A receipt for the obligation to repay money can be drawn up when a debt arises and money is transferred to the borrower. This document will be needed when making claims and filing a lawsuit in court; it can be used as evidence. Protecting the interests of the creditor depends on the correctness of the receipt and the indication of basic data that allows identifying the obligation and the debtor.

- How to properly issue a receipt

- Rules for drawing up receipts for obligations

- Sample

Features of handwritten receipts

A receipt is a document written in any form that confirms that one party provides any services or transfers funds to another. The legislation does not provide for a clearly fixed form that such a document must comply with.

This document, written by hand, is a more simplified form of the agreement, which does not require spending time on going to a notary and money on paying for his services. The place for drawing up such a receipt is a place convenient for both parties, which does not provide for any mandatory criteria. This concept exists in Russian legislation, so if the debtor refuses to fulfill his obligations, his rights can be restored through the court.

When legal relations arise

If finance is required, in some cases it is possible to obtain a loan. However, this requires approval from the bank, and in some cases a deposit may be required. Not everyone has the opportunity to get money this way.

A more convenient option is to borrow money from relatives or friends. If this is not possible, it makes sense to ask someone else for money.

At the same time, it is very important for the lender to be sure that he will receive the money back in full and by the agreed date.

For this, two main options can be used (when an individual borrows money):

- Registration of receipt.

- Signing a loan agreement.

Both of these options are regulated by the Civil Code of the Russian Federation.

The first of them is a simpler and less troublesome registration option compared to a loan agreement.

Cases when you can draw up a receipt by hand

Despite the convenience of drawing up and a number of advantages of a handwritten receipt, it cannot be used in every situation. Before drawing up such a document, it is important to know whether it will have legal force in this case. Since there is a list of agreements, for example, an agreement for the purchase and sale of real estate, an agreement for the donation of real estate and others, which are valid only after being certified by a notary.

You can limit yourself to a handwritten receipt if the amount borrowed does not exceed ten minimum wages. It is also better to record amounts less than the above in this document so that unpleasant situations do not arise. Large sums must be certified by a notary office.

When providing different types of services, such a receipt also continues to be valid.

It will also be relevant when renting/renting an apartment. In this case, two parties can protect themselves in this way: one - from dishonest landlords, the other - to exclude the option of terminating the transaction in a short time, which was not initially counted on. In such a situation, all financial relations must be agreed upon and recorded in the contract. It is necessary to indicate the amount of money transferred for the apartment and the period during which the tenants have the right to use the housing.

What to do when repaying a debt by receipt

When the debt amount is fully repaid, it is not enough to simply transfer the money to the creditor. It is also required to draw up another receipt, but this time for the repayment of the debt, which will certify the fact of the return of the money. The text should reflect the following important points:

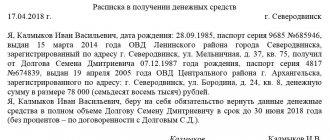

- full data of both parties: full name, date of birth, passport details, place of registration and actual residence;

- amount borrowed. It must be written out entirely in rubles and kopecks in numbers and letters;

- date of actual repayment of the debt amount and accrued interest;

- full name of the currency;

- purpose of money. In this case: as a return of debt;

- signature of the creditor and his full name;

- note that the borrower repaid the debt in full and within the specified time frame. It is also important to state that the lender has no claims against the borrower.

In addition you can:

- provide information about witnesses;

- have the receipt certified by a notary;

- For greater reliability, ask for a handwritten receipt.

How to write a receipt correctly so that it is valid in court

Most handwritten receipts are financial in nature. For example, a domestic situation when a friend or relative borrowed a large sum of money for a certain period of time.

In order for a simple piece of paper to turn into a document and be evidence in court, you need to know some rules:

- The receipt is written in the presence of both parties.

- It should be drawn up in legible handwriting by the person who borrows money or uses any service, and not by the person who provides any benefit.

- If a citizen refuses to fulfill his obligations, through a handwriting examination in court it is possible to identify the person who wrote this document.

- Unaware citizens prefer to print out a receipt because they believe that a handwritten receipt does not have any obligations. This is a misconception; moreover, when going to court, difficulties may arise in the process of identifying the person who wrote this document.

- The computer-printed form can be used for notarization.

When using a handwritten document, it will be more profitable if the debtor draws it up with his own hand.

Why do you need to issue a receipt when lending money?

In ancient Rome, there was a rule: if the borrower did not return the money for some reason, then with a high probability he could, as punishment for this, become a slave of the person who lent him.

Now, of course, other punishments are used against willful defaulters. But there are still frequent cases when the debtor, taking advantage of the gullibility and ignorance of the law of the lender, avoids returning the money and interest.

In the situation of lending money, the lender exposes himself to greater risk, so it is for his safety that a receipt is drawn up. You can also lend money at interest to relatives and friends, but even though you trust these people, you should not neglect the opportunity to certify the transfer of funds in writing, because anything can happen: they may forget some details of repayment of the debt and percent, mixed up dates, etc.

A promissory note is a very simple tool that will allow you to avoid all misunderstandings and controversial situations.

Many people who have a large amount of unused money on their hands think that these funds could not just lie there, but generate a small income. Therefore, people often borrow money at interest in order to receive passive income from this amount.

An interest receipt is one of several types of promissory note that has a narrow focus. By itself, this paper does not fully offer all the protections and guarantees; it is usually used as an auxiliary tool. But if the receipt for a loan with interest is drawn up correctly, in accordance with all the rules of the law, then it will be an irreplaceable document that has due legal force. This way, you can get your money back with interest on time, taking into account all the prescribed nuances.

The receipt indicates significant passport data and information about the registration of the person who receives the money as a loan. Thanks to this, in the event of non-payment, it will be easier for you to determine jurisdiction and file a claim.

As a rule, with a small amount of debt and a short period of repayment, few people in our country demand interest. In fact, most people in Russia do not make any written receipts at all and simply lend on the basis of verbal agreements only.

But when we are talking about an impressive amount that is lent, it would be wiser to take interest on it. In this case, of course, it is necessary to draw up a receipt confirming the agreement between the lender and the borrower.

Many experts advise resorting to drawing up a receipt, even when you lend money to your relatives, since this paper will clearly stipulate the obligations of the parties, payment terms and interest. This will help you avoid all the awkwardness that usually arises when it comes to asking to repay a debt.

Contents of the document

When drawing up a document, you must follow the following instructions:

- A prerequisite when drawing up a receipt is to indicate the person’s full name. Otherwise, if a controversial situation arises, such a document will have no force in court.

- A mandatory criterion by which you can recognize which person wrote this receipt is the indication of the borrower’s passport information. Hoping that it is impossible to meet a person with the same name is imprudent. Therefore, the presence of passport data will be indisputable evidence when establishing identity in court.

- If the debtor turns out to be unscrupulous and you still have to look for ways to get him in touch, the receipt must indicate his place of residence, telephone number and other similar information.

- The receipt must detail all the circumstances surrounding the provision of the service. The purpose of its writing should be accessible and understandable. If we are talking about lending a sum of money, then it is necessary to indicate what amount was transferred - in numbers and in words.

- Record the fact of receiving money. Indicating the amount in words is a mandatory criterion that the court pays attention to.

- Indication of the currency in which the money was transferred. If these are not Russian rubles, then it would not be amiss to indicate the rate at which the money should be returned.

- Particular attention should be paid to dates. The full date of preparation of the document and the date of refund or provision of services must be indicated.

- The receipt must be written without crossing out or corrections, so that there are no multiple interpretations.

- You should pay attention to the recipient’s signature in the passport and the one he puts on the document. This will eliminate the slightest doubt of the court about the authenticity of the person.

- The last thing to pay attention to is the pen that will be used to write the document. There are types of ink that lose their brightness over time and smear the text - it is better not to use them. A regular ballpoint pen will do just fine.

If you use the above rules, then if you need to go to court, it will be much easier for the creditor to protect your rights.

Compilation rules

The law stipulates that an amount less than 10 minimum wages can be borrowed on the basis of an oral agreement.

If a larger amount is involved, a simple written form is required. The Civil Code provides for the use of a receipt or loan agreement. The first option is more common.

In practice, the term may refer to a transfer of funds, an acknowledgment of obligations, or a transfer of property. The first of these options is the most common.

You need to understand that when a receipt confirms certain obligations, this document in itself does not create them. In this case, it requires the existence of an appropriate agreement or rule of law. We are talking only about the recognition by this person of his obligations.

It is important to emphasize that it is necessary to indicate the data in the receipts without errors and to mention all the essential aspects of this transaction.

Here are some examples of what can happen if you deviate from the rules:

- If money is transferred for a car, but the receipt only states that the money was transferred, the seller has the right to go to court and say that money was lent here, but the car was not paid for.

- When the receipt does not indicate that the money was actually transferred, the borrower can say that he filled out the receipt but did not see the money.

- If there is an error in spelling the last name, other personal data, or if incomplete information is provided, the borrower may claim in court that the money was lent to another person.

- If we are talking about compensation for losses, but the document does not indicate that moral and material damage has been fully compensated and there are no claims, then you can subsequently file a lawsuit again.

What power does a handwritten receipt have?

The receipt has legal force, and any person who has a passport of a citizen of the Russian Federation can write it personally. In fact, such a document is a loan agreement.

To ensure that there is no doubt that the receipt has legal force, you can read Article No. 808 of the Civil Code of Russia.

Is notarization necessary or not? Russian legislation, namely the Civil Code (Article 163), states that receipts must be notarized if both parties to the agreement wish this or in cases provided for by law.

There are no clear requirements that the receipt must be certified. The legislation distinguishes certain types of transactions, for example, those related to real estate or if the subject of the agreement is a large sum of money, which must be carried out only in the presence of a notary.

Doubts about drawing up a receipt without a lawyer are not justified. The reliability of signing by a notary lies only in the fact that often people, having written by hand, believe that they may not fulfill their obligations. But this is only bad faith, and all rights can be protected in court in any case. The only disadvantage of handwritten receipts is the waste of time and money on examinations and court hearings.

If a promissory note confirms the transfer of money to the debtor in an insignificant amount, then the notary has the right not to certify such a document at all. Only if it is drawn up as an annex to the loan agreement.

Whether it is necessary to certify, everyone decides for himself, since a handwritten document is a full-fledged legal act. In court, it is evidence, like any other, notarized. The presence or absence of a notary's signature is not a basis for claims or disputes. The law allows the use of this form without the involvement of witnesses and a notary when drawing up and signing an agreement.

Money against receipt

Receiving money against a receipt is one of the most typical uses of such a document. Transferring money against a receipt is inherently considered a loan. If the amount of such a loan exceeds the established minimum wage by 10 or more times, then according to Art. 808 of the Civil Code of the Russian Federation, the loan agreement is concluded in writing. If the lender is a legal entity, the agreement is drawn up in writing in any case, regardless of the amount of funds transferred. It is easier and faster to get a loan against a receipt from a private person than from a bank, which is why this lending format is becoming popular.

Statement of claim for collection of debt by receipt

Since the receipt is a document, it can be presented as evidence in court. A correctly drawn up receipt has the force of a contract. If the very fact of drawing up a document or a signature on it is disputed, the court may order a handwriting examination. The statement of claim to the court is drawn up according to the general rules and it must indicate all the information about the debtor, the amount of the debt, and the repayment period of the loan. The original receipt must be attached to the statement of claim and submitted to the justice authorities at the place of registration of the defendant. The statute of limitations for debts is 3 years.

Legal advice

- When drawing up a receipt, you should clarify whether the subject of the agreement can not be certified by a notary office. Compliance with all the recommendations specified in this article guarantees that if the debtor does not repay the debt or provide services, then they can be demanded through the court. You can get free advice on how to correctly draw up an agreement of this type on the Internet, in the public domain.

- As a creditor, you must keep the receipt until the debt is fully repaid. It should be remembered that there is a statute of limitations of three years. Therefore, if the debtor does not try to repay the debt, then there is no need to delay going to court. It can be quite difficult to restore your rights after the statute of limitations has expired.

- We should not forget that even with a simple form of receipt it is possible to demand not only the principal amount of the debt, but also a fine from the debtor for late payment.

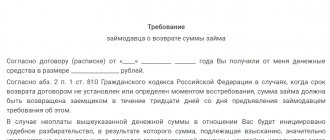

- If the debtor violated his obligations or did not fulfill the terms of the agreement, then the creditor must write a letter to the debtor. In this letter, you need to demand from the debtor the entire amount of the debt and indicate the date of repayment - usually this is a thirty-day period. It is better to send this document by registered mail so that there is confirmation of receipt.

- If the debtor ignored this message, then the next step would be to go to court, to a magistrate. It is necessary to write an application in which you need to demand to collect the debt from the debtor, attach a receipt and a document confirming payment of the state fee.

- The presence of both parties to the transaction in court is not mandatory. A court order can also be granted in the absence of the debtor. After a decision is made according to which he is obliged to pay the debt, the documents are handed over to the bailiffs. They, in turn, are required to make appropriate inquiries to find out the availability of real estate, information about earnings, information about bank accounts - everything that can be used to compensate for official obligations.

Video on the topic:

Receipt for borrowing money at interest according to the law

According to paragraph 2 of Art. 808 of the Civil Code of the Russian Federation, in order to confirm the loan agreement and its terms, you can provide a receipt from the borrower or another document that certifies the transfer by the lender of a specific amount of money or a certain number of things.

When the debt does not exceed 10 thousand rubles in total, the parties may well resort to concluding oral agreements on the return of money and interest. But if the value of the transfer object is greater, then you should definitely draw up the necessary documents; as a rule, this will be a regular loan agreement. It has legal force if it is signed by all parties. In addition, you can simply issue a receipt.

It is necessary to notarize a transaction in the following cases:

- when required by law;

- provided for by the agreement of the parties, at least by law this form was not required for transactions of this type (Clause 2 of Article 163 of the Civil Code of the Russian Federation).

Based on this, there are no strict requirements for notarization of a receipt. It is important to understand that the notary does not work with the receipt separately; he can only certify the loan agreement and along with it the receipt that is attached to it.

Therefore, if you are going to lend money and at the same time want to notarize this transaction, then you need to draw up a loan agreement. But if you have already given away the funds and have only drawn up a receipt for the loan at interest, you do not need to worry, because this document already has legal force and guarantees that the borrower will return the funds to you. If problems arise, in each case a lawsuit cannot be avoided.

Interest is usually paid along with the principal. If the money is returned in a lump sum, then the amount of interest must be paid immediately. When the debt is repaid in partial payments, interest is paid on the balance of the loan debt on the date of partial repayment.

[offer]

Interest payments can take place in different ways:

- with monthly payment;

- with payment according to schedule;

- lump sum payment;

- quarterly deposit of money.

All details of the transaction, such as: the procedure for repaying the debt, terms, and other significant conditions, must be reflected in the receipt, even though this is not a full-fledged agreement. If the receipt is issued only to confirm the fact of transfer of funds, then all conditions must be reflected in the loan agreement.

The conditions specified in the receipt come into force from the moment it is signed by the parties to the transaction, so there is no need to additionally go to a notary for certification.

Be sure to remember that only the original receipt for a loan with interest will be accepted in court! A copy of this document, even if certified by a notary, has no legal force.

It is important that only a properly executed document can confirm the fulfillment of obligations between people. You can also invite a witness to draw up a receipt. If the matter comes to court proceedings, he will have to confirm the fact of execution of the document.