Who is a private entrepreneur

A private entrepreneur is an individual who, without legal education, carries out entrepreneurial activities. Private businessmen in Russia appeared at the dawn of entrepreneurship in the early 90s of the 20th century. At first they began to be called state of emergency, but in the mid-90s the abbreviation PBOYUL (entrepreneur without the formation of a legal entity) began to be used in official documents.

Today, not a single current legal act contains the concept of “private entrepreneur”. Instead of this term, there is now the concept of an individual entrepreneur, so in the article we will talk about an individual entrepreneur.

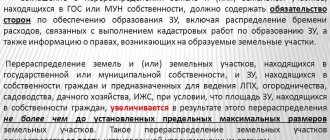

In accordance with the legislation of the Russian Federation, a citizen has the right to engage in entrepreneurial activity without forming a legal entity from the moment of state registration as an individual entrepreneur (hereinafter referred to as individual entrepreneur) (clause 1 of Article 23 of the Civil Code of the Russian Federation). Registration of an individual as an individual entrepreneur does not lead to the emergence of a new subject of law (the same individual remains such a subject). This registration is carried out only for the purpose of confirming the right of an individual to carry out entrepreneurial activities.

A citizen, regardless of whether he is registered as an individual entrepreneur or not, acquires and exercises rights and obligations under his own name (Clause 1 of Article 19 of the Civil Code of the Russian Federation), and is also liable for his obligations with all the property belonging to him, with the exception of property on which, in accordance with the law, cannot be foreclosed on (Article 24 of the Civil Code of the Russian Federation).

Registration of an individual as an individual entrepreneur does not imply the division of the property belonging to him into property that belongs to him exclusively as a citizen, and property that belongs to him exclusively as an entrepreneur. In other words, entrepreneurial activity is at the same time the activity of the citizen himself. The status of an individual entrepreneur does not limit the legal capacity and capacity of a citizen.

Thus, legally, the property of an individual entrepreneur used by him for personal purposes is not separated from the property directly used for business activities. This statement is true for any property owned by an individual registered as an individual entrepreneur.

Often, in his business activities, a citizen uses property that belongs to him as an individual. It does not matter how this property was acquired: before the registration of an individual as an individual entrepreneur or after, with income from business activities and for the purpose of carrying out this activity, or with other income and for other purposes. Even if the property was not initially acquired by a citizen for business activities, he has the right at any time to begin using it in such activities at his own discretion, as well as to stop at any time using personal property for business purposes and begin using it for personal purposes.

When acquiring real estate, ownership of it is subject to state registration in the Unified State Register of Rights to Real Estate and Transactions with It and arises from the moment of such registration (Article 131 of the Civil Code of the Russian Federation). Please note that if real estate is acquired by an individual, the extract from the Unified State Register (until July 15, 2016, the certificate of ownership) always indicates the individual as the holder of the relevant rights. Information about this person’s individual entrepreneur status is not indicated either in the extract (certificate) or in the register.

Areas of business activity

A person without legal education may, without special permission, engage in activities in the following areas:

- consulting and legal services;

- domestic services;

- printing and publishing activities;

- entertainment sector, event organization;

- creative work (design, photography, painting, etc.);

- wholesale;

- Rental Property;

- transport transportation (category B);

- advertising.

Some activities require licensing , for example, educational activities, private investigation, passenger transportation, drug production and medical activities. In total there are about 50 types of activities on this list.

There are also types of activities that do not require a license, but they require permission and approval from regulatory authorities. For example, catering, beauty salon services, hairdressers.

Another section is activities prohibited for individual entrepreneurs . An entrepreneur may not engage in the production and sale of alcohol, the production of medicines, the sale and disposal of weapons and ammunition, or security activities. This also includes activities prohibited by law, such as drug trafficking.

Entity

Entity:

- This is an organization that is registered, has the right to do business and has certain property.

- Has its own separate name and registration address (the registration address cannot be the business registration address)

- Bears separate responsibility.

- Required to keep accounting records, submit reports to the Federal Tax Service, as well as other funds.

- Has the right to obtain certain business licenses that are not available to individual entrepreneurs.

- Must have a stamp and bank account.

What is important is that a legal entity operates in the form of a certain team, in which there are managers and subordinates (each has their own responsibilities and rights).

Upon registration, the organizers of a legal entity invest part of the authorized capital into the “common piggy bank” of the business.

How to register an individual entrepreneur

If you decide to open your own business and have initial capital, you need to officially legitimize your desires. Registering an individual entrepreneur is very simple. You just need to contact the Federal Tax Service at your place of residence with the following list of documents:

- application for registration of individual entrepreneurs (fill out the application in form P21001 and have it certified by a notary);

- passport + photocopy;

- receipt of payment of the state fee of 800 rubles (you don’t have to pay if you submit documents for registration through the website of the Federal Tax Service, State Services, MFC or notary).

There are several ways to submit documents to the tax office:

- Visit the tax office or MFC in person with your passport;

- Use the tax office’s mobile application “Personal Account of Individual Entrepreneurs,” and then visit the tax office with your passport to sign the documents;

- Submit electronic documents signed with an enhanced qualified electronic signature through the website of the Federal Tax Service or State Services;

- Send by mail with a declared value and a description of the attachment (the signature on the application must be certified by a notary);

- Contact a notary.

An individual entrepreneur can choose different tax regimes, having thought through and calculated their profitability in advance. Here we told you what is more profitable - a patent or a simplified version.

The tax office will issue you a certificate of state registration of an entrepreneur indicating the OGRNIP number and an extract from the Unified State Register of Individual Entrepreneurs. By default, the documents will be sent to your email in electronic form with an enhanced qualified tax signature. Paper copies can be obtained if you tick the appropriate box on the application. The inspectorate independently sends information about the registration of individual entrepreneurs to the Pension Fund and the Compulsory Medical Insurance Fund.

The registration period for an individual entrepreneur is no more than 3 working days. The state has the right to refuse registration of an individual entrepreneur for the following reasons:

- you are subject to restrictions on business activities (for example, you are in the civil service or work as a magistrate);

- typos were found in documents;

- you were declared bankrupt, and less than a year has passed since that moment.

Pros and cons of IP

Advantages of IP:

- Easy registration

- Complete management of your income

- Simple reporting

- Office, seal and current account are not required

- Fines are less than for a legal entity

Disadvantages of IP:

- Personal property liability

- Some activities are prohibited

- A biased attitude on the part of large companies that will refuse to work with you because they do not trust small individual entrepreneurs.

- You will still have to pay to the Pension Fund. Even if you don't do anything.

Rights and obligations of an individual entrepreneur

The individual entrepreneur enjoys the following rights:

- manages his own activities;

- freely chooses partners;

- decides how and in what amount to pay wages to employees;

- disposes of the received profit at its own discretion;

- can act in court as both a plaintiff and a defendant.

Responsibilities of the entrepreneur:

- document monetary transactions;

- all employees hired must be officially registered;

- submit tax and employee reports;

- pay taxes, employee salaries and insurance premiums on time.

What does it include

Director of an individual entrepreneur - can an individual entrepreneur have one?

Important! An individual entrepreneur has a wide range of rights and responsibilities.

All his rights are divided into three groups:

- Entrepreneurial.

- Constitutional.

- Rights as a taxpayer.

The constitutional group of rights includes:

- The ability to use all available single economic space of the country without restrictions.

- Freedom of economic action.

- Unhindered movement of goods throughout the country.

- Any use of one’s abilities and property in business.

- Ownership.

- Maintaining competition.

Business rights include:

- Have a choice between all types of activities and entrepreneurship, excluding those prohibited by the legislation of the Russian Federation.

- Have the property necessary for work.

- Develop an action plan independently.

- Have accounts in any bank.

- Create your own trademark and seal.

- Use hired labor by concluding an employment contract.

- Decide independently who will be the supplier of raw materials and products.

- Choose yourself who will become the consumer of the goods.

- Take loans from banks.

- Be a participant in government programs and a recipient of payments, the purpose of which is to provide support to small businesses.

- The right to receive insurance.

- Possibility of processing municipal orders.

- The right to perform and provide any services and work not prohibited by law.

- Protection of property and rights from encroachment by officials.

Entrepreneur's rights

Individual entrepreneurs also have special rights as a taxpayer:

- Take advantage of various tax benefits established in legislative acts.

- Free information about taxation from the tax authorities.

- Requiring clarification in writing from tax authorities in controversial situations.

- Preservation of tax secrets.

- Receiving installments or a loan upon payment.

- If the tax collection authorities make incorrect calculations, the individual entrepreneur has the right to compensation for lost funds.

- Force tax services to act within the law.

- Do not begin to carry out actions required by tax authorities if the requirements contradict legal acts in the field of taxation.

- Appeal and trial in court of unlawful demands of the tax service.

In addition to rights, of course, an individual entrepreneur has a number of obligations:

- The activities of enterprises must be within the framework of existing laws and regulations established by the government.

- Have licenses in areas where specified by the state.

- Be attentive to the interests and rights of clients.

- Be responsible for all operations.

- Transfer funds for insurance premiums for hired workers.

- Always fulfill contractual obligations.

- Pay taxes to the local and state budgets.

- Engage in labor protection, monitor compliance with safety regulations, and carry out control checks.

Advantages and disadvantages

Waybill for a truck of an individual entrepreneur - what is it?

Important! Forming an individual entrepreneur has a large number of both advantages and disadvantages.

Positive features include:

- Ease of creation and liquidation of an enterprise.

- Full use of profits at the discretion of the owner.

- There is no need to stamp all documentation (except strict reporting forms).

- There are no fixed taxes required on property affected by the business.

- A simpler reporting system.

- Registration of each division with the tax office is not required.

- Possibility of using details registered in the name of an individual.

- When applying UTII, in fact, it may not report on the profit received.

But opening an individual enterprise also has some disadvantages:

- Bears property liability.

- Does not provide the opportunity to conduct a general business.

- You always have to personally participate in management, since it is impossible to introduce the position of director.

- There are some difficulties with working with foreign partners.

- There are restrictions in the areas of activity: for example, individual entrepreneurs cannot work with alcoholic beverages and dangerous explosives.

- Insufficient economic protection by the employer for employees in the event of unemployment and cessation of the enterprise's activities due to the death of the owner.