It was possible to pay taxes and provide income data only by directly contacting the tax office. Now an individual gets access to accruals via the Internet. You just need to open your profile on the web portal – https://www.nalog.ru/. Knowing how to register online in a taxpayer’s personal account, you will no longer have to visit a branch to get advice or get up-to-date data.

How to open a page on a web portal

There is no need to go to the tax office yourself if you open a personal account for an individual. You must register a profile and gain access to it.

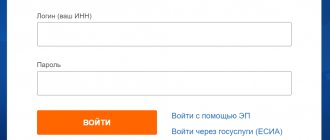

There are different options for how to register via the Internet in a taxpayer’s personal account:

- registration card;

- EDS;

- State Services web portal.

It is easier for an individual entrepreneur to gain access to the taxpayer’s personal account through the ESIA. An individual will not need to waste personal time and visit various authorities.

Registration card

You can set up a personal taxpayer account for individuals using a registration sheet. First, you need to take it from a Federal Tax Service specialist.

How to create a personal taxpayer account for an individual step by step:

- come to the territorial office;

- inform the tax officer that registration data is needed;

- present a passport (birth certificate for the child);

- submit an application (done by a specialist);

- take data;

- go to the web resource – https://www.nalog.ru/.

- indicate the account name and access code from the card.

Using the information received from a specialist of the Federal Tax Service, the user can register on the tax website in his personal account automatically. There is no need to perform any actions yourself.

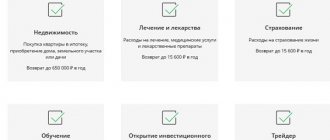

Tax deductions

Good news for everyone who hates long lines - the 3-NDFL deduction form can now also be filled out online. A digital signature is required; we have already written about obtaining it above. The key can be stored in the Federal Tax Service cloud or on removable media. The key password is created by the client; the code must contain different types of characters. The more complex the code information, the more difficult it will be to crack it.

The declaration is available directly on the main LC interface. Enter data on the website or in a special program. Use the same information as for offline documents. After completing the declaration, a window will open - upload the papers into it, on the basis of which the deduction is made. All you have to do is sign the paper using your digital signature and wait for the end of the desk check.

Signature of an individual (electronic)

EDS is an access key on a flash drive, smart card with an encryption and acts as a replacement for a real signature. Allows you to actively use the service.

How to create a personal taxpayer account for an individual step by step:

- Contact a certified center of the Ministry of Communications in person.

- Show the specialist your identity card, Taxpayer Identification Number (TIN) and SNILS.

- Fill out the form and sign.

- Pay for the service – 1.4-1.6 thousand rubles.

- Give the check to the operator.

- Pick up the digital signature and instructions.

The program is installed on a PC; taxpayers can register and gain access to their profile without visiting a Federal Tax Service branch.

How to open a page through the State Services web portal

After reading the detailed instructions on how to gain access to a taxpayer’s personal account through the ESIA, the user will be able to go through the procedure without the help of a specialist. To register an account, you need:

- Go to the tax organization’s web resource – https://lkfl2.nalog.ru/lkfl/login.

- Select the option to log in through your Unified identification and authentication account.

- On the page – https://esia.gosuslugi.ru/idp/rlogin?cc=bp enter the user’s personal data: login and password.

By indicating personal information, the tax payer confirms the login to the ESIA profile and merges the page with the personal account of the Federal Tax Service. Then he will be able to freely use the taxpayer’s personal account.

This option is convenient for those who have a verified account on the official website of the State Services. To confirm your identity, you will first have to contact the MFC; this may take 2-3 weeks.

How to get the current profile code

To obtain a password for a taxpayer’s personal account, you must enter reliable information into the Federal Tax Service system. Upon completion of registration, he is assigned a login and given a code. No matter how an individual was able to register in the personal account of the Federal Tax Service, he will receive a profile name, the corresponding tax identification number and a login password.

If the contribution payer decided to create an up-to-date page through the tax office, then he will have to change the issued code; for security reasons, it is better to do this right away. When an electronic digital signature is used, this is the authorization code.

Demo version

An individual's personal account is available in standard and demo versions. To start the demo mode, write to nalog.ru 12 consecutive zeros without spaces and any password.

The demo test version of the cabinet shows:

- basic information about the conduct of activities by an individual;

- data on registered objects, payments made, contributions made;

- debts or overpayments.

At the top on the right side you can see personal data about the owner - TIN, full name, date of last visit. The full version gives access to all options, including generating reports and filling out declarations.

How to log into the Federal Tax Service profile

In order for an individual entrepreneur to gain access to the taxpayer’s personal account, you need to enter the profile name and code. If a registration card is used, which contains information about the taxpayer, the data is taken from it.

If the payer decides to register in the personal account of the Federal Tax Service of an individual through the Unified Identification and Identification of Information (USIA), then you can access it through State Services by entering your account data. To log in using an electronic signature, you need to go to the application downloaded to your PC and insert a USB flash drive.

How to find out debt by TIN and last name?

All working people are required to participate in the national taxation system. For individuals running individual entrepreneurs, an annual payment of a fixed tax on earned income is mandatory. To find out whether there is a debt, a citizen can go to the “Overpayment/Debt” section of the LC and view the current data.

But if the right to access the personal account has not yet been obtained, then you can view the debt using the bailiffs website. The free fields indicate the full name and tax identification number of the citizen whose data needs to be obtained. If the taxpayer has a debt, then it will be reflected on the website and any person or organization can view it.

Recovering your password if you lose it

Now personal account owners can provide for the need to gain access to the profile in case of loss of the access code. When logging into your account, you need to indicate the option to recover your password using email, indicate your mobile phone, confirm your email address, and write a verification word. Save the entered data.

The taxpayer can enter the information by placing a plus sign next to the point where the access code can be restored via email in case of loss, without visiting the Federal Tax Service office in the “Profile” subsection.

If an individual has lost his password, on the main page of the tax inspectorate’s personal account, you must click on “Forgot your access code” and indicate: identification number, email address, verification question. You have 3 attempts to enter data.

If the information provided is correct, you will receive an email with a link to a page to restore access to your profile. The link is active for 12 hours and can only be used once. If you fail to log into your personal account due to incorrectly specified data, you can try again only after a day. Access can be restored in this way only after 24 hours.

The user will be able to receive a new access code by visiting a tax office in person.

Hotline Tax ru

If you are interested in any information related to the services of the federal tax service, you can contact the Federal Tax Service hotline at 8-800-222-2222. Calls within Russia are free. Use this Federal Tax Service contact center number to resolve general questions or obtain information.

The tax office also has a special helpline where you can anonymously report facts of corruption or bribes and other gross violations of the tax service. Calls to this number are accepted 24 hours a day.

Tax helpline of the central office of the Federal Tax Service of Russia

Service functionality

Individuals are required by law to pay taxes. Evasion is subject to administrative, tax, and sometimes criminal liability. To obtain data on accruals and existing debt, it is better for an individual to register in the personal account of the Federal Tax Service. To do this, he can visit a branch of the Federal Tax Service, obtain an electronic signature, or use the Unified Identification of Authorities.

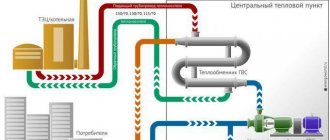

After the user has been able to open the taxpayer’s personal account, he gets access to its full functionality:

- control over property, transport, land taxes;

- tracking and repayment of debts, penalties;

- refund of overpayment to the account;

- receiving notifications from the Federal Tax Service;

- transfer of payments;

- Printing of payment slips for tax payments.

You can obtain a password to log into a taxpayer’s personal account at a branch of the Federal Tax Service, through State Services and through an electronic digital signature. The functionality is expanded through special programs that can be downloaded on the tax office web portal. Documents can be filled out online, it is more convenient. Using the web portal, you can apply for a refund of overpaid money. You can consult in the “Typical Questions” section.

The following two tabs change content below.

- about the author

- The last notes

Nikita Averin

In 2021 he graduated from the Federal State Budgetary Educational Institution of Higher Education “Saratov State Technical University named after. Gagarina Yu.A.", Saratov, in the field of preparation "Informatics and Computer Science". Currently I am the administrator of the site kabinet-lichnyj.ru. (Author's page)

Useful features

On the main page of the site you will see 4 categories.

"My taxes"

Here you can see the personal income tax paid for the current year. The “Additional information” subsection contains data on income for previous years. By clicking on the appropriate link, the user has the right to download a certificate with and without an electronic signature in form 2-NDFL in PDF format.

Taxpayer income certificates

The subsection “Information on income from the declaration” contains data on declared profit.

"My property"

This section displays information about all taxable objects, including cars, real estate, land, air transport, etc.

"Life Situations"

The following functions are available in this section:

- filling in the program and submitting tax returns;

- disposal of overpayment of taxes;

- submission of information about property;

- clarification of tax information;

- request for information;

- filing applications for benefits for disabled people, large families, pensioners and other categories of citizens;

- information about accounts opened in foreign banks;

- changing the taxpayer’s personal data;

- other situations (complaints, contacting technical support, registration).

Useful functions of a taxpayer’s personal account

"Contacts"

This section contains the support service number, work schedule, address of the nearest Federal Tax Service, and a link to make an appointment with the Federal Tax Service.