Filling out forms 1.2 and 2.8 on the website www.reformagkh.ru

During the first quarter of 2015, organizations managing apartment buildings (management companies, homeowners' associations, housing cooperatives, residential complexes) are required to disclose certain types of information about the management of houses based on the results of 2015.

Since most of this information is financial in nature, the accountant will be involved in one way or another in preparing the data for publication. Let us remind you that in pursuance of the Information Disclosure Standard approved by Decree of the Government of the Russian Federation of September 23, 2010 No. 731, Order of the Ministry of Construction of the Russian Federation of December 22, 2014 No. 882/pr approved forms of information disclosure by organizations operating in the field of management of apartment buildings. This order came into force on May 25, 2015; disclosure of information based on the results of the year using these forms will be made for the first time. It often happens that even inspectors from state housing inspection bodies cannot answer specific questions from representatives of the Criminal Code about filling out certain lines, but this will not prevent them from imposing a fine in the future in case of an error.

Administrative liability for violation of information disclosure requirements.

Inappropriate (untimely, incomplete) disclosure of information may serve as a reason for bringing the management company to administrative liability for violation of licensing requirements (clause 6, part 1, article 193 of the Housing Code of the Russian Federation, part 2, article 14.1.3 of the Code of Administrative Offenses of the Russian Federation). In this case, an important point is to determine the statute of limitations for bringing to administrative responsibility. The obligation to fill out forms 1.2 and 2.8 (see pages 65 and 66, respectively) must be fulfilled during the first quarter of the year following the reporting year, that is, no later than 03/31/2016 (clause 9 (3) of the Information Disclosure Standard). Please note that the date of publication of information is recorded on the website www.reformagkh.ru. As explained in paragraph 14 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated March 24, 2005 No. 5 and paragraph 19 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated January 27, 2003 No. 2, failure to fulfill the obligation provided for by the said legal acts by the established deadline indicates that the administrative offense is not ongoing . The period for bringing to administrative responsibility is calculated from the day following the last day of the period provided for the performance of the relevant obligation, that is, from 04/01/2016.

According to Part 1 of Art. 4.5 of the Code of Administrative Offenses of the Russian Federation, the total period is three months, since cases of this category are considered by a judge (Part 1 of Article 23.1 of the Code of Administrative Offenses of the Russian Federation). It should be remembered that for some categories of cases the statute of limitations for bringing to administrative responsibility has been increased to a year, in particular, for violations of legislation on the protection of consumer rights. When considering cases of violation of the Information Disclosure Standard earlier (Article 7.23.1 of the Code of Administrative Offenses of the Russian Federation), some courts qualified the offense in this way and confirmed that the statute of limitations is equal to a year (see Resolution of the Supreme Court of the Russian Federation dated March 25, 2013 No. 3-AD13-2, AS SZO dated November 24, 2014 in case No. A26-592/2014, AS UO dated August 25, 2015 No. F09-5446/15). At the same time, there were opponents of this point of view (Resolution of the Federal Antimonopoly Service dated June 16, 2014 in case No. A12-24444/2013). Explanations on this issue can be found in paragraph 21 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated June 2, 2004 No. 10. Thus, in the Code of Administrative Offenses of the Russian Federation, administrative offenses relating to consumer rights are not separated into a separate chapter, and therefore the courts, when qualifying the objective side of the offense, must proceed from its essence, the subject composition of the relations that have arisen and the nature of the applicable legislation. Courts must also take into account the purpose of legislation on the protection of consumer rights and its focus on protecting and ensuring the rights of citizens to purchase goods (work, services) of adequate quality and safe for life and health, obtain information about goods (work, services) and their manufacturers (performers, sellers). In this sense, courts must determine whether the protection of consumer rights is the priority goal of the law regulating relations for which administrative liability is established. Thus, there is a risk that a violation of licensing requirements, expressed in untimely disclosure of information, may be qualified as a violation of legislation in the field of consumer protection. And then the statute of limitations for bringing to justice will expire on 04/01/2017.

As for non-profit associations of citizens, they are not subject to liability for improper disclosure of information in accordance with the requirements of the relevant standard. Until May 1, 2015, Art. 7.23.1 of the Code of Administrative Offenses of the Russian Federation, which established liability for organizations carrying out activities to manage apartment buildings on the basis of management agreements. Despite the fact that the HOA does not enter into management agreements as an executor, there are cases when this responsibility was applied to it (Resolution of the Supreme Court of the Russian Federation dated December 22, 2015 No. 303-AD15-11489, AS UO dated December 3, 2014 No. F09-8335/14) .

Form 1.2

Information on the main indicators of the financial and economic activities of management companies, homeowners' associations, and residential complexes is presented for the reporting period - a calendar year, therefore, the start date of the reporting period is 01/01/2015, the end date of the reporting period is 12/31/2015.

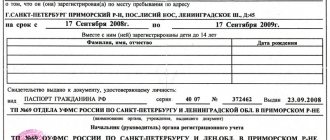

First of all, the manager needs to attach a scanned copy of the annual financial statements document for the reporting period in the form of files in electronic form (line 4). This means that all pages of the annual financial statements, to the extent required by accounting legislation and accounting policies, should be scanned and placed as a single document in the appropriate field when filling out the form. Reporting can be posted immediately after preparation (that is, after a paper copy has been signed by the head of an economic entity [1]), without approval by the company’s participants. This applies to both management companies and non-profit associations of citizens.

Income and expenses.

The next two lines are information about income (expenses) received (incurred) for the provision (in connection with the provision) of services for managing apartment buildings (according to separate accounting of income and expenses). When filling out these indicators, you need to consider that:

- in this form the data is reflected in total for all houses under management;

- here it is logical to disclose information on all services and work provided and performed on the basis of management contracts (not only on direct management services of apartment buildings, but also on utilities, as well as on the maintenance and current repairs of common property);

- since income and expenses are an accounting object, it is logical to assume that the indicators should be taken from accounting;

- One more thing follows from the previous provision: for a company paying VAT on the transactions in question, income should be shown excluding VAT (clause 3 of PBU 9/99 “Income of the organization”);

- Separate accounting refers to accounting methods by which income and expenses within the framework of MKD management activities are separated from other income and expenses.

Income related to the provision of services for the management of apartment buildings (line 5) certainly includes the amounts of fees accrued to the owners (tenants) of premises for utilities, maintenance of common property, management of apartment buildings, that is, revenue for the provision of services, performance of work, recognized in current period. From a taxation point of view, proceeds for current repairs qualify as funds for targeted financing (clause 14, paragraph 1, article 251 of the Tax Code of the Russian Federation), subject to separate accounting and targeted use. In accounting, revenues for current repairs can be classified as earmarked funds if they are collected in approximately the same way as contributions to the capital repair fund: detailed repair parameters are not agreed upon in advance. If, when making a decision to pay for current repairs, deadlines, lists and costs of work are established, we propose to generate future income. The disclosed indicator should most likely include revenue from the provision of services and performance of work (turnover on the credit of account 90 “Sales” for the reporting period). For the same reason, accrued contributions for capital repairs are not included in income if the fund is formed in a special account.

Income received for the provision of apartment building management services should be distinguished from revenue from the provision or performance of other services or work (renting out property, carrying out work on private property or individual work under contract agreements outside of apartment building management agreements). In addition, any company has a lot of other income, one way or another due to its core activities, for example, amounts of penalties received from unscrupulous payers, compensation for damage caused, interest on the use of the balance of free funds in the account, commissions from partners (if, to for example, the management company for a fee charges and collects payments from the population for the services of third-party organizations), intermediary remuneration from the owners of premises (for example, for participation on behalf of the owners of premises in a lease agreement for common property, in calculations related to the payment of remuneration to members of the council of MKD), etc. They can hardly be considered directly received for the provision of services for the management of apartment buildings. Therefore, such income should be separated in accounting and should not be included in Form 1.2.

In turn, in connection with the receipt of these incomes, the company inevitably incurs expenses (line 6). Some of them can be directly correlated with certain income, and some relate to several types of activities at once. In this case, separate cost accounting consists of a forced (calculated) distribution of the second part of the costs by type of activity. The method of distribution of expenses must be specified in the local act of the organization. Please note that direct costing can be adopted in accounting - a method of cost accounting in which the company does not determine the full cost of services and work, but writes off commercial and administrative expenses without distributing the total amount (paragraph 2 of clause 9 of PBU 10/99 "Organization expenses"). The need to disclose expenses in Form 1.2 does not mean that the organization must change the accounting method of recognizing expenses. It seems that the management company has the right to approve a special methodology for allocating costs for the purposes of information disclosure and, in accordance with it, calculate the indicator included in form 1.2 on line 6.

Another question that arises in practice: is a homeowners association (housing association, housing complex) required to fill out the indicators under consideration (information on income and expenses in connection with the provision of apartment building management services)? The fact is that, depending on the accounting policy of the partnership, the answer to the question of whether receipts from the owners of premises in reimbursement of expenses for the maintenance and current repairs of common property, payment for utilities are income in accounting, may be different. Many partnerships do not record revenue from the provision of services either in accounting or tax accounting. However, in the Housing Code you can find wording from which it is clear that the HOA still provides services (Part 2 of Article 143.1). In addition, from the literal interpretation of paragraphs. “a” clause 3 of the Information Disclosure Standard does not mean that partnerships and cooperatives are exempt from disclosing the main indicators of their financial and economic activities, including information on income and expenses associated with apartment management services. Also in Form 1.2 there are two footnotes to lines 17 (estimate of income and expenses of a partnership or cooperative) and 18 (report on the implementation of the said estimate), according to which this information is subject to disclosure for partnerships and cooperatives. This means that no exception forms have been established for other indicators.

Thus, the HOA should enter in line 5 (income) the amount of payments accrued to the owners and tenants of premises (both members and non-members) for the maintenance and repair of common property and utilities, and in line 6 (expenses) - all expenses incurred for the purpose of maintaining and repairing common property and providing utilities.

Report of the board and chairman of the HOA

A homeowners' association is, as is known, a legal entity.

And, like any other legal entity, this organization must report to the state, supervisory authorities, and also to other residents.

The only person to whom HOAs and housing cooperatives are not required to report is the Ministry of Justice...

Is it necessary to hold an annual reporting meeting of the HOA?

Mandatory - in accordance with the Housing Code (2017 edition), namely Art. 45. The event is held in the second quarter of the year that immediately follows the reporting year (Federal Law No. 176-FZ of June 29, 2015).

In addition to mandatory reporting on the initiative of groups of owners or individual enthusiasts, unscheduled meetings can also be held - but on an extraordinary basis.

The validity of a meeting is determined by the presence of a quorum. This takes place if at least 50% of the total number of votes are present - the owners of the apartments or their legal representatives. If a quorum is not reached, then the general meeting will still have to be held, albeit out of turn.

The association must notify each of the apartment owners about the upcoming event at least ten days before the day of the meeting - in writing.

The Partnership is obliged to maintain and promptly submit:

— Accounting and tax reports (this also applies to those organizations that have chosen a simplified system for themselves - Article 23 of the Tax Code of the Russian Federation, Federal Law No. 402-FZ); — Special reporting.

Types of reporting for HOAs

As for reporting to residents, ordinary citizens who are not burdened with legal “savvy”, then everything is not so simple. Yes, on the one hand, the law directly states that the partnership is obliged to report on all financial movements passing through their hands, as well as on the work done. And that any of the inhabitants of the house has the right to demand such transparency from the company.

Moreover, when the Disclosure Standard has been approved (Resolution of the Government of the Russian Federation No. 731 of September 23, 2010). But on the other hand, a single form of annual report for neither the board nor the chairman of the organization has not been established in any legal act, that is, again, everything is decided by the organization’s charter.

Therefore, any resident first of all needs to carefully read the charter of the HOA of their home. It describes how, when and in what order the partnership reports to the citizens who have trusted them.

Board report

According to housing legislation (Article 151 of the Housing Code of the Russian Federation), the board of the partnership has the right to dispose of the cash reserves that are in the organization’s bank account.

These actions must be carried out according to the financial plan.

In accordance with it, the board is obliged to provide data on exactly how and for what this money was spent.

This includes:

— contributions, all types of payments that come from members of the organization; — subsidies for the operation of common property; — income generated by the company’s economic activities; - other income.

An example of a HOA report to homeowners

Annual report on the activities of the board of the Bastion Homeowners Association for 2012.

Speaker Chairman of the Board Yu. N. Shaikhutdinova

The gradual restructuring of the psychology of the owners of our apartment building in accordance with the realities of today still remains an intractable task facing the board members of the homeowners' association. It turned out to be difficult to rebuild it on the principle of private property. By purchasing an apartment, a person receives the right to own, use and dispose of it. This is easy to understand. And the fact that with property comes responsibilities turned out to be difficult to understand. The apartment does not exist autonomously, in an airless space. There are inter-apartment landings, roofs, walls, basements, entrances, communications, general lighting and much more that apartment owners need to jointly maintain.

Collective living of a person in an apartment building does not contribute to the development of the principle of private property. Citizens living in the house continue to believe that the common property is not their property. Everyone should realize: the barrier that was broken is my barrier, the broken glass is my glass, the HOA is not a separate organization, it is you and me - the Homeowners Association. Over time, everything wears out: structures, networks, communications. And all owners need to solve the problems of current and major repairs today, looking ahead to the future.

1. REPORT for 2012:

Cash balance as of January 1, 2012 – 162,962.55 rubles

— received on the account for 2012: — from the owners: RUB 1,986,527.90. (d.b. 2,102,309.19 rub.) – debt 115,781.29 rub. for utility bills; — rent: RUB 462,554.14;

The balance of funds as of 01/01/2013 is 73,219.54 rubles.

TOTAL: 162,962.55 + 462,554.14 + 1,986,527.90 – 73,219.54 = 2,538,825.05 rubles – these are the costs for 2012.

Expenses amounted to: 2,572,349.31 rubles.

2,538,825.05 – 2,572,349.31= 33,524.26 rubles;

73,219.54 – 33,524.26 = 39,695.28 rubles. - a loss that was covered by rental funds. If all owners paid their receipts on time and in full, the HOA could make a profit of RUB 76,086.01.

Expenses - payments to suppliers and services 1,714.5 thousand rubles: (TGC-13 - 546 thousand rubles, Kraskom - 131 thousand rubles, Krasenergo - 206 thousand rubles, training - 3 thousand rubles, elevators, maintenance – 82 thousand rubles, solid waste – 32 thousand rubles, security – 34 thousand rubles, legal services – 3 thousand rubles, software – 22.5 thousand rubles, ATO - 13 thousand rubles, intercom - 15 thousand rubles, accounting services - 124 thousand rubles, taxes - 182 thousand rubles, salary (with vacation pay) - 286 thousand rubles, spare parts - 35 thousand roubles.);

- cash at the cash desk (household needs, remuneration, unforeseen expenses) - 86 thousand rubles; — repair of the entrance – 276 thousand rubles; — repair of interpanel seams – 96 thousand rubles. - dismantling of equipment - 11 thousand rubles, - communications, Internet - 28 thousand rubles, - events - 23.5 thousand rubles, - stationery, legal. literature - 19 thousand rubles, - materials - 22 thousand rubles, - landscaping, repairs of the surrounding area - 41 thousand rubles, - salary for cards - 210 thousand rubles, - bank services - 45 thousand . rub.

Rent – 463 thousand rubles. (Vimpelcom - 84 thousand rubles, Multinet - 12 thousand rubles, Rostelecom - 7 thousand rubles, IP Alimova - 150 thousand rubles, studio - 90 thousand rubles, pavilion - 120 thousand rubles) HOA personally did not exceed current utility tariffs.

According to order No. 288-t dated 10/07/2011. – there was an increase in the amount of fees for utility services by 6% from 07/01/2012 and by another 6% from 09/01/2012. An increase in tariffs is expected from 07/01/2013.

Accordingly, funds for the repair of the front side of the house, roof, barrier, electrical equipment, etc. were taken from funds collected under the article Maintenance and current repairs. Today, in our apartment building, the issue of charging for the cost of purchasing electricity used for lighting common areas and operating electrical equipment in an apartment building has been regulated (Resolution No. 354 of 05/06/2011). As well as costs for hot water supply, hot water supply and wastewater. The issue of heating is not touched upon, because... We are unable to calculate the MOP. MOP can be either positive or negative, it all depends on the timeliness and correctness (honesty) of the submission of meter readings, as well as on the timely verification or replacement of meters by the owners of the premises. It is very difficult to plan the expenses of a house when the debts of individual owners for utilities as of 01/01/2013. amounted to: 83,358.64 rubles (on average, monthly debt is 130 - 140 thousand rubles). During the reporting period, the following repair work was carried out:

— Entrance repair (100%) – RUB 276,240.72. — Repair of inter-panel seams (70%) – RUB 95,516.28. — Painting the house (lower part), HOA premises and switchboard room. — 40 motion sensors were installed - lighting in the entrance. — Street lighting has been dismantled - automatic on/off. — The lighting system in the entrance (staircases) has been dismantled - automatic on/off. — A new pump was purchased for the heating center, which replaced a failed analogue.

Recalculation for heating for 2011 in 2012.

The amount of recalculation for heating for 2011 amounted to 126,795.54 rubles: recalculation was made in the amount of 126,795.54 rubles.

The BASTION HOA has its own website: bastion.sitetsg.ru, launched in September 2011 (login and password can be obtained from the HOA). Also, to inform residents, we have 2 notice boards: at the entrance and in the HOA premises. In 2012, the following events were held with the participation of residents of the house:

1) cleanup day (two months) in May:

- landscaping of the territory - planting 30 shrubs and trees (coniferous, fruit, ornamental) and 250 flower bushes; — painted the fences, sports ground (horizontal bars, sandbox, etc.), benches and trash cans in recreation areas and surrounding areas; 2) children’s drawing competitions “MOM’S Day”, “Best New Year’s Toy”, the winners of the competitions were awarded prizes; 3) the children and pensioners of Our House were individually congratulated and given gifts by Father Frost and Snegurochka; 4) we provide assistance to pensioners in the form of 30% discounts on paid services provided by the HOA; 5) HOA “Bastion” participated in the competition “Best HOA of 2012”, took 1st place in the district, and was awarded a valuable prize (teapot) by the Administration of the Leninsky District;

2. Approval of estimates for 2013, staffing:

The tariff for the Maintenance and current repair service for 2013 is 19.01 rubles/m2, left unchanged. According to the estimate, we propose that the costs of the salary part be attributed to the tenants’ funds.

PS in 2012, they increased the receipt of rental funds by 16% (hair salon - 7,500 rubles, atelier - 20,000 rubles, pavilion - 10,000 rubles).

Staffing schedule for 2013: approve 4 units (chairman with remuneration of 20,000 rubles, janitor - 3,800 rubles, technician - 3,500 rubles, plumber - 3,500 rubles).

3. Recalculation for heating should be done at the end of the heating season (April-May), because There are not enough settlement funds in the account with service providers.

4. Holding a general annual meeting - hold the meeting at the end of April, when it will be possible to gather outside.

5. Plans for 2013.

- renovation of the entrance - cladding tiles on the 1st floor; — dismantling the heating and hot water system; — install video surveillance in the entrance and local area; — install a playground; — improvement and landscaping of the territory.

6. MISCELLANEOUS.

— Recalculation for heating for 2012.

The amount of recalculation for heating for 2012 amounted to 262,015.87 rubles: recalculation was made in the amount of 183,411.109 rubles. (70%), amount 78604.761 rub. (30%) – to the reserve fund. This amount (RUB 78,604.761) will be used to increase the tariff (from 07/01/13) for heat, i.e. the tariff will be reduced by this amount. (example: the city tariff for heat will be 26.4 rubles/m2, then the tariff of the BASTION HOA will be 23.8 rubles/m2).

— RESERVE fund.

From 2013, 30% (RUB 78,604.761) of the amount (RUB 262,015.87) of recalculation for heating for 2012 will be used.

— WORKING with debtors.

Your suggestions.

— Mold in apartment 53 - a request was made to Scientific and Technical Progress OJSC about the causes of mold and a response was received No. 155 dated 03/11/13, recommendations to install fans in the ventilation openings and install supply valves (price: 8,000 rubles without heating , 18,000 rubles with heating). Owners of the apartment 53 demand that these valves be installed at the expense of the owners of the BASTION HOA. Two valves are required - 36,000 rubles. In the fall of 2012, the interpanel seams were repaired.

Report of the chairman of the HOA for the year

This document is drawn up on the basis of the duties implied for the person holding this position.

What are these responsibilities?

— Drawing up the annual budget of the partnership. — Control over all payments. - Hire new people, also fire them. — Making decisions regarding repairs. — Maintaining accounting reports. — Conducting meetings. — Maintain current lists of partnership members. — Perform additional duties according to the charter.

Sample report of the HOA chairman on the work done at the general meeting

Report to the general reporting and election meeting of members of the HOA “Lenina, 28”

“Report on the work of the HOA board for the reporting period from 2013 to 2014.” The work of the HOA board during the reporting period was aimed at ensuring the stable operation of life support engineering systems and comfortable living in the house.

Organizational work During the reporting period from May 2013 to December 31, 2014, four general meetings of owners of all premises (residential and non-residential) and members of the HOA were organized and held: - April 03, 2013 - general meeting of HOA members “Report on the work done for reporting period 2012”, at which the estimate for 2013 was approved and the task was set to resolve in court the issue of the ownership of the technical basement of the first entrance to all owners of the apartment building. — May 22, 2013 — general absentee meeting of HOA members “Elections of new members of the HOA Board, Audit Commission, Counting Commission,” on the initiative of the Initiative Group of HOA members (12% of all HOA members as of May 2013). — December 24, 2013 — extraordinary meeting of owners of residential and non-residential premises with the agenda: “Formation of a capital repair fund on a special account.” 75.26% of the owners (3/4) took part in the meeting; a decision was made to form a fund and open a special account with Sberbank of Russia OJSC. — February 20, 2014 – general meeting of HOA members “Report of the HOA board on the work done for 2013, approval of the estimate and work plan for 2014” In 2014, 10 meetings of the HOA board were held. 59 issues were considered. The work of the board was based on the fulfillment of the requirements of the Housing Code of the Russian Federation, Chapter 14, Art. 143; 144; 145; 147 and the HOA Charter. Participation of members of the board in the work of the board: a) distribution of responsibilities between members of the board Odinokov A.S. Chairman of the board Khasnulin V.I. Deputy Chairman of the Board Averyanova L.N. Secretary (preparing minutes of meetings, meetings), Nikolaev N.L. control over the work of security, Novoselov Ya.B. work with administrative authorities (district, city), Osmekhina T.A. work with lawyers, preparation of documents for courts, Dikikh V.P. individual orders. b) participation in board meetings: Odinokov A.S. 10 Khasnulin V.I. 10 Averyanova L.V. 10 Nikolaev N.L. 9 Novoselov Ya.B. 0 Osmekhina T.A. 6 Dikikh V.P. 10 All members of the board participated in the preparations for general meetings. Personnel work: during 2014, 2 people were dismissed at their own request (passport officer, cashier), 2 people were hired. The following workplaces have not been certified: electrician technician; HOA engineer, due to changes in the requirements of the legislation “On licensing the activities of management companies and HOAs”, clarifications were received only at the end of the year. Work on home repairs and landscaping of the yard. To avoid repetition, we report on this section only for 2014. Household work was carried out by full-time employees of the HOA, as well as under contracts with individuals and legal entities. 1. Clearing the territory of the house from snow in winter and transporting it to the city dump. Under an agreement with Transkom LLC, in February 2014, 18 MAZ trucks of snow were removed in the amount of 23.8 thousand rubles. 2. Costs for improving the playground: - delivery of black soil and sand; — planting a lawn; — arrangement of a pedestrian path with laying of garden tiles and borders; — planting flowers; — repair of the sandbox Total costs of 45.5 thousand rubles (sand, black soil, paving slabs, curb) with payment of contracts for the performance of these works. 3. The parapet of the house was covered with galvanized iron in the amount of 66.0 thousand rubles. 4. Repairs of the external walls of the tenth floor were carried out with painting of metal structures, repairs of the porch of the third entrance with dismantling and liquidation of flower containers in the amount of 12,414 rubles. incl. taxes, work was carried out from the customer’s material. 5. Repair of the facade of the house, namely correcting the counter-slope of the canopy of the second entrance with restoration of plaster and painting, cleaning of all canopies followed by coating with primer and paint for a total amount of 12,414 rubles, customer’s material. 6. An emergency alarm system was installed for the sewerage system at a cost of 5.0 thousand rubles. 7. Repaired by major repairs of the electric gate drive (2 pcs.) in the amount of 6.8 thousand rubles. 8. The snowplow was repaired, the cost of repair was 4,025.00 thousand rubles. 9. Production of a pavilion for storing solid waste containers has begun RUB 8,276. wages, materials purchased in the amount of 8 thousand rubles. For comparison, the cost of a purchased pavilion starts from 45 thousand rubles. 10. Woland-lift LLC repaired the second entrance elevator with the replacement of the rope, electric motor and overhaul of the gearbox in the amount of 15,912.6 rubles, the homeowners association paid for materials and components . Construction materials and metal were purchased in the amount of 25.16 thousand rubles. Preparation for the heating season, heating the house, providing hot water.

Preparation for the heating season was carried out within the established regulatory time frames with the receipt of an admission certificate in August 2014. At the beginning of the heating season, we agreed with the temperature control department of Novosibirskgorteploenergo OJSC to increase the design diameter of the elevator cones in order to ensure the standard temperature level in all apartments of the building. Currently, there are no apartments where residents complain about a lack of heat. However, there are apartments where the heating radiators are covered with decorative screens, thermostats are installed to turn off the radiators instead of ball valves, in a significant part of the apartments, during repair and finishing work, the risers were embedded in the walls and replaced with plastic pipes, which have a heat transfer several times worse than a steel pipe . We know these apartments, these are apt. 50; 49; 33; 31; 64; 62 (plastic pipes); 61, etc. Previously, the normal operation of the heating system was influenced by sub-subscribers: the building of JSC Russian Railways at Omskaya, 1, and the Ministry of Labor, Employment and Human Resources of the NSO. By the beginning of the current heating season, these issues had been resolved with the SIBEKO inspector, and cones of the calculated diameter were installed. In the current heating season, there is a significant overpayment for heating for those owners whose heating system corresponds to the original project, this is about 500 rubles. per month per 100 m?. We propose to return the adjustment cones to the standard diameter calculations already in this heating season. For the new heating season, owners of apartments where deviations from the design solutions have been made must carry out repairs to the heating systems during the summer period and return to the design solution. The board asks that this issue be put to a vote. Water disposal (sewage). In October 2014, due to a blockage in the last well at the exit gate, the basement of the fourth entrance was flooded with fissile water, and they were forced to urgently draw up an agreement with the individual. face for cleaning in the amount of RUB 6,000.00. After an emergency flooding of the basement of the fourth entrance, it was decided to install an alarm signaling the failure of normal sewerage operation in the security room, which makes it possible to promptly call the city emergency service free of charge, while at the same time blocking the drainage system from which sewage water comes. Status of court cases related to the technical basement. In accordance with the decisions of the general meetings of HOA members in 2013. and 2014 work was carried out on the lawsuit of the HOA against V.V. Boyko. and the claim of Boyko V.V. to the HOA. Our newly filed claim from individuals was rejected by the court of first instance after the expiration of the statute of limitations (the same judge was Pimenova), the decision of the court of first instance was upheld in the court of appeal, etc. Now our cassation appeal has been sent and is being considered by the Chairman of the Supreme Court of the Russian Federation. We won the case based on the claim of V.V. Boyko. to the HOA “On the delimitation of responsibilities and operation of energy networks.” It was proven at the court hearing that no one had allocated the electricity limit for Boyko, and the documents presented by his lawyer would not be able to pass a technical examination, as a result of which the Plaintiff abandoned the claim. A construction and technical forensic examination was carried out to determine the actual purpose of the technical basement premises.

Financial work During 2014, there were no significant debts of residents and organizations for utility bills and operating costs. Targeted fundraising in 2014 amounted to 199,672.16 thousand rubles. The homeowners' association maintained a deposit account with OJSC Municipal Bank in the amount of 200 thousand rubles; upon closing the deposit, interest was accrued in the amount of 38,369 thousand rubles. and transfer these funds to the current costs of maintaining the building for 2015. In 2014, 259,986 thousand rubles were collected in a special account of the house capital repair fund at Sberbank of Russia OJSC. Contributions were made by owners of housing, offices, and the Ministry of Labor, Employment and Labor Resources of the NSO. In 2015 will the contribution be 5.6 rubles/m? total area, preserved 2015 - decision of the NSO government. By the end of 2015, the account will have 854.155 thousand rubles, which will allow one of the types of major repairs, for example, facade repair. At a meeting with the governor on housing and communal services, it was said about the continuation of the program for subsidizing capital repairs, the exact ratio was not stated how much the region and the federal government will supplement in the past year, the subsidy reached 60% 1. Execution of the 2014 budget The planned fees were for 2014: operating contributions — RUB 1,537,507.20 target fee 199,672.16 rubles. in total 1,749,295.40 rubles were collected. Actual expenses for the year amounted to: RUB 1,795,606.92. The overexpenditure from the estimate amounted to 46,311.52 rubles, which resulted in a decrease in working capital, which the Management Board did deliberately, because unrecorded working capital, including deposits, are depleted by inflation. Today we have no debts to resource supply and service organizations. Current debts on rent and offices do not exceed 50 thousand rubles, which is quite acceptable for our budget. More detailed information on the implementation of the estimate will be provided in the report of the audit commission. Estimate for 2015. Plans and tasks for 2015. The board reviewed the financial results of the year and makes the following proposal on the estimate for approval by the general meeting of the HOA members: 1. Index the wages of the HOA cashier by 7% and increase the remuneration of the chairman of the board by 7%, because last year there was no indexation for the chairman. All other employees (chief accountant, electrical technician, HOA engineer, passport officer, non-residential premises cleaners, janitor) will not receive an increase. Appendix No. 1 to the 2015 Estimates. 2. Maintain the contribution amount at 12.5 rubles/sq.m. from residential and non-residential areas. 3. Approve the structural change in the estimate for the following items: a) wage fund; b) lighting of public places (increase in tariffs); c) unforeseen expenses, reduction; d) landscaping of the territory (snow removal), increase to 30 thousand rubles. To resolve issues of economic management (repairs and landscaping), legal expenses, do not conduct a targeted collection, but use funds withdrawn from the deposit. In the event of insufficient funds to implement the work plan, it is proposed to hold a general meeting of HOA members in May - June to make a decision on the target fee and its amount. We're heading into a year of unpredictable inflation, and it's difficult to determine costs in advance. The draft “Work Plan for 2015” was reviewed at a board meeting and submitted for approval to the general meeting of HOA members. Work Plan for 2015: 1. Work carried out as prescribed by supervisory authorities a) Install emergency lighting for elevators while maintaining communication with the dispatcher. One elevator costs about 20 thousand rubles. The elevators were manufactured in 1991, then there were no requirements for emergency lighting. b) Equip a sealing unit for introducing cold water and hot water heating pipes into the building through the foundation of the house; now they are tightly sealed with brick and concrete. To obtain a Certificate of Readiness of Heating Networks for the Heating Season, SIBECO required a letter of guarantee confirming the completion of these works in 2015. At the same time, it is necessary to install valves at the inlet to the coarse water filters in the heating system. The cost of one valve is 13.9 thousand rubles. including VAT. Approximately total cost of work is up to 110 thousand rubles. 2. Work on the current maintenance of the building - Repair the storm outlet of the second entrance (entrance to the HOA board), a break in the storm pipe due to subsidence of the building. Up to 9 thousand rubles; — Replace the roof with a pitched roof over the security premises with a storm drain and snow catcher. Up to 45 thousand rubles; — Replacement of the storm sewer outlet from the level of -2.0 m to the level of + 0.5 m. on the premises of the Ministry of Labour, Employment and Human Resources. Up to 15 thousand rubles. — Build a concrete platform for placing solid waste containers. thousand roubles. — restore natural ventilation on the technical floor. Up to 8 thousand rubles. — carry out design and estimate work 30-40 thousand rubles. to make a decision on major renovations for 2021 (façade repairs, replacement of hot water pipelines), as well as estimates for work in 2015. (sealing unit) Total costs may amount to 360 thousand rubles, exhaustive measures will be taken to optimize costs. All estimates, contractors, and actual expenses for 2015 will be posted on the HOA website for the information of all HOA members. Taking into account inflation, the costs of the necessary work may exceed the funds currently in the current account and those that will be collected during the year (operational). The board decided to convene a general meeting in May - June of this year. to decide on additional targeted fees and their amount. The Board decided not to organize a specially equipped site for bulky waste. Owners who are renovating apartments are required to independently remove construction waste, and large packages of household appliances must be disassembled and shredded into large plastic bags. Such conditions will ensure that it is impossible to organize a traditional garbage site in our yard; we do not need this.

Tariff policy and our actions By Decree of the Government of the Russian Federation of December 17, 2014 No. 1380 “On the issues of establishing and determining standards for the consumption of utility services”, changes were made to the Rules for establishing and determining standards of consumption of utility services, approved by Decree of the Government of the Russian Federation of May 23, 2006 No. 306, including in terms of determining the standards for the consumption of utility services by the calculation method, according to which, if it is technically possible to install metering devices, the standards for the consumption of utility services for heating, cold and hot water supply, and electricity are determined taking into account an increasing factor of: from January 1, 2015 until June 30, 2015 - 1.1; from July 1, 2015 to December 31, 2015 - 1.2; from January 1, 2016 to June 30, 2021 - 1.4; from July 1, 2021 to December 31, 2016 - 1.5; from 2021 - 1.6.

Chairman of the Board of the Homeowners Association "Lenina, 28" Odinokov A.S.

Financial performance report

The state gives partnerships the right to conduct financial and economic activities (Article 152 of the Housing Code of the Russian Federation).

The financial statement means the following:

- use, maintenance, repair of the common property of the house, as well as providing it for rent or rental; — construction of additional utility buildings in an apartment building;

Sample report on the financial and economic activities of the HOA

Report on the financial and economic activities of the HOA for 2014.

"27" February 2015

The Audit Commission of the Vertoletnoe Homeowners Association was elected by a decision of the general meeting of premises owners consisting of 3 people: 1. Alimerzoeva Natalya Grigorievna 2. Galagan Elena Vitoldovna 3. Gagen Valery Fedorovich

The Audit Commission is obliged to:

— Check the implementation by the Board of the Partnership and its Chairman, and the Manager of the decisions of the Meeting and the Board of the Partnership, the legality of transactions made by the Board on behalf of the Partnership and members of the partnership, the condition of the property of the Partnership;

— Carry out scheduled audits of the financial and economic activities of the Partnership at least once a year;

— Submit a report on the results of the audit for approval by the Meeting of Members of the Partnership with recommendations for eliminating identified violations.

By decision of the HOA Audit Commission, an audit of the financial and economic activities of the HOA for the period from 01/01/2014 was appointed. until December 31, 2014 The audit involved studying the financial, economic and other documentation of the HOA, analyzing these documents in order to present the HOA members with the most complete and objective picture of affairs in the HOA.

Inspection of the financial and economic activities of the Partnership for the period from 01/01/14 to 12/31/14. was carried out by members of the Audit Commission from 02/22/2015 to 02/27/2015. 2015 in accordance with the developed plan:

1). Implementation of decisions of the general meeting of HOA members and the HOA Board, the intended use of funds, obligatory payments of owners, and other revenues; 2).The legality of transactions and agreements concluded by the Board on behalf of the HOA;

The audit was carried out on the basis of an analysis of the following documents provided by the accountant and the chairman of the HOA:

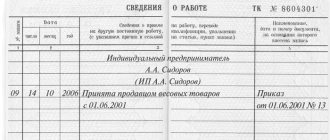

1) Labor contracts with HOA employees; 2) Agreements with contractors, resource suppliers and other organizations concluded for 2014; 3) Primary accounting documentation for 2014: - Certificates of completed work; Invoices; Invoices; — Cash book and cash reports; Bank statements and payment documents for HOA settlement accounts; - Expense reports; Financial statements;

Conclusion of the Audit Commission:

1). There were no deviations or illegal expenses incurred by the HOA. Based on this, the audit commission established that the use of the partnership’s funds is of a targeted nature. Accounting for expenses is carried out in accordance with PBU 10/99 “Expenses of the organization”. Expenses are reflected in a timely manner and in full. 2). During the inspection of cash reports, bank statements and payment documents, no violations were identified. The cash book is numbered, laced and certified with the seal and signature of the manager and chief accountant. 3). A check of advance reports showed that stationery, consumables, and materials for household needs were purchased in cash. No violations were identified in the preparation of advance reports. 4). A check of receipt documents and certificates of completion of work for services provided to the partnership showed that the documents were drawn up without violations and were presented in full.

We carried out an analysis of the income and expenditure side of the HOA's finances.

Analysis of the receipt and expenditure of funds from the HOA:

1. Cash balance as of 01/01/2014: on the current account 230,524.92 rubles

2. Receipt of funds to the current account: 3,791,004.63 rubles

3. Money spent: from the current account: 3,890,893.35 rubles

4. Total cash balance as of 01/01/2015 on the current account: 130,636.20 rubles

Reporting of the special account holder for major repairs

For those houses that have chosen this type of creation of a fund for major repairs, there is a special reporting form - about the contributions received and the remaining amount in the account (Article 172 of the Housing Code of the Russian Federation). The account holder is required to provide this data to the Housing Inspectorate.

Conclusion

Thus, even a non-legally savvy citizen can - and even should - be interested in the activities of the organization that has taken over the management of their home.

To do this, you need to familiarize yourself with both the current Standard and the general Charter of a particular organization, and then submit a request.

Estimate and report on its implementation.

In lines 17 and 18 of Form 1.2, the HOA (cooperative) must (must) attach scanned copies of the estimate of income and expenses for the reporting period, a report on its implementation in the form of files in electronic form.

Current legislation does not offer HOAs a universal form of income and expense estimates. Therefore, it is unlikely that inspectors will be able to reasonably make claims against its content.

All legal regulation comes down to clauses 2, 3, part 1, art. 137 of the Housing Code of the Russian Federation, from which it follows that:

- an estimate of income and expenses is drawn up for the year;

- the estimate includes, among other things, the necessary costs for the maintenance and repair of common property in the apartment building, costs for major repairs and reconstruction of the house, special contributions and deductions to the reserve fund, as well as costs for other purposes provided for by law and the charter of the partnership;

- on the basis of the accepted estimate, the amounts of payments and contributions are established for each owner of the premises in the apartment building in accordance with his share in the common property right.

It seems that the basis for drawing up cost estimates should be the annual plan for the maintenance and repair of common property (Clause 8, Part 2, Article 145 of the RF Housing Code), which describes the necessary work and services. The cost estimate for maintenance and ongoing repairs is the monetary expression of the specified plan. Having received the amount of planned expenses, you should evaluate possible revenues, ultimately calculating the main one - payments from property owners. The form of the estimate is arbitrary, the list of expenses is predetermined by the cost structure of each specific HOA (contract work by type, personnel costs, material costs, maintenance of the partnership premises, etc.).

The report on the implementation of the estimate contains real indicators for planned items and deviations from the plan. It seems that it would be logical, as an explanation to the report, to set out the reasons for overexpenditures and savings. By default, the annual general meeting of HOA members, at which the estimate report is approved, is held in the second quarter of the next year (Part 1, Article 45, Part 1.1, Article 146 of the Housing Code of the Russian Federation), that is, after the deadline for disclosing the relevant information. This means that decisions of the highest governing body of the HOA on issues of overexpenditure and savings will be published later.

Is it necessary to hold an annual reporting meeting of the HOA?

Mandatory - in accordance with the Housing Code (2017 edition), namely Art. 45. The event is held in the second quarter of the year that immediately follows the reporting year (Federal Law No. 176-FZ of June 29, 2015).

In addition to mandatory reporting on the initiative of groups of owners or individual enthusiasts, unscheduled meetings can also be held - but on an extraordinary basis.

The validity of a meeting is determined by the presence of a quorum. This takes place if at least 50% of the total number of votes are present - the owners of the apartments or their legal representatives. If a quorum is not reached, then the general meeting will still have to be held, albeit out of turn.

The association must notify each of the apartment owners about the upcoming event at least ten days before the day of the meeting - in writing.

The Partnership is obliged to maintain and timely submit:

- Accounting and tax reports (this also applies to those organizations that have chosen a simplified system for themselves - Article 23 of the Tax Code of the Russian Federation, Federal Law No. 402-FZ);

- Special reporting.

Debt to RSO.

The largest number of lines of Form 1.2 is devoted to the disclosure of information in the housing and communal services sector, namely data on the amounts of debt of the management company (HOA, housing complex) to the RSO, both in total (line 7) and broken down by type of utility resources (lines 8 – 16):

- thermal energy (separately for heating and hot water supply);

- hot water;

- cold water;

- drainage;

- gas;

- Electric Energy;

- other resources (services).

When filling out these indicators, you need to pay attention to the following features:

- the explanations for filling out Form 1.2 indicate that information in the housing and communal services sector is subject to disclosure of debt for the reporting period, however, the debt indicator is an indicator characterizing the financial position of the company as of the reporting date, and not the results of its activities for the period. Therefore, the wording “debt for the reporting period” is meaningless; we believe that the debt should be disclosed as of the end of the reporting period, that is, as of December 31, 2015;

- if the same resource is supplied by several distribution centers (for example, to different houses), the debt indicators should be summed up;

- the explanation to the form says: in the case of direct supply of a utility resource to consumers, a zero value is indicated. Currently, direct relations between consumers and RSO are possible in the cases described in Part 17 of Art. 12 of the Federal Law of June 29, 2015 No. 176-FZ. Here the manager really has no debt to the RSO. But in the case of direct payments for a particular utility service by decision of the general meeting in the accounting of the management company (HOA), the debt to the RSO is formed in the general manner, so the indicator must be disclosed;

- the debt indicator includes not only the unpaid cost of a utility resource, but also usually “input” VAT (turnover on the credit of accounting account 60). This means that in Form 1.2 the debt should be shown in full; this does not in any way affect the manager’s use of VAT deductions.

The only source of indicators of debt to RSO are accounting registers, information into which comes from primary documents. Before preparing financial statements, organizations are required to reconcile settlements with counterparties, but the accounting reflects data that the organization considers correct (clause 73 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n). You should not mechanically transfer RSO data from the reconciliation of calculations to Form 1.2 (inflated erroneous indicators are possible).

Partnership tax reporting

The HOA must also file tax returns, which are determined by the type of activity and nature of the business.

According to the legislation of the Russian Federation, HOAs are required to submit tax reports for the following tax categories:

- VAT. According to Art. 143 of the Tax Code of the Russian Federation, the HOA is a VAT payer, reporting on which is submitted to the tax office at the place of registration no later than the 20th day of the month following the reporting period. Note that, according to the Tax Code of the Russian Federation, the reporting period for HOAs is a quarter.

- Unified social tax. Another tax paid by the HOA.

The declaration for advance payments is submitted similarly to the VAT declaration, and the declaration for the results of the tax period is submitted before March 30 of the year following the reporting one.Before July 1 of the same year, the HOA is required to submit a copy of the declaration with the appropriate mark from the tax authority stating that the HOA has paid the unified social tax.

- All non-profit organizations, including homeowners' associations, must pay taxes on pension insurance. In accordance with Federal Law No. 167-FZ, the HOA must take into account all possible payments and rewards made in favor of all individuals and report to the tax service at the end of the reporting period. In accordance with the above law, the same filing deadlines are established for UST and pension insurance.

- An NPO, from whose activities an individual’s profit arises and is a personal income tax payer, is defined by domestic legislation as a tax agent. This means that the HOA, as a tax agent, must provide information about the income of individuals to the tax authorities at the place of registration before April 1 of the year following the previous tax period.

- In Art. 373 of the Tax Code of the Russian Federation provides that, regardless of the type of activity (commercial or non-commercial), organizations are subject to property taxation. In this case, tax calculations must be provided within one month after the end of the reporting period, and a tax return for the period following the previous one must be submitted by March 30.

- If NPOs have vehicles, taxes must also be paid on them. According to Art. 363.1 of the Tax Code of the Russian Federation, organizations that have vehicles must submit tax reports on vehicles to local tax authorities before February 1 of the year following the reporting year. A similar declaration is drawn up in those cases (the same deadlines are provided) when the HOA has land under ownership or in perpetual use.

- TZS has the right to apply the simplified tax system. According to Art. 346.11 of the Tax Code of the Russian Federation, when switching to the simplified system, all non-profit organizations have the right not to pay unified social tax, income tax and property tax of organizations, but the obligation to make insurance contributions for compulsory pension insurance remains. Also, NPOs do not pay VAT, except in cases where the tax is paid when importing goods into the territory of the Russian Federation. When on the simplified tax system, the HOA is required to submit completed tax returns by March 31.

Form 2.8.

Unlike the data disclosed in Form 1.2, the report in Form 2.8 is completed in relation to each house managed by the company separately. If we are talking about an HOA created to manage one house, some indicators of forms 1.2 and 2.8 may coincide. By the way, please note that Form 2.8 is called “Report on the execution by the management organization of the management agreement, as well as a report on the fulfillment by the partnership or cooperative of estimates of income and expenses for the year.” Management companies, having completed such a report for the purpose of disclosing information in the housing and communal services sector, are simultaneously considered to have fulfilled the obligation to submit a report to the owners on the basis of Part 11 of Art. 162 of the Housing Code of the Russian Federation, unless, of course, a different form of the report was provided for in the MKD management agreement.

On the other hand, does this mean for the HOA that the report on the implementation of the estimate, which must be placed in form 1.2, should be taken in the form of form 2.8? It seems that the authorities had no intention of duplicating information on the same source (www.reformagkh.ru), so the conclusion drawn is not an imperative requirement. The estimate report is drawn up on the basis (in the form) of the estimate, which cannot correspond to Form 2.8 for HOAs, at least because it includes details of the costs of maintaining personnel, the acquisition of fixed assets of the HOA, etc.

Insurance and target contributions in the partnership

The HOA is required to submit reports on insurance and target contributions made. Thus, targeted contributions must be indicated in the accounting report under account 86 “Targeted financing”.

In addition, sub-accounts must be opened for this account, which indicate the source of funds. The accounting report may indicate any targeted contributions to the HOA (for example, contributions for repair work, etc.).

IMPORTANT! Since the HOA attracts hired workers to ensure its activities, the partnership must necessarily act as an insurer for pension, medical or social insurance, in accordance with Law No. 167-FZ.

Partnerships that are on the simplified tax system have the right to apply reduced rates of insurance premiums if property management is one of their main activities. Such clarifications are indicated in the letter of the Ministry of Health and Social Development of the Russian Federation No. 800-19.

Please note that in accordance with Laws No. 167-FZ, 255-FZ, 326-FZ, HOAs are required to submit reports on insurance premiums, like other insurers. For this type of reporting, forms RSV-1 and 4-FSS must be submitted, the timing and procedure for filing which are regulated by Art. 15 of Law No. 212-FZ.

Form RSV-1.

Form 4-FSS.

Maintenance and current repairs: charges and receipts.

The first part of Form 2.8, which has the subtitle “General information on the work performed (services provided) for the maintenance and current repairs of common property in the apartment building,” provides data on the amounts accrued to consumers and the funds actually received by the manager. When filling out any line, specifying a zero value is allowed. This is possible if the manager does not have the necessary detail of data or no operations have occurred. We draw special attention to the fact that this section does not reflect information related to contributions for major repairs of common property. Among the disclosed indicators:

- advance payments by consumers (at the beginning and end of the period) (lines 4 and 18), which mean the funds actually contributed by consumers in excess of those accrued by the reporting date;

- consumer debt (also at the beginning and end of the period) (lines 6 and 20) - the amount of outstanding debt of consumers using premises in a particular apartment building for services (work) for the maintenance and current repairs of common property in the apartment building. We especially emphasize: indicators for both advances and debt can be filled in at the same time, because some consumers in the house may pay for services in advance, while others may have debt. This consideration once again confirms that combining the population into a single customer in the accounting program does not eliminate the need to accumulate information on calculations for each consumer;

- accrued for services (work) for maintenance and routine repairs in total (line 7) and including a breakdown for house maintenance, routine repairs, and management services separately (lines 8, 9, 10). These indicators correspond to the turnover for the year in the debit of account 62 (according to the corresponding subaccounts). Let us emphasize once again that it is allowed to specify a null value in any of the lines of the form. This means that if accruals in accounting were carried out in a single amount - for the maintenance of common property, in the report on Form 2.8 only one line 8 “For the maintenance of the house” will be filled in. This procedure does not violate the rights of citizens;

- funds received for the reporting period for the house for the provision of services for the maintenance and current repairs of common property (the total indicator cannot take a zero value) (line 11). This indicator is determined by comparing the turnover in the debit of account 51 and the credit of the account for accounting for settlements with consumers for maintenance and current repairs (the corresponding analytical account opened to account 62). By the way, if settlements with consumers are carried out through third parties, and the manager issues instructions to the latter to transfer money directly to suppliers and contractors (that is, only a small part of the funds ends up in the manager’s account), the manager is obliged to show receipts from consumers in full (according to the report of the paying agent ). In this case, to fill out this line of the report, you should analyze the accounting entries for the debit of the account for accounting for settlements with the paying agent and the credit for the account for accounting for settlements with consumers.

In practice, the question arises why the indicator “Cash received” has a different level of detail than the indicator “Accrued for services (work)”. In particular, revenues should be differentiated by sources (lines 12 – 16):

- funds from owners and tenants of premises;

- targeted contributions from owners and tenants of premises;

- subsidies;

- funds from the use of common property;

- other supply.

However, it does not follow from the form that incoming funds must cover exactly the amounts accrued to consumers for services (work). For example, when receiving a subsidy for improvement of the local area, the management company does not charge consumers (owners, tenants of premises) a fee for its work. Another case: funds from the rental of common property, by decision of the general meeting, allocated for the maintenance of common property in the apartment building, are first accumulated and only after the meeting makes a decision are used. Regarding target contributions (line 13), it seems that this line is most relevant for HOAs. Let us note that all these funds must be associated specifically with the provision of services and the performance of work on common property. For example, targeted contributions from the owners of common property as a whole may include payments intended to pay remuneration to members of the MKD council. However, these amounts are not related to the provision of management services, so they are not included in the report.

The largest number of questions is raised by filling out the line “Carrying-over cash balances” (shown at the beginning and end of the period) (lines 5 and 19). The developers of information disclosure forms provided the following explanation. The amount of money unused for the previous reporting period under the apartment building is indicated, formed as a result of payment by consumers for services (work) for the maintenance and routine repairs of common property in the apartment building and transferred to the next reporting period. Most likely, this refers to fees for funds that will obviously be used in subsequent periods. A classic example is the capital repair fund; however, we repeat, due to special regulations, calculations related to the filling and use of the capital repair fund are not disclosed in Form 2.8. For an HOA, these can be any trust funds created by decision of the general meeting of members in accordance with the charter. For a management company, the carryover balance is funds that are received by it, but cannot be spent in the reporting period when they were received. For example, these are funds from the use of common property by third parties, if the general meeting decided to accumulate them. The same applies to contributions to the current repair fund provided for by the decision of the general meeting. Carry-over balances do not belong to the manager and, when changing the management method, they can be claimed by the new manager on behalf of the owners of the premises in the apartment building.

The last indicator that I would like to pay attention to is “Total cash, taking into account balances” (line 17). It reflects the total amount of funds that were at the disposal of the manager during the reporting period and were intended for the maintenance and ongoing repairs of common property. It seems that it is incorrect to consider the amount of money as the amount that the manager must spend on the maintenance and ongoing repairs of the house. It can be stated with 100% certainty that the manager’s expenses (recognized by the accrual method as the occurrence of liabilities) will not coincide with the amount of funds under consideration. But there is no violation in this. In all likelihood, this indicator can make it possible to clearly assess the financial position of the manager, since the most popular justification for violations in the area of maintaining common property is lack of funding.

Reporting

Main types

In the course of its activities, the board of a housing association is required to report on several types of its activities at once. One of the main types of such reporting is the report of the board to homeowners . Since, based on Article 151 of the Housing Code of Russia, it is the board that manages all the funds of the partnership, then it should provide the main reports precisely on this topic. These include:

- a report on contributions and other payments received from residents - members of the partnership;

- funds received for the operation of property that is common to the HOA;

- income received as a result of economic and financial activities;

- as well as various other income received during the year.

Another type of annual report is the chairman's report . In it, he reports on the fulfillment of his duties prescribed in the charter. These include:

- drawing up the organization's budget for the next year;

- control of all payments made;

- hiring and firing new employees;

- control or maintenance of accounting work;

- making decisions regarding repairs or construction in the adjacent territory;

- holding meetings;

- updating information about all members of the partnership and compiling lists;

- as well as activities of another kind, if they are prescribed in the charter.

Also, since all residents' associations are vested with the right to conduct financial activities (which is stated in the Housing Code of Russia, Article 152), they must, in addition, report on the work done at the general meeting . A report of this kind, an example of which can be downloaded below, includes: information about maintenance, use, repair work, as well as leasing or renting premises included in the use area of this partnership.

In addition, it also includes additional information about new buildings under construction located in the surrounding area. The general annual report contains all this information (the report of the chairman, the board, and information relating to financial and economic activities).

In addition, it may include additional ones, for example, those related to major repairs (they must also be submitted to the housing inspection). Such a report contains information about the funds used, their balance, as well as the work that was performed.

Structure and content

IMPORTANT ! The annual reports of the residents' association must contain the most complete information covering all aspects of the activities of this organization (exactly what information should be contained in each of them was described above).

In addition, each HOA may introduce its own additional mandatory clauses, but only if they are specified in its charter. Also, in addition to reporting to residents on the work done and funds used, the management of the partnership is obliged to report to the state - for this it submits statistical, accounting, and tax reports.

Maintenance and current repairs of common property: types of work and their cost.

Lines 21 – 26 of Form 2.8 must provide information about the work performed, services provided and their annual cost. Please note that the list of works is entered on the website www.reformagkh.ru in form 2.3, and in form 2.8 it is displayed automatically. The actual annual cost of work (services), which should be entered in line 22, means the cost of such work (services) for consumers. If the work (service) is completed (provided) in full, its actual cost must correspond to the planned cost. From the sum of the annual actual cost of all work (services), obviously, the total indicator of the fee accrued for the year for the maintenance of residential premises should be obtained. It seems that the management company has no reason to show actual costs, either if they exceed the fee agreed upon with the owners of the premises (after all, the compliance of the established fee with the actual cost of mandatory measures is the risk of the management company), and if the actual costs are less than the price of the work ( services) (this difference represents the profit of the management company). In the case of a non-profit association (HOA, LCD), on the contrary, the annual actual cost of work (services) is nothing more than the actual costs of their implementation (provision).

Next, it is necessary to detail the above works (services) by type, if possible. In the explanations to all lines where you need to reflect information about the types of work (. Please note that for detailed work (services) there is no need to provide the annual cost, sufficient information is the frequency of work (services) (for example, annually, weekly, continuously) , unit of measurement (number of times, sq. m. area of premises), cost per unit of measurement.

Please note that the management company usually calculates the cost of services per 1 sq.m. for clients. m area of premises in the house. However, it appears that such value does not always need to be disclosed on line 26 of Form 2.8. This is due to the fact that the unit of measurement of the volume of work (service) can hardly be the area of premises owned by the owners in the apartment building. For example, if we are talking about a cleaning service for common areas, the unit of measurement is 1 sq. m of harvesting area. It is advisable to evaluate the elevator maintenance service per elevator, snow removal - by volume (cubic meters) of snow removed, annual inspections - in times, the service for holding a general meeting of premises owners - per one meeting, taking into account the number of premises owners in this house. In other words, these indicators (unit of measurement of the volume of work (service) and cost per unit of measurement) should be borrowed from contracts with contractors who directly perform the work and provide services.

Consumer complaints.

In the corresponding section of Form 2.8 (lines 27 – 30) you should indicate information about the claims of all owners of premises in the apartment building (regardless of the status of the premises) regarding the quality of work performed (services provided) for the maintenance and routine repairs of common property. It seems that this should also include claims related to violation of the frequency of work (see Rules for changing the amount of fees for the maintenance and repair of residential premises, approved by Decree of the Government of the Russian Federation of June 13, 2006 No. 491). Line 30 of Form 2.8 indicates the amount of recalculation made based on the results of satisfying consumer claims. It is logical to assume that the report for 2015 should include the amounts of recalculation made this year. We would like to add that management companies often carry out recalculation due to unlawfully inflating fees for the maintenance of residential premises, but these amounts are not included in this section.