The unstable economic situation forces many owners who could not withstand the financial tests to close companies and firms. In order for an enterprise to officially cease its business activities, a liquidation procedure must be carried out. Only on this basis all workers are forcibly deprived of their jobs.

Important

Employees on maternity leave are also subject to dismissal, but the whole process has significant differences from the annulment of employment relationships with other employees.

Is it possible to fire a maternity leaver?

According to Russian laws, women released from work duties due to the birth of a child have the right to take one of the following leaves:

- for pregnancy and childbirth - regulated by Article No. 255 of the Labor Code of the Russian Federation, which indicates the duration of the incapacitated period;

- for the care of minors - Article No. 256 of the Labor Code of the Russian Federation outlines guarantees for women on maternity leave for the period of their absence from organizations, but only with official employment (maintenance of position and remuneration for the performance of labor duties).

Russian legislators have protected the interests of women on maternity leave; they cannot be fired without obtaining their consent. The only exception is the liquidation of the company. Only during this process can the employment relationship with them be officially terminated. In this case, you must comply with all legal requirements:

- Article 261 of the Labor Code of the Russian Federation. It states that pregnant workers and women on maternity leave cannot be dismissed at the request of management, except in cases of liquidation.

- Article 140 of the Labor Code of the Russian Federation. The document obliges the employer to pay accrued wages and additional money to the employee on the day of her dismissal. If she is absent from the enterprise, then no later than the next day after her demands for the payment of the entire amount due.

Attention

The management of a closed company must pay maternity workers, in addition to accrued earnings, severance pay. In the future, social benefits are transferred to children by social security. If an employee does not have time to take maternity leave, she must visit the local branch of the Social Insurance Fund to receive a lump sum payment before giving birth.

What payments are due?

Upon termination of an employment agreement caused by the liquidation of an organization, an employee on maternity leave has the right to almost all the same payments that are due to other employees, including:

- Compensation for unused vacation days (if any).

- Severance pay, the amount of which corresponds to her average monthly salary.

- Maintaining the average monthly salary while looking for a job, in general - no longer than 2 months from the date of dismissal. Subject to registration with the employment agency within 2 weeks from the date of dismissal, the average salary remains the same for the third month.

The birth of a child and caring for him until he is one and a half years old gives a woman the right to payment of child care benefits for up to 1.5 years. When registering salary, it is necessary to proceed from the fact that it is provided by the employer at the expense of the Social Insurance Fund of the Russian Federation.

The legislator guarantees women with whom labor relations were terminated during maternity leave in accordance with clause 1 of part 1 of Article 81 of the Labor Code of the Russian Federation, payment of a monthly child care allowance (Article 13 of the Law of the Russian Federation “On State Benefits for Citizens with Children”).

By virtue of paragraph 45 of the Procedure and conditions for the assignment and payment of state benefits to citizens with children, approved by Order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1012n, payment of benefits in this case is made by the social protection authorities at the place of residence of the former employee.

Social security benefits are calculated based on average earnings for the 2 years of work preceding the vacation, after which a coefficient of 0.4 is applied to it. The amount of payments cannot be greater than the amount of contributions paid to the Social Insurance Fund. That is, after liquidating the company and applying to social security, the amount of the benefit should not change (see paragraph 4 of Article 15 of the Federal Law “On State Benefits for Citizens with Children”).

Child care payments are made to a dismissed employee if unemployment benefits are not paid. At the same time, a woman has the right to independently choose the type of benefit that she intends to receive.

For the month in which the employment contract was terminated, child care benefits are paid in proportion to the number of days that have elapsed from the beginning of the month until the date of dismissal. In this case, we are talking about calendar days, not working days (Part 5.2 of Article 14 of Law No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”).

In order to receive payments, an employee dismissed due to the liquidation of the company should contact the social security authority, and the following package of documents must be provided:

- a copy or extract from the Labor Code with information about the last place of employment;

- a copy of the order according to which the woman is on maternity leave;

- a certificate of the amount of previously made payments in connection with pregnancy and childbirth, as well as in connection with child care.

Find out from our materials about the procedure for dismissing a director during the liquidation of an organization and how to dismiss employees in connection with the closure of a branch or department of an enterprise.

The procedure for dismissing a maternity leaver during the liquidation of an organization

During the complete cessation of the company's economic activities, labor relations with personnel are terminated. The former management, in addition to paying the amounts due, does not provide any benefits to pregnant women and women on maternity leave. After contracts are annulled, their rights are protected by government agencies.

The procedure for closing employment contracts with women on maternity leave consists of several stages:

- At least 2 months before mass layoffs, all employees are notified of liquidation against signature.

- On the last day of work, an order is issued to cancel all employment agreements. The paper is provided for review by all personnel.

- The accounting department pays compensation and salary balances.

- The HR department issues documents to employees. Women on maternity leave additionally take some paperwork to receive social benefits from government services.

To completely stop business activities, an enterprise needs to spend approximately 4-8 months. During this time, the closing process goes through the following stages:

- a decision is made on the need to liquidate the company;

- a liquidation commission is organized;

- a corresponding notification is sent to the tax office;

- information about the closure of an organization is published in special periodicals;

- notification letters are sent to employees, the labor exchange, and creditors;

- tax officers conduct an on-site audit, lasting approximately 3 months;

- Debts are collected, inventory is taken, documents are drawn up.

Important

Maternity workers belong to a preferential group of citizens, so they are the last to be dismissed. Calculation with them is carried out with some subtleties.

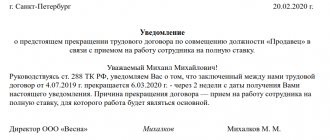

Notification to the employee

According to Article 180 of the Labor Code of the Russian Federation, women on maternity leave are notified of liquidation no later than 2 months before the scheduled date of closure of the company. This document does not have an approved form. It must indicate the reason and time of dismissal.

Attention

If the directorate notifies its employees only verbally, then this is a direct violation of the law, since such provision of information will not have any legal force and cannot be evidence of a warning about future dismissal.

Notifications are printed in 2 copies. One of them is given to the employee. If consent is given in writing, it is permitted to terminate the employment relationship early. The preservation of compensation and payments is guaranteed by law.

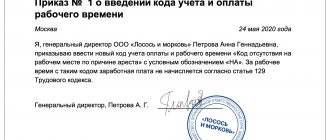

Paperwork

When dismissing a woman on maternity leave, the paperwork is filled out in the same sequence as for other employees. The head of the organization issues an order to terminate employment contracts with all employees due to liquidation. The document is supposed to display the exact date of dismissal and its justification, as well as a mention of the due settlement with the maternity leaver.

Attention

The order, immediately after review, is signed by all employees of the company. If this is not done, then the dismissal will be considered illegal.

The personnel service of the enterprise makes the appropriate entries, seals and stamps in work books.

Arbitrage practice

Dismissal of maternity workers during liquidation is the only situation when employees’ claims are practically not satisfied when going to court. Employers have the right to act on personal initiative.

Employers retain the right to dismiss, even if they were not warned about the pregnancy of their employees. At the same time, any actions are carried out as if they do not violate current laws.

A claim for violation of legal rights will be satisfied only if the pregnant woman did not receive notice of the upcoming event within the time limits specified by law. But even in such situations, more money is spent than real results are achieved.

It is better when there is agreement to sign an agreement on terms that satisfy both parties. Example - compensation can be reduced by half, but at the same time get rid of the need to stand in a general queue.

As a general rule, a company may show signs of bankruptcy. This process can take 18 months or more, even if the employer meets all the requirements. The actions of temporary managers and other features of the procedure often lead to the fact that the company is unable to transfer the minimum amounts.

Because of this, there is also a high probability that the woman will not receive the money due. Sometimes it is better to immediately reduce the amount, but get it as quickly as possible. So as not to face negative consequences later.

Enrollment in labor

Employees of personnel departments are required to correctly fill out documents for employees of the enterprise. The maternity book contains the following information in 4 columns:

- Number in order.

- Date of dismissal.

- Information about the order, the basis for the annulment of the employment relationship, a link to the article - clause 1, part 1 of art. 81 Labor Code of the Russian Federation.

- Signature of the responsible employee, company seal.

The work book filled out in accordance with all the rules and other documents are handed over personally to the maternity leaver for signature. At her request and in writing, she has the right to receive the following papers:

- certificate of earnings for the last 2 years;

- 2-NDFL;

- photocopies of orders relating to the labor activities of maternity leave;

- payslips.

Attention

A woman may need such documents to apply for required social payments to the Social Insurance Fund and social security - prenatal, postnatal assistance, benefits for caring for young children.

Features of the preparation of personnel documentation

It is necessary to adhere to the standard procedure associated with the dismissal of workers. A mandatory requirement is to draw up an order containing the following information:

- The reason why employment agreements are terminated.

- Indication of the position.

- The name of the document, a statement of its essence.

- The exact reason for dismissal.

- Business name.

- Document Number.

Closing an enterprise allows you to dismiss women on maternity leave using general grounds.

Instant notification of what is happening is often impossible due to the fact that the woman is not at her workplace. The employer must in any case involve employees in personally familiarizing themselves with the papers.

When the day of dismissal approaches, the employee must receive the following papers:

- A copy of the sick leave certificate.

- A copy of the application for benefits for caring for a child up to one and a half years old.

- Order of dismissal.

- Help 2-NDFL.

- Help regarding wages.

Compensation due

Accounting employees of a closing enterprise must correctly pay off maternity leave. They are required to transfer the following amounts:

- Accrued but not yet paid salary, lump sum or monthly child benefit.

- Compensation amount for the remaining days of vacation.

- Severance pay. This payment is equal to the average amount of 2 months' earnings. Former employees have every right to receive financial assistance again at the labor exchange if they have been unemployed for 3 months. An indispensable condition is to register within the first 14 days after leaving the enterprise.

Important

If a woman did not have time to calculate the amount of her monthly benefit before the company closed, then this is handled by the social security department at her place of permanent residence. The calculation is carried out by multiplying 40% by the amount of average monthly earnings for the year preceding dismissal.

A one-time payment given to women before going on maternity leave is calculated based on sick leave. If a pregnant employee manages to hand it over to the company before liquidation, then management is obliged to transfer the money to her in full. Maternity leave issued after the cancellation of an employment contract is paid by the state.

Immediately after receiving a work book, pregnant women and women on maternity leave should register with the labor exchange. To take advantage of government guarantees, this must be done in the first 2 weeks.

Additionally

Women who gave birth to children after liquidation have the right to receive a one-time postpartum benefit from the social security department or at the place of official employment of the spouse.

Features for sick leave

The average salary for the entire vacation period is the standard amount of compensation when sick leave is provided to the employer.

The obligation to pay benefits is removed if sick leave is filed in the month when the dismissal has already taken place.

Women retain their right to benefits in the following situations:

- The contract was terminated due to the need to care for a sick family member with a first group disability.

- The disease made further work and living in these parts impossible.

- Translation by husband.

Is the closure of a company a legal basis for laying off an employee on maternity leave?

In accordance with Art. 261 of the Labor Code - liquidation of an enterprise or termination of activities by an individual entrepreneur is the only legal basis for terminating an employment relationship with a pregnant woman.

Read more about whether an employee on maternity leave can be laid off here, and from this article you will learn about when it is legal to lay off a woman with children under 3 years of age and when it is not, as well as how the dismissal procedure goes.

Calculation of severance pay

The amount of the benefit for each month is determined as the average monthly salary of the employee (Articles 178, 296, 318 of the Labor Code of the Russian Federation). The average monthly salary is calculated by multiplying the actual number of working days falling during this period by the average daily salary of the dismissed employee. Accordingly, the amount of benefits attributable to an incomplete month will depend on the number of working days that fall within the period not worked in it.

Since the calculation is made separately for each person, taking into account the date of his dismissal, from which each paid month is counted, and his work schedule during work, the benefit amounts will always be individual.

For more information on the rules for calculating the average monthly salary in different situations, see the article “How to calculate the average monthly salary (formula)?”

The average daily salary is determined according to the rules established by the Labor Code of the Russian Federation (Article 139) and Decree of the Government of the Russian Federation dated December 24, 2007 No. 922, excluding from the calculation periods time periods not taken into account for these purposes:

- if the period worked is equal to or exceeds 1 year, the average daily salary will be equal to the amount of the actual salary received in the 12 months preceding the month of dismissal, divided by the actual number of days worked in these months;

- if the period worked is less than 12 months, then for the calculation they take data on salary and the number of working days for the actually worked period up to the month of dismissal;

- if an employee is hired and fired in the same month, the calculation period will be the time he actually worked (actual earnings and actual number of working days).

If the employer has set his own calculation period for calculating average earnings, which differs from 12 months, then he will have to do the calculation twice: according to the rules of the Labor Code of the Russian Federation and according to his own. The average daily salary calculated from your own pay period can be used when calculating benefits only if it is no less than that determined according to the rules of the Labor Code of the Russian Federation and Resolution No. 922.

Thus, the formula for calculating the amount of benefits for a full paid month in symbols will look like this:

Pos = SrmesZP = SrdnZP × RDfull,

where: Pos - the amount of severance pay;

Average salary - the amount of the average monthly salary;

Average salary - the average daily salary;

RDfull - the actual number of working days in a full month, calculated according to the work schedule of a specific dismissed employee.

For an incomplete month, the benefit will be calculated as follows:

Pos = SrdnZP × RDincomplete,

where: Pos - the amount of severance pay;

Average salary - the average daily salary;

RDincomplete - the actual number of working days in an incomplete month, calculated according to the work schedule of a specific dismissed employee.

The average daily salary will be:

SrdnZP = ZPrp / RDrp,

where: Average daily salary - average daily salary;

ZPrp - the amount of salary attributable to the billing period;

РДрп - the actual number of days worked in the billing period.

EXAMPLE of calculating severance pay from ConsultantPlus: The date of dismissal of an employee due to the liquidation of the organization is September 21, 2021. The average daily earnings of an employee is 1,142 rubles. The number of working days in the period... Get trial demo access to the K+ system and proceed to tips from experts. It's free.

When should I notify the employment service?

The employer is obliged to notify the employment service authorities in writing about the upcoming dismissal of employees (in connection with the liquidation of the individual entrepreneur). An organization must do this no later than two months before the start of the relevant events, and an individual entrepreneur - no later than two weeks.

In the event of a mass dismissal of employees, the organization sends a message to the employment service three months in advance (clause 2 of article 25 of the Law of the Russian Federation of April 19, 1991 No. 1032-1). The criteria for mass dismissal are established by Decree of the Government of the Russian Federation dated 02/05/93 No. 99.

Employer's liability

If an employer fires a woman who is on maternity leave without good reason, then this act will be punished. If the fact of the violation is known to the court, it may oblige the employer to restore the woman to her rights and position .

In addition, for moral damage, the employer is obliged to pay the woman an amount determined by the court .

As a preventive measure for future violations of the Labor Code, the court may subject the employer to a fine, in an individual amount for each case.