Living in your own home is the dream of many Russians. And with the development of home purchase lending programs, it is becoming increasingly feasible. But a mortgage on a house with a plot has pitfalls, which are often not realized by those who plan to apply for it.

What difficulties do you most often encounter when buying a house with a plot on a mortgage? What programs do Russian banks offer? Who will be denied a targeted loan? And how can you increase your chances of getting it? FAN asked these questions , Tatyana Reshetnikova .

Features of a mortgage on a house with a plot

The mortgage lending market for the purchase of houses with land plots in Russia is underdeveloped. Not all domestic banks offer the corresponding products. And everyone has their own, sometimes specific, requirements for real estate.

If the house itself or even the plot does not meet these requirements, the loan will be refused. This is how a mortgage on a house with land differs from that on an apartment. The conditions for purchasing square meters in high-rise buildings from most banks are similar, but with regard to houses there are a lot of subtleties.

Banks take into account literally everything - from the location of the object to its technical condition. Moreover, in one organization they will be more interested in the year of construction and the estimated value, while in another they will pay attention to the type of land on which the building is located.

May also be relevant:

- presence or absence of communications;

- suitability of the house for year-round use;

- distance from the city and location relative to other settlements;

- construction on individual housing construction lands;

- the degree of wear and tear of the structure - for wooden houses it should not exceed 40%.

Some banks lend only to their payroll clients. Others give money only for standard houses in complex residential development areas.

“The list of banks’ demands can be endless,” Reshetnikova clarifies. — Therefore, in such cases, it is always necessary to select a banking product for a specific object. Just going to any bank and taking out a mortgage on a house, like an apartment, won’t work.”

pixabay.com/

What should you pay attention to when purchasing? What should you do?

First of all, the buyer needs to carefully examine the house being purchased for possible defects or violations, since the seller often hides such violations.

If the buyer pays attention only to the interior decoration and exterior design, then he risks encountering many troubles in the future - from cold heating pipes in winter to cracks on the walls.

There are a number of important details that you should definitely pay attention to when inspecting the home you are buying:

- Condition of the attic and roof;

- Condition of the cellar (basement);

- Efficiency of communications;

- Location of drains;

- Parallelism of walls and evenness of the floor;

- Reliability of the sewerage system;

- The quality of drying of wooden structural elements;

- Condition of electrical wiring.

It should be remembered that it is best to inspect the house in March or April, during spring floods, since during this period all the shortcomings of the housing’s moisture insulation are clearly visible. If there is water or wet corners in the basement or cellar, it means that the foundation is leaking water, which can lead in the future to erosion of such a foundation and early destruction of the house, especially if the house has two or three floors.

If gutters are not positioned correctly, rainwater can erode the soil around the foundation, which can also lead to premature failure of the residential structure. To independently assess the location of gutters, you can observe their operation during rain, noting whether the water flows away from the house or fills low spots and holes near the walls and corners of the house. In the latter case, such drains must be redone or replaced with others.

The condition of the roof must be checked by going up into the attic (preferably during or after rain). This way you can determine how well the roof is laid and whether it is leaking.

To prevent the roof from leaking during rainstorms, there should be no gaps of more than 2-3 mm between the tile elements, and the overlap should be at least 0.5 cm.

If the house is wooden, then you can use a special moisture meter to assess the degree of drying of the wood. Over time, damp wood shrinks in width, and the geometry of the house is disrupted and cracks appear.

Then you need to ask the seller to demonstrate the operation of all existing communications for verification. Key communications include:

- Gas supply;

- Water pipes;

- Water disposal and sewerage;

- Wiring;

- Heating.

If the house is equipped with its own winter heating system, you need to start it and check the temperature of the batteries after a while.

After this, it is important to inspect the electric meter and power supply system. The wires must be copper according to modern standards, and grounding must also be present.

Water from taps should not have an unpleasant odor or cloudy color. To check the reliability of the sewer system, it is necessary to drain a large amount of water in a short period of time in order to assess the rate of water loss.

If you have any doubts about the thoroughness of the inspection, you can contact appraisers who will help you professionally assess the technical condition of a residential building.

Mortgage conditions for a house with land

Lending rates for such programs are usually slightly higher than for apartments. They start at 8.5% per annum, with the exception of specialized programs for corporate clients, who can be loaned at 7.7% per annum.

Another exception is the government-subsidized rural mortgage program. Within the framework of this program, you can get a loan at 2.7-3% per annum, but provided that the house being purchased is located on land recognized as rural. In most regions, these are defined as lands in the suburbs of large and medium-sized settlements or in small towns with a population of up to 30 thousand people.

“Each bank’s conditions are purely individual,” Reshetnikova clarified. — For most mortgage programs for a house with land, the down payment amount will be 25–50%. But there are also programs where they are ready to consider clients with a down payment of 10%.”

pixabay.com/

The nuances of a mortgage for the purchase of a house with a plot

A loan can be refused for various reasons. As per the “standard” - if the borrower is considered insolvent or his credit history does not suit the financial institution. So and according to specific ones, the main ones among which are two.

1. Insufficient estimated value of the property . Since the house itself becomes the collateral for mortgage lending, banks are in no hurry to allocate money for the purchase of housing without windows and doors, without communications, or located too far from the city. But even if in this regard everything is in order with the object, its estimated value does not necessarily satisfy the lender. Often appraisal companies cannot find analogues for a given object from those offered for sale in a particular locality. The houses are very diverse, some of them are unique, which creates an incorrect, often too low, from the buyer’s point of view, estimated value. The bank itself can further reduce it, taking into account the fact that during operation the housing may lose part of its value. And if there are problems with loan payments, you will have to sell it. And ideally, if the sale takes a little time, up to two months. If it is more, the object becomes completely uninteresting to the financial organization.

2. Difficulties with obtaining insurance . Insurance companies also evaluate the objects covered by their products. Old and worn-out houses are potentially risky for insurers. They often refuse to insure homes with stove heating or located in a flood zone.

“Many banks require property insurance,” continued FAN’s interlocutor. “Others can lend without it, but then they will increase the rate by 3–3.5%.”

pixabay.com/

Recommendations for design

When planning to buy a house with a plot on credit, you must first choose an object that suits you. And taking into account its features, select a bank and a mortgage program. The procedure itself is no different from mortgage programs for apartments. The borrower needs:

- obtain loan approval;

- coordinate the property with the bank;

- carry out an assessment of the object.

Some banks do not require an appraisal if the purchase requires less than 1.5 million rubles. If everything is in order, an agreement will be signed with the borrower and the required amount will be allocated.

If banks persistently refuse, it is worth considering other lending options. For example, taking out a consumer loan or a non-target loan secured by a city apartment. If you don’t have your own home, you can attract co-borrowers - third parties. These could be parents or close relatives who have an apartment and are ready to become mortgagors when signing a mortgage agreement.

Often these methods become the only way to obtain a housing loan. And they also have a number of advantages over mortgage programs for the purchase of a house with a plot. To obtain a non-targeted loan, you do not need to coordinate the object with the bank. No down payment is required, which often turns out to be an unaffordable amount for the borrower. No one forbids you to keep part of the loan for yourself to make repairs in the purchased house, buy furniture or use it for other needs. And finally, if something “goes wrong,” selling a home without encumbrances will be much easier than collateral from a bank.

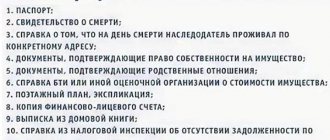

Required documents

No matter how much you like the seller and the land being sold, first of all you need to study the available documents.

According to Part 1 of Art. 14 Federal Law No. 218 of July 13, 2015 “On State Registration of Real Estate”, obtaining ownership of real estate is possible only if you have the following package of documents:

| Title documents | An agreement of gift, purchase and sale, exchange or a certificate of inheritance is provided. If the house and plot were received from the state, a privatization document is provided. |

| Technical certificate | This is a single document that includes:

The document is issued by the BTI at the location of the property. |

| Extract from the house register | If the house is considered suitable for regular habitation, a house register must be available. It lists all registered persons. The document will be required even if the buyer does not plan to register here. It shows who is registered here. It is better if these persons are discharged to their new place of residence before payment. |

| Cadastral plan | It can be obtained from the territorial department of Rosreestr. It shows what boundaries and territory the site occupies, the cadastral value and some information about the copyright holder. |

Request an additional extract from the Unified State Register. In it you can see information about the cadastral value and the copyright holder, the presence and absence of encumbrances. It contains information about location, area and boundaries.