In August 2021, the head of the Federal Bailiff Service (FSSP), Dmitry Aristov, said that over the past 3 years, bailiffs have recovered more than 2 trillion. rubles However, as before, half of the debtors in proceedings in the FSSP do not pay anything - they do not have a regular income, it is often impossible to find the debtor himself, such citizens do not have property that could be sold to pay off the debt.

The work of the FSSP is a state mechanism aimed at implementing court decisions and resolutions. Due to the high workload, it is not always possible to achieve success: for example, in 22.5% of cases the debtor simply cannot be found.

Powers and rights of bailiffs to collect debt

The list of powers of bailiffs is set out in Art. 12 No. 118-FZ, which regulates the work of the executive body. The bailiff can:

- carry out inspections at the place of work of debtors;

- find out information about the debtor’s place of work, position, and employer;

- submit various requests, obtain personal data of a person - in this case, bailiffs are not limited by the provisions of the law on the protection of personal data;

- visit the housing, premises of debtors, open them together with a police squad;

- open premises that do not belong to the debtor, but in which his property is supposedly located;

- demand withholding of funds from the debtor’s accounts: from a salary, deposit or any other bank account;

- serve summonses to visit the bailiff service to relatives, colleagues or other persons related to the debtor;

- negotiate with the owners of non-residential premises on the storage of certain property of the debtor. In this case, the costs are borne by the defaulter;

- seize property, transfer it to third parties for storage;

- sell seized property;

- put property on the wanted list;

- put the debtor on the wanted list;

- check documents of citizens;

- interact with the police, the FSB, military units, the National Guard, the migration service and other departments.

FSSP employees can use any of the listed actions if they are aimed at collecting a debt or implementing court decisions.

Rules for filling out an application to the FSSP of the Russian Federation

If it is not possible to recover money through the employer company, banks and other organizations, you need to submit an application to the FSSP.

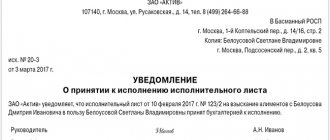

Initiation of enforcement proceedings is carried out by bailiffs on the basis of applications from claimants (or their representatives). In the application for the commencement of enforcement proceedings, you must attach the original writ of execution (and also, if the application is signed by a representative, a power of attorney for the representative).

Before transferring the writ of execution, you need to make sure that the 3-year limitation period for presenting the writ of execution has not expired. And also make sure that there are no errors in the writ of execution and all the necessary data is indicated (the list of information can be seen in Article No. 13 of the Federal Law “On Enforcement Proceedings”). In all other cases, the FSSP officer will refuse to initiate enforcement proceedings.

But we note that recently the courts have been critical of refusals to initiate enforcement proceedings given due to the lack of information about the debtor’s place of birth in the writs of execution, due to the insignificance of such identifying information (an example is case No. A60-19042/2015 and the Resolution of the Arbitration Court Ural District dated October 7, 2015).

Important: if there is a representative, his power of attorney must be given special attention. The document must specify the rights of the authorized person to revoke and present a writ of execution. Otherwise, the FSSP RF employee will refuse to initiate enforcement proceedings and return the writ of execution.

The representative’s power of attorney must also specify his other powers, such as:

- Conclusion of a settlement agreement;

- Refusal of collection under a writ of execution;

- Receipt of awarded property;

- Appealing actions or inactions, decisions of the FSSP;

- Retrust, because transfer of authority to another person.

When drawing up a power of attorney, you must make sure that the scope of powers provided for by the document corresponds to those powers that are actually required by the appointed person to represent the interests of the claimant.

When filling out an application to the FSSP of the Russian Federation, you need to apply for the seizure of any property that is known. May be indicated:

- Information about the debtor’s spouse (the spouse’s property may be seized, and you can insist on the allocation of the debtor’s share in court);

- Information from the Unified State Register of Legal Entities on the rights to the debtor’s shares in enterprises;

- Information about the place of work (telephone number, location address, employer details);

- Information about vehicles (a copy of the vehicle registration certificate can be made);

- Information about real estate (you can obtain an extract from the Unified State Register in advance), bank accounts.

It happens that due to a lack of data in the application, FSSP employees conduct enforcement proceedings for several months, despite the fact that the necessary measures could be carried out much faster.

Important: when submitting documentation to the FSSP office, find out which employee will receive your file, which office he works in and what his contact phone number is.

From the office to the bailiff, writs of execution along with statements from claimants are received within 3 three days. Please ensure that this 3 day period is respected. When determining the deadline, do not take into account holidays and non-working days. There are known cases when, without any legal reasons, enforcement documents were in the offices of the FSPP for more than a year.

Having received the writ of execution, the bailiff, also within the next 3 days, makes a decision:

- On the beginning of enforcement proceedings;

- On refusal to initiate enforcement proceedings.

At this stage, it is also important to monitor the work of the FSSP employee. If necessary, it can be recalled that the 3-day period is established by law.

In 2021, claimants can find out information about the progress of their enforcement proceedings remotely - the information is sent by email. To receive it, you must indicate your email address in the application to initiate enforcement proceedings (or in a separate notification). You can also send emails through your Personal Account on the official portal of the FSSP of the Russian Federation.

Let us note that online interaction between citizens and the Bailiff Service in Russia is not yet sufficiently complete. However, it is already quite convenient to receive and send petitions, statements and information.

On the website of the FSSP of the Russian Federation there is a section Data Bank of enforcement proceedings. Here you can also see current data on the initiation of enforcement proceedings and information about the appointed bailiff. You can also subscribe to notifications about changes in information on enforcement proceedings of your debtor.

Additionally, we advise you to subscribe to change data about your debtor on the arbitration case file website. If the debtor initiates bankruptcy proceedings (or it is initiated against him by another person), you will have (from the date of publication of the relevant information) 2 months to enter the register of creditors' claims. Upon completion of the process, the bankrupt enterprise will be excluded from the register of legal entities. A bankrupt private individual may be relieved of his obligations to pay debts.

How do bailiffs begin collecting debt from individuals?

In accordance with Part 17 of Art. 30 No. 229-FZ “On Enforcement Proceedings”, bailiffs are required to send a notice to the debtor’s residence address. As Sergei Sazanov, first deputy director of the FSSP, previously explained, a person is considered notified of the start of enforcement proceedings if he has not submitted an application for a change of residence to the registration authorities.

What does it mean? An excuse like “I haven’t received any letters from the bailiffs” will not work. Bailiffs are not required to send notices by registered mail or hand them over personally to the debtor.

Starting from the date a person formally receives a notice from the bailiffs, he has 5 days to independently and voluntarily pay off the creditor. If the debtor does not do this, then the enforcement procedure will be launched. Typically, up to 7 days are allotted for compliance with formalities between the expected date and the start of work of the FSSP.

Where is the writ of execution submitted?

There are several options for how a writ of execution can be presented for collection. According to the Federal Law “On Enforcement Proceedings”, you have the right to submit a writ of execution to the territorial branch of the Bailiff Service. This can be a branch located both at the place of residence (registration) of the debtor, and at the place of his stay (actual location), as well as at the location of his property.

In addition, you can bypass the appeal to the bailiffs and submit a writ of execution to the bank where the debtor’s current account is opened. To find out which bank the debtor uses, contact any tax authority with an application to provide information about the debtor’s accounts - and you will be able to receive this information after 7 days. And if your debtor is a citizen from the public sector, then you can start with Sberbank: given the share of the banking market that it occupies, the chances of writing off the debtor’s money “at random” are quite high. The bank that has received the writ of execution from the claimant is obliged to independently establish accounts and write off funds from all existing accounts within the amount specified in the writ of execution.

Finally, the writ of execution can be presented to the organization that pays the debtor-citizen periodic payments (salary, pension, scholarship). This could be the debtor’s employer company, a pension fund, an educational institution, etc. The legislation allows this method of collection if the amount of the debt does not exceed 25,000 rubles or if the writ of execution compensates for harm to health, alimony or other periodic payments are collected.

Stages of collection: how do bailiffs work?

First of all, bailiffs check the property and financial situation of the debtor. A person is sent an official request to provide information about the property he owns.

Bailiffs also request information:

- to the Federal Tax Service - the request concerns the determination of the debtor’s place of work and the amount of personal income taxes paid (NDFL);

- in Rosreestr - the request concerns registered transactions by the debtor;

- in the traffic police - the request concerns the availability of vehicles.

Property includes real estate, cars and other vehicles, shares and shares in companies, land, cash, and jewelry.

After all the circumstances have been clarified, the bailiff receives information about the ownership of the property. Further, he may impose various restrictions on the use of bank accounts and property.

The measures taken must be reasonable: for example, if the amount of debt is 50,000 rubles, the bailiffs cannot withdraw 600,000 rubles from the deposit account.

Additionally applicable:

- ban on traveling abroad;

- ban on the right to use vehicles;

- writing off money from bank accounts: wages, pensions, deposits and other accounts.

The seized property of the debtor is forcedly put up for auction by the bailiffs. Next, it is sold, then the money is transferred to the lender. But 7% of the amount of property sold, the so-called enforcement fee, remains with the bailiffs. If the amount of claims against the defendant is up to 30,000 rubles, the person has the opportunity to independently sell his property.

Get legal advice

Leave your phone number, a specialist will call you back within 1 minute

What tools will speed up recovery at the enforcement stage?

Integration with FSSP

Using this block in the “BIT.Debt Management” program, you can obtain open data on enforcement proceedings of individuals provided by the resource of the Federal Bailiff Service (hereinafter referred to as FSSP) fssprus.ru.

- Obtaining complete information on all past and current debts of a person;

- The ability to assess whether the debtor has movable and immovable property that can be recovered;

- Ability to assess the debtor’s solvency;

- The ability to add any information you need to the downloaded data from the FSSP into the program;

- The ability to receive information about bailiffs: full name, phone number for effective tracking of enforcement proceedings;

- Ability to upload information on debtors to BIT.UZ according to a given schedule.

Analytics of the enforcement stage of collection

At the executive stage, data from the official FSSP portal is analyzed using the integration of “BIT.Debt Management” with the website fssp.ru. We look at the amount of enforcement proceedings in the context of ROSP and bailiff, analyze contact information. We track the moment of initiation of the case and the amount of debt in enforcement proceedings, which was published by the FSSP.

The date of receipt of the writ of execution, the statute of limitations of the case and related cases regarding the debtor are also monitored. By analyzing this information, you can build a portrait of the debtor and understand his history of debt in other cases.

The current status and changes in the status of enforcement proceedings are probably the most important information that needs to be monitored at this stage. “BIT.Debt Management” defines three statuses of enforcement proceedings:

- active - corresponds to active enforcement proceedings on which work is being carried out;

- completed with execution - corresponds to enforcement proceedings for which the work ended with debt collection, and the FSSP no longer publishes information about it;

- completed without execution - corresponds to those enforcement proceedings in which the date and reason for completion are indicated; work on such cases was completed without debt collection.

All considered data is available by groups of debtors in the system in which you work.

At the stage of enforcement proceedings, the following reports are analyzed:

- report on the amount of debt in enforcement proceedings;

- report on the status of enforcement proceedings.

BIT.Debt management is a specialized CRM system for debt collection at all stages.

- Increases the percentage of successful collections by 30%;

- Increases employee productivity by 2 times;

- Allows you to scale quickly;

- Speeds up pre-trial collection;

- Reduces refusals in court by 2 times;

- Reduces collection costs.

More details Request a demo

Debt collection by bailiffs: how does it work in Russian realities?

Based on the provisions of Art. 35 No. 229-FZ, bailiffs can conduct various events between 6 a.m. and 10 p.m. strictly on weekdays. No one can harass the debtor on holidays and weekends: neither bailiffs, nor collectors, nor creditors: banks or microfinance organizations.

In practice, bailiffs often visit citizens in the morning - at 6-8 o'clock. This is much more effective than conducting evening raids; people are most often at home at 6 am.

The following collection rules apply:

- Visiting a residential apartment or other premises without the consent of the owner. The civil servant conducting such a raid must have permission from the senior bailiff to carry out the activity.

- The seizure of property is carried out only with the participation of witnesses. At the same time, they must sign a document drawn up based on the results of the arrest.

When visiting a debtor at his place of residence, bailiffs can describe almost everything that is in the apartment or house. In particular:

- household appliances;

- furniture;

- automobile;

- other expensive objects and items. For example, an antique striking clock.

In such a situation, relatives of debtors often object to the “arbitrariness” of the FSSP. But bailiffs are allowed to describe property thanks to Art. 119 No. 229-FZ.

If the debtor's relatives or other interested parties do not agree with the measures taken by the bailiffs, they can go to court to prove the ownership of the described property through:

- witness statements;

- contracts, for example, donations;

- receipts and receipts for the purchase of these items.

It is necessary to take into account the provisions of Art. 446 of the Code of Civil Procedure of the Russian Federation, which provides a list of objects not subject to collection. Bailiffs cannot take away, regardless of the origin and amount of the debt:

- the debtor's apartment, if it is his only one. But the bailiffs can impose a seizure on the right to dispose of a single apartment. It cannot be sold, mortgaged or donated;

- a car or other vehicle, if the debtor is disabled with mobility restrictions. For example, he has no leg or is diagnosed with cerebral palsy;

- a plot of land on which a house is built, recognized as the only dwelling;

- personal belongings of the debtor;

- Food;

- household items and other similar things.

As for household appliances, the situation here is ambiguous. Bailiffs recognize the immunity of:

- refrigerator;

- kitchen stove.

The washing machine is described according to the situation: if the family has young children or disabled people, it will also be recognized as property that is necessary for the debtor’s family. In this case, it will not be described. As for computer equipment and laptops, as a rule, they are subject to description. The exception is when the debtor works on a PC: for example, when he is a graphic designer.

We have already found out that the only housing will not be taken away under any circumstances. True, the Constitutional Court made a reservation in April 2021. He allowed the courts to seize and sell in bankruptcy the only luxury housing. For example, if the debtor has housing with an area of 100 square meters. And especially if such housing was purchased after the person incurred debts that he did not repay to creditors. The position of the Constitutional Court in August 2021 was also supported by the Supreme Court of the Russian Federation.

But the only apartment that is not subject to seizure cannot be considered a mortgaged apartment, even if the debtor has children, and besides this apartment he has no other housing or property. Bailiffs can seize and sell such housing.

The procedure for debt collection by bailiffs

This instruction will be of interest, first of all, to creditors. But it is also useful for debtors to read it - to understand how debt collection on a loan works. So, the court decided to collect a certain amount from the defendant. What's next?

- The creditor takes the court decision and goes to the FSSP to write an application to initiate enforcement proceedings. This case can be initiated not only by a court decision, but also by a court order, and by a notary’s writ of execution.

- The application shall indicate:

- Full name of the defendant and information about his property, if any;

Full name of the creditor, payment details - the bailiffs will transfer the money received to this account;

- Enforcement measures to be taken (in the opinion of the applicant);

- Amount of debt.

- Next, the package of documents is transferred by the service to one bailiff, who will conduct this proceeding. He studies the documents for 3 days - if they are all completed correctly, then proceedings are initiated over the next 3 days. The debtor and creditor then receive a ruling that a new case has been filed.

- If within 30 days there is no confirmation that the debtor has received the notice, the bailiff begins his actions.

The feasibility of appealing the actions of the FSSP

The requirements of the writ of execution must be fulfilled by FSPP employees within 2 months from the date of commencement of enforcement proceedings. However, this does not mean that over the next two months the money will actually be returned to the claimant. This also does not mean that the bailiff will issue a decision to complete the enforcement proceedings.

Completion of the period for carrying out enforcement actions and using enforcement tools does not entail consequences in the form of completion of enforcement proceedings. Writs of execution may remain in the FSSP for years. For this reason, an attempt to appeal the inaction of a representative of the Bailiff Service in connection with a 2-month delay may be unsuccessful.

The court or senior bailiff of the FSSP unit (higher official) will refuse to satisfy the application. The actual result is usually excessive formalism in the enforcement proceedings of the citizen-collector who filed a complaint against the bailiff.

Our recommendation: establish a trusting relationship with the bailiff. File a complaint against him only if your rights and interests have been violated quite seriously. Suppose you know that the FSSP employee is in conspiracy with the debtor (you have evidence). We also advise you to inform the bailiff in advance about your desire to write a complaint. Perhaps he will take up the matter with more enthusiasm.

How to collect a debt under a writ of execution through bailiffs?

Bailiffs can apply various measures, but usually they start proceedings with the easiest procedures. Collection under a writ of execution begins with clarifying the financial situation of the debtor. The bailiff is trying to find out how much money a person has, how much he earns.

Further:

- inquiries are sent to the place of work (about wages) and to banking organizations regarding the search for the savings of such a person;

- when a salary or other transfers are received into the account, the bank, according to the bailiff’s order, automatically withdraws 50% from the debtor’s card in favor of the creditor (if alimony is being collected, then up to 70%).

If there are not enough funds to satisfy the requirements, the bailiff becomes interested in the debtor’s property. The area of interest includes:

- vehicles;

- residential and non-residential real estate;

- expensive property owned by the debtor: intangible assets, jewelry, collections, for example, paintings or medals.

It is important to quickly carry out the necessary measures, otherwise the debtor will have time to get rid of the property. The simplest method used by bailiffs is seizure. Seizure allows you to protect property from possible sale.

What will be the bailiff's procedure?

- A request is submitted to Rosreestr to provide the Unified State Register.

- A request is submitted to the traffic police.

- The bailiff receives answers from departments, analyzes the value and quantity of the debtor's property.

- Further, the found property is seized.

Interestingly, the bailiff can also seize the only residence. A person can continue to live in it, but he will not be able to sell, donate or otherwise alienate it until the enforcement proceedings are completed.

- The seized property is assessed and then the sale is initiated.

- If the property cannot be sold within the first 30 days, the price is reduced by 15%. In another month - by 25%.

- The proceeds from the sale are transferred to the lender. If there are several of them, the order of debt collection under Art. 111 No. 229-FZ. First comes alimony, compensation for personal injury, then employees with unpaid salaries (if the debtor was their employer, for example, in an individual entrepreneur), then other persons.

- Of the funds received, the bailiff takes 7% as an enforcement fee.

- The remaining property, which could not be sold, is offered to creditors to repay the debt. It is believed that creditors will be able to sell this property themselves.

It is also necessary to describe the situation if the debtor hides property (or creditors have such assumptions). In this case, a procedure called “executive search” is launched. It is possible if:

- proceedings have been initiated regarding compensation for damage to health or life;

- it is necessary to cover losses from the crime caused by the debtor;

- alimony is being collected;

- the amount of debt is more than 10,000 rubles.

Searches are carried out by a special executor who has expanded powers:

- checking documents regarding suspicious citizens;

- submitting requests to closed registers of the Ministry of Internal Affairs;

- involving private detectives in the case;

- conducting surveys of persons who can provide information about the debtor or his property;

- posting information about the debtor in the media or on bulletin boards in public places.

If the location of the debtor and his property has not been identified, the proceedings end and the writ of execution is returned to the creditor. After 6 months, the creditor has the right to initiate proceedings again.

Restrictions on deductions in enforcement proceedings

Withholding of alimony for the maintenance of minor children is made from all types of wages (monetary remuneration, maintenance) and additional remuneration that parents receive in cash (rubles or foreign currency) and in kind (List of types of wages and other income from which alimony is withheld for minor children, approved by the Decree of the Government of the Russian Federation dated July 18, 1996 No. 841).

However, foreclosure cannot be applied to a closed list of types of income of the debtor (Part 1 of Article 101 of Law No. 229-FZ), in particular:

- for sums of money paid in compensation for harm caused to health;

- sums of money paid in compensation for damage in connection with the death of the breadwinner;

- compensation payments established by labor legislation

- Insurance coverage for compulsory social insurance (except for old-age pension, disability, temporary disability benefits).

- Benefits for citizens with children, which are paid from the budget, state extra-budgetary funds, budgets of constituent entities of the Russian Federation and local budgets;

- Maternity capital funds;

- Amounts of one-time financial assistance paid from the federal budget, budgets of constituent entities of the Russian Federation and local budgets, extra-budgetary funds, and other sources;

- Amounts of full or partial compensation for the cost of tourist packages.

Expenses for transferring money under writs of execution (bank commissions, fees for postal transfers) must be made at the expense of the employee (Part 3, Article 98 of Law No. 229-FZ; Article 109 of the RF IC). In this case, the restrictions on the amount of deductions from wages discussed above do not apply.

The order of deductions according to the writ of execution.

When withholding funds under several writs of execution issued to one employee, it is necessary to observe the order of satisfaction of the claims of claimants (Article 111 of Law No. 229-FZ):

First of all, claims for the collection of alimony, compensation for harm caused to health, compensation for harm in connection with the death of the breadwinner, compensation for damage caused by a crime, as well as claims for compensation for moral damage are satisfied.

The second includes requirements for the payment of severance pay and wages of persons working (who worked) under an employment contract, as well as for the payment of remuneration to the authors of the results of intellectual activity.

The third is the requirements for mandatory payments to the budget and extra-budgetary funds.

In this case, the requirements of each subsequent queue are satisfied after the debt to the previous queue is repaid in full. If there are several writs of execution from different collectors, the deductions of one queue within the maximum amount of deduction are distributed among all collectors of this queue in proportion to the amounts due to them (Parts 1-3 of Article 111 of Law No. 229-FZ).

Deadline for debt collection through the FSSP

After the opening of production, the bailiff gets exactly 2 months to achieve a certain result. But in practice this period is much longer. The following factors are taken into account:

- waiting for a response from the debtor;

- conducting searches for property or the person himself;

- suspension during the case;

- terms of property sale. There are other issues that delay the deadline.

The maximum production period is 3 years. The debt does not disappear anywhere - after six months, the creditor can again initiate the debt collection procedure using a court order.