Is the deposit refundable?

The deposit is a security payment. It is included in the principal amount of the contract. That is, for example, when buying an apartment worth 2 million rubles. a citizen can provide a deposit of 200 thousand. As a result, to complete the transaction, he will need to contribute another 1 million 800 thousand rubles.

In Art. 381 of the Civil Code of the Russian Federation contains provisions regarding the return of deposits:

- If the obligations under the contract were not fulfilled due to the initiative or fault of the party that transferred the deposit, then the funds received by the contractor are not subject to return.

- If the obligations under the contract were not fulfilled due to the initiative or fault of the party who received the deposit, then it will be obliged to reimburse the deposit to the sender in double amount.

If we translate these rules into the example described above, the situation will look like this:

- if the buyer who sent 200 thousand rubles. as a deposit, ultimately refuses to purchase an apartment, then the executor, represented by the developer, will retain the funds received by him;

- if the contractor, represented by the developer, for some reason cannot provide the citizen who has already transferred the deposit with the opportunity to purchase an apartment for the price specified in the concluded agreement (2 million rubles), then he will be obliged to fully return the funds received and additionally compensate for such the same amount (return 200 thousand rubles and compensate another 200 thousand, total - 400 thousand rubles).

What is more profitable for the seller and the buyer?

Natalya Tikhonenko, executive director of financial service QOOD

If a participant in a transaction is not completely sure that he will be able to fulfill his obligations, it is not beneficial for him to use a deposit in the contract - he can say goodbye to this amount forever. If this participant is the seller, he risks being required to pay double the amount of the deposit. The advance payment form, the most common in civil transactions, is “softer” for both parties.

The requirement for a deposit when registering applications is common among organizers of public auctions, including when selling assets of a bankrupt enterprise. An advance will not work here. In the case of participation in public auctions, it is unlikely that it will be possible to avoid an agreement on a deposit, which, as a rule, is no more than 20% of the initial price of the lot.

There is such a thing as a “strong” and “weak” side in a transaction. A strong party is one that is willing and able to conclude an agreement only on its own terms. If the strong party has decided that it is ready to enter into an agreement only with the condition of a deposit, then the weak party can only agree to such a condition or refuse to enter into a transaction at all. The weaker party is unlikely to be able to “push through” its terms and must carefully weigh its options. If you fail to fulfill your obligations, you can lose money.

If neither party wants to set strict conditions, for example, counting on further cooperation, it is better to choose an advance form of payment - this will bring the parties to parity conditions.

Irina Pryadeina, lawyer at legal

In a purchase and sale agreement, a deposit agreement is more beneficial for the buyer. In this case, if the seller violates the obligation, the buyer will return his money, receive compensation and be able to recover losses.

For the seller, an advance payment is often more profitable, because if the transaction fails due to his fault, he must return to the buyer exclusively the amount paid as an advance payment, without incurring any penalties.

Ekaterina Smoleva, lawyer

A deposit is more profitable for the buyer, since it forces the seller to comply with the terms of the contract, otherwise he will have to pay double the amount of the deposit. An advance does not provide such security; it can simply be returned to the buyer if the terms of the contract are violated.

If the seller does not want to guarantee the fulfillment of the contract for a specific buyer (for example, there are many people willing to buy an apartment), then an advance can be used. In this case, the seller will not be obliged to fulfill the conditions, but may simply return the money to the buyer.

If the seller wishes to ensure the fulfillment of obligations under the contract by the buyer, then a deposit can be applied. If the buyer refuses to fulfill the contract, the deposit remains with the seller.

Alexey Kuznetsov, General Director

The main disadvantage of a deposit is that in any unclear situation it will be recognized in court as an advance. The downside of an advance is the lack of a security function, which leads to a lack of sanctions for the parties if the deal fails.

If obligations are not fulfilled, there are no adverse consequences for the guilty party. The advance is simply returned to the person who gave it in full, regardless of which party’s actions caused the deal to fail.

When concluding a purchase and sale transaction, it is better to resort to the help of a deposit. Existing penalties encourage both the seller and the buyer to act in good faith, because if the transaction fails, they will have to answer for their guilty actions. An advance payment as such does not provide any guarantees, does not give weight and significance to the transaction, since it makes it easy to refuse to complete it without adverse consequences.

In my opinion, talking about benefits in this case is only possible if one of the parties is dishonest. If the buyer and seller act in good faith, then no one will be left in the red either when using the deposit or when making an advance payment.

For what purposes is the deposit used?

In practice, the deposit can be used for the following purposes:

- Providing a guarantee. The person who has paid the deposit will receive a guarantee of fulfillment of obligations under the contract by the other party to the transaction or reimbursement of expenses (the amount of the deposit) in a double amount.

- Incentives for fulfilling obligations. When concluding an agreement that requires the transfer of a deposit, both parties receive an incentive to fulfill their obligations at the risk of losing money.

- Obtaining evidence. The fact that the deposit has been transferred is proof that a formal agreement has been concluded between the parties.

When will the deposit be returned?

The deposit may be returned to the person who transferred it in two cases:

- the transaction was disrupted due to the fault of the person who received the cash tranche;

- the deal was disrupted due to reasons beyond the control of both parties.

In the latter case, the concept of force majeure is applied, due to which the parties were unable to fulfill their obligations. The so-called “force majeure” does not depend on the will of the participants and is not a manifestation of their intentions. Such a circumstance, for example, is the destruction of residential premises as a result of a natural disaster. If a deposit payment has been made for the apartment, it is transferred back to the buyer in a single amount.

For your information

Also, the money must be returned to the person who made the payment in situations where the opposite party voluntarily renounces its obligations specified in the text or changes the terms of the agreement. For example, by raising the price of an apartment, the seller violates the terms of the contract, which allows the buyer to terminate the preliminary contract. Since in this situation the refusal was made through the fault of the contractor or the seller, he is obliged to return the financial security in double amount.

Drawing up an agreement on the transfer of deposit

In the second paragraph of Art. 380 of the Civil Code of the Russian Federation states that the use of a deposit must be confirmed by a written agreement. Moreover, this must be done regardless of the size of the transferred amount.

There is no separate unique form provided for the agreement on the transfer of the deposit. Therefore, the document is drawn up according to the general rules for maintaining legally significant papers.

The content of the agreement must reflect:

- name of the document – “Agreement on transfer of deposit”;

- date and place of compilation;

- personal information about the parties to the transaction - if this is an individual, then full name, date of birth, residential address, passport details, if this is a legal entity, then the name of the organization, registration form, location address, full name of the manager, Full name and position of the employee who participates in the transaction on behalf of the company;

- the amount of the deposit transferred;

- the total cost of the concluded contract;

- type of contract object (property, service, rights, etc.);

- a list of rights and obligations (usually a list of tasks and deadlines for their completion);

- algorithm for resolving controversial situations related to contract failure;

- the period allotted for the fulfillment of obligations;

- the date from which the concluded agreement begins to be valid;

- list of attached documentation;

- signatures of the parties confirming that each of them agrees with the provisions of the concluded agreement.

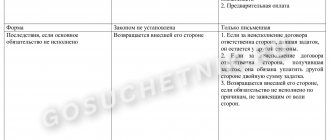

Similarities and differences between them

The table shows the ratio of deposit and advance payment (general features).

| Similar features | Prepaid expense | Deposit |

| Transfer moment | Before fulfillment of the main obligation | Before fulfillment of the main obligation |

| Accounting for the total amount of the contract | Taken into account | Taken into account |

| Calculation method | Cash | Cash |

There are few similarities, but the difference between an advance and a deposit is significant. This is easily explained by the nature of the payments in question. The difference is not noticeable when the deal is concluded, since the main differences between them are the consequences of failure to fulfill the main obligation.

It is clear what is the difference between an advance, a deposit and an advance payment:

Is an oral agreement acceptable when transferring a deposit?

It is strictly forbidden to transfer the deposit, limiting it to an oral agreement. In the second paragraph of Art. 380 of the Civil Code of the Russian Federation states that the transfer of funds on a deposit must necessarily be accompanied by the conclusion of a written agreement.

In turn, the content of Art. 162 of the Civil Code of the Russian Federation states that failure to comply with the written form of the contract or its complete absence in matters where this is necessary in accordance with legislative norms entails the invalidity of the transaction.

That is, by transferring a deposit without an agreement, a citizen will actually simply give away the money. However, he will not receive any guarantees of completion of the transaction. It is difficult to return such a payment, but it is still possible. A citizen can sue the recipient for unjust enrichment in the amount of the deposit received. However, this again involves additional financial and, most importantly, time costs. Therefore, when transferring a deposit, contracts should always be drawn up.

Is the deposit returned to the winner and loser of the auction?

Auction and competitive bidding is often accompanied by a preliminary deposit of funds as security for the intentions of the auction participant. According to Art. 448 of the Civil Code of the Russian Federation, the deposit payment is returned to the participant:

- in case of participation, but defeat in the auction;

- in case of auction cancellation.

Please note

: The refund period is 20 calendar days from the date of the auction or cancellation.

The funds contributed by the winner are taken into account as an advance payment for the subject of the auction. If the winner refuses to pay the full price, the deposit payment remains with the organizers.

Deposit, advance and pledge - what are the differences between these types of payments?

Deposit, advance and pledge are very similar. Each of this type of payments is paid under the concluded agreement as an advance payment. However, it is important to understand that these terms refer to different payments. The differences are presented in the table:

| Criterion | Deposit | Pledge | Prepaid expense |

| Definition | A sum of money transferred by one party to a transaction (customer) in favor of another (contractor) towards the principal amount of payment in accordance with the concluded agreement. | A sum of money or any property value transferred from one party to a transaction in favor of another within the framework of the obligations stipulated by the contract before the start of their execution. | A sum of money or any other property value that fully or partially guarantees the fulfillment of obligations under a contract. |

| Form | Cash. | Any property of value. This could be money, real estate, transport, securities, etc. The only condition: both parties to the transaction must come to a common agreement on the issue of using something as an advance. | Any property of value (with the consent of both parties to the transaction). |

| Transfer conditions | On account of the main payment under the contract that has not yet been made. | On account of the main payment, the execution of which will occur after the full completion of obligations under the contract. | To ensure the fulfillment of obligations under the contract. |

| Purpose | Proof of the conclusion of the contract. Providing a guarantee of fulfillment of obligations. | Payment for work, goods or services sent before the fulfillment of obligations under the contract. | Obtaining a guarantee of reimbursement of costs, expenses or damage incurred during the failure to fulfill obligations under the contract. |

| Return | Non-refundable if obligations were not fulfilled due to the fault of the party who gave the deposit. Subject to a double refund if the obligations were not fulfilled due to the fault of the contractor who received the deposit. | Subject to full refund if the recipient of the advance payment has not fulfilled its obligations under the contract. | Subject to a full refund if the obligations under the contract have been fulfilled in full. Non-refundable if obligations under the agreement have not been fulfilled. |

| Sum | Arbitrary, but not exceeding the basic payment under the contract. | In the amount determined by current legislation or the provisions of the concluded agreement. | Arbitrary, with the consent of both parties to the transaction. |

| Contract form | A written agreement. | Absence of any clear requirements: can be transferred either by written agreement or on the basis of an oral agreement. | Written agreement |

What are advance and deposit? How to get money back if the terms of the contract are violated?

Natalya Tikhonenko, executive director of financial service QOOD

There is no separate definition of the concept of “advance” in the Civil Code, but it is used in the Civil Code and in many other documents, and in practice there are usually no difficulties with it.

The legal nature of the advance is that the customer or buyer transfers a certain amount of money to the contractor or seller in order for him to perform work, provide services, or deliver goods. Theoretically, the advance can be returned until the parties begin to fulfill contractual obligations; this is how it differs from the deposit. In practice, the advance is rarely returned in full in the event of a unilateral refusal by the buyer from the transaction.

Let's consider a simple purchase and sale transaction. If the buyer refuses obligations, the seller loses the planned profit, so the seller can retain the debtor’s things in accordance with paragraph 1 of Art. 329 of the Civil Code of the Russian Federation. The buyer may respond by telling the court that the amount of penalties provided for in the contract is disproportionate.

If the seller has begun executing the transaction and delivered part of the goods, the buyer must reimburse the costs incurred by the seller, including through an advance payment. This situation is possible only if the seller fulfills his obligations in good faith. Otherwise, the buyer may demand an advance amount from the seller.

If in the same situation, instead of an advance payment, a deposit appears in the transaction, we are no longer talking about its return. In case of unilateral refusal to fulfill his part of the transaction, the buyer may lose the deposit provided. If the seller does not fulfill his obligations, he is obliged to pay the other party double the amount of the deposit, as well as compensate her for losses, unless otherwise specified in the contract. The court has the right, at the request of the defendant, to reduce the amount of half of the specified amount.

Ekaterina Smoleva, lawyer

The advance performs only payment and certification functions, but not security. It is paid before the execution of the contract against the payments due. In any case, the recipient must return the advance, regardless of compliance with the terms of the contract.

A deposit (Part 1 of Article 380 of the Civil Code of the Russian Federation) is a sum of money that one party gives to the other party to ensure the fulfillment of the terms of the contract. If the contract was not fulfilled by the one who gave the deposit, it remains with the other party. If the one who received the deposit does not fulfill the terms of the contract, he is obliged to pay the other party double the amount of the deposit.

By law, if you are in doubt whether the amount paid towards future payments is an earnest money, then it can be considered an advance.

For example, if citizen Ivanov sells an apartment to citizen Petrov without a preliminary agreement, the parties draw up a receipt reflecting their mutual desire to enter into a contract for the sale of the apartment and a deposit of 100,000 rubles, which Petrov transferred to Ivanov as security.

Petrov wanted to make a payment using a bank loan, but the bank refused him, so he asked Ivanov to return the deposit to him. Ivanov, citing the fact that the deposit is not refundable by law, refused him this, but since they did not enter into an agreement, such a sum of money cannot be considered a deposit. It can be recognized as an advance payment that must be returned to Petrov.