A person who from birth has a number of physical, psychological or mental limitations is assigned the status of a disabled person from childhood. Such people need constant supervision from relatives or other people (organizations). Parents of a disabled child bear great responsibility for his life and health. A huge amount of effort and energy must be spent in order for a disabled child to adapt to the environment. As a rule, the mother of a disabled child bears the heaviest burden.

Therefore, one of the parents of a disabled child is entitled to a number of benefits and rights that can be used to improve the life of the family.

What benefits and rights are entitled to the mother of a disabled child in 2021?

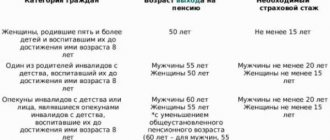

In accordance with the law on changes to the pension system adopted on October 3, 2021, the retirement age will not be increased, including for citizens whose pension was assigned earlier than the generally established retirement age for social reasons and health reasons, including one of the parents of disabled people with childhood, who raised them until they reached the age of 8 years (men and women), as well as guardians of disabled people from childhood or persons who were guardians of disabled people from childhood, who raised them until they reached the age of 8 years (men and women).

Among other categories of beneficiaries who will not be affected by the increase in retirement age:

- mothers of five or more children who raised them until the age of eight;

- mothers of two or more children who have the necessary work experience in the Far North or equivalent areas,

- disabled due to war trauma,

- visually impaired people of group I,

- dwarfs and midgets,

- as well as reindeer herders, fishermen and hunters permanently living in the Far North or equivalent areas.

Also among those who maintain the same retirement age are those affected by radiation accidents.

“Since this norm of the current legislation does not change, it is not mentioned in the draft federal law “On Amendments to Certain Legislative Acts of the Russian Federation on the Appointment and Payment of Pensions,” which provides for an increase in the retirement age,” explained the press service of the Ministry of Labor.

Features of the solution if you are raising a child with disabilities

In accordance with Article 32 of the Federal Law “On Insurance Pensions,” the parents of a minor who has been diagnosed as disabled have the right to count on early retirement . So, men begin to receive this kind of payment at 55 years old, and women at 50.

As for guardians, the situation with them is somewhat more complicated. The law establishes that for every year and a half during which these persons provided appropriate care for the child, their retirement age is reduced by one year. It should also be noted that in this case we are referring to the pre-reform figures of the retirement age.

Reform and raising the retirement age

Changes in the pension system in 2021 caused a deep resonance in society, but according to the Ministry of Labor, increasing the retirement age of parents of disabled children is not included in the draft reform.

In addition, those citizens who are entitled to early retirement will retain this right, regardless of changes in legislation.

Conditions for granting an early pension to a guardian of children with disabilities since childhood in 2021

Also, the right to receive an old-age insurance pension of a previously established retirement age is enjoyed by guardians of disabled people since childhood, and by persons who have been guardians of disabled people since childhood, even if they are not such at the time of applying for a pension.

- For this category of citizens, the retirement age is reduced by one year for every one year and six months of guardianship, but not more than 5 years in total, if they have an insurance record of at least 20 and 15 years, respectively, men and women.

- The age at which the right to an early old-age pension can be exercised is determined proportionally depending on the length of the period of guardianship over a disabled child.

- In this case, a mandatory condition is the establishment of guardianship and upbringing of the child until the age of 8.

- The duration of guardianship for the right to early retirement is determined only taking into account the periods when the child was recognized as disabled.”

Collection of documents and registration

In accordance with the law, there are 3 disability groups. At the same time, group I is assigned to very severe diseases and conditions in which the child lacks even basic skills and self-care capabilities. Such children cannot independently cope with everyday tasks and are not able to socialize. Group III is considered the mildest, health disorders in it do not imply loss of ability to self-care

Reference! Depending on the progression or weakening of the disease or condition leading to disability, the group may be changed. In addition, the possibility of disability being removed altogether cannot be ruled out if there are appropriate grounds for this.

The decision to recognize a child as disabled is made on the basis of the conclusion of the ITU, a referral for which is issued at the health care institution where the child is observed on an ongoing basis.

To assign an insurance pension, you should contact the Pension Fund or MFC with the following documents:

- statement;

- ITU conclusion;

- child's birth certificate;

- document identifying the applicant;

- marriage (divorce) certificate of the applicant;

- certificate of cohabitation;

- documents confirming work activity and the required length of service.

If necessary, pension fund employees may request other documents confirming certain additional information.

How to confirm that you are caring for a child

The basis for the provision of the benefits discussed in the article is the fact of caring for a sick minor, which led to the inability to fully carry out work activities. However, when assigning a pension, the responsible specialists of the Pension Fund require confirmation of this fact, which causes confusion and questions among many parents and guardians.

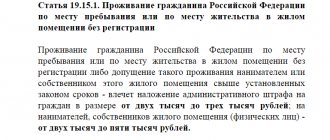

The fact that a particular person cared for a disabled child is confirmed by the fact that they are both registered at the same address in the same residential premises . Accordingly, the latter is certified by a certificate of family composition, which is issued by a housing organization or social protection.

If it is not possible to obtain such a document, then any other evidence of cohabitation should be provided.

If the state pension fund refuses to assign payments due to the absence of this document, then such a decision of the responsible officials can be challenged in court, where all available evidence will be taken into account.

What is important for parents to consider when applying?

The right to a pension arises for parents in cases where they raised a disabled child under the age of 8 years. The law does not contain special requirements related to exactly when the child’s health limitations were established. It also does not matter whether the disability was subsequently lifted.

When applying for an early pension, citizens must take into account that benefits for raising a disabled child can be provided to only one parent. The mother has the priority right to this. However, the second parent who does not take advantage of the benefit must give his consent to this. It is required if both parents meet the criteria necessary for the assignment of preferential support. If the mother refuses to provide support or switches to another type of pension, then the father also has a corresponding right.

Moreover, if there were two or more children in a family who were recognized as disabled, then in this case the right to preferential support arises for both parents.

When calculating the volume of pension rights, it should be taken into account that the periods during which a disabled child was cared for also form the IPC. So, for each year the parent is awarded 1.8 points.

To guardians

As for guardianship of a disabled child, there are certain nuances regarding the provision of the benefit in question.

Thus, guardians cannot count on early retirement only after raising a child . The duration of this period is important to them. It has been established that for every year and a half that a disabled person stays in the family, the retirement age is reduced by one year. There is also a limitation. Thus, in total, the retirement age cannot be reduced by more than 5 years.

In addition, only one guardian can use the right to early retirement. An important condition is that guardianship must be established no later than the child turns 8 years old. In this case, the age at which disability was established and the fact of its subsequent removal does not matter.

What pension is available to mothers of disabled children?

Article 28 of Federal Law No. 173 gives the mother of a disabled child the right to early exit.

You are also entitled to a number of preferential and additional payments:

- monthly pension supplement in the amount of 1,478 to 2,527 rubles (the exact amount depends on whether the mother of a disabled person wants to use the social package);

- social assistance in the amount of 5,500 rubles for caring for a disabled person;

- additional payments depending on the rules established in a particular region of Russia.

The mother of a child with a disability can receive an additional 5,000 rubles in the Moscow region. In other areas there are also allowances, but the amount differs. This depends on local government regulations.

Payment amount

The pension in this regard is not fixed; it is calculated individually, taking into account important points.

What does it consist of?

To obtain the exact amount, Pension Fund specialists use:

— total work experience;

— minimum social pension;

— term of care and guardianship for a disabled child;

— accumulated points (in general).

An advantage to the pension is a fixed monthly cash payment (FMC).

These calculations are relevant for the child’s official guardians who took care of him until he reached the age of 8, while the age at which he received special status within the specified period does not play a role.

How is work experience determined?

The parent's length of service is extremely important when calculating the pension. And according to the law it happens:

— labor — implies the general period of the citizen’s performance of work duties specified in the contract with the employer (the document must comply with the Labor Code standards);

- insurance - it is calculated according to the number of months and years when contributions to the Pension Fund were made.

In addition, the length of service may include the period of caring for a disabled person. For every 18 months of care, six months are counted. The possible maximum earned experience is 5 years.

Additional payments and pension supplements

Although early retirement appears to be good government support, the pension benefit may be negligible. In general, the parent of a special child has the right to receive funds in the form of:

- benefits for caring for a disabled person - 10,000 rubles;

— EDV in the amount of 1,627 to 2,782 rubles, depending on the monetization of the NSO (if services from the social package are provided in monetary terms, the monthly payment increases);

— additional payments so that the total amount reaches the subsistence level:

— regional assessments from the local budget.

Important! It’s worth finding out exactly how much the premium will be in your region, as a lot of factors are taken into account.

Minimum pension

The pension payment is not constant, it is indexed every year. For example, in January 2021, the benefit was increased to take into account the percentage of inflation. The increase will be 2.6%, that is, payments today are equal to 13,407.52 rubles (this is the minimum pension).

In Moscow and St. Petersburg

The quality of life of disabled people depends on many nuances, including regional characteristics. Local authorities throughout the country strive to:

— provide medical taxi services;

— stimulate inclusive education;

- provide families with additional funds;

— install handrails, ramps and make the environment more accessible, etc.

Of course, families with disabled children in each region can be supported in their own way. For example, in cities of federal significance money is allocated:

— Muscovites with a disabled person in their care can receive 12,000 rubles monthly as financial assistance;

— residents of St. Petersburg are entitled to an additional 6,571 rubles per month.

The money comes from the regional budget to a social card without the ability to cash out the amount. The card can be used to pay for purchases in specialty stores, pharmacies or travel.

Accounting for regional coefficient

If a disabled person and his family live in an area with a harsh climate, supplements are added to pensions and other payments as a “regional coefficient”. It varies between 0.5-1.0 and depends on a set of factors.

For example, in northern latitudes a scheme is being implemented: allowance plus allowance, multiplied by a certain coefficient.

This type of assistance serves as compensation for the physiological losses suffered by a resident in a harsh climate.

Factors influencing the amount

The size of the mother's pension depends on the following factors:

- the amount of the usual old-age labor pension;

- payment for caring for a disabled person;

- monthly payment;

- housing benefits and taxes;

- length of work experience;

- pension points;

- wage.

If the mother has no work experience at all, then a preferential pension is still assigned.

- Only its size will be smaller.

- But if the mother could not work due to the need to constantly care for a disabled person, then she is assigned an increased care payment.

Retirement of the parents of a disabled minor

The main condition for early receipt of a pension for the mother of a disabled child is the presence of specific work experience. In 2021, the volume of state support was 4959 rubles.

For people with childhood disabilities at the state level, the following amounts are established for groups I, II, III:

- persons who have reached and upon reaching 18 years of age are entitled to security in the amount of 11,903 rubles;

- with the second degree of disability - 9919 rubles;

- with the third group - 4215 rubles.

Appointment procedure

The assignment of state subsidies is carried out by the Pension Fund of the Russian Federation at the citizen’s residential address. The application should be sent when the right actually arises, however, no later than ten days.

If the parent applied for an appointment after the initiation of the right, then a preferential pension for the mother of a disabled child is issued from the moment the application is received by the Russian Pension Fund. In addition, it is necessary to prepare a package of documents, then the benefit is established within the framework of the month of visiting the department’s unit.

Retirement age

At what age does the mother of a disabled child retire? In this case, a reduced age for retirement is provided - this is 50 years. But in order to exercise this right, the mere fact of disability is not enough.

3 more conditions must be met:

- insurance experience of at least 15 years (with less experience, a preferential pension for a disabled person is also entitled, but you will not be able to use the early exit option);

- raising a child from an early age (if the offspring appeared in the family of guardians when he was already over 8 years old, then the mother will not be able to retire at 50);

- timely submission of applications and documents (before turning 50 years old).

If the child was disabled for only 1 year, after which this status was lifted due to improved health, the mother also has the opportunity to retire at 50 years old.

Article 28 of Federal Law No. 173 clearly states that the age of receipt of disability and the duration of this status do not play any role:

- The mother of a child who has been disabled for 1 year and the mother of a child who has been disabled for 18 years have absolutely the same rights.

- They are both entitled to preferential benefits.

Common mistakes on a given topic.

Mistake #1. Guardians of a disabled child, along with his natural parents, always have the right to early retirement five years earlier. The rule for guardians retiring earlier than the established period in connection with raising a disabled child is different and is as follows: for every 18 months of guardianship, one year is deducted from the retirement period. However, the maximum number of years for which you can retire early is five.

Mistake #2. In connection with the adoption of a new legislative act on increasing the retirement age by five years, the early retirement of parents who are raising disabled children was also postponed for this period. This legislative act specifies a list of persons who are not affected by this increase. And it is the parents/guardians of children with disabilities who are included in this list.

The procedure for assigning a pension to the mother of a disabled child since childhood

A pension for the mother of a child with a disability is assigned at the Pension Fund office at the place of registration.

The woman herself must initiate the appointment procedure by submitting an appropriate application. You must apply before you become eligible (that is, before you reach age 50).

The application deadline is 10 days from your 50th birthday.

- Therefore, the procedure should not be postponed.

- If you delay it, difficulties will arise with registration, and it will be very difficult to receive a preferential pension.

General position

The new pension reform has affected thousands of Russian citizens who are now forced to become pensioners 5-8 years later. However, the parents of a disabled child apply for a pension not according to the new reform, but guided by the old Chapter. 6 Federal Law No. 400-FZ (December 28, 2013).

The law clearly defines the circle of people who can use the right to retire early, for example, “northern” people working in hard work or military industries, women who have given birth to more than 2 children, as well as parents of disabled children

The increase in the age pension threshold will not affect:

- mothers or fathers (to choose) of a disabled child since childhood, who raised him until he was 8 years old (and beyond);

- guardians of disabled children appointed by the court;

- those who were the child’s guardians and raised him until he was 8 years old.

According to the new law, preferential retirement periods are also preserved for the following categories of citizens:

- living and working in difficult conditions of the Far North and equivalent other regions of the Russian Federation;

- dwarfs, midgets;

- those with visual impairment of group 1;

- who became disabled due to loss of health due to military operations;

- mothers who gave birth to 2 children and worked in the Far North.

Features of the appointment procedure

- The day the right to a pension is registered is determined by the day the application is submitted.

Even if the registration took several days, the main day is considered to be the day when the application was accepted. - The pension is assigned from the month when the application was accepted.

The date is not important. If a person visited the Pension Fund on September 30, then pension accruals are calculated from September 1. If it arrived already on October 1, accruals begin on October 1. - To apply for disability benefits for a child, you must have an appropriate certificate of disability.

To do this, you need to undergo a medical and social examination, based on the results of which a report will be drawn up. An extract from this act is a certificate of disability.

Some legislative concepts

Even before you start applying for the required benefits, you need to study some terms that significantly affect the definition of the circle of people retiring early. Thus, the following is legally taken into account:

- An early pension is a benefit from the state that is accrued earlier than the generally accepted retirement date. This applies, among other things, to parents who cared for a disabled child, but subject to full work experience;

- a disabled child who has not reached 18 years of age and has a number of diseases (conditions), confirmed by the conclusion of doctors and the Medical Examiner, which do not give him the opportunity to lead a full, active life;

- disabled since childhood, status is awarded only to a person who has reached 18 years of age;

- disabled group, a category according to ITU, which is assigned to a child after he reaches 18 years of age and is determined according to the severity of the disease and the ability to work (working, non-working).

The status of “disabled child” can only be given by the ITU based on the results of numerous studies, treatment and opinions of specialized doctors. Assigned if a child needs rehabilitation, if he cannot navigate in space and time, does not move independently and there are severe disorders in the functioning of the body.

What documents should I take with me?

To avoid the situation of visiting the Pension Fund again, you should study the list of required documents in advance.

You must take with you not only the original document, but also a photocopy of it. It is not always possible, given time pressure and long queues, to do this on the spot, so it is best to collect all copies in advance. If some documents are missing, you can submit them within 3 months from the day the application was submitted.

The list of documents includes:

- General passport.

- Work book.

- SNILS.

- Child's birth certificate.

- A certificate confirming the fact of disability.

- 2-NDFL, including information about any 5 consecutive years of labor activity for the period before 01/01/2002.

- Marriage registration certificate if there was a change of surname.

- Form No. 9 about family composition.

- A certificate confirming the child’s cohabitation with the applicant.

- Application for a preferential pension.

There are often cases when representatives of social protection visit families in order to make sure that a disabled child is not only registered in the apartment, but also receives the necessary help, support and education. The commission deciding on the assignment of pensions may request this information to make a decision regarding the accrual of retirement benefits for parents with a disabled child.

Algorithm for registration of pension benefits

In order to exercise your right to a reduced retirement age, you should go to the Pension Fund branch at your place of residence.

There are several ways to contact:

- Come in person.

- On the State Services website, you must first register.

- Send by mail.

- By writing a power of attorney for another person.

To retire the mother of a disabled child, an application must be submitted 10 days before the 50th birthday. For fathers - 10 days before their 55th birthday. But the best option would be to contact the Pension Fund six months in advance to resolve all problematic issues. If for some reason the time for early retirement is overdue, this right is still retained by the parent and he has the right to use it later.

After all the formalities have been completed, you should decide how best to receive your pension. With the help of Russian Post, it is possible to receive payments at home; if you use the capabilities of the bank, you need to either visit it in person or receive money on a bank card.

The amount of the preferential pension is individual, as it depends on several indicators:

- Salary amount.

- Work experience.

- Pension savings.

- Fringe benefits.

For example, the size of the pension for a mother raising a disabled child will contain: the basic amount paid to any person retiring, plus a 30% bonus for raising a child with special needs, plus 50% for working in the Far North. And to this is added the insurance part of the pension.

It can be useful to track changes in the amount of the early pension of the mother or father of a disabled child approximately every six months, since it is during such periods that indexation often occurs and the amount of payments increases.

If the Pension Fund has made a negative decision regarding early retirement, it can be challenged in court by filing a lawsuit. You should also attach a copy of the Pension Fund’s refusal, statements and correspondence with officials.

When applying for a preferential pension as a mother of a disabled child since childhood, it will be useful to find out whether you have the opportunity to receive additional compensation. This information can also be used after the pension has already been issued to increase its size.