June 21, 2021 GetHom expert 10,424

You can buy an apartment yourself, or through a real estate agency. If in your case a real estate agency was looking for an apartment, then we will analyze the developments in this situation.

After you have looked through several options and chosen the one that is suitable for purchase, the agency representative will immediately invite you to meet with the seller at the agency and draw up an agreement for the transfer of the deposit.

In our article we will tell you what kind of agreement can be signed at a real estate agency. What is the difference between an advance and a deposit and what legal consequences occur after signing a particular agreement. What risks may arise and how best to proceed.

This information will be useful for both buyers and sellers of their apartments or houses who decide to use the services of the agency.

We will tell you why you cannot give original documents to the agency. What is an act of acceptance and transfer of completed work? What other agreement might the agency force you to sign?

What are the legal consequences of the parties if the terms of the signed agreement are violated? Why does the agency always try to take away the original signed contract from you after the transaction has taken place?

How to buy an apartment without a deposit from a real estate agency

When purchasing real estate on the secondary market, some buyers resort to the services of intermediaries in finding a suitable property. These can be real estate agencies and their realtors, as well as private brokers.

But you can buy an apartment yourself, without resorting to the services of real estate agencies and without involving intermediaries. We have a useful article that details how to do this.

Related article: How to buy an apartment without intermediaries in Ukraine

How to buy apartments through a real estate agency

As a rule, each real estate agency has its own information base of apartments for sale. If a buyer calls or comes to the agency, he may be offered to view several options for apartments according to the stated parameters.

Safe period of cooperation with the agency

Selecting the right options and viewing apartments in the presence of an agency representative is usually free of charge. The realtor takes you to addresses and shows you apartments.

This is the so-called safe period of cooperation with the agency. It is so called because even if the buyer makes some mistakes at the initial stage, they can still be corrected without any losses.

Typically, at the preliminary stage, the agency announces the cost of its services for purchasing an apartment with their participation in the amount of 5% of the cost of the apartment. This price is not final; it can be adjusted and reduced in negotiations with the agency.

Dangerous period of cooperation with the agency

After the option you need has already been selected and reviewed by you, the most crucial period begins in the process of preparing for the upcoming transaction. This is a dangerous period of cooperation with the agency. Any mistake or inaccuracy in behavior at this stage can lead to loss of money or apartment.

Advice for real estate buyers

As a rule, the price of an apartment being sold is also a subject of negotiation. But reasoned bargaining is needed, so at this stage we recommend contacting a lawyer to check the documents for the apartment, the owners, the scheme of the upcoming transaction and the presence of certain risks.

We recommend that you negotiate the price of the upcoming purchase after the apartment has been checked by a lawyer. This way, you can point out the shortcomings and significantly reduce the cost, or you can decide to refuse the purchase if the item is problematic.

An example of buying an apartment through an agency

For example, after viewing several apartments, you stopped your attention on one of them, which the owner is selling for 32 thousand dollars. You liked this apartment, the lawyer checked the documents, you agreed on a second viewing, bargained with the owner and agreed on a price of 30 thousand, which suited you - you decided to buy.

After that, you agreed to pay the agency representative not 1,500 dollars for their services (that’s 5%), but only 1,000. The agency also agreed. Thus, 30 thousand to the owner, plus a thousand to the agency. Total 31 thousand.

How to secure preliminary agreements

But you agreed verbally. To confirm these agreements, you will be asked to meet at the agency and sign an agreement of intent and at the same time transfer a certain pre-agreed amount, which should guarantee the fulfillment of all the terms of the agreement. For example, 2 thousand dollars.

Each agency calls the contract you will sign differently. It could be:

- Agreement on transfer of deposit;

- Agreement on reservation of real estate;

- Preliminary purchase and sale agreement.

- Agreement on transfer of advance payment;

- Agreement of intent;

You need to understand that this agreement is signed between the buyer and seller. In this case, the agency plays the role of an outside observer, although it has its own interest here.

How an agency intervenes in a deal and protects its interests

As a rule, to give significance to the signing process and to justify the need for the agency’s presence in this action, a clause is included in the contract stating that it is executed in the presence of an agency representative who is a witness to everything that happens. The representative puts his signature on the document and certifies it with the agency’s seal.

For example, with this form of agreement, the agency signs another separate agreement with the buyer, which obliges the buyer to pay for the agency’s services in a pre-agreed amount. In our example, this amount is $1,000.

According to the agreement, the buyer makes an advance payment for the agency's services in the amount of, for example, $200. He undertakes to pay the remaining amount of $800 after execution of the main contract.

In some cases, the deposit agreement between the buyer and the seller and the buyer’s agreement with the agency are combined into one 3-party agreement, which states who pays whom how much and for what. But this does not change the essence.

Agency task

The agency’s task is to receive a deposit from the buyer and a promise to pay the remaining amount at the final stage of the transaction.

In addition, the agency strives to bind both parties as strongly as possible with mutual obligations so that the main agreement is ultimately concluded. After all, only in this case the agency will receive its reward in the amount of $800. This is the agency's interest in the transaction.

In order to tie the buyer more tightly to the upcoming transaction, he is “tied” with two deposits - one deposit is transferred to the seller, and the second to the agency. In our example, this is 2 thousand and 200 dollars.

The original documents must remain with the seller

As a rule, when transferring the deposit to the seller, the agency representative takes the original documents from him and leaves them at the agency “for safekeeping”. It should be noted that such actions are not legal. Never leave original documents at the agency.

For “literate” sellers who do not want to leave documents with the agency , a compromise option is provided. The agency retains “for safekeeping” the amount of money that the buyer transfers to the seller.

For example, this is 2000 dollars. The clause stating that the deposit remains in storage at the agency is included in the contract. That is, in this case, the buyer’s deposit does not go to the seller, but remains with the agency. But this does not solve the problem.

Why do agencies draw up a deposit agreement?

The whole point of this idea is that the buyer will be forced to transfer a certain amount of money to the seller, for example $2,000 in our case, as confirmation of the seriousness of his intentions.

This amount can also be called differently:

- Deposit;

- Prepaid expense;

- Pledge;

- Security deposit;

- Guarantee amount.

What is a deposit

According to Article 570 of the Civil Code of Ukraine:

- A deposit is a sum of money that is given to the seller from the buyer on account of further payments under the contract and serves as confirmation of the obligation and ensures its fulfillment. If the deposit secures the contract, then it is written directly into the purchase and sale agreement or in an additional agreement.

- If it is not established that the amount paid by the buyer under the contract is a deposit, it will be automatically recognized by the court as an advance.

Functions of the deposit

- Payment - issued against future payments under the agreement.

- Evidentiary – confirms the fact of concluding a contract.

- Security – encourages the parties to fulfill the obligation.

Please note that the deposit is drawn up after the conclusion of the main contract or simultaneously with it.

The deposit secures obligations arising from contracts. This is an additional guarantee of the fulfillment of the main contract. Therefore, if there is no main agreement, then there cannot be an agreement on the deposit.

Thus, in our case, you do not sign the purchase and sale agreement, therefore the transferred amount is not a deposit and it will be recognized as an advance .

What is an advance

An advance is an advance payment that the buyer gives to the seller in order to confirm his intentions to buy real estate.

But it does not have enforcing function.

As a rule, the advance is transferred before the counter obligation to re-register the apartment occurs, as a sign of the seriousness of intentions to buy it. It is considered part of the future payment.

You transfer the advance and undertake to sign the main contract in the future.

Advance functions

- Evidentiary – confirms the fact of concluding a contract.

- Payment – counted towards the final payment.

As you can see, if you compare it with a deposit, there is no third function - security .

The advance payment does not provide the main payment, but confirms the agreement to buy an apartment in the future.

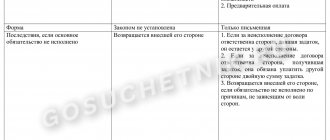

Differences between a deposit and an advance

If we consider the preliminary contract for the purchase and sale of real estate, the main difference is that the deposit cannot be transferred at all. This contradicts the very concept of a deposit.

You can only transfer an advance or a security deposit with penalties , since the terms of the transaction are being discussed and there is no main purchase and sale agreement yet. And this is done in a preliminary agreement.

In other cases, the deposit and the advance may seem similar to each other. That's why they are often confused. But in terms of legal consequences, these are different agreements.

The advance is returned

The advance payment is always returned to the buyer in case of any failure of the transaction, regardless of the reasons. This is beneficial if you are a buyer. If something goes wrong, your money will be returned.

The deposit is not refundable

The deposit is not returned to the buyer. This form of agreement is beneficial to the seller. The deposit remains with the seller in case of failure of the transaction due to the fault of the buyer.

If the seller himself breaks the deal, then he must return the deposit to the buyer in double amount. Article 571 of the Civil Code of Ukraine.

This is the main difference between a deposit and an advance payment when concluding contracts.

To pay or not to pay?

Attention! If you buy an apartment for cash, you can do without drawing up preliminary contracts and advance payments.

The terms of the purchase are negotiated in advance between the parties to the transaction and then written down on paper. A specific day is appointed and the documents are submitted for registration at the MFC. After 10-14 days, the buyer receives documents and becomes the owner of the property.

The conclusion of various types of contracts and advance payments is required if the transaction is complex and requires time to prepare.

When signing documents, be careful and do not sign if something is not clear to you . Try to understand the terms of the contract and ask for clarification on specific points. Only after this can you sign and transfer the money. It also makes sense to involve a realtor or lawyer in the process.

Why you can’t give a deposit to a real estate agency

The contradiction to the law in our case is obvious. Article 570 of the Civil Code is categorical - a deposit can be used to secure an obligation that has already arisen.

When purchasing an apartment, the obligation arises only after signing the purchase and sale agreement. But in our case such an agreement has not yet been signed. Therefore, armed with Article 215 of the Civil Code, the deposit agreement may well be declared invalid in court.

Article 216 of the Civil Code contains the phrase: an invalid transaction does not create legal consequences other than those related to its invalidity.

Let's explain what this means:

- Firstly , the parties are not obliged to fulfill their obligations under such an agreement;

- Secondly , they are obliged to return to each other everything that they received under this transaction.

Such a contested agreement benefits the buyer, since he will be able to return the amount paid under the deposit agreement, even if he himself is guilty of violating his obligations. The seller will be obliged to return the amount received from the buyer in full in any case.

Approximate deposit amount

The size of the deposit when purchasing an apartment is not fixed by law, but the generally accepted standards for an advance payment are 5% - 10% of the cost of the apartment. The more precise amount of the deposit when buying an apartment is determined by the specific benefit, for example, the buyer really wants to keep this particular option. The seller insists on increasing the amount of the deposit in cases where the price was inflated. In both situations, the parties are persons interested in the mandatory conclusion of a transaction.

If the client has not fully decided on his choice, he will insist on a minimum deposit, while at the same time looking for more successful options, even if he would not like to lose money.

Sometimes the seller insists on a minimum deposit amount when purchasing an apartment. This is possible if the price was initially lowered to attract buyers, but now the seller has the opportunity to sell the apartment to a buyer who has offered more favorable conditions.

Why it makes no sense to enter into a deposit agreement with a real estate agency

Whatever agreement you enter into with a real estate agency, the amount of money transferred within its framework cannot be considered a deposit.

This amount will be recognized as an advance and must be returned to the buyer in full if the transaction fails. Moreover, the reason why this transaction did not take place does not matter.

Even if the buyer changes his mind about buying an apartment, his plans or mood have changed - according to the law, the money must be returned to him. If the seller cannot or does not want to enter into a transaction, then he is also obliged to return the amount transferred by him to the buyer.

Thus, the transfer of an advance or deposit to a real estate agency under any of the proposed agreements cannot have a security function.

The deposit will be considered an advance and must be returned to the buyer if the transaction fails, regardless of the reasons.

Receipt

A receipt is an additional document confirming the transfer of money . How is it formatted? It is drawn up by hand by the seller of the apartment or in printed form. It states:

- passport details of the parties to the transaction;

- data about the property;

- transferred amount (in numbers and words).

By and large, a receipt is an analogue of an advance payment, only in a simplified version . At this stage, it is not always necessary and is drawn up if the buyer insists on it.

What contract should be concluded when selling an apartment?

There are two types of preliminary agreements:

- Preliminary agreement

- Agreement of intent.

What is the right thing to do in this case? Which agreement is better to conclude?

The letter of intent does not impose any obligations on the parties to the transaction. In the future, it is possible not to conclude the main agreement on the terms that were in the agreement of intent. Refusal to perform it does not cause any consequences. This is simply a written plan to buy an apartment.

The optimal solution is to conclude a preliminary purchase and sale agreement . As a rule, under such an agreement the parties, for a specific period of time, undertake to subsequently conclude the main agreement on the terms specified in the preliminary agreement (Article 635 of the Civil Code). Failure to comply may result in legal consequences.

Conditions of the preliminary purchase and sale agreement

It must contain the following items:

- Details of the parties to the agreement;

- Duration of concluding the main agreement;

- Description of the object;

- Price;

- The procedure and form of calculation;

- Moment of transfer of ownership;

- Penalties for failure to comply with the terms of the contract.

Money transferred under a preliminary agreement can be called a security deposit or a guarantee amount. The transferred amount confirms the seriousness of the parties’ intentions.

If at the same time penalties are prescribed for failure to fulfill the contract, then this amount will have the functions of a deposit.

For example, it often happens that at the time of concluding a preliminary agreement, the seller may not yet have title documents for the property, or there may be no separate documents without which it is impossible to complete a real estate purchase and sale transaction.

Form for concluding a preliminary purchase and sale agreement

The preliminary agreement must be concluded in the same form as the main one. That is, its notarization is required (Article 657 of the Civil Code). This may not always be convenient, but there is no other option.

According to Article 220 of the Civil Code of Ukraine, a transaction made in non-compliance with the notarial form does not oblige the parties to anything. And at the same time, it is not required to be declared void by the court.

Very often, when concluding a preliminary agreement, the parties try their best to save on notary services , but this should not be done.

What documents are required?

One of the stages of registering a deposit is the provision of a complete package of documents to complete the transaction, characterizing the object being sold and the identity of the seller. What documents are these:

- originals of passport and identification code;

- originals of title documents for the apartment - this could be a gift agreement, purchase and sale agreement, certificate of inheritance, extract from the State Property. register of real estate rights;

- documents characterizing the object of sale - these include a BTI certificate, technical and cadastral passports (check their data with the title documents to ensure there are no discrepancies);

- extract from the Unified State Register of Taxpayers (USRN);

- a certificate from the bank about the encumbrance (when applying for a mortgage);

- documents on family ties (marriage or death certificates, marriage contract);

- information about the presence of minor children and their registration in the apartment being sold;

- information about the absence of legal disputes and litigation regarding this apartment - you can monitor it yourself in the Unified Register of Court Decisions.

When making a deposit, the buyer must have a passport and identification code, marriage or divorce certificates. And, of course, the necessary amount of money to transfer it to the seller.

How to return a deposit or advance payment for an apartment

There are controversial situations with deposits and advances.

The advance payment is returned to the buyer in any case. If the preliminary agreement did not indicate penalties, then simply ask the seller to return your money to you. It is better to negotiate everything peacefully and not bring the matter to court.

For example, problems arise when the seller refuses to return the money for any reason. Then you need to draw up a statement of claim and go to court. And based on the evidence provided, act in accordance with the court decision.

Both parties to the transaction may go to court in the following cases:

- violation of the terms of the preliminary agreement;

- the emergence of disagreements between the buyer and seller;

- refusal to voluntarily return money in case of violation of agreements.

As a rule, if there are disagreements, the only legal way to return the advance or deposit under a preliminary agreement is to go to court.

A decision will be made based on the documents provided.

What decision can the court make?

- If the court decides that it was an advance , then it will be returned to the buyer, since it is refundable in 100% of cases.

- If the court recognizes that a deposit option was issued, the seller will have to pay the amount received in double the amount or in the amount stipulated by the contract. This is the case if the deposit was formalized as a security payment with penalties.

What kind of agreement should be concluded when selling an apartment - conclusions

As a rule, to minimize risks, you need to enter into a notarized preliminary purchase and sale agreement with clearly stated penalties for non-compliance. It protects the interests of the buyer and seller as much as possible.

If the agreements are violated, the court may recognize the security amount as an advance or deposit . Wherein:

- The advance is returned in any case if the transaction fails, and it does not matter who is to blame for the failure of the transaction.

- The deposit is returned in double amount if the transaction does not take place due to the fault of the seller. If the buyer breaks the deal, the deposit is not returned, it remains with the seller.

Recommendations - how to protect yourself when applying for a deposit through a real estate agency

Recommendations to the seller

- Do not leave original documents with the agency for storage under any circumstances. If necessary, the agency can make copies for itself. All originals can only be handed over to a notary for the execution of the main purchase and sale agreement.

- If the advance payment transferred by the buyer remains in storage at the agency and you have not received it in your hands, this must be clearly stated in a separate clause in the contract.

- Do not give away the original contract with the agency after the transaction. He must stay with you. This document confirms the agency’s participation in the transaction and can help if problems arise later at the stage of litigation.

Recommendations for the buyer

Why does the agency not check documents, but only creates the appearance of such a check:

Checking documents at an agency is usually just words. The agency receives its fee only if the transaction is completed. Therefore, even if there are problems with the documents, the buyer will not be told about it. Let's explain why.

It is important for the agency to bind the buyer and seller with mutual obligations with conditions unfavorable for both parties (for example, a large advance with penalties in case of a failed transaction). This factor will deter the buyer from refusing to complete the transaction.

And the problem with the documents (if any) will be resolved by the seller at his own expense. How he will do this and how legal and correct this is is not of interest to this agency. At the same time, the agency seems to be on the sidelines and patiently waits for the day the deal is concluded in order to receive its fee.

Why you can’t buy an apartment without checking

There are situations when it is possible to formally carry out a transaction, the documents allow this to be done and the notary will draw up a purchase and sale agreement. But problems can begin only later, after the purchase.

However, now this will only apply to the new owner. The seller will be far away at this time and will never voluntarily return the money for the sold apartment. Only by court decision.

You need to insure yourself against such a situation at the very beginning. Therefore, checking the documents by an independent lawyer, and not by a representative of a real estate agency interested in the transaction, will help to objectively assess the situation and make the right decision if there are any problems with the apartment.

The task of an independent lawyer is to check the apartment and the owners. If you find any negative aspects, inform the buyer about it. The decision whether to buy or not to buy such an apartment will be made by you based on complete information. Therefore, a check should always be done before the advance payment is transferred.

First CHECK, and then ADVANCE. This is the position the buyer should have during negotiations and it is the most correct one.

Buyer mistakes after viewing an apartment

If you looked at the apartment and liked it, then before making a final decision to purchase, you need to ask for documents for the apartment and documents of the owners for verification.

If you are in an apartment and the owner shows it, you can immediately ask for documents for review. Until the documents have been verified, no further action needs to be taken.

Typical situation

It happens that after viewing, a realtor offers to meet at the agency . In this case, you need to discuss and CLEARLY understand the purpose of such a meeting.

Why do the parties to the transaction meet at the agency?

As a rule, realtors are programmed in such a way that the meeting at the agency should be timed to coincide with the signing of the down payment agreement. But if you want to meet to receive documents for verification, meet the seller and discuss the terms of the deal, then such a meeting may end in conflict.

The realtor expects to receive an advance from you, but you are not going to give it. The realtor will insist on signing the contract, but you will refuse to sign it because the documents have not been verified and you have not yet made the final decision to purchase.

What is the result - possible consequences

Moral and psychological pressure will be put on you, as a result you will sign an advance agreement in a form that is unfavorable for you, and you will never receive a full package of documents for verification. This is the most likely outcome. Further developments of events may occur according to different scenarios, but you will not be able to change anything.

To avoid finding yourself in such a situation, use our recommendations.

How to do the right thing - recommendations

If you offer to meet at an agency, you need to directly tell the realtor that you are not ready to give an advance and will not sign anything until the final decision to purchase is made. Such a decision can be made only after checking the documents. In this case, there are only two options for the development of events:

- They will agree to provide you with documents for verification before making an advance payment. This is the most favorable option.

- If they refuse to provide you with documents without signing an agreement, then you must in advance to provide you with a COMPLETED advance agreement with all the details - parties to the transaction, object of purchase, terms, full cost, amount of the advance, expenses of the parties to the transaction, transaction scheme, place of conclusion of the transaction, method , form and place of payment, the seller’s obligation to personally attend the transaction. It is necessary to stipulate in the contract that when transferring the advance payment, you will be provided with a complete package of documents for the apartment (listed item by item) and documents of the owners for subsequent verification. This advance must be refundable, without penalties in relation to the parties to the transaction.

Who should I transfer the advance to?

The advance must be transferred exclusively to the owner. In this case, no matter what happens in the future, if the deal fails, the advance must be returned to you.

Sequence of actions after viewing the apartment:

- Before signing an agreement with the agency, you must check the documents for the apartment. To do this, you need to make copies (for example, photocopies or photographs) and submit them to an independent lawyer for review.

- Further actions depend on the results of the check. Only after checking the apartment, the owners, the scheme of the upcoming transaction and receiving a positive opinion from a lawyer, can you sign an advance payment agreement and transfer the money to the seller. Apartments can be problematic and you can’t buy them even cheaply.

- It is necessary in advance a COMPLETED advance agreement from the agency with detailed conditions for the scheme of the upcoming transaction, indicating the amount of the advance, the price of the object, the list of necessary documents and the timing of their provision, the procedure for payment by the parties of all related expenses, taxes and services with the unconditional condition of returning the advance in the event of a failed transaction regardless of the reasons.

- The advance payment is transferred to the owner (seller of the apartment).

- Do not make an advance payment or deposit for agency services. It is enough that you pay an advance to the seller. This step will protect the buyer from losing money if the transaction does not go through.

- Independently choose a notary who will draw up the contract.

- Payment for agency services must be made after signing the main purchase and sale agreement. As a rule, when transferring money, the agency must draw up, sign and provide you with an acceptance certificate for the work performed.

- Do not give away the original contract with the agency after the transaction. He must stay with you. As a rule, an agreement with an agency and an acceptance certificate confirm the fact of the agency’s participation in the transaction. For example, these documents can help in the future if problems arise with the purchased property.

Making an advance payment

Have you agreed on a price with the seller? The next stage is making an advance payment and signing an advance agreement. It is better to schedule a meeting with contractors at the apartment being purchased so that you have the opportunity to inspect it again and discover something previously missed.

The seller's realtor may offer you a deposit agreement. Its meaning is that if you refuse the deal, you will lose this deposit. And if the seller refuses, he must return the deposit in double amount. In addition, according to the law, the party that refused the transaction compensates the other party for the losses incurred.

We do not recommend concluding a deposit agreement, since it is unprofitable for the buyer. There is always a possibility that your situation will change: the bank will not approve this apartment, you will urgently need money, etc. Therefore, it is better to still be able to withdraw your advance.

There are also chances that the seller will change his mind, but they are less. If a person has already decided to sell, he sells. In any case, it will be very difficult for you to force the seller to return the deposit in double amount. Most sellers are very tight-fisted people. They are still able to give away other people’s money, but they won’t give up their own money for anything! Only through the court, and this is a whole epic.

Of course, when working for the seller, we are trying to conclude a deposit agreement in order to keep the buyer on the hook and prevent the deal from falling through. And when working for the buyer, we choose an advance agreement. For the buyer, a deposit is good in a growing market, when it is important to fix the price and prevent the seller from “switching over” to another buyer. And in times of stagnation, as now, an advance payment is more convenient.

Although the advance agreement may provide for various termination conditions. Sometimes this is complete freedom: either party can terminate the contract at any time, the money is returned, the topic is closed. The meaning of such an agreement is unclear.

In fact, it does not create any obligations, but it may be convenient for the buyer. Sometimes there may be penalties for canceling a deal without a valid reason. Naturally, the sanctions should be bilateral: if the buyer refuses, he loses the entire advance or part of it, if the seller refuses, he returns the advance plus pays a fine. The list of valid reasons may be open-ended or strictly limited. In general, as agreed.

Before signing the contract, it is necessary to discuss and resolve a number of important issues with the seller:

- When are you ready to make a deal? True, this period will be conditional, as in criminal law. You should always keep in mind that the deadline may be delayed due to the collection of documents by the seller, delays in obtaining a mortgage, illness of a participant in the transaction, etc. If the seller and buyer act without a realtor, this is also, as a rule, seriously delays the timing of the transaction.

- How long will it take for the seller and his family to leave the apartment (the so-called “legal release”)?

- When will the “physical release” of the apartment occur? In other words, when will the residents move out of the apartment?

- What contents of the apartment will be left to you?

- What contents will be removed and when?

- How will payment be made? Whole or parts? Cell or letter of credit? Which bank?

- What documents should the seller collect by the day of the transaction?

- Who will be responsible for registering the agreement?

All these issues should have been discussed at the negotiation stage, but if you forgot, resolve them before transferring the advance.

Typically, the advance payment for an apartment ranges from 30,000 to 100,000 rubles. For an expensive apartment, the advance amount may be higher. Of course, we encourage buyers to pay as little as possible and sellers to ask for as much as possible. Well, then it’s up to you to agree. In any case, the advance payment goes towards the cost of the apartment, that is, your total costs do not depend on the size of the advance payment.

Your main agreements on the transaction are recorded in the advance agreement. The realtor should bring it to the meeting. Naturally, if you buy without a realtor, and the seller sells with a realtor, the latter will offer his own agreement drawn up in favor of the seller. Read it carefully and don't hesitate to request changes.

If no one has a realtor, download the text of the contract from the Internet, but be sure to let a specialist (a realtor or lawyer you know) read it. The agreement can be called differently: “Advance Agreement”, “Prepayment Agreement”, “Reservation Agreement” - it does not matter. In fact, the Civil Code of the Russian Federation does not contain the term “advance payment” at all. In essence, this is just a partial advance payment, but historically it was called an “advance payment.” Remember that the name of the contract does not affect its consequences. All that matters is the content—the “substance of the contract.”

So, the advance agreement must indicate:

- exact address of the apartment;

- apartment sale price;

- information about the parties to the agreement;

- date of signing;

- contract time;

- conditions for termination of the contract and return of money;

- sanctions for non-compliance with the agreement.

Everything else is optional.

In addition to the advance agreement, it is advisable to draw up an annex that details the condition of the apartment at the time of signing the document. What should be listed in the application:

- elements of furniture and equipment that the owners promise to leave to the buyer;

- existing breakdowns and shortcomings of the apartment;

- description of the condition of the apartment (iron door, glazed balcony, brand of plumbing, etc.).

It is advisable to support all this with photographs, which are also attached to the contract.

Often real estate agencies enter into an agreement with the buyer on their own (that is, on behalf of the company) and take the advance for themselves. Supposedly for the safety and security of money. Separate large and “letters of guarantee” on beautiful paper with stamps. In fact, this does not give you any additional guarantees. From a legal point of view, a more correct advance agreement is one concluded between the seller and the buyer. From a practical point of view there is not much difference. If you trust this agency, sign it.

In addition to the agreement, it is necessary to obtain a handwritten receipt from the recipient of the advance regarding receipt of money. A signed agreement is not proof of transfer of money! Proof can only be bank documents (for non-cash payments) or a handwritten receipt (cash payments). The receipt indicates the recipient’s passport details, the amount received and information about the advance agreement for which the money was transferred. Signed? Have you paid? Now say goodbye to your money.

Why does the agency seek to take away the deposit agreement after the transaction:

Avoid responsibility

As a rule, the agency’s task in a transaction is to receive its commission and not be responsible for anything else. For example, many of the agency's actions violate current legislation.

At the same time, an agreement with an agency is the only document that confirms the agency’s participation in a transaction and can serve as the basis for holding officials accountable.

What laws do agencies violate?

- Law of Ukraine on the protection of consumer rights;

- Tax Code of Ukraine;

- Law of Ukraine “On Advertising”;

- Financial legislation.

Hide illegal activities

The contract specifies some actions that the agency does not have the right . Namely:

- keep funds for safekeeping;

- accept payments in foreign currency;

- seize original documents from the owner and store them at home.

Don't pay taxes

In this case, the agency works according to a “gray” scheme. Hides income and does not pay taxes. And each such agreement is evidence of receiving a large sum of money on which taxes have not been paid.

Refund of deposit

Upon expiration of the pledge agreement, taking into account the fulfilled obligations of both parties, the previously pledged property passes to the primary owner - the pledgor. You can return the deposit for other reasons if the conditions specified in the contract allow this. In most cases, it all depends on the collateral. After all, the pledge of various types of property, not only real estate, is regulated by separate laws. The legal relations of the parties may not even be regarded as collateral.

Conclusions regarding a deposit to a real estate agency

Despite the fairly common practice of filling out a deposit in the form of an independent agreement at a real estate agency, we do not recommend doing this.

How to do the right thing

The purchase and sale of real estate is a responsible step. In such a situation, only a preliminary agreement will serve as a better alternative to a deposit agreement.

At the same time, at the moment, a preliminary agreement with prescribed conditions and possible penalties is a reliable tool when purchasing real estate on the secondary market. The main thing is to get it through a notary and not skimp on this point. It's not particularly expensive.

Receipts and advance or deposit agreements at an agency are nothing compared to the quality and reliability of a preliminary agreement certified by a notary.

Contact real estate lawyers to protect your interests and support the transaction. Or at least get some advice. Because an experienced lawyer simply will not allow your rights to be infringed.

Giving a deposit does not always mean buying an apartment. You may lose your deposit and not be able to buy an apartment.

It is better to draw up a preliminary agreement with the advance amount through a notary.

Clarification of other difficult points

Insure yourself during a transaction by taking the following actions:

- be sure to check the documents for the property being sold - whether there are any illegal redevelopments, whether all the data matches everywhere;

- do not give a deposit in the absence of any important documents, especially proving ownership of the apartment;

- make sure that the sale of the property has the consent of the seller’s spouse, certified by a notary;

- check whether any restrictions (encumbrance) are imposed on the apartment and if so, then it’s better not to risk it;

- make sure that the apartment has no debts on utility bills;

- check everyone registered in the apartment and if there are several of them, write in the contract the requirement to register everyone before the transaction is completed.

What you need to check before buying an apartment is described in more detail here.

When buying an apartment, fill out the deposit correctly so that there are no problems later. Be sure to put the agreement in writing and take a receipt for receipt of funds. Be on the safe side by double-checking all the data on the apartment before transferring money to the real estate seller.