To whom does the property of the deceased go if the heirs do not appear?

Inheritance occurs according to two algorithms:

- By inheritance . If the deceased during his lifetime made a decision about who the heir is and formalized his expression of will by a notary, the property is inherited by the persons indicated in the document. You can challenge it, but there must be good reasons for this. A lawsuit will have to be initiated.

- In order of priority (by law) . What happens to property if there is no will means the transfer of assets to people who are closely related. There are 7 queues. The sequence is from the first to the seventh. But the right to property also arises for people who were dependent and not relatives.

If no one has declared a claim to join, the property is inherited by the state. But the problem is often that some were physically unable to react in a timely manner. And the law allows you to assume the rights of the owner even six months after the death of the testator.

What will happen to the valuables if there are no heirs?

The process of transferring inherited property is carried out according to a will or law . Each heir has the right to refuse the valuables received, for which he simply does not submit an application to the notary. If the persons indicated in the official order of the testator, for various reasons, refused to enter into the inheritance, then the valuables are transferred to the relatives of the deceased citizen, who are successors by law .

Many people are interested in the fact that if they don’t enter into an inheritance, what will happen is that it will go to the state . But usually some citizens simply learn about the inheritance late or for various reasons do not receive information about the death of the testator. Therefore, they have the right to demand this property even after the end of the period established by law.

Valid reasons for missing a deadline include:

Free legal consultation

+8 800 100-61-94

- undergoing treatment in a hospital setting;

- being on a business trip in another city or country;

- living in another state, so the person simply did not know that his relative died, leaving an inheritance.

Attention! According to judicial practice, judges restored the term for other reasons, but they will have to be proven with the help of official documents.

Circumstances leading to missing the deadline for entering into inheritance

Restore rights to inheritance through the courts. And in order for the judge to take the side of the heir who missed the deadline, it is necessary to prove that the reasons are objective and weighty. In judicial practice, this happens if the applicant for property:

- He suffered a serious illness, was under long-term treatment and was physically unable to know about the death of a relative who left an inheritance.

- I was on a long business trip, did not communicate with relatives, and had no reason to find out that it was time to take over as an owner.

- He lived abroad and for many months did not receive information from his homeland, was not in the country, did not know that the primary heirs had abandoned material wealth.

There are many other cases where judges grant the claims of plaintiffs in probate cases. In any situation, each argument will have to be supported by documents. Only papers that are properly executed and have legal force are accepted for consideration. Witnesses are also brought in who are ready to tell in the presence of judges what really happened.

If no one has entered into inheritance within 6 months

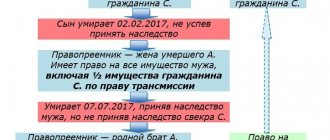

6 months is the standard period during which a citizen or representative of a legal entity (heirs) must apply for registration of an inheritance. If within this period no one has applied either to a notary or to court, the right to inheritance opens to the heirs of the next lines of inheritance.

From our judicial practice we can say that the most important thing is that it is important to correctly determine the person on whose behalf the inheritance will be accepted. So, for example, with living parents, the granddaughter is not an heir by law and cannot inherit at all (except, of course, inheritance by will). At the same time, the brother or sister of the deceased can successfully inherit and in the future give it to this granddaughter, whom the law did not include in the circle of “relatives”. If the application is submitted by a citizen who is not included in the list of heirs established by the Civil Code, the additional deadline for filing the application will be missed, and the heirs who could claim the rights to the inheritance will be “out of work.” Thus, no one will receive the property, and it will go to the state.

What to do? No matter how trivial it may sound, you need to consult a specialized lawyer. In our country, complex issues of registration of inheritance rights are dealt with by specialists from the Housing Department, headed by the head of Yulia Alekseevna Allaberdyeva. Lawyers have handled and positively resolved many different inheritance cases. Sometimes situations that seem tragic to you can be easily resolved by applying the law. Although there are some unanswered questions.

How to restore the right to inheritance?

It is better to reach an agreement without litigation, but this does not always work out. Therefore, you have to go to court. Understanding who the defendant is, writing a statement of claim is not difficult. To do this, they visit a notary and clarify who has now inherited the property. In order for confidential information to become accessible, it is necessary to prove the existence of rights of claim. That is, it is required to present documents proving the existence of family ties.

Through the court

Litigation is initiated by filing a statement of claim. The document does not have a unified form, but there are general requirements for the design and text, which contains a list of attached evidence of correctness. The purpose of the procedure is to achieve inheritance and become the rightful owner of the property. The court's decision is final, and a second claim with the same conditions will not be considered.

What should be included in the claim?

The header of the application states:

- name of the court;

- information about the plaintiff;

- information about the defendant;

- Contact details.

The text briefly and concisely describes the situation, provides arguments, and states the requirement to enter into an inheritance and receive the property due. The main thing is that every word or phrase is justified. Therefore, links to articles and clauses of laws are provided.

The list of documents must indicate that a receipt for payment of the state fee is attached. Without it, the meeting will not take place, the claim will remain without consideration. When it comes to missing the deadline for entering into an inheritance, it is necessary to indicate why the timely application was not made. If the reason is frivolous, far-fetched, or unproven, there will be no changes in the distribution of the inheritance.

No trial

You can always contact the person to whom the property was inherited. Even if a refusal follows, in court this will be a confirmation of the desire to resolve the issue without scandal. When the opponent is an adequate person, you can always find a way out:

- Transfer the inheritance to yourself according to mutual desire.

- Receive money in an amount equal to the value of the disputed property.

- Divide the inherited values and formalize the transaction legally.

In any case, everything depends on the specific case, but pre-trial measures to resolve the conflict should not be ignored. And based on the results of the negotiations, the further algorithm of actions is determined.

How to enter into an inheritance on time?

If a person has completed one of the following actions within 6 months, then he has assumed the rights of an heir, and he does not need to restore them in court:

- Submitting an application to a notary office . Additional documents must be attached to the application. For example, documents confirming a family relationship with the deceased. Not all papers can be on hand. You need to contact a notary with at least an application in order to open a case and not miss deadlines. How kinship is established during inheritance, read here;

- Actual entry into the rights of an heir . If the heir, within 6 months, has not presented his rights at the notary's office, but he actually disposes of the property, an actual entry into the inheritance takes place. This means, for example, living in an apartment, its maintenance, and paying for utilities.

Having a problem? Call a lawyer:

Moscow and Moscow region (toll-free call) St. Petersburg and Leningrad region

In the second case, you need to confirm the actual entry into rights.

To prove the actual acceptance of an inheritance, the following are suitable:

- witness's testimonies;

- receipts paid by the heir;

- a certificate stating that the heir lived in the same apartment with the testator.

Any information indicating the presence of the following circumstances is needed:

- Property management;

- Expenses for its maintenance;

- Payment of debts of the testator;

- Receiving sums of money from the debtors of the deceased.

Typically, the existence of these conditions must be confirmed in court. A person is sent to court if the notary decides that consideration of this issue is beyond his competence.

Actions of the heirs

It all depends on the stage and prerequisites of the situation. Inheritance cases can be classified according to their timing. Some take place in conditions where the acceptance of an inheritance has already expired, others take place in a situation where the property has actually passed to a new owner.

If deadlines are missed for a valid reason

Collect evidence of the objectivity of the requirements. You will also need to prove the degree of relationship. To do this, bring additional documents, such as birth certificates, marriage certificates, etc. Write a statement of claim, indicate in the text the demand to restore the deadlines, enter into an inheritance, and obtain the right to dispose of property.

Upon actual acceptance of the inheritance

After receiving a court order, it is necessary to re-register the inheritance (ownership). For this purpose, appropriate papers are obtained. If we are talking about real estate, in addition to obtaining a certificate of owner, they put a mark in the State Register.

Statute of limitations

The inheritance process must be completed within six months after the death of the owner of the property. But if for good reasons is missed , then it can be restored . The procedure is possible within the limitation period , which is 3 years . This applies to any property represented by real estate, cars, antiques or other items.

If within three years a citizen has not filed an application to receive escheatable property because he was not aware of its existence, then extended solely on the basis of a court decision . The maximum period for such cases is 10 years from the date of death of the testator. After this period, the court simply will not accept claims. This is due to the difficulty of finding successors, and often during this time property is completely destroyed.

Claims are considered by the court for 2 months . This period is required to study the received documentation, verify facts, conduct examinations or other purposes. After examining the evidence and interviewing witnesses at the court hearing, a decision is made. If the plaintiff really has the right to the property, and has also proven the legality of his claims and the validity of missing the deadline, then his claims are satisfied.

Documents for restoration of property rights

There are several categories of official papers that will be required to carry out the procedure for restoring inheritance rights, even if the property has been transferred to other entities. To file a claim in court you will need:

- Prove the legitimacy of claims . Certificates and extracts are provided showing that the plaintiff is a relative of the deceased.

- Justify the objectivity of the request . The reasons for missing the deadline for entering into inheritance must be compelling and respectful.

- Describe the property . They bring papers describing and specifying the disputed property. The same goes for evaluation.

A receipt for payment of the state fee, a passport - mandatory documents for any cases when you have to make an official application.

Distribution of property when close heirs miss deadlines

The inheritance is transferred to the state as a last resort. As a rule, there are people who have the right to claim the property of the deceased. But there are general principles that state that in the case where a will has not been drawn up, redistribution is carried out according to the procedure established by the state. There is a clearly defined queue.

Who is the first heir?

The primary successors are spouses, parents and children. Moreover, a minor child is assigned a mandatory share, which cannot be challenged even in court. The same applies to other persons if they were dependents during the year before the death of the testator.

But we are talking only about part of the inheritance; the rest of the property is distributed equally. You can formalize a waiver of inheritance in favor of another, and this is the best way to distribute property without scandal. If there are no first-priority applicants, the deceased’s inheritance is distributed among the participants of the second priority, etc. Persons living together without formal marriage do not have rights to property.

Recognition of property as escheat and the procedure for its acceptance

The legal consequences in the case where no one has accepted the inheritance after six months are established by the norms of the Civil Code of the Russian Federation - the property is recognized as escheated. In accordance with the rules of Art. 1151 of the Civil Code of the Russian Federation, the grounds for this are considered:

- lack of heirs;

- deprivation of heirs of their rights (recognizing them as unworthy);

- none of the applicants declared their rights legally or did not take actions aimed at accepting the property in fact;

- all applicants waived their rights and did not indicate in whose favor they were waiving.

It turns out that such a situation always arises when there are actually no heirs and no one can be recognized as a contender for receiving the inheritance.

An inheritance that is recognized as escheat is transferred (in accordance with paragraph 2 of Article 1151 of the Civil Code of the Russian Federation):

- in the ownership of a municipality, if it is real estate;

- in the ownership of a subject - a city of federal significance, if it is real estate and located on the territory of such an entity;

- everything else is the property of the Russian Federation.

There is no separate legal act that would regulate the procedure for transferring escheated property into the ownership of the relevant state or municipal authority.

However, in practice, the procedure is implemented in accordance with the general principles of inheritance. There are also some features:

- The Russian Federation or a municipal entity does not have the right to refuse to accept an inheritance (clause 1 of Article 1157 of the Civil Code of the Russian Federation);

- Acceptance of an inheritance is not required to acquire property (clause 1 of Article 1152 of the Civil Code of the Russian Federation).

The first step is for the owner to obtain a certificate from a notary. This point is regulated by several acts at once, such as the Civil Code in Article 1162, the Regulations on the Federal Agency for State Property Management in paragraph 5.35, and Resolution of the Plenum of the Supreme Council No. 9 of May 9, 2012 in paragraph 5.

The Federal Property Management Agency acts on behalf of the state, and the body vested with such powers acts on behalf of the municipality.

What is escheat property?

This term refers to the process of transferring inheritance in favor of the state. This is possible when:

- There is no one to accept inheritance rights due to the absence of relatives.

- All applicants refused due to personal reasons.

- Heirs belong to the category of persons who do not have the right to claim.

- The refusal does not indicate the third party in whose favor it is issued.

- No one applied for recognition in a timely manner.

As soon as six months have passed after the death of the testator, if there is no subject ready to become the owner, everything acquired during his lifetime is transferred to the state.

To whom does it go?

In most cases, the legal successor is the municipality of the subject or district. If we are talking about an apartment, it is entered into the housing register. This means that square meters are used to meet the social needs of citizens. The Federal Tax Service is responsible for the safety, the manager is the Federal Property Management Agency.

These structures can be called defendants in the claim, but in fact the application is filed against the property itself, which is due by inheritance. In any case, it is possible to return it to yourself, depriving the state of the right to further dispose of valuables, and for this there is a special procedure that involves applying to the court at the location of the object of the dispute.

How to restore rights if this property has already been sold?

There are no clear rules formed into special sections of laws. Lawyers use the main articles of the Civil Code to defend their rights, and in most cases this actually works. In any case, you will have to solve the problem in court with the involvement of specialists who know the law and have legal practice.

What happens if you don't join?

The answer to this seemingly straightforward question, however, requires some clarification.

It is connected both with the inheritance itself and with the form of “non-entry”. As already noted, the period allotted for making a decision on the inheritance is established from the date of opening the case and lasts 6 months. In six months, a citizen can:

- become a de jure heir, that is, submit documents confirming such a right, for example, through kinship, and write a statement from a notary confirming acceptance of the due inheritance share;

- enter into de facto rights - for example, if you inherit a car or an apartment/house, you begin to pay for its maintenance, taxes, care, etc. This, however, does not make his rights “privileged”, and if there are other heirs, the actual reception of the property will not be enough. A court decision may challenge this;

- write and certify with a notary agent his renunciation of the share of the inherited property recognized for him and completely relieve himself of responsibility for it, or transfer the right of inheritance to another person who can accept this inheritance;

- not to participate in the inheritance procedure and in fact “keep silent”.

And in the latter case, this “decision” of the citizen will be interpreted by the notary’s office as a refusal after the 6-month period of the case on inherited property ends.

The further situation will develop in two possible ways.

If the “silence” was motivated, that is, the citizen knew about the opening of the inheritance and did not intend to receive it, then he is deprived of his share/shares in favor of other heirs of a different order. This ends his participation in the fate of the property.

The matter may turn out differently if the citizen did not have time to make a decision within the deadline due to prevailing circumstances or without being notified of the fact of the death of the testator.

Causes

Most often, reluctance is associated with the presence of debts that are transferred along with the property. The person who receives the inheritance is obliged to pay off debts on mandatory payments. But many, at the moment when they enter into an inheritance, will have to pay off loans and other debts of the testator. The solution is not to become an heir. Debt obligations are not transferred without ownership.

There are cases when relatives voluntarily agree among themselves about what will go to whom. If everything is completed in a timely and correct manner, no problems will arise in the future. There are no obstacles to re-registration, and ill-wishers cannot challenge the deal. There are special methods and rules of behavior for this.

The inheritance is actually accepted, but not formalized

Some people refuse to contact a notary with a statement after the death of the testator, so they simply actually accept the property. For example, they live in an apartment, pay utility bills and take care of this property. They can use the property, but they do not have the right to dispose of it.

Under such conditions the property is not transferred to the state , but still is not the property of the heir. He will be able to sell or donate these valuables only after proper registration in Rosreesr. To do this, you will have to prepare evidence of a relationship with the deceased testator, as well as documents confirming that the citizen actually protected and maintained the property in optimal condition.

Actions

Failure to appear at a notary's office in the first six months is regarded as a refusal by both the notary and the court. However, it is worth understanding that if the refusenik changes his mind and is able to restore the terms, he will have to share. Some buy out the share, but do not formalize the transfer of money and property. The result is a lawsuit, loss of valuables, time, and nerves. To prevent this from happening, it is enough to format each step correctly.

Waiver is a document certified by a notary. You will have to pay a fee. This must be done within six months after the death of the property owner. The procedure will take no more than 15-20 minutes. And when it comes to transferring money as compensation, an agreement is drawn up, which specifies the amount, terms, conditions, duties and responsibilities. It is better to formalize the fact of transfer via a bank transaction. Then a bank statement is sufficient proof.