A person who from birth has a number of physical, psychological or mental limitations is assigned the status of a disabled person from childhood. Such people need constant supervision from relatives or other people (organizations). Parents of a disabled child bear great responsibility for his life and health. A huge amount of effort and energy must be spent in order for a disabled child to adapt to the environment. As a rule, the mother of a disabled child bears the heaviest burden.

Therefore, one of the parents of a disabled child is entitled to a number of benefits and rights that can be used to improve the life of the family.

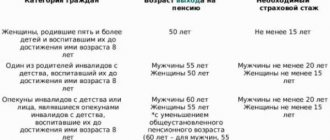

Who has the right to early retirement if there is a disabled child in the family?

Firstly , if the family is complete and there is only one disabled child in it, then only one of the parents can apply for early retirement on this basis.

If one of the parents first applied for a pension on this basis, and then applied for another type of pension, then the second parent is given the right to retire early.

Secondly , if the family is complete and there are two or more disabled children in it, both parents are given this right.

Thirdly , if a child is raised in a single-parent family, then the parent who is raising him (single mother, single father, guardian) can take advantage of the benefit.

It doesn’t matter whether we are talking about biological parents or adoptive parents or guardians. Also, the retirement of a parent who raised a disabled child is possible even if the latter has already died at the time of application. In this situation, the parent or guardian may retire early if:

- The child's disability is confirmed by a certificate of completion of the medical examination.

- The length of work experience must be:

- at least 20 years – for men;

- at least 15 years – for women.

- The reduced retirement age threshold has been reached:

- 50 years – for women;

- 55 years old – for men.

- Care is provided until the child reaches 8 years of age or more.

During this eight-year period, the child should not stay in boarding schools, orphanages, or other institutions fully supported by the state or under the guardianship of other persons.

Legislatively, the right of parents of children with special needs to early retirement is enshrined in clause 1. Part 1. Article 32 of the Federal Law “On Insurance Pensions” dated December 28, 2013 N 400.

Please note that when applying for a pension, it does not matter in what period the child’s disability was established. It can be confirmed after 8 years (even after adulthood). Let’s say disability was established at the age of 21 with the status “disabled since childhood,” that is, the cause of the disease before the age of 18. There will be a right to an early date. There is also a basis when the child was temporarily disabled, for example, from the age of 3 to 4.5 years.

For guardians, the calculation of the retirement age occurs under different conditions.

The retirement age is reduced by 1 year for 1.5 years of guardianship.

| Guardianship period | Number of years by which the retirement age is reduced | Retirement age | |

| Male | Female | ||

| 1 g 6 months | 1 | 59 years old | 54 years old |

| 3 g | 2 | 58 years old | 53 years old |

| 4 g 6 months | 3 | 57 years old | 52 years old |

| 6 years | 4 | 56 years old | 51 years old |

| 7 years 6 months | 5 | 55 years | 50 years |

In this case, the fact of caring for a child under 8 years of age must be officially confirmed. That is, the guardian must take into account the time of fulfillment of his obligations when the child is from 0 to 8 years old .

For example, a guardian raised a disabled child from 10 to 14 years old. There will be no entitlement to pension benefits.

The period of guardianship that reduces the pension qualification must occur during the period when the child was disabled.

Let's imagine a situation: a guardian raised a child from 3 to 10 years old. The child was recognized as disabled from 9 to 13 years of age. A guardian can be registered for only one year (from 9 to 10).

Both the current and former guardian can claim the right to premature retirement, the main thing is that the above conditions are met.

For adoptive parents, the same calculation rules apply as for natural mothers and fathers, that is, a year is counted as a year.

In this case, the period of caring for a child with a disability is counted towards the length of service with an increased pension point (a coefficient of 1.8 is applied).

Information about terms. A disabled child , when in childhood, a disability is established in real time (temporarily or permanently).

Disabled since childhood - disability is established after the 18th birthday, but for reasons (diseases) that arose in childhood (before 18 years of age).

The legislative framework

Issues related to the provision of pensions to citizens are resolved in current legislative acts. The fundamental and most important among them is the Federal Law of December 28. 2013 No. 400-FZ “On insurance pensions”. It is this legal act that establishes, among other things, the procedure and grounds for the early accrual of pension funds to parents raising children with disabilities.

In particular, Article 32 of this legal document determines the list of persons who have the right to retain an early pension. It also establishes criteria in terms of having a certain insurance period and the number of points that potential recipients of early payments must meet.

In addition, Article 12 of this federal law ensures the protection of the pension rights of citizens who are raising a disabled child. This is ensured by the fact that the time during which a citizen raised a minor with an established disability is counted in the insurance period with the assignment of labor points that form the IPC.

In addition, when considering issues related to preferential pension provision for citizens raising disabled children, one should take into account the provisions of the Federal Law “On Social Protection of Disabled Persons in the Russian Federation” dated November 24, 1995 No. 181-FZ. This normative act defines the concept of “disabled person”, “disabled child”.

In addition, the norms of the law establish the procedure for the activities of medical and social examination institutions (MSE) within the framework of a comprehensive assessment of the health status and working capacity of citizens when assigning them one or another disability group or refusing to do so.

Important! Until 2015, issues related to the regulation of the procedure for establishing early pensions for preferential categories of citizens were reflected in the provisions of the Federal Law of December 17, 2001 “On Labor Pensions in the Russian Federation” No. 173-FZ. However, due to the entry into force of Federal Law No. 400-FZ of December 28, 2013, this legal act is no longer used except in individual cases of applying some of its norms by analogy.

How to confirm the fact of leaving?

To confirm that you are caring for a disabled child, you must provide the Pension Fund with:

- An extract from the ITU examination report confirming the child’s disability status.

- Birth certificate, child's passport.

- An extract from the house register (certificate of family composition), confirming the fact that the child and the person caring for him live together. It can be obtained from the local administration, the MFC, the management company or the HOA, and can be issued through the State Services website or through the website of the territorial MFC.

- Certificate of place of residence , which can be obtained from the MFC, the nearest unit of the Main Department of Migration Affairs of the Ministry of Internal Affairs, the management company of a residential building, a homeowners association or housing department.

The decision on whether care was provided or not is made by the district pension commission. In addition, before this, representatives of social protection authorities often pay visits to the applicant’s neighbors to personally verify that the child was not only registered with a parent, but was actually raised by him.

Sometimes the fact of upbringing has to be proven in court. Then the court decision is submitted to the pension authorities.

Rights and responsibilities of a guardian

Caring for and maintaining a sick child imposes a large amount of responsibilities on a person.

Among them:

- Material provision for the needs of the ward for food, accommodation, care products, clothing and shoes, items for development and learning (toys, books, textbooks, etc.).

- Full medical support for a sick baby, including the purchase of medications and other medical products.

- Representing the interests of the child in relations with third parties.

- Disposal of funds and property of your ward. But only with the approval of the guardianship authorities!

State services have the right to conduct inspections of the child’s living conditions, the fact that the trustee is fulfilling his duties, and to request a report on the expenditures of the guardianship benefits received. The control in this part is quite strict. If violations are detected, the citizen may be deprived of the status of guardian.

As for rights, they consist in the ability to choose educational and medical organizations where a disabled child will be served, and to carry out simple civil transactions on his behalf.

At the place of work, the guardian may require: an additional two-week vacation and exemption from work on weekends and holidays.

Where and how to apply for early retirement?

The right to early retirement for parents of children with childhood disabilities can be used by contacting the pension authority at the place of registration (registration).

There are several ways to contact us:

- personally;

- in your personal account on the Pension Fund website (a mandatory condition is registration on the State Services website);

- by mail;

- through a trusted person.

In the latter case, along with other documents, you will need to provide a notarized power of attorney to the Pension Fund.

Employees of the pension department individually decide to grant such a right or not, based on an assessment of the documents provided and the candidate’s compliance with the requirements listed above.

If the Pension Fund refuses to provide a benefit, you can obtain it through the court by filing a statement of claim. Only in this case, to substantiate your claims, you will have to attach written correspondence with the Pension Fund. Your statements and written responses from officials to them are attached to the claim.

Which is better: guardianship or adoption?

There is no clear answer to the question of which is better.

The main features of adoption are:

- a special child will become a member of the family forever and will need to be taken care of throughout his life;

- the state does not pay money for care - only a disability pension for the sick person and benefits are provided;

- I can change my last name, first name and even patronymic.

Guardianship provides for the temporary stay of the child in the family, while compensation is paid for his maintenance, albeit small. A disabled minor is not considered a son or daughter; he cannot be given his own last name or another name.

Both forms can be cancelled. The choice remains up to the people themselves who intend to foster a child with special needs.

When should I contact the Pension Fund for early retirement?

According to the Rules established by Order of the Ministry of Labor and Social Protection of the Russian Federation dated November 17, 2014 N 884n, you must contact the Pension Fund 10 days before the right to early exit arises, that is:

- for women - 10 days before turning 50 years old;

- for men - 10 days before turning 55 years of age.

However, the optimal time to apply can be considered six months to a year before the expected early retirement.

Pension Fund employees will tell you exactly what documents you will need to bring specifically in your case. You will have enough time to prepare them. It may be necessary to confirm periods of work even during Soviet times, which may cause certain difficulties.

If, before the grounds for early retirement arise, the applicant does not contact the pension authorities within the specified time frame, he will not be deprived of his right. You can exercise your right later (at any time).

Example . Kalinina S.E. applied for an early pension at age 51, rather than at age 50, in March 2021. Her pension began to accrue in April 2021 from the age of 51. She will not receive any compensation for the lost year, which is why she should contact the Pension Fund in a timely manner.

Who can receive disability benefits?

Carers and assistants can look after people with disabilities. Guardians are the legal representatives of citizens with disabilities. They act in the interests of the ward without a power of attorney. The basis for representing the interests of disabled, incapacitated or partially capable persons is the “Act of Appointment...”. The document is issued and certified by the guardianship authority. The appointment of guardianship over incapacitated adults occurs by court decision.

The rights and responsibilities of guardians are determined by Article 15 of the Federal Law of April 24, 2008 No. 480-FZ. Applicants must be of legal age and legal capacity.

Assistants can also care for disabled people (with the exception of group I childhood disabilities). For example, one of the relatives or third parties. The disabled person independently determines the amount of assistance. Assistants are entitled to payments for the entire period of caring for a disabled person (Decree of the President of the Russian Federation of December 26, 2006 No. 145). The benefit is paid even if the assistant lives separately from the ward.

An assistant can be any individual over 14 years of age. The person must be able to work, but not work and not receive a pension or unemployment benefits.

On a note! Incapacity refers to a person's inability to understand the meaning of their own actions and control their actions. Guardians provide care for incapacitated persons.

Required documents

In order not to come to the Pension Fund several times, carefully study the list of documents for obtaining an early pension for the parents of a disabled child:

- Passport.

- Employment history.

- Insurance certificate of state pension insurance.

- Certificate of average monthly earnings of a citizen for any 60 consecutive months during his working life until 01/01/2002 (average monthly earnings for 2000–2001 are confirmed by an extract from an individual personal account in the compulsory pension insurance system, which is at the disposal of the Pension Fund of Russia).

- Marriage certificate (if you changed your last name).

- Child's birth certificate.

- An act of the guardianship authority establishing guardianship and appointing a guardian (for guardians).

- MSEC certificate confirming disability.

- A document confirming the fact of caring for a child under 8 years of age.

- Statement.

Prepare copies signed by the notary, but be sure to take the originals with you when you go to the Pension Fund department. They are also needed.

If something is missing the first time, the documents can be submitted within three months from the date of application, but no later than this period.

Features of the appointment procedure

- The day the right to a pension is registered is determined by the day the application is submitted.

Even if the registration took several days, the main day is considered to be the day when the application was accepted. - The pension is assigned from the month when the application was accepted.

The date is not important. If a person visited the Pension Fund on September 30, then pension accruals are calculated from September 1. If it arrived already on October 1, accruals begin on October 1. - To apply for disability benefits for a child, you must have an appropriate certificate of disability.

To do this, you need to undergo a medical and social examination, based on the results of which a report will be drawn up. An extract from this act is a certificate of disability.

Pensions for the mother of a disabled child: are they entitled to the father?

Most often you can find information on the Internet about the early retirement of the mother of a disabled person, so there may be a misconception that only women are entitled to such a benefit.

The abundance of information regarding mothers of disabled children is due to the fact that it is primarily they who provide child care and benefit from this benefit. There are not so many single fathers, and if we talk about two-parent families in which there is a disabled child, then in them, too, according to statistics, it is usually the mother who takes out early retirement.

However, according to the law, any of the parents, that is, including the father, can take advantage of the benefit.

Important points

When applying for an insurance pension, it is important to take into account some nuances related to the grounds for its calculation. So, the meaning of this benefit is to compensate the citizen for the stressful period of child care .

In this regard, it should be understood that in cases where parents, for one reason or another, were deprived of the corresponding rights, they cannot count on benefits. The same applies to situations where a child is permanently staying in a specialized social institution for the disabled.

Of particular note are those parents who are not registered at the same address as the child, although they actually cared for him. In this case, it will most likely be necessary to confirm the relevant fact by going to court (but only after the Pension Fund of Russia refuses to assign a payment).

What to do if the Pension Fund does not count work experience in the countries of the former USSR, is this legal?

The problem associated with the fact that the Pension Fund does not count the length of service earned in the USSR or in the former republics after its collapse is quite widespread. However, in this case the situation is not so clear-cut. Thus, today the Agreement “On Guarantees of the Rights of Citizens of the CIS Member States in the Field of Pension Security” is in force for all CIS member countries.

According to it, the Pension Fund of the Russian Federation is obliged to take into account the length of service, including that associated with preferential pension provision, which was received on the territory of any participating state, as well as on the territory of the Union republics during the existence of the USSR.

To confirm the length of service, the territorial office of the Pension Fund of the Russian Federation makes inquiries to the competent authorities of the state where the person’s labor activity was carried out.

However, if the Pension Fund of the Russian Federation refuses to recognize work experience obtained in the USSR or on the territory of a state party to the agreement, then such a decision can be considered illegal. To do this, the interested party should go to court. In court, the plaintiff has the right to present evidence of Soviet experience. In turn, they can be obtained by sending independent requests to the competent authorities of foreign states parties to the above-mentioned agreement.

If a person did not know about the right to preferential retirement and applied for it according to the standard procedure, then is he entitled to compensation?

Current legislation establishes that a pension is assigned only after a citizen applies for it . Thus, even if there is a right to pension provision, without the person applying for payments, they cannot be assigned.

Reference! The pension fund currently has no obligation to notify citizens about the payments due to them.

Compensation and other forms of material payments for lost funds are not provided for by law. Accordingly, it makes no sense to contact the Pension Fund or the court on this issue, since the assignment of a pension is of a declarative nature.

This rule is universal and applies to both preferential and regular pensions.

The list of benefits provided to persons raising a disabled child is quite extensive, with the most significant among them being the possibility of early retirement. However, to do so, the parent or guardian must meet certain criteria specified in the law, including, but not limited to, providing direct care.

Can parents of disabled children lose their right to early retirement?

A pension for a woman with a disabled child, as well as for a man who is a father, is awarded only if there are grounds for it. If there are none, it is denied. They don’t even accept documents for registration when:

- the applicant did not raise a child under 8 years of age for any reason;

- the applicant was deprived of parental rights until the pension was issued;

- the other parent took advantage of the benefit;

- the insurance period is below the established threshold;

- the age at which you can take early leave has not yet reached.

In these cases, the right is lost, and the Pension Fund immediately refuses to issue such a labor benefit.

But if the mother or father was deprived of parental rights after the pension was awarded (that is, at the time of its registration they met all the criteria), then the right to further receive a pension is not lost. They continue to receive it further.

Requirements for guardians

In the absence of mother and father, the child often ends up in a state institution. Close relatives are faced with the question of the possibility of taking him from the orphanage into care.

It is the closest relatives who have priority rights to obtain guardianship over a disabled child. These include: grandparents, aunts and uncles, adult brothers and sisters.

How to take custody of a child from an orphanage?

Understanding that a potential guardian assumes responsibility for the life of another person, especially a child suffering from a serious illness, the legislator establishes the following requirements for such persons:

- No previous convictions for serious crimes against a person or public order.

- Absence of mental illness and addictions (alcohol, drugs).

- Age from 18 to 60 years.

- Availability of housing, a place for education, upbringing and development of the child.

- No history of deprivation of parental or guardianship rights.

- Having a permanent source of income.

The guardianship authorities will definitely require a reference from the place of work in order to verify the positive moral qualities of the potential guardian.

If the child has reached the age of ten, then his opinion will also be taken into account when deciding on the establishment of guardianship.

Amount of preferential pension

The amount of the preferential pension is individual and is calculated separately for each case.

The size is determined by analogy with the algorithm for calculating the usual old-age insurance pension (not preferential) and depends on:

- the total amount of insurance premiums received by the Pension Fund of the Russian Federation for the insured person;

- the amount of pension rights acquired before January 1, 2002.

That is, essentially the size will depend on:

- the employee’s salaries in the past (the higher the salary, the higher the pension subsequently);

- duration of insurance period;

- age of application for an insurance pension;

- number of pension points.

Early pensions for the unemployed are subject to all indexation of the insurance pension.

Amount of pension accrual

The principle of calculating the insurance pension for persons raising children with disabilities is no different from that for all other categories of citizens.

Their pension consists of the following parts:

- Fixed payment. It is 5334.19 rubles in 2019. It should be noted that if at the time of accrual of payments the pensioner has disabled dependents, then the amount of the fixed payment will be higher. The same applies to citizens who worked in difficult climatic conditions, and some other categories of beneficiaries.

- Insurance part. It directly depends on the number of accumulated pension points.

Are there any additional benefits

Early pension is only one of the benefits provided for persons with a dependent disabled child.

Thus, they are assigned the following concessions and preferences:

- subsidies for housing and communal services;

- tax benefits and additional deductions;

- preferential provision of medicines and specialized medical care;

- additional days of rest and vacation for a working parent.

- payment in the amount of 5,000 rubles.

In addition, local benefits may be provided at the regional level, the availability of which should be obtained from social security.

Are parents of disabled people entitled to only one pension?

Currently, pensioners in the Russian Federation receive two types of pensions:

- insurance benefits received by able-bodied persons;

- social benefits received by disabled persons.

Above we discussed the conditions for assigning an insurance pension, which able-bodied parents with a certain length of service can receive on preferential terms.

Only parents who do not have a single day of insurance coverage can receive a social pension. Also, this type is received by disabled people and incompetent persons due to the loss of a breadwinner, but we do not even consider these categories, since they cannot, by law, be representatives of a disabled child.

That is, in fact, there is only one pension, the official recipient of which is the parent. But our help to families with a disabled child or childhood disability does not end here.

They also receive support not only in the form of pensions, but also in the form of social benefits, namely:

- to the parent or guardian of a disabled child (under 18 years of age) or a disabled person from childhood of group I (over 18 years of age) - in the amount of 5,500 rubles ;

- other persons – 1200 rub .

Parents of groups 2 and 3 disabled since childhood do not receive such care benefits.

In addition, the child himself, due to his disability, receives a social pension and EDV, and since the parents are legal representatives, in fact they are the ones who receive these payments.

| Social payment | Disabled children | Disabled since childhood | ||

| 1 group | 2nd group | 3 group | ||

| Monthly cash payment (MAP) | 2701,62 | 3782,94 | 2701,62 | 2162,67 |

| NSO (in monetary equivalent) | 1121.42 rub. | 1121.42 rub. | 1121.42 rub. | 1121.42 rub. |

| Social pension | 12432,44 | 12432,44 | 10360,52 | 4403,24 |

*in the bottom line in brackets the maximum amount of EDV is indicated, subject to refusal to use NSO in kind

Payments are indexed several times a year. As a rule, their size increases after this.

What types of state support are required?

Guardians of disabled people of group I have the right to monthly financial assistance. On the territory of the Russian Federation you can count on the following types of state support:

- Non-working parents receive 60% of the minimum wage in connection with caring for a disabled person.

- If a guardian takes care of a disabled child, the amount of the benefit is 11,445 rubles. monthly, if the disability is acquired, the amount of payments will be 9538 rubles.

- The state transfers a monthly allowance to the guardian in the amount of 3,357 rubles.

Payment amounts may vary depending on the region.

Important! The pension is assigned only to adults (a minor cannot be a guardian). The assistant must perform his duties with an official status.

Guardians can also count on additional privileges:

- discount of 50% of costs for housing and communal services and telephone communications (landline);

- free treatment in sanatoriums;

- tax benefits: · reduction in payment of transport and land taxes, abolition of property tax;

- free travel on all types of public transport.

Important! Payments are paid along with the pension.

Standard deduction of 3,000 rubles

To receive this deduction, the taxpayer must belong to one of the preferential categories:

- disabled military personnel - groups I, II, III;

- disabled people of the Second World War;

- liquidators of the Chernobyl disaster, etc. (clause 1, clause 1, article 218 of the Tax Code of the Russian Federation).

The deduction is provided provided that the individual has income taxed at a rate of 13% (15% if income exceeds 5 million). There is no income limit for this type of deduction.

The deduction is not provided by default; to receive it you must submit an application to your employer. In addition, you will need to confirm your right with supporting documents (for example, attach a copy of a certificate of disability).

If you were unable to take advantage of the deduction from your employer, you can get it from the tax office, as we will explain later in the article.

Current questions on a given topic.

Question No. 1. Does the disability group assigned to a child affect the period at which his parents have the opportunity to retire early?

Answer: This indicator is not significant under these circumstances. This, as well as a number of other factors, influence the amount of pension benefits received, namely:

- salary amount;

- seniority;

- availability of rights to receive additional payments;

- additional parameters specified by regional legislation.

Question No. 2. Are there any restrictions under which early retirement for the parents of a disabled child is not possible?

Answer: Yes, such restrictions exist. They are:

- Parents or guardians of a disabled child were previously deprived of parental rights.

- One of the parents has a criminal record for causing harm to health. Moreover, who the injured persons were in this case is not significant.