Last update: 03/15/2021

Question:

When purchasing an apartment, I made an advance payment to the Seller. While we were preparing the documents for the transaction, the situation changed and I changed my mind about buying. Is it possible to return the deposit (advance payment) for the apartment? And if possible, how?

Answer:

“To promise does not mean to marry,” this is what another Buyer thinks when he promises the Seller to buy an apartment from him. And he is in full confidence that if something happens, he will always be able to return his deposit or advance. But no! This is not always the case. It all depends on how the prepayment is made .

What are the options here? And when is it possible to return the deposit or advance payment when purchasing an apartment? Let's figure it out now.

In real estate market practice, it is customary to take an advance payment (in the form of a deposit or advance payment) from the Buyer of an apartment at the time of discussing the terms of a future transaction and making a decision to purchase. Why is this being done?

In order for the Seller to be sure that a Buyer for the apartment has already been found, you can remove it from sale and collect documents for the transaction. And the Buyer receives confidence that the selected apartment is assigned (reserved) to him and will not be sold to another person while he checks it and prepares money (including taking out a mortgage loan).

Cases when the Buyer makes an advance payment (advance payment or deposit) for an apartment may be the following:

- Concluding a reservation agreement when purchasing an apartment in a new building from the Developer.

- Conclusion of a preliminary purchase and sale agreement when purchasing an apartment on the secondary market (including from a real estate agency).

- Conclusion of a Deposit Agreement or Advance Agreement when purchasing an apartment on the secondary market (directly from the Seller-owner).

When and what kind of agreement is better to conclude and how an advance payment differs from a deposit is described in detail in a separate Glossary article at the link.

Here we will only consider cases when and how the Buyer can return the deposit or advance payment for an apartment if his circumstances have changed or he simply changed his mind about buying.

How to choose a Developer when buying an apartment in a new building? Qualitative and quantitative characteristics - see this note.

When is a deposit required?

The definition of a deposit is disclosed by the Civil Code of the Russian Federation.

In particular, Article 380 indicates that a deposit is considered to be a certain amount that is transferred to one of the parties to the contract towards future payments. In essence, the deposit becomes evidence of the conclusion of the contract and a guarantor of fulfillment of its terms. If we talk about specifics, a deposit is often used for transactions with real estate, vehicles, and land. By transferring the agreed amount, the buyer gains confidence that the property owner will stop looking for other clients. The seller, along with the deposit, receives guarantees that the buyer will not refuse to purchase the apartment.

Of course, the transfer of a deposit does not provide absolute guarantees, so each party may violate the terms of the preliminary agreement. However, there is a nuance here: for non-compliance with the contract, the violator bears financial responsibility. Thanks to this feature, legal relations between the parties to the agreement become more stable.

Important! The amount of the deposit is not regulated by current legislation, so the amount is set by the seller or agreed upon between the parties to the transaction. It must also be stated here that any amount under the contract must be agreed upon by the parties. Otherwise, the contract will not be concluded on legal terms. The seller can only offer this option. But the buyer is not obliged to agree to it.

Article 380 of the Civil Code of the Russian Federation “The concept of a deposit. Deposit agreement form"

Refund of advance payment for apartment

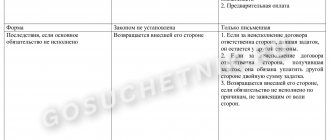

If the prepayment when purchasing an apartment is in the form of an advance , then the Buyer can always return it, except in cases where the agreement (under which this advance was transferred) contains conditions for withholding this advance (or part thereof) in the form of a fine (penalty) for failure to fulfill the conditions .

How can you understand that the transfer of money is in the form of an advance ? Everything is simple here. If the contract does not directly indicate that the amount is transferred in the form of a deposit , then this amount is recognized as an advance .

At the same time, in the agreement itself this amount may be called differently, for example - security deposit, advance payment, prepayment, etc. Doesn't matter! If it is not a deposit, it means an advance (clause 3, article 380, Civil Code of the Russian Federation). And the advance payment , transferred towards future payments under the transaction, is always refundable if the purchase of the apartment does not take place.

True, if in the terms of the transfer of money the parties provided for a fine for the Buyer for violation (non-fulfillment) of the terms of the agreement, then the Seller has the right to keep this advance (or part of it). For example, if the Buyer does not show up for the transaction on the appointed day.

The provision for penalties is included in the contract at the discretion of the parties to the transaction. At the same time, a fine may be provided not only for the Buyer, but also for the Seller. For example, if in the process of preparing the transaction he found another buyer and refuses to sell the apartment to the first one.

That is, the Buyer and Seller can arbitrarily set in the contract the conditions for the return and non-refund of the advance payment when purchasing an apartment (see example below). This applies to both the primary market (for example, a reservation agreement for a new building) and the secondary market (a preliminary agreement or an advance agreement).

With the deposit , things are a little more complicated.

How to properly arrange the purchase of an apartment along with furniture - see this article.

Difference between advance and deposit

These definitions are often confused.

In both cases, we are talking about a cash contribution that is paid to the seller before the goods are transferred to the buyer. However, from a legal point of view, the difference between these concepts is huge. In particular, if we turn to clause 2 of Art. 380 of the Civil Code of the Russian Federation, it can be noted that the transfer of the deposit is always confirmed by a written agreement. This is a mandatory condition that does not depend on the amount of funds transferred. If there is no agreement in writing, the payment is considered an advance payment.

The second difference is that the advance payment does not become a guarantee of compliance with the concluded agreement. In its form, this is an advance payment for goods or services, which does not require an additional written agreement in addition to the purchase and sale agreement.

The third difference is that the advance is always returned to the buyer, while the seller is released from liability. This trick will not work with a deposit. Article 381 clause 2 indicates that if the terms of the agreement are violated by the person who made the deposit, the money remains with the recipient. When the party who received the deposit refuses to fulfill the obligations, the funds are returned twice as much.

Article 381 of the Civil Code of the Russian Federation “Consequences of termination and failure to fulfill an obligation secured by a deposit”

Deadlines

The time frame within which the parties must conclude the main agreement is determined by them independently. They are indicated in the preliminary agreement. If the prescribed deadlines expire and the agreement is not concluded, then one of the parties must send the other a requirement to sign the agreement.

When the second party evades such a requirement, legal consequences apply to the deposit: it either remains with the seller or is returned in double amount to the buyer.

If specific deadlines for concluding the main agreement are not specified, then the preliminary agreement is considered to be valid for a year.

Certificate of temporary disability of an employee - find out how to get it. Proper payroll calculation is very important. Find out about the important nuances of this process in our professional article.

If you were sent on a business trip over the weekend, then you need our material!

Return Policy

Considering that the deposit is a security for the terms of the transaction, it is extremely difficult to return the deposited amount. However, there are a number of conditions that allow this to be done legally. For example:

- there is no written agreement (in this case, the return of money will be problematic if the other party refuses to return it voluntarily, since it will be necessary to provide the court with other evidence of the transfer of money) or is drawn up with violations - the transferred funds are recognized as an advance payment and are returned to the failed buyer;

- the transaction raises concerns - if the buyer suspects a fraudulent scheme, he has the right to refuse to fulfill the terms of the contract and return the deposit in court;

- the seller refuses the transaction on his own - this is considered a condition for breach of contract, so the deposit is returned to the buyer;

- mutual agreement - the return of the deposit in case of failure to fulfill obligations may be provided for by the terms of the concluded agreement;

- the terms of the transaction were violated due to circumstances beyond the control of the parties to the contract - serious illness, natural disasters, etc.

Note that some buyers who decide to refuse the deal and plan to return the deposit made resort to cunning. An acquaintance approaches the seller, offering to conclude a deal on more attractive terms. There is a possibility that, in pursuit of profit, the seller himself will offer to terminate the deal.

Double refund

This procedure is provided for in paragraph 2 of Art. 381, where it is expressly stated that if the terms of the contract are violated by the party who received the deposit, the funds are returned in double amount. In addition, the violator must compensate for losses caused by non-compliance with the agreement. For example, the parties draw up a contract for the sale and purchase of a garage. The buyer paid a deposit, but while collecting the rest of the amount, the seller made a deal with another person who offered a larger amount.

Buying an apartment: return features

If the transaction fails due to the fault of the seller, he is obliged to return the deposit received to the buyer in double amount. A refund of the deposit if the conditions are not met by the buyer is not possible. The only exception is if the person who made the deposit is faced with a “gray” sale and is not going to continue the deal with the fraudster, but this circumstance will have to be proven in court.

What does a contract look like?

The contract form is drawn up in a strictly defined form. According to the law, it must contain basic information relating to the subject of the transaction, personal and contact information of the seller and buyer and their obligations, as well as signatures.

The deposit agreement is drawn up by the owner selling the living space or his representative. The entire amount received after completion of the transaction must be transferred to the owner. Regardless of how the deposit agreement is drawn up (either independently or with the support of qualified specialists), the form must contain the following information:

- Date and address of the place where the deposit agreement was signed.

- The exact amount of payment (written verbally (in capital letters) as well as in numbers) that the seller will receive and the duration of the contract. You should also indicate exactly how the money will be transferred - most often the amount is transferred in cash from a notary.

- Passport details of both parties to the agreement (full full names and addresses of all co-owners of the apartment and the buyer of the property) and their contact information.

- The full amount of the apartment purchase and sale transaction and its characteristics. Here they describe the subject of the future transaction, its location, square footage, etc. The more fully the apartment is described, the safer the transaction.

- Description of the obligations assumed by the parties to the agreement. Indicate the most complete list of actions and what the violation of the terms of the agreement leads to - it is on the basis of the points of the agreement that the relations of the parties will be built.

- Personal signatures of the seller and buyer.

- Title document for the apartment. Its original must be in the hands of the seller, otherwise there is a risk of becoming a victim of a fraudster (copies, even certified ones, are easily forged).

- If the parties have previously entered into a preliminary agreement for the purchase and sale of an apartment, it is also necessary to indicate basic information about it.

If the apartment belongs to a minor owner, and the guardianship and trusteeship authority has authorized the sale of the property, their legal representatives must sign the form.

In addition, you can specify other information and conditions determined by the parties to the transaction:

- Technical condition of the apartment.

- The number of people registered in the apartment (if you don’t know this, the purchase and sale transaction may later be challenged in court).

- Transfer of furniture and household appliances in the apartment (if required by the terms of purchase and sale of the apartment).

- The procedure and timing for drawing up the final purchase and sale agreement for an apartment, as well as the procedure for mutual settlement (how the money will be transferred to the seller for the purchase of housing, when the transfer and acceptance certificate will be drawn up, etc.).

- Which party bears all costs associated with the transfer of ownership, collection of documents and registration of the contract.

A visual example can be provided to you by the civil service, or by a notary or lawyer. You can also download and view a sample deposit agreement here:

What guarantees does the receipt provide?

A written agreement on the transfer of funds as a deposit must contain the following points:

- passport details and addresses of participants;

- an accurate description of the object of the purchase and sale agreement;

- amount: in numbers and words;

- deadlines for completing the transaction;

- signatures of interested parties.

In addition to the general return conditions provided for in Article 381 of the Civil Code of the Russian Federation, the deposit can be returned on the following grounds:

- the purchase and sale agreement contains inaccurate information;

- there is no clear description of the object of the transaction, which causes ambiguous interpretation of the terms.

Do I need to return the advance to buyers?

The answer to this question is unequivocal - yes. If the prepayment was not formalized as a deposit, or the parties did not stipulate otherwise in the contract (for example, conditions of non-return or penalties), the seller must return the money to the buyer regardless of the degree of his guilt in not completing the transaction.

Please note that when returning the advance payment, in order to avoid fraudulent activities (the buyer can go to court and receive the money a second time), the seller must take a receipt from the buyer stating that he received the advance payment back, due to the fact that the deal fell through.