Is it possible to inherit pension savings?

First, let’s define what is considered pension savings. Every person who is officially employed or registered as an individual entrepreneur makes pension contributions to the pension fund.

They are formed from the insurance and savings parts. Insurance is transferred to the Pension Fund of Russia, and savings is transferred to a non-state pension fund for further investment.

A citizen himself can take part in determining the size of his future pension. To do this, you need to participate in the co-financing program or transfer maternity capital funds.

The insurance portion is not subject to inheritance. You can only inherit the funded part of the pension, funds received from co-financing and maternity capital funds (if they were transferred to the funded part of the pension). However, the procedure for receiving these funds by heirs varies.

able-bodied citizen

The funded part of the pension can be inherited in the following cases:

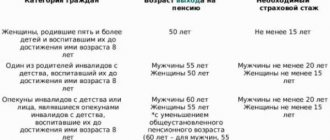

- If the monthly payment from pension savings has not yet been made. That is, the citizen has not yet reached pre-retirement or retirement age.

- If a citizen has taken advantage of the opportunity to receive an urgent pension payment. That is, he has reached pre-retirement age (55 years for women, 60 for men). In this case, the remainder of the accumulation part is inherited.

- If a payment has been assigned but has not yet been paid, then both the payment amount and the remaining funds are inherited.

That is, if the testator submitted an application to the pension fund for the unlimited payment of pension savings, then the heirs will not be able to claim them.

This inheritance procedure applies exclusively to the funded portion transferred by the employer and received from the co-financing program. Maternity capital and funds from its investment are inherited in a special order.

Pensioner

Funds from the funded pension of a citizen who has reached retirement age and has written an application for an indefinite payment are transferred to the reserve of the Russian Pension Fund. Heirs cannot claim them.

The exceptions are:

- maternity capital and funds from its investment;

- funds received under the co-financing program.

Maternity capital is subject to special rules. We'll look at them below. And the funds received from participation in the co-financing program can be received by legal successors according to the general rules of inheritance of savings, even if the deceased was a pensioner.

General provisions

The legal guarantee of succession to a funded pension is clause 12 of Article 9 of Federal Law No. 173 “On Labor Pensions in the Russian Federation ,” which specifies how funds from the individual personal account of the insured person are spent after his death.

Savings are not transferable to interested parties if the deceased owner of the pension received it at least once with the accrued funded part.

In other cases, the money will be paid to citizens who have the right to inherit funds by application (agreement) or by law.

The holder of payments has the right to determine the fate of his funded pension during his lifetime . He can appoint citizens to inherit a pension when concluding an agreement with a non-state pension fund on compulsory pension insurance (OPI).

In one of its paragraphs it is proposed to include legal successors and their respective shares of savings. Also, the administrative document in relation to the material assets of the deceased is his statement written in the branch of the pension fund at the place of residence. In it, the testator stipulates who and in what amount will receive money after his death.

Any citizens can be included in the agreement or application at the discretion of the pension owner.

Important! In the absence of administrative documents, the funded part of the deceased’s pension is distributed among his relatives. In this case, the first stage of heirs includes children, parents and spouses, the second - sisters, brothers, grandmothers, grandfathers and grandchildren of the deceased.

How to bequeath pension savings?

Every citizen has the right to independently choose the recipients of their pension savings.

But pension savings are not included in the total inheritance. They cannot be included in a will or inheritance agreement. The recipient must be selected by submitting an appropriate application to the non-state pension fund with which the agreement has been concluded. The recipient of funds can be any citizen, and not just a relative of the deceased.

If several applications were completed, the recipient will be the heir from the last application. In addition, in the application, a citizen can specify several recipients, as well as divide the total amount of pension savings between them in any shares.

Inheritance of a non-privatized apartment

Inheritance of bank (cash) deposits

How can an heir receive a pension?

Whatever fund the accumulated savings of the deceased are in, the fund will not initiate the inheritance procedure.

The initiative to receive an inheritance pension comes from the heirs themselves, who must submit an application to the Pension Fund or Non-State Pension Fund and attach the necessary papers.

The list of documents can be clarified at the fund. As a rule, this is: a death certificate of the insured person, a passport of the heir, SNILS of the deceased and the heir, documents confirming family relationships.

The application period is limited - no later than six months from the date of death of the insured person (Article 1154 of the Civil Code of the Russian Federation). A missed deadline can only be restored through a judicial procedure.

Who inherits pension savings?

The list of recipients of pension savings is established in clause 7 of Art. 7 Federal Law of 2013 No. 424. They are:

- persons indicated in the statement of the deceased;

- mother, father, adoptive parents, children (natural and adopted), official spouse;

- grandfathers, grandmothers, grandchildren, as well as full-blooded and half-blooded sisters and brothers.

That is, the list of recipients of pension savings is significantly smaller than the order of successors when inheriting other property of the deceased.

An exception is provided for the balance of maternity capital that remains after receiving an urgent pension payment. The remainder of the capital and income from its investment is transferred to:

- the father of the child at whose birth the right to maternity capital arose;

- children of the deceased certificate holder who, at the time of his death, have not reached the age of majority or are studying full-time (but not older than 23 years).

It is important to know

The legal procedure for receiving a funded pension from a deceased husband has a number of features that need to be taken into account in order to avoid complications and complications.

- Only the widow of a citizen born in 1967 and later can claim her husband’s savings. Those born before this date have no funds in the savings fund. The exception is those cases when a person formed this type of pension from personal funds.

- An application form for receiving a funded pension of a deceased spouse or for renouncing it can be downloaded on the Internet or obtained from the territorial division of the pension fund.

- Within six months from the date of the death of her husband, a woman can change her decision regarding the funded part of his pension. For example, if she first refused payments, and then decided to declare her rights to her husband’s finances, then an application with a later submission deadline to the pension fund will be accepted for consideration.

- If a woman restored the deadline for filing an application for payment of funds in court, then the documents she sent to the pension fund will be considered not five days, but ten.

Provided that all legal norms are observed, the succession process will not cause organizational difficulties. When filing claims for the funded part of the deceased husband's pension, the widow must take into account the deadlines for submitting documents, provide reliable information to the pension fund, and rely on the legislative framework in making any decision.

If you find an error, please select a piece of text and press Ctrl+Enter.

Procedure for registering pension savings as an inheritance

Regardless of how the rights to a citizen’s pension savings arose (according to the application, due to family ties), it is possible to inherit funds only upon the application of the heir.

If the successor does not independently apply to the pension fund within 6 months from the date of death of the testator, then the funds are transferred to the fund’s reserve. However, if the deadline is missed for a good reason, the heir has the right to restore it through the court.

In court, it is necessary to prove that the reasons are valid (long-term illness, long business trip, lack of information about the death of the testator).

Reference! If a citizen did not know that pension savings can be inherited, this is not considered a valid reason.

Registration procedure:

- Contacting a pension fund.

- Providing an application and documents.

- Receiving payment.

Reference! The pension fund cannot establish payments and fees from the heirs of the deceased’s savings.

Moreover, heirs of pension savings do not pay personal income tax on the inherited amount.

Where to contact?

The application must be submitted to the pension fund with which the testator entered into an agreement during his lifetime. You can find out in which organization the funds are stored as follows:

- from the testator;

- at the Pension Fund branch;

- upon notification from the non-state pension fund with which the agreement was concluded.

In accordance with clause 8 of the Decree of the Government of the Russian Federation of 2014 No. 710, the fund is obliged to notify the heirs of the deceased about the availability of pension savings within 2 months from the moment of receiving information about his death. A document on termination of the contract is sent as notification.

The form of notification is established by Decree of the Government of the Russian Federation of 2015 No. 177p.

Sample notification

List of documents

To receive funds, heirs must submit an application. The document must include the following information:

- name of the pension fund;

- document's name;

- date of;

- request for transfer of funds;

- testator's data;

- account number;

- information about the heir;

- list of documents attached to the application;

- signature.

The application form is provided for by Decree of the Government of the Russian Federation of 2014 No. 710.

Sample applicationAlong with the application for inheritance of pension savings, the applicant must submit:

- passport;

- documents confirming the powers of the legal representative of the minor heir (birth certificate, order appointing guardianship, agreement on creating a foster family);

- a document confirming the relationship;

- SNILS;

- death certificate;

- information from the Pension Fund about the personal account number of the deceased;

- court decision to restore the application period (if any).

As well as a notarized power of attorney if documents are submitted through a representative.

When will they be paid

The funds are paid to the applicant 6 months after the death of the testator. The applicant himself chooses the transfer method:

- via mail;

- to a bank account.

The transfer must be transferred no later than the 20th day of the month following the expiration of 6 months from the date of death of the testator.

If the funds have not been transferred, you must contact the pension fund with which the deceased had an agreement.

How to receive funds after the death of a spouse: step-by-step instructions

If all the conditions specified in PP No. 710 and PP No. 711 are met, then the spouse of the deceased has the right of inheritance (succession). To implement it, you must strictly adhere to the following instructions when receiving funds.

Application deadlines

The widow has six months to make a claim for her deceased husband's pension savings. Within this period provided by law, the citizen must write a corresponding application to the Pension Fund or NPF and attach to it the established package of documents. The day the pension fund accepts such an application will be considered the date of application for the inheritance. If the wife of the deceased sends the papers by mail, then the day of application will be determined by the postmark .

You can find out more about how to receive these funds and go through the inheritance procedure here.

Documents and writing an application

Appendix No. 2 to government regulations No. 710 and No. 711 is an application form that the widow of the deceased must submit to the institution where the funded part of her late spouse’s pension was accumulated. Its completion is a mandatory part of the procedure for inheriting the funds of the insured person. You cannot deviate from the application form established by law. The document must necessarily contain the following information :

- The name of the division of the Pension Fund or Non-State Pension Fund in which the fund holder kept his pension savings.

- The basis for the right of succession (agreement on compulsory pension insurance, an application to the pension fund for the distribution of funds, or legal succession).

- Personal data:

- FULL NAME;

- date, month, year of birth;

- residential address;

- passport number and series;

- name of the identity document;

- phone number;

- insurance number of the personal account.

- Degree of relationship with the deceased insured person (indicated if the woman inherits her spouse’s pension by law).

- The desired method of receiving the savings funds of the deceased husband.

- Information about other relatives of the deceased pension owner (this column can be filled in at will).

The widow must support her application with originals or certified copies of the following documents:

- identification document, age and place of registration of the testator's widow;

- death certificate of the insured person (if available);

- insurance certificate OPS of the savings holder;

- marriage certificate (it is provided if a citizen applies for the pension of her deceased husband by law).

The widow of the testator can use the services of legal representatives when registering the payment . In this case, it will be necessary to submit to the official authorities identification documents and confirming the legality of the activities of the people to whom the spouse of the deceased delegates her powers.

You can find out more about how the funded part of a deceased person’s pension is inherited, what is needed for this and what are the details of registration in this material, and you can find out more about how to receive the funded part of a deceased person’s pension here.

Where to contact?

You can apply for payment of the funded part of the deceased husband’s pension by contacting any territorial division of the Pension Fund or the office of the Non-State Pension Fund in which the insured person’s savings were accumulated.

Terms of consideration

The application of the spouse of the deceased insured person for payment of savings after admission to the pension fund goes through a number of procedures . Within five working days from the date of submission of documents, the territorial body of the Pension Fund or Non-State Pension Fund verifies the correctness of their execution and the compliance of the specified information with reality.

Also during this period, the institution copies the papers and returns their originals to the testator’s widow. After which the applicant is given a receipt notification of registration of the application.

When the documents are submitted for processing, the pension fund checks whether the spouse of the deceased is indicated as a legal successor in his contract on compulsory pension insurance or in the application for the distribution of funds. If the deceased did not leave administrative documents, the management company establishes the fact that its client was married to a woman claiming to receive his savings.

The pension fund determines whether the applicant is entitled to payments and in what amount no later than the last working day of the month following the month in which the deadline established for legal successors to file applications with the Pension Fund or Non-State Pension Fund has expired. The widow must be notified of the decision in writing .

Calculation and payment procedure

The widow of the testator receives her due part of her husband’s savings (or the entire pension) no later than the 20th day of the month following the month in which the decision to pay was made. The money is transferred in one amount (more information about how much is required can be found here). At the request of the successor, they can be paid in cash from the pension fund’s cash desk, transferred by money order through the post office or sent to the applicant’s bank account.

Do I need to contact a notary?

To inherit pension savings, you do not need to contact a notary. There is a special registration procedure for them. Accordingly, the state duty for entering into an inheritance is also not withheld from them.

Please note that citizens who received funds from the deceased's funded pension are not considered his heirs. That is, they can refuse to receive the main inheritance and not pay the debts of the deceased (clause 8 of the Bulletin of Judicial Practice of the Sverdlovsk Regional Court of 2015).

Is it possible to refuse money?

The testator's wife is not obliged to become his legal successor. If a woman does not intend to receive the pension savings of her deceased husband, she needs to write a statement of refusal to the Pension Fund or Non-State Pension Fund. The form for this application is Appendix No. 3 to government regulations No. 710 and No. 711. It is filled out according to the same rules as the application for payment of the deceased’s savings.

If the widow refuses her husband's savings, her share of payments will be proportionally distributed among other legal successors. In this way, a woman can renounce her share of the funds, for example, in favor of the children of the deceased or his other relatives .

Rights of minor children to inherit their parents’ pension savings

A situation often arises when some legal successors receive payment in full, without mentioning the presence of others. Therefore, the law protects the rights of first-degree successors: parents, spouses and children. They are entitled to a share in the pension savings, even if the deceased has established other beneficiaries.

That is, a minor child, spouse or parent has the right to apply to the pension fund and receive a share of pension savings, the size of which depends on the number of first-priority legal successors.

These payments are made from the reserve share of the fund.

Reason for going to court

Issues of succession in relation to the funded pension of a deceased insured person can be resolved by his widow through the court . This is permissible if the woman did not have time to apply to the Pension Fund or Non-State Pension Fund within six months with an application for payment of her husband’s pension savings. In order for the court to rule in favor of the plaintiff, the reasons for the delay in submitting documents to the pension fund must be very compelling.

For example: long-term treatment in a hospital, caring for a bedridden patient, being outside the Russian Federation, and so on.

Lawyer's answers to popular questions

I am the only heir after the death of my brother. I don’t want to inherit because he has a lot of loans. But can I get my pension savings and not pay my debts?

Yes. As judicial practice shows, pension savings are not included in the inheritance estate. The recipient is not considered to have entered into the inheritance. So you can get your retirement savings and stay debt-free.

My nephew died. I am the only heir and have submitted all documents for the inheritance. Can I get his pension savings too?

Only if the nephew indicated you as a legal successor in the application in case of death. Otherwise, you will not be able to receive them.

When my father died, I began to draw up an inheritance. But I didn’t know that you could get pension savings. Can I apply to the pension fund 1 year after his death?

To get the savings, you will need to restore the term in court. However, it is necessary to prepare strong evidence that the deadline was missed for a good reason.

I missed the deadline for inheriting my father’s pension savings. Can I sue in my city if my father lived and worked in another city?

No. The application can only be filed at the location of the defendant. In your case, this is a branch of the pension fund with which your father entered into an agreement.

Mom lived in Vologda, and I lived in Moscow. She worked officially for many years. She became seriously ill, so she had to be admitted to a neuropsychiatric boarding school. A month ago she died. Can I receive her pension savings if I have been paying for boarding school accommodation all this time?

As a child, you are the first-degree heir. It is necessary to clarify whether she has submitted an application to the pension fund to appoint another legal successor. If not, you can get her pension savings.

Legislation that must be complied with

In order for a widow to become the legal successor of the deceased, a number of legal norms must be observed. She will be able to receive the funded portion of her deceased spouse’s pension if :

- the deceased insured person was a participant in the compulsory pension insurance program and accumulated funds in a personal account;

- the citizen’s husband died before reaching retirement age;

- if the testator has reached retirement age, but has not received savings payments.

Government resolutions No. 710 and No. 711 regulate cases in which the spouse of the deceased savings owner will not be able to inherit money from his savings account. She will be denied payment if:

- In the OPS agreement or in the application for the distribution of funds, the deceased husband did not indicate his wife as a legal successor.

- The woman filed an application for payment of pension savings after the expiration of the period allotted by law.

Deadline for submitting claims to inherit a funded pension

The law establishes certain deadlines for inheriting a funded pension.

Thus, heirs (successors) of pension savings accounted for during the life of the insured person in a special part of his individual personal account can apply for payment of these funds within six months from the date of death of such person to the territorial body of the Pension Fund at his place of residence.

In accordance with paragraphs 1 and 2 of Art. 1183 of the Civil Code of the Russian Federation, the amount of a funded pension can be paid to family members of a deceased person who lived with him, as well as his disabled dependents, regardless of the fact of living with the breadwinner. These persons must present their claims no later than four months from the date of death of the testator . Such rules apply when a lump sum payment was established during the life of the insured person, but was not received due to his death.

In any case, the payment of savings funds to the Pension Fund will be made only six months after the date of death of the insured person.

Procedure and terms of payment of the funded part of the pension

All pension payments are handled by the Pension Fund of the Russian Federation or a non-state pension fund.

Heirs are invited to choose a convenient method for transferring funds:

- Post office cash desk (Russian Post).

- Recipient's bank account or passbook.

The period for notifying the heir of the decision is no more than 3 working days from the date of filing the application. If the Pension Fund approves the request, a positive decision is issued. The refusal to pay the funded part of the pension contains the reason for this decision. The heir has the right to go to court and appeal the refusal within the period prescribed by law. If the case is won, you should re-apply to the Pension Fund of Russia - this time with a court decision. Payment is made according to the standard scenario: via mail or bank account.

The term for transferring money to the heir does not exceed 20 working days , excluding holidays and weekends.

Please note that the Russian Post deducts a commission for transferring funds from the Pension Fund to the recipient. It is best to find out about rates and conditions from your local pension fund or post office.

Thus, family members and dependents can count on the funded part of the deceased’s pension. Inheritance occurs in two ways: by order, and in its absence, by law. The deadlines for registering an inheritance are different - in the first case you will have to meet the 4-month deadline, and in the case of inheritance - within 6 months. The procedure for registration depends on the chosen method - through the Pension Fund or with the participation of a notary. The pension is paid only upon the premature death of a citizen. If the account holder previously received payments, they are not subject to inheritance.

How to inherit a pension

According to Art. 1183 of the Civil Code of the Russian Federation, pension savings are inherited. Art. 2 FZ-360 defines payments of this nature:

- one-time;

- urgent when establishing time periods;

- lifelong (indefinite);

- intended for heirs.

If those insured in the compulsory pension insurance system die, and there are some savings in their personal accounts, their relatives can inherit such money.

This becomes possible if the testators have died:

- before funds are disbursed or transferred in full (including additional savings);

- after the appointment of urgent payments (savings balances are intended for payment);

- after the assignment (but before the payment) of lump sums.

Attention!

If the insured person dies (or dies a natural death) after the establishment of a funded pension in an open-ended format, then the savings are not inherited. In other words, if the deceased has already received capital generated through contributions to the Pension Fund, inheritance is unacceptable.

Download for viewing and printing:

Federal Law of November 30, 2011 N 360-FZ (as amended on June 29, 2015) “On the procedure for financing payments from pension savings”

Civil Procedure Code of the Russian Federation dated November 14, 2002 N 138-FZ (as amended on December 19, 2016) (as amended and supplemented, entered into force on January 1, 2017)

In what cases can you not inherit a pension?

There are two situations in which a funded pension cannot be inherited:

- Payments of pension savings are not due to relatives if the testator received part of the insurance pension during his lifetime.

- Use of maternity capital - if it was allocated to the funded pension of the child’s mother, then after the woman’s death the baby’s father can receive it. If it is not there, then payments are due to young children. As for adult children, they can count on pension payments when completing full-time studies at a university. The rule applies until the child graduates or reaches the age of 23.

In the absence of such persons, savings are inherited in the general manner. But the amount of maternity capital is returned back to the deposit account in the Pension Fund. In other words, the pension is not inherited by the relatives of the deceased citizen.

Funded pension

A funded pension is a monthly lifetime cash payment to citizens, which consists of the pension savings of the insured person.

The inherited funded pension consists of:

- amounts that the employer withholds monthly from the employee’s salary and transfers them to his individual personal pension savings account;

- amounts of investment income from the placement of these funds.

These funds are located in the Pension Fund of Russia (hereinafter referred to as the Pension Fund) or in the Non-State Pension Fund (hereinafter referred to as the NPF).

From January 1, 2009, citizens who voluntarily entered into the state co-financing program will receive a funded pension .

The funds of the insured person's funded pension accounted for in a special part of his individual personal account, which were not assigned to him before his death, are . In other words, it is possible to inherit the specified pension savings only if the person did not live up to retirement age or, upon retirement, did not have time to receive them. If a citizen has been assigned a funded pension, and he has received it at least once , then all remaining funds in the personal account are not subject to inheritance.

The pension savings of citizens who have entered into the state co-financing program are inherited not only in the part consisting of transferred insurance contributions, but also in the part consisting of co-financing funds (provided that they were not assigned or received).

The situation is more complicated with the inheritance of a funded pension, which is located in a non-state pension fund. There are two options for inheriting such payments: under a non-state pension agreement (hereinafter - NPO or DPO) and under a compulsory pension insurance agreement (hereinafter - OPS).

When inheriting under an NPO or DPO agreement, it is necessary to take into account the general rules prescribed in Chapter V of the Civil Code “Inheritance Law”, since special regulations on this issue have not yet been developed. Inherited property here is the property rights and obligations provided for by the terms of each specific agreement. Such agreements can be re-issued to the heir (legal successor) or he can declare a demand for the redemption amount under it. In any case, to formalize inheritance transactions, you first need to obtain a certificate of inheritance , which will serve as the basis for their completion.