What is inheritance law

Inheritance law is one of the main branches of civil law, which includes a set of rules relating to the transfer of inheritance rights.

Inheritance involves the transfer of property and property rights to the heirs. You can inherit by will or by law.

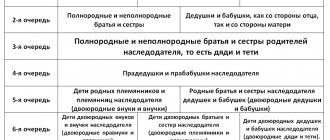

First of all, inherited property assets are transferred by law to parents, spouse, children or dependent disabled family members. By law, heirs can be appointed up to the sixth degree of relationship.

You can learn more about the inheritance procedure from the material “Inheritance Law”.

Entry into inheritance rights

The entry into inheritance rights is understood as a legal procedure that confirms the fact of a change of owner and the complete transfer of the obligations and rights of the testator to one or more heirs.

In order to exercise the right to receive property, it is necessary to perform the actions specified by law or submit an application to a notary’s office.

The actual transfer of the rights and obligations of a deceased citizen is enshrined in law. However, it must be confirmed in the event of a controversial situation with receipts and checks for the maintenance of an apartment or other inherited object.

You will find more detailed information on this topic in the article “How to enter into an inheritance.”

Ways to accept an inheritance

The actual entry into an inheritance is the basis for a notary to issue a certificate of right to it. But if a specialist considers the evidence insufficient, the fact of acceptance of property assets is established in court.

When deciding how to accept an inheritance, you need to understand that the transfer of rights and obligations in fact must be confirmed by certain actions of the successor:

- taking measures to preserve and protect inherited property;

- taking possession or management of property assets;

- payment of expenses for the maintenance of housing or other facilities;

- payment of the testator's debts at his own expense.

If the 6-month deadline for entering into inheritance rights by law or by will is missed, a claim is filed in court to establish the fact of acceptance of the inheritance.

The application is submitted at the place of his residence or the location of the real estate. The case is considered in a special proceeding, where the testimony of the applicant, other heirs and witnesses is taken into account.

If the successor has performed actions indicating the actual assumption of rights, then the law does not require the mandatory filing of an application to establish the fact of acceptance of the inheritance.

When the heir does not apply for a certificate to the notary, and he has reliable evidence of acceptance of the inheritance, the successor is considered to have actually accepted it.

Such circumstances most often occur in the case of joint residence of the testator and successor. In this way, the actual acceptance of the inheritance when living together is recognized.

Actions to actually enter into inheritance rights can be carried out both by the successor himself and by other persons on his behalf. They must prove that the heir does not renounce the property, but expresses his will to acquire it.

Find out more about the procedure for entering into an inheritance from the material “Accepting an inheritance.”

Inheritance by right of representation - what is it?

The Civil Code of the Russian Federation in Article 1146 establishes the legal successors of the deceased heir: the share of the legal heir in the event of his death before the opening of the inheritance or simultaneously with the death of the testator passes to the direct descendants of the heir, that is, to his children and is divided in equal parts between them.

Who can inherit by right of representation

The right of representation is valid only in the first three stages:

- spouses, children, parents;

- brothers and sisters (siblings and half-siblings), grandparents;

- uncles and aunts.

Therefore, the following can inherit by right of representation:

- grandchildren of the testator (as well as their descendants);

- nephews and nieces;

- cousins (cousins).

- That is, the circle of NPP persons is quite limited.

- In subsequent queues, the transfer of the right to accept inheritance occurs in the absence of applicants in previous queues according to the degree of relationship* (from third to sixth) - this is the general law of inheritance.

- Note*:

- The degree of direct blood relationship in neighboring generations and through generations (vertical relatives: parents - children; grandfather, grandmother - grandchildren; great-grandfather, great-grandmother - great-grandchildren, ... ancestors - descendants) is determined by the number of generations that passed before the testator was born.

- The degree of indirect consanguinity in one generation (horizontal kinship ties: full or half-siblings, twins, cousins, second cousins, fourth cousins, ...hereinafter referred to as the number of “tribes” brothers and sisters) is determined from a common ancestor.

- The degree of indirect consanguinity in neighboring “tribes” and through “tribes” is determined similarly to direct consanguinity: uncles, aunts - nephews (natives, cousins, second cousins); cousins and second cousins, grandmothers - cousins and second cousins, great-nephews).

Examples of inheritance by right of representation

First example

Single citizen N. has a married younger sister L. with two children, who is considered the second-line heir, and an aunt (third-line heir). According to the law, since N. has no direct heirs, the sister is a contender for the inheritance. But L.

dies of illness before his brother. After N.’s death, all his property, by right of representation, will pass to his nephews (sister’s children). But if L. had no children, then N.’s property.

would have passed to his own aunt, since the sister’s husband does not have the right of inheritance by representation (it is available only to descendants).

Second example

Citizen K. has no heirs of the first or second order (that is, there is no husband, no parents, no children, no siblings). The closest relatives are my uncle and aunt who have children. However, they die, and after K.’s death the right to represent the inheritance will pass to the cousins, who will divide it in equal shares.

Third example

Let's go through distant branches of the family tree to complicate the task:

- The closest heir of the 30-year-old citizen S. is the long-lived great-grandfather D. (heir of the fourth line, which includes relatives of the third degree of kinship).

- The great-grandfather has one surviving descendant, who is S.’s great-uncle.

- Of S.’s other relatives, there is only a great-niece (the granddaughter of S’s older half-sister, who is his paternal brother, that is, the daughter of his niece). The sister and daughter died tragically in a car accident. (Becoming a great-uncle at 30 is not a fantasy, but the consequences of unequal marriages of parents, when one is much older than the other, and he has an adult child from a previous marriage).

Question: How will the right to accept S.’s inheritance be transferred in the event of his death and the simultaneous death of D.’s great-grandfather?

Answer: Taking into account the fact that the representation of inheritance does not apply to the fourth stage, the right of inheritance passes to the next, that is, the fifth stage (great-nephews and great-uncles and grandmothers).

It turns out that the son of the great-grandfather and the granddaughter of the deceased sister will share S’s property.

among themselves, but it will go to both on the same basis - as to the participants in the subsequent (fifth) queue, since there are no applicants in the previous queues.

But after all, the son of his great-grandfather is his direct descendant, so how come there is no right of representation here? That's right, the children are direct descendants, but by right of representation (if there was one) the inheritance of S.

should have gone exclusively to his great-uncle (the only descendant of his great-grandfather).

But due to the fact that with the third degree of kinship this type of succession is impossible, the right of inheritance of the deceased’s property passed to the next line, in which, in addition to the great-uncle, there is also a great-niece.

When the descendants of an heir are denied the right of representation

Heirs by right of representation will not receive their share if:

- the will will deny them inheritance (according to Article 1118, paragraph 1 of the Civil Code);

- these persons will be recognized as unworthy heirs, in accordance with clause 1, art. 1117.

The point is quite contradictory and unclear:

Unworthy heirs (by law or will) are those who illegally tried to force a relative to change the will in their favor (or in favor of third parties), including them in the applicants or increasing the inherited share. These facts must be confirmed in court.

At the same time, despite the deprivation of the rights of unworthy heirs in court on the basis of confirmed facts (attention!), they “have the right to inherit property” (quote from an article of the civil code), if the deceased, after the loss of rights by scoundrels who tried to illegally squeeze out his property, will still indicate them in the will. Well, how can one not think here that legislators deliberately leave loopholes for criminals? It is interesting to look at who passed such laws.

Hereditary transmission

Transmission in inheritance law literally means the transfer of the right to accept an inheritance if the successor by law or specified in the will (transmitter) died after the death of the testator, without having time to assume his rights (Article 1156 of the Civil Code of the Russian Federation).

- The one who accepted the inheritance by way of hereditary transmission (transmissor) inherits only the property that the transmitter did not manage to accept from the testator.

- The rights to inherit the property of the deceased heir himself are transferred to his legal successors on the basis of standard rules of inheritance (in accordance with the law or on the basis of a will).

- The obligatory share of the inheritance is not transferred to the heirs. (The right to a compulsory share in the amount of at least half of the share due by law arises from disabled dependents, minor children of the testator and other persons listed in Article 1149 of the Civil Code of the Russian Federation).

Conditions for hereditary transmission

Hereditary transmission becomes possible if the following conditions are simultaneously met:

- the inheritance was opened;

- the term for accepting the assignment has not expired;

- the transmitter died before he could accept us (that is, he did not write an application for acceptance or refusal, or did not actually enter into the rights of ownership (use) of the property).

When can I receive it?

The inheritance can be accepted from the moment of its opening within six months. According to paragraph 1 of Art. 1114 of the Civil Code, the opening day is the date of death of the citizen.

If a person is absent for a long time and his disappearance subsequently has evidence of death, the period is determined by the court.

When a person is declared dead by a court decision, the countdown begins from the date established in the court order.

If you want to declare your consent to accept the property bequeathed to you, we recommend reading the article “Term for accepting an inheritance.”

What else do you need to know

The heirs acquire not only the property, but also the debts of the deceased. They are divided in proportion to the shares received. But this does not apply to all non-payments.

Olga Shirokova

Lawyer of the European Legal Service.

Some of them are subject to a strict non-inheritance rule. These are alimony payments, compensation for damage caused to the health and property of other people, loans from individuals not confirmed by a receipt, moral compensation. The heirs have nothing to do with such debts and are not obliged to pay them.

If the deceased is mired in debt and bequeathed it to you, sometimes it is more profitable to refuse the inheritance. Calculate which will be better. You can issue a refusal within six months. It cannot be cancelled. It is also impossible to refuse part of the inheritance - either everything or nothing.

Establishing the fact of acceptance of inheritance

When it comes to real estate and the testator is considered to have acquired rights under the law from the moment the case is opened, registration of rights to the property is necessary. It is impossible to legally own, manage and use a car without registering a license.

Documentary evidence is also necessary to carry out actions with bank accounts and other types of assets.

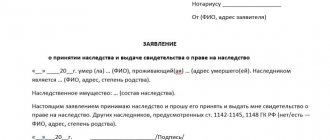

To obtain title documents, you need to contact a notary and submit materials proving the testator’s rights to the property, as well as confirm the fact of ownership and the existence of a family relationship with the deceased.

If the documents presented to the notary are not enough to conclude that property assets have been accepted, you should go to court. In this case, a claim is filed for actual acceptance of the inheritance and recognition of ownership.

Notary confirmation

First of all, it is necessary to prepare written evidence within the prescribed period. Then you need to contact a notary to obtain a certificate of inheritance.

Documentary evidence may include:

- rental agreements;

- certificates from housing maintenance organizations or local government bodies or internal affairs bodies about the cohabitation of the successor with the testator on the date of the death of the latter, about the residence of the heir in the inherited residential premises;

- a copy of the heir's statement of claim to the persons who have unjustifiably taken possession of the inherited property for the issuance of this property, with a court's note on the acceptance of the case for proceedings, as well as a court ruling regarding the suspension of the issuance of a certificate of the right to inheritance;

- receipts for repayment of credit debt;

- contracts for repairs in an apartment or house and more.

If evidence is presented, the citizen has the right to apply for a certificate when he considers it necessary. An application for the issuance of a certificate is submitted to the notary at the place where the case was opened, along with the above documents.

If recognition of the fact of acceptance of the inheritance is impossible, you need to ask a notary specialist to issue a certificate of refusal to issue a certificate indicating the reasons, and then go to court.

Proof through court

Initially, an application must be submitted to the court with a request to establish the fact that the inherited property has been accepted. After the claim is satisfied by the court, you need to submit a set of documents to the notary.

Having received judicial confirmation of the acceptance of property assets in fact, the notary draws up a certificate.

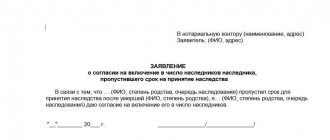

To exercise the right to enter into an inheritance, an application is submitted to establish the fact of its acceptance.

However, there are cases when the testator actually accepted the inheritance, but did not formalize it properly. Such an heir needs to formalize the legal right to the property through the court.

Documents for application

In court, the fact of acceptance of inherited property can be confirmed by documents on its contents and payment of the testator's debts. This may also include testimony of witnesses and certificates of place of residence if the successor lives in an apartment that is an inherited property.

When going to court, in addition to evidence and statements, you must submit the following documents:

- a copy of the death certificate of the testator;

- passport of a citizen of the Russian Federation;

- a paper confirming relationship with the deceased citizen;

- a notary certificate with information about which of the legal successors accepted the inherited property;

- a certificate from the housing maintenance organization or passport service stating who was registered at the same address as the testator;

- documents confirming the fact of opening and acceptance of the inheritance;

- papers confirming the existence of inherited property;

- receipt for payment of state duty.

This list cannot be considered final. The court may require other additional materials.

In order for all documents to have legal force, the date of their execution must be within the time limits established by law for entering into an inheritance.

The documents submitted to the court must bear the necessary signatures, seals and stamps.

Filing a claim

The statement of claim for recognition of the fact of acceptance of the inheritance must contain the date of death of the testator - a copy of his death certificate must be attached.

The application must indicate the reasons why it is impossible to establish the fact of entry into inheritance rights through a notarial procedure.

You can learn how to correctly draw up a document from the recommendation for its execution, “Sample Statement of Claim for Recognition of the Acceptance of an Inheritance.”

A claim to establish the fact of entry into inheritance rights, in accordance with Art. 266 of the Civil Code of the Russian Federation, is sent to the court at the place of residence of the applicant.

In the operative part of the document, it is required to indicate a clearly formulated legal fact: to indicate after whose death and by whom the property assets were actually accepted, as well as the reason for missing the deadline for acquiring rights.

Who can claim the inheritance

You can claim your rights to the deceased's property in several cases.

You have the right to an obligatory share in the inheritance

This is a priority reason for receiving an inheritance. Persons in this category participate in the division of property, even if the deceased wanted to dispose of it differently.

Among those who have the right of the Civil Code of the Russian Federation, Article 1149. The right to an obligatory share in the inheritance for an obligatory share in the inheritance:

- minor or disabled children of the deceased;

- disabled spouse and parents;

- disabled dependents of the deceased.

Disabled people, pensioners, and pre-retirees are recognized as disabled - men over 60 years of age and women over 55.

Persons in this category must receive a share of at least half of what they would have been entitled to upon inheritance by law (more on this below). Even if they are mentioned in the will, but their part according to this document is less than the amount determined by law, it will be recalculated to the required level.

However, the opposite is also possible. The share may be reduced or denied if the inheritance includes housing in which another heir permanently resides, or something that he uses to earn money.

If persons from this category receive a share in the inheritance fund (more on that below), the obligatory part is not allocated to them.

Your name is in the will

During his lifetime, a person can write a will of the Civil Code of the Russian Federation, Article 1118. General provisions and leave property to whomever he wishes - and not only what has already been acquired, but also what is only planned to be purchased. Family ties are not important here, what matters is the will of the testator. He can choose one or more heirs and divide the property among them in equal or different shares at his discretion.

The will is drawn up in the presence of a notary. It is important that the testator is considered legally competent at this moment. If there are reasons to believe that he was not capable of thinking soberly, then his orders can easily be challenged in court.

The contents of the will are revealed only after the death of the testator.

You have entered into an inheritance agreement with the deceased

Unlike a will, it is a public document. It sets out the conditions that the heir must fulfill in order to receive the property of the deceased. For example, this is how you can transfer an apartment to a person who will carry you a glass of water in old age. If he doesn’t, he won’t get anything.

The inheritance agreement is signed by a notary by all parties. It takes precedence over the will.

If the testator changes his mind about giving his property in exchange for certain actions, he must compensate the other party for losses associated with the fulfillment of the terms of the contract.

Keep in mind that the owner of the property can freely dispose of it even after concluding an inheritance agreement. For example, selling an apartment.

You are the heir at law

If the deceased did not draw up any wills or inheritance agreements, his property will be divided in equal shares by the Civil Code of the Russian Federation, Article 1141. General provisions between first-degree heirs - children, spouse and parents. When there are no such people, then the second one is brothers, sisters, grandfathers, grandmothers, nephews. If there are no such people, then the third one is the brothers and sisters of grandparents.

Usually three queues are enough, but in total there are eight of them in the Civil Code of the Civil Code of the Russian Federation (part three).

You are included in the charter of the inheritance fund

The inheritance fund is a new form of institution for Russia. The owner of the assets can order such an organization to be founded after his death - this cannot be done during his lifetime. The fund will earn money from the assets of the deceased and pay out profits to those designated by the testator. But the heirs cannot remove the property from circulation.

Claim for recognition of ownership rights

A statement of claim for recognition of property rights by inheritance is drawn up when the deceased is recognized as having the right to own the property transferred to the legal successors under a will, or when the heirs by law want to add this property to the estate.

According to Part 1 of Art. 30 of the Code of Civil Procedure of the Russian Federation, it is filed with the court at the location of the property. Recognition of property rights in court is required if a notary refuses to issue a certificate of inheritance to the heir.

According to the legal position of the notary, entry into inheritance is prevented by the lack of state registration of the testator's ownership of the inherited property. For this reason, the testator did not have ownership rights, and this property cannot be inherited.

You will find more detailed information on how to correctly file a claim and how it is considered by the court in the article “On recognition of property rights by inheritance.”

Inheritance by right of representation and hereditary transmission

Receiving an inheritance is a legal procedure governed by civil law.

In Russia, drawing up a will is not very common, so in most cases they adhere to legal acts.

Inheritance by right of representation and hereditary transmission, despite their similarities, are considered different concepts. In what cases is each of them used?

Inheritance by right of representation

The definition of this concept indicates that this is a special order of inheritance, which is regulated by Art.

1146 of the Civil Code of the Russian Federation. We can talk about it if the successor died before the testator or at the same time as him. This procedure applies subject to the following conditions:

- absence of a will in which a new heir is appointed;

- the date of death of the heir is the same as or earlier than that of the testator;

- the deceased person is part of the line called for inheritance.

In all these cases, the rights of the citizen are transferred to his relatives. The persons specified in Art. 1142-1144 Civil Code of the Russian Federation.

In accordance with this, the successors are:

- If the heirs were brothers and sisters, then their rights pass to their nephews and nieces.

- Deceased children are represented by grandchildren and great-grandchildren.

- Inheritance is passed on to cousins and other relatives.

If there are several successors, then the property is divided between them in equal parts. As an example, we can take the following situation. The family has two children: a son and a daughter. The woman has her own children. Father and daughter die in a car accident; a will is not drawn up. Accordingly, the son of the head of the family is appointed successor. The daughter's share is divided among her children in equal parts.

Hereditary transmission

Hereditary transmission is a similar concept, but has its own characteristics.

It is regulated by Art. 1156 Civil Code. In essence, hereditary transmission is a transfer of the right to accept an inheritance. In this case, the successors do not receive a mandatory share. Reference! The property that remains from the heir himself does not fall under the transmission, and is accepted in accordance with the general procedure.

Civil law stipulates that this concept does not apply if the heir and testator died on the same day, regardless of the time of death.

The following conditions apply to hereditary transmission:

- an inheritance case was opened;

- the successor (transmitter) did not have time to enter into the inheritance.

If there is a will, then the property goes to the persons indicated in it. Transmission is possible if the document is missing. In this case, inheritance occurs according to the law in order of priority. In the case where there are no transmitters, shares are allocated only to direct heirs.

Thus, if the transmitter dies before entering into the inheritance, then it passes to the relatives.

In the case when he managed to register the property, it is considered his personal property and is accepted on a general basis.

The law specifies relatives who can claim property in order of priority. If a citizen has left a will, then it also applies to inheritance transmission.

The following conditions apply to the procedure:

- The transmitter can claim property only if, at the time of the transmitter’s death, he has opened an inheritance case.

- The successor will not be able to receive more than the heir was entitled to.

- If there are several transmitters, then the property is divided in equal parts.

It is necessary to visit a notary within six months after the death of the transmitter to register the share. If the deadline is missed, you will need to restore it in court and prove the existence of a good reason. The successor may renounce his part, but only in favor of the persons specified in the will or those who inherit by law (Article 1158 of the Civil Code of the Russian Federation).

Differences between legal concepts

Despite the similarity of concepts, there are significant differences between them.

| Inheritance by right of representation | Hereditary transmission |

| Inheritance occurs only by law. | Both legislation and a will may apply. |

| The death of the heir occurred before or simultaneously with the testator. | The heir died after the transmitter. |

| Only descendants of a citizen's relatives can receive an inheritance. | Can be issued by persons who are heirs by law or by will. |

| Art. 1146 Civil Code of the Russian Federation | Art. 1156 Civil Code of the Russian Federation |

How to formalize inheritance by right of representation?

The legislation provides for deadlines that are the same as for the general procedure for registering property left by deceased relatives. They do not exceed 6 months from the date of death of the testator (Article 1154 of the Civil Code of the Russian Federation). The successors need to collect the necessary documents and write an application to the notary.

Possible obstacles to the consideration of the case

The requirement to recognize the fact of inheritance is considered by the court in a special proceeding. However, if a dispute arises between successors regarding the right of inheritance, the procedure for legal proceedings is provided.

In practice, quite often claims are left without progress due to the provision of only copies of documents confirming the fact that the testator owns the disputed living space - such court actions are illegal.

Controversial situations arise when there are several heirs in the case and the right to property is divided between them.

Problems may arise from providing copies of documents to the court without the originals or raising doubts about the authenticity of the papers.

For each specific case, the list of required documents may vary. If any information or documents are missing, or there are errors in them, then in court it will be necessary to establish the fact of the applicant’s relationship with the testator.

When there are no interested parties in the case, such problems in establishing the fact of acceptance of the inheritance are resolved by involving the Federal Tax Service at the place of residence of the deceased citizen.

Challenging the actual acceptance of an inheritance

Disputes between heirs who challenge the actual acceptance of the inheritance by one of them arise quite often.

Any interested person has the right to challenge the fact of acceptance of inherited property. As a rule, these are other heirs, but there may also be other persons with an interest in the inheritance.

You can challenge any conflicts between successors, as well as deadlines, procedures, and the fact whether the heir is eligible.

In such situations, the timing of going to court to protect your rights plays an important role. If the deadline for accepting an inheritance has been missed, then before challenging the fact of accepting the inheritance, it is necessary to restore the missed deadline for acceptance.

Lack of intention to accept property

The successor who has performed actions indicating acceptance of the inheritance has the right to prove the absence of his intention to accept it. Non-acceptance of an inheritance may be caused by the heir’s refusal of the inherited property, his serious illness or other reasons.

In essence, this is a factual situation in which the subject called to inherit does not show interest in the opened inheritance within the established period: does not submit an application to accept or renounce the property, and does not perform the corresponding actual actions.

The question of how to establish the fact of non-acceptance of the inheritance by the legal successor can be resolved by another interested heir. In accordance with Art. 1154 of the Civil Code of the Russian Federation, it is possible to prove the absence of intention to accept property even after the expiration of the period established by law. To do this, you need to contact a notary or the court with a statement to establish the fact of non-acceptance of the inheritance.

If there is evidence of inaction in terms of accepting property assets, the judicial authority establishes the fact of non-acceptance of the inheritance and decides whether to satisfy or reject the claim.

Restrictions on accepting refusal of inheritance

The legislator has established a clear list of circumstances and grounds for which refusal to accept an inheritance cannot be accepted. Thus, refusal to accept an inheritance is not accepted by law:

- if the waiver contains reservations or conditions;

- if the refusal is made in favor of persons not provided for by law;

- when inheriting a compulsory share;

- if there is a designated heir;

- when receiving an inheritance under a will (if the testator bequeathed all his property to his heirs).

Since the refusal of inheritance is recognized as a unilateral transaction, it can be appealed and declared invalid .