In what cases are such complaints filed?

Before appealing a decision (action, inaction) of the tax inspectorate in court, the taxpayer must appeal it pre-trial.

You can appeal an audit decision, a tax notice, a demand for payment and other documents or actions (inaction) of officials. Each subject of appeal has its own code.

By way of appeal, you can appeal decisions based on the results of an on-site or desk audit that have not yet entered into force.

It is impossible to appeal decisions made by the Federal Tax Service of Russia itself (its central office).

Recommendations for filling out the descriptive part

You can describe either any actions of employees or the inaction of the tax authority as a whole. For example, there are often situations when an application for a tax deduction was submitted in accordance with all the rules, but funds were not credited to the account. This is exactly the case when a complaint is required. It is also advisable to mention when contacting:

- number and date of the act or other document, the appeal of which is being discussed;

- arguments in your defense;

- references to relevant laws;

- papers with legal force that confirm the described circumstances.

The most important requirement is to avoid subjectivity and unfoundedness.

The form contains two parts of the document. One describes the current situation, the second suggests a way out of it. Moreover, the information is supplied in the form of a request. It can be formulated as:

- find a solution;

- cancel any decision made;

- accrue funds;

- change part of the accepted document;

- make a new decision on the appealed case, etc.

The paper is completed with a list of attachments (copies of them must accompany the complaint), a signature with a transcript and the date of filing.

When can I complain?

The deadlines differ for decisions based on the results of desk and field inspections that are not appealed, and for all other decisions, as well as actions (inaction) of the inspectorate.

Thus, an appeal must be filed before the decision based on the results of the inspection comes into force - that is, within 1 month from the day it was served.

You can appeal a decision based on the results of desk and on-site inspections that were not appealed on appeal within a year from the date of such decision. The date of delivery of such a decision does not matter.

Other decisions of the inspectorate, as well as its actions (inaction), can be appealed within a year from the day you learned or should have learned about a violation of your rights.

Filing a complaint or appeal

A complaint is filed when acts of the tax authority or actions/inactions of its officials have already entered into force and violate the rights of the taxpayer. It can be sent within a year to a higher tax authority through the same authority, whose decision must be appealed.

An appeal is filed if the tax authority’s decision to prosecute a person for a tax offense has not yet entered into force. The filing deadline is within 10 days from the moment the tax authorities’ decision is received. At the end of this period it comes into force (clause 2 of article 101.2 of the Tax Code of the Russian Federation).

A complaint can be submitted in writing or electronically, including through the taxpayer’s personal account. It must be signed by the manager or representative. If it is filed by authorized representatives of the taxpayer, a power of attorney must be submitted along with the complaint.

Only legal representatives of an organization (general director, manager, chairman) or an individual (parents, guardians, trustees) can represent the interests of a taxpayer without a power of attorney.

An authorized representative of a taxpayer (individual or legal entity) can represent the interests of the taxpayer on the basis of a power of attorney (Articles 185-189 of the Civil Code of the Russian Federation). To represent the interests of an individual entrepreneur, you need to notarize the power of attorney (Clause 3, Article 29 of the Tax Code of the Russian Federation).

There are decisions that cannot be appealed on appeal, but only in court. We are talking about decisions made by the federal executive body authorized for control and supervision in the field of taxes and fees.

Information to be included in the complaint and appeal

This information is specified in Art. 139.2 Tax Code of the Russian Federation:

- Full name and address of the applicant or name and address of the applicant organization;

- the act being appealed against, actions or inactions of its officials;

- name of the tax authority whose actions are being appealed;

- the grounds on which the applicant’s rights were violated;

- requirements of the person filing the complaint;

- method of obtaining a decision on a complaint: on paper, electronically or through the taxpayer’s personal account.

In addition, it is permissible to include additional circumstances in the complaint that may mitigate or eliminate the taxpayer’s liability. The complaint may also indicate other information necessary for timely consideration of the complaint, including telephone numbers, fax numbers, email addresses, etc.

The deadline for making a decision on a complaint is within a month after filing (clause 6 of Article 140 of the Tax Code of the Russian Federation), but it can be extended by another 15 days if the head or deputy head of the tax authority decides so.

Within another three working days, the taxpayer will be informed of the decision made. From the day the decision on the appeal is made, the decision of the tax authority based on the results of the audit comes into force.

The appeal is filed with the same tax authority that made the decision. He must transfer the complaint to a higher tax authority within 3 days. While the complaint is being considered by a higher tax authority, accrued payments are not collected.

A decision of a tax authority that has entered into force, which has not been appealed, may be appealed to a higher tax authority in the general manner within a year from the date of the appealed decision.

If you missed the deadline for filing a complaint for a good reason, you can restore it by filing a petition with the tax authority.

Why do you need to file a complaint?

- so that your application is subsequently considered by the court;

- it's free;

- it is simple and does not require the help of lawyers;

- you do not need to be present at the hearing of the complaint;

- if an appeal is denied, you can understand why this happened and prepare more thoroughly to defend your position in court;

- If the decision of the tax authorities or officials has been appealed to a higher tax authority, it will be suspended.

How to file a complaint

A complaint can be filed against the decision of the tax authority as a whole, or against its individual parts. The complaint must indicate the reasons why you do not agree with the tax office’s decision and state your demand - for a complete or partial cancellation of the decision, an additional audit or a change in the decision, otherwise it will not be accepted.

A sample complaint can be downloaded from the Federal Tax Service website.

How long will it take to consider the complaint?

The time frame during which complaints are considered differs for complaints about decisions on desk and field inspections and for complaints about other decisions, as well as actions (inaction) of the inspectorate.

Complaints about decisions based on the results of on-site and desk inspections are considered by a higher authority within a month from the date of receipt.

This period may be extended for another month if the higher authority needs to obtain additional documents.

Complaints about other decisions and actions (inaction) of the inspectorate are considered within 15 working days from the date of receipt.

The decision on the complaint will be sent within 3 working days from the date of acceptance.

How to file a complaint against the tax office online: basic rules

The rules for filing an electronic complaint with the Federal Tax Service are not established at the level of legal acts, therefore they follow only from the procedure established by the electronic resource nalog.ru. There are some features of filing an appeal in this form for individuals and legal entities, but the basic rules for filling out the form are general. Among the important rules for using the service for filing a complaint with the tax office online are the following:

- the service offers to select one of the specified bodies, and if the required one is not available, the user can select the required one in the corresponding directory;

- You must fill out all fields marked with an asterisk (failure to fill out such sections will result in the impossibility of sending the document);

- if the information about the taxpayer contains inaccurate information, then it is necessary to submit a corresponding application to the tax office to eliminate the inaccuracies;

- if an act is appealed, then indicating its details is mandatory;

- the applicant can receive a response by mail or directly in his personal account (for this he must choose a convenient method when filing a complaint);

- the document drawn up must be signed with an electronic signature, which is issued according to different rules for citizens (remotely, in a few minutes or hours) and legal entities.

Where to go

So, where can you complain about the tax service? This organization has a lot of powers, so not every organization can conduct inspections there. They can help you in three places:

- In the higher tax service. The best way to draw attention to a violation by a tax officer is to file a complaint with his superiors. If you have any difficulties with a certain employee, you can submit a complaint directly to the tax office, addressing it to the manager. If you think that the entire tax department is working inappropriately, then you can file a complaint with the main department in the city;

- At the prosecutor's office. If you believe that violations in the work of the tax service affected not only your interests, but also your civil rights, then it makes sense to file a complaint with the prosecutor’s office. It is this service that has sufficient authority to conduct tax audits, but it is advisable to contact it only when a regular complaint has not yielded results;

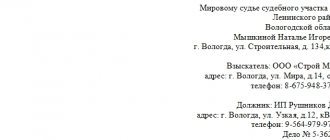

- In a court. If you think that complaints against the tax office to the prosecutor’s office and the tax office itself are ineffective, then you can go to court. Most often, they turn to a higher authority in cases where, in addition to the standard requirements, it is necessary to carry out any penalties. But going to court will not lead to an inspection, but to full-fledged hearings, which can take a lot of time, money and effort.

Is anonymous submission possible?

This is allowed, but the effectiveness of this measure is extremely low.

There are precedents, but their number does not exceed one percent of the total number of requests. Any person applying to the tax office must provide personal information, which is why this type of complaint is an unreliable way to convey data to the fiscal authority. If you decide to use this method, you can file a complaint against the actions of the tax office by calling the authority’s hotline, but you should not expect any decisive action, or even consideration of the document.

The legislative framework of the state does not have specific instructions on how to submit anonymous complaints to the Federal Tax Service and, moreover, the need to consider applications in this way. All precedents for working with such applications are carried out on a proactive basis, that is, the tax office accepts them at its discretion. An anonymous request can be submitted using the following methods:

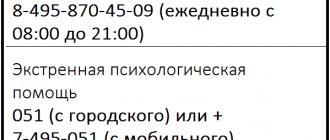

- By calling the helpline. A specific telephone number is determined for each subject, and you can find it on the nalog.ru resource - in the contacts tab.

- A written appeal left during a personal visit to the authority.

- By email to the tax office.

If you need 100% confidence that your application will be accepted, you should not use this method to submit your application.

Grounds for filing a complaint against the actions of the tax authorities

The opportunity to complain to a higher tax inspection authority is available to any person (individual, legal entity, including Individual Entrepreneurs) whose rights were violated by the non-standard performance of official duties by an employee of a lower-level Federal Tax Service.

You can file a complaint against the actions of the tax inspectorate if the following list of deviations from the norms is identified:

- The deadlines for the provision of services were violated.

- The deadline for submitting requests for services has been exceeded.

- Refusal to correct an error or typo.

- One of the government services was denied.

- Refusal to accept documentation.

- The employee demanded additional documents or a non-regulated fee.

All of the above violations are grounds for filing a complaint. The regulations on these issues are set out in Article 19 of the Tax Code of the Russian Federation and Article 20 of the Tax Code.

For guidance in specific situations, you can refer to Articles 137-140 of the Tax Code.

Reasons for contacting

In order to file a claim with the tax authorities, you will need to have some compelling and justified reason. There are many such reasons, the most significant are:

- Disclosure of personal data of citizens;

- Violations and errors in the collection and assessment of taxes;

- Exceeding official powers or using these same powers to commit crimes;

- Illegal fraud with funds;

- Violation of civil rights of taxpayers;

- Unreasonable refusal to carry out various tax transactions.

Info

Keep in mind that we have only listed the most common reasons. If you believe that your rights or interests have been violated, but are unable to file charges, please consult a lawyer.

Deadlines for consideration of applications in 2021

Complaints against decisions that have entered into force on holding persons accountable for acts that violate the established procedure or decisions to refuse such, may be considered by tax authorities in 2021 within a period of up to one month from the date of acceptance of the appeal. At the same time, a decision is made on the case.

However, the head of the Federal Tax Service or his deputy has the opportunity to extend the deadline for reviewing the document to thirty days. This is done in two cases:

- the applicant has provided an additional document;

- it was necessary to obtain documentation or information from lower tax authorities.

The decision that the authority made in this case will be sent to the complainant no later than three working days from the date of its approval in accordance with paragraph 6 of Article 140 of the Tax Code.

If the applicant does not agree with the response received, he can file a second complaint with the Federal Tax Service or the court, as noted in Articles 138 and 139 of the Tax Code.

How to file a complaint online on the Federal Tax Service website

Submitting an application through the Federal Tax Service website - nalog.ru is the most optimal way to carry out the procedure due to the complete automation of the system, which means that the applicant will not be able to fulfill the contradictory requirement of the tax authority.

Sending a document to a higher authority through third-party methods on the Internet, including an email, is an unnecessarily complicated process due to the lack of specific rules of procedure.

You can file a complaint from your Personal Account provided by the service. With this method, the identity and authority of the applicant are considered fully confirmed. To gain access to the Personal Account, the taxpayer must personally contact the tax office once, where it is necessary to certify the identity card, and then receive the details for accessing the profile on the website.

When going through the procedure of verifying your identity and credentials, you will also need to fill out the registration form of the application, namely the following lines:

- Name of the tax authority.

- Last name First name Patronymic name of the person.

- TIN.

- Which authority was the appeal submitted to?

- Contents of the document.

In addition, the complaint registration card can be supplemented by attaching a photo file or a scanned version of the appeal, which is presented in writing and contains the personal signature of the complainant.

Submission algorithm without a taxpayer’s personal account

Step 1

- Go to the Federal Tax Service website – nalog.ru

- Select region in the upper left field

- Select the status of the person filing the complaint - individual, legal entity or individual entrepreneur

Step 2

After following the link, scroll down and find the block “Filing a complaint with the tax authorities.” Click on it.

Step 3

Select the item “I want to address another issue.”

Click the “Create Appeal” button, select your life situation and fill out the data step by step.

If your situation is not in the list, then go back and select the “Other appeals” button. Fill the form.

How to send an appeal through the taxpayer’s personal account

On the main page you need to select the status of the person who is filing the complaint - individual, legal entity or individual entrepreneur. Click the “Login to your personal account” link. Enter your registration data and then select “Submit an appeal” in your personal account.

Read more about how to complain about the tax office via the Internet on our website.

What decisions can be made regarding the tax authorities?

In the event that the decision of the tax authority is considered to have entered into force, the applicant undertakes to comply with it. In general practice, the fact of filing an appeal does not affect the execution of the act involved. However, the applicant has the right to submit an application for suspension of execution of the established decisions to involve him in the execution of the actions specified in the act during the consideration of the complaint.

For this purpose, this person must provide a guarantee from a banking organization, under the terms of which the organization undertakes to pay an amount of money equal to:

- tax;

- collection;

- insurance premiums;

- fines;

- fines;

At the time of consideration, unpaid for the case under consideration. This application with the attached guarantee must be submitted to the tax authority along with a complaint against the decision considered to have entered into force (Article 138 of the Tax Code).