How long is a 2-NDFL certificate valid?

Tax agents (meaning firms, enterprises, individual entrepreneurs paying income to individuals) must, upon receipt of an application from a taxpayer (tax agent employee), issue him a reference calculation of 2-NDFL (clause 3 of Article 230 of the Tax Code of the Russian Federation) for any period, prior to the application date.

The current 2-NDFL form for 2021 can be downloaded here.

A sample application for issuing a 2-NDFL certificate can be downloaded from ConsultantPlus. To do this, sign up for trial demo access to the K+ system. It's free.

And although the validity period of the 2-NDFL certificate is not limited, its contents and date must correspond to the purposes for which it is taken by the employee. So, 2-NDFL is sometimes needed:

- to prepare the 3-NDFL declaration;

- when applying for a loan.

Let's see how long 2-NDFL is valid in these cases.

Normative base

Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ “On approval of the form of information on the income of individuals and the amount of personal income tax, the procedure for filling it out and the format for its submission in electronic form, as well as the procedure for submitting information about income of individuals and amounts of personal income tax and messages about the impossibility of withholding tax, amounts of income from which tax is not withheld, and the amount of unwithheld personal income tax" Order of the Federal Tax Service of

Russia dated October 15, 2020 No. ED-7-11/ “On approval of the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL), the procedure for filling it out and submitting it, the format for providing the calculation of the amounts of personal income tax calculated and withholding by the tax agent in electronic form, as well as forms of a certificate of income received by an individual and withheld amounts of personal income tax" (together with the "Procedure for filling out and submitting calculations of amounts of personal income tax calculated and withheld by a tax agent (form 6-NDFL)").

Validity and expiration date of the 2-NDFL certificate for the tax office

Let's move on to the question “How long is the 2-NDFL certificate valid for the Federal Tax Service?” When the year ends, an individual, based on the rule established by law (Article 229 of the Tax Code of the Russian Federation) or by personal expression of will, sends a 3-NDFL declaration to the tax authorities. Figures relating to income are transferred to it from 2-NDFL.

Although, as we have already figured out, there is no validity period for 2-NDFL certificates, the taxpayer is strongly recommended to check whether he has missed the time to contact the tax authority on an issue for which resolution is necessary, including the information presented in 2-NDFL . Most often, individual taxpayers go to the tax office in order to return previously transferred personal income tax from the budget. At the same time, the deadline for tax refund is 3 years (Clause 7, Article 78 of the Tax Code of the Russian Federation).

ATTENTION! Users of their personal account on the website of the Federal Tax Service of Russia have the opportunity to download Certificates to their computer using this service. It is necessary to take into account that tax agents submit information about an individual’s income for the past calendar year to the tax authority no later than March 1 of the following year. That is, the 2-NDFL certificate for 2021 can be available in your personal account no later than 03/01/2021.

Next, we will consider how long a 2-NDFL certificate is valid for a bank.

Validity period for tax deduction certificate

A 2-NDFL certificate is submitted to the Federal Tax Service:

- By a company or enterprise, annually no later than April 30 of the current year as reporting for the previous one.

- As clarification information if there is an inaccuracy in the submitted report.

- Individuals as confirmation of the 3-NDFL declaration.

Certificate 2-NDFL is needed to calculate deductions to the Federal Tax Service. There are 5 categories:

- Standard, provided at work. This includes deductions for children.

- Professional.

- Investment.

- Social. They can help cover expenses for education and treatment.

- Property. There is a deduction from the purchase of real estate, mortgage payments, construction or repair expenses.

The most common requests to the Federal Tax Service from individuals occur on the last two points. The validity period of 2-NDFL in this case is not limited; a request for a deduction can be submitted on any day once a year. You can receive the deduction within 3 years. If the certificate was issued a long time ago, it still remains valid. It can be brought to the Federal Tax Service within 3 years.

Receipt of benefits will be considered justified. That is, the period of possible application for benefits is regulated, but not the period of the certificate itself.

If the certificate was issued a long time ago, it still remains valid. It can be brought to the Federal Tax Service within 3 years

The main purpose of 2-NDFL is documentary confirmation of a person’s solvency and personal participation in the taxation process. In addition, a candidate may be asked for a certificate from a previous place of employment at a new place of employment. A certificate is also needed to receive benefits at school and kindergarten, as well as when receiving maternity benefits. If an employee does not have Russian citizenship, but plans to obtain it, 2-NDFL is one of the important documents on the list. Finally, in case of labor disputes between the company and the employee, filing a claim and further legal proceedings, it is impossible to do without a certificate.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Validity period and deadline for submitting the 2-NDFL certificate for the bank

It is extremely common for credit institutions to request the calculation of 2-personal income tax (when citizens contact them to borrow money for various needs).

The validity period of a 2-NDFL certificate for a bank will be determined by its requirements for the period of confirmation of earnings and/or the date of its preparation, which may vary in each individual case depending not only on the credit institution, but also on the characteristics of the loan product claimed by the potential borrower .

As for the deadline for submitting 2-NDFL to the bank, it is determined by the time limits for transferring to the bank all the documents necessary to consider the request to receive borrowed funds.

Read about banks checking the 2-NDFL certificate for a loan here.

When is proof of income required for a mortgage loan?

To apply for a mortgage loan from a bank to purchase a home, the borrower needs to confirm income. Sometimes banks require information from the employer (or several, if the person works part-time) in a form developed and approved by the credit institution itself, but more often an official form is used, which was developed and approved by the Federal Tax Service.

Using such a form has several advantages:

- it is easy for the bank to verify the accuracy of the information specified in the document;

- the document confirms official employment and the fact that income tax is withheld from the person.

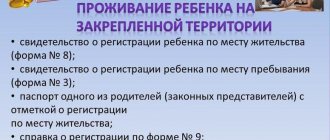

The main purpose is to confirm the borrower’s source of permanent income, necessary for timely repayment of the mortgage. But in some situations, it is necessary to make a 2-NDFL certificate for a mortgage not for the bank, but for:

- visa processing;

- employment;

- calculating the amount of alimony;

- adoption or child guardianship;

- registration of benefits and pensions;

- registration of benefits.

Deadline for issuing certificate 2-NDFL

The law does not directly say how quickly this paper is issued by the tax agent. But there is Art. 62 of the Labor Code of the Russian Federation, which limits the time for an enterprise to prepare documents for its employee at the latter’s request to 3 days, including the period for issuing a 2-NDFL certificate. Thus, if an employee has submitted an application for registration of 2-NDFL, it is within this period that it should be done and given to him.

Read more about the procedure for issuing a 2-NDFL certificate to an employee here.

For information about who can endorse the 2-NDFL, see the material “Who has the right to sign a 2-NDFL certificate?” .

What are the consequences of not issuing a 2-NDFL certificate at the employee’s request, read in the article “The employee was not issued a 2-NDFL certificate? Wait for the trial .

How long is a document confirming the amount of salary valid?

Banks independently set the period for the 2-NDFL certificate for a mortgage - for some, information for the current year is enough, some want to have data for three years. The bank’s wishes regarding the period must be taken into account when submitting an application to the employer.

The document submitted to the bank must be recent. A certificate taken in January will not be suitable for submission to the lender in June. It is necessary to clarify this information with the credit manager of the bank where the mortgage loan is issued. Sometimes information received last month is not suitable, but it also happens that it is acceptable to provide information prepared 3 months ago.

Results

The 2-NDFL certificate does not have a validity period, but it does have a deadline for its submission by the employer to the tax authorities and a deadline for issuing it to the employee. The employer is obliged to issue a 2-NDFL certificate to the employee within 3 working days. In addition to the employer, a 2-NDFL certificate for previous tax periods can be requested from the INFS.

Read more about this in the material .

Sources:

- tax code of the Russian Federation

- labor Code

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

For what period is it allowed to process information about wages and deductions?

The current legal regulations do not indicate the minimum period of time for which the tax agent provides information about the amounts paid and the tax withheld from them. But from the form of the document it is clear that this is a month. If a person quits without working a full month, or receives a one-time income, the tax agent provides him with information for the time actually worked.

Since the tax period for personal income tax is a calendar year, there is a limitation for the period for which a 2-NDFL certificate is issued - for the number of months worked within the calendar year. This follows from the certificate form, in which in the fields of the section with income data there is no indication of the year, there is only an indication of the month. This is what a fragment of a document issued for the first three months of 2021 looks like:

If a person got a job at an organization in November and requested information about his salary for the time worked, he will receive a document indicating November and December. A separate paper will be issued for each reporting period.

Income information for banks

Some credit organizations require certificates of salary and deductions on special forms developed by the banks themselves to issue loans. The employer has the right to issue such a document for any time period specified in the form. But when issuing information in the KND form 1175018, the former 2-NDFL is provided for a period not exceeding a calendar year.

IMPORTANT!

If information on income for several years is required, a separate document is issued for each of them.

Issuance of information upon dismissal

When a person leaves work, information about income received is included in the list of documents that the employer is required to issue on the last working day. In most cases, data is required only for the last calendar year, and paper is issued for it. If necessary, the employee has the right to request information for past periods; this will be prepared on separate forms.

How long is an income certificate valid for a bank?

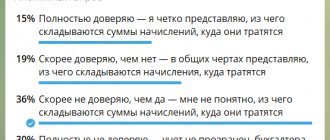

The expiration date of 2-personal income tax for a loan is determined in the official requirements of the bank. Each credit institution has a local procedure for issuing loans: this applies to both the list of documents and their validity period.

Typically, banks require up-to-date information; the validity period of the document for the bank in most cases is six months or a year. The credit institution specialist explains to the client for what period he needs to draw up the document. And the borrower turns to his employer for all the necessary papers.

Some banks have requirements for the expiration date of reference documentation. They accept papers issued no later than 30 days ago and refuse lending if the client has provided an overdue KND form 1175018. But these are not general conditions, but the regulations of specific banks.

By analogy with the deduction for the purchase of an apartment, the rule applies for how long a 2-NDFL certificate is valid for a tax deduction for a mortgage: the taxpayer has the right to return 13% of the amount of mortgage interest paid within three years. That is, in 2021, a property deduction is issued for interest transferred to the bank in 2020, 2021 and 2021.

What if the salary comes in an envelope?

Wages called “gray” are far from uncommon, especially for employees of small businesses. What to do if the official tax reporting shows only the minimum subsistence level, which is insufficient to obtain a loan for a large amount?

Fortunately, there are quite common banks in the country that provide loans without 2-personal income tax. There are credit institutions that are just beginning to develop a client base. These banks are ready to issue a loan without any documents about income, however, the interest rate will be justified for such risks.

In large banks in the country, for such cases, it is possible to confirm income with a certificate on a bank form. Alas, not every loan program allows such a document in its requirements. Nevertheless, credit institutions are interested in any solvent and conscientious borrower, and are often willing to accommodate the client halfway.

For those who plan to get a mortgage or loan for a large amount

The list of documents required by the bank to provide a loan can sometimes be quite extensive. This is especially true for mortgage loans. Therefore, before submitting an application for registration of 2-NDFL, you should once again check the availability of all certificates, and only then request the issuance of an income report.

How long is a 2-NDFL certificate valid for a bank when applying for a loan under a mortgage program? As a rule, for such cases the validity period of the certificate is even shorter - from 10 to 14 days. This is explained by the need to reduce risks for the lender. In order to issue a large sum of funds for a long period, the bank is obliged to verify the solvency of the borrower. For this reason, the latest data on his official income is so important.