The death of a loved one, and especially a parent, enters our lives without invitation. This sad event is faced by both adults, independent children, and minors. Regardless of how long the parents live, after their death, property belonging to them remains, which can be inherited by their children.

Why maybe? Because in addition to inheritance by law, where children are classified as first-priority heirs, there is inheritance by will, in which children, for various reasons, may not be included. However, there are certain nuances here: if the child is a minor or disabled, he, despite the text of the will, will be assigned a portion of the inheritance determined by law.

Features of the division of property after the death of a spouse

Everything acquired by spouses during the period of cohabitation is considered common and both parties have equal rights of ownership. This is movable and immovable property, except for things inherited by will or as a gift. During their lifetime, citizens have the right to independently change the legal ownership of their assets with the help of a marriage contract concluded by a notary or a general agreement between themselves, secured by a settlement agreement. These circumstances will not simplify the distribution of property after the death of the legal half.

The best option to resolve a dispute between claimants in advance is to draw up a will. Where the owner establishes in advance who and what he wants to leave after his death. Can give detailed orders relating to all assets, including small items. The testator is not limited in his rights; he can establish any reasonable requirements for applicants, including time periods for registering property. In the absence of a will, inheritance of the deceased's property occurs in accordance with the procedure established by law.

Regardless of the presence/absence of a will, the notary who conducts the inheritance case finds out the family status of the deceased. If he is married, ½ of the property is allocated - the marital share. Upon the death of one, half of his assets pass to the second spouse. Provided that the marriage is legal and was not dissolved before death.

When does the inheritance open?

According to Article 1114 of the Civil Code, the time for opening an inheritance is the date of death of the citizen. Moreover, if the exact date of death is not known (the person has gone missing), then the date of death will be considered the one determined by the court. Relatives of the missing person should go to court to declare the citizen dead. Property is divided after the death of a citizen in the same way as when a person is declared dead through a court; there are no differences on these grounds.

Heirs of the first stage

There are 8 lines of inheritance; after the death of a person, the notary in charge of the inheritance case identifies all the relatives of the deceased. And distributes succession rights between them. In the absence of a will, the heirs of the first priority have priority, then all the others:

| 1st stage | 2nd stage | 3rd stage | 4th stage |

| Legal spouse Children Parents Grandchildren | Siblings Step-siblings Grandparents Nephews, nieces | Uncles and aunts Cousins | Great-grandparents |

| 5th stage | 6th stage | 7th stage | 8th stage |

| Cousins and granddaughters Grandparents | Great-great-grandsons and great-granddaughters Great-nephews and nieces Uncles and aunts | Stepfather, stepmother Stepson and stepdaughter | Disabled dependents whom the deceased cared for and lived with |

Moreover, the rights of an adopted child are equal to the rights of natural children. If the specified heir of the first stage has not been born yet, the notary waits for his birthday. His share of the inheritance remains intact. The testator also has the right to designate any person as the main successor, even without a blood relationship with him. Thus, the legal spouse is considered the primary successor of his deceased half. Half of it will be allocated regardless of the orders specified by the deceased in the will. Also, the spouse has the right to challenge the document if the testator infringed on his rights to property.

How does inheritance work?

The procedure for dividing the property of a deceased spouse is described in detail in the legislation. The probate professional must first assemble the estate from the assets and liabilities of the deceased. If necessary, conduct an assessment of values using an appraiser. Further:

- ½ of the deceased’s total assets is received by his legal spouse, regardless of the instructions left by the testator in the will.

- The remaining portion will be equally divided among the first-stage applicants. If one refuses, the others will get more. If everyone refuses, choosing one, he will become the main successor.

- It is impossible to deprive persons who have the right of inheritance, regardless of the presence or absence of other applicants. These are dependents whom the deceased cared for during life, with whom he lived together.

The heirs have the right to agree among themselves and determine the procedure for dividing the property. For example, he carries out the procedure and arranges everything for himself alone, and then he will divide what he received among the others.

Distribution Rules

When dividing the joint property of a deceased spouse, the rules established by law apply:

- all property acquired by the deceased during his lifetime is subject to division;

- ½ of the inheritance belongs to the legal spouse;

- We must not forget about the dependents of the deceased, elderly parents and minor children;

- a citizen’s assets and financial obligations are divided equally; one cannot be separated from the other;

- any notary can handle inheritance matters; the procedure is initiated by interested relatives of the deceased;

- The procedure has a certain time frame that must be adhered to.

Property should be divided six months after the date of death of the citizen. Relatives can start an inheritance case by contacting any practicing notary. For example, upon the death of one of the spouses, the second will begin to act. All stages take place with the preparation of the relevant documents, and ownership must be registered with Rosreestr.

Procedure

After the death of a citizen, a notary opens an inheritance case on the initiative of the relatives of the deceased. They visit a specialist with an application, where the main document is the death certificate of the testator. Next, the lawyer must:

- Check the presence of a will - the document is certified by a notary, after which it enters the general database. Therefore, finding a will if there is one is not difficult. Some families have their own lawyers who keep important documents. They themselves read the last will of the deceased to his relatives, if necessary. In other cases, the lawyer looks at the database. If a will is found, then the division of the deceased's property will take place according to the instructions left there. Otherwise - according to the procedure established by law.

- Defines all the assets of the deceased from which the estate will be formed. If there is a will, the person himself describes his assets; otherwise, requests must be submitted to various places - Rosreestr for real estate, the traffic police system (transport), banks. Interviewing people living with the deceased will help. In addition to assets, you need to collect all the person’s obligations - outstanding loans, alimony, debts to individuals and organizations. They are an integral part of the estate and will also be distributed among the successors.

- Identify relatives of the deceased client, from close family members - spouse, children, parents, to distant ones - cousins and brothers, grandparents, etc. Distributes them according to 8 lines of inheritance.

- Summons interested parties, checks their documents: citizen’s passport / birth certificate and papers confirming relationship with the deceased. The age of a relative does not affect his rights to inheritance. Even newborn children can qualify on the same basis as adults.

- The legal spouse receives ½ of all assets of the deceased, because this constitutes joint property. Even a will cannot revoke this right. Even common children do not have such an advantage. The remaining portion will be distributed among them.

- The heirs of the first priority will receive half of the deceased's property in equal parts. Everyone, including your spouse. At the end of the division process, each heir receives a certificate from a notary, on the basis of which he can re-register the property in his own name in the appropriate authorities. Real estate - in Rosreestr, transport - in the traffic police (Federal Law - 218).

Each successor must pay tax, so they have the right to agree among themselves that they will accept the inheritance alone and then share it with others. It's cheaper and faster.

What documents are required when contacting a notary to open an inheritance?

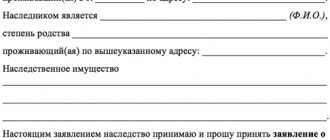

To begin the procedure for registering an inheritance, relatives or persons who consider themselves heirs must contact a notary with the following documents:

- death certificate of a person whose property is subject to inheritance;

- documents confirming family ties with the deceased;

- documents confirming the place of last residence of the deceased;

- a will or a copy thereof, if available;

- document proving the identity of the person applying.

Documents that confirm family ties may include:

- Marriage certificate;

- birth certificate;

- a copy of the court decision appointing the deceased as the adoptive parent of the person who applied.

A marriage certificate establishes the rights of the person who inherits property after the death of a spouse, namely the second spouse. If the official marriage has not been registered, then the relationship between the couple cannot be considered related, and the person cannot be an heir of the first category.

Documents that confirm the place of last residence of the deceased may include extracts from house books, a certificate of registration at the place of stay or residence.

Division by will

The division of property of one of the spouses under a will occurs in accordance with the orders left by the testator during his lifetime. He himself identifies the main successor and chooses who will get what, not limited by family or friendly ties. The right to appoint any person, even an entire organization. The contents of the will may remain secret until announced (closed will).

The document is drawn up by a notary, a specialist certifies and stores the document. When drawing up, 2 witnesses are needed; they will sign the envelope without seeing the will itself. The lawyer himself may not know the text. The inheritance is then divided according to it after death, when the notary solemnly reads the document in front of a group of interested parties.

Mandatory

According to the law, there is the concept of a mandatory share, i.e. part of the inheritance that will go to people whose right cannot be revoked even by a will:

- legal spouse;

- minor children;

- the parents of the deceased are pensioners or disabled;

- dependents whom the testator supported during his lifetime.

The above categories of citizens are required to receive their parts of the inheritance by right of succession. The legal spouse will get the most.

Marital

According to the law, the legal husband or wife has the right to receive ½ part of everything acquired during the marriage with the deceased. Also, the spouse is among the heirs of the first stage and will be able to receive a share of the second part, which will be distributed among the remaining applicants. Unless otherwise agreed in advance.

What to do with children when dividing property?

Children, along with parents and spouses, are among the primary heirs. They have the right to claim an equal share with the specified relatives, unless the deceased ordered otherwise in the will.

It is important that the child is born from parents who have entered into a legal marriage. But even in the absence of a legal marriage, the mother’s property belongs to the children, along with other heirs.

In order to inherit paternal property in this situation, it will be necessary to additionally prove the fact of paternity, if this was not previously confirmed by the deceased voluntarily. To do this, a biological examination should be carried out.

It must be taken into account that some categories of heirs, by law, claim to receive a mandatory share. This condition applies to the following persons:

- disabled, underage or adopted children of the deceased;

- disabled mother, father or wife of the deceased (in case of disability or reaching the age of sixty for men, fifty-five years for women);

- disabled dependents who were supported by the deceased, without whose material support, which was the main means of subsistence, they could not provide for themselves.

The size of such a share is determined regardless of the existence and contents of a will. It is at least fifty percent of what they would be entitled to by law.

Terms of inheritance

The law establishes a time frame for accepting an inheritance (Article 1154 of the Civil Code of the Russian Federation). According to general provisions, the procedure must be carried out within 6 months from the date of opening the inheritance case, i.e. the moment of the citizen's death. After declaring a person dead, the day of opening of the inheritance is the date of entry into force of the corresponding court decision, according to which the person was declared dead.

When the right of inheritance for others arises in the event of the refusal of the main successor or his recognition as unworthy, such persons have the right to formalize an inheritance within 6 months from the moment such a right arises.

Persons who have received inheritance rights due to non-acceptance of property by another applicant can carry out the procedure within 3 months from the end of the total 6-month period.

The countdown for accepting the inheritance will begin on the next day following the date on the calendar when the heirs acquired their right. The day after the opening of the inheritance case or after the court decision enters into legal force, the tomorrow after the death of the testator (Article 264 of the Code of Civil Procedure of the Russian Federation).

If you miss the appointed time, you can restore it through the court by filing an appropriate application. If the plaintiff has compelling reasons. For example, you learned late about your right to claim your spouse’s property, you were ill, or you were on a long business trip. This must be confirmed by attaching special documents.

Who opens the inheritance?

Opening an inheritance is the responsibility of a notary. Heirs or presumptive heirs must apply with a document on the death of a citizen to a notary who is located at the last place of residence of the deceased or at the location of his property.

Heirs cannot turn to different notaries to open an inheritance, since the law provides for an immutable rule - only one notary can conduct one inheritance case . Therefore, if the property of the deceased is not located at the place of his last residence, then the intended heirs can choose which specialist to contact. Read here which notary to contact to register an inheritance.

How to refuse an inheritance

Receiving an inheritance is the voluntary right of every person and he can refuse. According to the provisions of Article 1159 of the Civil Code of the Russian Federation, this can be done by submitting an application to a notary dealing with inheritance matters. In the application, the author indicates his desire to refuse in favor of someone (by naming the person’s name), or simply a refusal. Then the remaining successors will receive larger shares. Possible reasons:

- Reluctance to bear responsibility for the debts of the deceased, which will also be distributed among the successors.

- The result of an agreement between a group of relatives, this is done in order to reduce costs and simplify the procedure.

- Other.

A citizen is not obliged to thoroughly explain his goals to the notary; it is enough to draw up the application correctly and have time to submit it before the issuance of certificates of inheritance. Then the inheritance mass will be changed, the shares of the remaining successors will increase.

Through the court

If the parties do not find common ground on the issue of dividing shares of the property transferred by the testator, the only option for resolving this dispute is to appeal to the judicial authorities by filing an appropriate statement of claim.

This document must be drawn up in accordance with the requirements of Chapter 12 of the Civil Procedure Code of the Russian Federation.

Section order

In order to carry out the division of an inherited apartment in court, you must go through the following algorithm of actions:

- Conducting an assessment of the value of real estate. As in the case of concluding an agreement, such actions must be performed to determine the exact price of housing, as well as to calculate the state duty.

- Collecting the necessary documentation and drawing up a statement of claim, with further submission of the document to the court at the location of the disputed property.

- Participation in the judicial process and waiting for a decision on the case under consideration.

- Fulfillment of the requirements of the decision made by the court. If there is a evasion of the parties from fulfilling the requirements of the specified document, the interested person has the right to contact the territorial branch of the FSSP to enforce such a decision.

Claim for division of property

The claim is filed with a judicial body, the territoriality of which is determined by the location of the inherited property. This rule is in the interests of the heirs, as it can speed up the process of considering the case in court (the examination of real estate is carried out much faster).

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

To resolve the issue in court, it does not matter which of the recipients of the inheritance filed the claim. A more important role is played by the limitation period, which should not exceed three years, calculated from the date of opening of the inheritance. The claim must indicate exactly how it is preferable for the successors to divide the transferred property.

The general requirements for the application are specified in Art. 131 of the Code of Civil Procedure of the Russian Federation, while Article 132 of the Code of Civil Procedure of the Russian Federation establishes the requirements for the attached documents. There are no special requirements for this category of cases in the law; the claim is drawn up taking into account the realities that have developed in practice.

The claim must include:

- name of the judicial authority, its address;

- full names of the parties (heirs), their addresses of official registration and real place of residence;

- title of the application, price of the claim;

- circumstances of the dispute: when the testator died, what he left, description of the property;

- the reasons for the dispute between the heirs, a reference to the impossibility of resolving them peacefully;

- proposed option for dividing property, conditions, size of shares, compensation;

- link to the regulatory framework;

- evidence: conclusion of a construction expert on the possibility of division; technical documents, etc.

- demand for division of property addressed to the court;

- personal signature of the plaintiff, date of filing the claim;

- list of attached documents.

It is best to entrust the drawing up of a statement of claim to an experienced lawyer, since any mistake will lead to the abandonment of the claim and will give the heir the opportunity to hide the inherited property.

The claim is drawn up in two copies - one for the court, the second for the defendant. The plaintiff can take a third copy with him if he submits the claim in person - a mark indicating acceptance of the document will be placed on it.

If third parties are involved in the case - for example, co-owners of inherited property, they are also indicated in the application and a copy of the claim for the division of inherited property between the heirs is attached for them.

Sample statement of claim for division of property between heirs

To independently prepare a claim for division of property between heirs, you can use the sample presented below.

Claim for division of property between heirs

Please note that the document is not universal - it must be prepared individually for each situation. Consult with an attorney before filing documents with the court. Consultation with our specialist is free - just ask a question.

Documentation

In order for the statement of claim to be accepted by the court and not sent back to the applicant, the following must be attached to the specified document:

- report on the valuation of real estate;

- copies of the statement of claim for all parties to the case;

- confirmation of payment of state duty;

- documents identifying the identity of all participants in the process;

- death certificate of the testator;

- certificate of inheritance;

- other documents that are essential for a comprehensive and complete consideration of the court case.

Trial

Once the statement of claim has been drawn up and submitted to the appropriate judicial authorities, the process of resolving the dispute in court begins.

When considering the case, the court is guided by the arguments of the parties, the materials of the expert opinion, as well as other evidence substantiating the claims and, as a result, establishes the following circumstances:

- possibility of real division of the apartment;

- establishing the method of use of inherited housing by the parties to the case, the need to determine for such persons shares of residential real estate;

- the possibility of assigning monetary compensation to one or more heirs, proportional to the share of the transferred real estate;

- whether the successors agree to the sale of the apartment and the subsequent distribution of the proceeds from its sale.

Depending on which of the above division options will be preferable for each of the parties, the latter must argue their position, referring to specific evidence, as well as to the norms of the current legislation.

Expenses

Considering the fact that this category of claims is of a property nature, such a document is subject to evaluation. The amount of the state duty is calculated based on the amount of claims, that is, the estimated value of the divided apartment, in accordance with the standards provided for in Article 333.19 of the Tax Code of the Russian Federation. The calculation formulas are below.

| Cost of claim | Calculation formula |

| Up to 20 thousand rubles inclusive | 4% of the claim amount, but not less than 400 rubles. |

| From 20,001 to 100 thousand rubles | 800 rub. + 3% of the claim amount exceeding 20 thousand rubles |

| From 100,001 rub. up to 200 thousand rubles | 3200 rub. + 2% of the claim amount exceeding 100 thousand rubles |

| From 200,001 to 1 million rubles | 5200 rub. + 1% of the claim amount over 200 thousand rubles |

| More than 1 million rubles | 13200 rub. + 0.5% of the amount over 1 million rubles, but not more than 60 thousand in total |

The value of the disputed real estate is established by expert organizations or independent experts.

In addition, as in the case of an agreement on the division of housing, the heirs need to bear the costs of conducting an assessment of residential real estate, as well as, if necessary, pay for the services of lawyers involved in representing the interests of the parties in court.

Special situations

Inheritance matters do not always occur in a standard manner. It all depends on the degree of kinship between the successors and the deceased and other factors:

| Situation | Details |

| Common-law spouse | The rights of a cohabitant and a legal spouse are not equal. Registration of relationships in the registry office gives people equal rights to property acquired during the period of cohabitation. Without this, after the death of the husband, his common-law spouse will not be able to claim half of everything. In court, it is necessary to prove the fact of maintaining a common household, using documents and testimony of neighbors: • cohabitation with the deceased; • existence of a common economy; • the presence of a joint budget for the couple; • the presence of their rights to own real estate that was acquired with the investment of funds from both spouses, or through a guarantee. The former spouse is also deprived of preferential rights. |

| Children's rights | The right of inheritance is enjoyed by all persons who have the status of children of the deceased: • joint children from the real spouse; • children from previous marriages; • adopted sons or daughters; • illegitimate biological children. Paternity in relation to the latter is established legally through the court. During his lifetime, a citizen can donate DNA and verify the fact of blood relationship. After death, exhumation of the corpse or testing of direct relatives will be required for DNA testing. And children born within 9 months after the death of the husband will have the right of inheritance. |

| Poor relationship with spouse | The testator may directly refuse to transfer a share of the property after death to his legal half. By specifying another person as the main heir. Your child, distant relative or friend. Bad relations between spouses during the life of one of them do not matter if the marriage has not been dissolved. Although other applicants may try to recognize the husband or wife of the deceased as unworthy, using compelling reasons - documents and testimony of witnesses. It is possible to deprive a legal spouse of an inheritance if his unworthy behavior is proven: towards the deceased (insults, caused him physical or moral harm) or intentional damage to property. |

If there are actually many more heirs than the deceased described in the will, they can challenge the document in court. For example, a person might not know that he has children from an early relationship, or the biological parents of a deceased orphan might suddenly appear. The fact of relationship will have to be confirmed by doing a DNA test and providing the relevant documents.

How is property divided in the event of the simultaneous death of spouses?

A married couple can make a joint will in case both of them die at the same time. Then, acting as testators, they themselves distribute the property between the specified applicants. In the absence of a document and the death of the couple, the jointly acquired property will go to their relatives. First of all, it is divided in half, for example, an apartment belonging to a married couple. ½ of the living space will go to the wife's relatives, the other to the husband's relatives. Of course, their common children will have primary rights.

How is property divided after the death of a former spouse?

If at the time of the citizen’s death his marriage was dissolved, then the former spouse is automatically deprived of the right to inherit. And he will be excluded from the list of applicants. What matters is the official divorce, carried out in the registry office or through the court. The proof will be a divorce certificate, which shows the names and date of the divorce.

The former husband or wife has the right to demand the division of the spouses' property within 3 years after the divorce (Article 38 of the RF IC). It turns out that if the ex-spouse died shortly after the breakup (less than 3 years), then the right of ownership of the other party’s common things was violated. If, after separation, the property acquired jointly remained with the surviving spouse, and the deceased himself missed the statute of limitations for the division, then his heirs cannot make a claim. But if the statute of limitations remains, then:

- The share of the former spouse from the jointly acquired property in the event of the death of the former husband or wife is established by the court or by an agreement concluded between the citizen and the heirs of the deceased. This is necessary when, in the opinion of the successors, these things need to be included in the general inheritance mass.

- At the time of death, the former spouse did not have time to register a new marriage, then the inheritance mass will consist of not only its part from the common property of the spouses, but also everything acquired after the divorce. Even if the surviving half owns it, he will not be able to claim the assets during division. Therefore, he will be obliged to transfer part to the heirs of the deceased.

- If the deceased managed to get married again, then the number of heirs is replenished by the new spouse (Article 1142 in the Civil Code of the Russian Federation). Any property acquired in a new marriage is also subject to division and will be included in the inheritance.

A new marriage does not affect the procedure for dividing the property of the deceased. He only expands the group of potential successors.

Sale of joint property after the death of a spouse

The simplest option for dividing indivisible property would be its acceptance by one person and subsequent sale. In practice, people often do this in an attempt to save money on the re-registration procedure. After all, those who accept an inheritance must pay taxes. And everyone pays separately.

Nuances of the procedure:

- If the property was purchased during the period of cohabitation with the personal money of one of the spouses, then after the death of the other half, the property will not be included in the inheritance estate. If the owner can document the fact of investing personal funds.

- Before accepting the inheritance, it will not be possible to realize it, because a certificate of inheritance will be grounds for re-registering ownership in Rosreestr or the State Traffic Safety Inspectorate. After which the successor will become the new owner of the object.

- Inherited property is not considered joint property if the names of both spouses were not indicated by the testator in the will. Then everyone will get ½ part of the object, which they can sell.

- The sale of an object may be specified as a mandatory condition in the will. When the testator himself demands to sell the property that constitutes the inheritance mass. Then divide the money. A lawyer may engage an appraiser to determine the exact value of the item.

To avoid an ambiguous situation, it is easier to first accept the inheritance and then dispose of it. After registering ownership, the new owner will gain complete freedom.

Methods for dividing property after the death of a husband or wife

More often, the distribution of rights to property from the “joint” category, after the death of a husband or wife, is implemented in a simplified manner on a voluntary basis, through a notary. According to the law, the wife is entitled to 50% of the total property, unless a different value is specified in the marriage contract or court decision (clause 4 of Article 256 of the Civil Code of the Russian Federation). However, it is not possible in all cases to distribute property rights voluntarily.

If there are declared claims from heirs, creditors and other interested parties, the disputes that have arisen will have to be resolved through the court. Possible grounds for filing a claim are defined in Art. 39 of the RF IC: violation of the interests of minors, or the wife’s failure to receive income for unjustified reasons.