What is a deposit

To understand, it is necessary to understand the legal definition of a deposit. In Russian legislation, the corresponding term is set out in Article 380 of the Civil Code, clause 1. In essence, this is a guarantee payment, which serves as a reason that the buyer and trader will not refuse the contract if more profitable offers arise. If the goods were given to the buyer, then the transferred preliminary amount is actually recognized as an advance payment.

When drawing up a document for the sale and purchase of a car, real estate, land or other property, it is necessary to confirm in writing the presence or absence of a preliminary security payment. Otherwise, when resolving a conflict situation through the court, the transferred financial resources are recognized as an advance and must be returned to the individual or legal entity.

The fact of transfer of cash resources is confirmed by a receipt.

Is the deposit refunded or not?

If the pledgor fails to fulfill his obligations to the creditor, his property becomes the property of the latter.

The deposit is returned:

- the debt is paid to the creditor;

- the creditor poses a threat of loss or damage to property, the contract is terminated in court;

- sale of the collateral to repay the debt;

- termination of the object's existence.

If the above circumstances arise, an appropriate entry is made in the register in which the agreement is registered.

Under what conditions is it issued?

The parties, having come to a preliminary oral agreement on the need to transfer a security transfer, draw up a written document. Especially often, the need for a guarantee payment arises when purchasing land or real estate with a mortgage. Points of the advance transfer agreement include:

- Full name and passport details of all parties to the transaction.

- Reason for transfer of the guarantee payment.

- The amount of transferred financial resources.

- Total transaction volume.

- The period during which the main payment must be transferred and the goods must be transferred.

An important point in the contract is to indicate that the amount being deposited is part of the overall trading contract. According to the Civil Code of the Russian Federation, if the potential beneficiary refuses the transaction, the deposit is not returned. If the seller refuses the contract, the deposit will be returned in double amount.

The deposit must be accompanied in writing

What to do to get your prepayment back

To return the prepayment, you must contact the seller in writing. A sample application for a refund of the prepayment for a car can be found on the Internet. The application is written to the head of the salon. The complaint indicates the reason for termination of the contract. If the seller refuses, the complaint is sent by registered mail with notification. Within 10 days, the seller must consider the claim and return the advance payment to the buyer.

If the salon refuses to return the advance payment, you should go to court or Rospotrebnadzor. To do this, you need to collect a list of documents to prove the illegality of the seller’s actions. In the absence of an agreement, an examination will be required with the invitation of at least 2 witnesses.

It is also worth noting that you need to deal with trusted car dealerships. Our website contains reviews about AC Armada, Ugra and others. and other Russian cities. Only reliable information is published.

Author: Andrey Krivtsov

When is the deposit refundable?

Whether the deposit is returned or not depends on the outcome of the agreement. Practice shows that clients who have changed their mind about purchasing housing are interested in the question of how to return the deposit for the apartment. By law, the guarantee payment is returned in a couple of cases:

- When a transaction is canceled for reasons beyond the control of the participants.

- The purchase of a house, car or other valuable property for which a deposit was made did not take place due to violations of the terms of the contract by the seller.

Cancellation of a contract always has valid reasons. It could be a natural disaster that destroys the property being sold.

If the money was contributed as a guarantee when selling under the hammer, then it can be returned. Returning the deposit at an auction is an ordinary, ordinary procedure that does not require judicial intervention. If the public auction does not take place, then the funds are returned to the participants’ accounts using standard bank transactions. Funds transferred by losing participants in the auction are returned. When a prospective bidder decides to withdraw from the auction, their deposit will be returned to them before a certain deadline. If the cancellation occurs after the specified date, the deposit will not be returned.

The winner's funds are transferred as payment under the concluded agreement. The use of financial security at auctions is regulated by 448 articles of the Civil Code. If, after the agreed time, the auction organizer delays the completion of the transaction or refuses, thereby violating the rights of the participant, then the auctioneer must return the deposited funds in double amount.

A special option for bidding is organizing the sale of a company in relation to which bankruptcy measures are being taken. The deposit is paid by corporations or individuals wishing to purchase the company. Money will be returned to losing bidders.

Advance payment for an apartment is refundable or not

The advance payment is made as an advance payment. If the transaction does not take place, the amount of money must be returned in full.

The contract states:

- passport data in full;

- term of transfer of property;

- sequence of paperwork for sale;

- the amount paid, a receipt confirming its receipt;

- signatures of the parties.

You should not make a payment without documenting it. Notarized registration of the advance payment is a guarantee of payment of funds if one of the parties refuses to complete the transaction.

When it doesn't come back

As for whether the earnest money is refunded if the buyer backs out of the agreement, the most common answer is no. The financial meaning of the deposit is to guarantee the execution of the transaction; the return of the invested money will be a violation of the logic of the contract.

The deposit may or may not be returned.

In addition to purchase and sale transactions, the guarantee applies to rental agreements. Realtors and representatives of car dealerships offer a client who wants to rent a car or rent an apartment, cottage, garden plot, garage, to make a deposit, usually in the amount of a certain percentage of the value of the property. If the client damages it while using rented housing or other property, the owner takes the deposit as compensation.

Whether or not the deposit is returned when purchasing an apartment or cottage depends on the reason why the sale did not take place. In the event that the buyer is at fault, the money remains with the potential seller.

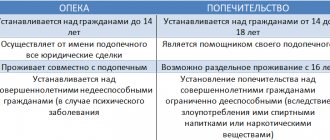

Pledge concept

You can pledge valuables and property owned by the pledgor. Serves as a guarantee of repayment of the loan in part or in full

When renting an apartment, a security deposit is paid, which is a guarantee of ensuring the integrity of the property located in the apartment and the proper condition of the apartment itself. The contract takes into account the degree of wear and tear during operation. When tenants move out, the owner checks the integrity of the apartment. If everything is in order, the deposit is returned. If damage is detected, the damage is assessed and paid from the deposit amount.

When purchasing a home on credit, the collateral is the purchased real estate. The bank issues funds as collateral; if the borrower fails to fulfill its obligations to repay the loan, the bank will sell the property at auction to recoup its losses.

The pledge agreement must be registered with a notary. A sum of money cannot act as collateral.

When the deposit is returned in double amount

The fundamental difference between a deposit and other types of advance payments is the presence of an additional function. The return of double the amount is important as a measure of influence on the unscrupulous participant in the transaction. The buyer transferred the deposit, thereby increasing the owner’s assets. By returning the transferred money, the owner of the property, in fact, remains with the original capital. The return of double financial security is a material loss for the selling party.

The deposit in double amount is transferred to:

- If the seller fails to fulfill his obligations to sell real estate or other valuable property (apartment, house, restaurant, yacht club, car, motorcycle, etc.).

- If the auctioneer refuses to enter into an agreement with the auction winner.

- If the landlord refuses the tenant to enter into an agreement.

- In other cases, when the agreement provides for a deposit, the transaction did not take place due to the fault of the person who received it.

How to apply for an advance

Unlike a deposit, the definition of an advance is more of an economic nature. This procedure is not regulated by legislative acts.

An advance payment is most often made in the amount of no more than 10% of the cost of the purchased object. It is better to confirm the deposit of the amount with documents with the signatures of witnesses or register it with a notary. The law does not impose strict requirements for making an advance payment when purchasing real estate.

If the transaction did not take place and the seller turned out to be dishonest, problems may arise with returning the amount paid if the agreement was not registered with a notary.

Registration of the contract

The process of drawing up an agreement on the transfer of a deposit is not very difficult if you prepare for its preparation in advance. The document must indicate all significant points that allow identifying the parties to the agreement, the amount of the transferred amount, and the conditions for its transfer. It is important to indicate that the funds are a deposit, otherwise, even in the Supreme Court it will be extremely difficult to prove that this is not an advance. The deadline for the execution of the main contract and the responsibility of the parties for improper execution are indicated.

Correct execution of the document is a guarantee that the participants will fulfill their obligations.

All documents must be prepared in accordance with the rules in order to avoid controversial situations in the future.

The deposit agreement is signed simultaneously or later than the main purchase and sale agreement, since it has a subordinate position to it.

Prepayment – what is it for?

Let's assume that you have already found the apartment of your dreams in Sochi and want to become its full owner. Making an advance payment in this case guarantees that the owner is guaranteed to sell it to you and will not consider other buyers.

An advance payment for the property chosen by the buyer is made for a certain period and is counted towards the total cost of the apartment or house. It is imperative to sign an agreement stating that the buyer transferred the funds and the owner received them. By the way, not only the owner, but also his authorized representative can accept advance payment.

For example, an employee of a real estate agency with appropriate powers. In addition, prepayment gives both parties to the transaction certain financial guarantees and fixes contractual obligations. The prepayment can be a deposit, an advance payment or a deposit.

Below we will look at each of the methods in detail, figure out what their main differences are and how to correctly make an advance payment for the apartment you have chosen.

Back to Contents

Registration of receipt

When transferring funds in cash or non-cash form, a receipt is issued. The main part of it duplicates the significant clauses of the agreement:

- Full name and registration details of participants.

- The reason for receiving the money.

- Amount.

- An indication that the finances were transferred as a deposit.

- Date of transfer of money.

The receipt is drawn up by computer, but when resolving disputes through the courts, a document written in the recipient’s own hand is more acceptable. At the request of the seller, the document can be drawn up in two copies.

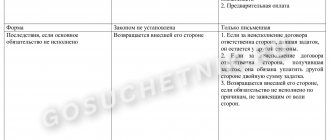

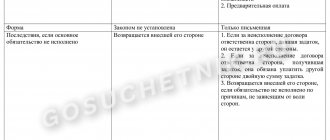

The concept of advance in the Civil Code

There is no clear formulation of what an advance is in the Civil Code. The meaning of this concept is interpreted on the basis of a systematic explanation of the norms in the comments to legislative acts.

⇒ Important to know! A prepayment made is considered an advance unless it is stated in writing that the payment is a deposit!

The advance serves a payment function. It is paid at the conclusion of a transaction as an advance payment for a product or service.

An advance payment is made so that the object of purchase is not intercepted by others. If either party fails to fulfill obligations, the advance is subject to a 100% refund.

The transfer of money is formalized by a bilateral agreement on the payment of an advance. The document describes the rights and obligations of the parties and liability in case of violation of obligations.

All documentation must be concluded in accordance with the legislative acts in force in the territory where the transaction is made.

If the contract stipulates obligations that are contrary to the law, then, by a court decision, liability arises in accordance with the law, regardless of what is stated in the agreement of the parties.