Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

You can return a product for many reasons: defective items found, return of unsold stock, inappropriate assortment. Even if everything is fine with the product, the buyer can return it. Read the article on how to reflect returns in accounting under the general tax regime.

Return of goods in 2020-2021

So, from 2021, VAT when returning goods to the supplier is required to be processed according to the following rules:

- The seller prepares an adjustment invoice and records it in the purchase ledger.

- The buyer no longer draws up an invoice, but registers the seller’s adjustment invoice in the sales book (if he managed to accept VAT for deduction, if not, then he accepts the deduction in the non-refundable part).

It does not matter for what reason the return occurs. This is how the return of both defective and high-quality goods is processed if it does not comply with the contract. If you issue a return with an invoice from the buyer (as was done previously, until 2021), the seller will lose the VAT deduction. The same procedure applies if the buyer does not pay VAT due to the use of a special regime (USN, UTII).

ConsultantPlus experts spoke about VAT deductions from the seller when returning goods. Study the material by getting trial access to the K+ system for free.

Such clarifications are provided by the Ministry of Finance (you can view the details of the letters using the links above). But at the same time, he makes the following addition: if the goods are returned under a purchase and sale agreement, where the parties change places, invoices are issued as for sales (see, for example, letters of the Ministry of Finance dated May 15, 2019 No. 03-07-09/34582, No. 03-07-09/34591).

Read more about issuing return invoices in this article.

How to design a reverse implementation in a new way

From 04/01/2019, you must issue a return of goods using an adjustment invoice issued by the seller. According to this document, he accepts VAT for deduction. The buyer, when returning the goods accepted for registration, is no longer obliged to issue an invoice to the seller.

Back in the letter dated October 23, 2018 No. SD-4-3/ [email protected] the Federal Tax Service of the Russian Federation wrote that in the event of the buyer returning goods accepted for registration, the basis for deducting VAT from the seller is the adjustment invoice issued by him. This procedure, starting from 01/01/2019, applies to the return of both high-quality (already registered by the buyer) and low-quality (defective) goods.

Thus, when returning from 01/01/2019 the entire batch (or part) of goods, both accepted and not accepted by buyers, tax officials recommended that the seller issue adjustment invoices for the cost of goods returned by the buyer.

That is, any return must now be processed through an adjustment invoice. Please note that we should not forget that the adjustment invoice is not issued on its own. To do this, you need documents confirming the change in the cost of delivery. In this case, it may be an agreement to return the goods.

VAT deduction from the seller

In case of return of goods to the seller or refusal of them, the amounts of tax presented by the seller to the buyer and paid by him to the budget when selling the goods are subject to deduction (clause 5 of Article 171 of the Tax Code of the Russian Federation).

These deductions are made in full after the corresponding adjustment operations in connection with the return of goods or refusal of goods are reflected in the accounting records, but no later than one year from the date of return or refusal (clause 4 of Article 172 of the Tax Code of the Russian Federation).

The basis for deducting VAT from the seller is the adjustment invoice issued by the seller (clause 13 of Article 171, clause 10 of Article 172 of the Tax Code of the Russian Federation).

And as of April 1, 2019, new rules for maintaining a sales book came into effect. They were introduced by Decree of the Government of the Russian Federation dated January 19, 2019 No. 15.

The innovations in this document finally resolved the issue of processing the return to the seller of goods previously accepted for registration by the buyer. There is no need to formalize this operation as a “reverse implementation”. In this case, the seller must issue a correction invoice.

Registration of adjustment invoices by the seller

Based on the adjustment invoice, the seller deducts the difference between the VAT amount in the original invoice and the new (lower) tax amount. The seller can claim a deduction within three years from the date of drawing up the adjustment invoice (Clause 10, Article 172 of the Tax Code of the Russian Federation). He does not need to submit an updated VAT return for the period when the shipment took place.

If the adjustment invoice is issued in the same quarter in which the shipment occurred, the seller records it in the sales ledger for the same quarter.

If the shipment and the shipment adjustment were made in different quarters, then the seller registers the adjustment invoice in the sales book for the period in which the documents that serve as the basis for issuing the adjustment invoices were drawn up.

The Tax Code clearly states the procedure for accepting VAT for deduction in the event of drawing up an adjustment document (clause 13 of article 171, clause 10 of article 172 of the Tax Code of the Russian Federation).

Thus, if the seller issues an adjustment invoice “for reduction”, then he can deduct VAT on it no earlier than the period of its issuance.

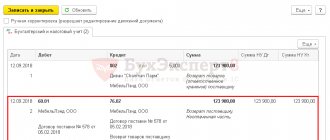

Previously recorded accounting entries must also be corrected.

The seller will make reversing entries in his accounting:

Debit 62 – Credit 90.1

— sales revenue decreased;

Debit 90.3 – Credit 68

— VAT is accepted for deduction in the amount of the difference between the original and adjustment invoices.

After receiving the adjustment invoice for the reduction, the buyer will have the following reversing entries:

Debit 20 – Credit 60

— the amount of debt to the supplier has been reduced;

Debit 19 – Credit 60

— the difference in VAT on the original and adjustment invoices is reflected.

The buyer must restore the amount of VAT previously accepted for deduction on the original invoice:

Debit 19 – Credit 68

— the amount of the difference previously accepted for VAT deduction was restored.

Adjustment invoice and income tax

A change in the price of a product or its quantity also leads to a change in the tax base for income tax.

Note that these changes are reflected in tax accounting not according to the compiled adjustment invoice, but on the basis of new data in the primary documents - on the date on which the documents with quantitative changes that led to an adjustment of the final value were issued. That is, all changes should be taken into account in the current period on the basis of primary scientific documents.

There is no need to recalculate past tax payments or submit an updated income tax return. If the tax base for previous periods was determined on the basis of originally issued invoices or acts, then it is considered that it was calculated correctly.

At the same time, based on the provisions of Articles 54 and 81 of the Tax Code of the Russian Federation, in situations with “overpayment” of tax, a company has the right to voluntarily adjust a previously filed income tax return.

Return under a new agreement

The Ministry of Finance warned: if the return of goods accepted for registration is processed in the old way, i.e. the buyer has issued an invoice, the seller has no right to claim a deduction for it.

However, from the same clarification of the department it follows that if the return is formalized by a purchase and sale or delivery agreement, then VAT can be deducted on the invoice of the buyer who returned the goods.

Indeed, in any case, we must proceed from the fact that in different situations it may be more convenient for the parties to formalize the return either as an adjustment to the transaction, or as a reverse sale. No one can prevent the supplier from undertaking to buy back unsold or defective goods at the selling price or simply doing so of his own free will.

That is, if goods previously purchased and registered by the buyer are subsequently sold on the basis of a new purchase and sale agreement (supply agreement), under which the buyer acts as the seller of the goods, and the former seller as the buyer, then invoices are issued for such goods - invoices in the manner prescribed by paragraph 3 of Article 168 of the Tax Code of the Russian Federation.

Thus, in our opinion, the right to choose remains with the partners: they can draw up a sales adjustment (with an adjustment invoice), or they can buy back their goods from the buyer under an independent sales contract. In this case, no adjustment invoice will be required from the former supplier, but a regular invoice for the supply of goods will be required from the former buyer.

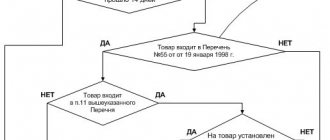

When the return will be a reverse implementation

As a rule, when returning goods, no one enters into a separate purchase and sale agreement, in which the buyer becomes the seller and the seller becomes the buyer. Therefore, it is not easy to immediately imagine the situation that the Ministry of Finance is talking about.

But even if there is no such agreement, reverse implementation may occur. Look carefully at the original contract. Does it contain a condition on the repurchase of goods by the seller? For example, if the buyer was unable to sell them before a certain time. This is the reverse implementation, in which the buyer must create an invoice.

The next point is important here. To avoid claims for deduction, the contract should clearly state that the return of the goods is carried out by return delivery, in which the buyer is the seller and the seller is the buyer. Then the inspectors will have no reason to find fault with the invoice (it will not be an adjustment, but a regular one). If there is no such specificity in the contract, claims are possible against any execution of the transaction:

- You made an adjustment invoice, and the tax office says: “You have a buyback, you need an invoice from the buyer” - and removes the deduction.

- Or, on the contrary, you have issued a return delivery, and the controllers tell you: “You don’t have anything written about return delivery, it says about a return” - and you also lose your deduction and are forced to go to court.

So review your contracts and make changes if necessary.

By the way, buyback is possible not only for unsold quality goods, but also for defective ones (letters from the Ministry of Finance dated May 15, 2019 No. 03-07-09/34582, No. 03-07-09/34591).

Basic Concepts

When purchasing a product for further sale (wholesale), the seller is called the supplier, and the buyer is called the counterparty. The role of the supplier can be directly from the manufacturer (manufacturer) of the product, a legal organization or an individual. In relation to the buyer, the supplier is obliged to:

- provide a certain number of purchased products of appropriate quality;

- fully satisfy legal claims regarding the acquisition from the counterparty;

- make deliveries within the terms specified in the contract, without delays.

The counterparty is obliged to accept the supplied objects and pay for everything provided to him in the manner specified in the contract: advance (preliminary) payment, upon receipt, upon sale (according to schedule).

If payment terms are violated, the seller has the right to file a payment claim against the consumer.

How to reflect the return of goods in tax accounting for income tax ?

If the supplier fails to comply with the terms of the agreement, the buyer has the right to return the goods in whole or in part. Problems with return transfer often arise due to a lack of completeness of the delivery or non-compliance with quality parameters. The supplier and counterparty document the transaction by making the necessary accounting entries.

By the way! By agreement, it is possible to replace the purchase or eliminate violations within a specified time frame. If the seller evades fulfillment of claims, the counterparty has the right to send a statement of claim to the judicial authorities.

Return of goods: difference in accounting

The differences between a return and a buyback are also important for reflecting the transaction in accounting.

Regular return

When returning goods that have been accepted for registration, the buyer will make the following entries:

- Dt 76 (not 62!) Kt 41 - for the cost of return;

- Dt 76 Kt 68 - for the amount of VAT on the adjustment invoice.

The seller must reverse:

- revenue: Dt 62 Kt 90;

- cost: Dt 90 Kt 41;

- VAT: Dt 90 Kt 68.

Buyback

The buyer reflects the sale of goods:

- Dt 62 Kt 90 - for the redemption amount including VAT;

- Dt 90 Kt 41 - for the cost of returned goods;

- Dt 90 Kt 68 - for the amount of VAT.

The seller, accordingly, enters these goods into his account:

- Dt 41 Kt 60 - for the cost of return (redemption);

- Dt 19 Kt 60 - for the amount of VAT;

- Dt 68 Kt 19 - VAT deductible.

When can I return goods?

The Civil Code allows the buyer to return the goods to the supplier if the seller:

- did not hand over components or documents related to the goods on time;

- delivered a smaller quantity of goods than agreed upon;

- delivered the wrong assortment of goods, which differs from the agreement;

- did not complete the goods on time as requested by the buyer;

- delivered the goods with defects or in improper packaging, these violations are significant and the costs of eliminating them are disproportionate to the cost of the goods.

If the buyer discovers any violation from this list, he must notify the seller (Article 483 of the Civil Code of the Russian Federation).

Results

The procedure for processing the return of goods to the supplier has changed since 2019 and is now uniform: the supplier draws up an adjustment invoice, and the buyer only draws up an invoice marked “return of goods.” The buyer does not issue an invoice for the return. Based on the adjustment invoice, the seller accepts VAT for deduction during the period of return of goods, and the buyer recovers the VAT.

For a sample of filling out a correction invoice for returning goods to a supplier, see here.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Differences in Concepts

Some accountants do not share the concepts of “return of goods” and “reverse sales,” resulting in numerous problems with the preparation of documentation and with the reflection of transactions performed in accounting (tax, accounting).

If, some time after shipment of the purchased shipment, the purchaser returns what he received (in whole or in part) to the seller, it is important to find out the exact reason for this.

When the reason for the return movement of products is the non-compliance of the supply with the terms of the agreement (specification) in terms of configuration, color, quality or size, then the procedure should be interpreted as a return.

This situation arose as a result of the seller’s failure to properly fulfill its obligations to deliver what was ordered.

If the contract is terminated for the reason specified in the Civil Code of the Russian Federation, the obligations of the parties are not fulfilled, and there is no fact of implementation. With such a transfer, a waiver of the owner’s rights to the acquisition received is obtained, and not a restoration of the transferred right of ownership. The buyer, who has already recorded the receipt in accounting, must make reversing entries to correct it.

In cases where the purchaser does not have any claims to the received product, and its movement to the place of sale is carried out by agreement with the seller (for example, a part that was not sold on time), then the process is a reverse sale. In fact, 2 transactions take place: in the first transaction, the supplier sold goods to the buyer, and then in the second transaction, the buyer sold the same objects or part of them to the supplier. Both parties formalize and record the transaction as a regular purchase or sale of products.

By the way ! A product received under an agreement that meets the quality requirements is returned to the seller only by decision of the parties to the transaction or if the situation is stipulated by the terms of the current agreement (Article 450, Article 453 of the Civil Code of the Russian Federation). Upon receipt, ownership of the product is transferred to the acquirer (Article 223 of the Civil Code of the Russian Federation), and upon reverse sale, carried out at the same cost at which the product was purchased, ownership changes to its original state (before sale).

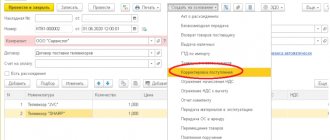

How to issue a refund to the buyer in 1C 8.3 Accounting

On March 21, the Organization sold Bureaucrat Chair T-9950AXSN/Black - 15 pcs. at a price of 23,600 rubles. (including VAT 18%) to the buyer ELITE STROY LLC. On the same day, payment was received from the buyer to the bank account in the amount of RUB 354,000.

On March 22, the entire batch of products sold was returned upon acceptance of the goods.

On March 23, payment was transferred from the current account to the buyer.

To register the transfer of payment to the buyer when returning goods, draw up the document Write-off from the current account, transaction type Return to buyer.

It can be created:

- based on documents Return of goods from the buyer or Adjustment of sales ;

- Bank and cash desk - Bank - Bank statements - Write-off button.

Postings

Postings are generated:

- Dt 62.02 Kt - refund of payment to the buyer.

We looked at how to process a return of goods from a buyer in 1C.

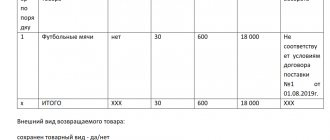

Return of defective goods to the supplier after acceptance

There are situations when you cannot return a defective product to the supplier immediately, although the defect was discovered at the time of acceptance. For example, the delivery was from another region, and the transport company - the seller's delivery contractor - does not accept anything back. Everything is more complicated here, including documenting the return of defective goods to the supplier. Despite the defects, you will have to accept the products according to the TORG-12 invoice, draw up a statement of discrepancies in quantity and quality, and place the inventory items in your warehouse. And only after that write a claim and wait for it to be reviewed by the supplier. Let's take a closer look at the process.

To begin the procedure for the documented return of defective goods, you must, with a representative of the supplier or transport company, fill out an Act on the established discrepancy in quantity and quality upon acceptance of inventory items in the TORG-2 form. It confirms the illiquidity of the product and is the basis for writing a complaint to the supplier.

Get a sample for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

The TORG-2 form is very complex. If you do not want to waste time filling out its numerous fields, then you can draw up an act in any form, indicating the details of the documents under which the goods arrived (delivery agreement and TORG-12 invoice).

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

Next, after the supplier has reviewed and satisfied the claim for the returned products, you need to draw up a TORG-12 invoice. It will already be returnable for you and creditable to the supplier, because he will already buy from you the goods that you are returning. Buy it because you previously received ownership of it. This is called "reverse implementation".

A return TORG-12 is also issued in two copies, in the “Bases” column you must write: “Return of low-quality goods.” All details are indicated from the contract and the invoice on which the defect was originally received.