The entire process of receiving an inheritance is associated with the activities of notaries, who open an inheritance case and complete it by preparing documents for the new owners for the property included in the estate after the death of the testator.

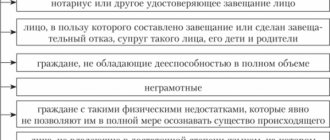

In the period of time between the heirs submitting applications for acceptance of the inheritance and receiving certificates of right to it, the notary carries out very painstaking work to establish the circle of heirs, identify persons who can claim an obligatory share in the inheritance, establish the composition of the inherited property, check the documents of the heirs, and determine the size each heir's share of the inheritance.

If the need arises, the notary takes measures to ensure the safety of the testator’s property.

How to find out about inheritance?

There are several ways to find out whether there is an inheritance after the death of a relative or not. The simplest case is when the inheritance is stipulated in the will, and the heir is aware of where it is. But this doesn't always happen. Asking a notary about the presence of heirs is not the only way. The debt of the deceased debtor to creditors is transferred along with the inheritance with which it is associated, and the successor will have to repay it. The sample will help you draw up an appeal to a notary correctly, if you take into account all the nuances.

To submit a request to the notary chamber, you must clearly formulate the questions that require answers. According to the rules of inheritance, the notary keeps a second copy of the will, drawn up during the life of the testator. The main thing is to know where this notary office is located. Otherwise, the situation becomes more complicated, but the result will be obtained as soon as the answer arrives from the archive.

The legislation allows six months to apply for division of inheritance and entry. Often the relatives of the deceased do not communicate, and it is necessary to clarify whether the application has yet been submitted. An example of a petition (request) for this information is also available on the Internet. The forms are issued by a notary who has samples of all the necessary papers. The sample request to a notary about an inheritance case indicates all the required details of the heir and the deceased.

Debt division

Paragraph 1 of Article 1175 of the Civil Code of the Russian Federation states that the heirs are liable for the debts of the deceased in the amount of the received share of the property. This applies to both bank loans and debt under purchase and sale agreements or utility services. Special mention should be made about the testator's husband/wife. They receive 50% of all jointly acquired property and an additional share of the rest of the inheritance. They will have the most significant debt.

Example : The deceased Ivan Ivanovich owes Vasily 100 thousand. He is survived by his widow Svetlana and two adult children: Nikolai and Sophia. Simultaneously with the receipt of property, Ivan, his wife and children become debtors on the loan. Svetlana, who received 50% of the property, and another third of the remaining property (50/3 = 16.67%), must return to Vasily 66.67% of the debt amount = 66.67 thousand rubles. Each of the children owes an additional 16.67 thousand rubles.

How to find out if there is a will for inheritance?

In order not to solve problems in court, it is enough to come to the notary’s office with a will and write an application for entry. People rarely communicate their intention to pass on an inheritance through a will. The paper is there, but no one knows about it. But it’s easier and cheaper to solve the problem with a notary. But there is a way to find out whether a will has been drawn up for inheritance. All you have to do is submit a request.

During the life of the testator, the secret is kept, and the inheritance is revealed only after the death of the owner of the property specified in the will. In samples of this paper, available online, it is clear that the document identifies movable and immovable property, but it is too early to write a statement. When the heir is informed that his relative has died, it is time to take a sample, draw up a request and go to the notary. If the presence of additional inheritance on the territory of the Russian Federation is unknown, an appropriate sample is needed.

The first thing they do is look in the personal belongings of the deceased. A copy of it must be kept in the apartment. As a rule, it is located in the same place as old-age pension papers, applications of various kinds, samples of receipts for payment of insurance benefits, etc. If your search is unsuccessful, go to a notary office. Usually a sample to fill out is taken from the nearest notary.

If there is no written expression of will, it is too early to stop the search. There can be quite a lot of applicants for the testator. What if the deceased bequeathed everything to the applicant? As for the testator himself, the death certificate is a mandatory document required to obtain a sample request from a notary. The Notary Chamber has an archive where all papers issued in the region are stored. We go there and submit a written appeal. The sample application for searching for an inheritance is slightly different in the details section.

Costs of conducting an inheritance case

Registration of inheritance involves certain financial costs. So, at the very beginning of the process, the heirs must pay for the publication of the will, for the fact that the notary accepted the statement of the heir’s intention to enter into the inheritance or refuse it.

In addition, a certain amount is paid for drawing up notarial requests. How much each of these services will cost depends on the region in which the notary office is located and the tariffs established there.

One of the types of expenses when accepting an inheritance is the payment of state duty. Thus, the issuance of a certificate of the right to inheritance will cost close relatives of the first and second order of heirs according to the law 0.3% of the value of the property (no more than 100,000 rubles). Relatives of the next stages will pay an amount equal to 0.6% of the value of the inheritance (no more than 1 million rubles).

Was the Recording helpful? No 46 out of 65 readers found this post helpful.

How to make a request to a notary about the presence of heirs?

At the request of the judicial authorities, all information is provided immediately. Civilians have to do things differently. To determine with whom you will have to fight for the inheritance, you need to collect documents in the following categories:

- Identity card – passport. The place of registration does not matter. The main thing is that it is valid at the time of requesting the sample application.

- Establishing the fact of family relationships. It all depends on the degree of relationship. Each connection is documented by certificates, extracts, etc.

- About the death of the testator. If you couldn’t get it from your relatives, contact your local registry office.

- About the number of residents. When contacting housing policy authorities, you will need a separate sample.

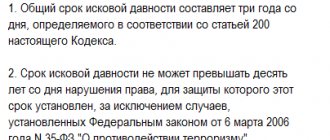

All this is provided to the notary for review and verification. The main thing is that the deadlines for accepting the inheritance are not violated. And this is six months from the date of death of the testator.

A sample request for a special kind of inheritance is taken from the notary. There may be securities, deposits, etc. The statement is useless in dealing with the bank. Agreements, information about the availability of open accounts, insurance, compensation after reinstatement, provision of subsidies, agreements with banks and other authorities, can be stored in a deposit box, access to which is prohibited unless there is a corresponding court decision. The need for a notary is also negligible if there is no will, and no samples will help.

, fill out the fields, check the correctness and contact a notary. In accordance with the Civil Code of the Russian Federation, papers acquire legal force only after being dated and signed. The absence of required attributes makes them invalid. Errors, corrections, inaccuracies in dates, property of the testator, details become the reason for refusal to accept the sample as an application.

Just as in the case of an application to initiate a criminal case, the sample has fields for entering personal data and information about the addressee. The last one is the notary who provided the sample and accepted the application. To obtain information, an application is required, otherwise no one will tell you anything, and they will never find out about the will. After 6 months you will have to restore the terms, but for this you will need to prove that there were good reasons (illness, etc.).

Enforcement proceedings

In most cases, after the court’s decision, the heirs themselves try to come to an agreement “in an amicable way” and begin to regularly pay the debt. If this does not happen, you will have to contact the enforcement service with a court decision and demand compulsory compensation. The creditor has no right to interfere with the work of the performers, but may demand a report on the work done.

If the creditor feels that the executor is not performing his duties properly, too slowly or incorrectly, he may demand that one executor be replaced with another.

Preparation and submission of documents to the court

Sometimes relatives of a deceased person think that the creditor will forget about them or write off the amount of the debt. However, the heirs' refusal to respond to the creditor's demands usually leads to litigation.

If there is written evidence, it will not be difficult for the lender to win the case. It is enough to prepare a claim, pay the state fee and attach a list of necessary documents. The application is submitted to the district court at the place of registration of the defendant.

The statement of claim must contain the following information:

- the name of the court where the case will be heard;

- information about the plaintiff (residence/location address, contact details);

- similar information about the defendant;

- cost of claim;

- document's name;

- essence of the claim;

- reference to the rule of law;

- the plaintiff's final request;

- list of attached documents;

- receipt of payment of state duty;

- date, signature of the plaintiff.

The amount of state duty is calculated based on the stated requirements (Article 333.19 of the Tax Code of the Russian Federation). The larger the claim amount, the higher the tax rate.

Example. The lender gave the borrower a loan secured by a car. The loan amount was 300 thousand rubles. On the day of the citizen’s death, the amount of debt was 200 thousand rubles. The heirs ignored the creditor's demands. Therefore, he was forced to go to court. Calculation of state duty – 5200 (3200 + 2000) rubles. The fixed rate is RUB 3,200. The difference from the minimum threshold is 2000 (100,000 × 1%) rubles. If the claims are satisfied, then the paid state duty is withheld from the defendants in favor of the plaintiff.

Based on the results of the court hearing, the court will make a decision to satisfy the creditor's claims. In such a situation, the heirs are charged not only with the amount of the debt, but also with the amount of state duty and other costs of the creditor. To do this, it is necessary to include the relevant requirements in the statement of claim.

Then the lender will need to take a writ of execution and submit it to the bailiff service. They will open production and begin forced debt collection. The heirs can resolve the issue with the creditor at any stage of judicial or enforcement proceedings.

Sample statement of claim for debt collection

For what obligations are heirs not liable?

If the testator committed an administrative offense, caused harm to a person’s health, or paid alimony to young children, then the heirs are not liable for such obligations of the deceased citizen.

However, this refers to future payments, not current debt. For example, if enforcement proceedings for alimony have been opened, and a debt has accumulated for several months, then it will need to be repaid. No accruals are made after the death of the testator.

Example. The plaintiff filed a claim against the heirs for the collection of arrears of alimony in the interests of the testator's minor child. The court satisfied the plaintiff's demands. He motivated his decision by the fact that the debt arose during the life of the deceased citizen. Consequently, the obligation to repay the debt falls on the heirs. In addition, the heirs received the apartment after the death of the testator (Determination of the Samara Regional Court dated November 8, 2010, case No. 33-11255).

Inheritance of property on several grounds

If there is a will, the procedure for inheriting property changes slightly:

- The testator can assign all or part of the property to one or more people.

- Assets that are not specified in the administrative document are inherited in accordance with the general procedure.

What to do if part of the property is under encumbrance, and the other half of the property is not collateral? It is necessary to proceed from the practical side of the issue. In some cases, creditors will not be able to present their claims to the heirs.

Example. Citizen I. was engaged in small business. He had a tire repair shop. During his lifetime, he made a will in the name of his daughter from a previous marriage. He gave her his 1-room apartment. The housing was rented out for long-term rent to tenants. Citizen I also had a second apartment and a credit car. His family consisted of 3 people. The businessman died suddenly. The relatives submitted documents to the notary in a timely manner. According to the will, the heiress was entitled to a 1-room apartment. The wife owned half of the jointly acquired property. The exception was the testator’s personal apartment, which he assigned to his daughter. The rest of the property is divided between 3 participants. Understanding the situation, the daughter of the deceased citizen renounced her share, which was due to her by law. She only inherited her father's apartment. Half of the spouse's property was allocated from the inheritance. The second part is distributed equally between the testator's wife and his son. Creditors asserted their rights to the collateral up to the amount of the debt. The income from the tire repair shop made it possible to pay off the car loan. Therefore, the son of the deceased citizen filled out all the documents in his name and continued to repay the loan according to the schedule.