Home/Services/Imposition

In everyday life, there are often situations when unnecessary services are imposed on consumers. Such offers can be encountered in the areas of insurance or lending. At the same time, the client is not simply offered a related option, but the conditions are stated under which it is impossible to receive the main service without an additional one.

For your information

Cellular operators also abuse the imposition of unnecessary benefits. Subscribers learn about the connected option, as a rule, only after discovering increased bills for using communications. There is not a single person who has not encountered advertising over the phone. But not many people know that there is legal authority for all of the above methods of influencing a client.

Normative base

Imposing services on a consumer is an illegal marketing ploy on the part of the organization providing them. Article 16 of the Law “On Protection of Consumer Rights” protects the interests of citizens in this matter. The main provisions of the normative act are as follows:

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

- The seller does not have the right to condition the purchase of a necessary product or service on the purchase of another product or the purchase of an unnecessary type of service.

- A trade organization does not have the right to include terms in a contract with a consumer that infringe on the latter’s rights.

- The organization providing services does not have the right to provide related services without the consent of the consumer. Otherwise, the person for whom the additional service was provided has every right not to pay for it.

Attention

If, as a result of the imposed contract, the consumer is forced to incur material costs, the service provider is obliged to reimburse them in full.

Article 14.8 of the Code of the Russian Federation on Administrative Offenses protects the rights of clients. Paragraph No. 2 of the regulatory document states that it is not allowed to stipulate in a written agreement conditions that infringe on the rights of consumers.

Article 426 of the Civil Code of the Russian Federation states that a commercial organization does not have the right to refuse a client to enter into a public contract without compelling reasons.

IMPORTANT

As for intrusive telephone advertising, regulation is carried out by a separate legal act. Federal Law N 38-FZ “On Advertising”, namely its 18th article, provides for the distribution of marketing offers by telephone only with the consent of the subscriber.

Price tags

At the pharmacy, some of the drugs had no price tags, and some of the goods had a digital code instead of prices. Customers could check prices via an electronic device or at flip-up display stands.

The company was found to have violated the rules for the sale of goods and was fined 10 thousand rubles.

The seller objected: there are no requirements to place a price tag on each product. The courts have indicated that the price tag must be in close proximity.

However, in order to obtain information, it was necessary to remember the name of the product, move away from the display case, and enter it into an electronic device. While one client was looking for a price, another was waiting, since there was only one device. And the elderly might simply not know how to use it.

Transfer systems are also not an alternative to price tags. The client should immediately see the information, and not go to the stands. The AC of the Ural District agreed with the conclusions.

(Resolution of the Arbitration Court of the Ural District dated December 14, 2020 N F09-7789/20 in case N A60-15328/2020)

When is a service considered imposed on the consumer?

Sellers are interested in selling as many of their goods or services as possible. To do this, they use various tricks. Clients are not always sufficiently competent in matters related to the acquisition of the necessary product or service. The seller, guided by psychological techniques and various marketing techniques, tries to sell a stale product or an unpopular service. He may force the consumer to sign an agreement that goes against the latter's interests.

Attention

It is not difficult to distinguish between a service imposed on consumers and promotions. When you go to a store that has a discount program, you may see a “2 for the price of 1” offer. This means that at the moment it is possible to purchase two goods, but pay only for one. Moreover, these items can be purchased separately, but at the current price without taking into account the discount. When a seller offers to buy a specific item only in conjunction with another lot (although it is presented individually), this will be considered an imposed service.

Paid delivery

On the website of the online store it was indicated that if an order with paid delivery is cancelled, its cost will be deducted from the buyer. The order status does not matter.

The client placed an order and canceled it a minute later. There is a delivery debt. The courts noted: the seller wrote off the money, although he did not deliver the goods and did not bear any expenses. This is a shortchange of consumers. It resulted in a fine of 40 thousand rubles for the society.

(Resolution of the Arbitration Court of the Moscow District dated December 8, 2020 N F05-16466/2020 in case N A41-69947/2019)

Consumer rights

The consumer should know that imposing a service or unnecessary product is illegal, and it is important to defend their interests in obtaining the material benefits offered.

The buyer is granted the following rights:

- freedom in choosing goods or services;

- lack of external pressure;

- The imposition of goods or services is not allowed;

- The buyer has the right to request reimbursement for expenses incurred.

The consumer has the right to receive all the information he is interested in about a product or service. This is stipulated in the Law “On the Protection of Consumer Rights”; the seller does not have the right to refuse to provide all the information of interest. To avoid unpleasant situations and the imposition of services on the consumer in the future, you should carefully read the contract before signing it.

Additional Information

If the seller actively imposes his services, despite the client’s reluctance to use the additional option, it is necessary to refer to the Law “On the Protection of Consumer Rights”. In most cases this is enough. If the seller stands his ground and refuses to sell the main service to the consumer, it is worth contacting higher authorities.

What the law says

Article 16 (clause 2) of the Federal Law “On the Protection of Consumer Rights” (No. 2300-1 of December 17, 1999) directly prohibits the imposition of goods and services in addition to the main purchase. The next paragraph 3 of Article 16 exempts from payment for services performed without the buyer’s consent, and if payment has already been made, it gives the right to demand a refund.

Important! The consumer must give his consent to the purchase of additional paid services only in writing.

The freedom of consumer choice in purchasing any goods (services) and concluding relevant agreements is protected by the Civil Code of the Russian Federation. Article 421, which talks about freedom of contract, directly indicates the inadmissibility of coercion to conclude a contract if the obligation to sign it is not provided for by law or the Civil Code of the Russian Federation.

Responsibility when imposing services on consumers

According to the legislation of the Russian Federation, the service provider bears administrative responsibility for imposing its service on the consumer, as a result of which the latter is forced to bear certain expenses.

Sanctions that can be applied to persons who violate Art. 16 Federal Law “On ZPP” and Art. 14.8 “Code of the Russian Federation on Administrative Offenses:

- Fine from 10 thousand to 20 thousand rubles - legal entities (Clause 2 of Article 14.8 No. 195-FZ).

- fine from 1 thousand to 2 thousand rubles – officials;

- full compensation for consumer losses associated with the operation of the contract, which contains conditions that run counter to the interests of the latter (Clause 1, Article 16 of the Federal Law “On ZPP”);

- according to Art. 13 of the Federal Law “On ZPP”, the seller must pay a fine in the amount of half the amount that appears in the satisfied consumer’s claim.

- The injured party has the right to demand moral compensation (Article 15 of the Law “On ZPP”).

Evidence is required to confirm that the additional service offered by the seller was imposed. If the consumer can prove the fact of abuse, he should contact the following authorities for further proceedings:

- Rospotrebnadzor;

- prosecutor's office;

- Federal Antimonopoly Service;

- Russian Union of Auto Insurers (in case of refusal of the MTPL contract);

- Central Bank of the Russian Federation (if banks violate the law);

- Roskomnadzor (offenses of mobile operators);

- court.

Imposition of banking services: how to avoid it and what the law says

News of the day

Mortgage for secondary housing: conditions, interest rates, monthly payment

In October 2021, prices for secondary housing in Russia increased by 1% compared to September. And if we take last year’s figures, the price increase was almost 15%. Why is the cost of resale; higher than apartments in new buildings? Is it possible to get a mortgage and which bank currently has the most attractive interest rate? We will answer the questions in the article. What is the difference between secondary and primary housing? Secondary housing is a house or apartment that in the past had at least one owner. Then as the primary; property directly from the developer. Often, buyers are looking for a resale apartment on principle: such apartments are already finished, the infrastructure around the house is developed, and you can move without additional hassle. Spacious housing with modern renovation costs more than square meters in concrete. But there are also opposite situations: killed; apartments are in poor condition. Their price is much cheaper. This means that the secondary housing market has options for every taste and budget. The main risks of the purchase are related to ownership documents. Does the property have one owner? Then there will be no problems. But sometimes a property has several owners, including minors. If the spouses are divorced, then these are additional difficulties. Was the apartment purchased using maternity capital funds? Be sure to check whether the shares are allocated to children. Otherwise, they will have the right to challenge the transaction upon reaching adulthood. Find out if any of the owners are disabled or incapacitated citizens. The law takes their interests into account first. How to get a mortgage for secondary housing Have you already found a suitable apartment on the secondary market? Now select the bank where you would like to take out a loan. Submit an application, attach documents. The list of papers is approximately the same for all financial institutions: passports of the borrower and co-borrower (if any); a copy of the work record book, a salary certificate from the accounting department; TIN, SNILS; marriage and birth certificates; documents for the object of the transaction (passports of owners, extract from the Unified State Register of Real Estate, preliminary purchase and sale agreement); assessment report; for men under 27 years old military ID. The bank reviews the application within three working days. If the answer is yes, you will be invited to sign a loan agreement. The money is not issued in person, but is transferred directly to the seller’s account. Review of conditions from Russian banks Do you want to buy an apartment with a mortgage? Go to the Bankiroff.ru website: current offers from domestic banks are collected here and the conditions for issuing a loan are described in detail. We have prepared a brief overview: Bank Rate Maximum amount (million rubles) Term (years) RNKB Bank 8.05% 15 25 Genbank 7.2% 15 25 RRDB Bank 9.1% 40 30 Databank 8.4% 15 30 Ak Bars Bank 9.45% 50 30 Rosselkhozbank 8.7% 8 25 Down payment required. Before the transaction, check how much percentage of the total cost you need to contribute. Typically the amount is 10-20% of the apartment price. According to the rules of mortgage lending, the property will remain pledged to the bank until the loan is fully repaid. If the client stops making payments, the financial institution will have the right to repossess the property and put it up for auction.

14.10.2021

0

30

How to refuse an imposed service?

If a situation arises in which the seller openly wants to impose an unnecessary service on the consumer, you must refuse, citing the law “On the Protection of Consumer Rights.” Most often, this is enough. If the service provider still refuses to provide the required service, obliging the buyer to use an additional option, it is necessary to take decisive action.

The consumer draws up a statement in 2 copies, in which he describes in detail the essence of the complaint and the requirements that he makes to the seller. This document is sent to the head of the organization, and the second copy remains with the addressee. If a written complaint was ignored by higher management, you should contact higher authorities. For this purpose, an application is also drawn up, but it is sent to the authorized bodies.

Attention

The consumer has the right to file a claim against the trade organization. If the amount indicated in it is less than 50 thousand rubles. - Magistrates deal with it, the rest of the claims are sent to district courts. The claim must indicate the details of the parties involved in the dispute. The document states the essence of the problem that has arisen and the requirement to the seller. It is also necessary to attach evidence and describe the process of pre-trial proceedings.

It is necessary to clarify with sellers the conditions for purchasing a particular service. And in the case of an agreement, familiarize yourself with its clauses even before signing and pay attention to the fine print. The consumer can report an offense one year after it was committed.

Refusal from an imposed paid service

If an undesirable, imposed service is detected, the buyer has the right to refuse it. To do this, you must personally contact the head of the organization with a request to cancel the service and refund the money, or draw up a written appeal addressed to the administrator in two copies with a detailed description of the complaint and how to solve the problem.

If your complaint is ignored, you must contact the following authorities for help:

- Rospotrebnadzor. You can submit the document either in person or online on the official website. It is advisable to provide documents proving the violation (photos, video and audio materials, witness statements, copies of receipts, etc.). After considering the complaint, employees of this service are required to conduct an investigation into the fact of violation of consumer rights.

- The Federal Antimonopoly Committee reviews complaints in cases of financial violations.

- Prosecutor's office. If contacted, carries out an unscheduled inspection of the organization.

- Court. This is where you should contact in case of serious losses or violations on the part of the organization.

When filing a claim, you must indicate the following:

- surname, name, patronymic of the applicant;

- name of the authority where the victim applies;

- details and name of the organization;

- a detailed statement of the essence of the claim with reference to applicable laws;

- applicant's requirements;

- information about the availability of evidence;

- date and signature.

More information about the grounds for collecting money and how to return money for a service can be found here.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 350-14-90

Poor quality provision of services is their improper performance: delay, non-compliance with GOST, etc. And if the service provided does not meet the safety requirements of the law, then the performer is liable in accordance with the administrative and criminal legislation of the Russian Federation.

Providing services by phone

Telephone spam is a fairly common phenomenon lately. Annoying calls or SMS occur at the most inopportune moments. At the same time, the subscriber did not give his consent to receive advertising in this way. Often requests to stop calling lead to nothing and telephone spam is repeated over and over again.

Additional Information

Often the consumer himself consents to the sending of advertising SMS. This happens, for example, when filling out a form in a store. To refuse the imposed service, the consumer needs to contact the seller and ask to stop the mailing.

To combat annoying calls and SMS, you should refer to Article 18 of Law No. 38-FZ “On Advertising”. Its essence boils down to the following: it is prohibited to distribute advertising via telephone unless consent has been given. If the subscriber contacts the advertiser to stop calls, the latter is obliged to comply with this requirement.

The consumer should file a complaint against annoying advertisers with the Federal Antimonopoly Service.

What it is?

The imposition of services refers to an attempt by a dishonest seller to force a consumer to purchase a particular product using various tricks. As a result, the buyer incurs unnecessary costs. Such actions on the part of the seller are illegal.

Reference. An example of a typical imposition of a service is the inability to purchase a product without purchasing related products. Thus, the consumer's right to freedom of choice is violated.

The most common options for imposed services:

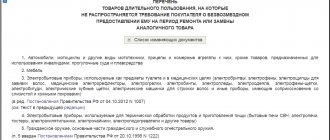

- imposing insurance when drawing up a loan agreement;

- imposition of additional medical studies and related medications;

- imposition of mobile communication and Internet services;

- inclusion of extra clauses in housing and communal services contracts;

- provision of notary services;

- advertising spam calls and SMS mailings;

- imposing services under the guise of promotions;

- imposing an intermediary service for processing large purchases.

Imposing services when obtaining a loan

In the field of lending, it is not uncommon to encounter the imposition of services on consumers, when the bank, in addition to any type of loan or installment plan, obliges the client to use paid insurance. If a person who decides to take out a loan refuses insurance services, the bank finds many reasons for refusing the loan.

IMPORTANT

The service will be imposed on the consumer if the loan agreement is conditional on the purchase of additional insurance. If a credit institution considers the purchase of a protection package against any circumstances as a separate type of service, this situation will be legal.

Criteria for a loan agreement with unfavorable terms for the client:

- an insurance package of any kind is considered as a mandatory addition to the loan;

- the contract does not contain a clause allowing the client to refuse the additional service;

- there is no place in the contract for a signature giving consent to insurance;

- it is impossible to change the data in the contract;

- according to the terms of the contract, the client cannot choose an insurance company;

- the method of payment for the additional service is not specified;

- the contract states that when purchasing insurance, the loan is provided on more favorable terms.

From the point of view of the law, insurance is only necessary for a loan in which it is necessary to pledge property.

If a loan agreement with the included cost of insurance is signed, it can be terminated, while returning the cost of the related imposed service to the consumer.

Beware: insurance

Compulsory insurance is common in all segments of retail lending and is perhaps the most popular additional service. This is confirmed by financial market monitoring conducted by ConfOP within the framework of the project of the Ministry of Finance and the World Bank “Promoting the level of financial literacy of the population and the development of financial education in the Russian Federation.” During the monitoring, it turned out that bank employees, when communicating with clients, say that obtaining insurance directly affects loan approval, and, moreover, without purchasing a policy, loan rates will be higher. However, the “mystery shoppers” insisted on calculating the size of monthly payments for a loan without insurance, but with a higher interest rate, and for a loan with insurance at a reduced rate. It turned out that in the first case the payment will be slightly lower.

Some credit institutions report that insurance does not affect loan approval, but it is better to apply for it. Allegedly, in this case, if the borrower becomes disabled or dies, the loan obligations will not pass to his relatives. Although, as consumer appeals to ConfOP show, it turns out to be impossible or extremely difficult to receive insurance payments in such a situation.

In addition, when lending, banks add the insurance amount to the body of the loan, as a result of which the borrower is forced to pay interest on it.

Illustrative examples of such practices can be found on the forums. “I was previously approved for a loan without insurance, but then the employee forced insurance on me.” “They wrote off a decent amount for insurance that I didn’t sign up for.” “I have been using a credit card since 2019. Just now I discovered that in addition to the service fee, there are write-offs “for arranging insurance.” This is up to 3 thousand rubles. monthly! I did not agree to such conditions.”

During the monitoring, we also discovered that banks do not inform potential borrowers about the 14-day “cooling off period” during which they can refuse insurance.

The interest of banks, which are the main intermediaries in the sale of policies, in the insurance business is understandable. Credit institutions earn decent amounts from commissions from insurers, which are growing every year. In 2021, commission income increased by 302 billion rubles, in 2018 - by 314 billion, and in 2017 - by 48 billion.

“A decrease in net interest income leads banks to the need to compensate for this with other types of income,” notes the analytical material of the Bank of Russia. Of the commissions credit institutions received from insurers last year, 66.4% were for life insurance of borrowers and insurance against accidents and illnesses (+16.5 percentage points for the year). The amount of remuneration to banks for insuring the life of borrowers amounted to more than 41 billion rubles. And although in the second quarter of 2021 the share of insurance sales through credit institutions decreased, the maximum share of rewards is still paid to banks (36.2%).

Imposition of services when purchasing an MTPL policy

Having decided to insure their car under the MTPL policy, car owners are faced with the imposition of additional insurance. This could be life or home insurance, which the client does not need. If you refuse an additional protection package, the insurer does not undertake to issue compulsory motor liability insurance, often explaining this by the fact that the forms have run out or for other reasons.

In this case, the car owner needs to know his rights. OSAGO insurance refers to public contracts. According to Art. 426 of the Civil Code of the Russian Federation, an organization providing services does not have the right to refuse to conclude this type of contract if there are no grounds for it. Article 15.34.1. The Code of Administrative Offenses of the Russian Federation provides for administrative liability in the form of a fine on an insurance company from 100 thousand to 300 thousand rubles for unauthorized refusal to conclude an insurance contract or the inclusion of additional services in compulsory motor liability insurance.

For your information

Life insurance, apartment insurance, any other policy and compulsory motor liability insurance are different services and they must be provided separately from each other. The motorist has the right to refuse to purchase an additional policy when purchasing compulsory motor liability insurance. And the insurer in this case does not have the right to refuse to provide the latter (Article 16 of the Law “On ZPP”).

Article 445 of the Civil Code of the Russian Federation obliges insurers to conclude an agreement with the car owner within a month if the applicant has all the necessary documents to issue a policy. The fourteenth paragraph of the MTPL rules also states that the insurance company does not have the right to refuse to conclude a contract.

Guilty without guilt

It is no coincidence that it is credit cards that cause concern among financiers. After all, this is where additional services and commissions are especially common. Despite the presence of an interest-free grace period, this product is profitable for banks. In particular, profits come from commissions for cash withdrawals, which, according to ConfOP, sometimes reach 5.5% of the withdrawn amount. Banks also generate income from the sale of insurance policies. Often, the consumer finds out that he is insured only after he discovers strange charges on his card. Lenders in such a situation insist that they are right, citing the fact that the borrower signed the agreement. Here is the response of one of the largest banks to a borrower who complained about the detected debits from the card for insurance. “The commission for organizing insurance is withheld based on your signed application for inclusion in the list of insured persons,” says a representative of the credit institution. “By signing the above document, the bank received confirmation that you are familiar with the insurance conditions.”

In fact, this is true: the client signed a long document, but did so only because he did not carefully read the contract, and the manager did not tell him anything about insurance. If the borrower asked to give him this agreement in order to read it carefully at home, the manager would most likely refuse.

Imposition of services by telecom operator

Often, cellular subscribers do not even know that the operator includes an additional option in their tariff. This becomes known when the amount of telephone bills exceeds the usual amount. Unauthorized activation of additional options and imposition of services on the consumer is illegal.

The Decree of the Government of the Russian Federation No. 328 of May 25, 2005 (clause 21) states that a mobile operator does not have the right to impose additional paid options.

Additional Information

Referring to this regulatory act and the law “On the Protection of Consumer Rights,” the subscriber can write a statement regarding the violation to the operator’s head office. If this action does not take effect, a complaint should be made to Roskomnadzor and other higher authorities.

"Free" installation

The consumer was promised free installation when purchasing an air conditioner. However, the cash register receipt had 2 prices: for the product and for installation. The seller was fined 20 thousand rubles. for deceiving consumers.

The first instance canceled the fine. Judging by the non-fiscal receipt, they gave a discount on the product in the amount of the installation cost.

The appeal disagreed and held that the client was misled. She emphasized:

- there was no evidence that the consumer was given or shown a non-fiscal receipt at the time of purchase;

- it is not confirmed that the client was correctly familiarized with the terms of the promotion (for example, they were posted on information stands);

- The magistrate has already recovered from the seller the amount of the imposed installation service, compensation for moral damage and a consumer fine

(Resolution of the Nineteenth Arbitration Court of Appeal dated October 15, 2020 No. 19AP-4834/2020 in case No. A64-8429/2019)

Application for repair

The client wanted to return the product for warranty repair and wrote the application by hand. The seller did not accept it. He insisted that the form must be signed in a certain form. The client did not agree and was denied repairs.

The administrative body fined the company 10 thousand rubles. for violation of trade rules. The courts confirmed that consumer rights were violated and the fine was legal.

(Resolution of the Arbitration Court of the North Caucasus District dated July 13, 2020 N F08-4840/2020 in case N A32-49201/2019)

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.