Author of the article: Anastasia Ivanova Last modified: January 2021 10436

If a citizen is entrusted with the obligation to pay alimony, a certain percentage is calculated from his wages in favor of the claimant. Situations often arise when an employee is fired, or he decides to change his job. When the alimony payer is dismissed, he is paid all the benefits and compensation due for a particular case. Let's figure out from which payments due to the employee alimony is withheld upon dismissal.

Law on dismissal of alimony worker

The procedure for the employer's actions in the event of dismissal of the alimony worker is regulated by Art. 111 IC RF and Art. 5 No. 229-FZ. According to this article, a company that withholds alimony on the basis of a court decision or a certificate certified by a notary is obliged to report the dismissal of an employee to the executive authorities. The deadline for this is three working days. Also, the person receiving alimony - the second parent - is notified of the dismissal of the alimony provider. If the employer has information about the subsequent place of work of the alimony payer, he must provide this information too.

When moving from one place of work to another, the parent involved in paying child support does not have the right to hide the new place of employment. He must inform the bailiff and the person receiving alimony about the change of employer. Notification of additional earnings, if any, is also required. Failure to comply with these requirements may result in the responsible persons being subject to administrative liability.

Should alimony be withheld when purchasing an employee's property?

In practice, a situation is possible when the employing organization purchases expensive property from an employee, for example, an apartment or a car. The relevant question is: is it necessary to withhold alimony under a writ of execution in this case?

Disputes on this topic have been going on for a long time. The current legislation of the Russian Federation does not clearly explain from which income alimony should be withheld. Therefore, some courts made decisions in favor of the recipients, while others argued that such income should not be subject to alimony. In other words, until recently, the solution to this complex issue was entirely left to the judges.

So, for example, in the Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Republic of Mari El dated May 20, 2010 in case No. 33-704, the following conclusion was made. Withholding alimony is possible if income is received from the sale of property (according to the case file - a car), i.e. the amount received exceeds the price of the property at purchase. Otherwise, there is no reason to believe that as a result of the alienation there was an increase in property, that is, the citizen received income from the sale of an item that was in his possession and use. Under such circumstances, it cannot be accepted as correct that the citizen has received income from which alimony for a minor child should be withheld on the basis of subparagraph “o” of paragraph 2 of the List, approved. Resolution No. 841.

The ruling of the Constitutional Court of the Russian Federation dated January 17, 2012 No. 122-O-O actually proclaimed the opposite conclusion - when selling real estate and other property, an obligation to pay alimony arises. This is a fairly large part of the cost - from 25% to 50%, therefore, despite the fact that decisions of the Constitutional Court of the Russian Federation are binding on all citizens and organizations, it is better to warn the citizen in advance that the organization purchasing the property, which has a writ of execution for alimony , will be forced to make deductions and obtain his consent to this.

In what cases can a child support worker be fired?

The fact that an employee is a child support worker does not protect him from dismissal . The employer has the right to dismiss such an employee, like any other, for the following reasons:

- evasion of fulfillment of assigned obligations;

- absenteeism;

- inadequacy for the position held;

- staff reduction.

Additional information

All this is described in detail by Article 81 of the Labor Code. If there are compelling reasons, the employer has the right to dismiss the alimony payer as well as an employee not burdened with monthly payments.

Features of collection

If the alimony payer quits his job, then payments are deducted from his total income only if they are used to support minor children.

The main basis for collecting alimony during a reduction are only two documents: an agreement between husband and wife, which was concluded and certified by a notary, and a court decision that carried out the divorce procedure for the former spouses.

If any of the described documents is in the accounting department of the resigning employee, then she can calculate alimony from the following payments (Federal Law Article No. 841):

- With bonuses and other forms of remuneration.

- With additional payments and increases that are associated, among other things, with the peculiarities of working conditions.

- From a fee or salary.

- From other types of employee profit specified by Labor legislation.

The possibility of paying alimony from subsidies, scholarships, and pension payments is not excluded, but in this situation they should be calculated not by the employer, but by other organizations.

It should be especially emphasized that from the employee’s final profit, which is obtained upon reduction, alimony has the right to be deducted only due to the maintenance of minor children, but not to pay alimony for (Article 100 No. 229FZ):

- Providing for a disabled child who has reached the age of majority.

- Maintenance of disabled parents.

- Providing for the ex-wife.

Dismissal procedure

Regardless of what was the reason for terminating the employment relationship between the employee and the employer - failure to fulfill labor obligations or the personal desire of the person to leave his position - the procedure for dismissing the alimony payer must be followed. For example, when removing a person from a position for absenteeism, the procedure will be as follows:

- identification of the fact of absenteeism and documentary evidence (memo, act, etc.);

- determining the reason for absenteeism - the presence or absence of valid reasons;

- registration of dismissal under the relevant article with making a note in the work book and personal file.

Because the presence of minor children who are entitled to monthly payments is not a “mitigating circumstance,” an employee can be dismissed according to the same scheme and on the same grounds as other employees. The only nuance can be considered an increase in bureaucratic procedures and mandatory compliance with the following formalities:

- drawing up and sending notices and writs of execution to bailiffs;

- sending a corresponding notice to the second parent receiving child support.

The employer is responsible for the timely provision of the specified documentation to the authorities.

The child support payer has a child

As a general rule, the amount of alimony is 1/4 of the amount of income for one child, 1/3 for two children, 1/2 for three or more. The size of these shares may be reduced or increased by the court, taking into account the financial or family status of the parties and other noteworthy circumstances.

It is important for an organization’s accountant to remember that the birth of their own children (in a new family) is not a basis for reducing the amount of child support for a child left with the other parent. It is either the court or the child’s parents by mutual consent that must change the amount of alimony, and not the accountant.

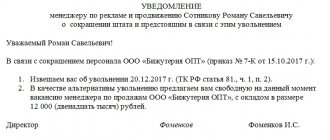

How to create a notification?

As a rule, the HR department is responsible for preparing a letter to the bailiff service. The notice of dismissal of the alimony provider is drawn up strictly in accordance with the sample. Only in this form will it be accepted for consideration. The document is drawn up in the application format. It must contain:

- table of contents or “header” of the document;

- date of dismissal of the employee and termination of employment;

- the position held by the employee before termination of the contract;

- amount of payments.

The notice of dismissal of the alimony provider is marked with: date, signature and seal.

It is also necessary to take care of timely notification of the employee’s wife (husband). The other parent and child have a legal right to know the work status of the person paying child support. Such a notification indicates on what date and on what grounds the alimony payer was dismissed, and therefore transferred from the status of “payer” to the status of “debtor”.

At the top you should indicate the name of the organization itself, followed by information about the recipient - in whose name the notification is written. For example, “To the bailiff in the OSP for the Zelenograd joint-stock company.” Then the next line indicates the last name, first name and patronymic of the person receiving alimony. For example, “To the collector of alimony, Surina Irina Nikolaevna.” Below is the phrase “Message about the dismissal of an employee.” The subsequent text in the notice reflects information about the reason for the dismissal of the alimony worker, for example, under the article or at his own request. If the employment contract is terminated due to absenteeism or neglect of assumed obligations, then the letter indicates the article under which the employee was dismissed.

Reasons

If there are signs of a crime under the Criminal Code of the Russian Federation, namely, refusal to pay alimony, systematic non-payment, concealment of one’s actual earnings, failure to report a place of work, its change or change of residence with evasion of deductions under a writ of execution, the state executor draws up an act of violation.

A resolution to bring the citizen to justice is sent to the relevant law enforcement agencies. Based on the results of consideration of the submissions of state executors, one of the following decisions is made in accordance with the Code of Criminal Procedure no later than three days:

- to initiate a criminal case;

- regarding refusal to initiate criminal proceedings;

- about the direction of representation according to affiliation.

If it is necessary to conduct an inspection at the request of a state executor, it is carried out by a law enforcement agency within a period of no more than 10 days. In the event of a groundless refusal to initiate a criminal case against a debtor who evades payment of alimony, the state executor is obliged to take all measures to appeal it in the manner prescribed by law.

A fairly common question is from what types of income it is necessary to withhold alimony: is it possible to withhold alimony from sick leave, which is financed from the Social Insurance Fund, material assistance, compensation for days of unused vacation and other payments.

The basis for suspension of enforcement proceedings for the collection of alimony is the death of the recipient. In the event of the death of the parent with whom the minor remained, the state executor is obliged to notify the guardianship and trusteeship authority to establish supervision over the child, and apply to the court with a proposal to replace the deceased party with a successor; enforcement proceedings are subject to suspension in accordance with the Law. The court shall consider the submission within ten days, notifying the parties and interested persons.

One of the documents on the basis of which child support is assigned and paid is a certificate from the executive service about the impossibility of collecting alimony due to evasion of payment.

Thus, if the actions (inactions) of the debtor contain signs of evasion from paying alimony, as a result of which it is impossible to implement the decision to collect alimony, the state executor issues the appropriate certificate to the claimant for submission to the labor and social protection body for registration of temporary state assistance to the child. To resolve the issue of providing such certificates in a single form, their form was established by a joint letter from the Ministry of Justice and the Ministry of Labor. Responsibility for the accuracy of the information provided rests with the state executor and the head of the relevant territorial GIS body.

How to send a notice to the bailiff service?

In Art. 111 IC RF and Art. 5 No. 229-FZ states that the employer is obliged to send a notice to the bailiffs within three days from the date of dismissal of the alimony worker. However, there is no exact time frame for returning the writ of execution. The best solution would be to send the documentation the next day after dismissal. There is no point in delaying this, since untimely notification of executive authorities about the removal of an employee from position is punishable in accordance with Part 3 of Art. 17.14 Code of Administrative Offenses of the Russian Federation:

- a fine of 15-20 thousand rubles for an official who neglects his obligations;

- a fine of 50-100 thousand rubles, which is imposed on an organization for late notification.

You can provide all documents to the bailiffs by mail - registered mail with notification. In exactly the same way, a letter is sent to the second parent – the child support collector.

Is alimony charged on compensation for unused vacation?

Unused vacation entitled to an employee by law can be received in the form of monetary compensation. The number of days allocated to this employee for rest during the period of time worked is taken into account.

As mentioned earlier, not all income can be recovered from alimony payments.

However, compensation for unused vacation in Russian Government Decree No. 841 is included in the list of income, which means alimony is collected from compensation for unused vacation upon dismissal.

An enterprise that is paying for an employee from whose income alimony was collected is obliged to withhold part of the funds from compensation for unused vacation and transfer them to the recipient of alimony. But, this is done only after tax costs.

What should an accountant do?

After the dismissal of the alimony worker, the accountant needs to do important work - collect a personal file and send it to the company’s archives. The following documents should be placed in your personal file:

- a copy of the writ of execution, which contains information about funds withheld from wages and the balance of payments;

- a duplicate of the dismissal order;

- copies of notification letters sent to the executive authorities and to the second parent;

- a list of papers that make up a personal file.

If the company has a documentation log, then a corresponding note is made in it, the date of dismissal and sending of documents is indicated.

Retroactive dismissal of an employee

It often happens that the alimony payer introduces ambiguity into the issue of employment, dismissal or continuation of work in the same place. For example, he repeatedly plans to submit his resignation and then changes his mind. A company manager may be faced with a difficult question regarding what to do if an employee is fired retroactively. After all, in fact, we are dealing with a violation of the law in the form of delays.

For untimely submission of a writ of execution and some other inconsistencies, the employer may be punished with a fine. Therefore, it is extremely important to correctly explain the reason for the untimely submission of documents to the executive bodies. If an employee regularly committed unlawful acts, failed to fulfill assigned obligations, or was noted for absenteeism, the employer can fire him on his own initiative by applying the article. In this case, the retroactive dismissal of the alimony payer cannot be considered a violation of the law.

Amounts of alimony payments for the unemployed

In what amounts should alimony be paid if you are fired, if the debtor does not work (or works “in the dark”)?

This is determined by exactly how the relevant duty was established:

- Agreement on payment of alimony. In this case, all issues regarding the payment of alimony depend entirely on the parties themselves.

- By court decision. Such alimony can be paid in the form of:

- a fixed amount of money;

- percent of the payer’s income;

- a fixed amount and interest at the same time.

It is alimony in a predetermined amount that is most often prescribed by the court when a parent turns out to be unemployed or “gets by” doing odd jobs or working unofficially. Most often, the basis in such cases is the cost of living and the average salary, which depend on the region of residence of the alimony recipient. When assigning the amount, the number of children whom the alimony payer is obliged to support is also taken into account.

Payment of alimony cannot be canceled in any way due to lack of work , so amounts not paid on time accumulate in the form of a debt that can be collected through the debtor’s property.

If the alimony payer quits or is fired, and in fact does not have a job (is unemployed) and is registered with the employment service, the court may establish alimony as a share of the benefit received. However, if the second party can prove that the benefit is not the only type of income, and the debtor has other regular income (for example, from renting out housing), the court may additionally award alimony in a fixed amount.

Nuances

The dismissal of an alimony payer does not mean the termination of payments. After delivering a letter of termination of the employment contract to the second parent, he has the right to control the situation by inquiring about the receipt of information about the new place of work from the bailiffs.

A notification letter must be sent to the parent on the day of termination. Timely information is clearly regulated by law. A delay of even one day may be grounds for filing a complaint.

By agreement of the parties

When an employment contract is terminated by agreement of the parties, the employee is paid a salary on the last day of payment for the time actually worked, as well as compensation for vacation that was not used during the working period. Additional payments under labor legislation are not provided for on this basis, since the parties voluntarily agreed to terminate the employment relationship.

Consequently, alimony upon dismissal by agreement of the parties is withheld from all of the above payments. Regardless of who and on what basis they were accrued during the work of the alimony worker.

Withholding of funds must be carried out from amounts from which personal income tax has already been calculated, since these payments are not subject to personal income tax benefits .