the postponed vacation days, vacation payments will need to be accrued again.

As in the program “1C: ZUP 8” ed. 3 register sick leave received by the accounting department after a vacation?

Reversal of vacation pay

The employee did not report that he was on sick leave during his vacation. He deposited the vacation pay transferred to him into the organization's cash desk. Please tell me the wiring.

Apparently, vacation pay was accrued and paid on the basis of an order granting vacation. If an employee falls ill on the eve of a vacation, then this order should be canceled by another - on the cancellation of vacation due to illness.

Based on this order and the certificate of incapacity for work, in settlements with the employee, reflect the reversal entries for vacation amounts and the accrual of disability benefits. In wiring it will look like this:

| Dt 96 “Reserve for vacation pay” Kt 70, 69 | Reversal (with minus) amount of vacation pay |

| Dt 20, 26, 69 “FSS” Kt 70 | Disability benefits |

| Dt 70 Kt 68 Personal income tax | Personal income tax accrued on benefits (clause 2 of article 226 of the Tax Code of the Russian Federation, article 223 of the Tax Code of the Russian Federation, clause 1 of article 224 of the Tax Code of the Russian Federation) |

| Dt 50 Kt 70 | The employee deposited vacation pay into the organization's cash desk |

| Dt 70 Kt 50, 51 | The employee is transferred the amount due after all payments have been made. |

The material was prepared based on experts’ answers to questions from users of the reference and legal service Kontur.Normative.

Accounting for leave postponed due to illness

In accounting, you need to reverse part of the vacation pay (we remind you that we are talking about a situation where an employee decides to transfer “extra” vacation days to the future). This must be done at the moment when the employee submits an application for transfer of leave along with sick leave and the organization will accrue sick leave based on the leave.

As for tax accounting, the amount of vacation pay, as is known, is included in labor costs (clause 7 of Article 255 of the Tax Code of the Russian Federation). If vacation pay is subsequently recalculated downward, how can this be done in tax accounting? Through a decrease in previously recorded expenses or through the reflection of the recalculation amount (reimbursed by the employee) as part of non-operating income?

There are different opinions among experts. Unfortunately, there are no clear explanations from officials on this matter. There is only one old letter from the Ministry of Finance of Russia dated December 3, 2009 No. 03-03-05/224, in which officials in similar cases advise including compensation amounts in income.

Since there is no clarity on this issue, the company can choose any of the options and write it down in its accounting policies. Or contact your tax office and act based on the answer received.

Results

How sick leave is paid during vacation depends primarily on the type of vacation. Only leave that is classified as annual paid leave (it can be basic or additional) is subject to extension or transfer. Depending on the option chosen by the employee, he must in any case receive sick leave benefits, but vacation pay can either be recalculated if the vacation is postponed, or remain as is if the vacation is extended for the duration of the sick leave.

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Calculation of insurance premiums when recalculating vacation pay due to illness

How will the fact of recalculating vacation pay affect insurance premiums and filling out calculations for them?

It turns out that the base for insurance premiums in the month of accrual of vacation pay was overestimated. Some experts advise making an adjustment for this month, which may entail filing an adjusted DAM. However, in our opinion, it is better to make an adjustment when calculating insurance premiums for the month in which the amount of the employee’s debt for “extra” vacation pay will be deducted from payments.

But here one more point should be taken into account. In practice, accountants are sometimes faced with the fact that the program generates “minus” indicators for a specific employee in a certain month. This happens, for example, if in the month of leaving vacation the amount of payment for that month turned out to be insufficient to deduct the “extra” part of the vacation pay from it. As a result, negative values may also be included in the calculation of insurance premiums (for example, section 3). It is better not to allow this to happen. Otherwise, the tax authorities will either not accept the report at all, or will demand that it be corrected, that is, a “clarification” must be submitted. The fact is that the Pension Fund cannot distribute “negative” information to citizens’ personal accounts. The Federal Tax Service, in a letter dated August 24, 2017 No. BS-4-11/ [email protected] , warned that there should not be negative amounts in the DAM.

In this case, the “uncovered balance” can be transferred to the next nearest payment.

How to calculate sick leave

Sick leave is calculated based on the employee’s average daily earnings:

Average daily earnings = Amount of payments for the previous 2 years / 730 days

To find out the average daily earnings in 2021, sum up all payments in 2021 and 2021 from which contributions to extra-budgetary funds were paid. The law establishes the maximum values of payments when calculating sick leave: in 2021 - 865,000 rubles, in 2018 - 815,000 rubles. Even if the employee earned more during these periods, do not take amounts above the limit into account. Then the maximum earnings for sick leave in 2021 will be:

(865,000 rubles + 815,000 rubles) / 730 days = 2,301 rubles 37 kopecks.

The law also provided for a lower limit of payments. The minimum earnings when calculating sick leave cannot be less than the minimum wage:

12,130 rubles * 24 months. / 730 days = 398 rubles 79 kopecks.

The average daily earnings of an employee should be between 398 rubles 79 kopecks. and 2,301 rub. 37 kopecks We calculate the amount of sick leave as follows:

Sick leave amount = Average daily earnings * % of length of service * Number of sick days

The percentage of length of service depends on how many years employers have made contributions for the employee. For example, Innokenty worked for 1 year, and for 4 years. The insurance period will be 5 years.

The percentage ranges from 60% to 100%:

- the maximum rate of 100% is received by employees with at least 8 years of insurance experience;

- 80% - for employees with 5-8 years of experience;

- employees working less than 5 years receive 60%.

Check your work experience using your work record.

If an employee is ill, the company pays for the first 3 days of sick leave. Starting from the fourth, the Social Insurance Fund covers the costs. The organization must accrue benefits within 10 days from the date of presentation of sick leave. It is paid along with your salary or advance payment.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

What does average daily earnings consist of?

Labor legislation has formulated and enshrined the cliché for calculating average earnings for benefits.

SDO = SZRV / 730 days,

where SZRV is the amount of actual remuneration of the employee for the entire estimated time.

The basis for calculating the determination of average daily earnings includes all actual wage accruals, subject to contributions to the Social Insurance Fund, for an estimated time period equal to two calendar years preceding the year of the occurrence of the disability event. When determining the amount of payment for sickness in 2021, you should take into account all wages accrued in 2021 and 2021.

To calculate payment for the period of incapacity, the total total value of the accrued wages in each calendar year of the calculated time is taken into account in an amount not exceeding the maximum value of the accrued base of insurance contributions:

| Estimated calendar time, year | Maximum value of the base for calculating insurance premiums, rub. |

| 2020 | 912 000 |

| 2019 | 865 000 |

Data on the amounts of accrued wages for past years are provided by the employee in a certificate in form 182n.

For rules and requirements for issuing a certificate for calculating payment for a certificate of incapacity for work (form 182n), see the material “Certificate for sick leave from a previous place of work.”

ConsultantPlus experts explained how to calculate sick leave if the employee has not provided a certificate from his previous place of work. Get trial access to the system for free and upgrade to a ready-made solution.

Find out more about how to calculate sick leave in this article.

An employee fell ill on vacation and was subsequently dismissed

When granting leave with subsequent dismissal in accordance with Part 4 of Art. 127 of the Labor Code of the Russian Federation, an employee has the right to withdraw his resignation letter before the start of his vacation. Consequently, the employment relationship with such an employee is terminated on the last working day before the start of the vacation, and therefore the vacation is not extended by the number of sick days.

During illness during the period of vacation followed by dismissal, the employee is paid temporary disability benefits in the usual amount, which depends on the length of insurance (part one of Articles 6, 7, 9 of the Law of December 29, 2006 N 255-FZ, Letter of Rostrud of December 24, 2007 N 5277-6-1).