Sub-appointment of an heir is a procedure for appointing a secondary successor to the right to own the inheritance in the event that the main applicant, for some reason, cannot enter into the inheritance. The expression of will is in advance, which means it is impossible to predict what situation will arise at the time the document is opened. Considering that the heir is capable of dying suddenly or refusing to use the assigned property, the testator can make appropriate adjustments.

Who can become a designated successor?

The rights to appoint an heir in case of sub-appointment arise from the requirements of the Civil Code of the Russian Federation, which lists the categories of entities that can act as the main heir. The designated heir must be legally competent. This means coming of age and the ability to adequately perceive reality. Minor children also have the right to be the object of assignment and subassignment, but there are a number of features here.

On the one hand, on the basis of sub-appointment, the property is managed by the parents or guardians of the heir. No one can sell, give, exchange or bequeath material goods except the heir. The main task is to preserve the inheritance until the child comes of age. A separate category of heirs for subassignment are emancipated citizens. These are people whose minority is not the reason for the prohibition on accepting an inheritance within the framework of subassignment. To do this you need:

- Be financially independent.

- Have a permanent place of work.

- Get married or get married.

- Have one or more children.

Such young people are recognized as legally competent and are given the right to sign legal documents, which is necessary for inheritance without guardians.

Medical incapacity is the inability to consciously make decisions due to developed nervous and mental illnesses. It can be permanent, which prevents you from using sub-assignment. If the incapacity is temporary, the heir presents documents confirming his recovery. This requirement applies to main and subordinate inheritance. The full list of categories of subjects in respect of which the appointment and sub-appointment of heirs in a will are legal includes:

- Relatives of the deceased without taking into account the degree of family ties.

- Third parties meeting the above requirements.

- Commercial organizations, enterprises, companies, corporations.

- Associations and funds that do not conduct commercial activities.

- Research institutes, regardless of the type of activity.

- Charitable foundations, shelters, other legal entities.

- The state represented by specific structures and bodies.

The country to which the heir belongs does not matter. This could be a subject from Russia or any state in the world. This list of heirs is no different from cases when a successor is not appointed as part of a sub-appointment, but is indicated as the main contender. The testator is not obliged to transfer the share of the subassigned person to persons claiming a part of the inheritance. Transfer to those indicated in the will or to subjects who, other than sub-assignment, have no relation to the document is allowed.

Sample sample of a will

City of Vidnoye, Moscow region, March sixteenth, two thousand and fifteen,

I, gr. Sablin Anatoly Petrovich, born on April 14, 1959, passport series 77 09 N641753 issued by the department of the Federal Migration Service of Russia for the Moscow region in Vidnoye on February 18, 2009, department code 712-009, residing at the address: Moscow region, Vidnoye st. . Tchaikovsky, 32, apartment 79, being of sound mind, sound memory and clear consciousness, acting voluntarily, understanding the meaning of my actions and without being mistaken, by this will in the event of my death I make the following order:

- All property that by the day of my death will belong to me by right of ownership, whatever it may be and wherever it may be located,

I BEQUET: to my daughter – Marina Anatolyevna Solovyova, born on January 20, 1988.

- The content of articles 1118 clause 2, 1119 clause 2, 1149 clause 2 of the Civil Code of the Russian Federation was explained to me by a notary.

- This will is drawn up and signed in 2 copies, one of which remains in the files of the notary LARISA YUREVNA KORKINA, notary of the city of Vidnoye, Moscow region, and the other copy is handed over to the testator.

The text of the will was read aloud to me by a notary, and also read by me personally.

SIGNATURE: Sablin Anatoly Petrovich

The city of Vidnoye, Moscow region, Russian Federation.

The sixteenth of March two thousand and fifteen.

This will is certified by me, KORKINA LARISA YURIEVNA, a notary of the city of Vidnoye, Moscow Region, valid on the basis of license No. 167/214, issued by the Department of Justice of the Moscow Region on October 6, 1993.

The will was written by me from the words of gr. Sablin Anatoly Petrovich.

The will was fully read before signing and personally signed in my presence.

The identity of the testator has been established and his legal capacity has been verified.

This will is certified at the location of the notary's office: the city of Vidnoye, Moscow region, st. Sadovaya, 115, phone 495-42-67.

Registered in the register under No. 19876

The tariff charged is 100 rubles.

NOTARY: KORKINA LARISA YUREVNA

Seal.

Note: the date and place of drawing up of the will are indicated in words.

When composing the text of a will, the testator may include in it a requirement that one or more heirs included in the will fulfill property obligations in favor of one or more persons. Fulfillment of this requirement must be done at the expense of the inherited property.

Such requirements may include imposing on the heir to whom the residential premises have been bequeathed the obligation to provide this premises for residence to another person for the period of his life or for a certain period.

It should be noted that, in accordance with the law, a will can be certified not only by a notary. In accordance with Article 1125 of the Civil Code of the Russian Federation, officials of local governments and consular offices of Russia abroad are given the right to perform notarial acts, including certifying wills of citizens.

If the testator cannot independently come to the notary's office to complete the will, then it is possible to invite a notary to the house, where all the necessary notarial actions will be performed.

A notarized will is the most reliable way for the testator to dispose of his property and can protect his heirs from unlawful attacks after the opening of the inheritance.

Subappointment of an heir: what is it?

The list of rights of the testator when drawing up a written lifetime expression of will includes the following possibilities:

- Appointment of heirs from the list above.

- Determination of the share participation of each of the applicants.

- Transfer of the entire hereditary mass or its parts.

- Redistribution of wealth.

- Transfer of intangible rights.

- Indicate not only relatives as heirs.

- Prepare subassignment and conditions for inheritance.

Previously, during the time of “Russian Truth,” only people included in the family tree were heirs. Now the list has been expanded, and the subassignment allows us to anticipate situations when the main heir:

- He died after the will was made, but before it was opened.

- Died on the same day as the owner of the inherited property.

- Formalized an official renunciation of the share or inheritance as a whole.

- Ignored the requirement to apply for membership.

- Recognized as unworthy in accordance with current legislation.

- Became incapacitated at the time of adoption.

- Transferred to another category of subjects who do not have the right to participate in the inheritance procedure.

If we do not foresee the development of the situation in this direction, then the share will be distributed among other applicants in equal parts. When the heir is without sub-designation, the property goes to the use of the first line of applicants, which includes children, spouses, and parents. Inheritance by law involves 7 queues, which are arranged according to the degree of relationship. The eighth is allocated to dependents who are supported by the testator in the last year of his life.

Reasons for subassignment

Disposing of one’s own property is an inalienable right protected by the Constitution of the Russian Federation. Directions in the event of death are specified in the probate documentation. The declaration of will is drawn up in the presence of two disinterested witnesses and notarized. In this case, circumstances may arise when the leading heir will not be able to take ownership. Subassignment allows you to dispose of acquired values in this case as well.

When the owner of the property does not want property values to pass to the legal heirs after the occurrence of special conditions, it is permissible to indicate in the will a new successor who will take over after the main one. Before that, he cannot be an heir by right of inheritance in a will. If the heir dies, his part is considered accepted. This fact makes adjustments when distributing shares. Sub-appointment is required to determine a specific heir.

Now the inheritance share is divided among his successors. If this development of events is not satisfactory, a sub-inheritance is drawn up. Having appointed a new heir, the owner himself decides who to give his earnings, which does not contradict the requirements of Russian civil law. Everything is decided solely by the will of the deceased, expressed on paper during his lifetime. It is possible to cancel orders, but only in court and only if there are compelling reasons proving the illegality of the document.

Who is the designated heir?

According to Russian inheritance law, this is a subject that is endowed with the status of an heir by the will of the testator. But only if the initially appointed heir was unable or unwilling to express his claims. The same applies to cases where he fell into the category of persons who do not have legal grounds for taking ownership. This is possible when:

- An application for accession is not submitted within the established six months after the opening of the inheritance.

- A refusal is issued without indicating in whose favor the inheritance mass is being written off.

- The court has established unworthiness, which deprives the right of inheritance.

- Proven incompetence. To legitimize the reasons for such deprivation, a medical examination will be required.

But refusal in favor of a third party cancels the subassignment, unless otherwise stated in the text of the expression of will. The term “subassignment” itself, from an etymological point of view, indicates that property can be obtained only after the rights of the primary heir have been abolished. It follows that subassignment involves orders in the event of the formation of exceptional circumstances that completely cancel the aspirations of the testator.

Mandatory share in inheritance

Despite the primacy of the freedom of expression of a person who is ready to dispose of his property, the law defends the interests of the least socially protected persons - the testator’s closest relatives, whom he must take care of during his lifetime and after his death. In the legislation of the Russian Federation there are concepts of a mandatory share in the inheritance . Some successors will receive it regardless of whether they are mentioned in the will (Article 1149 of the Civil Code of the Russian Federation).

Such heirs include minor children of the testator, if any, and disabled adult offspring. A disabled spouse or parent of a deceased testator, as well as dependents who are not relatives, can claim part of the property within the compulsory share. Incapacity for work occurs due to reaching retirement age or becoming disabled.

Those who were deprived of parental rights, caused harm to the testator during his lifetime, or performed other actions for which the court was recognized as an unworthy heir .

The size of the mandatory share is established by clause 1 of Art. 1149 of the Civil Code of the Russian Federation. It is no less than half of what the heir could have received by law if there had been no will. However, the amount may be adjusted by the court depending on the conditions of inheritance and other circumstances.

Example: The testator bequeathed all of his property to his second wife and partly to a friend. After the death of the testator, the legal heirs included a child from his first marriage (6 years old), a second wife and a working mother who had not reached retirement age. Of these, only the minor son of the testator will receive the right to a compulsory share. Its minimum share in monetary terms will be determined as follows: the total estimated value of the property left as an inheritance will be divided by 3 (according to the number of legal successors) and 2 (according to the requirements of paragraph 1 of Article 1149 of the Civil Code of the Russian Federation). Thus, the child will be able to claim 1/6 of the inheritance. It will need to be allocated from the property left to the two heirs under the will, in proportion to their shares.

Example Larisa Nikolaevna owned an apartment in equal shares with her able-bodied adult son. She also bequeathed her share to him. However, the woman had a daughter, a group 2 disabled person. After the death of her mother, she received the right to an obligatory share of her part of the home. If there had been no will, there would have been two legal heirs: the son and daughter of Larisa Nikolaevna (her husband and parents died long ago). They would receive 1/2 of the woman’s share, that is, 1/4 of the entire apartment. As a mandatory share, the court allocated the daughter half of what she could have received by law, that is, 1/8 of the housing. Thus, after dividing the inheritance, the son will own 7/8 parts of the apartment, and the disabled daughter will own 1/8 part.

Legal entities that can become designated heirs

When the testator indicates a person who will replace the removed heir, he must understand the consequences of this action. It is possible that relatives will want to challenge the document, cancel its validity and enter into inheritance without subassignment. People will appear who, during the owner’s lifetime, refused to communicate with him, help him, or maintain connections. Greed can push them to take drastic steps, and therefore it is necessary that the sub-appointment be formalized in accordance with all the rules established by law.

In judicial practice, there are many cases where people, suddenly remembering the family relationship with the deceased, file a lawsuit, trying to declare the will void or voidable. The judges take everything into account:

- possible incapacity;

- having a criminal record;

- remoteness of place of residence;

- level of well-being;

- age category;

- health status.

This applies to the person who files the claim and the entity whose rights are being challenged in the substitution case. In such conditions, it is difficult to adequately participate in debates without a lawyer. Even an initial free consultation will help you decide on the basic principles. Further, the help of a lawyer is needed to develop an effective defense strategy and tactics. When drawing up the complaint itself, you will have to rely on articles of law that you need to know thoroughly.

When can you not include valuables in a will?

Everything acquired by a person after his death passes to his closest relatives. Anything else can be provided only by a will. The text of the document states to whom and what the person wants to leave after his death. If we are talking about several heirs, then the values between them are divided according to specific names or in shares. But in the case of determining the sole heir, two formats are possible: with or without the transfer of all property.

| Format of a will for all property | With a list of values | No listing of values |

| pros | The document itself contains a list of valuables, which simplifies the procedure for determining their quantity and location. It is easier for the heir to deal with his inheritance. | The will will be valid for any period of time, regardless of whether the values were acquired before the document was drawn up or after - all of them will go to the heir. There is no need to bring numerous property documents to the notary, since their list will not appear in the will. |

| Minuses | Some values may not be included in the text of the document, and then they will be inherited by law. For each item, it is necessary to present property documents confirming the fact of ownership. | There is no possibility to transfer part of the property to other persons. The heir may not know the entire list of the deceased’s values, which will create difficulties for him in identifying the inheritance mass. |

In both cases, the deceased has one will - to transfer all the valuables he has acquired into the hands of one person.

If a person often buys and sells property or other valuables, then it is better to make a will for all property without transferring it. Otherwise, you will have to change the text of the document every time, which means additional time and costs for the notary.

What is the meaning of super-appointment?

The main importance is the exercise of the right to dispose of one’s own property. Everything acquired during life cannot remain with the deceased. The fact of death ends the physical and legal existence of a person. But until the time of the last breath has come, the owner has the right to sell, donate, exchange and bequeath any valuables with or without sub-purpose. The main condition is justification of ownership. Valuables can be bought, accepted as a gift, inherited, etc. And sub-assignment is part of the implementation of these rights.

By appointing an heir, the testator determines who will use all or part of the property. In an example, the purpose looks like this. The will-maker entered the heir into the document, indicating the conditions of the sub-appointment. Assuming that something might happen to the successor or that he does not consider it necessary to participate in the division at all, he writes who will receive the inheritance in this case. For example, Smirnov leaves property assets to Zvyagintsev, who helped him during his illness. At that time, the Smirnov family did not want to show concern and did not communicate with the testator.

If Zvyagintsev refuses, sub-appointment will determine who will become the heir. According to the law, these must be relatives of the testator. But there is a nephew who took part in Smirnov’s life, and the testator has the right to formalize a subassignment for him. If Zvyagintsev dies suddenly, refuses material wealth, or the impossibility of entering into an inheritance is proven, the property is unconditionally transferred to the testator’s nephew, which is his will.

There are many ancestral and hereditary intersections. Situations are different and require different approaches when defending interests. In most cases, collisions are inevitable. Relatives are confident that the valuables will be passed on to them. They learn about the heirs by sub-designation in the will after the opening of the notary business. Until this moment, the contents of the document are a secret, which the witnesses and the notary are obliged to keep. And so that the expression of will cannot be challenged or canceled, it is important to do everything correctly.

Refusal

Article 1157 of the Civil Code of the Russian Federation provides for the right of heirs to abandon the property of the deceased . Refusal can be directed , that is, when the person refusing determines the person in whose favor he transfers things, and unconditional - without identifying the person. If a sub-heir is specified in the will, only an unconditional refusal can be made.

Then all the property that the main legal successor should have received will pass to him. Let us remind you that you cannot refuse a part .

If a person accepts one part of the property, he is considered to accept all. But if inheritance occurs on several grounds, then it is possible to register the property received on one basis and refuse the other. For example, to formalize the right to things that the heir receives under the will, and to refuse what is transferred by law.

You can refuse to accept the property of the deceased in fact, that is, not take any action to register it or write an application to the notary for refusal. This must be done within the period specified in Art. 1154 of the Civil Code of the Russian Federation, that is, within 6 months .

It is impossible to return things that the successor has refused. But it is possible to abandon the property after its acceptance, even after missing a six-month period, but in court .

Example

Let's analyze the situation. A relative of the deceased is determined as the main heir to the apartment according to the will, and by law he has the right to receive the dacha.

If he gives up the apartment and, according to the will, an additional legal successor is registered in it, then this can only be done unconditionally - it will go to the sub-heir . And if he refuses to give the dacha, then this can be done to any heir by law or by will, even one who was not called upon to register things.

How to draw up a will with sub-designation of a legal successor?

You will need to come to a notary's office. For registration, contact a notary at your place of residence. In this case, there is a greater chance that after opening the inheritance case, the successors will quickly find the paper. In a big city such as Moscow, there are many offices, but most of them accept citizens according to certain rules. The first letter of the surname is decisive. But information about the existence of an expression of will flows into the notary’s archive, where the appropriate mark is placed.

Two witnesses are called. This requirement applies to cases with sub-assignment and without sub-assignment. The notary's certification is proof that the will has been drawn up:

- a capable citizen;

- without psychological pressure;

- at the own will of the property owner;

- taking into account legal norms.

The paper is written by hand. Printed text is not acceptable. The original is packed in an envelope on which the signatures of witnesses are placed. The last person to read is the requirement to keep the information secret, since before sealing they get acquainted with the text, the names of the heir and legal successor by sub-appointment. The shares determined by the applicant and due under the will are also disclosed.

The willer is given a copy. The original is kept in the notary's office until it is opened. You can change the conditions at any time. It is allowed to draw up another document, which automatically cancels the previous one. For example, the initial will did not provide for sub-appointments. Later, the need arose to change the order. Then, in addition to sub-assignment, you can change shares, indicate other applicants and special conditions for entry.

Form of this type of document

The legislation does not offer a unified form or prescribe a strict framework, but there are general requirements for official papers. Ignoring accepted norms leads to the fact that the documents are deprived of legal force, i.e. the court will not accept the heir’s case for consideration as intended. The conditions of the testator are canceled, and further actions are carried out according to the law, when the rights are transferred to the relatives of the deceased on the basis of priority.

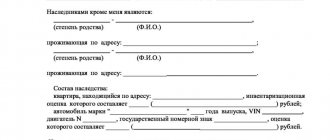

Taking dictation is prohibited. Sheet format – A4, orientation – vertical. The text is written taking into account formatting. Each requirement and explanation is documented in a separate paragraph. At the beginning there is a preamble with the definition of the testator. The objects included in the inherited mass are listed. These may be individual items, shares, amounts or entire property. It is important that everything listed is acquired legally. The details of the title documents that you must have with you are indicated.

The heir and the secondary successor with the rights of sub-appointment are clearly defined. Complete details are provided. Ideally, this is passport data. If they are absent, the last name, first name, patronymic, date of birth, and place of official registration are written. This is enough to identify the heir and the person indicated by purpose. Own details are also provided in full. The transaction is one-sided. Therefore, the signatures of the heirs (on a general basis and by purpose) are not required.

Required details

There is a clear list of mandatory attributes that are required to give the paper legal force. A will with sub-appointment will not be valid if it does not include:

- document's name;

- name of the city, region, region;

- Date of preparation;

- testator's signature;

- full name.

The text begins with a preamble, which provides the full details of the testator. Next, information about the heirs (primary and by sub-appointment) is written down in the relevant sections.

Notarized registration is required. A certification mark is placed on all sheets that are numbered. The absence of at least one mandatory requisite will serve as a reason for cancellation of validity. Competitors who benefit from the paper becoming null and void will make every effort: they will hire a lawyer, conduct legal monitoring of compliance, and file a claim. If the reasons are significant and objective, the judges will side with the plaintiff. But the content must also meet the requirements.

Content

When defining a sub-purpose, it is required to write in official language. Each condition is a separate item with a number. Numbering can be complex if the orders are extensive, suggesting different developments. A notary will help you formulate what you want, but it is better if a specialized lawyer does this. An experienced lawyer knows how to challenge a subassignment.

Preservation of the interests and wishes of the testator is the main condition. The initial consultation at the law office is free. All you have to do is dial the phone number posted on the website, send an email or ask a question online.

When drawing up a document, it is important to motivate legality. For this purpose, specific articles of laws are introduced that determine the order of inheritance by sub-appointment. The situations in which the sub-assignment is activated are also listed specifically. It is allowed to introduce special requirements for the new heir. If they are not met, the inheritance will be distributed in accordance with the current laws of the Russian Federation. The number of copies is written at the end of the text, after which a signature is placed.

Making a testamentary disposition

In order to draw up such a document, it is enough to contact the bank where the inherited property is stored. When applying, it is enough to have a passport of a citizen of the Russian Federation with you. Bank employees will offer you a document ready, all you have to do is sign it.

Important: a document not certified by a bank employee is invalid

The order can indicate heirs and sub-heirs, as well as the shares inherited by them

One copy is given to the testator.

How to make changes or cancel an order

In order to change the order, you need to contact the bank where it was issued. The Civil Code stipulates that if a new will is drawn up, the old one will be considered revoked. If the new order is declared invalid, the inheritance is distributed according to the first document.

The consent of the heirs is not required to make changes. There is also no need to explain the reasons for making changes to bank employees. In this case, it is not necessary to draw up an act of cancellation of the previous one. It must be drawn up if there is a need to cancel the document (for example, a bank client changes his mind about bequeathing something). A bank employee will offer you a ready-made document that you just need to sign. If it is not possible to come to the bank in person, you can send a representative with a power of attorney who can draw up the deed without the presence of the testator.

Required documents

A visit to a notary is accompanied by the collection of papers necessary to formalize the subappointment. The list may vary, but the following are always necessary:

- The applicant's civil passport. It must be valid. Additional identification is preferred, but not required.

- Legal documentation for inheritance. Objects transferred for sub-purposes must be owned by the testator. Sale and purchase agreements, extracts and certificates from civil registration authorities are presented. In the case of motor vehicles, a title is required. Household ownership is transferred on the basis of cadastral documents.

- Heirs' passports. You can provide copies or any paper where the details are written without errors. This is necessary in order to clearly identify the primary heir and formalize the subassignment to him. From the words, you can indicate your full name, address of residence according to registration, as well as the date of birth.

- Other. This clause includes special cases if the object of a transaction with a sub-purpose is securities, deposits, savings, business, etc. Bank statements indicating accounts, a register of shares, originals of bills and bonds are presented. Everything is determined by the situation and the type of inheritance.

When registering a sub-appointment, a state fee is paid. The receipt is provided to the notary as proof that the services are provided in advance. A copy can be kept along with the duplicate will.

Making a will

The most common will is the will of property and business. Although there are other wills. If you live in a big city, a will can be drawn up at any notary. You can (if you are not going to move anywhere) draw up a will with the notary who handles inheritance affairs in your area. If the will is complex (a sample will will not work), then this advice is very effective, since a will from another notary may cause misunderstanding among the notary who will handle the inheritance case in the future. And if you made a will yourself, carry it out yourself! Here we must remember that after 01/01/2012, you can open an inheritance case with any notary. It’s better to contact the person who made the will.

If there is no notary in your location, the will, by law, can be certified by another official who will subsequently be responsible for its preparation, including such a person may be brought to court in disputes about the will.

Possible expenses

State duty is not the only possible expense item. Sometimes it is necessary for the notary to take additional steps. In this case, each service is paid according to established tariffs. In large cities, fees are higher than in the regions. In addition, if the testator wants the subassignment to be formalized in absolute accordance with the current laws of the Russian Federation, he will have to spend a small amount on a lawyer.

Most services are indicated in the price list, and you can view pricing on the law firm’s website. There is no need to pay extra for sub-assignment. This is a standard condition for expressions of will. When it is necessary to restore lost documentation, money is spent on paying fees to the authorities. An assessment of the value of the inheritance is not required. This will be done by the heirs when a dispute arises. If you have to share, the solution is to pay the cash equivalent of the share and preserve the inheritance.

It must be completed at the place of registration. It is allowed to submit an application to a notary office located in the same city and region where a large share of the inherited property is located. When the testator actually lives in another place, expenses have to be spent on transportation and accommodation. The solution is to entrust the procedure for registering a subassignment to an official representative. However, you will have to write the text of the will, sign it and listen to it in the presence of witnesses in person. It is prohibited to bequeath unregistered or incompletely formalized property for a sub-purpose.

But in some circumstances, judicial intervention is required. When it is necessary to obtain a conclusion on recognition of the owner’s rights, the claim is filed subject to payment of the state fee. The work of a trustee is possible upon execution of a notarized power of attorney. Services are paid. The fee is calculated individually. You will have to bear the costs of remunerating the law firm. But this is better than giving everything that you have accumulated over the years to people who do not have the moral right to do so.

Minimum fee

The fee determines the current tariff established for the notary's office. It differs in different regions. You need to remember one thing. It is allowed to transfer not only valuables and real estate for sub-purposes. The heir will have to pay off all debts of the testator related to his activities or transferred property. The moment of death is unknown to anyone unless suicide is suspected.

In this situation, remember that suicide can be regarded as indirect evidence of incapacity. Lack of self-preservation instinct is not the norm for people. And if it is proven that the heir specified in the subappointment order is the reason for such a step, he will be recognized as unworthy.

When receiving an inheritance by right of subassignment, the successor will pay a fee of 0.3% if he is a close relative. This category includes persons from the first line of inheritance: children, parents, spouses. Other relatives pay twice as much - 0.6% of the value of the inherited estate at the time of taking ownership. And if it is real estate or vehicles, you will have to pay income tax if the property is sold. In this case, the transaction is paid and the state will require payment of personal income tax (for Russians - 13%, for non-residents - 30%).

Additional payments

Every document, agreement, form of official paper, certified by a specialist at a notary office, involves costs in the form of a fee. Obtaining duplicate documents will also require you to pay for government services. It is better for the testator to ensure that all debts are repaid on time if possible. Otherwise, creditors will demand that the sub-appointed heir pay off. As a result, the advisability of accepting the inheritance as such is called into question.

When copies are submitted instead of originals, you must go to the nearest notary office and have them certified. This is considered sufficient evidence of conformity and reliability. The service is paid, although inexpensive. And if a previously incapacitated testator wishes to take advantage of the subassignment, it is necessary to prove that the incapacity was temporary. An examination is paid for, the result of which is the issuance of an appropriate conclusion. The text must indicate that the applicant is healthy at the time of receipt of the property. Legal costs are included in the estimate, since they are inevitable when it is necessary to obtain an act of recognition.

To determine who can become a designated successor, sometimes you have to contact lawyers, which will also require financial expenses. And if property received by inheritance is transferred (with or without subassignment), you must first assume the rights of the owner, and only then indicate the values in the will . Otherwise, the right to transfer them by hereditary sub-appointment does not arise, which means that the expression of will can be challenged or declared void. Only lawyers can help you understand all the intricacies of the process, since each situation is unique in its own way.

Similarities and differences between refusal and assignment

According to Article 1137 of the Civil Code of the Russian Federation, testamentary refusal is understood as the transfer of certain property responsibilities to a specific heir. For example, an obligation to provide accommodation in an inherited apartment to a third party, or the right to use a personal plot.

Testamentary assignment (Article 1139 of the Civil Code of the Russian Federation) is the performance of actions for the implementation of generally beneficial activities. For example, caring for the testator’s beloved pet. In case of improper care, the funds left for this entrustment may be seized from the heir.

There are differences between bequest and assignment:

- a testamentary assignment does not have a property nature, which usually accompanies a testamentary refusal.

- When entrusting the will, there is no clear indication of the person to whom it is entrusted. If there are several heirs, this assignment must be divided between them according to the shares of inheritance. In case of hereditary refusal, a specific person is indicated.

- When assigned, this assignment is transferred by inheritance. There is no such failover.

Will of the company

. And after the departure of the Leader or Recipient of large dividends, actions of interested parties are possible in concealing the property of the company or preventing inheritance. Therefore, it is right now to take counter-steps.

The will of a company can be made in different ways: described in the Charter, made a will with a detailed description, taken measures against the seizure and withdrawal of the company or property into the shadows... But this is only one step

It is important to do the second thing: today to organize the prerequisites for a good “tomorrow”. Our specialists will help you with advice and real legal actions.

Challenging and canceling an order

A testamentary disposition, like any other document that has legal force, can be challenged in the court of first instance. This requires reasons listed in the Civil Code of the Russian Federation and strong evidence on the grounds for cancellation.

To begin the process, you must submit a statement of claim and a package of documents, a full list of which is given in the work “How to recognize an heir as unworthy?” Pay the state fee and then participate in the trial.

Making changes

To change the contents of a document, you must go to the bank where it was drawn up. This can be done independently or through a representative. Creating a new order automatically cancels the old one.

To introduce innovations, it is not necessary to explain their reasons. It is also not necessary to create an act of cancellation of the previous order.

Cancellation of an order

The testator has the right to cancel the order drawn up at any time . For this purpose, you need to go to the institution where it was compiled. Cancellation of a document is carried out by writing an application. You can ask for a sample of such a statement from a financial company.

How to enter into inheritance rights

Inheritance of bank deposits occurs on a general basis in accordance with the rules of succession. But in order to receive an inheritance, you need to comply with some formalities and take into account the specifics.

An important feature is the fact of lack of demand. That is, in the event of the death of the testator, the bank will not look for heirs

If the heirs do not show up, the bank can transfer the property deposit to the state. If one of the heirs is a legal spouse, the time of opening the deposit is important. For example, the deposit was opened until the date of marriage registration; during the marriage, the deposit was not supplemented. Such a contribution relates to personal property and is subject to inheritance in full.

In cases where the heirs are children. they will be able to use these funds upon reaching 18 years of age. Until this moment, representatives of the children can use funds for the maintenance of children and their upbringing, but on the condition that the guardianship and trusteeship authorities have given consent and a supporting document.

Bank deposits and deposits are not subject to tax

Recipients of the inheritance will only have to pay a fee and notary services. The tax fee is 0.3% of the inherited amount, but not more than 100,000 rubles. This applies to parents, spouses, children, brothers and sisters. The remaining heirs pay 0.6%, but not more than 1,000,000 rubles. In order to receive an inheritance, you need to enter into inheritance rights.

Entry into inheritance

You will need to have the following documents with you:

- passport of a citizen of the Russian Federation;

- death certificate of the testator;

- certificate of registration of the deceased;

- testamentary disposition, if any;

- bank documents (for example, an account opening agreement);

- confirmation of family ties.

After checking all the documents, the notary will issue a certificate of entry into the right of inheritance. The issuance must occur six months after the death of the testator. For example, the testator died on January 1. In March, the heirs contacted the notary, and a certificate could be issued on July 1.

After joining, you need to contact the bank. In addition to the certificate, additional documents may be required:

- passport or identity documents of the heir;

- agreement on the division of property indicating shares (if there are several heirs);

- a notarial decree on reimbursement of funeral expenses (if funds are withdrawn for this purpose);

- a copy of the court decision (if the process of recognition of property rights was carried out).

After checking the documents, the bank will issue funds to the heirs according to the shares specified in the order. By the way, the heir can leave a deposit in the bank if this option is more convenient.

If the account was opened before 03/01/2002, then only a passport, death certificate and documents for opening an account will be required, and a certificate of inheritance is not needed.

A testamentary disposition is a document confirming that the testator inherits his property to certain persons. There are several types of such a document, and the heirs receive the inherited property according to the order. Can be amended, canceled or invalidated. To enter into an inheritance, you need to contact a notary, obtain a certificate of the right to inheritance and, on its basis, receive the funds due.