Is it necessary to enter into an inheritance after the death of a husband?

Spouses living in an official marriage jointly use property that is the personal property of the husband or wife and the joint property of the spouses. In the event of the death of her husband, a woman may not know that she must register an inheritance in the general manner.

Only a woman who is officially married to him has the right to inherit from her husband. The exception is not situations where the spouses did not actually live together or the man had a de facto marital relationship with another woman.

Important! Only the official wife has the right to inherit from her husband.

To do this, you must submit an application to the notary office at the place of last registration of the spouse. To prove the existence of an official marriage union, you must present a marriage certificate.

Possible problems

During the time allotted for the inheritance procedure, problems may arise related to various life situations. One of these situations may be late filing an application within the prescribed deadline . If a widow misses the due date after the death of her husband, she will need to go to court and present compelling evidence why the due date was missed.

Important! If the deceased had loans, then they will also be inherited. The person accepting the inheritance has two options: abandon the property with debts or accept it and pay the bills.

The documentation required by the notary must correspond to the established package of documents , and if any of them are missing, it will need to be conveyed. Otherwise, the registration will take a long time.

Who inherits

The basis for inheritance is:

- norms of law (Chapter 63 of the Civil Code of the Russian Federation);

- will (Chapter 62 of the Civil Code of the Russian Federation).

Depending on the presence/absence of a will, it is determined who inherits. However, the official spouse is given priority rights to the property.

In the case of legal inheritance, property is divided between the parents, all children of the deceased and his wife.

The following situations are an exception:

- parents were deprived of parental rights in relation to the deceased owner;

- the children were not officially registered in the name of the testator;

- one of the heirs committed a crime against the life and health of the deceased owner or other recipients of the property.

In such a situation, the relative loses the right to receive the deceased’s inheritance. A spouse can be deprived of inheritance rights only if a will is made or a crime is committed.

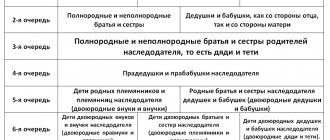

Inheritance queues

The order of inheritance is determined by Article 63 of the Civil Code (Articles 1141 – 1151). The legislation establishes that close kinship is a priority in the matter of receiving property after the death of a citizen.

In the absence of a will, the queue is distributed:

- first - husbands, wives, children, mothers and fathers of the deceased person;

- the second – sisters and brothers, grandfathers and grandmothers;

- third - aunts and uncles;

- fourth - great-grandparents;

- fifth - cousins' granddaughters and grandchildren, great-aunts and grandfathers;

- sixth - cousins' granddaughters and grandchildren, cousins' nieces and nephews, cousins' aunts and uncles.

Important ! If one of the heirs died at the same time as the testator or before entering into the procedure, the right to the property is received by his successors by right of representation, if any. This rule applies to relatives unless they are unworthy heirs.

This category includes:

- relatives whose actions were aimed at the detriment of the testator, so that his property would be distributed after death taking into account their personal benefit (this fact must be proven in court);

- the applicant was entrusted with responsibility for the maintenance of the deceased, which he maliciously avoided;

- persons who do not have the right to inherit or are excluded from this event.

Adoptive parents and adopted children are considered to be blood relatives, and therefore have the right to expect to receive ownership of property legally along with other family members. This category of citizens has a court decision indicating adoption.

What is included in the inheritance

The hereditary property includes the following objects:

- apartment;

- car;

- House;

- company;

- land plot;

- vehicle;

- securities;

- stock;

- jewelry.

The marital share must be excluded from the inheritance. It includes ½ share of all joint property. To allocate the wife's property, you must contact a notary.

The specialist will issue a certificate of allocation of the marital share. Based on the specified document, the wife’s property is not subject to inclusion in the inheritance mass.

Important! Obtaining a certificate of allotment of the marital share does not deprive the wife of the right to inherit her husband's property.

How is property divided according to law?

When dividing property, it may happen that the husband did not have a will prepared in advance for a certain person, then the property will be divided on the basis of the law. Half of the husband's remaining property will go to the wife , unless, of course, they were divorced.

The second half will be distributed among first-degree relatives , including parents and children of the deceased. Moreover, the wife will also participate in the division of the remaining half belonging to the husband. Thus, she will receive half of the common property and a share of the second part of the property.

Who will get the property if there is a will of the deceased?

When a will is drawn up, the division of property will be done differently. According to Article 1120 of the Civil Code of the Russian Federation, a person can bequeath any type of property.

The person specified in the will will receive property , but we must not forget about the categories of relatives for whom the state allocates certain shares even in bequeathed property. These include:

- children;

- dependents;

- disabled citizens;

- disabled people.

What documents are needed to enter into an inheritance after the death of a husband?

List of documentation when registering an inheritance with a notary

| No. | Title of the document | Comments |

| Passport | The document must include all the necessary notes (record of children, marriage stamp) | |

| Owner's death certificate | Issued by the district registry office at the place of last registration of the deceased or at the place of death | |

| Certificate of last place of registration | Can be issued at the passport office, MFC, housing department | |

| Certificate of registration of marriage union | Issued by the district registry office at the place of registration of the union | |

| Document on removal from the place of registration | Issued by the passport office | |

| Title documentation | For property that is subject to inheritance | |

| Legal documentation | Extract from the Unified State Register of Real Estate (issued by Rosreestr) | |

| Cadastral passport for an apartment | Issued by BTI | |

| Property Valuation Report | For real estate you can get it from Rosreestr, for other property you need to order it from a specialized company |

The list of documents may vary depending on what property is included in the inheritance mass.

Inheritance contract

A special type of will, which is concluded during the life of the testator with the heir. The contract specifies the conditions under which one party agrees to transfer and the other to receive the inherited property. It is concluded only with the consent of the heir, thereby differing from a will. The agreement cannot be changed by the testator, unlike a will. Changing the agreement is possible only with the consent of both parties. The concluded agreement is subject to notarized registration and certification by a notary. Drawed up in three copies (for the heir, the testator and the notary).

Changing or terminating an inheritance agreement is possible only in court.

How to register an inheritance after the death of a husband if there is no will

In the absence of a written expression of will, the registration of the property of the deceased is carried out according to the law. Its peculiarity is the receipt of property in order of priority.

The wife, parents and children belong to the first line of heirs. If there are other dependents, they also inherit first.

In the absence of other recipients, the spouse receives rights to all property in full.

An alternative option is the actual entry into inheritance (Article 1153 of the Civil Code of the Russian Federation). In the absence of other applicants, the widow often lives in her husband’s apartment, uses his other property, ensures its safety, and pays bills.

The question of registration arises in the case of preparation of a will, sale of inherited property or the presence of funds in accounts. To do this, it is necessary to establish the actual acceptance of the inheritance in court.

Procedure

To register the property of the deceased owner, the following procedure must be followed:

- Collect documents.

- Submit an application to a notary.

- Pay the fee.

- Get a certificate.

- Re-register property.

Submitting an application

The wife must report her decision regarding her husband’s property to the notary who opened the inheritance case. If there are no other recipients, the woman herself must initiate the process.

To do this, you need to contact the notary office at the place of last registration of the spouse. You must have a civil passport, a certificate from your husband’s place of registration and a death certificate.

If the spouses did not live together, then the woman needs to find out where to open the inheritance case. To do this, you need to contact any notary office or log on to the website of the Federal Notary Chamber.

Let's look at how to properly fill out an application.

The document must contain the following information:

- notary office details;

- information about the applicant;

- title of the application;

- details of the deceased husband;

- information about inheritance under the law;

- request to enter into inheritance and issue a certificate;

- date and signature.

Sample application for inheritance without a will

Duty and other expenses

Main expenses when entering into an inheritance:

- Valuation of inherited property.

- State duty.

- Payment for notarial actions and services.

- Registration of ownership of objects.

The cost of property valuation depends on the type of property. Each object is paid separately.

For a real estate assessment in 2021 you need to pay 3,000 rubles. The assessment of a passenger vehicle costs from 3,000 rubles, a cargo vehicle – from 5,000 rubles.

Important! Before concluding an assessment agreement, it is necessary to clarify the availability of a license to carry out the necessary assessment work. Otherwise, the notary will refuse to accept the report for calculating the state duty.

To obtain a certificate of inheritance rights, you must pay a fee. It is calculated based on the valuation of the inherited property.

The spouse must pay 0.3% of the value of the property received. The maximum payment amount is 100,000 rubles.

Important! Funds placed in the accounts of the deceased are not included in the calculation.

The cost of other notary services is set by regional notary chambers, and therefore varies throughout the country. You can check the tariffs on the Federal Tax Service website. The information is for reference only.

The regional chamber sets maximum tariffs. Each specific notary can determine a lower payment.

A woman may be exempt from payment in the following cases:

- the spouse has been declared incompetent by the court;

- the deceased died in the line of duty;

- the woman inherits insurance payments, salary, royalties of the deceased or other cash in the accounts.

Additional funds must be paid when re-registering property that is subject to state registration. To register an apartment in Rosreestr you need to pay 2,000 rubles.

Taxes

The law exempts all recipients of property from paying income taxes.

However, if the estate is sold within 3 years, the spouse will have to pay 13% as income tax.

Deadlines

The law sets a deadline for submitting an application to a notary (Article 1154 of the Civil Code of the Russian Federation). It is 6 months . If the spouse did not manage to submit documents in a timely manner, the property will be transferred to other heirs.

The period for receiving an inheritance can be restored in the following cases:

- the woman underwent long-term treatment;

- the wife was on a long business trip;

- the woman was serving a sentence in prison.

The list of reasons is not final. The court considers situations on an individual basis.

If the deadline for registering an inheritance has expired

If you did not manage to enter into an inheritance within six months, you will have to go to court. The only way to resolve the matter without litigation is to obtain written consent from all other heirs who have already accepted the inheritance to recognize your right. This happens very rarely. In order to restore your rights through the court, you need to prove that you missed the deadline for a good reason. For example:

- were abroad for some reason and could not return;

- were seriously ill and were unable to move;

- were in prison or colony without the opportunity to contact a notary;

- did not know about the relative/inheritance;

- did not know about the death of a relative.

There is no exact list; situations can be very different, but these are the most common reasons. Evidence of a valid absence can include, for example:

- medical certificates;

- documents from work, if we are talking about a long business trip.

The documents depend on the situation and the reason for the absence. After considering your case, the court makes a decision either to refuse due to insufficiently valid reasons/lack of evidence, or grants the request and restores the term, or allows you to enter into the inheritance immediately.

- Lawyers for inheritance issues

Entry into inheritance under a will

A will is a document that contains the deceased person's dispositions regarding his personal property. The document may give one of the relatives rights to all or part of the deceased’s property.

Important! A special feature of a will is the ability to transfer rights to property to any recipient (relative, stranger, legal entity or state).

If the spouse is the only heir, then men rarely make a will. The document is drawn up in order to assign specific property to the wife (for example, an apartment) or to deprive other recipients of the right to claim.

The procedure for entering into an inheritance under a will is almost identical to receiving property by law (Chapter 64 of the Civil Code of the Russian Federation). Main differences:

- application form;

- list of documents.

As a basis document, the spouse provides not a marriage certificate, but a will. However, you will still have to present the certificate. Otherwise, the fee will be calculated as for a stranger (0.6% of the value of the inherited property).

Submitting an application

The application is also submitted to the notary's office. However, in the case of inheritance by will, documents may be filed not at the place of last registration of the deceased, but at the place where the will was kept.

The application must include the following information:

- name and address of the notary office;

- wife's details.

- title of the application;

- information about the deceased husband (full name, date of birth and death);

- information about the existence of a will;

- requirement to enter into inheritance and issue a certificate;

- date and signature.

Sample application for inheritance under a will

Types of will

Notarial will

It is drawn up by a notary in 2 copies, information about this is entered into the Unified Register. One copy is given to the testator, the other remains with the notary, in case a duplicate of the document is needed if the original is lost.

It is important to know!

If the will specifies only part of the property, then the rest of the property will be subject to the rules of inheritance by law.

Closed will

This document is drawn up personally by the testator and sealed in an envelope. The envelope is given to the notary and placed by him in a notarial envelope, which is not opened until the death of the testator. Only the testator knows the contents.

Joint will

This type was introduced in 2021, it allows you to draw up a joint will for married spouses. Allows you not to divide jointly acquired property between the surviving spouse and other relatives. Makes it possible to determine the order of division of property at the time of death of one of the spouses or both of them. This will can only be changed by spouses together. Upon the death of one spouse, the deceased spouse's share of the property passes to the other spouse. He can dispose of this property or rewrite the will to a new one.

A will made in an emergency

Situations in which the life and health of a person are in danger are recognized as emergencies. During these situations, a person without contacting a notary has the right to write a will with his own hand in the presence of two adult and capable witnesses who sign this document. If the person who wrote the will dies, the heirs are required to apply to the court to recognize this situation as an emergency and the will to have legal force. If the testator has not died, then within 30 days he must contact a notary to draw up a notarial will.

It is important to know!

The legislation does not establish situations that are recognized as emergencies; this fact is established by the court.

How to enter into an inheritance if you have children

If a man dies, his property will go to his children, wife and parents. In such a situation, everyone is entitled to equal shares in the deceased's property.

Unborn children also have rights to the property of the deceased father (Article 1166 of the Civil Code of the Russian Federation). In such a situation, entry into inheritance is suspended at the request of the pregnant widow.

Example. After the death of citizen P., his apartment remained. The property was given to him by his parents during his marriage. His heirs are his wife, 2 children, mother and father. Each of them has the right to a share in the real estate. Due to negative relations between the widow and the parents of the deceased, all applicants entered into the inheritance. Each of them received a certificate of inheritance (1/5 share per apartment).

When entering into an inheritance, a woman submits an application on behalf of her young children (from 0 to 14 years old). The mother does not have to present a notarized power of attorney to register the property of the deceased.

If the child is a minor (from 14 to 18 years old), then he independently submits an application to a notary. But the mother must agree to accept the inheritance.

Important! The mother cannot refuse to accept the inheritance on behalf of the children. To do this, you must obtain the consent of the district guardianship department.

How is the marital share allocated?

The joint property of the spouses is considered to be the property that they acquired during the marriage. Consequently, it is subject to division on the eve of registration of the inheritance.

If there are supporting documents, the notary independently allocates the marital share. However, the issuance of the relevant certificate is carried out upon the application of the spouse.

The procedure is paid. The applicant must pay for notary services. In 2021 in Moscow you need to pay from 4000 to 6000 rubles.

The remainder of the property is divided among the legal successors in equal shares.

Features of dividing a spouse's property

The wife always receives an inheritance, except in cases where she is not included in the will or is recognized as an unworthy heir. However, this does not mean that the husband had the right to distribute all the property that the spouses acquired during marriage. After all, the deceased testator could include in his will those objects that belonged to the family.

This means that the property is first subject to division, and only after the deceased spouse's share has been allocated can the option of division be considered. Issues regarding the allocation of a share are considered by a judge, who also makes a decision on the basis of documents and witness testimony. In addition, during his lifetime the spouse could:

- lead a parasitic lifestyle (live off your wife’s income);

- spend earned money not on the needs of the family, but on strangers and on projects that were not agreed upon with the spouse;

— invest family funds in the business, but do not return the benefits from the project to the family;

- spend on dubious needs.

Then the deceased spouse's share is significantly reduced, and his wife's share increases proportionately. Serious legal support will be required to confirm these facts during the trial. Sometimes it even makes sense to hire a highly qualified lawyer who deals with inheritance issues in special situations.