The procedure for collecting utility bills

Let us immediately note that this procedure is not too complicated and has three stages: pre-trial, judicial and enforcement proceedings:

- The pre-trial procedure for collecting utility bills involves filing a claim against the defaulter. Such collection of utility bills cannot be called effective, since no more than 30% of debtors respond to it. A notice of disconnection from a utility service gives the greatest result in working with debtors (follow the link for more details on the procedure for disconnecting utilities for non-payment).

- Court. Mostly housing and communal services resort to judicial proceedings. Since it takes a long time to wait for payment during a peaceful settlement of the conflict, moreover, issues of quality of services provided by the service organization or recalculation constantly arise between the parties. As a rule, all controversial issues cannot be resolved without a trial.

- Execution of a court decision. Next, the court receives a writ of execution or a court order, submits an application to initiate enforcement proceedings at the bailiff service, and begins enforcement of collection of amounts collected from the debtor.

ATTENTION: do not miss the opportunity to consult a lawyer for free without a phone through commenting - by subscribing to our YouTube channel.

The procedure for paying housing and communal services debt within the framework of an executive document

Debts in housing and communal services - why they don’t pay.

Collection of debt for utility services by court order is carried out within the framework established by law. The debtor, in turn, is transferred money in the required amount. It is not allowed to ignore the writ of execution or delays in payment of compensation.

The regulations establish that penalties and sanctions can be avoided if you arrange a deferred payment. To do this, you must submit a corresponding application to the bailiff service, attaching a copy of the order. If a citizen has valid reasons for not paying a debt through a one-time transfer, then evidence should be attached.

It is allowed to provide a package of documents:

- medical certificate confirming the completion of treatment, receipts for expenses;

- an extract from the work record book about job loss - dismissal, layoff or bankruptcy of the organization.

Once an agreement is reached between the debtor and the FSSP employee, a schedule is drawn up within which the arrears must be repaid.

In the absence of such a petition, bailiffs have the right to take appropriate measures - to impose an encumbrance on property, to freeze accounts in financial institutions.

If no person is identified or there is no money for them, then the FSSP employee sends an order to the debtor’s employer. Based on the writ of execution, the accounting department transfers 50% of the salary to the specified details. The debt will be charged until full repayment.

Important: Additional measures include imposing restrictions on movement within the country and abroad.

How is the statute of limitations for utility bills calculated?

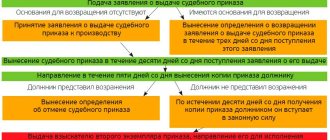

The initial stage of the process after a claim is the issuance of a court order. In this case, one should also take into account such a term as the statute of limitations, according to which debts are collected for services already provided exclusively without fail within a certain time period.

Please note that the time frame for collecting utility bills is provided as a general one (it is set for 3 years for claims from the moment the debt was incurred for the current month).

The debt is collected for payments within an indefinite payment period, a uniform period of 3 years is applied. During this period, a person has the right to pay off the debt, distributing it at his discretion over the entire period, but at the same time he risks receiving penalties for using the money.

Claim for collection of utility bills or court order

Collection of utility payments by court order or through litigation in the event of an obvious dispute is beneficial for both the debtor and housing and communal services. The court for the collection of debts on utility bills makes it possible for utility companies to obtain a writ of execution and begin proceedings to force the debt to be closed, and helps citizens understand the correctness of the accrual.

Why is a court order for utilities more profitable?

If the debtor has not responded to the pre-trial claim, we begin to go to court. In any case, if there is no particular dispute regarding charges, it is advantageous to start with an application to the magistrate for the issuance of a court order for the amount of utility debt.

IMPORTANT: during writ proceedings, the management company saves on state fees by receiving a 50% discount on it, and there is also a reduced period of time spent on judicial consideration of the application.

When is a claim for collection of utility bills required?

If the debtor has sent an objection to the court order to the magistrate or there is a clear dispute over charges, then the housing and communal services service files a claim for collection of utility payments. After which, meetings will be scheduled, for which the utility service must have strong evidence and present it in the form of:

- debt period;

- amounts;

- the entire period of late payments;

- the amount of penalties accrued for late payments;

- the amount of expenses for initiating legal proceedings.

If the service wins, the debtor is obliged to pay the court collection of utility payments in the form of the principal debt for services, accrued penalties and all legal costs.

A court order for the collection of utility bills from registered persons automatically comes into force if the debtor refuses to receive it or does not send an objection to the judge. In this case, housing and communal services have the opportunity to submit an order to the bailiff service.

IMPORTANT: watch the video on the topic of recalculation of utility bills, disputes with management companies: advice from a lawyer on housing issues

Court order in housing and communal services: instructions

Decisions of courts of any jurisdiction in disputes over housing and communal services are not uniform, and the system of enforcement of court decisions sometimes nullifies all collection efforts. It seems that writ proceedings should help in this situation. But how is a court order actually executed in housing and communal services? Let's consider the main nuances of collecting debts for utilities

Rules of law : clause 118 of the Rules for the provision of utility services to owners and users of premises in apartment buildings and residential buildings, articles 309 and 311 of the Civil Code of the Russian Federation, part 1 of article 153 of the Housing Code of the Russian Federation. These legislative norms oblige citizens and organizations to make timely and full payments for premises and utilities.

Debt collection for utilities

Debt collection for housing and communal services is important in the management of housing and communal services. That is why the work of management companies, homeowners associations, residential complexes, housing cooperatives needs to be structured according to a single algorithm. An employee of an organization responsible for debt collection must know what exactly needs to be done, when and how. Our instructions will help with this.

Work with accounts receivable can be divided into five stages:

- Preventive measures: notification of debt through all available communication channels, discussions at general meetings.

- Collection planning: correspondence with the debtor, claims work, negotiations through an intermediary.

- Judicial proceedings, obtaining a judicial act for collection.

- Ensuring the execution of a judicial act on debt collection at the stage of enforcement proceedings, including a ban on travel and the sale of the debtor’s property.

- Debtor's bankruptcy.

Going to court deserves special attention here. Civil procedural legislation provides for two ways to collect debts for utility services: lawsuit proceedings and in the order of writ proceedings. From June 1, 2016, it is significantly simplified when working with accounts receivable up to 500 thousand rubles, since judicial proceedings are a simplified procedure for debt collection.

Court order in housing and communal services

Federal Law No. 45-FZ dated 02.03.2016 introduced into the Civil Procedure Code of the Russian Federation (Chapter 21.1 of the Code of Civil Procedure of the Russian Federation) and the Arbitration Procedure Code of the Russian Federation (Chapter 29.1 of the Arbitration Procedure Code of the Russian Federation) provisions on the order of collection of debt for payment of residential premises and utilities, as well as telephone services.

Writ proceedings are a procedure for considering undisputed claims of a creditor in a shortened time frame by examining written evidence provided by the creditor without holding a court hearing, calling the parties and hearing their opinions, and issuing a court order.

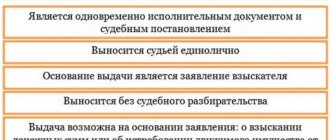

A court order in housing and communal services, as in other areas, is both a court order and an executive document. Thus, a creditor who has received a court order in the housing and communal services sector can, without wasting time, proceed to debt collection.

A similar procedure existed in trials before (Chapter 11 of the Code of Civil Procedure of the Russian Federation). However, it did not apply to the housing and communal services sector.

The institution of writ proceedings frees the courts from those cases that do not require a detailed review procedure, from cases for the consideration of undisputed claims. It is still difficult to assess the usefulness and effectiveness of such an innovation.

Advantages of a court order

- promptness of receipt - within five days from the date of receipt of the application for a court order;

- lack of trial and summoning of the parties to hear their explanations;

- equating a court order to a writ of execution and executing it in the manner established for the execution of court decisions.

Disadvantages of a court order

For the debtor, this is the absence in the court order of a motivational part justifying the decision made in the case; uncontrollability of the collection process, which may lead to encumbrance of the debtor’s property and even restriction of his movements throughout Russia and abroad.

For the lender, this is an opportunity for simplified cancellation. The judge will cancel the court order in the housing and communal services sector if the debtor raises objections within ten days from the date of receipt of a copy of the court order. In this case, you will have to go to court again with an application to collect debts for payment of housing and utility services, but this time through a claim proceeding. In practice, court orders were canceled even after the expiration of a one-year period, if the claimant proved that he did not receive the court order.

Grounds for applying to court to obtain a court order

Before going to court, you must make sure that:

- the debtor has not paid for services for more than 3 months;

- the amount of debt did not exceed 500 thousand rubles;

- the amount of debt is confirmed by documents (invoices for payment).

Particular attention should be paid to the fact that a creditor can apply for a court order to collect debt for housing and communal services if there is a debt of no more than 500 thousand rubles. (Clause 1 of Article 121 of the Code of Civil Procedure of the Russian Federation).

The creditor here is the management organization, homeowners' association, residential complex or other consumer cooperative, or resource supply organization. In other cases, disputes regarding debt collection are considered according to the general rules of litigation.

Application for a court order

When preparing an application for a court order to collect debts for utility services, you need to pay attention to the following.

1. The application is submitted to the court at the location of the defendant or to the court specified in the contract. Therefore, it is recommended to include provisions on contractual jurisdiction in the management agreement for an apartment building. For example, indicate that disputes arising from a management agreement must be resolved in court at the place where such an agreement was concluded or at the location of the management organization.

2. The application for issuing a court order should indicate:

- information about the creditor: name of the creditor (creditor) and his location;

- information about the defendant: name of the defendant (debtor) and his place of residence, as well as date and place of birth, place of work (if known);

- list of requirements and documents confirming these requirements;

- creditor account details.

Documents confirming the indisputability and validity of the creditor’s claims may be, for example:

- contracts, in particular the management agreement for apartment buildings;

- acts confirming the performance of work and provision of services;

- acts of reconciliation of mutual settlements;

- debt calculation (extract from the debtor’s personal account indicating the amount of overdue debt);

- correspondence with the debtor;

- other documents, for example, the constituent documents of the creditor, the charter of the HOA, housing complex, housing cooperative.

In addition, the management organization must necessarily confirm the legality of managing the apartment building by submitting to the court a license for the right to manage the apartment building and a protocol of the general meeting of owners on its election as a management organization. It would be useful to provide information about the management organization from the GIS Housing and Communal Services - screenshots of the pages.

3. The application must be accompanied by a document confirming payment of the state fee. In this case, a reduced amount of the state fee is provided for when filing an application with the court - 50% of the amount of the fee charged when filing a claim of a property nature (clause 2 of Article 123 of the Code of Civil Procedure of the Russian Federation).

It is important to remember that the judge may return the application for a court order or refuse to accept it in cases provided for in Art. 125 Code of Civil Procedure of the Russian Federation.

In particular, the judge may refuse if the application and documents submitted by the creditor indicate that there is a dispute about the right. Therefore, the court must present undisputed and duly certified evidence in order to prevent refusal to accept the application.

When a judge issues a court order in housing and communal services

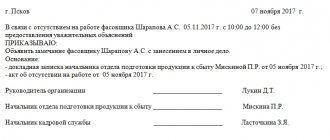

The judge is considering the issue of issuing a court order to collect debts for utility services without holding a court hearing, without notifying the parties, without keeping a protocol. And makes a decision based on the documents submitted by the creditor. Court order in housing and communal services on the merits of the stated requirement:

- issued within five days from the date of receipt of the application;

- made in two copies on a special form. One copy of the court order remains in court proceedings. A copy is made for the debtor;

- consists of two parts : introductory and operative. Unlike the solution, it does not contain a descriptive part. His motivation is limited only to an indication of the law on the basis of which the requirements are satisfied.

The mandatory details of a court order for the collection of debts for utilities are named in Art. 127 Code of Civil Procedure of the Russian Federation. Among others, the mandatory details of the operative part of a court order are:

- the amount of state duty collected from the debtor - in favor of the claimant, if the duty was paid by him when submitting the application, or to the income of the corresponding budget, if the claimant was exempt from paying state duty by law;

- details of the recoverer's bank account to which the funds to be recovered should be transferred.

If a demand was made for the collection of a penalty , then the operative part of the order indicates the amount of such a penalty. Let us remind you that from January 1, 2016, liability for non-payment of housing and communal services has been increased. The penalty is collected from the owners of the premises from the second month of delay in payment in the amount of 1/300 of the refinancing rate. The tightening will begin on the 91st day of delay, when the increased rate of 1/130 begins to apply.

Sending a court order to the claimant

The judge sends a copy of the court order to the debtor. As noted in the ruling of the Constitutional Court of the Russian Federation dated November 20, 2008 No. 1035-О-О, a court order is sent once - to the address indicated by the claimant (creditor); however, due to the fact that the period during which the debtor has the right to file objections to the court order begins to count from the moment the debtor receives the court order, and the debtor can change his location, it is possible to re-send the court order to the debtor at his new location.

The current procedural legislation does not determine in any way how the debtor should be notified of the issued court order. And the debtor runs the risk of finding out about it only at the stage of enforcement proceedings.

In practice, judges often send a copy of the court order to the debtor by simple letter. In a number of cases, judges do not consider it their duty to notify the debtor at all about the court order issued against him, or they instruct secretaries to notify the debtor by phone specified by the creditor.

Cancellation of a court order

The debtor has the right to challenge a court order to collect debt for utilities within 10 days from the date of receipt of a copy of the court order (Article 128 of the Code of Civil Procedure of the Russian Federation). In this case, the judge cancels the court order (Article 129 of the Code of Civil Procedure of the Russian Federation). In the ruling on the cancellation of the court order, the judge explains to the creditor that the claim he has made can be presented in the manner of claim proceedings. Copies of the court ruling to cancel the court order are sent to the parties no later than three days from the date of its issuance. To protect his rights and legitimate interests, it is enough for the debtor to submit to the judge who sent a copy of the court order an objection regarding the execution of this court order.

But this is not the end of the debt collection story. If the creditor does not receive the payments due, he will file a claim . Its consideration already requires the presence of both parties, including the debtor. The meeting is adversarial in nature, that is, the defaulter has the opportunity to present documents that confirm his reluctance to pay. For example, if the amount of payments does not correspond to the figures adopted at the general meeting. Or if the tariffs for services are unreasonably high. You can also object to the accrued penalty, for example, by providing a counter-calculation.

As practice shows, a small portion of debtors file objections. Most people prefer to pay off their debts. Or he discovers that the required amount has been forcibly debited from his salary account.

When a claimant receives a court order in housing and communal services

If the debtor does not submit any objections to the court within the prescribed period (within 10 days), the judge issues a second copy of the court order to the collector. The court order is certified by the official seal of the court in order to present it for execution.

As a general rule, a court order in housing and communal services is issued to the claimant (his representative) in court or sent to him by registered mail. However, there are exceptions to this rule. At the request (petition) of the claimant, the court order may be sent for execution to the bailiff directly by the judge.

A court order in the housing and communal services sector for the collection of debts for utility services is carried out in the same manner as established for the execution of court decisions.

The legislation establishes the following deadlines for the transfer of the writ of execution to the bailiff:

- within three days from the date of receipt by the bailiff department (as a general rule);

- immediately, i.e. on the day the writ of execution is received by the bailiff department, if the writ of execution is subject to immediate execution (demand for securing a claim, reinstatement, etc.).

More articles in the “Disputes and Courts” section

Court order in housing and communal services: instructions

3.7 (74%) 10 vote[s]

Calculation of debt for collecting utilities

Debt occurs when a person is 30 calendar days late. From the 31st day the calculation of the debt for collecting utility bills begins. A penalty of 1/300 of the refinancing rate is charged on the amount of debt for all days of delay. Moreover, if the debtor ignores this fact within 3 months, more stringent measures are applied.

If a claim for payment of utility bills needs to be drawn up professionally, then the management company can contact us for help. If, on the contrary, a citizen requires protection, then an objection to a court order for the collection of debts on utility bills or a counterclaim for recalculation will maximally defend the interests of the debtor.