5

Alimony obligations serve to provide support to citizens who are not able to independently acquire everything necessary for their life. These are mainly minor children, but the law also provides for alimony for disabled parents, spouses, and some other persons.

Payers of alimony are obliged to fulfill their obligation within the established time limits, but in some cases they do not pay the assistance voluntarily. In such situations, recipients have the right to use the mechanisms provided for the collection of payments for the past period.

Grounds for collecting alimony for the past period

Alimony is calculated from the date of filing the application with the court. According to Art. 107 of the RF IC, it is possible to recover alimony for the past in 2021 in the following cases:

- no alimony agreement has been concluded between the parties;

- the defendant canceled the child support order;

- the payer intentionally evaded alimony payments;

- the recipient tried to collect alimony through the court or enter into an agreement.

Note! You cannot collect alimony if you have a notarized alimony agreement. If the father does not comply with the agreement, you should immediately contact the bailiffs. This document is equivalent in legal force to a writ of execution.

Period for calculating alimony

For the past period, it will be possible to claim money for no more than three years.

The terms of alimony obligations are established depending on the situation:

- child support until adulthood.

- alimony for a spouse on maternity leave – until the end of maternity leave. If she starts working before the child turns 3 years old, the alimony payer can file an application to cancel alimony for the former spouse due to her ability to work;

- alimony for a disabled person - for the period of establishment of the disability group.

The period for payment of alimony for needy pensioners is set by the court individually. Most often, obligations are lifted when a spouse enters into a new marriage or when disability is removed (Article 120 of the RF IC).

Amount of alimony for the past period

According to the law, alimony for the maintenance of minors is established in a shared amount or in a fixed monetary amount.

If the payer has several sources of income, mixed payments are assigned. To collect alimony for the past time, several circumstances are taken into account:

- Availability of verified income.

- Lack of official income, unemployment.

- Providing property to pay alimony.

Let's consider each option in more detail.

Have verified income

If the alimony obligee can confirm earnings during the time when he had to transfer money and the recipient tried to claim it, the amount of the debt is determined as follows:

- The salary is set for the entire period. The data is taken from the 2NDFL certificate.

- Earnings are multiplied by interest depending on the number of children.

When receiving different salary amounts, recalculation is carried out monthly.

Example. In April, R. N. Panteleimonov earned 20,000 rubles, in May – 35,000 rubles, in June – 29,000 rubles. All this time, the ex-wife tried to agree with him on the payment of alimony for their common child, but he avoided obligations. Then the woman filed a lawsuit to recover money for the future and for the past period. 20,000 x 25% = 5,000 rub. – amount for April. 35,000 x 25% = 8,750 – for May. 29,000 x 25% = 7,250 rub. - for June. 5,000 + 8,750 + 7,250 = 21,000 rub. – the amount of debt for the past period.

The defendant is unemployed or works unofficially

If the father does not work, but is not registered with the employment center or works unofficially, then alimony is calculated in a fixed amount. TDS is a fixed amount proportional to the cost of living per child in the region. For example, alimony can be assigned in the amount of 1 monthly salary. That is, when collecting alimony for the past period of 3 years, the amount of payment will be 36 months x 1 RM.

Example. Ilyin K.L. After the divorce, he did not pay child support for his son. His ex-wife repeatedly tried to conclude an agreement, but the man did not come to the notary. Official work with Ilyin K.L. there was none, but he had a constant income from renting out 3 apartments. The woman went to court to collect alimony for the past period. She asked for alimony in the amount of the subsistence minimum for the child. The court determined that Ilyin K.L. must pay alimony from the date of divorce, that is, for 12 months. The amount of PM in the region was 11,000 rubles. That is, the father must pay: 12 x 11,000 rubles. = 132,000 rub. and monthly another 1 PM.

Repaying debt by providing property

If the debtor owns real estate or valuables, he can provide them to pay off the debt. But this can only be done by notarial agreement.

What is needed for this:

- Determine the amount of debt.

- Establish the value of the property. For this purpose, an expert assessment is carried out.

- Transfer property into the ownership of a minor under a notarial agreement on transfer in payment of alimony.

Important! It is necessary to draw up an agreement, not a deed of gift. Drawing up a gift agreement without an agreement on the transfer of real estate to pay off alimony debt does not exempt the payer from transferring money to the child. The document must indicate that the property is transferred specifically to pay off alimony debt. In this way, you can pay off debts for the past period or save yourself from payments before the child comes of age.

How to collect arrears of alimony through the court?

How to recover additional expenses for a child, in addition to alimony?

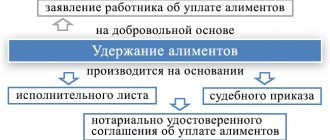

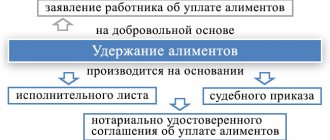

We check executive documents

Withholding of alimony is made on the basis of the following documents:

- writ of execution (form approved by Decree of the Government of the Russian Federation dated July 31, 2008 No. 579), which is issued on the basis of a court decision. Alimony can be collected in a fixed amount, in a share of the employee’s income, or simultaneously in shares and in a fixed amount;

- court order (a decision made by a single judge based on an application for the recovery of monetary amounts). In this case, alimony is collected only as a share of the employee’s income;

- an agreement on the payment of alimony concluded between the alimony payer and the recipient.

Each of these documents should be checked for compliance with legal requirements.

Performance list

This is a document issued by the court that states the reason and amount of deductions from the employee. Withholding under a writ of execution is possible only if it contains all the required details:

- name of the court that issued the sheet;

- number of the court case for which the sheet was issued;

- the date of the court decision to withhold funds from the employee;

- statement of the decision of the judicial authority;

- date of entry into force of the court decision;

- date of issue of the sheet;

- the name of the debtor and the person in whose favor the collection is being carried out.

The writ of execution is signed by the judge and certified with the official seal. Withholding of amounts of money from an employee’s income on the basis of a writ of execution is carried out without issuing an order from the manager on withholding and without the consent of the employee.

After the writ of execution is received by the organization, it must be registered and no later than the next day submitted against receipt to the accounting department.

In accounting, all executive documents are registered in a special journal and stored as strict reporting forms.

Agreement

If with a writ of execution (must contain the mandatory details listed in Article 13 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings” (hereinafter referred to as Law No. 229-FZ)) and a court order (the requirements for it are established by Article 127 of the Code of Civil Procedure of the Russian Federation) usually everything is in order, since they are issued by the court, then the verification of the agreement must be approached more thoroughly.

Thus, the agreement must be concluded in writing and certified by a notary (clause 1 of article 100 of the RF IC). Changes made or termination of the agreement are also certified by a notary. The document must comply with the requirements of Chapter 16 of the Family Code and contain:

- amount of alimony;

- the procedure for indexing the amount of alimony;

- methods and procedure for payment.

Let us remind you that alimony can be paid:

- in shares of the earnings (other income) of the alimony payer;

- in a fixed amount of money periodically or at a time;

- by providing property or other means (clause 2 of article 104 of the RF IC).

The agreement may provide for a combination of different methods of paying alimony.

Writs of execution can be presented for execution during the entire period for which alimony is awarded, as well as within three years after the end of this period (Part 4 of Article 21 of Law No. 229-FZ).

The procedure for collecting alimony for the past period

Algorithm of actions:

- Try to negotiate a voluntary transfer of funds.

- Save correspondence and recordings of telephone conversations - they will be needed to claim money in the future.

- Collect documents and evidence.

- File a claim with the district court at the defendant’s place of residence.

- Come to the court hearing. The parties are notified of the appointed date in writing or via SMS a few days after the registration of the statement of claim and other documents.

- Receive a court decision and writ of execution. The claimant himself transfers the IL to the FSSP. The bailiff will initiate enforcement proceedings within 2 months.

To collect a debt, the bailiff must:

- conduct a conversation with the debtor so that he pays off the debt voluntarily;

- request information about his property from the traffic police, from Rosreestr;

- request account information;

- send the writ of execution to the accounting department of the enterprise where the debtor works.

If the debtor is officially employed, then payments will be transferred automatically no later than 3 days after receiving the salary. Up to 70% of his salary will be withheld.

If a man evades obligations, an FSSP officer has the right to seize bank accounts, prohibit travel abroad, and petition for the confiscation of a driver’s license if the amount of debt exceeds 10,000 rubles. Repossession of property and subsequent sale at auction is carried out if the amount of debt is approximately equal to the cost of housing.

Who is eligible to apply?

Collection of alimony payments in 2021 for the past period can be made not only for minor children, but also for other relatives. Among them:

- spouses and former spouses during pregnancy or maternity leave, caring for a disabled child or an adult disabled child of group 1 since childhood;

- disabled former spouses who became disabled during marriage or within a year after divorce;

- needy former spouses who retired within 5 years after the divorce, if the marriage was long (5 years or more).

A spouse or former spouse can recover money for their maintenance if they prove in court that they asked the debtor to help them financially (Part 2 of Article 107 of the RF IC).

Jurisdiction

In 2021, the claim with the remaining documents will be filed in the district court:

- at the place of registration of the child’s father;

- at the mother’s place of residence, if the child is small or she has a disability;

If the man’s registered address is unknown, you should contact the court at the location of his property or at the last known address of his residence.

Adult relatives can only appeal to the district court at the place of registration of the defendant.

Statement of claim (sample)

The law does not establish the form of an application for the collection of payments, but it must comply with the requirements of the Code of Civil Procedure in terms of content.

The claim includes the following:

- name of the court;

- Full name, addresses of the plaintiff and defendant;

- passport details of the plaintiff;

- information from marriage registration and divorce certificates;

- data from children's birth certificates;

- an indication of the facts of deliberate evasion of child support payments by the defendant;

- links to evidence and legislative norms that allow you to claim money for the past time; claims - to recover payments from the defendant in a fixed or shared amount;

- a list of proposed documents.

- At the end there is a date of compilation and a signature.

Sample claim

Evidence base

When submitting documents and at court hearings, you will need evidence confirming that the defendant evaded collecting alimony.

It could be:

- Recordings of telephone conversations, witness statements, copies of paper letters, electronic correspondence. In them, the plaintiff must ask to buy clothes, shoes for the child, or transfer money for the maintenance of the child.

- The fact that a man evades transferring funds for a child is a complete lack of financial assistance on his part.

Unscrupulous fathers believe that they can transfer 1,000 - 2,000 rubles each so that they cannot collect alimony for the past. In fact, if the father’s income allows him to transfer more, then alimony will be collected, despite the minimum payments.

Required documents

When going to court, in addition to the statement of claim, the following is provided:

- calculation (it is carried out by the plaintiff independently to substantiate the claims);

- passport;

- an extract from the house register that the child lived with his mother;

- salary certificates;

- certificates of marriage and divorce, birth of children.

If a representative acts on behalf of the plaintiff, you will need his passport and a notarized power of attorney.

Payment of state duty

Based on Art. 333.36 of the Tax Code of the Russian Federation, the plaintiff is exempt from paying state duty. In cases of alimony, it is paid only when the amount of payments is revised or alimony obligations are canceled under Art. 120 IC RF.

Maintenance of minor children and disabled parents

Alimony legal relations are regulated by Section 4 of the RF IC. According to Art. Art. 80, 87 of this legal act, parents are obliged to provide for their children until they reach the age of majority, in turn, adult and able-bodied children must take care of their parents if the latter loses their ability to work. Both parents and adult children establish the conditions and procedure for their maintenance independently; as a rule, the burden of providing for persons in need of financial assistance falls on them equally.

However, there are cases when an independent solution to the issue of paying alimony is impossible due to the existence of such reasons as the evasion of one of the parents, and sometimes both, from supporting the children, failure to fulfill obligations by children who have the opportunity to help the mother and father, but refuse to do so. Then the conditions and form of provision of maintenance by the debtor are established through the court.

In some cases, the guardianship and trusteeship authority is involved in the consideration of the case, which is also endowed with the necessary powers to initiate the procedure for the forced collection of alimony from the debtor through the court.

Financial support for spouses

In accordance with the provisions of Art. 89, 90 of the Family Code of the Russian Federation, spouses, both married and former, can demand the recovery of alimony through the court. However, to file a claim, the following grounds must be present:

- The spouse requesting alimony is incapacitated at the time of the appeal;

- Pregnant spouse, if the spouse refuses to provide for her voluntarily. Moreover, being married at the time of application does not matter. A claim can also be filed in the event of a divorce. To do this, you need to prove the fact of paternity of the debtor, if the spouse insists on the contrary, by providing a corresponding certificate from a medical institution about the duration of pregnancy;

- The spouse has the right to demand funds for her maintenance if the family has a common child under 3 years of age. As a rule, the mother devotes this period to caring for the baby, so she is not able to work and, consequently, needs financial support. The application can be submitted after a divorce, provided that a child is born during the marriage or within 300 days from the date of its dissolution;

- A spouse who has a dependent disabled child.

How can a father avoid paying child support for previous years again?

Often, after a divorce, parents agree that the man will transfer money voluntarily (without court and without agreement).

But after a few years, the woman goes to court and collects alimony for the past period. She explains that the money was transferred as a gift for her or as a loan, and the father did not give money for the maintenance of the child. There are real cases of judicial practice where such requirements were satisfied. To avoid fraudulent actions on the part of your ex-wife, when paying alimony voluntarily (without court or agreement), you must:

- transfer money to a bank card and indicate in the purpose of payment: Child support for (full name of the child) for January 2021;

- transfer money in cash only if the ex-wife writes a receipt confirming receipt of money for alimony.

Receipts from the bank for the transfer do not need to be saved. They spoil quickly. If you need proof, you can always take a bank statement. And the ex-wife’s receipts must be kept for at least 3 years.

Arbitrage practice

A review of judicial practice allows us to draw the following conclusions:

- If the court determines that during the disputed period the father financially helped the child, the court will refuse to satisfy the demands. Decision of the Leninsky District Court of Smolensk on January 23, 2021 in case No. 2-456/2020.

- If the defendant admits the claims, then the court collects alimony for the past period without additional evidence. Decision of the Central District Court of Sochi dated November 28, 2021 in case No. 2-5583/2019.

An example from judicial practice. The Martynovs divorced in 2017, leaving a common minor son with their mother. The woman applied for a restraining order. The father filed an objection to the court order and overturned it. The former spouses agreed on voluntary payments. Payments were received only for 2 months, then the ex-husband stopped communicating. For a year, the woman tried to demand alimony from him, but he did not respond to messages and calls.

In 2021, the ex-wife filed a lawsuit to recover payments through the court. Since the mother had taken measures to collect child support earlier, the court satisfied her demands. The funds were collected over the past 3 years. To calculate the debt, we took the average salary in the region - 29,000 rubles.

Calculation procedure: 29,000 x 12 (months) = 348,000 rubles. 348,000 x 25% (amount of alimony for one child) = 87,000 rubles. – the total amount of debt for the year. 87,000 x 3 (years) = 261,000 rubles. 29,000 x 25% = 7,250 rub. – payments for 1 month. Thus, alimony for the current period in the amount of 7,250 rubles will be withheld from the payer. per month and alimony for the past time. The total amount should not exceed 70% of the total income of the alimony holder.

Life situations

For a detailed analysis of the specifics of collecting alimony for the past, it is enough to familiarize yourself with the most common situations.

If the child is over 18 years old

You can collect child support for the past period until the child reaches 21 years of age. While the child is 18 years old, alimony can be collected for 3 years, at 19 years old - for 2 years, at 20 years old - for one year.

Example. The couple divorced when their daughter was 12 years old. From that moment on, the woman tried to claim alimony from the man, but went to court when the child turned 18 years old.

Evidence of attempts at a peaceful settlement is presented. Despite the fact that the plaintiff tried to obtain payments for 6 years, alimony was collected only for 3 years.

If the mother did not try to collect child support

If the mother did not take action to collect child support, the court will refuse to satisfy the requirements. This means that if the father did not know about the child, then he should not pay child support for previous years.

Example. The plaintiff filed a demand for the collection of alimony payments for the last 3 years, indicating that she and the defendant had not lived together for 12 years, but did not formally file a divorce.

It was established that the man did not know about the presence of a daughter, and his wife did not try to voluntarily demand money from him.

The latter is the basis for refusing to satisfy the claim, but the defendant himself invited the plaintiff to draw up an alimony agreement and indicate in it the amounts for repaying the debt for 3 years, as well as the amount of alimony for the future.

If paternity has been established

If paternity was established a year ago, it will be possible to claim funds only for this period, and not for 3 years, since the payer was not legally the father before.

Example. The child was born in 2021, there is a dash in the “father” column. His mother began living with his biological father in 2021, divorced in 2020 and decided to establish paternity. The examination showed a relationship. After this, the woman filed a claim for the recovery of alimony for the past period, i.e. for 2021, 2021 and 2021. The claim was denied, since obligations to provide financial support for children arise at the time paternity is established. If it had been received at the time the child was registered at the registry office, it would have been possible to recover the money.

Differences between alimony for the past period and alimony debt

There is a significant difference between these two concepts, although many people confuse them. To understand the differences in detail, just look at the comparison table:

| Alimony for the past period | Alimony debt |

| The recipient tried to claim money from the payer for alimony obligations, but to no avail | The payer was ordered by a court decision or other document to pay alimony, but he did not fulfill this obligation |

| Money is collected only for the last 3 years | The debt is collected for the entire period from the moment of formation and is not limited to 3 years |

| Termination of alimony obligations is made in connection with the death of the payer; it is not inherited | Debts for alimony are inherited. Inherited property may be seized for collection if its value is equal to the amount of debt. |

Limitation period for child support after the child reaches 18 years of age

Once the child reaches the age of majority, the right to receive financial support from the debtor ceases and alimony is not awarded.

What you can count on in this case:

- Demand the collection of debt from the debtor, which was previously formed as a result of the alimony payer’s evasion from fulfilling the obligation, provided that it exists. The statute of limitations in this case is 3 years.

The court decision must be transferred to the bailiffs, who will be responsible for ensuring its execution. If the debtor is not officially employed, his property becomes the source of debt repayment. Repeated appeal to the court with the same demands is not allowed.

Note!

If there are valid and justified reasons, the court may extend the limitation period. To do this, it is necessary to provide evidence of the circumstances that prevented the person from applying for restoration of his right within the prescribed period.

The reasons for absence may be the serious illness of the plaintiff, a long business trip, or other circumstances the occurrence of which prevented the filing of a claim (death of relatives, unforeseen events);

If a child is incompetent or disabled, he has the right to maintenance until he fully recovers. At the same time, disability alone is not enough; according to the law, it is necessary to prove that an adult disabled child is in need of financial assistance, since he is not able to provide for his own existence. Otherwise, he has no right to demand alimony.

Lawyer's answers to private questions

My son is 20 years old. I have been divorced for a long time and have not applied for alimony. Can I collect child support now?

If the child is 20 years old, then you can only recover child support for the past period. That is, for 1 year.

My ex-husband and I entered into an agreement. But he hasn’t paid alimony for a day, can I collect money for the past time?

To do this, you need to submit an agreement to the bailiffs. Explain that the agreement was not fulfilled. The money will be collected from the date of conclusion of the agreement.

I have a daughter born in 2021 from a woman with whom we were not married. The cohabitant established paternity through the court. Can she collect child support starting in 2021 if I transferred money to the child every month?

Alimony can be collected from the date the court decision enters into legal force.

I received a court order for alimony, but my ex-husband canceled it. If I file a lawsuit now, will alimony be collected only when the court decision comes into force?

You can indicate in your claim a demand for the collection of alimony for the past period. In this case, the court will order alimony from the date of filing the application for the issuance of a court order.

The ex-husband promised to transfer 10,000 rubles each month for 2 children. to each. But after six months the money stopped coming. Can I collect child support for the months when he did not pay money?

You can file a claim to collect alimony for the past period if you tried to get it. If during the months when he didn’t pay, you didn’t call, didn’t write, didn’t ask, didn’t go to court, then the court will refuse to satisfy the demands.

Alimony obligations of other family members

A number of persons entitled to collect alimony and the procedure for providing maintenance are presented in Chapter 15 of the RF IC. Thus, persons who have lost their ability to work have the right to receive financial support from close relatives. Close relatives are considered to be: sisters, brothers, grandparents, grandchildren, stepsons and stepdaughters. Also included in this category is a person who, not being a blood relative, actually supported and raised a minor child (educator).

Basic conditions for filing a claim:

- The plaintiff is a minor;

- It is impossible to demand child support from parents;

- The financial solvency of the defendant (bank accounts, property, high salary);

- The debtor's age and ability to work;

- A disabled person who has reached the age of majority has the right to alimony from other family members, provided that it is impossible to claim funds from able-bodied parents, spouses, and children.