Top cards

According to Deloitte's annual consumer spending survey, gift certificates rank fourth in the top ten most popular gifts among Russians, ahead of books, event tickets and smartphones.

According to the analytical agency Research and Markets, the gift card market in Russia in the period from 2014 to 2021 grew by an average of 13.7% per year, reaching a level of 35 billion rubles. The market is expected to grow to RUB 47.6 billion between 2021 and 2023. For comparison, the volume of the perfume market, which is also actively in demand on the eve of the holidays, according to estimates by the marketing company Discovery Research Group, amounted to 45.4 billion rubles in the first half of 2021.

Answer

In general, the buyer has the right, within 14 days from the moment the non-food product is transferred to him, unless a longer period is announced by the seller, to exchange the purchased product at the place of purchase and other places announced by the seller for a similar product of a different size, shape, dimension, style, color or configuration, making the necessary recalculation with the seller in case of a difference in price. If the seller does not have the goods required for exchange, the buyer has the right to return the purchased goods to the seller and receive the amount of money paid for it. The buyer's request for an exchange or return of goods must be satisfied if the product has not been used, its consumer properties are preserved and there is evidence of its purchase from this seller. There is also a list of goods that cannot be exchanged or returned (Article 502 of the Civil Code of the Russian Federation). It was established by Decree of the Government of the Russian Federation dated January 19, 1998 No. 55 “On approval of the Rules for the sale of certain types of goods, the List of durable goods that are not subject to the buyer’s requirement to provide him free of charge for the period of repair or replacement of a similar product, and the List of non-food products of appropriate quality that cannot be returned or exchanged for a similar product of a different size, shape, size, style, color or configuration.” In accordance with this document, the following are not subject to exchange or return: - goods for the prevention and treatment of diseases at home (sanitary and hygiene items made of metal, rubber, textiles and other materials, medical instruments, devices and equipment, oral hygiene products, spectacle lenses , child care items), medications; — personal hygiene items (toothbrushes, combs, hairpins, hair curlers, wigs, hairpieces and other similar products); — perfumery and cosmetic products; — textile goods (cotton, linen, silk, wool and synthetic fabrics, goods made from non-woven materials such as fabrics - ribbons, braid, lace, etc.); cable products (wires, cords, cables); construction and finishing materials (linoleum, film, carpets, etc.) and other goods sold by the meter; — sewing and knitted products (sewing and knitted linen products, hosiery products); — products and materials in contact with food, made of polymeric materials, including for one-time use (tableware and kitchen utensils, containers and packaging materials for storing and transporting food products); — household chemicals, pesticides and agrochemicals; — household furniture (furniture sets and sets); - products made of precious metals, with precious stones, made of precious metals with inserts of semi-precious and synthetic stones, cut precious stones; — cars and motorbikes, trailers and numbered units for them; mobile means of small-scale mechanization of agricultural work; pleasure boats and other household watercraft; - technically complex household goods for which warranty periods are established (household metal-cutting and woodworking machines; household electrical machines and appliances; household radio-electronic equipment; household computing and copying equipment; photographic and film equipment; telephones and fax equipment; electric musical instruments; electronic toys , household gas equipment and devices); - civilian weapons, main parts of civilian and service firearms, ammunition for them; - animals and plants; - non-periodical publications (books, brochures, albums, cartographic and musical publications, sheet art publications, calendars, booklets, publications reproduced on technical media). The conditions for the circulation of gift certificates are established by the seller and familiarized with them to the buyer who purchases them - verbally or printed on a form (Article 421 of the Civil Code of the Russian Federation). As a rule, these rules do not provide for exchange for money and return of the difference between the purchased product and the face value of the certificate.

Ask your question on the forum|All questions

IG "Berator"

Solid advantages

And what? A great option for a last-minute gift or for a not-so-close person/colleague.

The popularity of such a gift is also explained by the fact that the certificate or card gives its owner the freedom to choose options for use:

1. The first and most obvious thing is to simply treat yourself to your loved one and purchase a product or service, for which, in fact, the certificate was given.

2. The second option is also very popular, but it is not customary to advertise it. Everything is simple here: the certificate/card can be transferred as a gift! There is nothing illegal in this, because the ownership of the certificate has already passed to the donee, and he can dispose of his thing or his right as he pleases. In this case, donee No. 1 simply transfers his right to receive performance under the contract to another person - donee No. 2.

3. And finally, the most delicate and controversial option is exchanging the certificate for money. Of course, this method is most often used by those who do not like the gift or are unable to use it for its intended purpose.

However, there are also those who earn money by cashing in certificates for their bread and butter.

Let's still focus on respectable citizens and consider an example when you need to cash out a very expensive certificate because of its intended use (let's say a diabetic was given a gift card to a candy store).

What if the certificate was given to me?

It doesn’t change the essence of the matter; the person who received it as a gift can return (=cash out) the certificate. At the same time, the absence of a receipt is not an obstacle to returning the money; the consumer can refer to witness testimony.

The Rules for Using Gift Cards state that they cannot be partially used, returned, etc. That's it, can't get the money?

Not at all! Such conditions infringe on consumer rights, contradict consumer protection laws and are therefore invalid.

What is a gift certificate

Gift certificates have become widespread because of their undoubted advantage in selecting goods and services for other people. When going to a birthday party or congratulating a person on some other occasion, it is extremely difficult to decide on a purchase. Choosing a gift requires an analysis of the needs and requirements of the birthday person, his tastes and interests. This is only possible if the birthday person is a close relative or friend. Often, even a thorough analysis of desires does not lead to a positive result, and you don’t particularly want to spend money on a trinket that no one needs.

Certificates have a wider range of choices; they allow the recipient to choose products or services from those offered in the store where they were purchased. If this form involves the provision of services, then a person can choose not only what appeals to him, but also independently determine the date of receipt of the service. All this increases the chances that the recipient's wishes will be satisfied.

Features of gift certificates are:

- Expanded price segment, as a rule, each store has several amounts to choose from.

- Sufficient time for purchasing goods on it. It often ranges from one month to six months, each seller individually stipulates the validity period.

- If the card was purchased at a store that is part of the network, then the recipient also has the opportunity to choose where exactly he will buy the products.

The essence of gift certificates is that the giver pays in advance for future purchases of the birthday person.

Arbitrage practice

The Uspensky District Court of the Krasnodar Territory considered a lawsuit from a citizen who purchased two gift certificates from a chain of jewelry stores. Each of them had a cost of 25,000, and they totaled 50,000.

The plaintiff stated the following on the merits:

- He purchased gift certificates by bank transfer.

- The coupons themselves were given to him in a sealed envelope, on the back of which there was information about their validity period. It was 6 months.

- The envelopes were opened directly in the store while trying to buy jewelry.

- After opening, it turned out that the information indicated on the envelope was incorrect and the certificates' validity period was less than specified. By the time of delivery it had expired.

- The seller refused the consumer’s written request for a refund.

Based on the stated facts, the plaintiff demanded the return of the spent 50,000, to collect interest for the illegal use of funds, and also to demand payment of legal costs from the defendant.

The defendant objected to the stated requirements, arguing that the buyer was provided with comprehensive oral information about the validity period of the coupons.

The court, having considered the arguments of the parties, decided to fully satisfy the plaintiff’s demands, on the basis that the failure to return funds is not justified and is considered illegal enrichment.

Decision of September 28, 2021 in case No. 2-649/2017

Penalties

Some gift certificates for men and women include additional information in fine print. Often this is information about penalties that will follow for termination of the preliminary agreement. Based on this, the store returns only part of its value to the card owner, which is not legal.

However, do not forget that the cost of issuing it may be withheld from the certificate holder. In such a situation, it is necessary to insist on documentary evidence that this exact amount was spent.

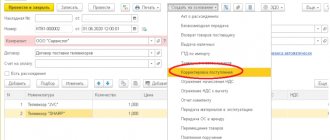

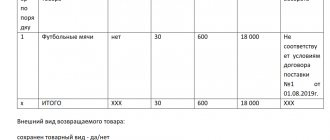

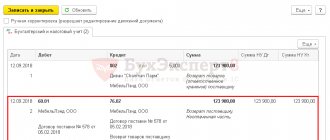

Accounting and tax accounting of certificates

In accounting, the costs of producing certificates are taken into account in account 10 “Materials” and are written off as expenses as sales proceed.

In addition, the accounting of certificates and their movement are reflected by the travel agency in the off-balance sheet account 006 “Strict reporting forms”. The occurrence of obligations associated with the issuance of certificates is accounted for in the debit of account 009 “Securities for obligations and payments issued,” and repayment is recorded in the credit of this account.

A travel agency that applies the general taxation system has the right to include expenses for the production of gift certificates among others on the basis of subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. After all, the list of expenses taken into account for tax purposes is open.

When “simplified”, the services of a third-party organization for the production of certificates can be taken into account as the cost of work (services) of a production nature as part of material expenses (subclause 5, clause 1, article 346.16 and subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation). It should be noted that if certificates are sold by a travel agency under an agency agreement, then their production should not be included in the travel agency’s own expenses. In order to take such expenses into account, the terms of the contract with the principal must stipulate that the travel agency agent carries them out at its own expense.

Is it actually possible to exchange a gift card for cash?

Yes, definitely! You need to understand that a gift certificate is not a product, but only an intention to purchase a product or service. Advance on a future purchase. Accordingly, until the transfer of goods or provision of services, the contract will not be considered concluded. This follows from Art. 492 of the Civil Code of the Russian Federation and Art. 23.1 of the Law of the Russian Federation of February 7, 1992 No. 2300-I “On the protection of consumer rights.” This position is also supported by the Supreme Court of the Russian Federation.

Whether or not to enter into legal relations with the seller (i.e., to buy or not), the buyer has the right to decide independently, and if a citizen decides to refuse the purchase, then he has the right to demand a refund of the advance payment (i.e., the cost of the certificate/card).

Method No. 2

Can I get a refund for a gift certificate if it is expired? Yes, the law allows the cardholder to insist on this. Writing off funds in favor of the store is not legal and is regarded as unjust enrichment. This means that the seller did not fulfill his obligations to the certificate holder on time, despite the fact that he was paid an advance.

Expiring a gift card is another viable way to get its value in cash. To implement it, you just need to clarify the expiration date of the certificate and wait the necessary time.

Method No. 3

The third method is useful to holders of a card that gives the right to receive certain services. So, how to return a gift certificate to the salon? The legislation allows a person to refuse a service at any time; this is also true if a full prepayment is made for it.

The Contractor has the right to demand compensation for costs. In this case, we mean actual expenses incurred by the company in fulfilling its obligations, which can be documented. For example, if a company spent money only on printing a certificate, it has the right to withhold this amount from its owner after providing evidence.

How to make a claim

So, how to apply for a refund for a gift certificate? First, you need to figure out when exactly to write a claim. The owner of the gift card has the right to do this before going to court, as well as as an additional measure.

The claim does not have a set form. However, when drawing it up, it is advisable to adhere to the plan proposed below:

- Details of the seller and buyer.

- Indication of the reason for the return. Here it is necessary to list the facts that prove the impossibility of using the card. For example, inform about the expiration of the certificate, the absence of desired goods, and so on.

- Requirements for the seller. The buyer must indicate whether he wants to receive money or exchange the goods that were purchased using the card.

- List of documents that are attached to the application. This could be bank card details (if paying by bank transfer), or a photocopy of a receipt.

- An indication of the period during which the certificate holder is legally entitled to receive a response from the seller.

The completed claim can be submitted by registered mail with notification or by coming to the store in person.

Going to court

Let's assume that the store reviewed the claim and refused to satisfy the cardholder's demands. Is it possible to return a gift certificate in such a situation? A person can achieve his goal by appealing to the court.

It is worth remembering that new claims can be added to the claim. We are talking about material compensation for legal expenses incurred and moral damage, as well as payment of a penalty. You should definitely notify the store of your intention to go to court. There is a high probability that the seller will decide to meet the cardholder halfway in order to avoid litigation.