We are accustomed to calling advance payment of wages an advance payment of wages. As a rule, employers, when paying an advance, do not think much about the correctness of setting its size, compliance with the deadline and procedure for payment. And some do not pay it at all, limiting themselves to one salary payment per month. Meanwhile, the advance is the same salary, only for half of the month worked. According to the Labor Code, it is mandatory to pay it. At the same time, it is also necessary to correctly establish its size, term and conditions of payment. We will talk about the rules for paying an advance on wages, the procedure for reflecting it in accounting, as well as the need to calculate personal income tax on its amount in this article.

Mandatory advance payment

The obligation to pay an advance on wages is indicated by Art.

136 Labor Code of the Russian Federation. According to its provisions, wages must be paid at least every half month. Thus, paying wages once a month is a violation of labor laws. Administrative liability is provided for violation of labor legislation.

It should be borne in mind that the employee’s statement of consent to receive wages once a month does not relieve the employer from liability. Rostrud specialists draw attention to this in Letter No. 472-6-0 dated 03/01/2007.

Provisions of Art. 136 of the Labor Code of the Russian Federation are imperative, that is, mandatory for execution. Labor legislation does not provide for any exceptions to the established rule. It does not matter where a person works: at his main place or part-time. Thus, in relation to part-time workers, the employer is also obliged to pay wages in two parts: advance and payment (Letter of Rostrud dated November 30, 2009 No. 3528-6-1).

What happens in practice

As you can see, the calculation method proposed by legislators is quite labor-intensive. This leads to doubling of calculations for accounting employees. Essentially, they have to count their salaries twice a month instead of one final count.

To simplify things, employers set a specific percentage in the local documents of the enterprise. Advance - what part of the salary? Usually this is 40-50% of the official salary. However, simply indicating a specific percentage in the employment contract will be incorrect. For example, if an employee is on vacation or sick leave, then in this case he will still have to pay an advance payment. After all, there are no indications of actual time worked.

Moreover, indicating exactly 50% is also incorrect. Since deductions are made from wages: personal income tax, and there may also be writs of execution and voluntary deductions (for example, in favor of insurance premiums). Therefore, this must be taken into account when determining the advance (what percentage of the 2019 salary).

As a result, both options are acceptable for use in practice: both percentage and actual calculation. However, if the employer decides to calculate advance amounts using the percentage method, he must be prepared for fines from the labor inspectorate. Read more about this in the article “What advance payment to pay to employees to avoid a fine of 50,000 rubles.”

Deadlines for payment of wages

According to the new[1] version of Art.

136 of the Labor Code of the Russian Federation, in force since October 3, 2016, the specific date for the payment of wages is established by internal labor regulations, a collective or labor agreement no later than 15 calendar days from the end of the period for which it was accrued. If the payment day coincides with a day off or a non-working holiday, wages are paid on the eve of this day (Part 8 of Article 136 of the Labor Code of the Russian Federation).

For example, an advance for the first half of August cannot be paid later than August 30, and wages for the second half (calculation) cannot be paid later than September 15.

Thus, the Labor Code contains a requirement for the maximum permissible period of time between payments of parts of the salary while regulating specific terms for its payment at the employer level.

For incorrectly setting the deadline for paying the advance, as well as violating it, the employer will have to pay a fine.

Accrual and issuance of an advance: what is important to remember

When calculating and issuing advance amounts, you need to pay attention to some nuances:

- Deadlines. If the deadline for issuing the main part of the salary is set, for example, in the middle of the month (15th day), then the advance must be issued no later than the last (30th or 31st) day of the same month. In this case, according to the provisions of the Tax Code of the Russian Federation, personal income tax should be withheld from the advance (Article 223-2 of the Tax Code of the Russian Federation) - the last day of the month is the day the income was received, and the advance, as legislators themselves recognize, is part of the payment. At the same time, letter No. 14-1/ОOG-549 of the Ministry of Labor dated 05/02/19 prohibits reducing the advance by 13%, subtracting personal income tax from it. What should management and accountants do? In our opinion, this problem can be solved by postponing the deadlines for issuing advances and salaries in the organization, registering them in local acts and observing an interval of 15 days; do not issue an advance on the last day of the month.

- Dates. In the LNA or collective agreement, it is necessary to indicate unambiguous, specific dates for the issuance of payments, and not an interval or deadline. When audited by the management, it will be difficult to prove that there was no violation of the terms of payment of the advance payment upon the fact.

- Weekends and holidays. It is prohibited to miss the deadline for paying an advance even if the date specified in the LNA coincides with the days of rest. In this case, management is obliged to issue an advance the day before.

- Advance as a percentage of salary. Now it can be used only if the employee has worked the period covered by the advance in full. Otherwise (for example, the employee was on vacation or was sick), such a calculation is prohibited: actual earnings at the end of the month may not cover the advance. If there are no accruals for the second half of the month, it will be impossible to withhold income tax.

- Newly hired employees. The regulatory authorities consider that general rules apply to this category. Conclusion: even if a new employee worked for several days (one day), the advance should be calculated taking into account the time worked and issued.

On a note! On the issue of payment of income tax on advance payments paid on the last day of the month, both the Ministry of Finance (letter No. 03-04-06/69181 dated 11/23/16) and the judges (determined by the Supreme Court No. 309-KG16-) are arguing with the tax authorities. 1804 FROM 11/05/16).

On a note! The fixed advance amount does not take into account actual work time and actual payments. It is risky to use this method of advance payment.

Summing up

- The advance, in other words, the first part of the salary, is issued once every half month. The terms reflected in the collective agreement, labor agreement, LNA must be fixed.

- The advance is calculated taking into account the actual time worked.

- Included, in addition to salary, are all payments that can be determined at the time of calculation.

- The advance as a percentage can only be calculated if the employee has worked the entire period.

- Issuing fixed advance amounts may lead to a conflict with regulatory authorities.

- For new employees, the advance is calculated and issued on a general basis.

- It is prohibited to reduce the advance payment by the amount of personal income tax. Personal income tax is deducted from the salary upon final payment to the employee for the month.

Setting the advance amount

Often the amount of the advance is set at a certain integer, constant value.

Moreover, for some, this value is approximately 40% of the total salary for the month, for others - 30%, etc. According to the author, since the advance is the same salary, only for the first half of the month, it is impossible to formally approach the establishment its size.

Despite the fact that the Labor Code does not regulate the specific amounts of the advance, specialists from Rostrud and the Ministry of Labor note: when determining the amount of wage payment for half a month, the time actually worked by the employee (the work actually performed by him) should be taken into account (letters dated 02/03/2016 No. 14-1/ 10/B-660, dated 09/08/2006 No. 1557-6).

Thus, with the advance method of calculating wages for each half of the month, wages should be accrued in approximately equal amounts (Letter of the Ministry of Health and Social Development of the Russian Federation dated February 25, 2009 No. 22-2-709).

Based on the above, the advance payment should be set in the amount of wages accrued for the days worked in the first half of the month based on the submitted time sheet. Since the amount of wages varies from month to month, the amount of the advance cannot be a constant, round amount.

The Ministry of Labor recommends

Officials declare: the abstracts of the documents are not normative acts or explanations to them, however, the letters set out the official position of the Ministry, therefore, during inspections, inspectors will be guided by it. The main idea contained in the document (No. 14-1/B-725 dated 08/10/17): the advance should be calculated taking into account the actual time worked for the corresponding period.

If an employee receives a salary and additional payments (allowances) of a fixed nature every month, both parts of the salary should be included in the calculation of the advance payment. At the same time, additional payments (allowances), which cannot be taken into account before the full calculation of wages, are not included in the advance payment. For example, an employee combines two positions, the additional payment for the combination is known in advance and is taken into account in the calculation. It is impossible to calculate the bonus until the end of the period and the performance indicators influencing it are identified. It is not included in the advance payment.

Important! Regional coefficients apply only to the full amount of earnings for the month; they are also not included in the advance payment, only in the final calculation for the month (Doc. No. 11-4/OOG-718 dated 04/18/17).

Letter 14-1/OOG-549 dated 05/02/19 generally repeats the provisions previously issued by the Ministry of Labor (payment of wages once every half month, reflection of deadlines in the LNA, payment of an advance in proportion to the time worked, inclusion in the calculation of salary, rates and permanent allowances). At the same time, the document also contains one significant innovation: a ban on the so-called personal income tax reservation when calculating and issuing an advance. Previously, when calculating an advance, the accountant applied a coefficient of 0.87 to it, i.e. reduced the amount by 13% for personal income tax. This is now prohibited as it is considered by officials as discrimination against workers.

Conclusion from the new letter from the Ministry of Labor: regardless of the remuneration system, the employee must be paid the amount actually earned for the first half of the month, and personal income tax must be taken at the final payment for the month, at the end of the month for which wages are calculated.

Question: Until recently, salaries in our organization were paid twice a month. Currently, they offered to write a statement refusing the advance payment and stated that the salary would be calculated once a month. Is this legal? View answer

Example

The salary of accountant Ivanova is 35,000 rubles. In March, from 1 to 15, she acted as a senior accountant with an increase of 25% of his salary. The salary of a senior accountant is 50,000 rubles. According to the calendar of a five-day working week in March, there are 20 working days. Ivanova worked completely for half a month.

Advance on salary: 35,000/20*10= 17,500. Additional payment: 50,000/20*10*25% = 6,250. Total advance accrued: 17,500 + 6,250 = 23,750. The advance payment to accountant Ivanova is 23,750.00 rubles. Personal income tax is not deducted from the advance payment.

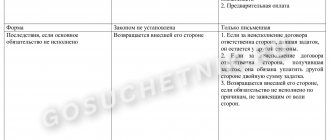

Other conditions for advance payment

Otherwise, the same conditions apply to the payment of the advance as for the payment of monthly wages.

Let us remind you that according to Art. 136 of the Labor Code of the Russian Federation, wages are paid to the employee, as a rule, at the place where he performs the work or is transferred to the credit institution specified in the employee’s application, under the conditions determined by the collective or labor agreement. The employee has the right to change the credit institution to which the salary should be transferred by notifying the employer in writing about the change in the details for transferring the salary no later than five working days before the day of its issue.

The amount of the advance paid (as a component of wages) is indicated in the payslip, the form of which is approved by the employer, taking into account the opinion of the representative body of employees.

Results

Advance is called part of the salary for the first six months. In 2021, the salary advance is calculated based on the time actually worked for this period, including additional payments and allowances, which can be calculated without waiting for the end of the month. Advance payments and final payroll cannot be issued later than 15 days from the date of completion of the periods for which they are calculated.

Sources:

- Labor Code of the Russian Federation

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Responsibility for violating the terms of advance payment

Violation of the deadline for payment of advance wages, establishment of its amount, as well as other conditions of payment provided for by labor legislation, entails the imposition of an administrative fine under Art.

5.27 Code of Administrative Offenses of the Russian Federation. It is worth noting that from October 3, 2021, Federal Law No. 272-FZ dated 07/03/2016 introduces a separate fine for violating the terms of payment of wages (including advance payments) in the amount (clause 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

– from 10,000 to 20,000 rubles. in relation to officials;

– from 30,000 to 50,000 rubles. in relation to legal entities.

For a similar repeated offense, liability will be increased. The official faces a fine of 20,000 to 30,000 rubles. or disqualification for a period of one to three years, for a legal entity - a fine of 50,000 to 100,000 rubles. (clause 7 of article 5.27 of the Code of Administrative Offenses of the Russian Federation).

For other violations of labor legislation (including violations of the conditions for payment of advance payments) the following is provided (clauses 1, 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

a) in the case of a primary violation:

– fine from 1,000 to 5,000 rubles. (for officials);

– fine from 30,000 to 50,000 rubles. (for legal entities);

b) in case of repeated violation:

– fine from 10,000 to 20,000 rubles. or disqualification for a period of one to three years (for officials);

– fine from 50,000 to 70,000 rubles. (for legal entities).

How is an advance calculated as a percentage of salary?

Some employers prefer to set the amount of the advance as a percentage of the salary according to the staffing table. This approach reduces the amount of accrual work, but payments do not take into account actual time worked.

Example

At Vympel LLC, the advance is 40 percent of the salary. Poletaev’s employee has a salary of 28,000 rubles. How the accounting department will determine the advance amount:

28,000 x 40% = 11,200 rub.

Since personal income tax is not withheld from the advance, Poletaev will receive 11,200 rubles in his hands.

However, the State Labor Inspectorate believes that the advance should be calculated based on the actual time of work or taking into account the volume completed (explanation on the official ]]>website of Rostrud]]>).

Accounting (budget) accounting of advance payment transactions

Not so long ago, account 0 206 11 000 “Calculations for advances on wages and accruals for wage payments” was introduced into the charts of accounts of accounting (budget) accounting of state (municipal) institutions, as well as instructions for their use, in particular:

– to the Unified Chart of Accounts and Instruction No. 157n[2] – by Order of the Ministry of Finance of the Russian Federation dated 01.03.2016 No. 16n;

– in the Chart of Accounts of Budget Accounting and Instruction No. 162n[3] – by orders of the Ministry of Finance of the Russian Federation dated 08/17/2015 No. 127n and dated 11/30/2015 No. 184n;

– in the Chart of Accounts for accounting of budgetary institutions and Instruction No. 174n [4] – by Order of the Ministry of Finance of the Russian Federation dated December 31, 2015 No. 227n;

– in the Chart of Accounts of Autonomous Institutions and Instruction No. 183n [5] – by Order of the Ministry of Finance of the Russian Federation dated December 31, 2015 No. 228n.

The specified account applies from 2021.

By virtue of clause 202 of Instruction No. 157n, account 0 206 00 000 takes into account settlements for advance payments provided by the institution in accordance with the terms of concluded agreements (contracts), agreements (except for advances issued to accountable persons). At the same time, it is not specified which agreements we are talking about. Thus, the provisions of this paragraph can be fully extended not only to civil contracts concluded with suppliers (contractors, performers), but also to employment contracts concluded with employees of an institution, which stipulate the conditions for the payment of advance wages.

With the introduction of account 0 206 11 000 in instructions No. 162n, 174n and 183n, only one accounting entry was added for its use - an entry to reflect the employee’s wage arrears arising from the recalculation of wages previously paid to him (Account debit 0 302 11 000 / Credit accounts 0 206 11 000). This accounting entry is prepared using the “red reversal” method.

The question arises: is it necessary to use this account for the generally accepted (monthly) payment of advance wages, since there are still no such entries in the specified instructions?

According to the author, in order to put into practice the additionally introduced accounting entries for accounting in account 0 206 11 000 of the amounts of excess wages accrued, institutions must initially reflect the payment of advances on wages in this account. Based on this, operations for the calculation and payment of wages must be accompanied by the following accounting entries:

| Contents of operation | State and budgetary institutions | Autonomous institutions | ||

| Debit | Credit | Debit | Credit | |

| Advance payment of wages for the first half of the month was paid | 0 206 11 560 | 0 201 34 610 0 201 11 610 (only for budgetary institutions) 0 304 05 211 (only for government institutions) 0 201 21 610 | 0 206 11 000 | 0 201 11 000 0 201 21 000 |

| Monthly salary accrued for actual hours worked | 0 109 00 211 0 401 20 211 | 0 302 11 730 | 0 109 00 211 0 401 20 211 | 0 302 11 000 |

| The advance has been offset | 0 302 11 830 | 0 206 11 660 | 0 302 11 000 | 0 206 11 000 |

| An overpayment of wages was identified as a result of recalculation (in terms of amounts subject to deduction from future wage accruals with the consent of employees). The posting is reflected using the “red reversal” method | 0 302 11 830 | 0 206 11 660 | 0 302 11 000 | 0 206 11 000 |

Taking into account the current ambiguous situation with the reflection in accounting (budget) accounting of transactions for the payment of salary advances, we recommend that the use of account 0 206 11 000 for these purposes be agreed upon with the founder and fixed in the accounting policy.

How is a salary advance calculated for piecework wages?

The piecework worker's salary depends on output. Specific prices are set by the employer.

Example

The plant's accounting department pays piece workers an advance payment based on the number of parts processed. Turner Smirnov's price is set at 20 rubles. for every detail. From June 1 to June 15, Smirnov managed to process and transfer 950 pieces to the quality control department, so the advance payment was given to him in the amount of:

950 pcs. x 20 rub. = 19,000 rub.

In any case, the timing of payment of funds to employees does not depend on the form of remuneration.

The employer does not pay an advance

If an employer neglects his obligation to pay remuneration for work at least twice a month, this is a direct violation of the law. Such an administrative offense is subject to punishment, according to Article 5.27 of the Code of Administrative Offenses of the Russian Federation:

- officials who established an unlawful procedure for calculating salaries will have to pay a fine in the amount of 1-5 thousand rubles, and in the event of a relapse of such a violation - 10-20 thousand rubles, and possibly receive disqualification for 1-3 years;

- Individual entrepreneurs are required to provide at least two-time payments, otherwise they face a fine of 1-5 thousand or 10-20 thousand in case of repetition;

- a legal entity is liable to its employees for a fine of 30-50 thousand rubles, and repeated involvement is fraught with amounts of 50-70 thousand rubles.

IMPORTANT! The amount of fines is paid to the budget. Additionally, an employee who has suffered from late payment of salary has the right to demand compensation for its delay (Article 235 of the Labor Code of the Russian Federation).

Also read: where to go if you don’t get paid

When is the advance paid?

The date separating the payment terms is chosen by the enterprise arbitrarily. The law does not give strict instructions in this regard, however, there are recommendations from Rostrud, the Ministry of Social Development of the Russian Federation and the Federal Service for Labor and Employment, based on the logic of things.

When is the advance payment and the second part of the salary paid ?

Since remuneration for labor must be paid for the time actually worked and occurs twice a month, it is quite logical to divide the month approximately in half and choose the 15th-16th as the payment date.

FOR YOUR INFORMATION! With this choice of payment dates, it is recommended to divide the salary into approximately equal parts.

However, in the absence of strict legal requirements, the entrepreneur has some freedom in choosing dates for salary payments. You just need to take into account some nuances:

- it is allowed to divide payments not necessarily into 2 parts, you can split the salary into smaller shares, paying it three or four times a month, then the logic for setting dates will be different;

- if the gap between the advance and pay is more than 15 days, then according to the law, the employee theoretically has the right to complain about the delay in wages, suspend work and even go to court;

- the selected time periods must be recorded in the internal documents of the organization.

NOTE! The time for paying the advance must be a specific date, not a period. It is impossible to schedule advance payments, for example, from the 5th to the 10th, and paydays from the 25th to the 30th. Thus, the requirement to comply with the frequency of payments is violated.

If the appointed date coincides with a weekend or holiday, the employee will receive the required advance payment the day before.

Question: Is it necessary to calculate and transfer personal income tax to the budget from an advance payment of wages (clause 2 of Article 223, clause 6 of Article 226 of the Tax Code of the Russian Federation)? View answer