Nowadays, citizens often face a situation where they inherit a land share. People often get confused with concepts and do not know what type of property to classify as. There are a number of features when registering a share in property. The inheritance is allowed to be accepted all at once according to the Civil Code. Article 1152, in the second subparagraph, states that choosing the property that you will receive is not allowed. When the testator does not have any other property, the share can be received separately, also if citizens did not contact the notary in time with the question of inheritance. This should be done no later than six months after the proclamation of the will.

Legal regulation

Article 130 of the Civil Code of the Russian Federation describes a land share as a type of real estate. The peculiarity is that a citizen has the right to receive a plot of any size. It is mistakenly believed that the allotment is transferred in its entirety, usually only part of the total land. If a person is given the entire agricultural plot, he can register it as his own. In this case, no one can take it away. The territory will have boundaries, for this it is worth going through the land surveying procedure.

You can partially take possession of a share before it is allocated locally. There is a law “On the turnover of agricultural land”. It specifies permissible actions with part of the allotment. This document states that the owner of the share can dispose of it at will. He can sell it or donate it. If the owner wants, he can bequeath his part to someone.

If a plot of land with boundaries is not regulated in the land share, then not all transactions can be carried out with such property. The owner of the territory can only bequeath it. He has no right to sell it or rent it out to tenants. If the area has already been selected, then all these actions are possible.

When a person has a document in his hands confirming ownership of a share, it means that a certain plot of land has not yet been given to him. This factor cannot prevent you from receiving your share under the will. The procedure will take from a month to six months.

Stages of registration

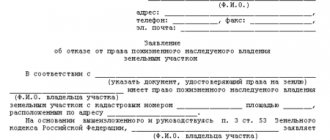

Having in hand all the documents confirming your right to this property after the death of their previous owner, you need to apply to the notary, where the inheritance case has been opened. This must be done no later than 6 months from the date of death of the relative. Otherwise, it will be possible to restore the missed deadlines only through the court.

Within the six-month period allotted by law, the notary is obliged to collect applications from all relatives who have views on this property, check the authenticity of the documents, and allocate the obligatory legal shares due by law. A certificate confirming inheritance is issued after a six-month period. This document will be the basis for the re-registration of existing rights to the share.

Re-registration is carried out on the basis of an application. It is necessary to have a passport, as well as payment of duties due to the state. The registration procedure takes up to 5 working days . After its completion, the heir receives a certificate confirming his legal right to dispose of this property.

Is land share inheritable?

The share can be inherited by citizens, provided that the privatization procedure has been completed. It consists of several points:

- You need to fill out an application for land registration. It should contain information such as the area of the plot and its coordinates. It is necessary to indicate the purpose of using the land. The application is submitted to the leadership of local authorities. It reviews it within a month.

- You should wait for confirmation of this procedure from the authorities. Consent comes in writing, with the signature of the manager on the form.

- It is necessary to carry out land surveying, mark the boundaries of the site, this will be needed for further registration of ownership rights.

- It is mandatory to register the land with cadastral registration and obtain the necessary documentation. After registration, the owner receives a cadastral number for the territory.

- The next step is to register ownership. To do this, you need to collect all the papers confirming your rights.

- A document is issued indicating ownership of this plot.

Is an assessment necessary?

When receiving a share as an inheritance, it is necessary to evaluate it, which is a sequence of several actions:

- Determining the purpose of the assessment.

- Analysis of documentation and information.

- Valuation of the share by a specialist.

- Receiving a reading with the result.

How is property distributed between relatives? The answer is presented in the article “How the distribution of shares in an inheritance is carried out.” You can find out about Russian inheritance legislation in 2021 here.

Presence and absence of a will: entry procedure, cost

The easiest way to receive an inheritance is through a will. If the correct procedure for completing the document was followed, further actions will not take much time. The will must be drawn up in the presence of a notary. After this, all persons indicated in the paper receive their right to inherit the share.

This process has its own nuances. It is possible to have a mandatory share in the land plot. If the maker of the will has a family that includes children under 18 years of age, elderly parents or a wife (husband), then they can enter into an inheritance. The rule is appropriate even if relatives are not indicated in the document being sought. The law of our country protects people who are left without the main breadwinner of their family. Such situations, according to judicial practice, rarely arise.

The land reform, which took place en masse in 1990, helped residents of rural areas register shares as personal property. Registration took place through the administration. Based on the fact that many citizens do not know their legal rights, some are not even aware that they have part of the land plot. Another category of citizens does not know what to do with the shares that appeared thanks to hereditary ties. Many people don't even leave a will due to misunderstandings about what they own and how to use it.

If there are several heirs

Situations when several people claim an inheritance often arise, and in this case the inheritance mass is divided between them in equal shares. The land can also be divided, and if this is not possible, it is given to one of the applicants, with the cost of the remaining parts being paid off in money or other objects of the inheritance estate of equal value. The priority for owning a plot is given to the applicant who conducts economic activities on it, cultivates it, and resides there.

Documents for inheritance

To legally receive your inheritance, you need to prepare the following documents:

- The original death certificate of the person who left the inheritance will require another copy.

- You must provide documents confirming that you are a relative of the testator. The list includes: birth certificate, marriage document. If there is a change of surname, then documents certifying this fact are required.

- If it was necessary to go to court to recognize family ties, then you need to include a copy of the court decision in the general package of documents.

- The notary must confirm that the will has not been amended.

- Certificate of value of the allotment.

- Certificate of absence of debts to the tax office.

The legislative framework

In addition to the general rules on inheritance enshrined in the Civil Code of the Russian Federation, it is necessary to pay attention to Federal Law No. 122 of 1997, which establishes the possibility of receiving a share by inheritance.

Issues of taxation and payment of duties are regulated by the Tax Code, and numerous judicial practices will allow us to assess the situation in the event of controversial situations.

The process of receiving a share as an inheritance is generally no different from receiving other property through inheritance. In addition to generally established documents, you will need to provide documents on the rights of the deceased to the corresponding transferable share of land by inheritance. The peculiarities lie only in understanding the nature of the institution itself, its features, the procedure for disposing of it, its taxation, and so on.

Deadline for accepting land by inheritance

In order to become a land owner, you must wait six months. This period is determined by the Law of the Russian Federation, it is standard, but there are exceptions. It happens that special deadlines are assigned when:

- The testator disappears, but evidence of his death appears. Six months begin to count from the date on which the person is officially declared dead.

- It happens that citizens refuse to accept an inheritance or, conversely, the court recognizes that they are unworthy of such responsibility.

- The exception will be people in whose favor other relatives have renounced their inheritance rights. For them, the period of entry into rights begins from the day when the refusal is confirmed by a notary.

Rights and obligations of a member of a consumer cooperative

After joining the company, participants acquire the following rights:

- leave society voluntarily;

- actively participate in improving activities and eliminating deficiencies;

- to be elected to control and governing bodies and to participate in the elections of other citizens;

- receive share payments according to the terms and amounts established as a result of the general meeting of shareholders;

- through a cooperative, purchase goods and services from consumer society organizations and sell the products of their farm or industry;

- have an advantage in hiring in accordance with their qualifications and the need for workers;

- receive a referral to receive education at educational institutions;

- receive complete and reliable information about the activities of the consumer cooperative;

- submit complaints to the general meeting.

Thus, shareholders have quite a lot of rights. Invested shares also bear a number of responsibilities:

- members of the cooperative are obliged to comply with the charter and obey the decisions of the general meeting, as well as the control bodies of the cooperative;

- shareholders are obliged to fulfill obligations to participate in the activities of the company.

Before joining the company, the future shareholder must familiarize himself with the organization’s charter and clearly remember his rights and obligations, since in each specific case of the transaction there may be additions.

Taxation

This issue is covered in the Tax Code of the Russian Federation. There is a burden that a person has to pay after registering the property.

Owners of plots must pay additional taxes if they grow garden crops as part of their business or raise domestic animals. These funds go to the regional budget. The state budget receives taxes that citizens pay for property and for the use of their land. The tax amount is determined depending on the cadastral value.

If the owner of a land share does not pay his bills, he may be held liable. Do not forget about the land tax in case of unlimited use of the territory.

How much does it cost to register, taxes and duties?

There are no inheritance taxes today, but the need to pay a fee remains relevant. It is necessary to pay it, since without it you will not be able to obtain a notarial certificate. How much does it cost to register land? The duty is 0.3 percent of the total value of the inheritance for heirs of the 1st and 2nd stages, which is why it is important to evaluate the site. For more distant relatives, the duty is calculated as 0.6 percent of the cost of the plot. In the first case, the upper payment ceiling is 100 thousand rubles, in the second it should not exceed a million.

Resolution of disputes through court and statute of limitations

When entering into inheritance rights, disagreements often arise. If citizens cannot resolve controversial issues themselves, they go to court. Citizens often do not have time to assume ownership rights under a will within the required six months. If there are good reasons, the court takes them into account; this is considered to be a person’s illness.

To accept an inheritance, you need to file a claim. The statute of limitations must be taken into account.

When there are several heirs in the case, disputes naturally arise. They are trying to divide the shares, everyone wants to grab a larger part. The court resolves such issues within the framework of the Civil Code of the Russian Federation.

Disputes are usually resolved over several meetings. A decision is made based on documentary evidence of participation in the inheritance. Russian legislation exercises control over the process of obtaining land plots, as well as individual shares. If a person wants to receive his allotment in a timely manner, he must follow government regulations and requirements. This year all these rules are valid.

Claiming the right to an unclaimed plot

A pressing issue for those persons who, due to ignorance about the inheritance of a land share, missed the deadline for accepting the inheritance. In this case, the right to submit a written application to the local government authorities of the locality to which the disputed land plot is assigned is provided.

The heir also undertakes to declare this fact at a meeting of participants in shared ownership at the location of the share. This serves as a reason for excluding the land share from the list of unclaimed plots of land (Federal Law No. 101, Article 12.1, paragraph 6).

The heir will not be able to request his share if one of the above conditions stipulated by law is not fulfilled.

In this case, the resolution of the issue goes to the judicial authority. In most cases, the court rules in favor of the plaintiff, and local authorities will be forced to remove the site from the list.