Free legal consultation!

8 Hotline in the Russian Federation

8 Moscow and Moscow. region

8 St. Petersburg and Len. region

- home

- Donation

The desire of parents to help their children when buying an apartment directs them to the question of how to formalize the donation of money and avoid misunderstandings in the future. The whole point is that in this way you can confirm the personal property rights of your child. This is true if the son or daughter is already married. In order for the registration process to proceed correctly, we recommend that you familiarize yourself with the features of drawing up such an agreement, take into account all possible nuances, and familiarize yourself with the document template.

General information about the transfer of funds as a gift

The transfer of movable and immovable property as a gift, as well as all contractual legal relations between citizens, are regulated by the Civil Code of the Russian Federation. This regulatory act does not contain articles that would specifically regulate the targeted transfer of funds, therefore, the general provisions on donations are applied to this type of transaction by analogy.

According to the Civil Code of the Russian Federation, donation is the gratuitous transfer of a property from one person (donor) to another (donee). The main characteristic feature of this legal relationship is gratuitousness. Thus, if in the text of the agreement fixing the transaction it is indicated that the donor receives any material benefit for the transfer of property or it is established for the recipient to fulfill a counter-obligation, it will be declared invalid.

This transaction is bilateral. For its conclusion, the will of not only the donor, but also the recipient is important. Thus, the receiving party may refuse to enter into such a legal relationship before signing the agreement, despite the gratuitousness. In this case, the recipient is not obliged to motivate his actions.

The legislator classifies funds as movable property. The agreement on the transfer of money can be formalized orally or in writing. This matter is left to the discretion of the parties, except in the following cases:

- if the donor is a legal entity and the amount of the gift exceeds 3,000 rubles;

- if a person promises to make a gift in the future.

A donation of funds for an apartment can be made orally, when there is no need to separate the acquired property from the total amount of property jointly acquired by the spouses. Also, if the donor completely trusts the recipient and under no circumstances intends to challenge the transaction in the future. Otherwise, it is not possible to prove the fact of gratuitous transfer of money without an agreement if mutual claims arise in the future.

What is a special purpose gift agreement?

This is an agreement according to which one person (the donor) undertakes to transfer free of charge funds to the property of another (the donee) for the implementation of certain goals. This transaction is practically no different from a deed of gift. It is unpaid and free of charge.

The donor does not set the conditions for accepting the money and does not require a gift in return.

Property under such an agreement becomes the property of the person to whom the gift is made. But the agreement is targeted, so you won’t be able to use the money at your own discretion. The donor alienates them for a specific purpose that the recipient needs to achieve.

Advantages of notarization of a transaction and costs

The legislator also does not establish mandatory notarization for this type of deed of gift. The parties can take advantage of this measure at their discretion in order to ensure the legal purity of the transaction and protect the agreement from challenge by third parties.

Notarized documents have increased evidentiary value in court proceedings. Transactions recorded by a notary are extremely difficult to challenge. An office employee is obliged to check compliance with the rights and legitimate interests of the parties, as well as third parties, when entering into a legal relationship.

Notaries for such services charge a fee at the rate established by the Tax Code of the Russian Federation, as well as for related legal and technical actions. The second component of the amount is usually several times larger than the first. The price for certification of a deed of gift will depend on the status of the notary. In most cases, the fee for such services varies from 3,000 to 10,000 rubles.

Difference from a regular gift agreement

How to draw up a deed of gift for money?

You can give almost any thing, except those prohibited for free circulation. Donating money, like any movable property, has its differences from the same procedure for real estate.

The main thing is a simpler requirement for the form of the concluded agreement.

In many cases it can simply be oral. There is no need to register a written agreement for a deed of gift for money.

In addition, in real estate transactions, other essential provisions are added in addition to the subject matter. To complete such a procedure, a large amount of documentation is not required.

How to register a donation of money

To draw up a contract for the donation of funds, it is necessary to determine in what form it will be concluded: written or oral. This should be determined depending on the amount of the gift; if it is significant, then it is worth concluding an agreement in writing, but if, on the contrary, you can get by with an oral form of donation.

When giving orally, money is transferred personally into the hands of the recipient or transferred to his bank account. A contract is concluded in writing.

The donation agreement should indicate the main points :

- about the subject of the agreement;

- about the rights and obligations of the parties;

- about general provisions (usually it is indicated that disputes that arise are resolved peacefully, etc.);

- information and signatures of the parties.

You should also indicate the place and date of drawing up the deed of gift. When indicating the subject of the agreement - a sum of money, it is worth writing the amount in capital letters, and also be sure to indicate how this amount was transferred.

Example

- The donor, free of charge, transfers to the recipient a sum of money in the amount of 500 thousand rubles.

- The funds specified in clause 1 are transferred against a receipt for receipt of funds, signed by both parties, where the receipt is an integral part of this agreement.

Information

Concluding a contract for the donation of funds from a notary depends on the desire of the parties to the contract. The deed of gift can be drawn up in simple written form yourself. There is no requirement to register the transaction with government or other authorities.

Prohibition of donating funds

In some cases, the Civil Code of the Russian Federation (Article 575) establishes a ban on donating money in excess of 3 thousand rubles.

A ban on donating funds is imposed in the following cases:

- on behalf of minor citizens or incapacitated persons;

- employees of educational, medical organizations, organizations that provide various social services, citizens who receive these services from them, spouses or relatives of these citizens;

- between commercial organizations;

- persons holding state and municipal positions in the Russian Federation in connection with their official position or in connection with the performance of official duties.

Do I need to pay taxes?

Does donating money to buy an apartment between close relatives have any special implications for paying taxes?

Tax legislation provides for the need to pay certain deductions on the amounts of income received.

However, there is an exception for cash. Article 217 of the Tax Code of the Russian Federation establishes that there is no need to pay tax when donating money by individuals. It does not matter whether these persons are related to each other or not.

Expert opinion

Valiullova Antonina

Expert of the site pravozhil.com

Ask a Question

In the case where the Donor is a legal entity, the Donee, according to the Tax Code of the Russian Federation, is obliged to pay tax on the donated amount in a single amount - 13%. Relevant actions are carried out when transferring funds exceeding an amount of over four thousand rubles.

It is worth noting the fact that the transfer of money as a gift between legal entities is prohibited by the legislator.

Workers in the social, medical and educational spheres are also prohibited from accepting gifts, but only from persons who use the services of the represented organizations. Such gifts should not exceed the value of more than three thousand rubles.

What can you donate money for?

As for giving money as a gift, the recipient has the right to use it at his own discretion. He can buy himself equipment, things, an apartment, a car, a plot of land and much more, on which he deems it necessary to spend this money. But all situations have their exceptions, and this situation also has those.

The party receiving the gift cannot use the money at its own discretion if it is given as a donation or transferred under an agreement for a targeted donation, in other words, it is intended for a specific expenditure.

Drawing up a promise of gift agreement

There is a situation when the donor does not immediately transfer money to the recipient, but only promises to transfer it in the near future. The execution of a promise of gift agreement serves as confirmation of the donor’s intention to transfer funds to the donee in the future. Such an agreement must indicate a specific date, event or other situation, in the event of which the funds will become the property of the donee.

The agreement can be found at the link.

Such an event could be, for example, a wedding, entry into a university, graduation, moving to another city, as well as other situations that the donor, at his discretion, specifies in the contract. That is, in such an agreement the text will be almost the same as in a regular deed of gift, only there will be a reference to a specific event or date.

what is the tax rate

Income in cash and in kind, which is received from individuals as a gift, is not subject to personal income tax (Article 217 of the Tax Code of the Russian Federation).

In this case, we are not talking about exceptions to this rule:

- apartments;

- cars;

- shares;

- shares;

- share.

Targeted donations of money will not be subject to personal income tax, regardless of who the parties to the agreement are. The parties to the deed of gift may not be relatives, but the agreement between them will still remain non-taxable.

Examples of using

An agreement to donate money for the purchase of an apartment can be drawn up for various reasons .

For example, a parent wants to financially help his daughter, who recently got married, to buy an apartment. At the same time, it is known that she wants to start her own business, for which she needs money.

The parent assumes that the transferred amount may go towards a risky venture , and does not want such an outcome. In this case, it makes sense to draw up a written agreement, which will indicate the purpose of donating money.

Donation agreement for the purchase of an apartment, sample (between close relatives).

Also, agreements for the donation of money for the purchase of an apartment are used to prove ownership of real estate during a divorce . As you know, all valuables acquired during marriage are considered the common property of the spouses.

A money donation agreement will help establish the fact that the apartment was purchased not with the help of the husband and wife’s savings, but with the funds of the parents of one of them, who donated money for the apartment.

Consequently, the apartment itself will be the property of the spouse to whom the money was donated for its purchase .

Questions and answers

- Question one:

If we certify a deed of gift, do we need to pay some kind of tax?Answer:

When concluding a gift transaction between close relatives, there will be no tax in any case. Personal income tax is not assessed on donated/inherited property. If you decide to have a document certified by a notary, you will have to pay a notary fee. The certification procedure is not mandatory.

- Question two:

If we transferred funds to our son to buy an apartment, we confirmed the transaction with an agreement. Four months have already passed, we stipulated a three-month period in the agreement, but he still hasn’t bought an apartment. He is not going to return the money, what should he do in this case?Answer:

You need to go to court to cancel the transaction on the basis of non-fulfillment of obligations by the other party. The court will order your son to return the amount you previously transferred.

- Question three:

We gave our daughter 2 million rubles under a special gift agreement. To buy an apartment, real estate was purchased with her money. Will my son-in-law be able to sue part of the apartment from our daughter, since the property will be jointly acquired? Did you buy an apartment after your wedding?Answer:

The main thing is that you have in your hands a receipt for the transfer of money to your daughter for an apartment + a target agreement. Then it will be necessary to prove that the apartment is the daughter’s personal property. You also need documentary evidence of the amount paid for the real estate.

- home

- Donation

Article rating:

(votes: 2 , average rating: 5.00 out of 5)

Share with friends:

Related publications

- Donation

Deed of gift for a house and land in 2021

- Donation

Cancellation of deed of gift for an apartment

- Donation

Cancellation of deed of gift for a house in 2021

- Donation

Is it possible to draw up a deed of gift without a notary?

Add a comment

Click to cancel reply.

You need to be logged in to leave a comment.

Popular material

Rules for registering a target deed of gift

When donating money from relatives, there is no need for a written agreement, regardless of the amount of cash. If the donor plans to give money upon the occurrence of an event (for example, a wedding or receiving a diploma), or he specifies the actual time of delivery of his gift, then a written form of donation is required.

Expert opinionDmitry NosikovLawyer. Specialization: family and housing law. When giving small amounts to your loved ones, there really is no point in drawing up an agreement. But when donating significant funds for the purchase of an apartment, it is better not to rely on family understanding. Judicial practice shows the recklessness of such actions. To avoid problematic situations, it is imperative to prepare the document in writing. In some cases, it would not hurt to have the deed of gift certified by a notary.

If the donor is an individual entrepreneur/legal entity, then a written agreement is required.

If the contract is concluded verbally

Having decided on an oral form of the transaction, you should understand that it is the least protected in the legal aspect. It is unlikely that it will be possible to prove that the money was not used for its intended purpose.

To protect your rights as much as possible when making an oral gift, it is recommended that you negotiate the terms and transfer the money in the presence of witnesses. It would also not hurt to take a receipt for receipt of funds - the law does not prohibit drawing up a transfer deed when the transaction is carried out orally.

In accordance with Art. 574 of the Civil Code, the oral form is possible only in cases where:

- the subject of the transaction is not real estate;

- movable property is transferred immediately;

- the owner of the money donated is an individual.

An oral promise of a gift is considered void. In accordance with Part 2 of Art. 572 of the Civil Code, the donee cannot demand its fulfillment.

If the deed of gift is made in writing

When drawing up a deed of gift in writing, it must contain:

- information about the donor and recipient;

- purpose (providing money to purchase an apartment);

- amount, type of funds;

- place/date of the transaction;

- conditions (if any);

- validity period (the document comes into force from the moment of execution and terminates its powers when the parties fulfill their obligations);

- rights/obligations of the parties;

- methods of resolving disputes (the first stage is negotiations, the second is the court).

The document is drawn up in 2 copies, certified by the signatures of the parties. A receipt serves as confirmation of receipt of money. There may be a section devoted to confidentiality - in this case, the parties undertake not to disclose the terms of the transaction to third parties.

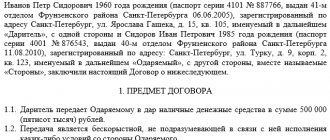

what is written in the sample

Typically, a targeted donation agreement consists of the following sections:

- information about the parties to the agreement and their expression of will;

- gift item;

- rights and obligations of the parties;

- confidentiality;

- dispute resolution;

- duration and termination of the contract;

- special conditions and final provisions;

- signatures of the parties.

The section on the subject of the agreement specifies the amount of money donated and the purposes for which it is alienated. The moment of actual transfer of money is indicated. The second section outlines the rights and obligations of the parties.

agreements for targeted donation of funds.

Download a completed sample receipt for receiving money.

In the case of a targeted transfer of money, the basis for termination of the transaction may be the misuse of the gift. If the agreement is cancelled, the donee cannot claim to challenge this fact.

The recipient has the right to refuse to accept the gift at any time in writing. And the donor may refuse to fulfill his promise.

Refuse if, after the conclusion of the transaction, his financial situation or standard of living has decreased significantly. The initiator of the transaction can cancel it if certain conditions are met (Article 578 of the Civil Code of the Russian Federation).

The confidentiality section provides for non-disclosure of data and terms of the transaction. Regarding the resolution of disputes, the procedure is quite simple: the contract states that the parties must initially resolve their differences through negotiations, and if this does not help resolve the conflict, then such disputes pass into the hands of the court.

How much does a deed of donation of an apartment cost from a notary, read here.

The contract for the targeted gift of money comes into force from the moment of its conclusion. Terminates after the parties have fulfilled all obligations.

Agreements of this kind can be terminated early by agreement of the parties or on legal grounds. In the final paragraph of the document, the parties undertake to resolve all unforeseen problems within the framework of the law, as well as make changes to the agreement in writing.

A mandatory addition to the monetary deed of gift is a receipt.

The receipt is drawn up in two copies. In it, the donee confirms the receipt of money in the specified amount for the implementation of certain goals.

This is interesting: Application to the prosecutor's office for non-payment of wages - sample

Procedure

In order to register a donation of money, you need:

- Discuss with the recipient of the funds all the terms of the future “transaction” . In particular, it is the destination point, so that there is no misunderstanding in the future.

- Prepare money . They can be transferred in cash or transferred by bank transfer.

- Draw up a gift agreement . This can be done in person, however, given the fact that the document will still have to be certified by a notary, it is better to immediately contact him so that he can draw up the document.

- Sign the contract . Signatures are placed by both the donor and the recipient. You will also need to indicate the date of signing, which must be real and current.

- To certify a document . This must be done by a notary. The service is paid, but it helps reduce possible risks for both parties to the transaction.

- Transfer funds and write a receipt . Simultaneously with the transfer of money (provided that this is done in cash), a receipt is drawn up and signed. It should be noted that it must be in two copies: one for the donor, the second for the recipient. For the donor, this document confirms the fact that the money was transferred (the obligation assumed by the person under the gift agreement was fulfilled), and for the donee, such a document confirms the fact that he received the money. In fact, the donee does not particularly need the receipt, but it is better if each party to the transaction has its own copy.

- Check the intended purpose . Considering the fact that the donor wants to give money specifically for the purchase of an apartment, he will have to control the very fact of where this money will be spent.

Notarized donation of money

Contacting a notary is not mandatory, but if the agreement contains a large amount of money and obligations to spend it for specific purposes, then it is advisable to have the transaction certified by a notary.

In order to register a transaction with a notary, you need to pay a sum of money for paperwork. If you lose a copy of the deed of gift, you can contact a notary to obtain a copy, which is stored in the document archives. In addition, the notary will confirm the authenticity of the signatures in the document, because he will be present at the time of signing the deed of gift.

Additionally

When registering a transaction with a notary, you can be sure that the specialist will conduct this transaction in accordance with the law, draw up and execute the document correctly, explaining to the parties their rights and obligations, and will also provide consultation, if necessary.

Nuances of drawing up a contract

Before concluding a deal, you must consider the following nuances:

- obtain the consent of the recipient, discuss the terms of the transaction with him;

- formalize the donation of money for an apartment in writing, since in such cases large sums are transferred;

- You can involve two witnesses in the registration process, who will confirm with their signatures the fact of the transfer of funds. Citizens must be adults and fully capable;

- the agreement is drawn up in at least two copies, one for each party;

- the transfer of money must be recorded with a receipt;

- Despite the fact that money is most often property acquired during marriage, the consent of the donor’s spouse for its gratuitous transfer is not required. But if there are suspicions about the emergence of claims in the future, it is still worth enlisting them. This document must be drawn up in writing and certified by a notary.

The law does not impose special requirements for such donations. Obviously, it must contain the essential terms of the transaction, and must also identify the parties. It is also important to indicate the intended purpose of the funds. In the deed of gift, the parties to the transaction reflect the following points:

- information about the parties (full name, passport details, date and place of birth, registration address);

- subject of the contract. The monetary amount is indicated in full, in numbers and capital letters. The intended use of funds “for the purchase of an apartment” is also reflected;

- the gratuitous transfer of money by the donor and the expression of will of the recipient aimed at accepting the gift;

- general provisions. In most cases, a clause is indicated on resolving disputes peacefully;

- date of conclusion of the agreement and personal signatures of the parties.

It is also important to indicate the method of transferring funds to the recipient.

It is important to formalize the transfer of funds in the form of a receipt. In essence, this document is an act of acceptance and transfer of funds. It specifies the parties, indicates the fact and method of transfer of funds in a certain amount. The recipient confirms receipt of the money with a personal signature.

Sample agreement of donation of money for the purchase of an apartment

judicial practice on the agreement of donation of money for the purchase of an apartment

The parties to the contract try to resolve all difficulties and issues without going to court. Especially if the donors and recipients are close relatives. But there are cases when it is impossible to do without the intervention of the court.

One example of such a situation is the following case. The crux of the matter: the parents decided to give their son money to buy an apartment. The deal was completed according to all the rules, the son accepted the gift and signed a receipt.

Three months after signing the contract, the parents filed a claim for forced termination of the deed of gift.

Find out a lot of information about the dacha donation agreement here.

This article will tell you how to draw up a donation agreement for an apartment with the right of lifelong residence of the donor.

The basis for this was the fact that the donee did not fulfill the terms of the agreement and the receipt. The money was not used for its intended purpose and the apartment was not purchased.

Court decision: the court decided to satisfy the donors' demands in full. From the point of view of the practice of considering cases regarding forced termination of deeds of gift, this case can be considered an exception to the rule.

Any agreement can be forcibly terminated only if one of the parties does not fulfill it. As such, the deed of gift does not establish financial obligations in relation to the donee.

The gift agreement is gratuitous, but the agreement on the targeted alienation of money has certain conditions that must be observed. The money had to be spent on buying an apartment. It was for this purpose that the donee signed the receipt.

Another case in judicial practice concerned the cancellation of earmarked gift money. The crux of the matter: the father gave his daughter money to buy an apartment. The agreement was fulfilled and the recipient purchased the apartment. A year after that, she died. The father filed a lawsuit demanding the cancellation of the deed of gift on the basis of Part 4 of Art. 578 Civil Code of the Russian Federation.

Article 578 of the Civil Code of the Russian Federation gives the donor the right to cancel the agreement in the case when he outlives the donee.

The court's decision was to dismiss the claim. The transaction was completed by the parties. The recipient bought an apartment. At the time of filing the claim, the deceased’s legal heir did not have the subject of the transaction.

The agreement was concluded in relation to a certain amount of money, and the apartment that was purchased became, moreover, the joint property of the spouses.

A targeted donation of money for the purchase of an apartment is an excellent alternative to a gift for real estate. A targeted donation allows you to donate money to purchase an apartment and avoid taxation.

A gift expressed as a monetary amount is not subject to personal income tax.

Gifts for real estate are not subject to personal income tax only between close relatives. Distant relatives or people who are not related must pay personal income tax in the amount of 13% (for real estate alienation agreements).

Therefore, for parents who want to initially purchase real estate and then give it to their child, it is easier to transfer money to them using a trust deed of gift.

This document is drawn up in simple written form and does not require registration or notarization.

Video: Receipt.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Tax

A person who is lucky enough to receive a gift in cash will have to pay tax - 13 percent of its value .

A nice feature is the exemption from this tax on property donated by close relatives : parents, children, grandmothers, and so on.

Therefore, if the donor is not a close family member of the recipient of the property, it is best to present the apartment right away. Or not to formalize the agreement in writing, so as not to advertise the very fact of transfer of funds.

It is necessary to take into account that registration of an agreement with a notary requires payment of a state fee . If we are talking about amounts intended for the purchase of real estate, the duty can reach impressive amounts.

essential terms of the agreement

The essential terms of a contract are those without which it cannot be concluded. In relation to gift documents, the condition regarding the subject of the gift will be essential.

The subject of the agreement in contracts on the targeted alienation of funds is money in a certain amount. The transfer of funds is formalized by signing a receipt. The money is considered transferred from the moment the receipt is signed.

Deadlines for filing a tax return and paying taxes

According to the tax code, 3-NDFL must be filed no later than April 30 of the following year after receiving the gift.

After reviewing the declaration, the person will receive an answer as to whether they need to pay tax. If the result is positive, payment must be received no later than July 15 of the corresponding year.

For example, in 2015, Yu. L. Belova, I. K. Ivanov’s second cousin, gave her uncle a dorm room. Since the girl is not a close relative of the citizen, Ivanov filed a tax return with the appropriate authority by April 30, 2016 and paid a tax of 13% of the total cost of the room by July 15, 2021.

How to prepare and submit a tax return 3-NDFL

The procedure for submitting 3-NDFL to the tax office is as follows:

- Filling out the form. To properly formalize it, it is recommended to visit the official website of the tax office.

- Sending the document to the tax authority at the place of registration. This can be done in two ways: contact the nearest branch in person or send scanners of certificates and a completed application by email.

When donating money, it is recommended to draw up an appropriate agreement with a notary so that there are no serious consequences after making the gift. Not all persons are subject to taxation, but only those who are not close relatives.

Challenging the purchase of an apartment

The contract of donation of any thing is a unilateral transaction . Donating money to buy an apartment is no exception. This means that, in essence, a person can dispose of the received property at his own discretion.

In the situation under consideration, when money is donated for a specific purpose, the recipient must spend it on buying an apartment . In the future, the donor will no longer be able to influence the choice of a specific residential premises.

If the intended use of the gift is confirmed , the former owner of the money has no legal opportunity to challenge the purchase of the apartment.

Subsequently, the apartment can be sold, and no document will prevent the former owner of the property from using the funds as he pleases.

Agreement of donation of money for the purchase of an apartment, judicial practice.

The scope of application of this type of contract is quite limited.

In a situation when it comes to money and family ties, it is always better not to use legal instruments, but to have interpersonal relationships.

Mandatory conditions under which it is impossible to challenge the agreement

For this target agreement to be “clean” from a legal point of view, it is necessary that the donor:

- was absolutely competent;

- had at his disposal the required amount of money;

- secured the consent of the other half to complete the transaction.

Sample agreement of donation of money for the purchase of an apartment

A monetary deed of gift may have certain conditions of acceptance and purposes of execution.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

A money gift agreement allows close relatives to financially support their child and help him buy an apartment. A trust deed of money is most often drawn up by parents in order to protect the individual property of their son or daughter who is married. But in practice this is not so easy to do.

Is it possible to cancel?

The donor may cancel the gift agreement (Article 578 of the Civil Code of the Russian Federation) in the following cases:

- a sharp deterioration in one’s financial situation;

- if the person who received the gift from him caused harm to the health of him or his loved ones;

- if possible, prove that during the procedure for drawing up this agreement he was subjected to pressure or blackmail;

- if the money was spent not on purchasing an apartment, but on other purposes.

Also, this deed of gift can be canceled through the court (if an interested person applies there) in case of violations of legislative norms by a legal entity or individual entrepreneur. For example, money was donated, and a few months later the entrepreneur declares himself bankrupt, thereby violating the Federal Law on Bankruptcy (No. 127-FZ).

Many people believe that it is not at all necessary to draw up a written agreement if the process of donation occurs between close relatives; oral agreements are sufficient. But no one is immune from possible problems and surprises. And if a targeted donation is carried out between third parties, of course, everything should be confirmed only by documents and, for reliability, certified by a notary.

Concepts and signs of donation

A gift for money is a transaction in which the donor voluntarily and free of charge transfers a certain amount to the other party or undertakes to do so in the future. If funds are provided for the purchase of an apartment (house), then a special-purpose deed of gift takes place. Receipt of the donated amount is confirmed by a receipt certified by signatures.

The money that the donor plans to give must actually belong to him. If you are married, you must obtain the consent of your spouse. When initiating this transaction, a person must clearly understand the consequences of his actions. By law, both parties must be legally competent.

The recipient can reject a cash gift. The donor also has the right to refuse to fulfill the promise (the most common reasons: the person’s financial situation has seriously deteriorated, his health has deteriorated and treatment is required). Refusal of a deed of gift is regulated by Art. 578 Civil Code of the Russian Federation.

Although this type of gift is not separately considered in the Civil Code, it is often used in practice. Since the contract clearly states the purpose (purchase of an apartment), this condition must be met.

If the donated funds were used for other purposes, this may be grounds for termination of the transaction. Having failed to prove in court that the conditions have been met exactly, the recipient is deprived of the right to the money. It is not possible to dispute this.

Receipt for receiving money from parents

If the parties have come to the conclusion that it is necessary to draw up a written agreement, they can draw up a receipt to certify the very fact of transfer of funds.

This document is similar to the act of acceptance and transfer of an item under other contracts. Only a receipt indicates the transfer of funds in the amount stated in the agreement.

A sample receipt from parents for donating money can be found at the beginning of the article. Compiling it yourself will not cause problems, you just need to take into account the following conditions:

- drawn up in writing;

- Two copies;

- can be handwritten or typed;

- it is necessary to indicate the amount of funds being transferred, currency, purpose and method of transfer (cash or transfer to card);

- indicate the full details of the parties, according to their personal passports;

- There must be handwritten signatures of the parties.

Judicial practice knows cases of recognition of receipts for receipt of funds without indicating the passport details of the parties (Determination of the Leningrad Regional Court dated September 20, 2012 No. 33-4325/2012).

The receipt is part of the gift agreement, recording the fact of transfer of money. For greater confidence, the parties can invite witnesses to transfer money and draw up a receipt, who will also have to sign the document .

Notarization of the receipt is not required . Let us note that it is not always an annex to the agreement and can be drawn up as an independent document, which will also have legal force.

The law does not impose requirements on the form of the receipt. However, we advise you to compile it only in handwritten form. It is possible that in the future it may be necessary to conduct a graphological examination - resolutions on the document alone will not be enough to obtain high-quality results.

Thus, donating funds between individuals does not require mandatory registration. Parents who want to give their child a gift can play it safe and draw up an agreement, and confirm the transfer of the amount of money with a receipt.

How to challenge a loan agreement (promissory note)

The most common document in divorce proceedings is a promissory note. It is often compiled “retrospectively”, and the receipt of money from it is also recognized as personal funds. But there are much more options to challenge such a document than a deed of gift.

The most popular method is a motion to falsify evidence. This application has a number of mandatory procedures that must be carried out to verify the applicant’s arguments.

Alexey Lobanov

Head of Legal Bureau

Ask a Question

For example, if you believe that a loan agreement or promissory note was drawn up later than the date specified in the agreement, then it is worth submitting an examination of the prescription of drafting. In this case, the judge warns the parties about criminal liability for falsifying evidence if the arguments are confirmed, and about knowingly false testimony if they are not confirmed. But in the latter case, the case rarely moves into the criminal procedural plane.

Moreover, before starting this procedure, the judge gives the right to the party that submitted the disputed documents to exclude them from the case file and then no one will be punished. And such cases are not uncommon.

Excerpt from the court decision

Appeal ruling of the Moscow City Court dated November 14, 2018 in case No. 33-49194/2018

While giving explanations on these circumstances in the court of first instance, V.E. indicated that their family was helped financially by their parents, and even presented two receipts about this, but after filing V.A. statements about falsification of evidence, refused said evidence.

Financial capacity of the lender and debtor

If a party refers to the fact that he received money from a third party (for example, a relative), then the other party is not deprived of the right to demand evidence of the origin of the money in order to be able to lend it.

You can also check the debtor’s income based on the receipt - whether he could have fulfilled it within the time limits indicated or whether the transaction was imaginary in order to exclude the property from the list of jointly acquired property.

Excerpt from the court decision

Appeal ruling of the Moscow Regional Court dated June 29, 2015 in case No. 33-15158/15

Assessing the arguments of the plaintiff, who believed that T.V. did not have the financial ability to loan a large sum to the defendant, since he himself acquired a plot of land in the Ramensky district of the Moscow region, with an area of 2147 square meters. m, for summer cottage construction, with the right to erect a residential building, which is confirmed by an extract from the Unified State Register. T.V. After acquiring the land, a house with an area of about 200 sq. m. was built. m, while the average monthly income of T.V. amounted to no more than 20,000 rubles per month, the court declared them wealthy.

Causality and dates

It is also worth paying attention to the amounts under the loan agreement and the dates. For example, if the date of the loan agreement was earlier than the property purchase and sale agreement, then the party claiming to recognize the funds as personal must prove that this particular money was contributed under the disputed agreements

Excerpt from the court decision

Appeal ruling of the Moscow City Court dated 10/12/2018

The receipt from the date of receipt of I. from L. is not reliable evidence of the payment of the specified amount as payment for the disputed car, given that the receipt is dated before the date of conclusion of the purchase and sale agreement, the amount received does not coincide with the amount of the down payment

Each protection method has its own characteristics and nuances. The court will not always grant a request for falsification, which means there will be no examination. Also, he does not always agree to request documents on the financial solvency of the lender or debtor on a receipt. This is a topic for independent articles, which may be written later, since this cannot be covered in one page.

Results of our court cases

Arbitrage practice

How to prove the intended use of donated money?

In court practice, questions regarding money donation agreements are most often encountered in family disputes between spouses.

If they get divorced and divide property, then often one of them tries to prove his sole right to the apartment. And to confirm it, he provides an agreement on the targeted donation of funds.

It should be borne in mind that the presence of a document with such a condition does not yet prove the purchase of an apartment with these funds. This circumstance must be proven in the process of considering such disputes.

As for the cancellation of a donation, it is possible only in cases established by law:

- committing any actions aimed at causing bodily harm and even death to the donor (his family);

- mistreatment of the donated item, creating the threat of its loss;

- in connection with the death of the donee;

- when making a donation in violation of the provisions of the bankruptcy law.

Penalty and writs of execution during the moratorium period

One of the consequences of the introduction of a moratorium is the cessation of accrual of penalties (fines and penalties) and other financial sanctions for non-fulfillment or improper fulfillment by the debtor of monetary obligations and mandatory payments for claims that arose before the introduction of the moratorium.

In addition, the introduction of a moratorium against the debtor also means that it is impossible for the creditor to obtain compulsory execution by presenting the writ of execution directly to the bank. However, it is worth considering that the moratorium applies only to the most affected sectors of the economy

8-921-903-17-16

One of the spouses submitted a loan agreement (deed of gift) to the court. How to prove a fake? - Saint Petersburg

| A fine of five times the cost of goods for each month and other changes to the law “On the Protection of Consumer Rights” |

During the divorce process, unexpected promissory notes or deeds of gift often appear that directly affect the distribution of shares in jointly acquired property.

Alexey Lobanov

Head of Legal Bureau

Ask a Question

There are even cases when one of the spouses tries to prove that all payments for an apartment (or mortgage) were from personal funds received from relatives, which means that the purchased property is not jointly owned and is not subject to division

Question for a lawyer

Why do they prove that the funds were personal?

Property purchased with personal money, even during marriage, is not marital property. Accordingly, if you bought an apartment worth 5,000,000 rubles, and the other party presented a receipt confirming that he had received a debt from a relative in the amount of 4,000,000 rubles, then if you do not challenge the presented document, you will only have to divide 1,000,000.

Conclusion

Donating money is quite common. The agreement does not require registration, notarization, or even mandatory written form in all cases.

Transferring money to purchase an apartment is not prohibited by law. And in many cases, such an agreement can serve as evidence in the event of disputes about the division of property.

You can learn about some issues of registering a transaction for the purchase of real estate using earmarked funds received for its acquisition by watching the video:

Sources

- https://dgkh.ru/art/darenie-kvartiry/deneg-na-kvartiry.html

- https://pravopark.ru/grazhdanskoe/darenie/deneg/na-pokupku-kvartiry.html

- https://PravoZhil.com/dar/darenie/tselevoj-dogovor-dareniya-deneg.html

- https://bukvaprava.ru/2018/04/18/dogovor-dareniya-denezhnyh-sredstv-mezhdu-rodstvennikami/

- https://el-form.ru/darenie/dogovor-dareniya-deneg

- https://svoe.guru/zhilaya-sobstvennost/kvartira/darenie/dengi.html

- https://law-divorce.ru/dogovor-dareniya-deneg-na-pokupku-kvartiry/

- https://ros-nasledstvo.ru/dogovor-dareniya-deneg-na-pokupku-kvartiry/

- https://yurzona.ru/darenie/deneg-mezhdu-fizicheskimi-litsami-nuzhno-li-platit-nalog.html

- https://mylawyer.club/nedvizhimost/kvartira/kuplya-prodazha/dogovor-dareniya-deneg.html

- https://45jurist.ru/ugolovnoe-pravo/raspiska-kak-dogovor-dareniya-deneg-sovetnik.html