MIP online legal encyclopedia - » Family law » Articles on alimony » Determination of alimony debt

Get an expert opinion on alimony in two clicks

Child support arrears occur when the payer stops transferring funds.

Child support arrears occur when the payer stops transferring funds. Considering that alimony is intended to provide financial support for the child, failure to pay is a serious violation that ignores the rights and interests of the child. In such conditions, the recipient of alimony has the right to demand repayment of the debt through the court.

In modern conditions, most citizens encounter difficulties when trying to collect alimony. The fact is that debtors try to resort to various methods to avoid fulfilling their obligations. In such a situation, only bailiffs can help resolve issues with alimony debt.

Content

1. Mechanism of enforcement proceedings

2. From what sources are amounts of money collected to eliminate debts?

3. How is the penalty calculated and collected on debt obligations?

4. Mechanisms influencing the defaulter established by law

5. Deprivation of parental rights for non-payment of child support obligations

6. Criminal liability for non-payment of alimony

7. Is it possible to release the debtor from paying alimony arrears?

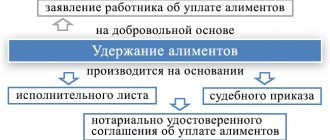

Responsibilities for paying child support are assigned to the parent living separately from the child. After the divorce process, the volume and procedure for payment of alimony obligations are established by a settlement agreement between the spouses or by the court (formation of a decision or order).

In situations where funds are not paid to the alimony recipient on time, arrears on alimony obligations are formed. There are situations when the debt becomes impressive and is not paid off by the alimony provider.

In this article we will look at what actions to take in this situation and what mechanisms exist for collecting alimony.

Will alimony be written off in bankruptcy?

Many citizens are sure that personal bankruptcy is a kind of indulgence. You went through the procedure, declared yourself bankrupt and you don’t have to worry anymore.

Old debts are written off - it's time to make new ones. However, there is a whole set of obligations that are not reset in bankruptcy. Among them are alimony payments.

But alimony can lead to bankruptcy.

According to Article 223.2 of the bankruptcy law, if we are talking about an out-of-court procedure (this is when debts do not exceed 500 thousand rubles and you need to apply for bankruptcy at the MFC), alimony must be included in the calculation of the obligations that the debtor indicates in his application.

That is, the amount that is subject to mandatory collection. But as mentioned above, bankruptcy will take place, and alimony debts will remain with the applicant. Therefore, it makes no sense to initiate this procedure in order to legally write off overdue alimony.

But if the amount of alimony debt is large enough, then other creditors may not get anything. The fact is that in case of judicial bankruptcy, alimony is compensated from the funds of the bankruptcy estate in the first place.

Creditors can, of course, try to challenge the payments, but it is unlikely that they will succeed. At the same time, if for some reason alimony does not fall into the bankruptcy estate, then its recipient will not lose anything except time. Sooner or later he will be paid alimony.

For violation of terms of payment of alimony, a penalty is charged. This is stated in Art. 115 of the Family Code of the Russian Federation. Since 2018, the amount of the penalty is 0.1% for each day of delay, but it can be higher if the parents agree on this.

Mechanism of enforcement proceedings

When an act of execution is received, collecting alimony debt, it must be submitted to the local authorities of the bailiff service. Only on the basis of a judge's decision or order is it possible to open enforcement proceedings.

Service employees send a resolution document with a letter of proposal to pay off debts on alimony obligations voluntarily. The resolution sets out the total amount of the debt and the period for its repayment. To confirm payment of the debt, the alimony payer must provide the payment to the bailiffs. If the payment deadline has expired and the funds are not received, the bailiff begins to forcibly collect the funds.

The bailiff first collects the required information about the alimony payer. To speed up the work, the recipient of alimony himself can write a statement in free form and indicate information about the location of the debtor, place of employment, unearned sources of income of the alimony, whether there are bank accounts or rights to property.

In addition to the information that the bailiff receives from the recipient of alimony, a personal search is conducted for information about the defaulter. The contractor sends requests to the place of employment and to government agencies. In situations where there is no information about the whereabouts of the defaulter, he is put on the wanted list within 3 days.

In the practice of enforcement proceedings, there are often cases of delays in the case, delays in the repayment of debt obligations and inaction of bailiffs. The reasons for this turn of events may be the following:

- The bailiff does not have experience or does not have enough information about the defaulter.

- Bailiffs are too busy with work.

- Corruption in bailiff services. Alas, bribes among officials are not uncommon. Bailiffs can wait or receive funds from the alimony defaulter to freeze the collection process. This is often used by child support payers. In situations of extortion, you must immediately contact a higher authority or anti-corruption authorities with a complaint.

Be that as it may, the problem of suspension of enforcement proceedings regarding the collection of alimony cannot be hushed up. It is necessary, without exception, to facilitate the actions of the bailiff. If he does not take any action to resolve your case, immediately send complaints about non-fulfillment of obligations to higher officials.

If you don’t find any reaction here, contact higher-ranking authorities. At the same time, you can contact the prosecutor and file a complaint about the lack of payments for alimony obligations. For more information, call the Child Support Lawyers Hotline.

Conditions for debt collection after 18 years

In accordance with paragraph 2 of Art. 120 of the Family Code, a child’s 18th birthday is grounds for termination of parental support obligations. This only means that awarded alimony payments stop accruing after reaching adulthood. But it does not cancel the outstanding alimony debt. If it arose due to the fault of the payer, then it continues to be collected even after reaching adulthood, since it has no statute of limitations and no deadline for the past period for which it can be collected.

The amount of the debt is approved by the bailiff, therefore, in order to collect it even after 18 years, a number of conditions must be met:

- the deduction was carried out on the basis of a writ of execution or a notarized agreement with the alimony provider;

- the debt was caused by the payer;

- the writ of execution until the age of majority was for compulsory execution in the district OSB and continues to be there;

- by order of the bailiff, the debt incurred at the time of majority was calculated;

- the payer has a permanent source of income or liquid property that can be foreclosed on.

Note!

The controversial issue is who is the debt collector:

- on the one hand, the provisions of Art. 80 of the Family Code are interpreted in such a way that alimony is money for the maintenance of a child, and therefore it is he who, after reaching the age of majority, is the owner of the debt and the proper collector;

- on the other hand, Art. 80 of the IC guarantees children not parental money, but the right to full maintenance. Therefore, arrears of alimony are compensation for the second parent of the child, who alone supports the common child and bears the expenses.

From what sources are funds collected to eliminate debts?

Problems usually do not occur when the debtor officially works and has income in the form of wages. Under such circumstances, recovery from wages occurs gradually, in parallel with the payment of alimony itself. According to Russian law, the amount of interest on collection from the defaulter cannot be higher than 70 percent.

Often, problems with debt collection arise when the debtor does not have a job or has unofficial income. In this connection, the debt is difficult to collect, as is the alimony itself. In such circumstances, the penalty is imposed on the personal property of the debtor.

The property of the alimony recipient is either transferred for the right of use to the recipient, or sold, and the funds received are used to eliminate the debt. The alimony holder can himself order the collection of a specific element of property. It is worth mentioning that only the executor has the right to formulate the order of property recovery. In a situation where the bailiffs discover savings in a bank account, they will immediately be arrested to liquidate the debt.

How is a penalty calculated and collected on debt obligations?

Not everyone knows that failure to repay a debt entails liability for late payments. Let's take a closer look at this issue.

Since the alimony payment responsibilities and arrears are not relieved from the alimony holder, he can be held financially responsible for the missed deadline for making payment amounts. This penalty is called a penalty. She leaves half a percent of the total debt amount daily until it is repaid. It turns out that the outstanding debt is not only being written off, it is increasing every day.

To collect the penalty, you need to contact the bailiffs to get a certificate about the current amount of the debt. Next, you need to contact the court with a statement of claim for the recovery of a penalty and attach a certificate. It is worth noting that a claim can be filed at any time, since the law does not limit this issue by statute of limitations. It is recommended to do this periodically, since huge amounts of debt and penalties will only delay the payment process.

In addition, family law prescribes payments not only for non-payment and alimony, but also compensation for losses that the alimony recipient suffered due to late payments. Unfortunately, the connection between losses and debt is difficult to establish.

How to find out debt by last name in 2021

The procedure for obtaining information about alimony debt is simplified as much as possible: in a special form on the website of a government agency or in an application, you only need to enter the full name of the alleged debtor, his date of birth and region. You will not need a passport or other documents, and the result will be ready within a few minutes.

It is most convenient and reliable to use the official FSSP website, but if you do not have access to the Internet or sufficient ability to use it, alternative methods will also help in solving this problem.

By calling the Federal Bailiff Service 8 you can obtain information about the debt by providing the full name, region and date of birth of the debtor. Calling this number from any region of the Russian Federation is free.

You can also find out the debt by visiting the territorial department of the FSSP during reception hours or the multifunctional center (MFC) of the region of residence; to obtain information you will need an identification document (passport). The bailiff may require clarification of the reasons for the debt and the timing of its repayment.

Mechanisms affecting the defaulter established by law

If all material methods of collecting debts from the alimony provider have been tried, you can turn to other methods of encouraging payment. They have nothing to do with the material side of the issue. Non-material methods of incentives appeal to the inner morality of the defaulter. These methods include:

- The process of depriving a parent of parenting rights for non-payment of child support.

- Criminal liability.

Such radical methods are used extremely rarely and are applied to persistent defaulters. Let's take a closer look at each of them.

Criminal liability for non-payment of alimony

Consistent evasion of alimony payments is a criminal offense. Therefore, only a court can hold people accountable, and on very serious grounds.

Based on criminal law, a stable evasion of alimony payments is considered to be:

- The alimony payer changed his place of residence in order to deliberately not pay money.

- Deliberate understatement of income.

- The alimony worker is not looking for work.

- Payment of alimony does not occur for more than nine months.

- An impressive amount of alimony debt.

- The alimony holder has already received a warning letter from the executor about the possibility of criminal prosecution.

- The alimony recipient has already received a warning letter about the lack of action to pay the debts.

The legislation reflects the following forms of punishment for non-payment of alimony:

- Correctional work - they are performed either at the place of employment or are determined by local authorities. Duration from two to twenty-four months.

- Compulsory work - performed during free time from work or study. Duration from 60 to 480 hours, but no more than 4 hours a day.

- Arrest – isolation from society for a period of one to six months.

- Deprivation of liberty is isolation from society in penitentiary institutions.

In addition to such strict measures, the bailiff can bring the debtor to administrative liability. In this case, it is difficult for the alimony worker to travel abroad, or he is deprived of his driver’s license. Such methods of influence often work, but the possibility of getting a criminal record is certain.

The procedure for the alimony collector in the event of a debt

If enforcement proceedings for the collection of alimony have already been opened, then it is not recommended to contact the bailiffs immediately as soon as there is a delay. Sometimes payments are simply delayed for reasons beyond the control of the alimony provider and arrive a little later than usual.

You can visit the bailiff approximately 4 months after the start of non-receipt of payments, since 4 months is a quarter, therefore, the bailiff will be able to fully determine the amount of debt accumulated during this period and take the necessary measures to collect it.

First, the claimant needs to write a free-form application notification about the termination of alimony payments:

It is advisable to attach proof to this application confirming the absence of payments , for example, a printout of a bank card account for recent months.

Simultaneously with the notification, a statement (petition) is written for the calculation of alimony arrears:

These documents are handed over to the bailiff conducting enforcement proceedings: you can visit the civil servant at a personal reception or send applications by registered mail with acknowledgment of delivery. Once the debt calculation is ready, the bailiff will be able to hold the debtor accountable for various types of liability in order to pay off the debt.

Is it possible to release the debtor from paying alimony arrears?

In court practice, there are situations when the amount of debt is reduced or completely written off from the debtor. Of course, there must be serious reasons for this that prevent the payment of alimony.

Such circumstances include: serious illness, loss of employment, financial difficulties, the emergence of new dependents, and the like. There is no specific list of situations in the legislation. Mitigating circumstances are supported by documents or witness testimony at the hearing.

Thus, enforcement proceedings can be called the initial mechanism for collecting debt from the alimony provider. Sources of liquidation can be not only wages, but also the property of the debtor. In addition, the recipient may file a claim in court to recover a penalty.

The legislation establishes various methods of putting pressure on the defaulter, including imprisonment. In addition, the alimony provider has the opportunity to avoid debt payments. To prevent this, you can ask a lawyer by phone or online on our portal.

What circumstances are considered valid for writing off part of the alimony?

Sometimes the courts accommodate debtors and, given the difficult situation in which they find themselves, decide to write off part of the unpaid debt.

Here are the reasons that the court will consider valid:

- Serious illness of the payer;

- Serious deterioration in the financial situation of the payer that occurred through no fault of his (war, unrest, man-made or natural disaster);

- A change in the payer's marital status that makes payment of alimony impossible. For example, the emergence of new disabled dependents.

Let us dwell on these points in more detail.

A serious illness of an alimony debtor can be recognized as such damage to health, due to which the payer lost his job and is unable to find a new one. And he is now forced to live on a disability pension.

Deterioration of financial situation. If a person, along with his property, finds himself in the epicenter of military operations or natural disasters that destroy him (the property), then his debts will be written off.

Finally, when new disabled dependents appear: newborn children, young adopted children, disabled people or simply disabled relatives, the amount of alimony may be reduced.

But in this case, the payer must prove that after paying alimony (and the amount, according to the law, in case of forced collection can reach up to 70% of income), his new family will not have money left even for minimal needs.

But the most important thing: for debts to be written off, a combination of two circumstances is necessary - the lack of funds to pay them and the objective nature of the reasons that led to this absence. This requires evidence.

These include:

- Medical report on health status or disability status;

- Certificate of payment of unemployment benefits as proof of lack of work;

- Court verdict of imprisonment;

- Certificate of disability;

- Certificate of new marriage;

- Birth certificate of another child.

Depending on the situation, other official confirmation of your own personal or financial ill health will also be useful.

There are situations when child support can be written off

Firstly, if the payer proves that the child for whom he pays child support lives with him most of the time. In this situation, the court will most likely recalculate the amount of payments, reducing them proportionally.

Secondly, if the payer disputes his paternity. Moreover, simply filing a statement that he does not consider the child his own is not enough.

The payer must prove that he was misled by the child's mother. In these cases, the court may take the plaintiff’s side and release him from child support for someone else’s child.

The amount of alimony can be reduced or even the debt written off, but this is an exception to the rule

This can be done if you find yourself in a really difficult life situation. If alimony was paid by mutual consent of the parties, that is, by agreement, the parties can change the amount and payment rules. If the decision was made by the court, only it can make a new decision. But in any case, it will not be possible to disown payments for minors (your own) children.