Every person, when borrowing money from a friend or colleague, pursues a completely good goal - to help the person. However, he does not always receive gratitude and timely repayment of the debt in return. Often, the borrower begins to hide from the lender and try in every possible way to delay the moment of repayment of the money. The situation is especially unsightly when the lender does not have any confirmation of the completed transaction. Having a receipt makes debt repayment somewhat easier, but even here there are many pitfalls. It is important to know what to do if a person borrows money against a receipt and then does not pay it back.

Legal issue

The courts are considering many cases of debt repayment in the presence of a promissory note. But there are even more of those who do not have any paper - neither handwritten, nor, especially, notarized. Very often it is psychologically difficult for a person to ask for a receipt for receiving money from his relative, friend or colleague.

Writing a written obligation or simply a receipt is regulated by Article 808 of the Civil Code of the Russian Federation. According to the same article, such a document must indicate information about the borrower and lender, the repayment period and the amount of the debt.

Notarization is not necessary at all; personal signatures of the two parties to the transaction are quite sufficient. Even such a document has legal force and can become a significant advantage when considering a case in court. Courts usually take the creditor's side in such disputes, especially if there is confirmation in the form of a receipt.

Options for formalizing relationships

Another thing is a large loan. Business, improvement of living conditions or vehicle fleet, illness of loved ones, God forbid...

The request has been voiced, the decision has been made... Perhaps, under the influence of various factors: it is inconvenient to refuse, the opportunity to invest free funds, or some other reasons... In this case, you should start by formalizing your new relationship

.

There are several options. The first one is the simplest. Oral agreement

.

No advice can be given here. If this method is acceptable to you, then it is the easiest. It is important to understand that you will not have any, in any case, legal opportunities to collect such a loan. If your relationship with the borrower does not require the necessary degree of trust, we move on to other options regulated by law

.

Drawing up a loan agreement

A loan agreement is a civil law agreement that specifies all the terms of your relationship: loan term, amount, repayment conditions, interest for use, if any. You can draw it up yourself by downloading a sample from our website, you can contact a notary, paying a certain commission for services

.

From the point of view of the Law, the difference is not fundamental, and notarized paper does not provide

, except for the fact that it will not allow the borrower to refuse to sign the document in the future, or to protest the loan “due to lack of money.”

Refusal to sign will entail the need for an examination

and can significantly delay the process, although, due to a number of circumstances, such cases are quite rare, because by claiming that he did not sign the agreement, your former friend automatically accuses you of fraud and creates a situation that requires legal assessments from the point of view of criminal law enforcement, risking being held accountable, at a minimum, for a knowingly false denunciation (Article 306 of the Criminal Code of the Russian Federation).

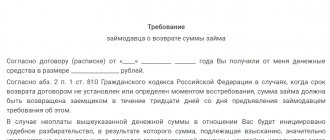

Receipt for receipt of funds

Receipt for receipt of funds is essentially identical to the loan agreement

, it is fundamentally important to state in it that the money is transferred specifically “as a loan”, and is received by the borrower at the time of signing it.

Otherwise, there may be difficulties in identifying the legal relationship that has arisen

in court - what if you simply donated money... It is preferable to write this document “by hand” in order to avoid those unlikely but possible situations that we mentioned in the paragraph above.

Resolving the issue without trial

Litigation always costs a lot of time, money and paperwork. Moreover, both the borrower and the lender himself suffer equally. That is why the priority should always be to resolve the issue without trial, through a peace agreement.

Unfortunately, very often the lender is left alone with the problem, since the borrower is in no hurry to fulfill his obligations, despite the long-expired agreement. The lender should not delay too much in resolving this issue, since with any delay he risks losing his money. This is due to the short statute of limitations for such cases. It is very short and lasts only 3 years.

If there is not a single reaction from the borrower during these three years, then, most likely, the lender will have to forget about his money. If the person who borrowed the money does not receive it back, he should immediately begin to take action. The issue needs to be resolved in this order:

- Peaceful negotiations with the debtor. Perhaps the borrower should simply first be reminded of the need to repay the money. Very often this is enough for everything to be resolved.

- Written claim to the debtor. The letter must indicate the expiration of the terms of the agreement, and also indicate that the debt is expected to be repaid as soon as possible. It would be useful to add that if there is no payment, interest will be charged at the refinancing rate. The claim is sent by mail using the recommended letter, always with notification.

- Repeated written complaint. It is appropriate when the first one did not receive any reaction from the debtor. This is done so that in the event of a trial, evidence can be presented that amicable attempts were made to resolve the issue.

Search for the debtor's property

Current legislation provides for the possibility of an appeal by an interested party, in this case the creditor, against transactions made by the debtor several years before he became aware of his violated right.

In practice, this means that, having found out the circumstances indicating that the debtor has deliberately withdrawn his assets - sale, re-registration in the name of relatives and friends, etc. - you have the right to apply to the court with a demand to recognize this transaction as non-compliant with the requirements of the law and to cancel its consequences, that is, to return the re-registered property to the debtor

with the subsequent seizure of it

as part of enforcement proceedings.

It is unlikely that you will be able to do this without professional help, because it is necessary, firstly, to locate the relevant assets, and then take the necessary steps to return them. In addition, working contact with the bailiff is necessary, on which the possibility of an immediate response

to the return of property and preventing its re-alienation will depend.

The Law “On Bankruptcy” adopted several years ago provides similar opportunities to the creditor, although, in practice, the bankruptcy procedure for a citizen is complex and, at times, unpredictable

, especially if the financial manager authorized by the court to conduct the procedure pursues interests different from yours.

This is possible if there are other creditors in the procedure, or if there are other circumstances that we will not discuss in this article. Violations committed by the financial manager can be appealed to the Roseestr - the organization that controls their activities, as well as to the court, but you should keep in mind that not all of his possible actions that seem incorrect from your point of view will be recognized as such based on the results of consideration of your complaint . I can give an example from personal practice when a bankruptcy trustee, seeking to take revenge on one of the creditors for a complaint filed against him, filed a claim to recover from this creditor the funds

paid to him by the debtor even before the start of the bankruptcy procedure, within the framework of the loan agreement concluded between them.

Despite the fact that the bankruptcy procedure was initiated

.

One way or another, the issue of bankruptcy is a difficult subject for separate consideration, so we will return to the enforcement proceedings, in which the bailiff, thanks to the help of you and the specialists you attracted, managed to seize the property belonging to the debtor. The next stage will be the process of its implementation, which is also quite clearly regulated by the Law and will take a lot of time. Although the very presence of property that can be foreclosed on is a gratifying factor and gives hope for a successful outcome of the case

.

Here we should return to the previously mentioned situation, namely the appearance, during enforcement proceedings initiated at your request, of another creditor with independent demands

and with a similar court decision that has entered into legal force.

It must be understood that, in such cases, the current legislation provides for the possibility of combining enforcement proceedings initiated on the basis of submitted documents into one, with the distribution of amounts collected from the debtor in proportion to the amounts of the claims presented. In practice, this means that if you managed to foreclose on some asset of the debtor, a land plot, for example, and you were counting on satisfying your claims from the proceeds from its sale, then the entry into the matter at this stage of a new creditor with a large the volume of demands on the debtor can dispel your hopes. Often, as mentioned above, this creditor enters into an enforcement procedure in agreement with your debtor

, in order to be able to preserve, if not the asset itself being sold at auction, then at least the lion's share of its value. In this situation, it is not possible to offer any ready-made solutions; everything is very individual and depends on many factors. In any case, remember that combining materials in the work of different bailiffs into consolidated proceedings is the right, and not the obligation, of the relevant head of the Service; the decision can be made taking into account various circumstances.

Written receipt

A written promissory note is a document drawn up when transferring funds. It states that the lender transfers a certain amount of money to the borrower, and he undertakes to return it exactly on time.

The receipt clearly indicates the amount of debt and the repayment period. But even if the deadline was not specified for some reason, this is not a problem. By default, the debt period for the receipt is 30 days from the date of receipt of money. If the money was issued at interest, then the original amount and the one that should be returned taking into account interest are indicated.

Features of drawing up receipts:

- Up to 10,000 rubles, money can be transferred based on a verbal agreement. For larger amounts, written receipts are strongly recommended. You can also draw up a standard loan agreement; it will only be valid if there are signatures of both parties. Both the receipt and the loan agreement are documents that form the basis for a debt claim.

- Notarization. It is mandatory in cases provided for by law, as well as in any other situations not provided for by law (at the request of the parties).

For his part, the notary will only be able to certify the loan agreement drawn up in accordance with all the rules and the receipt attached to it. He will not certify a separate receipt.

What you need to know when asking to borrow money

There are situations in every person’s life when a relative or closest friends asks to borrow money. In such cases, talking about a receipt is simply inconvenient. At least in Russia this is the case. Then you can apply some rules:

- Lend amounts that you are not afraid of losing. In this situation, the lender does not infringe upon himself economically and at the same time does not refuse to help a loved one.

- If the amount you are asked to borrow is more than 20,000 rubles, you can hint about drawing up a receipt, explaining to the borrower that it will be calmer for both of you. If a person understands this procedure, then he will not have any unnecessary questions. And if he refuses, then it’s worth thinking about whether he needs financial help at all.

- If it is inconvenient to talk about a receipt for ethical reasons, then you can carefully record the conversation about the loan on a voice recorder, or make a video recording at the moment of transferring the money. In any case, this will make it easier to return the money if the borrower refuses.

Important

If you have no desire to lend, then there is nothing wrong with refusing a potential borrower. This is a personal choice of each person. In addition, you can simply explain that at the moment there are no available funds.

Receipt requirements

The law does not have clear requirements for drawing up promissory notes. It can be written by hand, or printed. Handwritten documents are preferable, since it is always possible to conduct a graphological examination and identify the debtor.

In order for the receipt to be informative and have legal force, it indicates:

- The parties to the agreement, their passport details, places of registration and actual residence.

- The amount of debt in numbers and letters in the currency in which the debt was issued. Interest is also included here, if applicable. If the money was transferred in foreign currency, it is important to clarify at what rate it should be returned.

- The return period is a specific date.

- Signatures of both parties.

What should you consider when drawing up a loan agreement?

In order for your friend to repay the debt, you can stipulate interest in the loan agreement. The law does not prohibit individuals from lending money at interest.

You can also secure the loan as collateral, this will help insure yourself in case the person does not repay the debt. This can be any thing of value equivalent to the amount owed. You have the right to demand a laptop, car, land and other property of the debtor as collateral. Remember: the pledge of real estate must be registered in the Unified State Register of Real Estate with the authorities of Rosreestr. This rule does not apply to movable property, except cars and other categories of vehicles.

Types of IOUs

All receipts are divided into the following types:

- Receipt with interest. In this case, the interest that the lender takes from the debtor for the use of borrowed funds must be indicated. Thus, in addition to the initial amount of the debt, the final amount (initial + interest) must be indicated here. Such a receipt implies that if the debtor does not repay the debt on time, interest will still continue to accrue. For large amounts, it is recommended to draw up a full loan agreement.

- Receipt without interest. Only the initial amount received by the debtor will be recorded here. It is possible to designate a condition - for each day of delay interest will be charged, for example, in the amount of 1%.

- Receipt with monthly payments. In such cases, it is also recommended to draw up a loan agreement. Making monthly payments implies that the amount of debt is quite significant, and there may even be a payment schedule.

The court will almost always be on the side of the creditor who lent his personal funds. After the trial, the debtor is obliged to pay the debt, interest and pay all legal costs of the creditor.

Peace negotiations

A negotiation meeting between both parties will help clarify the reasons for the debtor's protest. First, you need to find out how stable a person’s financial well-being is. Often, when borrowing funds, we do not think about the fact that a situation may occur in the borrower’s family that undermines his economic situation. This could be illness, job loss, tragic event, etc. Therefore, it is better to try to meet halfway and postpone the return date.

If it was initially known about multiple loans and the deplorable financial situation of the debtor’s family, then most likely nothing will change, and it makes no sense to expect a timely return of funds. In this case, it is easier to sign an installment agreement, having discussed in advance what amount will actually be paid once a month.

It is also recommended to conclude a loan agreement that will calm and reconcile both parties. The agreement must be accompanied by a payment schedule agreed upon by both the owner and the borrower. It happens that the debtor does not always agree even to such conditions and simply refuses to return the funds borrowed by him. What to do in this case? You need to act actively and it is better not to delay.

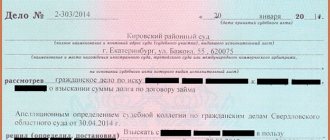

Court order

If the debtor is unwilling to fulfill his obligations, and written complaints have no effect, something more serious will be required. Such a measure is going to court. You need to have a receipt or loan agreement in hand.

The initial purpose of a visit to court is not to file a lawsuit, but to obtain a court order. Let's consider the inversion algorithm:

- First of all, an application for obtaining a court order is written. It is issued by a judge on the basis of a receipt or loan agreement.

- Next comes the payment of the state fee, its amount is approximately 1/2 of the cost of the statement of claim.

- Often, the debtor decides to pay off the debt after receiving a court order. This will become a settlement agreement between the two parties.

How to return for a long time without a receipt and witnesses: is it possible, how to force it, judicial practice

Sometimes circumstances are such that when lending money it becomes impossible to ask for a receipt. Some are simply embarrassed to ask, especially if the borrower is a loved one: a friend or relative. But the moment when the debt must be repaid has arrived.

A little more time passed... And a little more... But the debt was still not repaid. Many in such cases can afford to give up.

But what about those who really need this money, especially if the amount is rather large? In fact, it is possible to repay the debt if the money was given without a receipt and even without witnesses.

How can you repay a debt without a receipt, agreement and witnesses?

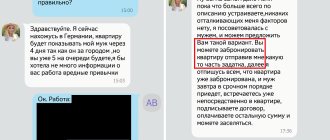

Often, when the terms of debt repayment are violated and a receipt has not been drawn up, those who borrowed are afraid that they will have to say goodbye to the money and make mistakes. Some people start calling annoyingly, forcing the debtor to change the number and sometimes the address. Some even begin to threaten, write letters and abusive SMS messages.

The braver ones can come to the debtor’s work and cause a scandal there. This is all completely wrong. The debtor can sue for extortion, threats, etc. And this will already be a criminal case. Many will say “well, so be it.”

But if the debtor collects from you for moral damage an amount exceeding the amount of the debt, the meaning of such actions will be lost.

There are quite civilized ways of returning. To begin with, you can try to negotiate peacefully and calmly find out about the reasons for such a delay. What if the debtor has good reasons? If the dialogue is successful, perhaps the debtor will even be able to write a receipt. In any case, after the conversation the situation will become a little clearer and you will be able to discuss new conditions: deadlines, etc.

Any unauthorized violent attempt to collect money is a criminal offense

Negotiations with the debtor through an intermediary

If a close friend or relative has become a debtor, an attempt to communicate on the topic of debt can develop into a scandal. In the event of a conflict, it will be impossible to reach an agreement or prove anything. In such a situation, if you do not plan to go to court, you can find a conciliation service. Not all Russian cities have developed this area, but still... You need to understand how such services work.

Trial

This measure remains the only one if no others have brought the desired effect. It is good if the statement of claim is drawn up by a professional lawyer.

A statement of claim is a document that must be drawn up in full compliance with current legislation, namely Art. 131 Code of Civil Procedure of the Russian Federation. Such a statement must indicate:

- Full name of the judicial authority to which the appeal is sent.

- Passport details of the parties to the agreement, registration or actual place of residence.

- Data of witnesses to the transaction, their signatures.

- The deadline for the refund to be made, as well as exactly how long the delay is.

- Amount of debt. In addition, you can specify the amount of interest, indexation and inflation.

- It is necessary to list all the actions that were taken to resolve the dispute peacefully. This is where you will need to attach written claims, receipts for payment of state fees when receiving a court order, and other confirmed expenses. All documents are submitted in two copies: original and photocopies. This is necessary because the originals remain in court, and copies are sent to the defendant.

Important! The court sets a date for consideration of the application. Before the start of the trial, the creditor has the right to provide new evidence important to the case.

It is more likely that the court will side with the creditor. After the decision is made, a writ of execution is issued and handed over to the creditor. This is the document according to which he will be obliged to repay the debt within 5 days.

If this is not done voluntarily, the writ of execution goes to the bailiffs for development. All further measures will be taken by the bailiffs. Such measures may include seizure of the debtor’s property, his accounts, suspension of business activities and any transactions.

Where to find evidence

You cannot lose hope even in their absence, if the transaction took place together, verbally and without the voice recorder turned on.

Perhaps they will appear later. Write down all contacts, the debtor may accidentally let it slip, you will find information on social networks, etc.

What can be accepted as evidence in court:

- audio and video materials;

- printouts of phone calls, SMS correspondence;

- social network information, email correspondence;

- transfers through electronic payment systems;

- recordings from surveillance cameras;

- any documents confirming the existence of a debt, for example, other agreements and receipts.

Attention! Witness testimony is accepted only in written form.

Lenders' tricks often help. Let me give you an example.

Let's watch the video. On it, the lender asks when the borrower will repay him the debt of 50,000 rubles (and only gave 30 thousand). The borrower exclaims in amazement: “Like 50 thousand!”

Can this recording be considered evidence?

Often such tricks saved the situation, and a court decision was made in favor of the creditor.

Important. Additionally, you can provide evidence of the borrower's ability to repay the debt. An example is information from his place of work about his income for the last 3 months, photos and receipts of his expensive purchases made simultaneously with complaints about his “difficult financial situation.”

Receipt fraud

If a lender lends money to a stranger, there is always a risk of running into a scammer. Then, when drawing up a receipt, he may indicate incorrect passport and contact information, or put a non-existent signature. All this is done to make it impossible to identify the individual in the future.

If scammers are serious about their business, they may even have a fake passport. In such situations, only a handwriting examination can clarify everything.

In order to protect itself as much as possible, the lender is recommended to carefully check the borrower’s passport and obtain a photocopy of it. In addition, you should not accept receipts printed on a printer or, especially, in electronic form. This will make it impossible to carry out a graphological examination and deprive the creditor of the only argument in his favor.

If fraudulent activity occurs, the lender has no choice but to contact the police. There you need to provide everything that is left of the fraudster - his receipt, a scan of his passport, and you also need to describe the current situation as reliably as possible.

Instead of output...

So, despite despair and righteous anger, when faced with a choice - blow the dust off the writ of execution or rely on promises of a “quick resolution of the issue,” try to maintain prudence and prudence

.

In any case, do not count on the “wizard in the blue helicopter” who will come and, with the wave of his wand, solve the problem that you have been struggling with for years. This is unlikely to happen. So that you don’t end up in a dead end on the way to your goal, don’t skimp on competent, timely consultation. The sooner you realize that this time has come, the problem has arisen and is unlikely to resolve itself, the better

.

Or be guided by the principle formulated, apparently, by one of the unlucky creditors: “If you want to be friends with me, don’t ask me for anything .

Contacting third parties

Sometimes a creditor who is unable to get his money back decides to turn to third parties for help. Collection agencies play this role.

This is not the best idea; it is better not to resort to it unless absolutely necessary. When a debt is turned over to a collection agency, the creditor may not be able to fully recover all of their money. This is due to the fact that such agencies will also charge a fee for their services. It will be 10-30% of the amount of debt collected from the debtor.

Important! Collectors will be able to return only 90-70% of the debt to the client if there is already a writ of execution for it. If there is no such sheet, collectors will return 50% of the debt.

Still, this method has its advantages:

- Short terms of debt repayment, high probability of receiving part of the money.

- There is no need for personal contacts with an unscrupulous debtor.

Don't lose count of friendships

Photo: depositphotos/AllaSerebrina

Financial disagreements with friends and acquaintances are one of the painful topics.

“Everyone perfectly remembers the proverb: “If you want to lose a friend, lend him money.” But at the same time they continue to fall into this trap over and over again. In a strange way, it’s the one who lent it and then just wants to get it back that feels awkward,” complained psychologist-psychotherapist Olesya Maryaeva.

How can you remind about the debt and ask for it back without ruining the relationship and getting your money back?

The most important thing is not to use aggression, not to put pressure and not to be tormented by feelings of guilt.

It is important to remember that it is the one who is dishonest who is putting the relationship at risk, not the one who just wants to get his way. Olesya Maryaeva

psychologist-psychotherapist

In this case, psychologists advise not to take on the entire burden of responsibility for the relationship, because this burden is always evenly divided in half.

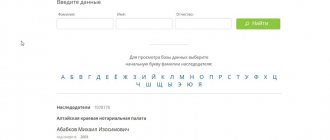

Debt collection depending on the amount

According to the law, if the amount of debt is less than 50,000 rubles, then in order to return it, you must proceed through writ proceedings. Such cases are dealt with by a magistrate at the site where the debtor is registered. The creditor applies for a court order to collect the debt, but the debtor can cancel it.

If the amount of debt exceeds 50,000 rubles, cases are heard in the district court. Then the debtor does not have the right to cancel the court order. It follows that it is much more difficult to return small amounts than larger amounts.

No property - no debt repayment

Now let’s assume that despite all the measures taken, the enforcement proceedings ended on the basis of Part 1 of Article 47 of the Law “On Enforcement Proceedings”, with the so-called “act of impossibility of collection”. This document summarizes the ineffectiveness of the steps taken by the bailiff and is the basis for returning the writ of execution to you, the repeated presentation of which is possible within three years from the date of receipt by the claimant

. At the same time, there will probably be no reason to assume that the debtor, having been notified of the termination of enforcement actions against him, will immediately begin to acquire and register some assets for himself, which you can claim when you re-submit the sheet to the SSP. As a rule, people who have gone through the procedure of forced debt collection and have not settled it continue to live “with an eye” on the possibility of its repetition.

So, you have taken all possible measures that depend on you to return your recklessly borrowed money. We went through many months, or rather years, of negotiations

, legal proceedings, enforcement actions, but realized that the result was a thin stack of greenish A4 sheets containing your right, formalized in accordance with the procedure established by law, to demand from your former friend the return of the funds entrusted to him. And the understanding that he is unlikely to return them...

Collectors - your last chance

The next step taken by most unlucky creditors is to contact organizations offering assistance in debt collection, the so-called debt collectors

.

When deciding to take this step, consider several fundamentally important points. Firstly, no one will work to repay your debt with the expectation of payment “based on the result.” You will definitely be required to pay in advance

, and the amount you paid will be non-refundable.

Second: no one will buy from you the right to claim against your creditor for some reasonable money, even if the company’s website contains exactly this promise

.

Professional collectors understand, much better than you yourself, the prospect of the debtor fulfilling an “unsecured” claim, that is, one not backed by a pledge of any property. And third: from the moment the law “On Collection Activities” was adopted, all structures providing such services in the legal field are required to have an appropriate license

, which provides, among other things, insurance for their liability.

Only large players in this market were able to fulfill such requirements, whose leverage over debtors is limited to tedious phone calls with reminders. Everything else is outside the scope of the law. Turning to so-called “black” collectors who practice more effective but illegal methods may lead you to the need to resort to the services of a lawyer

. And it’s not a fact that he will be able to help you.

Why don't ATMs return cards?

The reasons can be very different, from quite compelling ones (protecting your money) to banal software glitches and mechanical malfunctions. The ATM will not return your card if:

- you entered the wrong PIN code several times in a row;

- you tried to use an expired or blocked card;

- the card is demagnetized or has mechanical damage;

- you are trying to carry out a suspicious operation from an ATM point of view - for example, withdrawing all funds from your account;

- you did not withdraw the card after the time indicated on the ATM screen;

- the ATM is frozen or broken.

In the latter case, the ATM will either completely stop showing signs of life, or a service message about a malfunction or technical malfunction will appear on the screen. If the ATM swallows the card and displays a standard invitation to service the next client, this means that your card has been delayed, and not just stuck.

Under such circumstances, in most cases, ATMs issue a receipt that indicates the card detention code. Do not throw it away; you will need it when filing a return application. If the ATM does not give you such a check, it’s okay. The absence of a receipt is not a reason to refuse to return the card.