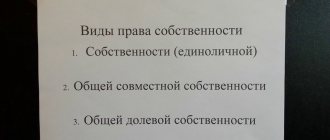

Common joint property as a concept

The concept of common joint property is given by the Civil Code of the Russian Federation.

This is a type of common ownership of an apartment in which several people can be its owners, when the share of each of them in the ownership right is neither mathematically nor physically determined.

In accordance with current legislation, the emergence of the right of common joint ownership of an apartment is provided only for spouses acquiring a property during marriage.

Purchasing an apartment for common joint ownership

The purchase of residential premises in common joint ownership occurs in accordance with the general procedure.

The procedure includes the following steps:

- Checking the legal “purity” of the apartment;

- Concluding a purchase and sale agreement with signing a transfer deed;

- Settlements with the seller (carried out even after state registration);>

- State registration of joint ownership rights.

Let's look at each of the stages.

Checking the legal “purity” of the apartment.

When an apartment has been selected and the terms of purchase have been agreed upon by the parties, before completing the transaction it is necessary to check its legal “purity”.

The check includes:

- Checking the seller's title documents for the apartment.

- If there are several owners of an apartment, all owners must act as sellers.

- If an apartment was purchased in the name of one spouse during marriage, the notarized consent of the second spouse to the transaction with it is required.

- If minors or incompetent citizens are registered in the apartment or are its owners, the consent of the guardianship and trusteeship authorities is required.

Before the transaction, order a “fresh” Extract from the Unified State Register of Real Estate, confirming that the Seller’s ownership is not encumbered by the rights of other persons and the apartment is not under arrest.

Concluding a purchase and sale agreement.

The procedure for concluding a purchase and sale agreement depends on several factors:

- The apartment has one owner or the apartment is jointly owned by spouses - the purchase and sale agreement is drawn up in simple written form.

- An apartment in common shared ownership requires notarization of the transaction.

- The apartment is purchased with the participation of borrowed funds - before the procedure for concluding a purchase and sale agreement, the bank approves the loan, the purchase and sale agreement is drawn up taking into account the requirements of the bank.

- The apartment is purchased with the participation of maternal (family) capital - approval of the transaction by the guardianship authorities is required. If there is also a mortgage, then a notarial undertaking is provided to the guardianship authorities to allocate shares to the children after the mortgage is repaid.

Regardless of the form of the contract, it must contain the following information:

- information about the parties to the contract is described in detail;

- information about the real estate property;

- the Seller's title documents for the apartment are indicated;

- the price of the contract and the procedure for settlements with the Seller;

- liability of the parties for failure to fulfill obligations;

- information about persons retaining the right to use residential premises after a change of owner (if any).

Procedure for settlements with the Seller

The procedure for settlements with the Seller is not regulated by law and is carried out by agreement of the parties, with the exception of the purchase of an apartment using credit funds.

In practice, settlements with the Seller are carried out in the following order:

- The first stage of settlement is the transfer of an advance or deposit against the purchased apartment against the receipt of the Seller.

- The second (main) stage of settlements is made when signing the purchase and sale agreement.

Possible payment options with the Seller:

- With a signed purchase and sale agreement, the parties visit the bank they have chosen for settlements and transfer the money to the account of the seller, who immediately gives a receipt for the money.

- The parties rent a safe deposit box, and the Seller receives money only after providing an extract from the Unified State Register of Registers on registration of the transfer of rights.

- A deposit account is opened in the bank, into which the Buyer deposits funds into the account of the Seller, who receives the money after providing an extract from the Unified State Register of Real Estate on registration of the transfer of rights.

The Buyer simply transfers cash to the Seller from hand to hand against receipt.

Submission of documents and procedure for state registration of transfer of ownership of an apartment

Documents for state registration of the transfer of rights can be submitted to any Multifunctional Center in the Russian Federation.

The application for registration is submitted by both parties to the agreement or their representatives under a notarized power of attorney.

In accordance with Federal Law No. 218-FZ dated July 13, 2015 “On State Registration of Real Estate,” registration of the right of common joint ownership of an apartment can be carried out on the basis of one of its participants, unless otherwise provided by law or an agreement between spouses.

The required package of documents includes:

- identification documents of sellers and buyers;

- purchase and sale agreement with transfer deed;

- loan agreement (in case of using a mortgage);

- receipt of payment of state duty (in 2021 - 2000 rubles).

After state registration, an extract from the Unified State Register is issued, certifying the emergence of the right of common joint ownership of the residential premises.

Property tax deduction for the purchase of housing by spouses in common shared ownership

In the case of acquisition of housing by spouses in common shared ownership, the shares of each spouse are clearly defined and stated in the extract from the Unified State Register of Real Estate (certificate of registration of property rights). Until January 1, 2014, in this situation, the deduction was distributed strictly in accordance with shares in the property.

However, changes in the Tax Code of the Russian Federation have changed this order. According to the updated Tax Code of the Russian Federation and the opinion of regulatory authorities, the deduction for purchases in shared ownership is distributed in accordance with the amount of expenses of each spouse, confirmed by payment documents .

Reason: Letter of the Federal Tax Service of Russia dated March 30, 2016 No. BS-3-11/ [email protected] , Ministry of Finance of Russia dated June 29, 2015 No. 03-04-05/37360, dated June 1, 2015 No. 03-04-05/31428, dated 03/10/2015 No. 03-04-05/12335.

In this regard, consider two possible situations:

1) Both spouses bore expenses confirmed by payment documents and each paid their share independently. In this case, everyone can count on a deduction in the amount of their expenses incurred.

Example: Spouses Levashov P.V. and Levashova I.S. in 2020 we bought an apartment in common shared ownership (each spouse's share was 50%). The spouses have payment documents, according to which each spouse paid 1.5 million rubles for their share. In this case, the spouses will be able to receive a deduction in the amount of their expenses for purchasing an apartment of 1.5 million rubles. Each person will be refunded 195 thousand rubles.

2) Officially, the expenses were made by one of the spouses or they were registered as one total amount for both spouses. In this case, according to the opinion of the regulatory authorities, the spouses can distribute the expenses independently in any proportions based on the spouses’ Application for the distribution of actual expenses.

Reason: Letter of the Federal Tax Service of Russia dated March 30, 2016 No. BS-3-11/ [email protected] , Ministry of Finance of Russia dated June 29, 2015 No. 03-04-05/37360, dated June 1, 2015 No. 03-04-05/31428, dated 03/10/2015 No. 03-04-05/12335.

This position of the tax authorities is due to the fact that, according to the Family Code of the Russian Federation, regardless of which of the spouses actually bore the costs of purchasing housing, both of them are considered to be participating in such expenses (Clause 2 of Article 34 of the RF IC).

Example: While the wife is officially married, Berestov G.K. and Berestova N.G. in 2021, we purchased an apartment worth 4 million rubles as common shared ownership (the share of each spouse was 1/2). All payments were made by the spouse and payment documents were issued in his name.

In order for each spouse to receive a maximum deduction of 2 million rubles, the spouses, along with other documents, submitted to the tax authority an application for the distribution of actual expenses in the following proportions: 50% (2 million rubles) - Berestov G.K., 50% (2 million rubles) - Berestova N.G.

In accordance with this distribution, each spouse received a maximum deduction of 2 million rubles (for a return of 260 thousand rubles).

Distribution of mortgage interest deductions for common shared ownership

In accordance with paragraphs. 4 paragraphs 1 art. 220 of the Tax Code of the Russian Federation, a taxpayer can receive a deduction for credit interest in the amount of expenses incurred to pay them. However, as we have already indicated above, all expenses incurred by spouses during marriage are considered common (Articles 33, 34 of the RF IC).

Accordingly, regardless of who actually paid the loan, the spouse has the right to distribute the interest deduction independently in any proportion by writing a corresponding application to the tax authority (Sample application for the distribution of expenses for paying interest on a loan) (Letter from the Ministry of Finance of Russia dated May 16, 2017 N 03-04-05/31445).

Example: In 2021, the spouses Vykhin S.V. and Vykhina Z.K. bought an apartment worth 4 million rubles as common shared ownership (each spouse's share was 50%). To purchase an apartment, the Vykhins took out a mortgage loan in the amount of 2 million rubles.

In this case, the loan was issued entirely to the wife, and the husband acted as a co-borrower. Loan payments were also made by the wife. Since the official income of Vykhin S.V. more than that of the wife, the Vykhins decided to distribute the interest deduction entirely to the husband, writing a statement on the distribution of expenses for paying interest on the loan.

As a result: - Vykhina Z.K. can count on a deduction of 2 million rubles (260 thousand rubles to be returned); — Vykhin S.V. can count on a deduction in the amount of 2 million rubles (260 thousand rubles to be returned), as well as a deduction on mortgage interest and return 13% of the interest paid on the loan.

According to the tax authorities, spouses have the right to annually change the proportion in which the mortgage interest deduction is distributed. Reason: Letters of the Ministry of Finance of Russia dated November 6, 2015 No. 03-04-05/63984, dated October 1, 2014 N 03-04-05/49106.

Property tax for individuals

The calculation of property tax for individuals on an apartment is based on its cadastral value, which is indicated on the website of the Federal Tax Service or Rosreestr.

The tax rate for residential premises is 0.1% of the cadastral value. It should be noted that the Tax Code provides benefits for certain categories of citizens. Pay attention to this, perhaps you are one of the beneficiaries.

To calculate the tax on real estate that is jointly owned, the shares of co-owners are recognized as equal.

Tax deduction for personal income tax

Since 2014, for an apartment purchased in joint ownership, each co-owner can receive a personal income tax deduction in the amount of 13% from the amount of 2,000,000 rubles.

When a property is purchased with a mortgage loan, the owners also have the right to recover income taxes on the interest paid on the loan. The amount of interest paid is limited for deduction to the amount of 3,000,000 rubles.

You can apply for a tax deduction for the purchase of several residential premises, provided that their total cost does not exceed 2,000,000 rubles.

Property tax deduction for the purchase of housing by spouses in common joint ownership

When purchasing a home in joint ownership, both spouses have the right to a deduction with the opportunity to distribute it by agreement . By default, the deduction is distributed in equal shares (50%), but spouses can redistribute it in any proportion, up to 100% and 0%.

The shares of the deduction are determined by submitting to the tax office an Application for the distribution of the deduction, signed by both spouses (Letters of the Ministry of Finance of Russia dated 03/29/2017 No. 03-04-05/18320, dated 04/20/2015 No. 03-04-05/22246, dated 04/08. 2015 No. 03-04-05/19849, Federal Tax Service of Russia dated September 18, 2013 No. BS-4-11 / [email protected] ).

When distributing, it is important to remember that:

— the maximum amount of deduction for each spouse cannot exceed 2 million rubles (to be returned 260 thousand rubles).

— an application for distribution of the main deduction is submitted once, and subsequently the spouses cannot change the ratio in which the deduction will be received, including transferring the remainder of the deduction to the other spouse.

Reason: Letters of the Ministry of Finance of Russia dated 09/07/2012 No. 03-04-05/7-1090, dated 08/28/2012 No. 03-04-05/7-1012, dated 07/20/2012 No. 03-04-05/9-890, dated May 18, 2012 No. 03-04-05/7-647.

Note: If the cost of housing is more than 4 million rubles, then when contacting the tax office, it is not necessary to submit an application for a deduction, since the deduction is distributed by default at 50%. Accordingly, each spouse will be able to receive the maximum possible deduction in the amount of 2 million rubles (260 thousand rubles to be returned).

Example: Spouses Shapovalov O.I. and Shapovalova N.T. In 2021, we purchased an apartment worth 4.5 million rubles as joint property. Since the apartment costs more than 4 million rubles, each spouse will be able to receive a deduction in the maximum amount of 2 million rubles (for a return of 260 thousand rubles).

Example: In 2021, the spouses of Avesov E.Z. and Avesova T.M. We bought an apartment worth 3 million rubles for joint ownership. Since Avesov E.Z. income is greater than that of Avesova T.M., the spouses decided to distribute the deduction in proportion: 2 million rubles to the spouse (for a return of 260 thousand rubles) and 1 million rubles for the wife (for a return of 130 thousand rubles). In the future, when purchasing another home, the spouse will be able to receive an additional deduction of 1 million rubles (towards a return of 130 thousand rubles).

Example: Spouses Ptichnikov P.P. and Ptichnikova A.A. purchased an apartment worth 2 million rubles in 2021 for joint ownership. Since Ptichnikov P.P. does not officially work, then they decided to redistribute the entire deduction (100%) to the spouse. As a result, the spouse will receive a deduction in the maximum amount of 2 million rubles (260 thousand rubles to be returned).

Distribution of mortgage interest deductions for common joint property

Before January 1, 2014, the mortgage interest deduction was always distributed in the same proportion as the main deduction. However, from January 1, 2014, the interest deduction was allocated as a separate type of deduction, and now it can be distributed separately and in a proportion other than the main one (clause 4, clause 1, article 220 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated 16.05. 2017 N 03-04-05/31445, dated 10/01/2014 N 03-04-05/49106).

Accordingly, at their own discretion and regardless of the distribution of the main deduction, spouses can distribute the deduction by interest in any proportion (for example, 50/50, 0/100) by submitting an Application for Distribution of the Deduction to the tax office.

Example: Spouses Chirkov A.B. and Chirkova Y.V. In 2020, we bought an apartment in joint ownership worth 4 million rubles. To buy an apartment, the Chirkovs took out a mortgage loan in the amount of 2 million rubles. In this case, the loan was issued entirely to the husband, and the wife acted as a co-borrower.

The spouses submitted to the tax office an application for the distribution of expenses, according to which they would receive the main deduction of 50% each, and the husband A.B. Chirkov would receive the full deduction for interest. (100% for him, 0% for his wife).

As a result of the purchase, each spouse will be able to receive a basic deduction in the amount of 2 million rubles (refundable in 260 thousand rubles) from the cost of purchasing the apartment, and Chirkov A.B. will also receive a deduction for interest in full, regardless of who the payment documents for the loan payment will be issued to.

According to the opinion of the Federal Tax Service of Russia, spouses have the right to annually, on the basis of an application, redistribute the amount of costs for repaying interest (Letter of the Ministry of Finance of Russia dated November 6, 2015 No. 03-04-05/63984, dated October 1, 2014 N 03-04-05/49106).

Example: In 2021, the spouses Tishin E.E. and Tishina A.S. We bought an apartment in joint ownership worth 4 million rubles. To purchase Tishina’s apartment, we took out a mortgage loan in the amount of 2 million rubles, on which we paid interest in the amount of 200 thousand rubles for 2021. In 2021, the spouses submitted an application to the tax office to distribute the main deduction and the interest deduction by 50%. Accordingly, each of them declared a basic deduction in the amount of 2 million rubles (to be returned 260 thousand rubles) and an interest deduction in the amount of 200 thousand rubles. x 1/2 = 100 thousand rubles. (to be returned 13 thousand rubles).

In 2021 Silence A.S. went on maternity leave, and therefore in 2021 the spouses decided to redistribute the interest deduction entirely to the husband (100%), submitting to the tax office a new application for the distribution of the interest deduction in the proportion of 100% - Tishina E.E. and 0% - Silence A.S.