Money in non-cash accounts is not the most reliable way to store money. Bailiffs, on the basis of enforcement proceedings, impose an arrest, and the finances are written off as debts. Where to open an account without being arrested by bailiffs? You should understand the topic of the issue in order to avoid seizure of the account or blocking of the bank card.

Bailiff partner banks

Several years ago, more than a hundred financial organizations entered into a cooperation agreement with the bailiff service. Information about debtors should be provided not only by state banks, but also by private ones. The larger the company, the higher the likelihood that the necessary information will reach the bailiffs.

The following banks cooperate precisely with government officials:

- Rosselkhozbank;

- Gazprombank;

- "VTB 24";

- "Sberbank";

- Promsvyazbank;

- "Post-Bank";

- "Alfa Bank".

Only a miracle will save you from writing off debt funds from the cards of these banks.

How bailiffs find out about bank accounts

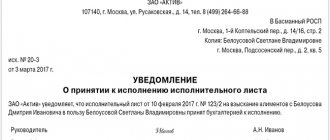

Having received the writ of execution, the bailiff is obliged to send requests to the banks in which, according to creditors, the debtor has accounts. And each bank is obliged to respond within 7 working days.

The bailiff's request to the bank must contain:

- Full name and passport details of the debtor;

- Number of the writ of execution (or court order);

- The requirement to report the presence of ruble and foreign currency accounts and deposits, as well as the amount of amounts stored in these accounts;

- Are there any financial products other than deposits open at the bank in the name of the debtor?

For example, this could be an individual investment account (IIA), an accumulative or investment life insurance agreement, information about whether a person has shares of investment funds purchased from a management company affiliated with the bank, or other stock assets. For example, a person has a brokerage account, and from it he actively trades futures for Brent oil on the Moscow Exchange; - Are individual safe deposit boxes rented from the bank in the name of such a person and what property is stored in them. This can be jewelry made of precious metals, precious metal bars, registered securities, paper bills, and much more. And - most importantly! — there may be cash there. Yes, yes, exactly the kind they show us in crime films - in neat crispy piles.

The bank draws up an official response to this request and sends it back to the FSSP. Failure to respond almost always means that the bank will be fined a large amount. Following the fine, the credit institution will receive an unscheduled inspection from the local branch of the Bank of Russia, during which other violations will be revealed.

Those, in turn, will definitely result in increased contributions for the bank to one of the many reserve funds. And in Russian this means that the bank’s funds in its account with the Central Bank will be frozen. Which is also tantamount to arrest.

There are no banks in Russia that refuse to respond to requests from bailiffs

If the bailiffs did not find an account or deposit in the bank, then the debtor was simply lucky - the bailiff did not think to send a request to this specific bank. But enforcement proceedings have no statute of limitations, so don’t relax. The bailiff has an eternity ahead of him to find your accounts and deposits. There would be a desire.

In addition, a significant fine will be imposed on the bank that ignored the bailiff’s request, and from the Bank of Russia as part of a violation of Article 115 of the Law “On Combating the Legalization (Laundering) of Proceeds from Crime.” Since ignoring a request from any branch of government is regarded by the regulator as a violation of the Central Bank’s “know your client” regulations.

Blocking a card in accordance with the provisions of Law 115 is practically the only case when a bank blocks an account and a card on its own initiative. Not at the request of the Federal Tax Service, not at the request of the bailiff and not at the request of the client. If the card does not work, and bank employees cannot clearly explain at the request of which department the card was blocked, then this is almost always the suspicion of the compliance control service that the client is “washing money”. We wish you never to find yourself in such a situation.

And the performer who “missed” the bailiff’s request will also be significantly punished with rubles or even fired.

Tell me, in your right mind, will the bank take such risks? No.

Which banks' accounts and cards cannot be seized by bailiffs?

Finding a bank that does not interact with bailiffs is quite possible. However, this often has to be done by trial and error: when opening an account, the organization will not provide such information. There is a list of financial institutions that bailiffs usually ignore:

| "Raiffeisen Cashback" |

| "Home Credit Benefit" |

| "UBRIR PORA" |

| "MTS Cashback" |

| "Sovcombank Halva" |

Debit cards

It is best to have a card account from a non-large bank. Many organizations are quite loyal to their clients: they have optimal offers for cooperation.

Cashback from Raiffeisen

A debit card from Raiffeisen is a special offer for clients among banking products.

Its advantages:

- The debit card has completely free issue and maintenance;

- through the fast payment system, a transfer to a card of absolutely any bank is carried out using a mobile phone number;

- up to 1.5% cashback is awarded for all expenses - in real rubles, not bonuses;

- It is possible to connect to the “Beneficial Solution” savings program. (then the income on the account balance will be 4% per annum);

- The courier will deliver the finished card to your home; this service is free.

Design

"Benefit" from "Home Credit"

A debit card with free service allows you to use all the features of the bank and make purchases.

- The withdrawal limit is no more than 500 thousand per day. There are no monthly limits on transactions, however, when moving more than 600 thousand, the bank may impose an additional commission.

- The owner of the plastic card automatically becomes a participant in the bonus program. For each purchase, cashback of 22% is awarded.

- If necessary, the card can be easily reissued. The service will cost no more than 200 rubles.

- When replenishing via the Internet or mobile application, you do not need to pay a commission.

Design

“IT’S TIME” from “UBRIR”

The card is issued by UBRD Bank and belongs to the debit category.

Main characteristics of plastic:

- Receiving a card takes from one to two days for all residents of Russia;

- the service is free for the first 2 months (further for free service you need to spend at least 15,000 rubles on the card);

- Bank reward: up to 6% of each purchase in the selected category.

Design

Credit cards as a way of protection

Credit cards are not subject to seizure by law, and the bank itself is not interested in disseminating information about them. To attract new clients, some organizations allowed them to store their personal funds on credit cards with interest payments.

In fact, the money on the card does not belong to the borrower, but to the financial institution. If the funds are nevertheless written off, proceed as follows.

- You need to contact the bank for a certificate indicating the bank account details and the terms of the loan agreement.

- The card owner writes an application to remove the arrest from the account and submits a set of documents to the FSSP reception.

- The bailiff will make a decision on cancellation within ten days.

The bailiffs have already figured out this loophole: a proposal has been made to introduce appropriate amendments to the legislative framework. However, the Supreme Court has not yet addressed this issue.

Top 3: Credit card from MTS Bank

A credit card from MTS is considered universal. Main characteristics:

- it has a grace period, cashback and the ability to accrue income through interest on the balance;

- the card, as well as the account linked to it, is serviced free of charge during the entire validity period of the product, which is 3 years;

- when withdrawing money from cash desks and ATMs owned by MTS, no commission is charged;

- The client is provided with Mobile Banking and Internet banking free of charge.

Design

Top 3: Virtual credit card “Kwiku”

It is not plastic that is issued, but an account with a cash limit, number, and information about the holder and expiration date.

This data is enough to arrange profitable shopping online.

- The credit card is linked to the Visa payment system.

- The decision about the possibility of issuing money comes in a couple of minutes.

- You can get a card even with a bad credit history.

- Payments are made twice a month.

- The preferential rate and interest period are calculated individually.

Design

Top 3: Tinkoff Platinum Credit Card

The Platinum card confidently occupies one of the leading places in popularity among users.

- Using borrowed funds from the card, you can pay for purchases and utility bills, or even rent a car and book a hotel room.

- For goods purchased in installments, the client does not pay interest for a year.

- When repaying loans from third-party banks, the borrower is provided with an extended interest-free period (120 days).

- You will not have to pay for the release, reissue, use of the mobile application and consultations with specialists (in chat or by phone).

Design

Where else can you keep money so that it can’t be arrested?

The banks where requests to search for debtor accounts are most often made have already been listed above. There is a list of banks that bailiffs mostly ignore:

- Raiffeisenbank.

- Home Credit.

- Ural Bank for Reconstruction and Development.

However, clients of these credit institutions should not be completely confident in the safety of their funds. If the bank receives a request from the FSSP, it will necessarily indicate all of its client’s accounts.

Another place where you can more or less safely store your funds are electronic wallets , but only those banks or payment systems that do not require you to provide your personal data during registration.

Here, even if an account is discovered, which is unlikely, since the bank cannot link a wallet to a specific individual, it is still necessary to identify the personal account in court - to prove that this particular wallet belongs to the debtor. This procedure takes a long time, which allows the owner of the money to withdraw it from the payment system or electronic bank.

Storing money on credit cards seems interesting. These accounts are not subject to seizure by law, and the bank itself is not interested in providing information about them.

This opportunity arose when, in order to attract customers, some banks allowed personal savings to be stored on credit card accounts with interest payments. The Bailiff Service is aware of this and has made proposals to include appropriate amendments to the legislative framework. But the Supreme Council has not yet considered this issue.

And one last thing. The easiest and most affordable way to save your accounts is to open them in any bank in the name of friends or relatives, for example, grandparents. But not on my wife. Here, the safety of money from bailiffs is fully guaranteed.

Advantages of electronic wallets

Electronic wallets are a reliable way to store assets and not show them to third parties. Some of them can be registered even without passport data - just an email. If the account is “discovered, its identification must be proven in court. This is a long process: the owner will have time to withdraw money from the payment system.

To start using the Yoomoney wallet (Yandex. Money), you need to go through a simple registration. However, if you need to make a financial transaction for more than 15,000 rubles, you will still have to send your passport information. The advantage is that electronic wallet data is almost never transferred to the tax office and bailiffs.

Debit cards linked to an electronic wallet

Today, many payment systems offer debit cards with favorable rates.

For example, Qiwi makes it possible to issue a debit card from the bank of the same name using a link. Validity period: 2 years. The card will be delivered by Russian Post or via courier. To complete an application, registration in the payment system of the same name is required. The daily limit depends on the user status. If the client has passed the identification procedure, 60 thousand are available to him, if he has not passed, 50 thousand. The Yoomoney system (Yandex. Money) offers a gold card for a period of 3 years (link). It is possible to pay for purchases with one touch - without entering a code. The cost of delivering the card within Russia is 149 rubles. For all completed transactions, free SMS information is provided: they are available in the “Personal Account” or on the payment system website itself.

The limits depend on the status of the personal wallet in the system. “Anonymous” users can spend no more than 15 thousand per day, identified users - one hundred thousand.

Removal of arrest imposed by mistake

It also happens that a salary card is seized unreasonably. Such situations, according to Alla Semenova, are not uncommon. The reason is that bailiffs use only “basic” data to identify debtors: first and last name, date and place of birth. If this information is the same for several people, the full namesake may well suffer due to a technical error.

In this case, you need to find out the details of the bailiff on the FSSP website and contact him personally with a statement. In this application, you should indicate the fact of the error and provide information that allows you to accurately identify you: passport data, SNILS number. A copy of the application should be sent to the main and regional departments of the FSSP.

After reconciliation of the data, the decision regarding the “namesake” will be canceled, and the money written off will be returned. How quickly this will be done depends on whether the bailiff managed to transfer the funds to the collector or whether they are still on his deposit.

pixabay.com/stevepb

Megafon card linked to a phone account

Megafon offers its customers a bank card linked to a mobile phone number.

Advantages:

- free service;

- monthly accrual of eight percent per annum on the account balance;

- When making purchases, cashback is awarded - from 10% of the total amount;

- acts like a regular bank card: you just need to put money on your phone number, and you can immediately use it to pay using the card number;

- money from the balance is transferred anywhere in the world without commission;

- funds are kept by the operator and not in the bank, and there have been no cases of license revocation from mobile operators;

- cardholders are guaranteed to be protected from unwanted charges (Megafon automatically blocks all dubious subscriptions).

For owners of the All Inclusive tariff, the card will be free; for others, registration will cost 99 rubles. (you don’t need to pay anything for annual maintenance).

But why don’t bailiffs find accounts in some banks?

“I know for sure, my neighbor told me that his neighbor deceived the bailiffs, they were looking for his money in Moscow, in Sberbank, and in Uryupinsk, in the Stella bank, so they found it in Sberbank, and in the Soaring Jack bank - noooo!” - such statements can be read on many bankruptcy forums.

Does this mean that the money must be urgently transported by overnight fast train to Volgograd, and then by cart (yes, in crisp packets of cash) to Uryupinsk? Also no.

Why don’t bailiffs find deposits and accounts in some banks? Yes, because they simply didn’t think to ask for these banks. If there is no request to the bank, there is no answer to it.

Here the root of the problem lies in the eternal maxim: “the bailiff is also a person.” He has a great many cases and debtors in production at the same time. Therefore, the bailiff forgets about something, and openly “puts a bolt” on something.

Therefore, bailiffs, as a rule, request those banks whose list was given to them by the lender. For example, a person took out a loan from Vostochny Bank and then did not return it. But when he applied for this loan, among others there was an account statement from VTB Bank - a salary card was opened in it. This is what the bailiffs will ask VTB for first.

And also Sberbank - the majority of citizens of our country receive benefits there - payments for children, pensions, etc. Therefore, it is generally accepted that almost everyone has a Sber card.

Automatically, bailiffs usually send requests to the largest banks in the country, especially to banks with state participation. This:

- Sberbank,

- VTB,

- “Otkritie” (since it was in this institution that many banks merged together),

- Post Bank,

- Rosselkhozbank.

- Promsvyazbank (PSB).

It does not matter at all in what currency the money is stored in accounts in these banks: funds will be written off from ruble and foreign currency accounts - the amount of debt will be converted from currency into rubles at the bank exchange rate on the day of write-off.

As a rule, bailiffs also make requests to large retail commercial banks. These will be those banks that actively work with the population - providing consumer loans, issuing credit cards, and actively promoting mortgages.

The list of requests will probably include Tinkoff Bank, as one of the most “card” banks. Or, if an individual debtor has a mortgage, then Gazprombank is an institution that is actively working in the field of mortgage refinancing.

Here is a partial list of such banks:

- Alfa Bank

- Tinkoff Bank

- Home Credit and Finance Bank (HCFB)

- "Renaissance Credit"

- Absolut Bank

- Rosbank

- Raiffeisenbank

- Sovcombank

- Bank Rosgosstrah

If the debtor has money in these banks, and the bailiff did not get to it, the debtor is lucky. But it’s not a fact that it will never happen - after all, enforcement proceedings based on a court decision can be resumed many times and there is no statute of limitations for it.

Advice. If you are “dynamizing” a court decision, but suddenly received an inheritance, or someone simply returned a debt to you, and you put this money that suddenly fell on you in the bank - keep quiet about it.

Don't brag to your friends, colleagues, or relatives. Money loves silence. Remember that most crimes are solved because the person was unable to keep his mouth shut and somewhere in the company he blurted out too much or bragged. This is how the information reached the ears of the creditor, bailiff or investigator along the chain. And then it’s just a matter of technique and the official zeal of the official.

Issuing a card or account for relatives: will it help or not?

Representatives of the FSSP have the right to seize the accounts of only the debtor himself. Therefore, many of them draw up accounts for close friends or relatives. You can transfer money in cash or do it through a deposit. However, it is important to understand: there is always some risk in this situation. It all depends on the decency of a particular person. If a third party does not want to return the money to the owner, no one can oblige him.

By law, bailiffs do not have the right to conduct a search. If you keep your money in cash, chances are they won't find it.

What will the bailiffs take away first?

They will start with money, because it is easier to take it out and return it to the lender. There are two easiest ways:

- Find out if the debtor has accounts. The bailiff has the right to request Federal Law No. 229-FZ of October 2, 2007 from banks for such information. If the accounts are found, the institution will be obliged to withdraw money from them and transfer it to the bailiffs. If funds are insufficient, debts will be collected from future earnings.

- Act through the employer. If the debtor receives a white salary, part of it, according to the court decision, will immediately be sent to the bailiffs. The amount usually does not exceed 50% Federal Law of October 2, 2007 N 229-FZ of earnings. But if we are talking about alimony debts, then you can lose up to 70%. All calculations occur after income tax is withheld from the salary.

What Federal Law No. 229-FZ of October 2, 2007 will definitely not take away from you are various types of benefits and compensation related to harm to health, death, and so on.

If it was not possible to pay off debts with money, the bailiffs move on to the next stage: they confiscate and sell the property.

Information transfer algorithm

Representatives of the FSSP (Federal Bailiff Service) send a request to the bank by email or regular mail - by registered mail with notification. Since delivery takes time, arrest is not imposed immediately. Next, the bank conducts an inspection and, based on its results, the financial institution is obliged to provide the bailiffs with the personal account number and other information about its owner.

After the delivery of the writ of execution, legal proceedings are initiated within three working days. The money in the account is temporarily frozen: the debtor will not be able to make financial transactions. In the future, funds will be debited from this card to the defendant’s account. If the amount of money is not enough to pay off the existing debt, the amount begins to accumulate in the account.

Information about the bank can be provided by the employer after the initiation of enforcement proceedings.

How do bailiffs find debtor cards?

In the process of searching for property, the bailiff sends various requests:

- to the Federal Tax Service;

- to the monitoring service of the Bank of Russia;

- at the place of work to find out where the salary card is open;

- to the banks where the debtor's accounts are supposedly located.

It is impossible to send requests to all banks at once, so the bailiff sends the document only to selected organizations. The selection of banks is carried out on the basis of:

- experience of a bailiff: usually the FSSP sends requests to the most popular retail banks;

- participation of the collector: if he knows where the debtor keeps the money, he prompts this information to the bailiff.

- response from the Central Bank monitoring service and the Federal Tax Service inspection at the place of registration of the debtor.

Which banks do bailiffs send requests to first? Among the popular financial institutions of the FSSP, the following should be highlighted:

- Gazprombank;

- Sberbank;

- VTB;

- Rosselkhozbank;

- Alfa Bank;

- Bank opening".

Some debtors are trying to outsmart the bailiffs. They obediently accept the blocking of accounts, and after 2-3 weeks they open an account in another bank. As a result, we have a situation: enforcement proceedings are open, the bailiff has already checked the data and taken action. But the debtor still uses the card.

There are two possible scenarios here:

- The bailiff periodically sends requests again to the banks, and from them learns about the card.

- The creditor learns about the situation and turns to the bailiff in order to block a specific card opened by the debtor during enforcement proceedings.

In real life, bailiffs rarely recheck cards after the opening of enforcement proceedings. But if the collector is sufficiently interested in repaying the debt, then checks cannot be avoided.

Don’t forget, most often what ruins people is bragging. If you managed to deceive the bank and use a card, don’t shout about it on the pages of your social networks. Bailiffs definitely don’t read other people’s social networks, but the debt collector, especially if he is an individual. face - may well track the events of your life.

In what cases are bailiffs unable to calculate the debtor’s account?

At first glance, everything seems hopeless: the bailiffs have entered into an agreement on electronic document management with almost all banks existing in the Russian Federation. However, the human factor has not been canceled: bailiffs cannot seize an account that they have not found.

Here is a list of the main reasons when the debtor’s account cannot be calculated.

- Employees search for information manually: they send relevant requests to different banks. In conditions where the bailiff has dozens of claims, it is realistic to print out and send requests to one or two dozen organizations.

- There is no general list of debtor accounts: with each bank everything starts from the very beginning.

- We have to face the realities of the state postal service: letters to the organization are delayed in transit and sometimes get lost.

- The search task becomes more complicated if the debtor does not have official employment.

Russian banks with state participation usually do not risk hiding information about debtors.

Which banks does SPI turn to first?

To save time, the bailiff initially turns to the large banks of the country: Sberbank of Russia, VTB, Alfa-Bank, Rosselkhozbank, Gazprombank, MKB, Sovcombank, Rosbank, Otkritie. Then the request is sent to all regional banks: it is logical that an individual is more likely to open a deposit in a bank within the region of permanent residence.

Taking into account the provisions of Article 81 of the Federal Law “On Enforcement Proceedings”, a bank and other credit organization are obliged to immediately provide SPI with information on deposits, cards, accounts opened in the name of an individual. The order in which requests are submitted gives the result: the bailiff receives data on the monetary assets of the debtor-citizen. If they are not enough to satisfy the requirements of the creditor(s), it makes sense to contact other Russian banks.

Electronic wallets and cards issued by NPOs

Electronic payment systems have become widespread in the Russian Federation: Yandex.Money, QIWI, Webmoney, PayPal. Thanks to these systems, citizens can make transactions with funds, as well as store their assets in a non-cash form. Previously, there was an opinion that bailiffs do not have access to electronic wallets, so they cannot seize money on their balance sheet.

Indeed, some time ago, bailiffs may not have detected funds placed on an electronic wallet. After tightening the rules for using electronic payment systems, the likelihood that the account will not be seized is minimal. This is explained as follows:

- Unidentified users cannot make or receive transfers—there is practically no point in registering a wallet without uploading passport data.

- From April 1, 2021, banks servicing electronic payment systems are required to transmit information to the Federal Tax Service on all identified electronic wallets.

For these reasons, it will most likely not be possible to hide the presence of money on your wallet balance from SPI. The same rule applies to bank cards. For example, the NPO Yandex.Money issues bank cards based on the Mastercard payment system. Money on the accounts of these cards is subject to seizure and collection in accordance with the general procedure.

What accounts can be seized by law?

Article 81 of the Civil Code clearly lists the types of accounts that may be subject to seizure:

- salary;

- debit (for everyday expenses or savings);

- stock;

- pension;

- deposit.

Alimony, military pensions, disability or survivor pensions, child benefits and other social and insurance payments are not subject to seizure. If they are written off, the money can be returned to the account: you must write an application addressed to the head of the department where the bailiff serves.

To reduce the risk of money seizure as much as possible, it is recommended to open card accounts in several organizations at once or create an electronic wallet: the bailiffs are unlikely to be so diligent that they will detect them all at once. It is better to keep some of the money in cash in a safe place. However, none of the methods will give a 100-degree guarantee: here a lot is decided by chance and trial and error.

What other banks can bailiffs cooperate with?

This chapter is more concerned with the work of regional FSSP services than with the bailiffs of central cities, in which many approximately identical banks operate.

After all, in the regions, as a rule, there is one or a couple of local banks, which are usually called “core”. They often store budget funds and service large enterprises. They also have well-developed retail, they issue loans to individuals and even organize separate divisions to serve individuals or legal entities.

A characteristic feature of such banks is their separate mortgage offices, which work only with housing lending.

An example of such banks:

- "Orenburg" (respectively, for Orenburg)

- "Ak Bars" in Kazan

- SKB-bank in Yekaterinburg

- "Let's go to!" in Novosibirsk

So, the bailiffs in Kazan will definitely send a request to Ak Bars. Because “just in case” an account with the debtor can be opened there.