On Thursday, January 23, State Duma deputies in the third reading adopted a law aimed at protecting the housing rights of a child in the event of the divorce of parents. According to the document, the Family Code is supplemented by a norm obliging parents who are unmarried or divorced to provide housing for their children.

According to the vice-speaker of the lower house of parliament Olga Epifanova , before the adoption of the amendments, there was a rule according to which a parent can demand from the ex-spouse - the father or mother of the child - reimbursement of expenses associated with the treatment of a common child. According to the adopted amendments, parents must pay additional amounts to child support not only in case of problems with the child’s health, but also in the presence of certain housing problems. At the same time, it will be possible to recover money for housing for a child from one of the parents not only immediately after the divorce. This can be done if, for example, minor children lose their housing due to a fire, emergency or other reasons, even several years after the divorce of their parents.

Will alimony recipients be banned from getting married? More details

What happens to your mortgage after divorce?

After divorce, the mortgage can be distributed between spouses in several ways:

- If the apartment was purchased on credit before the marriage was formalized, then the debt obligations are paid exclusively by the citizen who purchased it.

- If the spouses have entered into a marriage contract, then the loan goes to the person who owns the property.

- If, upon divorce, the common property was divided through a notary office, then the calculation of debts is carried out taking into account the share received in the property.

- If the mortgage issue is resolved through the courts, then the obligations are distributed equally between the parties.

It is worth noting that the methods described above relate to the settlement of debt disputes between husband and wife; no changes are provided for the creditor. According to the general rule of an agreement concluded with a credit institution, the bank may require payments from any of the citizens.

Benefit amount

Until today, the benefit was assigned in the amount of 50% of the regional subsistence minimum per child.

This year, if, when paying this benefit, the average per capita family income does not reach the regional subsistence level, then the benefit will be assigned in the amount of 75% of the subsistence minimum.

If, with an increase in the payment, the average per capita income in the family does not rise to the level of the subsistence minimum, then the benefit will be assigned in the amount of 100% of the subsistence minimum.

Is alimony reduced if there is a mortgage?

To correctly answer this question, you need to study in more detail the situations associated with the purchase of mortgage housing.

- If the property was purchased by one of the spouses before marriage and the birth of a child, then in the event of a divorce it is not subject to division. Mortgage payments also remain with the owner of the apartment, regardless of the child’s registration in it;

- if the mortgage was taken out during marriage, then after the divorce the housing will be recognized as jointly acquired property and, along with the mortgage debt, will be divided equally.

In general, the circumstances of the purchase of a home and the person paying the loan (one parent or both) do not in any way affect the collection of alimony for the maintenance of a common child, since alimony is the primary responsibility of the parents, which must be fulfilled regardless of the presence or absence of debts.

As it was before

Is paying off a mortgage with alimony a violation?

- Persons working without registration, for example, freelancers, part-time workers.

- Persons who receive remuneration for their work in foreign currency or in kind (food products, industrial goods).

- Individuals with irregular or variable income, such as entrepreneurs or investors.

By clicking “Ask a question” I agree to the privacy policy and user agreement.

How is alimony collected if you have a mortgage?

The distribution of mortgage obligations can be made on a voluntary basis or in court; there are several classic forms that spouses use upon divorce.

Concluding a peace agreement regarding who gets the apartment and who will repay the loan. Most often, this happens when one of the spouses cannot make monthly contributions in full or at least half of them, for example, a woman on maternity leave has income that is clearly less than upcoming expenses, so she is unlikely to be ready to take responsibility for the mortgage .- One of the parties gives the other part of the previously contributed joint money and keeps the apartment, along with future payments, for itself.

- The mortgage loan (as well as real estate) is divided equally between the ex-husband and wife, so payments are made in equal shares.

Important! Regardless of whether a peace agreement was concluded or the future fate of the apartment was in the hands of a judge, alimony penalties are assessed in any case. The alimony payer will have to give part of his own or pay financial assistance in a fixed amount.

How to get an increased benefit for those who already receive it at the old rate

You need to resubmit the application on the State Services portal (federal or regional portal) or in person at the MFC or social security authorities.

Families who had previously been assigned a monthly payment for 12 months can apply for its assignment in a new amount starting from April 1, 2021 until the end of 2021.

Social security authorities will check information about income and property, and if the family is low-income, the required amount of payment will be calculated. In addition, the family will receive an additional payment for the first 3 months of 2021.

How to reduce the amount of alimony through the court

It is impossible to reduce the payment of alimony solely because of the mortgage; in order for the court to satisfy the claim from the alimony payer, he must prove the occurrence of other exceptional circumstances:

- serious illness of the payer himself or his close relatives, due to which he will have to incur additional financial expenses;

- retirement or disability.

You can refer to the payment of a mortgage loan only when the property is directly related to a minor child, that is, he is registered in the apartment or has a share in it.

First of all, the interested citizen should apply to the magistrate’s court with a claim to reduce the amount of alimony, and then confirm insolvency, citing a reduction in wages, dismissal from work against his own free will, disability, or the presence of a mortgage loan.

After assessing all the circumstances and needs of the child, the judge makes a decision on the advisability of adjusting the amount, taking into account the interests of all parties to the legal relationship.

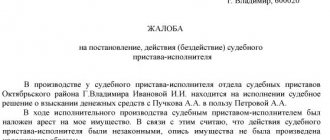

Sample statement of claim to reduce the amount of alimony for a mortgage

A claim for a reduction in alimony payments for a mortgage is subject to standard requirements: the document must be in writing and contain the following information:

- Name of the judicial authority, information about the plaintiff and defendant.

- In the main part, the applicant describes the current situation, namely, on the basis of what financial assistance is paid, to whom and in what amount.

- Next, the alimony payer must list the arguments in favor of reducing the amount (the presence of dependents, disability) and indicate the desired amount of alimony if it is paid in a fixed amount.

- The application is supplemented by a package of documents: a copy of the passport, a child’s birth certificate, a writ of execution, loan receipts for recent months, a disability certificate, etc.

New law on child support for housing

Housing alimony A woman left with a minor child after a divorce often does not have her own home, and sometimes does not even have the means to rent a living space. The currently provided alimony paid by the second parent for the maintenance of children cannot always help in this situation. In October 2021, the Government introduced a bill on the collection of “housing alimony” to the State Duma. On January 23, 2021, the draft law was adopted in the final, third reading. On February 6, 2020, it was signed by the President of the Russian Federation. The law came into force on February 17, 2021.

Payment of a mortgage loan towards alimony payments

Alimony collected in court is assigned to meet the primary needs of the child, so it is impossible to demand repayment of the mortgage instead of classic alimony.

The only legal way out of this situation is to conclude a voluntary agreement at a notary’s office, on the basis of which, instead of standard monthly payments, the alimony payer will pay a certain amount to a credit institution as mortgage obligations from the mother.

Only in this case the legal rights of the child are not violated, because the money that would have been spent by the guardian to pay off the debt will now remain in the family and will be spent on the child.