Is there a threat of criminal liability for debts?

Most often, late payments and debts are subject to civil liability. It consists of collecting debt through the court, charging penalties, penalties, and fines. In some cases, property may be taken from the debtor for debts.

Failure to pay a debt may result in criminal liability only for the offenses specified in the Criminal Code of the Russian Federation. When concluding contracts and making transactions, the parties themselves cannot establish the grounds for initiating a criminal case. All conditions for prosecution are specified in the Criminal Code of the Russian Federation. Explanations on the application of articles of the Criminal Code of the Russian Federation can be found in the practice of the Supreme Court of the Russian Federation.

Several important nuances related to criminal prosecution for debt obligations:

- a criminal case for debts can be initiated only against an individual

- if a debt has arisen from an enterprise, then the manager, chief accountant, and other officials can be tried for intentional guilty actions; - Punishment for a crime related to non-payment of debts can only be imposed by a court

- in this case, the Ministry of Internal Affairs, bailiffs, and officials of the Federal Tax Service have the right to conduct an inquiry or investigation into such criminal cases; - bringing to liability under the Criminal Code of the Russian Federation does not relieve one from the obligation to repay the debt

- collection is allowed under a civil claim in a criminal case, which the injured party has the right to file.

A criminal case can be initiated only if there is guilt in non-repayment of the debt. If the delay is caused by valid reasons or circumstances beyond the control of the citizen, then there will be no grounds for initiating a case. These points will be checked during the inquiry, investigation and trial.

They can be held accountable for debts at the request of the victim. For example, this could be a lender or creditor, a recipient of alimony. If damage is caused to the state, the relevant departments will submit a statement on its behalf. For example, for deliberate and malicious evasion of taxes, a case is initiated at the request of the Federal Tax Service. Therefore, in every criminal case there will definitely be an injured party.

For what debts can a criminal case be initiated?

There are several articles in the Criminal Code of the Russian Federation that provide for liability for debts. The case may be initiated:

- for evasion of repayment of accounts payable confirmed by a court decision;

- for systematic delay in alimony payments, but if the debtor has previously been brought to administrative responsibility;

- for tax debts of an individual or legal entity.

To initiate a criminal case, it is not enough to prove guilt in creating a debt. The size of the debt is also of great importance. Until it reaches a large size, they have no right to prosecute under the Criminal Code of the Russian Federation. The exception is alimony obligations, where it is not the size of the debt that is important, but the period of delay.

There are several other compounds that are indirectly related to debt obligations. For example, a case may be filed for credit fraud. In this case, we are talking about the deliberately illegal receipt of a loan without the purpose of returning it. In this case, money for an illegally issued loan will be recovered through a civil claim in a criminal case.

Conditions for criminal prosecution

To impose a criminal penalty, the investigation and the prosecution will have to prove the elements of a crime. Articles of the Criminal Code of the Russian Federation for non-repayment of debt provide for the following elements of a crime and conditions for bringing to justice:

- the fact of debt formation

- it is confirmed by court decisions, materials of the criminal case; - amount of debt

- according to the Criminal Code of the Russian Federation, punishment will be imposed only if the debt is large (with the exception of alimony); - maliciousness and deliberate evasion of debt repayment

- this means that the citizen had a real opportunity to repay the debt at least in parts, but deliberately avoided doing so; - the fact of bringing to administrative responsibility

- this sign is important only for criminal liability for alimony debts.

Criminal liability threatens for debts on credits and loans, taxes and alimony.

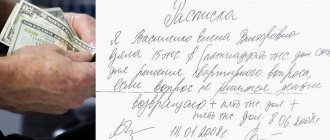

A criminal case can be initiated for debts of 2 million 250 thousand rubles, and for tax arrears - from 2 million 700 thousand rubles. For debts on alimony, criminal punishment threatens if there is a delay of two months, if the defaulter was previously brought to justice under the Code of Administrative Offenses of the Russian Federation.

In the articles of the Criminal Code of the Russian Federation one can find such a concept as qualifying characteristics. These are special conditions under which the punishment will be more severe. For example, such signs are in Article 198 of the Criminal Code of the Russian Federation for tax delinquency. Different sanctions are applied for large or especially large tax debts.

Amount of debt for criminal liability

How much debt can be subject to criminal liability? On this issue, the articles of the Criminal Code of the Russian Federation say the following:

- for malicious evasion of payment of accounts payable, the delay must exceed 2 million 250 thousand rubles. (large size);

- for tax debts they can initiate a case if there is a delay of 2 million 700 thousand rubles. (for three consecutive financial years);

- for alimony debt, its size does not matter, since the case is initiated on the basis of systematic non-payment (more than two months in a row).

The amount of accounts payable must be confirmed by a court decision that has entered into force. Tax delinquency is confirmed by declarations, calculations and other documents. At the same time, a tax debt can be recorded based on the fact of failure to submit a declaration or calculation.

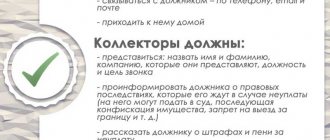

What can the bank do in relation to debtors - individuals, except for debt collection?

In addition to collecting an individual’s debt on a loan in court or out of court, the bank takes other actions in relation to the debt and the debtor. We’ll look at what these actions might be in the article.

Debt restructuring

This action of the bank is not related to the collection of debt on the loan, but is aimed at assisting the borrower in repaying the debt.

Currently, due to the unfavorable epidemic situation, on the basis of letter N 04-14/796, the bank can restructure the loan debt, including providing a deferment (installment plan) for the return (repayment) of the loan and the payment of interest for its use.

Deferment of payment under a loan agreement is a change in the terms of the agreement, when the payment period for the loan and (or) the payment of interest for its use and (or) the deadline for full repayment (repayment) of the loan is postponed to a later date in comparison with the period established by the loan agreement < *>.

Installment payment under a loan agreement is a change in the terms of the loan agreement, when a different procedure is established for repaying the debt on the loan and (or) paying interest for its use by changing the amount payable in the corresponding period, and if necessary, postponing the loan payment period and (or ) payment of interest for its use and (or) the deadline for full repayment (repayment) of the loan at a later date in comparison with the period established by the loan agreement <*>.

Debt restructuring can be carried out at the request of an individual for restructuring.

Consequences of the bank granting the application:

1) the bank makes changes to the loan agreement. Making such changes is free for an individual <*>;

2) the bank does not charge increased interest and does not apply penalties for non-fulfillment (improper fulfillment) of obligations under loan agreements committed by the borrower due to the deterioration of its financial situation from the date the application is received by the bank until the bank makes an appropriate decision on it <*>.

The bank has the right to refuse to restructure debt under loan agreements, including deferment (installment plan) of repayment (repayment) of the loan and payment of interest for its use.

Consequences of the bank not satisfying the application <*>:

1) the bank informs borrowers about the reasons for the refusal;

2) information is transmitted in such a way as to inform the borrower personally:

- on paper;

— in the form of an electronic document;

— a document in electronic form, including using remote banking systems, by sending an SMS message, etc.

Request for early repayment (repayment) of the loan

The bank has the right to demand early repayment (repayment) of the loan in the event of failure by the borrower to fulfill obligations under the loan agreement <*>.

Under new loan agreements concluded from May 1, 2021, in the event of non-fulfillment (improper fulfillment) by an individual borrower of obligations under the loan agreement, the bank may demand early repayment (repayment) of the loan, notifying the borrower of the need to repay (repay) the loan. The notification is sent to the borrower, including through the use of remote banking systems. The procedure and timing for sending such notification are established in the loan agreement <*>.

From May 1, 2021, new loan agreements include a condition on the right of the borrower - an individual to repay (repay) the loan three months from the date of receipt from the bank of a notification about the need for early repayment (repayment) of the loan <*>.

Under loan agreements concluded before May 1, 2021, such a right of an individual borrower was not provided for, but it was established that the period during which the individual borrower is obliged, if provided for in the loan agreement, to repay (repay) the loan ahead of schedule in case of failure to fulfill the terms of the loan agreement, it must be at least three months from the date the lender sends a request for early repayment (repayment) of the loan <*>.

In practice, such agreements specified the procedure for early repayment of the loan at the request of the bank.

Temporary restriction of the debtor's right to leave the country

The bank may submit a petition to the court for a temporary (until the fulfillment of obligations) restriction of the debtor’s right to leave the Republic of Belarus <*>.

This can be done in each of the cases <*>:

- the debtor, without good reason, did not fulfill his obligations to the bank under the loan agreement established by court decisions that entered into legal force;

- the debtor did not fulfill, without good reason, the requirements for repayment of debt under the loan agreement contained in the writ of execution, for example, in the writ of execution.

In enforcement proceedings, the bank may apply to the court or to the bailiff with a petition for the court to take measures to ensure the execution of the executive document in the form of a temporary restriction of the debtor’s right to leave the Republic of Belarus <*>.

This can be done when the debtor does not fulfill or evades fulfillment of the requirements contained in the writ of execution, or when measures to ensure the execution of the writ of execution, taken by the bailiff in enforcement proceedings, are not enough for the timely and complete execution of the writ of execution. A motion to temporarily restrict the debtor's right to leave may be sent to the court by a bailiff at the request of the bank <*>.

Temporary restriction of the debtor's right to drive a vehicle

In enforcement proceedings, at the request of the bank or at the request of the bailiff, the court may take measures to execute the writ of execution in the form of a temporary restriction by the debtor of the right to drive motor vehicles. In this case, the period of temporary limitation is until the debtor fulfills the requirements of the writ of execution, but for no more than five years <*>.

To apply this measure, the bank may apply to the court or to a bailiff in each of the cases <*>:

- the debtor does not fulfill or evades fulfilling the requirements contained in the writ of execution;

— measures to ensure the execution of the writ of execution, taken by the bailiff in enforcement proceedings, are not enough for the timely and complete execution of the writ of execution.

The court will not satisfy the bank's application (representation of the bailiff) when the use of the right to drive a motor vehicle is necessary for the debtor due to disability or as the only means of generating income <*>.

In one application to take measures to ensure the execution of a writ of execution, you can ask the court to take several measures.

Including debt information in your credit history

Information about the loan agreement, including the amount of debt on the loan, the amount of overdue payments for the return (repayment) of the loan, payment of interest and fees for using the loan, as well as the dates to which this information corresponds, the bank includes in the credit history <*>.

Credit histories are stored in the Credit Register <*>.

Based on the information included in the credit history, a credit report is generated, which the bank, with the consent of the individual, requests from the Credit Register when considering the individual’s application for a loan <*>.

Information about untimely fulfillment of obligations under a loan agreement may be grounds for the bank to refuse to provide a loan. When subsequently applying for a loan, the bank may refuse lending if, based on an analysis of the information in the credit report, it comes to the conclusion that the loan that the individual applied for will not be returned <*>.

Read this material in ilex >> *follow the link you will be taken to the paid content of the ilex service

Procedure for criminal prosecution

The principle “borrowed money and didn’t pay it back - a criminal case was opened” does not apply on its own. To achieve criminal liability, you first need to collect the debt through the court and record the large amount of the delay. If the debtor begins to pay, even in small amounts, then malicious evasion of debt repayment in his actions is unlikely to be confirmed. Therefore, there are very few criminal cases under Article 177 of the Criminal Code of the Russian Federation.

The situation is different for alimony debts. The state tightens enforcement measures against alimony defaulters almost every year. For this purpose, changes are being made to the Code of Administrative Offenses of the Russian Federation and the Criminal Code of the Russian Federation (in terms of toughening punishment), new restrictions and prohibitions are introduced. Therefore, criminal cases regarding alimony debts are often initiated without statements from the claimant. Bailiffs have the right to initiate a criminal case and begin an investigation into it. True, we should not forget that bailiffs most often perform their work “carelessly.”

What is the punishment for debt?

Criminal punishment for debts is imposed by a court verdict. According to Art. 177 of the Criminal Code of the Russian Federation for evading payment of accounts payable, a person may face:

- fine up to 200 thousand rubles;

- forced or compulsory labor;

- arrest for a period of up to 6 months;

- prison term up to 2 years.

The exact type and amount of punishment will be determined by the court. To do this, all circumstances surrounding the occurrence of the debt, mitigating and aggravating factors will be taken into account. If the defendant repays the debt in full before sentencing, he will be given a minimum sentence.

For late alimony payments, the debtor may be sentenced to forced labor or correctional labor, or to arrest for up to 3 months. In what case and to what? Find out this in an online consultation with our lawyers. The most severe sanction under Art. 157 of the Criminal Code is deprivation of liberty. He can be appointed for a period of up to 1 year.

Criminal prosecution for tax debt may entail the following types of penalties:

- fine from 100 to 300 thousand rubles;

- forced labor;

- arrest for a period of up to 6 months;

- imprisonment for up to 1 year.

Let us repeat once again that in addition to punishment under the article of the Criminal Code of the Russian Federation, all accumulated debt will be collected from the convicted person.