Types of income from which alimony is withheld

According to Art. 80 of the RF IC, parents must fulfill obligations regarding the financial support of minor children. If they divorce or do not live together, the one with whom the child remains can collect alimony from the spouse.

The list of income for deduction of alimony payments is strictly regulated by law.

It includes:

- wage;

- military personnel's allowance;

- cash payments accrued to citizens for time worked;

- salaries, allowances and bonuses to salaries and tariff rates;

- coefficients and percentage bonuses related to working conditions;

- remuneration to teachers for classroom management;

- average earnings retained by an employee during sick leave and under other circumstances;

- payments to medical workers;

- additional rewards;

- all types of pensions and scholarships;

- sickness or unemployment benefits;

- business income;

- income from renting out real estate;

- earnings received from shares and other securities;

- payments to doctoral students;

- material assistance, except for payments from the municipal or federal budget;

- earnings received under a civil contract.

Alimony is withheld from military personnel (in particular from pensions), employees of the Ministry of Internal Affairs and other law enforcement agencies, as well as from employees of the Ministry of Emergency Situations. The amount depends on the method of collection and the amount of wages.

Monetary allowance

Serviceman Agapov N.O. receives 30,000 rubles monthly. After deducting personal income tax, contributions to the Social Insurance Fund and the Pension Fund, alimony is paid for one child. Size – 25% of allowance.

30,000 x 25% = 7,500 rub. per child. Agapov N.O. has 22,500 rubles left in his hands.

Earnings from shares

Yuzhakov L.D. is a shareholder of the PJSC, the enterprise is profitable, no loss has been recorded. He left two children with his ex-wife. To collect alimony, she went to court, then handed over the writ of execution to the bailiff.

Based on the IL, the bailiff made a request to the registrar, and the amount of earnings was provided. In such cases, income is not fixed, and the amount of alimony is different each time.

Earnings from shares are subject to tax. Payments for children in shares of income are deducted subsequently.

Based on the information provided by the registrar, it was established that the payer earned 500,000 rubles in a month.

500,000 x 33% = 165,000 rub. - funds for the maintenance of minors.

Important! In practice, it is problematic for the claimant to receive money from the income from shares. He does not have the right to independently request information from the registrar, so he will have to contact the bailiffs in any case - only they and the court are authorized to perform this action.

Disability benefits

Mochalov E.T. was ill for 10 calendar days. During this time, he was credited with 8,000 rubles. as sickness benefit. The calculation took into account his length of work and the amount of average earnings.

To begin with, personal income tax is deducted; insurance premiums are not paid:

8,000 x 13% = 1,040 rub.

8,000 – 1,040 = 6,960 rubles. – the amount from which payments are withheld for one child.

6,960 x 25% = 1,740 rub.

If the employer independently rounds up the benefit to average earnings, the calculation is based on the total amount after deduction of tax.

Income from rental housing

Yudin N.G. is officially employed, earns 50,000 rubles. monthly. Child support for two children is withheld from wages - 33%. Additionally, he has income from renting out the apartment. The hiring cost is 10,000 rubles. after withholding personal income tax. From this part of earnings, payments for the child are withheld in a fixed amount - 3,000 rubles. Thus, mixed alimony is applied in accordance with Art. 83 RF IC.

How the calculation is performed:

50,000 x 13% = 6,500 rub. – personal income tax amount.

50,000 – 6,500 = 43,500 rubles. – amount to withhold alimony in shares.

43,500 x 33% = 14,355 rubles. – payments for two children from the salary.

14,355 + 3,000 = 17,355 rubles. – total amount for minors.

43,500 + 10,000 = 53,500 rub. – the total amount of income of the alimony obligee.

53,500 – 17,355 = 36,145 rubles. - the amount remaining on hand.

Bonus for annual work

Antonenko N.R. at the end of the year received a bonus in the amount of double salary for conscientious work (13th salary). The amount was 35,000 rubles. after personal income tax. He pays child support for three children. The bonus was paid simultaneously with the salary, a total of 55,000 rubles was accrued. after paying taxes and government contributions. Calculations are made from this amount.a

55,000 x 50% = 27,500 rub. – the accountant transfers the child support to the recipient.

More information about collecting alimony from premiums

Maximum withholding amount

In general, under a writ of execution (several documents), no more than 50% of wages and other income can be withheld from the debtor.

This restriction does not apply when collecting alimony for minor children, compensation for harm caused to health, compensation for harm in connection with the death of a breadwinner, and compensation for damage caused by a crime. In these cases, the amount of deduction from wages and other income of the debtor-citizen cannot exceed 70%. These standards are prescribed in paragraphs 2 and 3 of Article of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”. Thus, in any case, more than 70% cannot be withheld from an employee’s salary. Moreover, deduction in the specified amount is possible solely to satisfy the above requirements (alimony for minor children, harm to health, etc.). If the collection is made to satisfy other requirements, then no more than half of the earnings are collected.

Calculate your salary with alimony deduction in the Calculate web service

It might seem like a simple rule, but in practice it causes problems. Especially when the organization has received several writs of execution, each of which requires deductions to be made in a certain amount. Let's look at specific examples.

Types of income from which alimony is not withheld

In addition to the list of income for deduction, there are types of profit from which alimony is prohibited from withholding:

- severance pay due to dismissal;

- compensation for travel expenses;

- compensation from the manager received for the employee’s use of personal tools at work;

- financial assistance paid for family reasons: the birth of a child, the death of a close relative;

- financial assistance in case of a natural disaster, fire, accident;

- funeral benefit;

- compensation for caring for a seriously ill close relative;

- survivor's benefit;

- other alimony transferred to the payer. For example, from children or other relatives;

- state benefits: maternity capital, humanitarian aid.

You cannot withhold alimony from income received as a result of inheritance or receipt of a state award.

Is alimony deducted from vacation pay?

Is alimony deducted from business trips?

Results

There are several situations for deducting alimony from employee income.

The payments themselves can be either forced or voluntary. However, the fact of their deduction in any case will be reflected by the posting Dt 70 Kt 76. Alimony can be paid to the recipient in different ways: in cash (Dt 76 Kt 50), through a bank (Dt 76 Kt 51), by postal order (Dt 76 Kt 71). Expenses incurred during payment are repaid at the expense of the alimony payer (Dt 76 Kt 71). Payment can be made either from income (Dt 70 Kt 76) or in cash (Dt 50 Kt 76). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How much is child support deducted from?

According to the law, accountants must deduct 13% of personal income tax from the actual accrued salary, as well as insurance premiums and payments for health insurance. The money is paid according to the details of the Federal Tax Service, since the Pension Fund has transferred its powers to the tax service since 2021.

Alimony is deducted from the remaining amount after deducting government payments. In 2021, the following deductions are made:

| View | Size |

| Personal income tax | 13 % |

| Pension insurance | 22 % |

| Health insurance | 5,1 % |

| Social insurance | 2,9 % |

Let's analyze the calculations in detail:

“Dirty” employees are charged 50,000 rubles. All contributions are calculated from this amount.

50,000 x 13% = 6,500 rub. – Personal income tax.

50,000 x 22% = 11,000 rub. - pension contributions.

50,000 x 5.1% = 2,550 rubles. - honey insurance.

50,000 x 2.9% = 1,450 rubles. – social insurance.

In total, 43% of the salary is withheld in favor of the state.

6,500 + 11,000 + 2,550 + 1450 = 21,500 rubles. – amount of payments.

50,000 – 21,500 = 28,500 rubles. – remains in the hands of the employee.

If there is one child and the share method of collection, the amount of alimony will be:

28,500 x 25% = 7,125 rub.

If there are two children:

28,500 x 33% = 9,405 rub.

For three or more minors:

28,500 x 50% = 14,250 rub.

Alimony payments without divorce

Z°ÃºÃ¾Ã½Ã¾Ã´Ã°ÃÂõûÃÂýþ ÃÂÃÂõñþòðýøõ ÿþ ÃÂÿûðÃÂõ ðûøüõýÃÂþò ò ñÃÂðúà òÃÂôõûõýþ þÃÂôõûÃÂýþ, ýþ ÿþüøüþ ÃÂÃÂþóþ þýþ òÃÂÃÂõú ðõàø÷ ÃÂþûúþòðýøàýõÃÂúþûÃÂú øàÃÂÃÂðÃÂõù. ÃÂþûþöõýøàÃÂÃÂ. 89 áààä ÃÂõóûðüõýÃÂøÃÂÃÂÃÂÃÂ, ÃÂÃÂþ ÿàðòþü ýð ÿþûÃÂÃÂõýøõ þñÃÂ÷ðÃÂõà»ÃÂÃÂÃÂò ò ñÃÂðúõ þñûà°Ã´Ã°ÃÂÃÂ:

- áÃÂÿÃÂÃÂóð ò ÿõÃÂøþô ñõÃÂõüõýý þÃÂÃÂø ø ýð ÿÃÂþÃÂÃÂöõýøø ÿÃÂõàûõ ààüþüõýÃÂð ÃÂþöôõýøàÃÂÃµÃ±ÃµÃ½à ºÃ°.

- àþôøÃÂõûÃÂ, úþÃÂþÃÂÃÂù ÷ðýøüðõà ÃÂàòþÃÂÿøÃÂðýøõü ø ÃÂþôõÃÂöðýà ÃÂõü ÃÂþòüõÃÂÃÂýþóþ üðûÃÂÃÂð àøý òà°Ã»Ã¸Ã´Ã½Ã¾ÃÂÃÂÂàôþ 18 ûõÃÂ, ûøñþ àòÃÂþ öôõýýþù øýòðûøôýþÃÂÃÂÃÂà1 óàÃÂÿÿÃÂ.

- áÃÂÿÃÂÃÂó, úþÃÂþÃÂÃÂù ÃÂòûÃÂõÃÂÃÂàýõàÃÂÃÂôþÃÂÿþÃÂþñýÃÂü ø ýÃÂöôðõÃÂÃÂàಠÿþôôõÃÂöúõ.

ÃÂþüøüþ ÃÂðÃÂÃÂüðÃÂÃÂøòðõüÃÂàúðà VALUE ¸Ãµ ôõýõó þñûðôðÃÂàø ô õÃÂø â ýð ýøàýõ þúð÷ÃÂòðõàò ûøÃÂýøõ ÃÂÃÂðÃÂÃÂàÃÂþôøÃÂõûõù, ñÃÂû ø þýø ò ñÃÂðúõ . õûÃÂÃÂÃÂòþòðûø. àÃÂðúþù ÃÂøÃÂÃÂðÃÂøø òÃÂÃÂÃÂÿðÃÂàò àøûàòÃÂõ ÿþûþöõýøÃÂ, úþÃÂþÃÂÃÂõ à VALUE ýàø ÷ðÃÂøúÃÂøÃÂþòðýàò ÃÂÃÂ. â áààä.

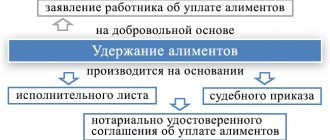

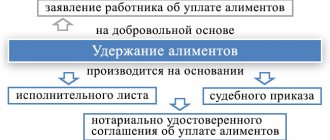

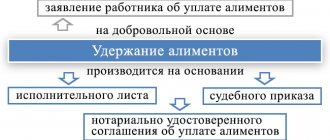

The procedure for collecting alimony by method

The direct basis for the forced collection of alimony is the evasion of the alimony obligee from voluntary transfer of payments.

However, to go to court it is not necessary to attempt to conclude an alimony agreement - filing a lawsuit or applying for a court order is sufficient. If the parents are divorced or in the process of divorce, there is no need to prove the non-participation of one of them in financial support. If there is no divorce, you will have to present evidence of separation to the court. Witness testimony will also be needed.

Alimony is withheld based on one of three documents:

- performance list;

- court order;

- alimony agreement.

The claimant can submit them at the payer’s place of employment or transfer them for enforcement to bailiffs at his registered address.

The procedure for collecting alimony depends on the method. Before contacting the appropriate authority, you should familiarize yourself with each of them.

It is important to take into account that a court order and alimony agreement have the force of a writ of execution, therefore the employer does not have the right to refuse to accept these documents to the claimant.

Satisfactory agreement

Everything is simple here: the parties independently determine the amount and procedure for paying alimony, submit the draft agreement to a notary, having previously paid the state fee.

It is allowed to provide valuable property to pay off alimony obligations.

Court order

A court order is issued at the request of the claimant and is issued within 5 days. A copy of the document is sent to the payer; he has the right to challenge it within 10 days from the date of execution by filing an application to cancel the order.

To receive an order it is enough:

- written request;

- marriage and divorce certificates;

- children's birth certificates.

Claim proceedings

A claim is most often filed when a woman is unable to agree with her ex-husband on the payment of alimony amicably.

What it looks like:

- The plaintiff draws up a claim and sends it to the magistrate's court.

- The parties receive written notification of the date of the first meeting.

- On the appointed day, the plaintiff and defendant appear in court.

- The period for consideration of the case does not exceed 1 month. Based on the results, the operative part of the decision is announced, an extract and a writ of execution are made.

The plaintiff receives the status of a claimant. The IL is transferred to the organization at the place of work of the alimony obligee or to the bailiffs.

Rules for drawing up an application

The paper is drawn up in accordance with the document management rules adopted by the company. The document has a unified form if the organization has many employees and such transfers are carried out periodically. The paper states:

- information about the applicant (full name, position, mobile phone);

- FULL NAME. the leader to whom the request is made;

- content of the appeal (where and for what to transfer funds);

- payment amount;

- payment details (if necessary);

- start (end) date of transfers;

- date and signature of the employee.

Is it possible to print an application for deduction from salary or do you need to write it by hand? Both options are acceptable. The most important thing is that the paper bears the applicant’s handwritten signature.

Withholding of alimony from other sources of income

Let's consider special cases of withholding alimony from other income of the alimony obligee.

Alimony from the income of military personnel

Military personnel receive cash allowances instead of wages. The wording is different, but the essence is practically the same.

What is included in the allowance:

- salary according to position;

- salary according to rank;

- monthly constant payments.

Questions often arise regarding ration payments - some believe that alimony is not deducted from them. An explanation is given in the Resolution of the Armed Forces of the Russian Federation, which states that such compensation is systematic in nature, therefore, money for the maintenance of children must be deducted from them.

The general calculation procedure applies here: the accountant of the military unit, on the basis of the writ of execution, makes monthly deductions according to the details specified in the claimant’s application.

Alimony from income from individual entrepreneurs

It is problematic to establish the exact earnings of individual entrepreneurs, so they are usually assigned an obligation to pay alimony in a fixed amount. The tax system used is also important:

| Simplified | Alimony is paid from net profit. The amount is calculated using the income and expense ledger |

| BASIC | The deduction is made from the amount subject to personal income tax. The court will require a declaration |

| UTII or PSN | Tax is paid on the imputed (expected amount) profit, alimony is paid on the real one. If a book of income and expenses is not provided, payments for children are calculated taking into account the average earnings in the Russian Federation |

Lack of income as an individual entrepreneur is not grounds for termination of alimony obligations. In this case, the calculation will be based on the average salary in the country, even if the entrepreneur provides “zero” declarations for a long time.

Learn more about withholding alimony from an individual entrepreneur.

Alimony from foreign citizens

If a foreign citizen lives in the Russian Federation and is officially the father of the child, alimony is collected within the framework of Russian legislation.

When the payer lives abroad, the presence or absence of a legal agreement between countries matters. If it is not there, documents drawn up in the Russian Federation will not have legal force in another state.

The possibility of collecting payments for children from a foreigner is determined by the following regulations:

- Convention on Legal Assistance of January 22, 1993 (Minsk).

- Convention on Legal Assistance of October 7, 2002 (Chisinau).

Claims are made in two ways:

- Conclusion of an alimony agreement.

- Filing a lawsuit.

If the payer lives in another country and there is no agreement on legal assistance between the states, enforcement documents drawn up in the Russian Federation will be invalid for him.

If there is a legal agreement, alimony is assigned in a fixed amount.

Alimony from the sale of an apartment

When selling real estate, citizens are required to pay income tax unless there are grounds for exemption. However, such income is not subject to taxation, since what is happening here is not making a profit, but a change in the form of ownership.

The exception is real estate trading for the purpose of making money. Here the plaintiff will have to prove that the defendant is conducting economic activity, and the transactions are not one-time, but systematic. If the decision is positive, alimony will be withheld from the amount of earnings received.

Details about withholding alimony from the sale of an apartment

How to claim alimony debts within the statute of limitations

First of all, the parties should try to come to an agreement on the payment of alimony payments, in which they voluntarily agree on the terms and procedure for payments.

Write down in it the period from which, according to the alimony recipient, alimony should have been paid, even if this is a point in the past (even several years ago). If the payer agrees with this, then he simply repays the debt and then pays according to the terms of the agreement. If an agreement already exists, but the debtor delays payment, he can be held liable under Art. 115 of the RF IC and collect a penalty in the amount of 0.1% of the debt amount for each day of delay in payment.

Debt collection through court

It is used when it is not possible to reach a voluntary agreement, and the parties argue about the procedure for payment and the amount of alimony payments. In this case, it is worth going to court, where all calculations are made and the payment procedure is established. A claim will be considered in court, which should be filed if the bailiffs do not take proper measures to collect funds.

If the debtor has no official income, the court may:

- seize bank accounts and withhold the amount of debt;

- describe and auction the debtor’s property in order to repay the debt;

- transfer of the debtor's property to the recipient of alimony.

The court decision that has entered into legal force must be handed over to the bailiff service to resume enforcement proceedings.

Debt collection through bailiffs

If the recipient of alimony has a document confirming the right to receive it - a notarized agreement with the payer, a court order or a writ of execution, you need to contact a bailiff. He will begin enforcement proceedings and take measures to collect the debt.

The duties of the bailiff include notifying the debtor about the opening of proceedings, the amount of the debt, and also learn about his place of work, income, accounts and other property. The debtor is asked to repay the debt voluntarily within a certain period of time. If he refuses, the bailiff service takes further measures:

- withholds the debt from the payer's salary;

- freezes bank accounts;

- seizes property.

The bailiff controls the process of forced collection of alimony debt.

Previous AlimonyHow you can reduce alimony payments by law: procedure Next AlimonyHow to file for divorce and collect alimony at the same time

Should alimony be withheld when purchasing an employee's property?

In practice, a situation is possible when the employing organization purchases expensive property from an employee, for example, an apartment or a car. The relevant question is: is it necessary to withhold alimony under a writ of execution in this case?

Disputes on this topic have been going on for a long time. The current legislation of the Russian Federation does not clearly explain from which income alimony should be withheld. Therefore, some courts made decisions in favor of the recipients, while others argued that such income should not be subject to alimony. In other words, until recently, the solution to this complex issue was entirely left to the judges.

So, for example, in the Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Republic of Mari El dated May 20, 2010 in case No. 33-704, the following conclusion was made. Withholding alimony is possible if income is received from the sale of property (according to the case file - a car), i.e. the amount received exceeds the price of the property at purchase. Otherwise, there is no reason to believe that as a result of the alienation there was an increase in property, that is, the citizen received income from the sale of an item that was in his possession and use. Under such circumstances, it cannot be accepted as correct that the citizen has received income from which alimony for a minor child should be withheld on the basis of subparagraph “o” of paragraph 2 of the List, approved. Resolution No. 841.

The ruling of the Constitutional Court of the Russian Federation dated January 17, 2012 No. 122-O-O actually proclaimed the opposite conclusion - when selling real estate and other property, an obligation to pay alimony arises. This is a fairly large part of the cost - from 25% to 50%, therefore, despite the fact that decisions of the Constitutional Court of the Russian Federation are binding on all citizens and organizations, it is better to warn the citizen in advance that the organization purchasing the property, which has a writ of execution for alimony , will be forced to make deductions and obtain his consent to this.

Definition and mechanism of occurrence of alimony obligations

Definition

The word “alimony” has ancient Roman origins, as evidenced by the translation of this word from Latin. There are 2 known translation options:

- Nutrition.

In ancient Rome, the word “alimentum” was the gratuitous provision of monetary amounts from one family member to another family member as maintenance.

In the modern world, the meaning of this word has remained virtually unchanged. As in ancient times, the alimony obligation refers to the relationship between 2 family members or close relatives, one of whom undertakes to pay money or transfer property for the maintenance of the second party to the obligation, and the second party to the obligation has the right to demand the provision of this maintenance.

How do they arise?

The legal scheme of any alimony obligation includes 3 key features, without which its occurrence is impossible:

- Kinship or family ties must not exist in words, but be certified by documents. In the Russian Federation, the responsibility to register civil status rests with the state civil registry office. Information about civil status is recorded in special register books, and citizens receive certificates. Let's give an example: the birth certificate of a minor certifies several facts: the baby's name with surname and patronymic, the date he was born, information about his parents. Thus, this certificate is written evidence of the relationship between a minor child and his parents.

- Certain categories of alimony recipients have grounds unique to them that allow them to demand maintenance from the alimony provider. For example, in the case of child support obligations, this is a minor; in the case of alimony obligations of spouses, former spouses, parents, incapacity for work (disability or reaching retirement age) or neediness (income below the subsistence level; need for funds for treatment). In the case of a wife or ex-wife, pregnancy or raising a common child who is under 3 years old.

- Documentation of alimony obligations within the framework of an agreement certified by a notary, or an act (order or decision) issued by the court.

Signs

| Name of features | Legal explanation |

| Personal character | This property means that the alimony holder cannot shift his responsibilities to another person in any legal way. If the alimony payer dies, his heirs should not continue to provide maintenance to the alimony recipient. |

| Gratuitous | The provision of alimony is not accompanied by any counter conditions for the recipient of the funds and does not make him obligated in the future to in any way compensate for the expenses of the alimony. |

| Time limit | The law clearly establishes the time frame for alimony obligations, for example:

When the child reaches the age of 3 years, when maintenance is provided to the wife or ex-wife. |

Classification of alimony obligations

| Basis of classification | Types of child support obligations |

| Alimony payment terms |

Temporary or appointed for a clearly defined period, for example, obligations of parents to minor children, obligations of an ex-spouse to a pregnant ex-wife. |

| Composition of subjects of legal relations |

|

| Collection methods |

|

| Methods for calculating child support for a minor child |

|