It is difficult to manage in any commercial enterprise without hired personnel. Registration of an individual is a step that imposes a number of obligations on the entrepreneur not only to the employee. The hiring of employees is carried out according to certain rules; the businessman is obliged to deduct certain taxes and insurance contributions to the budget and extra-budgetary funds from their total wage fund.

Documented relationships between an entrepreneur and an employee may fall under the jurisdiction of either labor or civil law. Let's consider both options, and then compare them in terms of economic benefits for the business owner.

Registration of an individual under the Labor Code of the Russian Federation

Employment of a citizen in Russia occurs as follows:

- a specialist is selected from several job applicants when a competition is announced;

- an employment agreement (contract) is concluded between this individual and the entrepreneur, which can be fixed-term or signed for an indefinite period;

- In large companies, lawyers are involved in the development of this agreement, because it is this document that is checked primarily by regulatory authorities;

- the procedure for employing a citizen under the Labor Code must take into account a number of nuances, in particular - the employee becomes familiar with a number of local regulations: regulations on remuneration, internal labor regulations, collective agreement (if any), etc. Personnel accounting requires significant labor and time expenditure from the entrepreneur.

The advantages of drawing up employment contracts between an employee and an entrepreneur are listed in the table below:

| Obvious advantages of an employment contract | |

| For the employer - individual entrepreneur | For individuals |

| use of knowledge and experience of highly qualified specialists | the presence of a permanent, stable job every day, the possibility of long-term planning of the family budget |

| absence of staff turnover in the absence of conflicts of interest between the parties | social guarantees that an employee receives when signing an employment contract (the right to paid leave, receiving additional payments and bonuses in accordance with local regulations, payment of sick leave and the right to proper rest) |

| professionals can increase business profitability several times | prospects for career growth if you have the makings of a leader and creative potential |

| accumulation of insurance experience and formation of pension savings (caring for the future) | |

An employee hired under the Labor Code of the Russian Federation is obliged to strictly follow the labor regulations in the team. His working day is strictly regulated, i.e. has a clear duration. For all overtime, the individual entrepreneur must pay extra money or provide additional time off.

Important: the minimum amount of remuneration paid under employment contracts in Russia is established and approved by law. For example, as of January 01, 2021 The minimum wage is 9,489 rubles, and from May 1, another increase in the value is planned - it will be equal to the amount of the regional subsistence minimum.

When an employee is dismissed, according to the Labor Code of the Russian Federation, he is entitled to be paid compensation for unused vacation, and in case of staff reduction, severance pay.

Advantages and Disadvantages of the Standard Agreement

An employment contract is the most common form of agreement between parties to a working relationship.

For an employee

It is beneficial for an employee to enter into a TD for the following reasons:

- Guarantee of salary receipt in the amount established by the contract.

- Upon completion of the probationary period, the specialist is included in the company's staff.

- The employee receives the entire list of guarantees: dismissal benefits, salary twice a month, various guarantees for employees with children, annual paid leave.

- An employee has the right to demand that the employer provide comfortable conditions for himself.

- Rights to social and health insurance, payments for which are made by the employer.

- The employee is accrued length of service, on the basis of which the funded part of the pension is formed.

However, not all employees strive to conclude an employment contract, as it is not without its drawbacks. In particular, under this agreement, the employee is “tied” to the company. He must act within the framework of local regulations: come to work on time, carry out all the instructions of the employer, go on vacation according to the staffing schedule.

For the employer

The employer may require the employee with whom the TD is concluded to fulfill his duties:

- Compliance with internal regulations.

- Carrying out instructions from the employer.

- Notice of dismissal 2 weeks in advance.

Important! If an employee violates the regulations, the employer has the right to impose punishment: disciplinary action, deprivation of bonuses, dismissal.

The manager, based on the TD, can demand a lot from the employee, but he must give in return all the necessary guarantees:

- Timely payment of wages not lower than the minimum wage.

- Contributions to various funds.

- Providing paid leave.

- Benefits for employees with children.

- Providing maternity leave.

If the employer does not provide social guarantees, the employee has the right to file a complaint with the labor inspectorate.

Nuances of drawing up contract agreements

The procedure for concluding civil contracts is regulated by another code - the Civil Code of the Russian Federation. Registration of an individual under such a document to perform certain work occurs as follows:

- the entrepreneur needs to perform some kind of work that can be measured in quantitative terms - hours, tons, kilometers, etc.;

- an individual is ready to undertake a given amount of work for a certain remuneration;

- the work of a person hired under a contract does not have a time frame - he can work day, night, take any breaks, etc. The main thing is that he must achieve the result by the initially agreed upon date;

- a civil contract may contain a list of the rights and obligations of the parties, but the main points of the document will remain the scope of work, its specification, the amount of payment and completion dates;

- Upon delivery of the work to the customer-entrepreneur, all legal relations between the parties are terminated. No compensation, vacation pay, sick leave, etc.

Important: the contractor has the right to involve assistants in the work, the goal is a faster solution to the task.

The amount of deductions to extra-budgetary funds from work contracts is slightly less when compared with the tax burden on the fund of employees with employment agreements. The difference is insurance premiums for temporary disability in the Federal Social Insurance Fund of Russia. But there are exceptions to this rule - the employer specifically insures some contractors against injuries (most often these are workers whose work involves a risk to life).

A executed GPC agreement is not the basis for making entries in a citizen’s work book. The insurance period does not accumulate.

Preparation of “closing” documents

There are other differences too. For example, Article 720 of the Civil Code of the Russian Federation requires that the transfer of work results be documented in a separate document (act or other similar document). If this document is missing, then there is no reason to believe that the contractor has fulfilled his duties, and, therefore, he does not have the right to receive remuneration (resolution of the Arbitration Court of the Central District dated April 2, 2018 No. F10-551/2018 in case No. A84-228 /2017).

The service agreement, on the contrary, does not require the execution of any “closing” documents (resolution of the Arbitration Court of the Central District dated 04/09/18 No. F10-1299/2018 in case No. A23-140/2017). This means that the customer’s obligation to pay for services does not depend on whether the parties have drawn up an act (another similar document) or not. The opposite rule may be provided for in the contract itself (resolution of the Arbitration Court of the East Siberian District dated July 18, 2018 No. F02-3133/2018 in case No. A58-7306/2017).

Attention

The absence of “closing” documents corresponding to the actual type of contract can also result in tax problems for the customer.

Exchange legally significant “primary data” with counterparties via the Internet. Free inbox.

Documents of an individual when applying for a job according to the Civil Code and Labor Code of the Russian Federation

Registration of personnel by an entrepreneur involves requesting the following documents from hired persons:

| When concluding an employment contract (agreement) | Signing a contract |

| passport of a citizen of the Russian Federation | |

| SNILS | |

| TIN | |

| copies of birth of children (to provide standard tax deductions for personal income tax) | |

| questionnaire | |

| education documents | |

| certificates from the previous place of work: about personal income tax withheld since the beginning of the year and payments made for the 2 previous years of work for calculating sick leave | |

| employment history | |

| recommendations from previous employers | |

| certificate of medical examination | |

| military ID for men | |

| other documents at the discretion of the entrepreneur | |

As can be seen from the table, the list of documents when concluding a GPC agreement is minimal. Passport data, INN and SNILS numbers are required to submit annual and monthly reports to the Federal Tax Service and the Pension Fund of the Russian Federation.

What are the consequences for an entrepreneur who refuses to sign a contract with an employee?

Since 2015, tax authorities and labor inspectorates have begun to fine negligent employers who, in pursuit of tax savings, do not draw up contracts with employees. Moreover, we are talking about both labor and civil relations between the parties.

The main article establishing the measure of responsibility for improper registration or failure to formalize contractual relations with hired personnel is 5.27 of the Code of Administrative Offenses of Russia. The fine amounts are as follows:

- for a manager or individual entrepreneur as a business owner - from 10,000 to 20,000 rubles;

- for a legal entity (organization) – from 50,000 to 100,000 rubles.

The concept of a service agreement

The correct name for the form of agreement is an agreement for the provision of paid services. This form of interaction is regulated by Chapter 39 of the Civil Code of the Russian Federation. A clear definition of a contract is given in Article 779 of the Civil Code of the Russian Federation.

In accordance with this norm, the contractor undertakes to perform certain actions or provide certain services, which are paid for by the customer. Both parties receive the desired benefits: the customer is provided with the necessary services, and the contractor is paid the agreed remuneration. The subject of the agreement may be the following services:

- Medical.

- Consulting.

- Veterinary.

- Auditing/accounting/legal.

- Educational.

- Informational.

- Tourist.

- Connections

Exceptions for services that cannot be made the subject of such agreements are specified in Art. 779 of the Civil Code of the Russian Federation. Consequently, contracts for paid services do not apply to all legal relationships. In particular, a row appears among the exceptions. For this reason, it is safe to note that a service agreement and a contract are different from each other.

Execution of services under the contract

A special feature of this type of contract is the personal performance of services by the contractor. The only exception is the presence of a clause in the contract, according to which the involvement of third parties is allowed. A similar circumstance occurs quite often. But in most cases, the customer turns to a specific contractor because of his professional and business qualities.

The customer is obliged to pay for the services provided to him in the manner and within the terms specified in the contract. If the contractor, due to the fault of the customer, was unable or did not have time to perform all the services specified in the agreement, the latter pays for their full amount. Such clauses often appear in the contract.

If, during the provision of services, due to circumstances beyond the control of the parties, further cooperation becomes impossible, the customer pays for the volume of services actually rendered up to that point. The contractor also has the right to demand reimbursement of all costs and expenses incurred in the process of interaction with the customer.

Why do labor inspectorates find fault with work contracts?

GPC agreements are an option for the legal employment of individuals. In fact, if the document is properly prepared, there should be no claims against it from regulatory authorities and supervisory authorities. But in practice, not everything is so rosy. Extra-budgetary funds, tax and labor inspectors regularly conduct inspections of contract agreements. The main goal of the inspectors is to find reasons to equate these legal relations with labor relations with all the ensuing consequences.

Important: in order to avoid penalties with additional assessment of contributions and amounts of compensation to individuals, it is worth entrusting the preparation of civil contracts to professionals - experienced and competent lawyers.

Types of GPA

The GPA is in relation to the activities performed by an employee, including those on staff of an institution. Company employees also have the right to be involved in duties that are not their main ones, both in the manner prescribed by law - the Labor Code, and by concluding an agreement with the contractor.

The essential conditions of the GPD are its subject, the material result of tasks performed on the instructions of the counterparty, which the contractor undertakes to complete by a certain date.

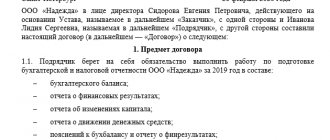

This is what a contract for contract work with an individual (provision of services) looks like.

The Civil Code of the Russian Federation provides for the following types of civil agreements (an agreement between individuals for the performance of work is also included in their number):

- household contracting. Feature is the purpose of the thing being created. It is used for personal, non-commercial consumption;

- construction contract. Subject: buildings and structures. It provides for both the creation of a new facility and its reconstruction, major repairs, installation and other actions related to construction;

- to carry out design and survey work. This type of work activity, as a rule, precedes the conclusion of a construction contract. Specifics: creation of technical documentation;

- work for state and municipal needs. The customer is a Russian state or municipal authority. He enters into an appropriate agreement with the contractor based on the results of the tender, the conduct of which is regulated by a special law.

IMPORTANT!

An important nuance: a civil contract with an individual for the performance of work cannot be concluded with a person provided that he performs the functions of a full-time employee and obeys internal rules and labor regulations. If it turns out that the GPA covers up labor relations, then it will be recognized as imaginary. In this case, the employer has the right to be held administratively liable.

Identifying the sham of an agreement is carried out by:

- tax inspectors;

- representatives of the labor inspectorate, if an employee files a complaint about the unlawful conclusion of a labor contract with him instead of labor relations.

What type of contract with an employee is more beneficial for an entrepreneur?

The characteristics of both types of legal relations listed above allow us to draw an obvious conclusion - it is more profitable for an entrepreneur to hire people under contract agreements. In this case, savings can be noted on the following cost items:

- payment is not tied to the minimum wage;

- compensation (vacation, sick leave) payments;

- ensuring certain working conditions so that regulatory authorities do not find fault with violations of safety requirements, etc.

A contractor is hired when his services are needed. If the volume of work is large, you can hire several people. Upon completion of the order, payment is made and any legal relationship is terminated.

But not every specialist can be registered as a contractor by an entrepreneur. If the employee’s labor functions are repeated from day to day, from month to month (cleaner, storekeeper, accountant, etc.), it is impossible to constantly draw up GPC agreements for this volume of work. In this case, inspectors will reclassify the relationship as an employment relationship and force you to count all payments due under the Labor Code of the Russian Federation.

Personal income tax on remuneration to contractors

Personal income tax is withheld from payments to citizens under the GPA, since in this case the organization is recognized as a tax agent. Remuneration (advance) is included in the tax base for personal income tax on the day the remuneration (advance) is paid in cash or in kind (clause 1 of Article 223 of the Tax Code of the Russian Federation). It does not matter in which tax period the person will perform the work or provide the services. Tax is withheld on the day of actual payment of income, regardless of whether this payment is an advance payment or a final payment.