If you look at the applied solution, you will notice that in it almost all types of payroll calculations that are used in self-supporting organizations, and the associated contributions, taxes and deductions, are performed automatically.

As for existing forms of remuneration, the following have been implemented:

- piecework;

- time-based (using hourly, daily, monthly tariff rates).

In addition, their options have also been implemented, such as piecework-bonus and time-bonus forms of remuneration.

If, when hiring a person, you plan to use time-based wages, then you should indicate the exact amount of the payment, as well as a schedule according to which the time worked by the employee will be calculated.

In practice, personnel changes often occur, as a result of which an employee’s work schedule may undergo changes. In this case, such events should be documented using the information base.

There is no need for special recording of time worked. In this case, the time that was worked by the employee will be deducted as the amount of planned time that the employee should have worked according to his schedule. Moreover, all existing deviations from the established schedule must be additionally documented (for example, cases when the employee was not at his workplace due to being on sick leave or on vacation).

If piecework payment was chosen, then for monthly payroll calculation it is necessary to register the actual output of the employee with certain documents - the so-called piecework orders. Moreover, in this case it is also necessary to indicate the schedule, since it can be used when carrying out certain types of calculations.

Accruals and deductions

It is necessary to pay attention to the fact that all accruals of the enterprise are combined into the following categories:

- Basic. This may include those types of accruals that have a validity period (for example, payment for days when the employee was not at work, payment according to the tariff).

- Additional. These are accruals that differ only in one accrual date (for example, dividends, as well as bonuses). These categories of accruals are often calculated taking into account the amounts that were previously accrued for the main accruals.

Please note that each type of accrual differs in the method of calculation and other parameters.

A distinctive feature of the configuration is that it contains a sufficient number of predefined deductions and accruals. For example, appropriate accruals are provided for different categories of downtime (during working hours), for several categories of vacations, as well as alimony deductions. If necessary, the user adds other types of required deductions and charges.

If you look at the basic charges, we can conclude that they can be calculated in the following basic ways:

- According to a fixed amount.

- According to the tariff rate. The calculation occurs for the period of validity of this accrual.

- A percentage of the amounts that were accrued according to basic accruals.

- According to the average salary for vacation by calendar days.

- According to the average salary for vacation when calculated from days that are working days.

- According to the average salary for calculating temporary disability benefits.

- According to the average salary (for example, to pay for business trips).

- As a benefit for caring for a child under 1.5 years of age.

- As a benefit for caring for a child less than 3 years old.

Additional charges are calculated:

- fixed amount;

- a percentage of the amounts that were accrued for the selected basic accruals;

- for deduction under various executive documents.

The procedure for calculating salaries in 1C UPP

After data on the current output of employees, existing deviations from the schedule, one-time charges, and deductions have been entered into the information base, you can calculate salaries and charges associated with it.

To perform payroll calculations, you need to use “Payroll for employees of an organization.”

To start the calculation, the user should create a new document and then specify the general calculation parameters. Namely: organization, month for which payment is calculated, and so on. After this, you should proceed with the remaining actions: first you need to fill out the document table, and then make the calculation (these actions can be performed automatically).

It is in automatic mode that the following deductions will be calculated: income tax, amounts of loans for which the repayment terms have come, as well as alimony payments. Deductions will be reflected on the corresponding tabs of the document table.

The configuration can automatically cope with various complex situations (for example, when data on the reasons that an employee is absent from the workplace will be entered several times). If it is indicated that the employee is absent from work for an unknown reason, then wages for these days will not be accrued. But if it later turns out that he was temporarily disabled due to illness and the employee brings sick leave for the specified period as proof, then the next time the monthly salary is calculated, the money for the period of illness will be returned to him.

In companies with a large staff of employees, wages and other types of accruals are much easier to calculate by department, rather than by all subordinates at once. But if we are talking about a large corporation, then several users of the configuration will have to do payroll calculations at the same time. You can assign specific departments to each payroll clerk and enter data into the database.

If you specify a biller when creating documentation, then only those employees who are serviced by the specified biller will be included in the table.

To prepare the payment of wages, you should use the document “Salaries payable to the organization.”

This document will be generated and filled out automatically. It allows you to register payments through the company's cash desk, as well as through non-cash transfers of funds to employees' bank accounts. Salaries that were not received on time can be registered as deposited.

Using the configuration, all paper printed forms that are associated with payroll are created: pay slips, payslips.

Labor compensation accrued: postings

Salaries must be paid at least every half month. For example, until the end of the current month for the first half and until the middle of the next month for the second half. Thus, the generally accepted approach is that the components of salary are:

- An advance paid before the end of the billing month.

Accounting records only reflect the fact of payment of the advance (later in the article we will look at the entries used for such purposes).

- The main part of the salary paid at the end of the payroll month.

If wages are accrued, the posting is as follows: Dt 20 Kt 70 - for the amount of wages for the entire month (regardless of the amount of the advance payment transferred).

In this case, the posting can also be generated by debit of accounts:

- 23 - if the salary is intended for employees of auxiliary production;

- 25 - if salaries are transferred to employees of industrial workshops;

- 26 - if the salary is accrued to management;

- 29 - when calculating wages to employees of service industries;

- 44 - if salaries are paid to employees of trade departments;

- 91 - if the employee is engaged in an activity that is not related to the main one;

- 96 - if the salary is calculated from reserves for future costs;

- 99 - if payments are calculated from net profit.

The salary accrual date is determined based on tax accounting standards, according to which salaries are recognized as income only at the end of the billing month (clause 2 of Article 223 of the Tax Code of the Russian Federation).

Transferring salaries to employees' accounts

In order to distribute wages that were sent to the bank among the accounts of company employees, a data exchange mechanism was proposed, developed by 1C in collaboration with Sberbank of the Russian Federation. In more detail, the exchange of information about the transferred salary amounts is carried out using XML files.

The proposed mechanism makes it possible to transmit to a financial institution the information in electronic form that is required to open employee accounts. Thanks to this, you can receive appropriate confirmation from the bank that the accounts were opened with the required parameters of the card accounts of the organization’s employees. Next, you should take care of organizing the regular transfer of wages to staff accounts.

Thanks to this application solution, you can automate all the main types of payroll calculations that are usually used in enterprises. Additionally, all taxes, fees, and deductions will be automated.

The most popular forms of remuneration were implemented: not only time-based and piece-rate, but also their modifications.

When choosing time-based wages for staff, it is enough to indicate the established amount of wages and work schedule when registering the employee.

Moreover, you do not need to take into account the time worked. It is calculated as the amount of planned time that must be worked by the employee according to the schedule minus the deviations recorded in documents. We are talking about absences that occur due to being on vacation or sick leave.

When choosing piecework payment to calculate the amount of payment, you should indicate the employee's output monthly using piecework orders. Additionally, it is required to indicate the exact work schedule, since it is necessary for making other types of calculations.

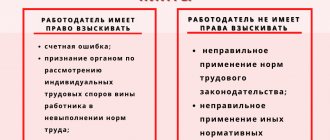

Compensation for training costs at the expense of the employer upon dismissal of an employee

The employee is obliged to reimburse the costs of your organization for his training in the event of dismissal without good reason before the expiration of the period established by the student or employment contract. Calculate the amount of compensation by the employee for training costs in proportion to the time actually not worked after completion of training, unless otherwise provided by the employment contract or training agreement, and reflect the employee’s debt in accounting as of the date of dismissal.

Include the amount reimbursed by the employee as part of other income (clause 7 of PBU 9/99 “Income of the organization”). Such income must be reflected in accounting in the reporting period, obtaining the employee’s written consent for partial reimbursement of training costs (clause 10.2, 16 PBU 9/99).

To account for settlements with employees for transactions not related to wages, including reimbursement of training costs upon dismissal, account 73 “Settlements with personnel for other transactions” is intended.

An employee can repay the debt by depositing cash into the cash register or transferring it to the organization’s current account.

He can also submit an application to the accounting department with a request to withhold the existing debt to the employer or part of it from wages. Such an operation will not constitute forced retention within the meaning of Art. 137 Labor Code of the Russian Federation. Therefore, the norms provided for by the provisions of Art. Art. 137, 138 of the Labor Code of the Russian Federation, on limiting the types and amount of deductions from wages. A similar point of view regarding the possibility of repaying the amount of the loan provided at the expense of wages at the request of an employee is expressed in the Letter of Rostrud dated September 26, 2012 N PG/7156-6-1.

The entries for recording employee compensation for training expenses are as follows:

Debit 73 Credit 91-1

— The debt recognized by the employee for partial reimbursement of expenses for his training is reflected;

Debit 70 Credit 73

— The amount of partial reimbursement of training costs is withheld from wages;

Debit 50 (51) Credit 73

— The employee’s debt is repaid by depositing cash into the organization’s cash desk (by transferring money to the current account).

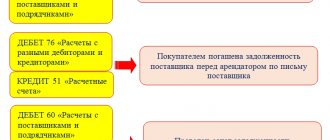

If you receive compensation for training costs after the dismissal of an employee, then settlements with him should be carried out on account 76 “Settlements with various debtors and creditors”. In this case, on the date of dismissal of the employee, transfer the amount of debt from account 73 to the debit of account 76.

Opening hours

To take into account the time worked, you need to use the following types of work schedules: six-day, five-day or shift. Additionally, in the application you need to set the duration of each working week, as well as the exact working hours. In addition, in addition to work intervals, shifts excluding lunch breaks should be indicated.

Additionally, automatic filling of the staff work schedule calendar is provided in compliance with national holidays, working days, shortened days, pre-holiday days and postponed non-working days. An important point: a complete list of all national holidays is in the database.

Payroll calculation process in 1C UPP

After all information about the current output of personnel, deviations from the schedule, one-time deductions and accruals has been entered into the information database, the calculation of wages and accruals associated with it is carried out.

To perform payroll calculations, you should use the document “Payroll for company employees.”

Thanks to the application, you can create printed forms of various types that are associated with the accrual of funds for work.

Salaries are paid using the document “Salaries payable to the organization.”

In order to distribute wages across the accounts of all employees, the configuration included an information exchange mechanism - developed by Sberbank of the Russian Federation and the 1C company. Moreover, the exchange of data on the volume of transferred wages is carried out using the XML standard. This mechanism allows you to send data to the financial institution in electronic form, which is needed to open employee accounts (salaries will be credited to them). Thanks to this mechanism, you can also receive confirmation from a financial institution about opening accounts with certain parameters. Using the mechanism, you can periodically charge wages to your card account.

Comments: 13

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Svetlana

09.24.2021 at 17:43 The payment order was passed. On August 26, the register for payment did not go through, since the register indicated an amount of 500 rubles more, how to create a new register?

Reply ↓ - Anonymous

08/06/2021 at 21:28Delay from Sberbank to Moscow Metro employees. All the banks have already paid out a long time ago. Why did I just switch? I’ll be leaving Sberbank. It’s a complete mess. Aren’t you ashamed?

Reply ↓

- Anna

07/30/2021 at 22:49I quit my job today, July 30, 2021, it’s Friday, the personnel told me that the documents for payment were just sent to Sberbank, is this legal? After all, the payment should be made on the day of dismissal, is there any hope that the salary will arrive on time, or will the payment be postponed to Monday?

Reply ↓

Anna Popovich

08/01/2021 at 20:32Dear Anna, payment must arrive ahead of schedule if the payment day falls on a weekend.

Reply ↓

07.27.2021 at 20:32

why hasn’t the money arrived at Sberbank yet? On the 27th we receive an advance payment already at 17:00 and there is no money in the account

Reply ↓

- Anna Popovich

07.27.2021 at 23:28

Dear Ekaterina, it depends on the employer, but you can clarify your question with the Sberbank support service at 900 or with the operator in the chat of the mobile banking application.

Reply ↓

07/10/2021 at 11:15

Good morning! When will the money arrive from the employment center, if in your personal account it is written that the money should have arrived yesterday, there is still nothing

Reply ↓

- Olga Pikhotskaya

07/10/2021 at 12:56 pm

Oksana, good afternoon. This information can be clarified by contacting the Sberbank support service at 900 or by contacting the operator in the mobile banking application chat.

Reply ↓

07/09/2021 at 22:26

All colleagues receive money by lunchtime, from Promsvyazbank, VTB, etc. I have Sberbank and my salary arrives closer to 8 pm (((I’ll change banks, otherwise I’m worried that I’ll get caught before the holidays)

Reply ↓

06/16/2021 at 00:19

What should I do if I’ve been working at Sberbank for the 3rd month, they don’t give me an employment contract, and they don’t pay my salary?

Reply ↓

- Anna Popovich

06/17/2021 at 17:41

Dear client, please contact onlineinspektsiya.rf.

Reply ↓

05/02/2021 at 03:22

The author praises his swamp. Did Tolik or German pay for the advertising? Sometimes it takes 2 days for the transfer to the cards to come from the employer, but the bribes from the bank are smooth.

Reply ↓

04/30/2021 at 23:24

There is a delay in salaries for employees of the Moscow metro from Sberbank, and VTB has already transferred at 14.00 we are served by two banks, how much will Sberbank spend our money on?

Reply ↓

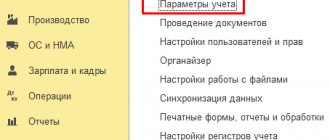

Reflection of salaries in regulated accounting in 1C:UPP

In the 1C: UPP program, such documents as “Payroll”, “Salary payment” do not provide postings. To reflect wages in regulated accounting in this program, you should use “Reflection of wages in regulated accounting.” In addition, the “Cost Items” directory is an analysis of cost accounts in both accounting and tax accounting. Two new items should be added to Cost Items.

The article “Payment (General Expenses)” was created in order to keep track of salaries of management personnel.

“Salaries (Production Expenses)” was created to record the salaries of production personnel.

To create different ways of reflecting the “basic” wages of employees, one-time accruals, as well as deductions in tax and accounting accounts, you must use the “Methods of reflecting wages in accounting.”

Moreover, each individual element of the directory is a correspondence of accounts containing elements of analytics (if necessary). Please note that this directory contains several predefined elements.

If there is a need for this, the user can independently complete the addition of the directory. An important point: tax transactions do not need to be entered here. This is due to the fact that their formation occurs automatically.

Using “Methods of reflecting salaries in accounting” you need to create template entries to reflect salaries in 1C:UPP.

Using “General business expenses account 26”, transactions will be created to reflect the salaries of the managerial level and will be marked as an expense item.

Using the “Main production 20 account” reflection method in 1C:UPP, the postings necessary to reflect the wages of the organization’s production personnel will be created. The expense item will be the item “Salaries (Production Expenses)”.

Calculation of insurance premiums

Account 70 is not included in postings for insurance premiums, because they are not accrued to employees and are not deducted from their salaries.

Insurance premiums are included in the cost of production, i.e. pass through the debit of accounts 20 (26, 29, ...) or 44 in correspondence with account 69 “Calculations for social insurance and security”. 69 accounts usually have subaccounts for each contribution. Wiring:

Convenient online accounting

Quick establishment of a primary account, automatic payroll calculation, multi-user mode in Kontur.Accounting

Try it

D20 (44, 26, …) K69

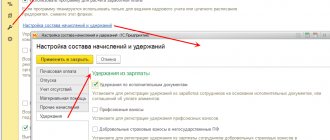

Setting up accounting entries for accruals

Postings are the reflection of wages in regulated accounting. Please note that postings for accruals are entered in several available ways. Below we will discuss the main possibilities for entering transactions, and then they will be ranked in order of priority.

Accounting for the basic earnings of employees of organizations

It is possible to specify the rules for reflecting the salaries of company personnel in the form of the “Organizations” directory. Moreover, in this case, “Accounting for the main earnings of an organization” is used.

If you open the “Organizations” directory, you can select a suitable company.

Next, you need to pay attention to the “Salary accounting” tab and click on “Set salary accounting for the organization”, after which “Salary accounting for the organization’s employees” will open. In order for all wages of the company’s employees to be taken into account using the “General business expenses account 26” method of reflection, a corresponding entry must be added to the register.

Accounting for the basic earnings of employees of organizational units

For example, you need to open the “Divisions” directory and select the appropriate division.

Next, after clicking, “Salary accounting for department employees” will open on the “Salary accounting” tab. To account for all wages of personnel of a particular department according to the method of reflection “General expenses 26 account”, you need to make a corresponding entry in the register.

To record the wages of department personnel using the “Main production 20 account” method of reflection, you need to open the corresponding department and make a certain entry in the register.

Document “Accounting for the basic earnings of employees of an organization in regulated accounting”

It is recommended to use it to register changes in the reflection of wages of enterprise employees in regulated accounting. It can be introduced on the basis of a person’s admission to a certain place of work.

When carried out, this document creates an entry in the “Accounting for basic earnings in regulated accounting for employees of organizations.” For example, for a specific employee, you should select a specific reflection method from the “Methods of reflecting wages in accounting.”

Document “Inputting the distribution of the basic earnings of the organization’s employees”

This document is intended to register the distribution in accounting of the basic earnings of employees according to different methods of reflection in a certain proportion for the current month. You can find the document if you go from “Calculation of salaries of organizations” to the “Salary accounting” menu, and then to “Entering information on the distribution of basic earnings of employees.”

Thanks to the document, you can assign the following distribution of remuneration to a previously selected employee: for example, eighty percent according to the “Main production 20 account” method and twenty percent according to the “General business expenses 26 account” method.

Document “Entering information on regulated accounting of planned accruals for employees of organizations”

To register changes in the reflection of permanent accruals of company employees in regulated accounting (except for basic wages), you should use this document. Thanks to it, when posting, you can make an entry in the “Regulated accounting of planned accruals to employees of organizations.”

Using this document, you can assign to a previously selected employee salary accounting using the “General business expenses 26th account” method, and accounting for the regional coefficient using the “Main production 20th account” method.

Setting up calculation types

To configure the distribution of not only accruals, but also deductions across accounting accounts, you can resort to plans for the types of calculation “Basic accruals of the organization” (or “Additional accruals of the organization”).

Let’s open the first plan of calculation types and select the accrual type “Salary on weekdays”. When going to the “Accounting and UTII” tab, select “General business expenses account 26”.

Priority when entering transactions for accruals

During completion, transactions are determined based on the ways in which they were assigned. Additionally, the priority for accruals must be observed depending on the method in which the posting was assigned (on a descending basis):

- Postings that were generated by the “Loan Agreement”, “Agreements for the performance of work with individuals”, “Piecework earnings”, “Accrual for sick leave of organizations”.

- Postings that were entered by such a document as “Entering information on accounting for planned accruals to employees of organizations.”

- Postings that were entered through setting up calculation types.

- Postings that were entered by the document “Entering information on accounting for the basic earnings of employees of organizations.”

- “Divisions”, “Accounting for salaries of department employees”.

- “Organizations”, “Accounting for the main earnings of an organization”.

- Reflection of accruals by default in “Methods of reflecting salaries in accounting.”

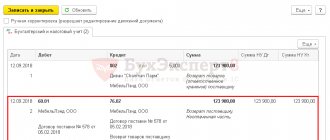

Document “Reflection of salaries in regulated accounting”

The document is used to automatically create entries for both accounting and tax accounting of accrued wages. If you click on the “Fill” button, all information about the calculation performed will be indicated in the document as follows:

- “Basic accruals” will contain the expected reflection in both types of accounting (tax and accounting). This occurs taking into account the reflection rules that are in the information base.

- The “Additional charges” tab is similar in terms of additional charges.

- The “Transactions” tab displays summary transactions for reflecting wages in both types of accounting (accounting and tax).

Deduction from wages: postings

The general rule when creating entries for deduction from salary is that the amount of deduction is always reflected in the debit of the account. 70 regardless of its type:

- Dt 70 Kt 68.01 - personal income tax withheld;

- Dt 70 Kt 76 - withheld according to a writ of execution;

- Dt 70 Kt 73.01 - the employee’s debt on the loan issued is withheld;

- Dt 70 Kt 73.02 - withheld to compensate for material damage caused by an employee.

There can be many types of deductions and each requires a document giving the accountant the basis for the deduction.

Such documents include writs of execution, employee statements or accounting calculations used in cases established by law. An accounting certificate will be needed when calculating personal income tax on material benefits and on income paid in kind.

SCP support from the First BIT company

SLA support is a specialized support service for corporate systems. The service allows you to get the expected result from maintaining information systems at a fixed price and within a specific time frame.

Technical support for corporate systems (including the 1C: Manufacturing Enterprise Management platform) is carried out in accordance with the International Industry Standards ITIL (IT Infrastructure Library) under the SLA (Service Level Agreement).

For whom: The service is recommended for medium and large businesses who want to receive information systems (IS) support according to international standards and at the same time reduce maintenance costs by up to 60%.

What are the benefits of SLA?

- Up to 70% savings in support costs;

- You don't need to maintain your own support staff;

- Specific and measurable parameters of quality, processing time for requests and resolution of issues specified in the contract;

- Payment is not for the work of a specialist, but for the absence of downtime and a guaranteed solution to problems;

- Financial responsibility for the quality of support and performance of information systems falls on us;

- Clear and transparent control system and appeal management;

- Projected budget;

- Personal manager and support;

- Monthly detailed package of documents with reporting for each application.

Do you need 1C support? Just fill out the form. We will call you back within 10 minutes and find the best solution for you!

Awards

Bonuses are incentive payments that are paid to employees for conscientious performance of job duties or achievement of certain performance indicators. Bonuses are paid within the time limits established by the collective agreement or local regulations of your organization (Articles 129, 191 of the Labor Code of the Russian Federation, Letter of the Ministry of Labor dated 02/14/2017 N 14-1/OOG-1293, Information from Rostrud).

In accordance with Art. 144 of the Labor Code of the Russian Federation - bonuses may be provided for by the remuneration system. The remuneration system adopted by the enterprise may provide for the payment of bonuses to a certain circle of people based on established specific indicators and bonus conditions. It is these bonuses that are included when calculating average earnings. When paying one-time bonuses, the circle of bonuses is not defined in the remuneration system. These bonuses are not included when determining average earnings. Bonuses are awarded on the basis of the bonus order.

Bonuses provided for by the remuneration system must be approved in a local regulatory document, that is, in the regulations on bonuses adopted by the organization. This provision must contain: bonus indicators; bonus conditions; size and scale of bonuses; circle of employees receiving bonuses; source of bonuses. In accordance with the bonus regulations, the amount of the bonus is determined by the employee’s specific performance results.

One-time incentive bonuses are awarded by decision of the enterprise administration. To accrue them, a provision on bonuses is not required; their accrual is also formalized by order.

Depending on the source of financing, premiums can be paid out of profits, and can also be included in the costs of the enterprise.

Debit 84 Credit 70

— the shareholders or participants of the company made a decision on the distribution of profits, in particular the payment of a bonus at the expense of the profits generated at the time of distribution.

In other cases, it is calculated from the same account as the employee’s salary directly:

Debit 20 Credit 70

— payment of bonuses to workers of the main production.

Debit 23 Credit 70

— the accrual of bonuses to workers in auxiliary production will be reflected in the posting.

Debit 25 Credit 70

— awarding bonuses to employees servicing the main production.

Debit 26 Credit 70

— awarding bonuses to management employees.

Debit 91 Credit 70

- accrual of bonuses for work, the costs of which are not taken into account as expenses.

Debit 08 Credit 70

— calculating bonuses to workers for capital costs.

Accrued bonuses are taken into account in the employee’s total income when determining the tax base for personal income tax and are taxed in the generally established manner at a rate of 13%. In accounting, the accrual of income tax is reflected in the following entry:

Debit 70 Credit 68, subaccount “NDFL”

— personal income tax is withheld from the premium.