Legal regulation of the issue

In cases where there are several creditors or several debtors in an obligation, each of the creditors will be able to demand the fulfillment of obligations, and each defendant is obliged to fulfill his obligations to the plaintiff, unless otherwise provided by regulations or law (Article 321 of the Civil Code of Russia).

Therefore, it would be useful for defendants in such cases to find out what it means to jointly collect a debt before the start of the trial. We are talking about joint and several obligations when the solidarity of demands or the solidarity of obligations is established by law or provided for by the relevant agreement.

Legal standards

Issues of joint liability (debt) are regulated by the Civil Code of the Russian Federation (Articles 322, 323, etc.).

This document must be studied before taking any action related to the division of joint and several debt through the courts or by concluding an appropriate agreement.

Article 323 of the Civil Code of the Russian Federation provides for the right of a creditor to demand fulfillment of an obligation both from one of the joint and several debtors and from all joint and several debtors at the same time. By virtue of Article 325 of the Civil Code of the Russian Federation, a debtor who has fulfilled a joint and several obligation has the right of recourse against the remaining debtors in equal shares, minus the share falling on himself.

What forms of joint and several debt are there?

Due to the fact that various legal relationships arise in civil trade, in practice there are several forms of joint and several debt. Let's look at them in more detail.

Passive form of joint and several debt

In the passive form, joint and several debt arises on the part of the debtors. That is, there is one creditor and two or more debtors who are liable to him for a debt obligation. Each of them can pay off the debt regardless of the size of their own share.

Example 1. After the death of Stepanov A.V. his property was inherited by two sons Stepanov N.A. and Stepanov E.A. The estate includes an apartment acquired by the testator during his lifetime on a mortgage. The heirs accepted the property as an inheritance, and therefore became joint and several debtors on the mortgage loan.

Active form of joint and several debt

In the active form, one debtor is liable for debt to several creditors. Any of the creditors has the right to demand full repayment of the debt from him. Payment of a debt in full to one creditor releases the debtor from obligations to other joint creditors.

Example 2. Spouses Afanasyev D.A. and N.E. entered into a purchase and sale agreement for an apartment with E.V. Gutorova. The buyer transferred the money for the property to D.A. Afanasyev, for which a receipt was issued in his name. Obligations to joint creditors were terminated. The funds entered the family budget and acquired the status of joint property.

Mixed joint and several debt

The latter form of joint and several debt obligation is rare. Several people participate in this legal relationship, both on the part of the creditor and on the part of the debtor. Joint and several obligations acquire a reciprocal nature.

Is it possible to divide a joint and several debt?

Many citizens who have become joint and several debtors decide not to pay another person’s debts. At some point, other debtors begin to evade their obligations, which leads to the fact that all responsibility for the debt falls entirely on one person.

In addition to the principal debt, interest for the use of other people's funds or contractual penalties is added, which increases the total amount of debt. In this regard, there is a need to divide the joint debt.

Civil legislation allows for the division of joint and several debts on a loan, writ of execution, utilities and other obligations.

By loan

Most often, the division of joint and several loan debts is carried out when dividing the joint property of the spouses. For example, during their marriage, a husband and wife purchased an apartment with a mortgage, which acquired the status of jointly acquired property.

If the spouses have not entered into a prenuptial agreement under which the apartment and debts are transferred to the husband or wife, then they can divide the apartment and mortgage debt upon divorce. Each of them receives 1/2 of the ownership of residential real estate, and also assumes the obligation to repay half of the debt to the bank.

The division of debt is formalized by two loan agreements, which are concluded with each of the spouses. In the future, the ex-husband and wife are independently responsible for their half of the loan debt.

You should know! The division can be carried out in such a way that all rights to housing are transferred to one spouse, and the second is paid compensation for his share. The obligation to pay the loan also passes to the person who has become the sole owner of the apartment.

According to the writ of execution

It happens that the court issues a writ of execution to collect debt from several people at once. The bailiff is not obliged to divide the amount of debt by the number of debtors and collect equal amounts from them. Recovery is made from the person whose property is found the fastest.

After repaying the debt, debtors decide on dividing the paid amount in certain shares with payment of compensation to the citizen who paid the entire amount of the debt. If one of them avoids reimbursing his part of the debt, the issue is resolved by filing a claim by way of recourse.

For utilities

Family members living in the same apartment bear joint obligations to pay for utilities. If one of them systematically does not pay bills or refuses to pay their share for the use of utilities, the question arises of dividing the debt for the apartment between the residents.

The most convenient option is to split the personal account, after which each tenant will be issued a separate receipt indicating the payment amount corresponding to his share. Residents draw up an agreement on payment for housing and communal services, determining the shares of each of them and transfer it to the RCC.

Legal standards

Joint and several compensation of debt is one of the forms of civil liability, regulated by the provisions of Article No. 322 of the civil legislation of the Russian Federation. This legal term implies repayment of a debt, or compensation for damage, made simultaneously by several persons. A joint obligation to indemnify arises when it is impossible to hold any one person liable separately from the other debtors.

The decision to collect funds from several persons at the same time is made directly by the court. The plaintiff to whom the debt arose files a petition to the court to collect it. In principle, it does not matter to him whether it will be claimed from one defendant or from a group of persons. The applicant can make claims against one specific debtor, or against several at once.

The fact of a joint obligation is determined during court proceedings. In this case, responsibility is distributed among several persons, in proportion to their “involvement” in the resulting debt. Both large companies and private citizens can act as co-defendants here.

To better understand what joint debt collection is, let's look at a small example. The citizen's property and health suffered some damage as a result of a traffic accident. As a result, both the insurance company under the MTPL policy and the culprit of the accident are obligated to compensate it. In this case, the shares of these co-defendants are distributed as follows:

- The insurance company compensates the injured citizen for losses in the maximum amount established by current legislation.

- The amount of damage exceeding the limits of payments under the “automobile title” is subject to compensation from the personal funds of the defendant.

The articles of the Civil Code of the Russian Federation give the following interpretation to this legal concept:

- Article No. 322. The joint and several procedure for debt collection can be applied in legal proceedings if mutual obligations of several persons arise to the creditor based on the concluded agreement, or from the provisions of the current legislation.

- Article No. 321. The plaintiff has the right to demand fulfillment of the obligations of the loan agreement, and the debtors are obliged to fulfill it in the shares determined by law.

In this case, the mutual liability of the debtors lasts until the plaintiff’s claims are fully satisfied. Legal regulations provide for the possibility of repaying a loan or other debt, collected jointly and severally, by one co-borrower.

Such a need arises when one person urgently needs to get rid of debt encumbrances, and other defendants are in no hurry to pay their share. After one citizen or organization has repaid the debt, it has the right to legally recover the overpayment from the remaining debtors.

Joint and several liability and writ of execution

Additional Information

A sample claim for debt collection can be found

Here

.

After a court decision is made in the case of joint defendants, a writ of execution is issued, which indicates the total amount that must be jointly recovered from the defendants, dividing it among all. In the event that part of the amount is recovered from one of the defendants, the total amount of the debt is subject to reduction.

It is imperative to inform the bailiff who is conducting joint and several collection in enforcement proceedings, as well as other executive bodies involved in the execution of the court decision in this case: the bank that services the debtor, the organization at the debtor’s place of work, about this fact. To collect jointly and severally from the defendants is the ability of the creditor to collect the entire amount of the debt from several debtors, including when one of them is unable to pay the bills.

If there is joint and several liability in the relationship between the creditor and the debtor, then the likelihood of full and prompt repayment of the debt increases several times. It also increases the likelihood of recovery even in cases where one of the defendants is unable to repay the debt.

Read about what to do if the debtor does not pay in the article: how to force the debtor to pay under a writ of execution.

If you have questions about joint recovery, leave them in the comments

Application area

The procedure for collecting debt in case of joint liability is determined by the Civil Code of the Russian Federation. In a similar way, you can claim sums of money from the debtor through the court in the following situations:

- When repaying a debt incurred as a result of the borrower’s failure to fulfill its loan obligations. This case is the most common. Joint loan obligations arise here if the overdue loan was issued under the guarantee of several persons. When collecting a loan through the court, all available guarantors bear equal financial responsibility to the borrower. Accordingly, the judge makes a decision on compensation of the debt by all guarantors in equal shares.

- Debts of insurance companies incurred to individuals or organizations in accordance with concluded insurance contracts. The joint and several procedure for debt collection is applicable here if the judicial authorities cannot divide the overall responsibility for payments between individual defendants.

- In some circumstances, debt liability is shared among the heirs. This is possible if the property of the deceased, written off by him under the will, has certain debt encumbrances. For example, co-heirs of a land plot are required to equally share the existing land tax debt. When the text of the will provides for the distribution of property not in equal shares, then payment obligations for each heir are determined based on his personal share.

- The resulting debts to utility services are subject to joint repayment if the residential premises are rented on an equal basis by several people. Another example from recent municipal practice: expenses for common house needs are subject to reimbursement by all residents of an apartment building.

- Joint credit obligations of a married couple. They arise when a married couple takes out a bank loan or purchases something on credit. According to the Civil Code of the Russian Federation, in this case both citizens have equal responsibilities to repay the loan to the borrower.

One for all and all for one

The well-known slogan of the musketeers reveals the mechanism of joint responsibility in the best possible way. Key aspects to know:

- joint liability arises if the debtors are several persons jointly liable to the creditor;

- demands are presented to debtors in any sequence convenient for the creditor;

- claims can be made against all debtors or against one of them; justification for the choice is not necessary;

- each debtor is liable for the obligation in full and must be ready to repay the full amount of the debt alone;

- When the total amount of debt is paid by one debtor, all other debtors are released from fulfilling this obligation.

If only one of the debtors has fulfilled the obligations in full, he has the right to demand reimbursement of his costs from the remaining debtors by filing a recourse claim in court.

Determine the likelihood of collecting receivables from your debtor

By answering 11 questions, you will receive an expert assessment of the right of the claim and the likelihood of its recovery, as well as recommendations for further actions from recovery experts. After this, you will be able to determine how quickly the problem needs to be solved, because delay is a loss of your money.

No. 1 Have there been any cases when you, as a manager or founder, on behalf of the company, sold its property to yourself or your relatives?

Yes, there were I don’t remember, maybe yes No, within the last three years there were none

No. 2 Has your company sold its property over the past three years: real estate, vehicles, equipment? How did you determine the selling price? Why did you decide to sell the property?

They sold their property because there was not enough money to pay off their debts. They sold at a reduced price in order to sell it faster. They sold old property to buy a new one. The sale price was determined as market price, based on prices for similar property from other sellers. Did not sell

No. 3 Does your organization practice checking counterparties for good faith: do you request their constituent documents, check the information on the website of the Federal Tax Service of Russia, the Bailiff Service, and in the files of arbitration courts? Do you (or your employees) meet in person with the managers (employees) of counterparties when concluding contracts, or do documents exchange by mail?

Yes, always We don’t check all counterparties, but most do. We rarely check We never check

No. 4 Is it known that bankruptcy proceedings or surveillance have been introduced against your company?

Not really

No. 5 Does your company currently have overdue debt? What is the period of delay?

We have no overdue debt. We do have debt. The period is no more than 1 month. There is a debt for a period of up to 90 days. There is a debt for a period of 90 days to a year. There is a debt for a period of more than 1 year.

No. 6 Have your counterparties filed debt collection claims against your company over the past three years?

No, not served Served several times Served constantly

No. 7 Are there any errors in your accounting and tax reporting? Have you received error messages from tax authorities?

No, there have been no serious errors in the last three years. We haven’t received any messages from the tax office. Sometimes there are mistakes, but we correct them right away. I don’t delve into this issue, the accountant deals with it

No. 8 Were there any cases of loss of accounting documents?

Yes, the documents have not been restored yet Yes, but they were restored No

No. 9 Does the organization or you, as a director, have any fines or debts that were assessed by the tax service and other government agencies, as well as by the court for violation of tax, administrative or criminal legislation?

No Yes, there are small fines and charges, up to 1 million rubles. Yes, there are significant charges and fines, more than 1 million rubles.

No. 10 Have you entered into the Unified Federal Register of Information on the Facts of Activities of Legal Entities (EFRSFYUL) information that: – a monitoring procedure has been introduced in relation to your company? – there was a change of address – property was pledged – change of founder director, etc.

We always enter information, or there was no reason. I don’t remember / don’t know if someone should enter it, but I don’t know if they did or not. They didn’t.

Features of conducting consolidated enforcement proceedings

Everything that the bailiff does within the consolidated consolidated enforcement proceedings automatically applies to each case included in its composition. But it would be a mistake to think that SIP “absorbs” all old production, creating some new one. Not at all, consolidated cases remain independent even within the framework of consolidated enforcement proceedings. And this is not just a matter of formalism.

Any proceeding within the framework of the SIP can be completed (terminated, suspended) for its own reasons. And this will not affect the existence of the remaining cases in any way. If we are talking about suspending the entire summary proceeding, then the actual circumstances should be analyzed in detail. Challenging certain actions of a bailiff in an individual case from the SIP should not violate the rights of other persons. One situation is when the issue of the legality of the seizure of the debtor’s property is decided in favor of all claimants. And it is completely different when certain procedural actions are disputed within the framework of one case out of all those combined into consolidated enforcement proceedings.

From which of the joint debtors will the bailiff collect the debt?

The bailiff himself will determine from which of the debtors and in what proportions it is better to collect the debt; this is not regulated by law.

It seems that the following will be of decisive importance:

- voluntary repayment of the debt in whole or in part by any of the debtors (Part 11, Article 30 of the Law);

- the solvency of debtors and whether they have property that can be foreclosed on;

- the existence of the right to defer (installment plan) execution by any of the debtors. If one debtor received a deferment or installment plan, it does not automatically apply to the rest. In this case, the bailiff will work with those debtors who do not have the right to a deferment (installment plan);

- location of the debtor and (or) his property. It is more convenient for the bailiff to work with a debtor who is located in the same city.

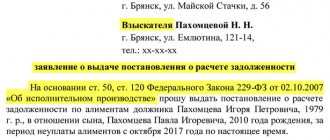

Procedure for drawing up a statement of claim

To collect debts from a group of persons, creditors must turn to judicial organizations. The application submitted to the court must meet certain requirements. The rules for document execution are described in Article 131 of the Code of Civil Procedure of Russia.

Contents of the statement:

- In the first part you need to indicate the name of the judicial organization, as well as information about the plaintiff.

- The preamble should briefly indicate information about the subject of the dispute. If there were attempts to resolve the conflict before trial, then this is also indicated.

- The main part is to prove that something or another legal entity is in debt. A legislative act, contract, surety agreement and other documents can be used as evidence.

- You need to calculate the total amount of debt and indicate it in the document. The amount must include all interest, penalties, and penalties.

- The penultimate part should contain the requirement with which the court is addressed.

- The final part must contain additional documents or copies thereof, a signature with a transcript, seals, and an indication of the current date.

The document must be sent to the court, which is located near the debtor’s place of residence. If a claim is filed against a group of debtors, then you can apply to several courts.

If the defendants live in different places, you can file a claim with any of the judicial organizations. The arbitration court considers applications submitted to legal entities or individual entrepreneurs. However, if there are individuals involved in the agreement, then the application will be considered by the general courts. Applications are submitted to the general courts, which contain demands to collect the debt from the company and its founder. This legal norm was approved in 2015.

Features of joint claims

Not only obligations are joint and several, but also claims, for example, from a group of creditors. Each of them has the right, separately from the others, to demand that the borrower repay the debt in full.

If there is no such requirement, the debtor can pay the debt to any of the creditors. If the debt is paid in full, then the debtor no longer has obligations to other solidary creditors.

The creditor to whom the debt was paid must, in turn, distribute the amount received in equal or contractually determined shares among his partners.

In cases specified by law, debt repayment is permitted through the court or through a notary, to whose deposit the required amount is transferred.

On the role of guarantors in joint and several liability

The contingent of citizens who are included in the payers along with the main borrower must include his guarantors, who confirm his solvency. If the terms of the loan stipulate the presence of a guarantor, then until the debt is finally paid, he is responsible for its repayment. The income of the guarantors is not taken into account when drawing up the contract, but when the borrower becomes insolvent, the legal norm on joint and several liability comes into force. In accordance with this, the guarantor becomes a person who is obliged to repay the loan on an equal basis with the main borrower.

In this case, the responsibility of citizens who vouched for the borrower cannot be canceled even in court.

For example, if the main borrower disappeared in an unknown direction or is simply unable to pay debts, responsibility is redirected to his guarantors, as persons who have assumed part of the responsibility for the loan by signing the agreement.