Recently, citizens' complaints about erroneous or illegal debits from their bank cards have become more frequent. In addition to errors related to the debts of namesakes, people complain that money for the same fines is written off several times. There are also technical problems, for example, the seizure of the debtor’s credit account - the credit card balance goes into the minus, and the bank begins to charge interest. How to return erroneously written off money and how to minimize the risk of such errors?

How to return overpaid money to bailiffs

According to Part 11 of Art. 70 of the Law on Enforcement Proceedings, the bailiff must return to the debtor the money received in excess of the amount owed.

If the bailiffs do not return the money on their own, you must contact them with a written application for the return of the money.

However, you should not count on the fact that the bailiffs will voluntarily return the money, since not everything is always so simple in these structures.

If the bailiffs refuse to voluntarily return the money, then you can file a complaint with the prosecutor’s office so that an inspection can be carried out; perhaps, based on the results of the inspection, the bailiffs will transfer the money.

If contacting the prosecutor’s office does not help, then you should go to court.

What and how much can bailiffs write off?

As stated above, official documents confirming debt most often do not specify restrictions on writing off money. For this reason, bailiffs write off all money received on the card.

But there are situations when bailiffs initially write off not the entire amount received, but only half of it

. After some time (usually the next day), the bailiffs write off the remaining amount. Why this practice of writing off exists is unknown. Perhaps this decision is made by the bailiff himself.

In addition, Sberbank and other banks have their own tactics. They place a hold on funds in an individual’s current account, but do not block it completely. That is, the debtor can still use the money

.

To put it simply, when an account is blocked, money can be transferred to it, but it is prohibited to write it off. If an account is seized, the bank notifies the bailiff service about the receipt of money, and just at that time (while the notification is sent to the bailiffs), the debtor may have time to withdraw or transfer the money. Usually the debtor has 1.5-2 hours. If the money was received over the weekend, then even better, it will not be written off until Monday or the first working day.

According to Article 101 of the Federal Law of October 2, 2007 No. 299-FZ “On Enforcement Proceedings,” bailiffs do not have the right to write off:

- social benefits;

- pensions;

- alimony;

- compensation for damage caused to health;

- survivor benefits;

- government compensation payments;

- state child care benefits;

- “coronavirus” benefits in the amount of 5 and 10 thousand rubles for children aged from birth to 16 years;

- other.

In total, Federal Law No. 299-FZ stipulates 19 payments from which the debt cannot be written off

individual. But such payments must have a corresponding purpose of payment. If the amount of benefits from the state or compensation payment from the employer comes with the comments “other income” or “wages,” then the bailiff has every right to write off such payment.

In addition, bailiffs do not have the right to write off money from credit cards,

simply because this money is the property of the bank. Yes, bailiffs have the right to seize funds in a card account, but they will not write off money from them. The only exception is if the card is a credit-debit card (with overdraft). In this case, the bailiffs will write off the entire excess amount (above the size of the loan or overdraft) - that is, their own funds.

If the debtor's credit card has been seized

, then he can safely make the monthly payment and use the credit limit. But if in doubt, you can try to deposit a small amount of money on the card and see what the bailiffs do next.

If desired, you can agree on a certain amount of write-off - directly with the bailiff (individually). To do this you need to bring a certain package of documents:

- certificate of salary;

- copies of children's birth certificates;

- certificate of being on parental leave;

- court ruling on the amount of alimony;

- other.

From wages in accordance with Article 99 of the Federal Law “On Enforcement Proceedings” no more than 50% of the amount can be withheld

(as well as from other income - royalties, royalties under the GPA). But this condition does not apply to wages transferred to the card. Therefore, in order to establish a write-off standard, all information about the income received should be provided to the bailiff.

With corporate debts, everything is different. Banks automatically block accounts for legal entities by order of a bailiff or other departments

. That is, until the account is completely unblocked, until the debt is fully repaid, the company cannot use the money in its accounts.

In addition, legal entities do not have a list of income that cannot be withheld. Since in most cases all the money in the current account is the company’s profit or loans from the founders.

It is also impossible to determine write-off rates (as a percentage of income). Even the fact that a company cannot pay wages to its employees on time is not a reason to limit the amount of monthly write-offs.

The procedure for returning money from bailiffs

How to proceed so that the bailiffs return the money?

- Prepare an application for a refund.

- Submit or forward an application to the appropriate unit of the bailiff service.

- Clarify information about the receipt of the application by the bailiffs, if the application was not submitted in person with a mark on the applicant’s copy.

- Contact the bailiff or come on the reception day to clarify the information on your application and when the refund will be made.

- In a situation where the bailiff refuses to return the money, ask to give you a written refusal or wait 30 days from the date of filing the application.

- If a response from the bailiffs is not provided, file a complaint with the prosecutor's office about the violation of the deadlines for considering your appeal, as well as the non-return of funds.

- Wait for the results of the prosecutor's investigation.

- You can appeal the bailiffs' refusal in court.

In a situation where the bailiffs agree to return the money, they must do this as soon as possible. The law does not specify such deadlines, but, as a rule, transfers from the bailiffs’ deposit are made within 5 business days.

Facebook won't help

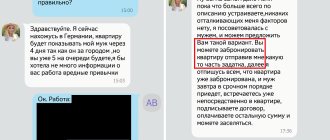

Finding himself in such a situation, a person, as a rule, does not know what to do: where to run and should he run at all?

And in the first hours, forgetting about my legal education, I succumbed to emotions and could not figure out what to do. Many turn to the help of the all-powerful Facebook, writing angry posts blaming the bank, asking for advice, calling friends, acquaintances, and relatives. Nobody offers anything sensible. “I have a good lawyer - he’ll get it inexpensively”... “Go to court!”... “Yes, you can demand such moral damages from this bank!”... “Say that you were sick and you urgently needed medicine, but they took it away from you last money!" This is all bad advice. Even harmful ones. Because at the initial (and preferably the only) stage, you can deal with the problem yourself.

Here are step-by-step instructions on what to do if your funds were wrongfully seized by the Federal Bailiff Service. I pay special attention to the word “illegal”. Based on personal experience. So…

Terms for returning money after the arrest is lifted

After the arrest is lifted from the account, the bailiff must return the money that was excessively written off or paid. Any specific deadlines for return are not specified in the law, but according to current practice, if the bailiffs return the money, the transfer occurs within a week.

When the money is returned, the bailiffs issue appropriate decisions and forward them to the accounting department for execution. In addition to the bailiff service, this process also involves the bank in which the debtor’s account is opened.

Taking into account the above, the applicant needs to monitor this issue and constantly check with the bailiff about whether the money has been returned, since the human factor also plays a certain role, and therefore the bailiff may simply forget to take steps to return the money due to the large amount of work.

When writing a statement to the bailiffs, you can refer to Art. 314 of the Civil Code of the Russian Federation, which specifies a reasonable period for fulfilling obligations, which is 7 days.

At the same time, in Art. 110 of the Law on Enforcement Proceedings specifies 5 business days for transferring money to the recoverer when it is received in the account of the bailiffs. Taking this into account, it is possible to apply the provisions of this article by analogy to the return of money to the debtor.

How to remove sanctions from a card?

The standard procedure for removing a seizure from a card or a personal account linked to it always begins with obtaining information about the writ of execution on the basis of which the bailiffs act. There are several ways to do this. The easiest one is in your Sberbank Online personal account. For this it is enough:

- log in to your personal account;

- go to the desired card, next to the name of which the arrest icon will be indicated;

- click on it to follow the link, after which another icon will open - “Use. documentation";

- Click on the link again, which will take you to the page with the details of the writ of execution with detailed information about the reasons for the blocking and the amount of the seized amount.

For Sberbank clients, using the remote service is the easiest way to obtain information about the reasons for the arrest. However, there are other possibilities, including Internet services.

After determining the reason for the arrest, it is necessary to decide on further actions. There are two options. If you agree with the debt, top up the card balance in any way available to a Sberbank client. This will allow:

- pay off the debt, as the money will be automatically written off. After the enforcement proceedings are closed, the bank will unblock the card and remove the seizure marker;

- receive funds in excess of the blocked limit, which can be used without waiting for the arrest to be lifted.

If you disagree with the sanctions imposed by the bailiffs, you should contact the FSSP. It can be done:

- upon a personal visit to the service unit that initiated enforcement proceedings;

- directly on the website of the federal department;

- by contacting the FSSP hotline.

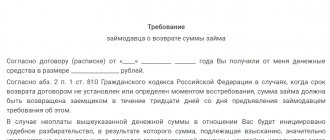

Application to bailiffs for the return of funds

In an application for the return of money overpaid to bailiffs, you must indicate the following information:

- The application is submitted to the head of the FSSP unit;

- Information about the applicant is indicated, i.e. Full name, address, telephone number;

- The document is called an “application for refund”;

- Directly in the text of the application it should be stated under what circumstances the money was transferred to the bailiffs by mistake;

- In the pleading part of the application, indicate that the applicant is asking to return such and such an amount of money using such and such details to such and such an account

- In the appendix, list the documents that are attached to the application in support of the applicant’s arguments and the circumstances of the excessive payment of funds;

- At the end of the application there is a date, signature and transcript of the signature.

The application can be sent by e-mail, registered mail, or delivered under a mark on your copy.

If you have any questions regarding enforcement proceedings related to the return of funds from bailiffs, you can always turn to our lawyers for help.

How to prevent bailiffs from withdrawing money from a Sberbank card?

Here's what you need to do to prevent bailiffs from withdrawing money from your card:

- Before you apply for a Sberbank debit card, be sure to look in the terms of financial services for the clause under which you give your consent to the bank to write off money from your personal account (card) to pay debts, mandatory payments or commissions - you must refuse this immediately . This will not save you from a writ of execution, but it will help if your credit and debit cards are in the same bank (for example, Sberbank)

- If you have a card on which benefits, pensions, or any social payments are accrued, then in the event of an arrest, you can contact the bailiffs with a statement not to write off money from this card. To do this, you will need to contact the Pension Fund and get a certificate of enrollment, it will indicate the current account into which the funds are received. Based on this document, the bailiff will exclude her from security measures. This will only help those people whose bank cards are intended only for social payments.