Chapter 9 “Transactions” of the Civil Code says nothing about major transactions. This is due to the fact that issues of special legal regulation of large transactions are not relevant for all legal entities, but mainly for limited liability companies (hereinafter referred to as the company, LLC) and joint-stock companies. Accordingly, the necessary information can be found in two special laws - Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies” (Article 46) and Federal Law of December 26, 1995 No. 208-FZ “On Joint Stock Companies” societies" (Chapter X).

“What do I need this share for?”

The ability to complete a major transaction directly depends on the decision of all participants in the limited liability company. The law even provides for a situation where the desire of some participant to “swim against the general tide” and not make a major transaction inevitably results in the redistribution of shares.

According to the general rule of paragraph 1 of Article 23 of the Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies” (hereinafter referred to as the LLC Law), the company itself cannot acquire shares (parts thereof) in its authorized capital. One of the exceptions concerns large transactions.

The law states: if the general meeting of LLC participants makes a decision to carry out (approve) a major transaction, the company is obliged to acquire, at the request of a company participant, his share in the authorized capital. This obligation arises in two cases:

- this participant voted against the deal;

- this participant did not take part in the voting.

A participant can demand that an LLC buy a share within 45 days from the day he learned or should have learned about a decision made on a major transaction, and if he nevertheless participated in the general meeting - within 45 days from the date a decision was made with which he was not I agree (clause 2 of article 23 of the LLC Law).

By law, the company has three months to acquire the share of a participant who disagrees with a major transaction. In this case, the charter of the LLC may provide for a different period (it can only be established unanimously by all participants).

Special rules

The charter of an LLC may prohibit the alienation of a share or part of a share of a company participant to third parties.

The acquisition of a share means in practice the payment to the participant of the actual value of his share in the authorized capital. The actual value is determined on the basis of the LLC's financial statements for the last reporting period preceding the day the participant filed a claim. But another option is also possible - with the consent of the participant, the company has the right to give him property of the same value instead of money, that is, in kind.

Major transactions and interested party transactions under European law

In the Russian Federation, the legislation on major transactions and interested party transactions has undergone many changes, introduced at the level of changes to federal laws and the Plenum of the Supreme Court. The Supreme Court points out: any transaction of a company is considered to be completed within the framework of ordinary business activities until proven otherwise. The burden of proving the “excessiveness” of such a transaction, according to the position of the Plenum, lies with the plaintiff. In addition, there is a presumption that there is no obligation to examine whether the transaction is a large transaction or an interested party transaction for the counterparty.

The International Accounting Standards Board (FASB) defines an interested party transaction as a transfer of resources, services or obligations with one of the conditions: the transaction is entered into by at least two entities, either one of which controls the other or both are controlled by a third party. In this case, the actual transfer of funds from account to account is not taken into account, for example, one object can receive services from a second, related object for free and without a record of receiving services[1].

The lack of a definition of the concept of ordinary business activity in legislation presents some difficulties when considering disputes in this category. In the period until January 1, 2017, the criteria for delineating ordinary business activities were: the regularity of transactions of this type in the company on similar terms and the connection of transactions with the types of activities listed in the company’s charter, based on a formal criterion - enshrining the codes of the All-Russian Classifier in the constituent document or the Charter types of economic activities. The Plenum of the Supreme Arbitration Court of the Russian Federation dated May 16, 2014 No. 28 “On some issues related to challenging large transactions and interested party transactions” clarified that the use of a formal criterion for classifying a transaction as beyond the scope of ordinary business activities is not enough. Since 2021, additions and changes to the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies” have come into force, which, among other things, contain criteria for making transactions in ordinary business activities.

The Plenum of the Supreme Court of the Russian Federation adopted the Resolution “On challenging major transactions and transactions in which there is an interest.” Resolution of the same name of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 16, 2014. Detailed explanations are given on the issue of the moment from which the one-year limitation period is calculated for claims to challenge transactions made in violation of the rules on their approval (clause 2 of the Resolution).

The charter can expand the range of transactions recognized as interested party transactions and, accordingly, requiring approval, by expanding the circle of interested parties; narrowing the range of transactions is unacceptable. Interested party transactions are characterized by the presence of a counterparty, whose participants include related persons who have significant control over the company. According to British law, signs of significant control by individuals over a company are: 1) ownership, directly or indirectly, of more than 25% of the nominal value of shares; 2) owning, directly or indirectly, more than 25% of the voting rights (again, the joint and indirect interests mentioned above); 3) the right, directly or indirectly, to appoint and revoke decisions of a majority of the board of directors (or similar body); 4) the right to exercise or actually exercise significant influence or control over the company.

The Plenum of the RF Armed Forces provides clarification regarding the criteria for recognizing a major transaction that provides for the obligation to make periodic payments, that is, lease agreements, service agreements, and others. Such agreements will be recognized as large in cases where the amount of payments under them during the period of validity of the agreement exceeds 25% of the book value of the company’s assets. Contracts concluded for an indefinite period are considered large if their value exceeds a quarter of the company’s value for the year of the transaction.

The statute of limitations for challenging a transaction begins to run from the moment when the sole executive body of the company or, if there is a plurality of directors, one of the directors learned or should have known about the violation. If a company publicly discloses information under the Securities Market Law, then from the moment of such disclosure of information the participant is recognized as having learned about the transaction; provided that the information was disclosed, a conclusion could be drawn that the transaction was completed in violation of the procedure for its completion.

The qualification of major transactions in world practice comes down to the definition of a major transaction as “extraordinary”, since the transaction leads to the acquisition or disposal of property, or could potentially lead to the disposal of property or its transfer for temporary possession or use or provision to a third party, including use results of intellectual activity and means of individualization under a license, if the value of the underlying transaction exceeds 25 percent or more of the book value of the total assets of the company as of the date on which the reporting quarter preceding the date of transfer ended. A transaction cannot be considered a major transaction if it was completed in the ordinary course of business. In Germany, there are such organizational and legal forms as: limited liability company, joint stock company and partnership. German legislation regarding legal entities differs in regulation for companies in the management of which trade union organizations participate, for companies whose shares are listed on the stock exchange and for non-public companies. Several directors can be appointed to manage the company, which reduces the risk and frequency of transactions concluded without authority or in excess of authority.

In Poland, the regulation of major transactions is contained in the Code of Business Enterprises 2000. Major transactions may include: 1) the acquisition or alienation of real estate, shares in real estate or rights of permanent use; 2) acquisition of fixed assets; 3) alienation of a right or assumption of an obligation in an amount exceeding the authorized capital of such a company twice; 4) alienation or lease of an enterprise or its subdivision, as well as the emergence of a limited property right to an enterprise or subdivision; 5) other transactions listed in the company’s charter.

The acquisition and alienation of real estate and fixed assets by a company requires mandatory approval at a meeting of shareholders or participants, but this provision can be changed by the company’s Charter (clause 4, article 228 of the Code of Commercial Enterprises). Mandatory approval of the transaction is required if the contract price is more than 25% of the company's authorized capital. This rule is mandatory and is valid for 2 years from the date of registration of the company. The Code also establishes a criterion for large transactions - the amount of the transaction exceeding the authorized capital by two times or more (the Charter may provide for a different amount in the direction of increase). Regardless of the amount, approval of transactions is required, as a result of which a limited proprietary right to an enterprise arises, aimed at alienating the company or its division[2].

The quorum of the general meeting is 50% in general; in case of alienation of the company it is 2/3 of the total number of voting shares of the company.

A major transaction concluded without a corresponding resolution of shareholders or, accordingly, a general meeting of shareholders is invalid. A transaction can be recognized as valid if the general meeting of shareholders makes a decision to approve the transaction, which has retroactive effect within two months from the date the board of directors announced its intention to conclude a major transaction (Article 17 of the Code). After this period, the transaction is deemed to have not been approved by the shareholders and is void from the very beginning.

Other provisions apply to major transactions provided only by the Articles of Association or Memorandum of Association. Such transactions concluded in violation of the procedure for their approval, according to Polish law, are not invalid. Members of the board of directors are liable to the company for losses caused by such a transaction.

In Germany, there is no concept of large transactions, which exists in Russian legislation; the book value of assets at which a transaction becomes large has not been established. German legislation on major transactions is discretionary and leaves such issues to the discretion of society.

The German Joint Stock Companies Act contains the following provision: “Obligations to transfer all corporate assets.” To conclude an agreement under which a joint stock company undertakes to transfer all its assets in another way, the consent of the general meeting of participants of such a company is required, even if such an agreement is not related to a change in the subject and goals of the company's activities. The charter can only provide for a higher share of participation of company shareholders in voting (quorum)[3]. The quorum at a meeting of shareholders can be increased to a qualified majority of shareholders - ¾. The consequences of failure to approve transactions entail their invalidity, unless they were subsequently approved by the company.

The question of what powers the director has and what transactions will require approval in a particular company is left to the discretion of the companies themselves. The Board of Directors has the opportunity to provide in the Charter and other internal documents the list of transactions that require approval[4].

Interested party transactions in Germany are regulated in the following way: firstly, the director cannot enter into a transaction with himself, and secondly, the conspiracy of the parties to the transaction to cause losses to the company leads to the invalidity of the transaction (Articles 134, 138 of the Civil Code). In some cases, rules on abuse of power are also subject to application, also leading to invalidity. The company may make claims for damages or compensation against the party to the transaction that received a greater benefit, or against the majority shareholder (Articles 302, 303, 311, 317 of the German Law on Joint Stock Companies). Additionally, claims may be filed against the directors or board of the company if the latter did not act in the interests of the company.

Under Russian law, unless a transaction results in the cessation of the company's activities or a change in the type of such activities or a significant reduction in its scale, the transaction is presumed to be completed in the normal course of business. To classify a transaction as a large transaction under Russian law, the simultaneous presence of two criteria is required: quantitative and qualitative.

Thus, the requirement to recognize a transaction as invalid according to Russian law as being made in violation of the procedure for approving major transactions and (or) interested party transactions of a business company is subject to consideration according to the rules of paragraph 5 of Article 45, paragraph 5 of Article 46 of Federal Law No. 14-FZ, paragraph 6 Article 79, paragraph 1 of Article 84 of Federal Law No. 208-FZ and other laws on legal entities, providing for the need to approve such transactions in the manner established by these laws and the grounds for challenging transactions made in violation of this procedure (Federal Law of November 14, 2002 No. 161-FZ “On state and municipal unitary enterprises”). These rules are special in relation to the rules of Article 173.1 and paragraph 3 of Article 182 of the Civil Code of the Russian Federation. A special regime for carrying out these transactions, associated with the need for their approval by certain bodies of a legal entity, is established for limited liability companies, joint-stock companies, state and municipal unitary enterprises.

Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 26, 2021 No. 27 “On challenging major transactions and transactions in which there is an interest” The limitation period for claims to recognize major transactions and interested party transactions as invalid and to apply the consequences of their invalidity is calculated according to the rules of paragraph 2 of Article 181 of the Civil Code of the Russian Federation and is one year. On June 17, 2021, the new Law of Ukraine “On Limited and Additional Liability Companies” dated February 6, 2018 No. 2275-VIII (hereinafter referred to as the LLC Law) came into force. This legal act is intended to become the basis for regulating the legal status of almost 600,000 business organizations formed in the form of limited liability companies (hereinafter referred to as LLC) and additional liability companies (hereinafter referred to as ALC). In Ukrainian law, even if the owners decide that the director has the right to sign contracts for any amounts (this is especially true if the owner is also a director), the 50% net assets limitation cannot be canceled or reduced. Although from a practical point of view, in a situation where almost every transaction needs to be approved, such a rule significantly complicates “life” for limited liability companies. In addition, the company may introduce additional restrictions in the articles of association by defining contracts that require the approval of the meeting.

Alienation by a participant of his share under Ukrainian law can occur without the participation of the company through state registration of changes in information about the size of shares in the authorized capital or the composition of the LLC’s participants. To do this, it is enough for the seller or purchaser of a share (their authorized representative) to send to the state registrar the documents provided for in Part 5 of Art. 17 of the Law of Ukraine “On State Registration of Legal Entities, Individuals - Entrepreneurs and Public Formations”.

According to Part 2 of Art. 24 of the Law of Ukraine “On Limited Liability Companies”, a company participant whose share in the company’s authorized capital is 50 percent or more can leave the company only with the consent of other minority participants, since in the vast majority of cases it is he who exercises control over the company and its executive body, while at the same time giving him the opportunity to demand withdrawal from the company in conditions where he controls the executive body, creates an extremely high risk of violating the rights of company participants by withdrawing most of the assets on the basis of paying him compensation for the value of his share in the capital of the company.

At the same time, when concluding large transactions under the law of Ukraine, it is possible to stipulate in the contracts that the parties are obliged to provide a balance sheet at the end of the previous quarter or an accounting certificate about the amount of net assets at the end of the previous quarter. If the amount of the agreement exceeds 50% of net assets, then a protocol of the participants on approval of the conclusion of this agreement is provided. By subsequent approval of a transaction in excess of authority (an agreement worth more than 50% of the net assets), the transaction is considered approved if the legal entity has taken actions indicating acceptance of the transaction for execution[5].

An interested party transaction under French law is a transaction that is concluded between a director and a company and (or) a major shareholder and a company, etc., and this transaction should not be prohibited. In French law, interested party transactions are divided into three types: a) prohibited transactions; b) transactions requiring permission; 3) free transactions. Approval of transactions occurs at two levels: the Board of Directors (Supervisory Board) and the meeting of shareholders. Approval is required for interested party transactions that are concluded between a member of the board of directors, if the transaction goes beyond the scope of ordinary business activities; if the transaction is planned between the company and a shareholder owning 10% of the company's shares. In addition, transactions require approval if a member of the board owns the counterparty company, is personally responsible for this company, or holds a position on the supervisory board and other bodies of such a company[6].

Free transactions under French law are contracts that do not go beyond the scope of ordinary business activities, including if such transactions have an interest[7]. In this case, the approval procedure by the Board of Directors is not required; a simple notification to the Chairman of the Board of Directors is sufficient.

The voting shares of the interested party are not counted towards the quorum of the meeting. The legal consequences of non-compliance with the established rules regarding the approval of interested party transactions in accordance with the French Commercial Code are as follows: firstly, the company's shareholders or other persons from the board can appeal such transactions and the court will declare them invalid. However, related party transactions in this case must have adverse consequences for the company.

The statute of limitations for challenging an interested party transaction is three years from the date of conclusion of such a transaction or from the moment such a transaction became known. A decision to invalidate the agreement may be made at a general meeting of shareholders.

In English law, when qualifying related party transactions, the emphasis is on persons, directors and shareholders who own a significant stake in the company. Regulation of related party transactions in England is based on the establishment of controlling persons in the company, which are designated as “related persons”. The concept of “related person” means: 1) any shareholder who owns at least 10% of the shares and can directly or indirectly vote at the general meeting of shareholders with that number of shares; 2) director and shadow director who held or holds office within 12 months before the conclusion of the transaction; 3) family members of a major shareholder or director, companies in which they own more than 30% of shares/shares.

Related party transaction means: a) a transaction entered into outside the ordinary course of business between the company or any subsidiaries and a related party; b) any arrangement under which the company or a subsidiary and related entity invests in or provides financing to another enterprise or fund; c) a transaction (other than transactions for consideration entered into in the ordinary course of business) between the company and (or) subsidiaries and any other individual or legal entity that has significant influence over the company. The director is required to notify of his interest in the transaction via a “declaration of interest”[8], failure to comply with this requirement will result in a fine being imposed on the director.

In recent years, there has been a tendency to liberalize the legislation of different countries on control over the implementation of large transactions and interested party transactions. Despite the global trend to protect the rights of minority shareholders, limiting the actions of directors is ineffective.

[1] FASB Statement of Financial Accounting Standards (FAS). - No. 57. – 2009

[2] Code of the Polish Republic “On Commercial Enterprises”. — 2000

[3] Björn Paulsen “Major transactions and interested party transactions under German law.” Scientific round table "Major transactions and interested party transactions: regulatory strategy." — 02/06/2014

[4] Art. 111 German Law on Joint Stock Companies. — “Commercial Code of Germany; Law on Joint Stock Companies; Law on Limited Liability Companies; Law on production and economic cooperatives": trans. with him. Wolters Kluwer Russia, 2009 - 606 pages.

[5] Supreme Court Decision No. 916/980/16 of March 27, 2018

[6] Articles 225-38, 225-86 French Commercial Code 1807 – (2006 edition).

[7] French Law No. 2003-706 “On financial security”. — 2003

[8] UK Companies Act 2006

Main threats

A major transaction is always a reason to be nervous not only for society and its participants, but also for counterparties and business partners. The point is that one should never exclude the danger of such a transaction being recognized as invalid (void).

It is important to understand that the decision of the general meeting of LLC participants to enter into a major transaction does not in itself mean that such a transaction has been approved and we can call it a day. After all, both the general meeting itself and the decision-making procedure may subsequently turn out to be illegitimate. Therefore, during the general meeting one of the main questions should be asked - is there a quorum?

In general, the charter of an LLC may provide that large transactions do not require a decision from either the general meeting of participants or the board of directors (supervisory board). However, in this case, there are high risks of acquiring illiquid property, withdrawing assets, etc., which can inevitably cause a conflict of interests between participants and undermine the financial position of the company.

If the transaction is not only large, but at the same time is a transaction in which there is an interest (member of the board of directors, supervisory board, sole executive body, member of the collegial executive body, simply a participant in the company), then the provisions of Article 45 of the Law also apply to the procedure for its approval about LLC (exception - when all participants are interested in concluding a transaction).

Features of approval

The main feature of large transactions is that they must be approved. The approval procedure depends on the legal organization of the company:

- OOO. Approval is issued by the meeting of founders. If the transaction amount is 25-50% of the total capital of the entity, it is necessary to contact the supervisory board for a decision.

- JSC. Transactions are approved at a meeting of auctioneers. Sometimes the decision is made by the board of directors. If the transaction amount is more than 50% of the total value of assets, the decision must be received at a meeting of shareholders with voting shares.

- Budget institutions. To carry out a major transaction, you must obtain permission from the body that is the founder of the entity.

Consent must be obtained in the manner prescribed by law. If this order is violated, a major transaction can be challenged.

Rule of 25 percent or more

As you can see, large transactions should be treated with special attention. That is why the provisions of Article 46 of the LLC Law establish the criteria for a major transaction and other rules.

Not only one transaction (including a loan, credit, pledge, guarantee), but also several interrelated transactions that are related to the acquisition, alienation or possibility of alienation by the company of property directly or indirectly can be considered major.

The main criterion for classifying a transaction as a major transaction is the value of the property that appears in the contract and other documents. It must be 25 percent or more of the value of the LLC’s property, determined on the basis of the financial statements for the last reporting period that precedes the day the decision to make such a transaction was made. Keep in mind: the charter can specify a higher qualification (size) to classify a transaction as a large one.

Depending on the type of transaction, the source of information about the value of the property is different: in case of alienation, this is the accounting data of the LLC (seller) itself, and in case of acquisition, it is the price offered by the seller, that is, the other party.

In any case, the burden of proving to the participant and other persons that the transaction concluded by the company is not major and that adverse consequences will not occur lies with the company itself. If there are contradictions in documents or a direct conflict between participants, accounting expertise can help resolve the situation. This is especially true for LLCs that use a simplified taxation system. Let us remind you that such companies are not required to keep accounting records for tax purposes, so some documents necessary in such a situation may be missing.

“It smells like a big deal here.”

Clause 7 of Article 46 of the LLC Law states: the charter of the company may provide for other types and (or) size of transactions that are subject to the procedure for approving them as major transactions. This rule was introduced, firstly, to take into account the specifics of the statutory goals of the activities of each LLC, and secondly, so that the participants (management) could more effectively control the financial and economic turnover within the company.

The concluded settlement agreement may also be a major transaction. Since it is approved by the court (Article 141 of the Arbitration Procedure Code of the Russian Federation), it is also obliged to simultaneously check whether there are signs of a major nature of the transaction (since it may violate, among other things, the rights and legitimate interests of third parties). Please pay special attention: such a transaction can be challenged in the presence of a court-approved settlement agreement only if a complaint is filed against the judicial act itself that approved the settlement agreement.

The rule of unusualness and obligation

Major transactions are not considered to be transactions made in the normal course of business of the company. In practice, there are big problems with this provision, since it is often difficult to unambiguously compare “ordinary business activities” with the statutory goals, its vision by the LLC participants and the realities of doing business. Accordingly, the threat of recognition of the transaction as invalid increases. In arbitration practice one can encounter many disputes on this matter.

Also, transactions are not recognized as large if two conditions are met (although they are large in nature in terms of financial and economic indicators. – Editor’s note):

- their implementation is mandatory for society by virtue of federal laws and (or) other legal acts;

- settlements for them are made at prices and tariffs established by the state (in particular, the Government of the Russian Federation).

Here are a few examples of large transactions: making a contribution to the authorized capital with property worth a large amount, repurchase of previously rented non-residential premises, a real estate pledge agreement (mortgage), etc.

Welcome to the deal

The decision to approve a major transaction is made by the general meeting of LLC participants. The main tasks at this stage are to ensure the presence of participants at the meeting and inform them about its agenda, so that later they do not refer to the fact that they were not notified that a major transaction was being considered.

The general meeting of the company's participants is held in the manner established by the LLC Law, the company's charter and its internal documents. To the extent not regulated by the LLC Law, the charter and internal documents of the company, the procedure is established by a decision of the general meeting (Clause 1, Article 37 of the LLC Law).

Interruptions are allowed during the work of the general (including extraordinary) meeting. Their duration is not limited by law. For example, in the decision of the Federal Antimonopoly Service of the Central District dated July 20, 2006 in case No. A36-288/3-04, the arbitrators recognized that the break in the work of the extraordinary general meeting, which the plaintiff (member of the LLC) knew about, did not violate his rights and the norms of the Law about LLC. Meanwhile, the break was five days.

Example

Excerpt from the charter of Intelpro LLC:

10. The decision to carry out a major transaction or an interested party transaction is made by the general meeting of the company’s participants by a majority vote of the total number of votes of the company’s participants who are not interested in the transaction.

Given its importance, the law imposes special requirements on the content of the decision to approve a transaction. It must necessarily indicate information about the transaction, namely: parties, beneficiaries, price, subject of the transaction and its other essential conditions. As a rule, it is documented in the minutes of the general meeting and is considered legal if it does not contradict the terms of the charter and the norms of current legislation.

Other essential conditions should be understood, in particular, as conditions that are named in the law or other legal acts as essential or necessary for transactions of this type (clause 1 of Article 432 of the Civil Code of the Russian Federation).

Thus, if the decision (minutes) of the general meeting of participants does not contain the specified conditions, the transaction completed by the company is not considered approved.

The decision to approve a major transaction may contain other conditions that are not considered essential by law or other legal acts. This is indicated in paragraph 15 of the Recommendations of the Scientific Advisory Council at the Federal Arbitration Court of the Ural District on the consideration of disputes related to the application of legislation on the creation, reorganization, liquidation of commercial legal entities, their legal status, as well as the rights and obligations of participants (founders) .

Dangerous moment

Keep in mind: entering into a settlement agreement can be considered a major transaction!

Meanwhile, the parties and beneficiaries in a transaction may not always be known in advance (for example, if it was concluded at auction, etc.). In such cases, it is permissible not to indicate all the required information about a major transaction.

The charter of an LLC may provide for the formation of a board of directors (supervisory board) of the company. In this case, the adoption of decisions on the approval of large transactions with property, the value of which is from 25 to 50 percent of the value of the entire property of the LLC, can also be attributed by the charter to the competence of the specified body.

In general, the establishment by law of requirements for the procedure for carrying out large transactions is aimed at:

- protection of the rights and legitimate interests of the company and its participants in preserving the property of the company;

- receipt by the company of an equivalent provision upon alienation of its property.

Templates for drawing up a Solution

Preparation of a universal document suitable for procurement under 223-FZ and 44-FZ will facilitate the submission of applications and work with the submitted documentation. The following templates will help you create such a universally designed Solution:

- Download the template Minutes of the general meeting of participants

- Download the template Decision on the transaction amount for a single participant

It is worth noting that there is no need to provide transaction approval on letterhead, since this is not provided for by law.

If it is necessary to make changes (to the wording of some paragraphs, or the validity period, or change the amount of the approved transaction) to an already registered Decision or any document that is used in procurement, it must be replaced in the EIS LC, because Data from there is transmitted to the sites.

Moment of approval of the transaction

It is not entirely clear from the LLC Law the moment at which a major transaction is considered approved. From a formal legal point of view, this is most likely the moment of signing the minutes (decision) of the general meeting by each participant in the company.

Is it possible to approve a major transaction “retroactively”? It is difficult to answer unequivocally, although the judges do not exclude this possibility. Thus, in paragraph 29 of the Recommendations of the Scientific Advisory Council at the Federal Arbitration Court of the Ural District No. 3/2007 on the consideration of disputes related to the application of corporate legislation and disputes related to the application of legislation on enforcement proceedings, it is said: the possibility of subsequent approval is not excluded in in relation to major transactions carried out by a limited liability company (i.e. after they have been completed).

When "good" is not needed

The rule on approval of major transactions does not apply (Clause 9, Article 46 of the LLC Law):

- to companies with one participant, who simultaneously acts as its sole executive body;

- during the transfer of rights to property in the process of reorganization of the company, including under merger and accession agreements;

- upon transfer to the company of a share (part of a share) in its authorized capital in the following cases provided for by the LLC Law:

- failure to provide compensation within the prescribed period for the early withdrawal by a participant of property transferred to the company to pay for the share (Article 15); incomplete payment of a share in the authorized capital upon establishment of a company (Article 16);

- alienation or transfer of a share (part of a share) to third parties in violation of the procedure for obtaining consent, as well as in case of violation of the prohibition on sale or alienation in any other way (Article 21);

- withdrawal of a participant from the company (Articles 23 and 26).

The concept of interrelated transactions

A major transaction can be recognized as interrelated transactions with a small value, which together form a contract with sufficient value. Let's look at the signs of interconnectedness:

- Uniformity.

- The transactions were completed in the same period.

- The parties to the transactions are the same persons.

- Single economic goal.

For example, an institution may carry out a number of operations aimed at withdrawing property during the period of declaration of insolvency. In this case, you can combine all transactions into one and recognize it as a major transaction.

What's new?

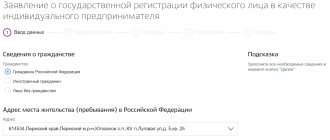

It is no secret that active discussions are currently underway on a project to amend the Civil Code. It is expected that they will also affect the procedure for approving large transactions. In particular, it is planned to supplement the provisions on state registration of legal entities (Article 51 of the Civil Code of the Russian Federation). According to them, before the state registration of a legal entity, changes in its charter or before the inclusion of other data not related to changes in the charter in the Unified State Register of Legal Entities, the tax inspectorate will be obliged to check the compliance with the law of the contents of the charter, including information on the procedure for approval by the authorities legal entity of major transactions.

When is such approval needed in the contract system?

To start participating in government procurement, you must register in the Unified Information System. To do this, they provide a general package of documents, which includes consent to the transaction. Please note: this is always required, including when the purchase is considered small. As for suppliers who were accredited before December 31, 2018, they are required to register in the Unified Information System by the end of 2020. Both will need an up-to-date sample decision on a major transaction 44-FZ.

Information must also be included in the second part of the application if required by law or constituent documents, and also when both the security for the contract or application and the contract itself will be large for the participant. In the absence of this information, the candidate may be rejected at any stage before the conclusion of the contract. The customer’s auction commission is responsible for checking the data (clause 1, part 6, article 69 No. 44-FZ).

IMPORTANT!

Individual entrepreneurs, unlike LLCs, are not classified as legal entities. As a result, they are exempt from the obligation to submit such a document for accreditation to the ETP.

"I will complain!"

As noted earlier, the provisions for a major transaction are contained in Article 46 of the LLC Law. In case of violation of the requirements provided for in this article, the transaction may be declared invalid at the request of the company itself or its participant.

The specified claim can be filed in court only within one year (statute of limitations). The missed deadline cannot be restored.

Example

The subject of the claim can be formulated approximately as follows: a demand for invalidation (not having legal force) of the purchase and sale agreement as a major transaction made by the defendant (company, LLC - Ed.) in violation of the requirements of the law, and the application of the consequences of its invalidity.

Thus, paragraph 3 of Article 43 of the LLC Law establishes a limited circle of persons who have the right to apply to court with such a claim. This is the society itself or its participant.

However, under certain conditions, the dissatisfied participant does not need to prove anything. This applies to the situation when it clearly follows from documents and reporting that the disputed transaction is unprofitable for the company. Consequently, it violated the rights and legitimate interests of the participant (plaintiff), unless otherwise proven. Sometimes, even without documents, it is clear that a transaction inevitably entails losses and other unfavorable consequences (for example, foreclosure on the mortgaged property of a company on a large scale).

It is important to know the following: the mechanism for challenging is such that invalidation of a decision of a general meeting of participants or a decision of the board of directors (supervisory board) of a company to approve a major transaction does not entail recognition of the corresponding transaction as also invalid (in the case of appealing against such decisions separately).

Berator "We are going to court"

Qualified legal support in court proceedings will be provided to you by the “We are going to court” berator. He will also tell you how to save on legal fees.

"Inviolability" of a major transaction

However, not all so simple. Let's say that there is an objectionable participant who wants (and will) challenge almost every transaction that seems large to him. The legislator took care of this in advance: an exhaustive list of circumstances is provided in the presence of which the court will refuse to recognize a major transaction as invalid (even if the requirements of Article 46 of the LLC Law are violated). Let's list them (we are talking about an LLC participant who filed a lawsuit to declare the transaction invalid. - Ed.):

- the vote of a company member could not influence the results of voting on a major transaction, although he took part in voting on this issue;

- it has not been proven that the completion of this transaction has entailed or may entail causing losses to the company or the participant or the occurrence of other adverse consequences;

- by the time the case is considered in court, evidence of subsequent approval of this transaction according to the rules of the LLC Law has been presented;

- it was proven in court that the other party to the transaction did not know and should not have known about its completion in violation of the stipulated requirements for a major transaction.

Participation in procurement under 223-FZ

According to 223-FZ, participants are required to attach to their application for participation in the auction either a Decision or a reasonable confirmation that the transaction does not fall into the category of large ones.

In rare cases, there is a requirement to draw up a Decision for a specific transaction that is planned to be concluded based on the results of the purchase, or the transaction amount must be stated in the form established by the Customer. That is why it is so important to carefully study the conditions, as well as carefully check the documents before sending and correct them in time (before registering an application for participation).

In applications under 223-FZ, it is also recommended to play it safe and duplicate the Decision in Part 2, even if such a requirement is not established.