Similarities and differences between them

The table shows the ratio of deposit and advance payment (general features).

| Similar features | Prepaid expense | Deposit |

| Transfer moment | Before fulfillment of the main obligation | Before fulfillment of the main obligation |

| Accounting for the total amount of the contract | Taken into account | Taken into account |

| Calculation method | Cash | Cash |

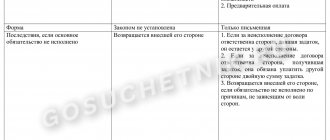

There are few similarities, but the difference between an advance and a deposit is significant. This is easily explained by the nature of the payments in question. The difference is not noticeable when the deal is concluded, since the main differences between them are the consequences of failure to fulfill the main obligation.

It is clear what is the difference between an advance, a deposit and an advance payment:

Do I need a receipt to receive money?

The buyer must take a receipt from the seller for receipt of money immediately after transfer. In the future, this may be necessary to confirm the fulfillment of obligations under the contract.

Note! The receipt is drawn up in simple written form; there are no separate requirements for it. It is important to indicate the amount and the fact that the seller received the money.

Sample receipt

What to choose when buying real estate

Which payment to choose depends on the confidence of the parties to the transaction in concluding it, since the difference between an advance and a deposit when purchasing real estate lies in the consequences for the seller and the buyer in the event of a failed contract.

Example 1. Ivan decided to buy an apartment from Mikhail. To ensure the seriousness of his intentions, he made an advance payment of 100,000 rubles, for which he received a receipt from Mikhail. Two weeks later, Mikhail changed his mind about selling the apartment. All that Ivan gets: lost time, thwarted plans and 100,000 rubles. On the other hand, if Ivan changes his mind about buying an apartment, he will not lose anything, since Mikhail is obliged to give him 100,000 rubles back.

Example 2. Ivan decided to buy an apartment from Mikhail. To ensure the seriousness of their intentions, they entered into a preliminary agreement with a deposit of 100,000 rubles. Two weeks later, Mikhail changed his mind about selling the apartment. Ivan receives: lost time, thwarted plans and 200,000 rubles, that is, the security given to him in double volume - these are the requirements of the Civil Code of the Russian Federation. On the other hand, if Ivan decides to refuse to buy an apartment, then he will not receive 100,000 rubles back (Article 381 of the Civil Code of the Russian Federation).

The issue that is often on the agenda is whether the advance or deposit will be returned if the deal falls through. It is more correct to answer, referring to examples, that it all depends on the situation. Advance payment is always refundable. And the payment in the form of security for the fulfillment of obligations, provided for in paragraph 7 of Chapter 23 of the Civil Code of the Russian Federation, is returned:

- either double the amount or not returned at all: depending on who is to blame for the failure of the deal;

- in the same amount to the party who contributed it, if the agreement is not concluded due to circumstances that do not depend on the will of its participants (clause 1 of Article 381, Article 416 of the Civil Code of the Russian Federation).

Be sure to look at all the specified conditions when concluding agreements that involve the preliminary payment of funds towards future real estate. Firstly, the names and types of payments are often confused, but the essence is always important. Secondly, in the agreement that states the advance condition, the other party sometimes includes penalties if the deal falls through due to the fault of the counterparty.

How to confirm an agreement on a deposit or advance payment?

Natalya Tikhonenko, executive director of financial service QOOD

It is enough to indicate in the contract that part of the amount is paid as an advance, and the rest - within a certain time after its execution. It is also possible that the entire transaction amount is transferred as an advance. The advance nature of the transferred funds is also indicated in the purpose of payment in the payment order. Even if the contract does not indicate that payment is an advance, the courts in most cases take this point of view.

The deposit agreement must be in writing. To avoid discrepancies, I recommend indicating in the payment order that it is the amount of the deposit under such and such an agreement that is being transferred, and not some other payment. Otherwise, there will be grounds for doubt on the part of both the parties to the transaction and the court.

Alexey Kuznetsov, General Director

You can confirm the payment of an advance by a receipt given by the recipient, an advance agreement drawn up, or the inclusion of a corresponding clause in the preliminary purchase and sale agreement.

The deposit agreement should be approached with the utmost seriousness, since the law requires compliance with the simple written form of this agreement. Failure to comply will result in the recognition of the deposit as an advance payment, and in the event of a dispute being considered in court, you will not be able to refer to witness testimony to confirm the fact of the transfer of funds (Article 162 of the Civil Code of the Russian Federation).

In documents directly confirming the transfer of the deposit (receipts, payment documents), it should be explicitly stated that the transferred amount is a deposit.

Who is it registered to?

The advance payment is made by the buyer to the property owner after signing the documents and confirms the preliminary agreements. The advance can also be accepted by a trustee or real estate agency representing the interests of the owner. At the same time, it must have title documents for the property and have a notarized power of attorney.

Obligatory payments

In general, there is no need to pay personal income tax on the advance payment. After all, income in the form of wages is considered received only at the end of the billing period.

But if the advance payment date is set on the last day of the month, then the employee’s income from a tax point of view has already been generated. Therefore, officials believe that in this case the employer has an obligation to pay personal income tax (letter of the Ministry of Finance of the Russian Federation dated November 23, 2016 No. 03-04-06/69181).

Insurance premiums are also calculated at the end of the month based on all payments accrued during the period in favor of employees.

Therefore, to avoid controversial situations, do not schedule an advance payment on the last day of the month.

Should you give money to a realtor?

When inspecting an apartment, you may encounter a situation where the sale of the property is handled by a private realtor, and the owner lives in another city. The realtor may ask for an advance payment for the apartment and only then call the seller for a deal. In this case, you should be able to familiarize yourself with the title documents for the property being purchased and the owner’s passport (copies), and talk by phone with the seller of the apartment.

Help: Order an extract from the Unified State Register or find out on the Rosreestr website about the presence of restrictions and encumbrances on the property, talk to your neighbors and only then make a decision. In this case, you can make a small advance payment in the name of the realtor and ask for a copy of his passport indicating his registration.

Practical details

Realtors answer the question differently when an advance is charged - before the buyer checks the title documents or after. There are also serious differences of opinion about the amount of payment.

The amount of the contribution depends on many factors. Thus, the cost of the apartment, the legal situation, and the technological chain of the transaction are taken into account. It is taken into account whether there is a move, whether the property is purchased with a mortgage, whether the apartment is secured... Well, much more depends on the agency’s position in the market. Often, the higher the status, the greater the amount. But usually no less than 10% of the total contract price.

10 mistakes that can lead to the failure of a real estate transaction Seller and buyer in real estate transactions >> The agreement on making an advance payment itself must include a number of mandatory clauses. The contract specifies the amount of the advance and the condition that this amount goes towards payment for the apartment. The property must be described, indicating the address and final price. The parties to the transaction have been named. The legal nature of the contract should be specified. And it is advisable to insist on a clause providing for the return of the amount if any legal risks are identified at the site. It is better to support this point with a list of documents that the seller must submit to confirm the legal purity of the apartment.

It is necessary to indicate the terms of the legal and physical release of housing, the terms and conditions of the transaction - for example, whether the property is purchased on a mortgage and whether it is required to go through the guardianship and trusteeship authorities. By the way, it would be wise to take into account that going through additional authorities usually takes much longer than expected.

You need to worry about confirming the deposit of money in advance. Not all agencies confirm the movement of amounts with cash receipts. Issuing some paper with an agency seal in exchange for an order carries certain risks for the buyer.

Conclusion

An advance is a mandatory payment, the need for which arises from the requirement of the Labor Code of the Russian Federation to pay remuneration to employees twice a month.

Employers can determine the date of issue and the amount of the advance themselves, but taking into account the restrictions established by the Labor Code of the Russian Federation and the recommendations of regulatory authorities.

It is most convenient to set the date for issuing the advance from the 20th to the 29th, and the amount - in the amount of 40-45% of the monthly remuneration, taking into account the actual time worked for the first half of the month.

When prepayment is not possible

There are groups of goods for which advance payment cannot be applied. Their list is given in Order of the Government of the Russian Federation No. 21-r dated January 16, 2021. It includes goods according to 22 OKPD2 items, for example, some types of transport, clothing, computers, etc.

In addition, Government Order No. 21-r contains a list of services for which advance payment is prohibited. It includes repair services for certain types of machinery and equipment, as well as furniture and household items.

Term

The advance payment is made before the collection of documents and certificates begins. After signing the preliminary agreement and paying the amount, 30 days are given to prepare all the documents and reach the final stage. This is common practice and the parties to the transaction agree to such terms. No one forbids you to register a contract before the established time, but there is no need to rush anywhere.

Important! If one of the participants does not have time to prepare for the deal on time, then it is necessary to meet again and extend the agreement.

Example 2

Let's assume that there are 20 working days in the billing month. Petrova I.V. I was on vacation from 01 to 07 and worked in the first half of the month not 10, but 5 days. Then the advance for her will be set in the amount: 50,000 x 40% / 10 x 5 = 10,000 rubles.

Total accrued amount for the month (without vacation pay): 50,000 / 20 x 15 = 37,500 rubles.

Personal income tax = 37,500 x 13% = 4,875 rubles.

Payment at the end of the month: 37,500 – 10,000 – 4,875 = 22,625 rubles.

As you can see, the amount of the final payment is almost no different from the option considered in example 1.

Arbitrage practice

The deposit, security payment or advance payment is returned upon cancellation of the transaction by agreement of the parties. If the issue cannot be resolved amicably, the party entitled to receive the money may go to court for forced collection.

Here are some examples of decisions on real cases:

- Decision No. 2-345/2014 of March 26, 2014 in case No. 2-345/2014.

- Decision No. 2-1927/2014 2-1927/2014~M-1749/2014 M-1749/2014 dated August 20, 2014

- Decision No. 2-554/2019 2-554/2019~M-475/2019 M-475/2019 dated August 15, 2021 in case No. 2-554/2019.