Cooperative apartments are not subject to privatization due to the fact that they do not belong to the state. Knowing why it is necessary to register cooperative housing as a property, the shareholder will not have problems in the future if it is necessary to sell or perform other manipulations with the residential premises.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

The concept of a cooperative apartment

The concept of cooperative apartments entered the lives of people who lived during the USSR period in the last century. Citizens began to build housing at their own expense. It was at this moment that this concept arose. Construction was carried out on the basis of local documentation that regulated the activities of construction organizations.

Let's celebrate! The erected house was the property of the enterprise that built it, and the shareholders, after paying the entire required amount, received ownership of the square meters allotted to them.

Cooperative apartments belonged to the housing cooperative (housing cooperative), and not to the state.

Is it necessary to privatize a cooperative apartment?

According to the letter of the law, there is no need to go through the privatization procedure for cooperative housing; ownership of such real estate must be registered.

Good to know! Otherwise, transactions with this real estate cannot be completed. The certificate of full contribution of the share and the housing order have no legal force.

If you do not register ownership of a cooperative apartment, the following problems may arise:

- In the event of the death of a shareholder, housing can be inherited, but only if the share has been paid in full. If the amount has not been paid in full, then the heir will receive only the existing contribution, and the apartment will remain with the housing cooperative or HOA (association of residential premises owners).

- Persons living in a cooperative-type apartment may have an advantage in joining a housing cooperative only if this clause is included in the cooperative’s charter. Rights can be transferred to a person who is 18 years of age or older.

- If a shareholder has not paid the full share for housing, he may be excluded from the housing cooperative. After the decision is made at the meeting, the shareholder must vacate the living space within a month, otherwise, eviction will follow, followed by court.

To avoid troubles, the shareholder needs to register ownership of the cooperative housing.

Required documents

To obtain a cooperative apartment according to the order of inheritance, a list of necessary documents is provided:

- passport proving the identity of the heir;

- an agreement confirming the fact of the testator’s entry into the cooperative, indicating the cost of housing, its area, as well as the amount to be contributed);

- death certificate of the original owner;

- a certificate from the cooperative containing data on full payment of share contributions;

- documentation of the technical view of the apartment;

- documents certified by a notary confirming the degree of relationship between the heir and the testator;

- paid state duty and a receipt confirming it.

We recommend reading: Privatized apartment after the death of the owner without a will

The donation or will of a cooperative apartment is formalized by a notary, and the application is registered according to the procedure specified by law.

How to privatize a cooperative apartment?

There is no need to privatize cooperative housing; it is necessary to register ownership of it.

Procedure

Before starting to collect the necessary documentation, the shareholder will need to know the following:

- Have apartments in the cooperative building been registered as ownership? If not, then the chairman of the housing cooperative (housing cooperative) must have all the constituent documents available.

- The citizen needs to make sure that there is no debt to the housing complex for share contributions; if there is any, then it must be repaid.

The BTI must submit a certificate of full payment of the share, which is signed by the chairman of the cooperative and the accountant.

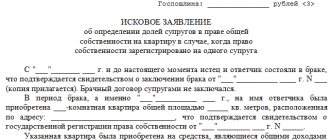

Let's celebrate! After collecting all the necessary papers, the shareholder must submit an application to Rosreestr (if the applicant is married, then together with his spouse).

Required documents

In addition to the certificate, you need to collect the following package of documentation:

- passports of the spouses (if the shareholder is in a marital relationship) or the passport of the applicant;

- statement;

- TIN;

- receipt of payment of the State duty;

- if the certificate and the application indicate different people, then you must additionally submit a document confirming the ownership of the property;

- cadastre passport for residential premises;

- a warrant to move into a given residential premises.

If the apartments have not been registered before this shareholder’s application, the following documents must additionally be submitted:

- copy and original of the cooperative's constituent documentation;

- protocol on the election of the chairman of the Jogorku Kenesh;

- confirmation that the applicant is a member of the cooperative;

- LCD composition.

Good to know! This package of documents is provided only by the first applicant from the cooperative house.

Rosreestr service employees may refuse to accept an application for the following reasons:

- not the entire package of documents has been provided;

- The housing cooperative was registered in violation of the law;

- Rosreestr employees had doubts about the authenticity of the documentation provided;

- the package of documents does not meet the necessary requirements;

- The applicant does not have the right to register ownership of housing.

If the applicant is denied, he has the right to appeal this decision through the court.

Terms and cost of registration

All documentation must be collected as quickly as possible, because... certificates are valid only for a month from the date of issue.

Rosreestr employees check the accepted package of documents within two weeks; in some cases, the time frame can be a month. Only after checking the documents, the applicant will be invited to the registration procedure.

The state duty that must be paid is 2 thousand rubles.

Lawyers advise! If there is no technical passport and plan (floor plan) for the residential premises, they will need to be issued. For this procedure, an additional fee of 1.5 thousand rubles is charged.

Rights and obligations of a member of a cooperative

When joining a cooperative and becoming an owner, a member of the cooperative has a question about his rights and responsibilities. Regardless of the size of the share contribution paid to the housing cooperative, the participant has the following rights:

- Use and dispose of your property.

- Maintain living quarters in proper order.

- Free access to your property.

- To participate in the management of the house.

- Participate in elections of governing bodies and be elected to them.

- Approve annual reports, participate in the adoption of income and expense estimates, approval of salaries for management and in drawing up the staffing table.

- Participate in the rental of non-residential premises of the cooperative.

- Make proposals for improving housing cooperatives.

In turn, the owner of a housing construction cooperative is obliged to:

- Comply with the internal regulations of the cooperative.

- Comply with technical, fire and sanitary rules for maintaining residential premises.

- Pay contributions towards repairs.

- Use common property objects only for their intended purpose.

- Eliminate at your own expense damage caused to other apartment owners or common property.

- Pay taxes and utilities (read about the formation and payment of payments for housing cooperative services here).

Important! All rights and obligations of both the housing cooperative itself and its owners are spelled out in the Charter, so before joining the cooperative you should not neglect to study the statutory documents.

Thus, the property of a housing construction cooperative includes both the apartment building itself, with all its residential and non-residential premises, and the land plot with all additional buildings on it. A participant in a housing cooperative can use the apartment allocated to him by the cooperative until the share contribution is paid in full. He will be able to become the owner of this apartment only after full payment of the share contribution.

All these provisions are clearly stated in the Housing Cooperative Charter, therefore, before joining, it is important to carefully study all the documents of the cooperative. This will allow you to avoid troubles while using the apartment.

Is it possible not to register ownership of a cooperative apartment?

Registration of ownership of cooperative housing is not a mandatory procedure, but it must be completed if in the future the shareholder wishes to make any manipulations with the apartment (sale, donation, etc.).

It is advisable to start the procedure for registering the right in advance if real estate transactions are planned in the near future, because the process may drag on for a long period.

Let's celebrate! If unregistered housing is transferred by right of inheritance, the heir may have some problems. If the share contributions have not been fully paid, the heirs may be left without an apartment; they will only receive the contribution made by the shareholder. It is for this reason that registration should begin immediately after the full contribution of the share.

Free question for lawyers online

If you find it difficult to formulate a question, call, a lawyer will help you: Free from mobile and landline Free multi-channel phone If you find it difficult to formulate a question, call a free multi-channel phone, a lawyer will help you Subscribe to notifications Mobile application We are on social media.

networks

© 2000-2021 Legal social network 9111.ru *A response to a question within 5 minutes is guaranteed to the authors of VIP questions. Moscow Komsomolsky pr., 7 St. Petersburg emb.

R. Fontanki, 59 Ekaterinburg: Nizhny Novgorod: Rostov-on-Don: Kazan: Chelyabinsk: close

Nuances of privatization of cooperative housing

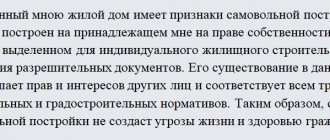

Registration of property rights provides for the allocation of an apartment from an apartment building to the shareholder.

Before submitting the package of documents, you need to consider the following:

- Only the citizen who is a member of the housing complex as a shareholder can register housing ownership.

- If the shareholder was married at the time of payment of contributions, the housing will be considered the property of both spouses.

- No one other than spouses has the right to a share in a cooperative apartment, even if at the time of payment of contributions close relatives lived together with the shareholder.

Only after the applicant receives an extract from the Unified State Register of Real Estate will he be able to fully dispose of real estate at his own discretion (sell, exchange, allocate shares, donate).

Any owner of cooperative housing must obtain a certificate of ownership for it. If a person does not have this document, he will not be able to sell, exchange, gift or allocate a share in the apartment to his relative.

In the event of the death of a shareholder, the residential premises will be inherited by someone; if the share contribution has not been paid in full, then the heir may remain on the street.

Worth remembering! That when submitting an application for registration of housing ownership, the applicant may be refused. In this case, you can appeal the decision only by filing a statement of claim in court.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

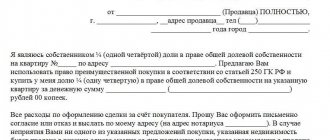

Get a certificate for your daughter

The right to a cooperative apartment can be transferred to children or other relatives only after the transfer of this right is confirmed by state registration. The full owner, who has a Certificate of State Registration of his right in hand, implements it as he sees fit. Any methods of alienation are allowed: If the transfer occurs free of charge and between close relatives (parents and children), then such income is not taxed. But when selling, the seller is obliged to pay tax on the amount received, even if the buyer is a relative.