No matter how strong the spirit of camaraderie and mutual assistance is in the company, almost always when asking a colleague for help, an employee formally has the right to say: “This is not my job.” It’s a completely different matter if the expansion of functionality is formalized. In the Rabota.ru material you will find step-by-step instructions for completing the combination and a warning about possible problems.

Combining positions often becomes inevitable to replace an important employee who has gone on vacation, especially maternity leave. It can also be useful for survival in difficult times for a company, especially in conditions of labor shortage. How to arrange a combination correctly?

What is part-time work

Part-time work is when an employee works in his free time from his main activity and performs additional tasks. The key here is in your free time. Here is an excerpt from the Labor Code.

An internal part-time worker is employed by one employer.

An external part-time worker works for several employers.

For an employer, part-time work is good because it allows you to fill the need for an employee without paying the full salary. For an employee, part-time work provides additional income and the opportunity to gain experience in another position.

Cleaners, cashiers, visiting accountants, lawyers, personnel and other specialists work part-time.

Ivan sells building materials. On weekdays the flow of customers is small, on weekends everyone is running for putty and new wallpaper, which means another cashier is needed. There is no point in taking on a full-time job: there will be downtime. Therefore, Ivan found Marina - an external part-time cashier, a weekend cashier. She works part-time on Saturday and Sunday. This is possible, because Marina’s main job is only busy on weekdays.

In what cases are positions combined?

Most often, the employer resorts to this measure temporarily. If, for example, he wants to “wait” for the main employee to return from vacation and therefore sees no point in hiring a new one. Or there is no suitable candidate on the labor market, and an already hired employee wants to try himself in a new position.

Attention! The combination conditions are different. The only thing you should make sure of before signing the order is that the decision made will not affect the overall efficiency of the company.

How to register a part-time worker

Internal part-time workers do not present any new documents to the employer - you already have them, but bureaucracy still cannot be avoided.

To register an internal part-time worker:

- draw up and sign the second employment contract in two copies: keep one for yourself, give the second to the employee;

- fill out the second personal card with the data of the second employment contract;

- issue a second hiring order and familiarize the employee with it against signature within three days;

- entry in the work book - only at the request of the employee.

Registration of the form

The application can be typed on a computer, but it is best to write it by hand. Not all employers accept printed application forms from employees - this is due to the fact that in the event of any legal proceedings regarding a handwritten document, it will be easier to determine its authenticity and authorship (using graphological or handwriting examination).

It is recommended to write the application in two absolutely identical copies. One is handed over to the employer’s representative, the employee keeps the second, having previously secured a note on it that a copy has been received.

Sick leave and maternity leave for part-time workers

Part-time workers are paid sick leave, just like other employees under employment contracts.

to internal part-time employees in the same way as regular employees: to calculate, add up the remuneration for the main place and part-time position. Calculate your average daily earnings taking into account all payments.

There is a special procedure with external part-time workers. Who pays sick leave depends on where the employee works on the day the sick leave opens and where he worked during the pay period. The calculation period is two calendar years before illness. If an employee gets sick in 2021, the payroll period is 2021 and 2018.

If possible, consult with an accountant to avoid mistakes. For those who are used to relying only on themselves, we have collected all the situations in a table.

| Where does he work? | Who pays | What to consider when calculating benefits |

| With the same employers as in the billing period. | Every employer has sick leave for temporary disability and pregnancy and childbirth. One employer at the employee's choice - child care benefits. | Earnings for the pay period from the employer who pays the benefit. |

| Not with the same employers as in the payroll period. | One employer from those where the employee works at the time of the insured event - at the employee’s choice. If an employee decides to receive benefits from you, ask him to bring certificates from other places of work stating that benefits were not provided there. | Earnings for the billing period for all places of work. |

| With several employers, and in the billing period - both with the same and with other employers. | The employee chooses one of the companies in which he works at the time of the insured event. Or asks each employer to calculate sick leave for themselves. | In the first case: earnings for the pay period for all places of work. In the second case: earnings from the employer who pays the benefit. |

A one-time benefit for the birth of a child is paid by one employer. An external part-time worker is entitled to this benefit if he did not receive it at his main place of work.

Step-by-step instruction

Position preparation

If we are talking specifically about combining positions as such (as opposed to expanding the service area), then the following conditions must be met:

- the position must be included in the staffing table;

- the position must be vacant.

The last condition does not directly follow from the requirements of the Labor Code, but is often taken into account by courts and inspectors.

Sometimes a new position is introduced into the staffing table specifically for combination purposes. It is worth remembering that a temporarily unoccupied position is not vacant, that is, if the employee replacing it is on vacation, including maternity leave. To assign additional work for a temporarily unoccupied position, the wording “performing the duties of a temporarily absent employee” is used.

2. Written consent of the employee

In accordance with Article 60.2 of the Labor Code of the Russian Federation, additional work can be assigned to an employee only with his written consent. Such consent can be obtained in two ways:

- At the employee’s request, he writes an application with a request to be assigned, in order to combine duties, for the desired position (Appendix 1). Alternatively: in order to expand the service area or in order to perform the duties of a temporarily absent employee. In the latter case, along with the position, the name of the temporarily absent employee is indicated. Then the head of the organization supplements the statement with his positive resolution, instructing the head of the personnel department to prepare drafts of the relevant documents.

- At the suggestion of management, a memorandum from the head of the department is drawn up with a request to assign the employee the duties of a combined position (Appendix 2). In turn, the employee supplements the memo with his written consent with the signature “I agree to combine positions.” Then the manager's resolution is imposed.

The application or memorandum may already contain an indication of the duration of the combination if it is issued for a specific period.

3. Additional agreement to the employment contract

The combination affects the employee’s labor functions, and they are the subject of the employment contract. Therefore, combination requires the conclusion of an additional agreement with the employee to the employment contract (Appendix 3). The agreement must include the following parameters:

- Type of additional work (part-time position, performing the duties of a temporarily absent employee or service area).

- Deadline for additional work.

- The content of additional work, that is, additional labor functions.

- If the basis for the preparation of an additional agreement was the employee’s statement, it is indicated that the responsibilities are assigned to the employee at his request.

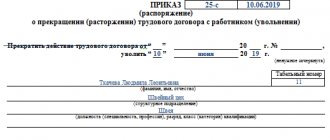

4. Order on personnel

The basis for starting work on combining is the corresponding order on personnel (Appendix 4). It is drawn up on the basis of an additional agreement in free form on the form of orders for personnel. The order must contain a number of elements:

- Type of additional work (part-time position, performing the duties of a temporarily absent employee or service area).

- The position for which the combination is established (if additional work is assigned in the order of combination).

- Deadline for additional work.

- The content of additional work, that is, additional labor functions.

- Pre-agreed amount of remuneration for additional work.

- Special conditions (if required).

Special conditions are new responsibilities or new authorities required to perform additional functions. For example, for the position of a cashier - financial responsibility, for a HR specialist - responsibility for maintaining work books, for a managerial position - the right to sign and the right to make management decisions.

Dismissal of part-time workers

An employment contract can be terminated if a part-time employee is replaced by an employee for whom this position will be the main one. Companies with a small document flow often need a part-time accountant. Then the business grows, they hire a new full-time employee, and part with the part-time employee. This is fine.

Give your co-worker at least two weeks' notice. To do this, prepare a written notice and present it to the employee against signature. After this, issue a dismissal order, pay wages and compensation for unused vacation. Such dismissal is possible if the employment contract is concluded for an indefinite period. But a fixed-term employment contract cannot be terminated for this reason.

If a part-time worker resigns of his own free will, the procedure is the same as for regular dismissal. The only difference is in the work book, where the entry is made at the request of the employee.

Common mistakes when working with part-time workers

Labor law expert, publisher of the Aktion-MCFER media holding, Veronika Shatrova, notes three common situations that can lead to serious fines from the labor inspectorate:

“Firstly, there are employees who can work part-time only with the permission of their main employer. In particular, this rule applies to the heads of the organization - Art. 276 Labor Code of the Russian Federation. At the same time, it doesn’t matter what kind of activity the manager plans to do part-time: run another company or become a teacher. Therefore, if you hire a part-time manager, be sure to require an additional document - consent. Violation of this rule will cost the company 50,000 rubles under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Secondly, if this is a former civil service employee, do not forget to notify him of his employment according to the general rules . The fact that such notice was sent during the main employment of your part-time worker does not matter. Otherwise, the company risks running into a fine of up to 500,000 rubles under Art. 19.29 Code of Administrative Offenses of the Russian Federation.

Thirdly, many companies continue to mistakenly believe that since a part-time worker works no more than half the working time and receives a proportional salary, then vacation only for half the days of the generally established number of rest days. Such a misconception threatens the company with another fine from the labor inspectorate of up to 50,000 rubles - in case of a primary violation. And up to 70,000 ₽ - if repeated. These are the sanctions established in Art. 5.27 Code of Administrative Offenses of the Russian Federation.”

About the amount of additional payments for replacement

The amount of additional payment is not limited. The specific amount is established by agreement between the employer and the subordinate performer. It is permissible to establish an additional payment for replacement as a percentage of the official salary. Or fix the premium in absolute value - a fixed amount.

Example No. 1. Additional payment as a percentage.

In a small company, the director can replace personnel; the additional payment for the combination is set by the director himself. The replacement order establishes an additional payment of 10% of the director’s official salary for a fully worked month. Salary - 50,000 rubles. The month has been completely worked out.

Calculation: 50,000 × 10% = 5,000 rubles - the amount of additional payment for replacing the duties of a personnel officer.

Example No. 2. Additional payment in a fixed amount.

The accountant is given a bonus of 10,000 rubles for a fully worked month. For 15 days out of 21 working days, the amount of additional payment for replacement will be:

10,000 / 21 × 15 = 7142.86 rubles.

IMPORTANT!

The additional payment is subject to personal income tax and insurance premiums in the general manner. The amounts can be taken into account in the wage fund when calculating income tax.