Life is an unpredictable thing! And a situation can happen to each of us when we suddenly need money urgently. It is possible that a couple or three thousand will last until the salary. Maybe a more significant amount to urgently repair a car, buy a new phone because the old one has already served its purpose, or just to please your significant other. What to do if “normal” banks refuse to issue a loan or credit card? Are your relatives or friends’ financial situation no better than yours?

Then there is only one way out. No, don’t go rob a bank, but turn to a microfinance organization for money. The only thing that can stop you from going to a microfinance organization for money is the “crazy” loan conditions and the “excesses” of specialists in collecting overdue debts, or, more simply, collectors. In this article, we’ll take a closer look at how to write a complaint against a microfinance organization and “press down” snickering moneylenders.

We will try to answer the questions:

- What actions of microfinance organizations can be appealed;

- Violations committed during the processing and issuance of a loan;

Violations committed during the collection of overdue debts;

- How and where to file a complaint about illegal actions of microfinance firms.

Basic legal norms for the operation of microfinance organizations

Until recently, the microfinance market really had little control, so MFO borrowers often faced incomprehensible actions of creditors, inflated debts, huge rates and other difficulties. Now all this is gone, since the Central Bank has thoroughly taken charge of microcreditors.

On his initiative, important norms were introduced at the legislative level that help protect the rights and interests of borrowers. Unfortunately, it is in this area that most often borrowers are citizens with a low level of financial literacy. For more detailed information about the laws relevant to MFO clients, see the material Laws on microloans.

Important standards that all MFIs must comply with:

- Only legal companies that have passed the inspection of the Central Bank of the Russian Federation and are included in its register are authorized to issue loans.

- The amount of interest, penalties and fines cannot exceed the initial loan amount by more than 1.5 times. That is, with a total amount of 5,000, they cannot demand more than 12,500 rubles from the borrower.

- Microfinance organizations cannot set a loan rate higher than 1% per day.

- MFOs are required to comply with the interest rate limits specified by the Central Bank of the Russian Federation. Exceeding these values is a violation of the law.

The size of the maximum allowable rate depends on the amount of the microloan and the period of its issuance. The Central Bank revises the value every quarter, but overall it changes little. For example, for the second quarter of 2021 the following figures are set:

If a microlender does not comply with the above important standards, it is necessary to protect its interests and file a complaint.

Submission of documents

A complaint to any government agency can be filed in one of several ways. The first of them is a personal appeal from a citizen to a government agency. It is necessary to provide documents to one of the institution’s employees.

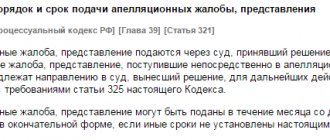

You need to know: a complaint about violations of the client’s rights by the bank can only be filed within one year from the date of the conflict situation . After this period, the application will not be considered.

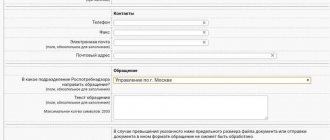

Other methods provide the consumer with the opportunity to report a violation of their rights by banks without personally contacting the authorities. You can fill out an application electronically: send the application and evidence by email to the local department of Rospotrebnadzor or report a violation through the official website of the department.

You can also submit a complaint by mail. To do this, the application, as well as other documents, must be enclosed in a letter for correspondence and sent to a government organization. It is worth choosing a shipment with a return notification of receipt of the message by the addressee. The delivery receipt will be proof of your request.

If you contact Rospotrebnadzor by any means, the complaint against the bank will be accepted and considered.

Complaint to SRO

If there is a reason to file a complaint against a microfinance organization, the best option is to contact the self-regulatory organization (SRO) of which it is a member. By law, all microfinance organizations must be members of some SRO, which coordinates the “sponsored” company and controls its activities. We can say that MFOs are subordinate to the SRO.

Today there are 3 main SROs operating on the market, across which microfinance organizations are scattered. If you want to file a complaint against an MFO, you must first find out which SRO it belongs to. It could be:

- Unity, the largest SRO on the market, number of members - 685;

- Microfinance Alliance is in second place, the number of members is 481;

- Microfinance and development, it includes 471 organizations.

The current register of SROs and microfinance companies that are members of them is published on the website of the Central Bank. Information is regularly updated, available on the website of the Central Bank of the Russian Federation.

When looking through the register, choose SROs that work with microfinance organizations. The last column of the table contains a link to the list of participants. Look for the organization you need there:

Having determined which self-regulatory organization the MFO is a member of, you can go to the SRO’s website in the contacts section and submit an appeal. You can first call the phone number provided by the structure and get advice.

What regulations regulate the activities of MFOs?

In case of a conflict with the MFO, you will need to file a complaint. What to refer to, what laws to point out?

In 2021, the activities of microfinance organizations are regulated by legal acts:

- Federal Law No. 59-FZ On the procedure for considering appeals from citizens of the Russian Federation.

- Basic standard of the Central Bank of the Russian Federation dated June 22, 2021 on the protection of the rights of individuals and legal entities in the provision of financial services.

- No. 353-FZ, on consumer loans.

- No. 230-FZ, which sets restrictions for collection agencies. It also regulates the behavior of financial institutions in case of delays.

- No. 152-FZ, which protects the personal data of borrowers.

- No. 151-FZ, which establishes standards and rules for MFOs.

- No. 123-FZ, which establishes the rules and regulations for the financial ombudsman.

- No. 229-FZ, which establishes regulations for the activities of bailiffs.

- Rulings of the Supreme Court of the Russian Federation dated June 21, 2019 No. 20-AAD19-2, dated June 13, 2019 No. 11-AAD19-4, dated September 27, 2018 No. 53-AAD18-10. They establish cases in which the Central Bank does not consider complaints from the population.

Complaint to the Central Bank

You can send a complaint about the actions of a credit institution directly to the regulator - it is the most important supervisory body over microfinance organizations. But the bank itself recommends doing things a little differently:

First file a complaint with the MFO itself. Perhaps the issue can actually be resolved within the company without higher authorities. Contact the SRO that supervises the MFO. In most cases, a complaint filed with the Central Bank of the Russian Federation is sent to the SRO, since it can solve the problem without involving the regulator. This takes time.

- If you still decide to contact the Central Bank, you can first get advice by calling its toll-free hotline 8800 300-30-00.

- It is not necessary to visit the regulator’s office; there is an online reception on its website where you can submit your request. Pay attention to the recommendations; you need to document your request:

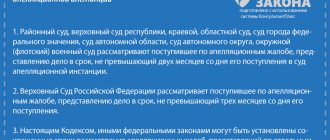

After sending a complaint via the online reception, within 3 days a message will be sent to the email address specified by the applicant notifying that the complaint has been accepted. Typically, the result of the review comes within 30 days, in some cases the period can be extended to 30 days.

If we are talking about an illegal creditor who is not part of the SRO, the complaint should be sent to the Central Bank of the Russian Federation.

Borrower reviews

This is a system that works. This is proven by consumers who have solved problems with the help of the organizations described.

“It was necessary to return the amount up to 30,000, the period was a month. The calculator indicated the exact parameters when applying for a loan. All this was reflected in the contract. But the MFO demanded that the loan be repaid within 3 weeks. I said that I would pay at the agreed time and threatened to contact the Central Bank. Fears of communicating with the commission at the LLC quickly had an effect. The main bank did not have to make a decision - it didn’t come to that. If you know your rights, you can achieve a lot.”

What violations can you complain about?

The Central Bank and the SRO will consider any complaint that concerns non-compliance with the law and the rights of the borrower. Standard reasons for contacting:

- an inflated interest rate exceeding the maximum percentage specified by the regulator. We are talking about the rate at the time the loan is issued;

- The lender charges illegal fees. For example, for issuing a microloan, for early repayment;

- the creditor demands to return more than the law provides. We are talking about 1.5 times the amount of interest and late fees;

- The MFO disclosed the borrower’s personal data. This really happens. Additionally, you can file a complaint with Roskomnadzor;

- the organization increased the interest on the loan after it was issued, which is illegal;

- illegal issuance of microcredit. For example, the microfinance organization is illegal, the borrower is incompetent;

- fraudulent activities related to the microcredit market. For example, applying for a loan using someone else’s passport;

- abuse of authority by the collection service of a credit institution.

If the reason for your appeal is some other reason, it will still be considered. Submit requests and wait for a decision.

Where to go

If problems arise with a microcredit company, the question arises where to complain . The claim is sent to the agency that has the right to resolve the problem.

Depending on the causes of the conflict, the application is submitted to such government agencies as:

- Rospotrebnadzor;

- FSSP;

- Central Bank;

- Antimonopoly Service;

- Prosecutor's Office;

- Financial Ombudsman.

Reference!

Before filing a complaint with a government agency, you should try to resolve the issue peacefully by submitting a written statement directly to the MFO. Most often, consumers file a complaint for the following reasons:

- imposition of additional services;

- refusal to conclude a contract;

- calls from employees;

- refusal to repay the loan early;

- transfer of personal data to third parties;

- violation of the terms of the agreement, etc.

In accordance with regulations, an MFO must register in the register of the Central Bank of the Russian Federation. But not all organizations comply with this condition, so their activities are difficult to control.

Before applying for a loan from an MFO, you should check whether the company is included in the register on the official website of the Central Bank of Russia.

Complaint against MFO to the prosecutor's office

This body receives appeals related to violations of the law. In general, inflating rates and illegally inflating debts is also a violation of the law, so this can also be a reason to contact the prosecutor's office.

But most often this body is contacted due to the actions of the MFOs themselves and the collection services representing their interests. It could be:

- exceeding the number of calls required by law. This is once a day, 2 times a week, 8 times a month;

- similar excess of SMS messages;

- visits more than once a week;

- insults, threats;

- Concern among claimants for group 1 disabled people, pregnant women and citizens undergoing hospital treatment.

If you decide to contact the prosecutor’s office, then at the same time file a complaint with the SRO, and indicate that you also applied to the government agency. Some citizens file identical complaints to all possible authorities; this is not prohibited. Moreover, it may even enhance the effect of the appeal.

Examples of situations when complaining is irrational

It’s hardly worth downloading your license if they call you about delays in returning funds. Of course, if your phone rings off at night, you need to defend your interests.

There is no point in contacting higher authorities regarding the transfer of debt to a collection agency if this clause is specified in the agreement with the microfinance organization. Complaining about debt collectors in this case is unreasonable.

In any case, before writing a conditional statement to the prosecutor's office, you must try to resolve the problem amicably. MCCs that value their reputation (for example, Green Finance) try to conduct client-oriented business. This means that they do everything to ensure that cooperation with adequate borrowers is as productive as possible for both parties.

Contacting the police

This should be addressed only if the microcreditor or the collectors representing his interests exceed their authority. This may include threats to the borrower and his loved ones, damage to property, physical impact, and the like.

This kind of action against the debtor is prohibited, so you must write a statement to the police. The violator and the company where he works may face administrative or even criminal liability.

We looked at how to write a complaint to the Central Bank against an MFO, and where you can apply. We hope this information helps you. If a credit card company actually breaks the law, it will be stopped. Moreover, she may face fines and even exclusion from the register of microfinance organizations, which equates to the loss of the opportunity to work in the market.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

General provisions

The activities of MFOs are regulated by Law No. 151-FZ of July 2, 2010.

Organizations do not belong to banking institutions. When applying for a loan, companies are guided by Law No. 353-FZ of December 21, 2013. The differences between MFOs and banks are as follows:

- simple registration conditions;

- money is issued only on the basis of an application and a passport;

- short terms (from several days to months);

- small amounts (usually from 1 to 50,000 rubles);

- interest is accrued for each day the funds are used.

The activities of MFOs are regulated by the Bank of Russia and legislative acts. But it happens that employees of an organization put forward demands for debt repayment that are not specified in the contract, or in other ways exceed their authority and violate the rights of clients. In this case, it is permissible to file a claim against the MFO.

Comments: 26

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Marat

09/20/2021 at 00:32 I took out a loan from the MFO “MiGcredit” and successfully repaid it, which I was notified about electronically, but in the BKI the loan is listed as active. In response to my request to the MFO about the reasons why the data in the BKI was not updated, they asked me for a scan of my passport, an application for my permission to information on my data, an application to change my passport data, citing the fact that when applying for the loan, a mistake was made in the last name .How did they open and close the loan with an error + send information on the loan to the BKI? What can I do if I can’t take out a mortgage and I have an active loan from BKI?

Reply ↓ Anna Popovich

09.20.2021 at 16:32Dear Marat, if the microfinance organization does not make these changes within a reasonable time, you can contact the credit history bureau and apply for changes to your credit history. The application can be brought in person to the bureau office, or sent by mail. BKI will send a claim to the source, based on the results of its consideration, changes will be made to the credit history or a reasoned refusal will be provided. The bureau will inform you about the credit institution's response or lack thereof within 30 days.

Reply ↓

08/26/2021 at 21:49

Hello. I took money from cash-u microfinance organization for a month. I couldn't pay it off on time. There were calls from microfinance organizations more than 5 times a day. I told the employee that I would pay, but at the moment I can’t pay. But this bank employee creates a fake page in contact and sends messages to my children, acquaintances, relatives, and even friends of my children that I am a fraudster and wanted. Although I said that I would pay my debt. And this employee, even on the second day after our conversation, again creates another page in the contact and again sends out SMS newsletters to everyone he can. That I'm a scammer.

I paid my debt. But these mailings are now on social networks, and each person passes them on to others. Where can I file a complaint against this company?

Reply ↓

- Anna Popovich

08/26/2021 at 22:13

Dear Nika, you can complain about the actions of debt collectors to the FSSP.

Reply ↓

08/12/2021 at 16:50

They allegedly give MKK before payday at 0%, but in fact, as it turns out later, this is only for those who purchase a package of legal services from them. I once took out a loan from them, they sent 11,666 rubles, but they immediately wrote off 4,666 rubles - that’s for a package of legal services. On the same day, they repaid their loan immediately, wrote a refusal of legal services., 2 weeks later they sent an answer that they would return the money. 2 months have passed, still no money, empty spam promises are received in the mail, as if we are doing everything It’s possible to get the money back faster, etc. in the chat when you write to them, they can’t even answer what date the application is from and for what amount, phone number. Calls also say wait, we apologize, etc. I wrote to the reception office of the prosecutor's office. They continue to issue new loans every day, deceiving people, that is, they are illegally enriching themselves with my money,

Reply ↓

08/02/2021 at 23:03

Good evening, there is such a microfinance organization Guru Kesh, which brazenly misleads people, enticing the first loan at 0%, I needed an amount of 15 thousand rubles for 5 days, I was approved for 10, I was waiting for an agreement, as is the case in normal organizations, I it was written, enter the code and the contract will come, I entered it, no contract, nothing came to my personal email or personal account. But I received a message that the card had been replenished, I logged in, but the amount was 4200, instead of 10 thousand. I immediately tried to contact the company at the phone number provided, but in vain. I wrote to them by email, also silence. After 5 days, a representative of the company called me and told me to pay, I explained everything to him, it was said that we will now send the contract, and the payment is already 10 thousand plus interest, it is unclear where it came from. I ask you to send the contract, there were threats and insults. I went to the website for registering microfinance organizations in the Central Bank and there were such reviews, it’s just shocking. So what's now? Pay? For that) I hope for your answer. How to proceed? Natalya Nikolaevna

Reply ↓

- Anna Popovich

02.08.2021 at 23:38

Dear Natalya, we recommend that you write a complaint to the Central Bank regarding illegal actions (lack of agreement, misinformation on the amount). Next, you can contact the prosecutor's office regarding insults from a service representative.

Reply ↓

09.09.2021 at 20:45

Good afternoon, the same story, they approved 8000, no contract or anything, they sent 3800, I immediately wrote to them to take it back, now I owe 22000, they call and threaten me, they don’t answer calls, they’ve already called my relatives, I don’t want to pay, because we see that’s all I still have to stay.

Reply ↓

07/01/2021 at 00:04

06/20/2021 I took out a loan of RUR 12,000 Gurukesh. That is, they approved 12,000, transferred them to the card and immediately withdrew 5,690 as supposedly purchasing information. When they signed up, they didn’t warn that they would write off and give back half and pay 16,000. There are no details, just how much they gave and how much to pay. Now, starting from June 26, they write on WhatsApp and send audio with threats. Pay only by card. I blocked it and then there were many attempts on their part to write it off. I wrote to the Central Bank. While it’s quiet, I want to write to the prosecutor’s office. Tell me how

Reply ↓

- Anna Popovich

07/04/2021 at 21:44

Dear Oksana, the application to the prosecutor’s office does not have a clear form, describe the situation, focus on the incorrect behavior of the creditor and wait for a reasoned response after the inspection.

Reply ↓

09.10.2021 at 22:14

I also got into a loan, only not Gurukesh, but Belkash, these two names are the same loan. There was such a story, I took a loan from Belkashesh, they approved 12,000 thousand, 4,600 thousand rubles came to the card and the loan term was given 7 days, they sent me these 4,600, then out of curiosity I looked how much I owed and my eyes popped out of my head that on the same day I I owe 19,600 thousand rubles, this is what the interest should be for one day, if they gave me a loan term for 7 days, and now they are trying to write off without my knowledge 10 times with different amounts and call several times a day and send SMS. I read about this Gurukesh and Belkash that they are one company and they cheat people out of large sums of money, also their site has Bear Cash and another one, and then some of these names are blacklisted for fraudulent actions and deceiving people. Now I’m already 4 days overdue and I’m not going to pay yet, because the amount that was given to me and I will only pay the amount that was given to me and for 7 days of interest, but there is no amount that was calculated for me. Tell me how can I do it the right way so that later I don’t owe them anything?

Reply ↓

Anna Popovich

10.11.2021 at 17:01

Dear Alexey, we recommend re-issuing the card with new details.

Reply ↓

06/17/2021 at 14:52

Due to a sudden life-threatening attack of illness (the attack occurred on 06/05/2021), I was unable to renew (pay) the microloan extension in a timely manner (06/09/2021). For the same reason, I did not (could not answer) phone calls. My sister informed the microfinance organization that I was unable to be contacted due to a life-threatening illness. Only on June 12, 2021, I began to return to normal. However, on the 4th day of delay (06/13/2021) for the extension of the microloan, the IFC wrote off (without my order/acceptance to the operator) the funds from my account (debit card) at the bank. The IFC wrote off the funds from the card with which I had previously paid for the extension of the microloan on my own. As a result of my payments for the extension of microloans, the IFC became aware of some details of the specified card and, as the IFC explained to me, they set up an auto payment from my card in their favor. And the operating bank does not ask me for acceptance for such automatic debits (does not send an SMS with a confirmation code). I did not give the operator an acceptance for auto payment in favor of the IFC at his request. IFC believes that it does not violate the rights of the borrower when funds are written off from the borrower’s accounts, without his acceptance, issued, according to the law, to the operator, but not to the recipient of funds, in favor of the recipient. I became aware of the transaction the next day (07/14/2021) after the funds were written off, when I wanted to pay for some medical procedures. I immediately contacted the bank where I opened the specified account and wrote an email to the IFC. The bank, in response to my claim about the unlawful debiting of funds from my account without my order, said that it would give an answer only on 07/04/2021. MFC refers to my consent (when registering on the IFC website) to write off funds from my accounts in favor of IFC at their request. And, although the document called “Consent and Obligations of the Borrower” states that I am obliged (?) to issue an acceptance to the operator to write off funds from my accounts at the request of the IFC, no one asked for an acceptance from me and I did not issue it. IFC refuses to return funds illegally debited from my account. I intend to appeal to the Central Bank of the Russian Federation with a complaint against the IFC, which: - firstly, illegally imposes on the borrower the obligation to issue an acceptance to the operator to write off funds from his accounts. - secondly, without the borrower issuing an acceptance to the operator, having received some details of the card linked to the payer-borrower’s account at the time the borrower pays the funds, he connects (without the payer’s knowledge) autopayment from the borrower’s accounts in his favor. - thirdly, having been informed by the payer that funds were debited from the payer’s account illegally (without issuing an acceptance to the operator), not only does not return these funds, but also repeats the attempt to write off funds from the same account (15.06 .2021). True, this attempt was unsuccessful, because... On June 14, 2021, I blocked the card that was linked to the specified account. Do you think a complaint to the Central Bank of the Russian Federation about such actions by the IFC makes sense?

Reply ↓

- Anna Popovich

06/17/2021 at 16:48

Dear Tatyana, as a rule, when concluding a microcredit agreement, the lender is given the right to write off funds without acceptance. As for connecting autopayment, this fact violates the rights of the cardholder, but not on the part of the IFC, but on the part of the bank. You can contact the Central Bank of the Russian Federation with a complaint, and after receiving a response from the regulator, decide on the tactics for further action.

Reply ↓

Anonymous

06/25/2021 at 01:31

It is clear that the bank violated the law when it allowed IFC to debit money from my account without acceptance. However, I believe that IFC violated the law by including a condition in the contract that initially did not comply with current legislation. IFC includes in the terms of the agreement the unilateral debiting of funds from ANY CARDS of the borrower, which became known to IFC as a result of the transfer of borrowed funds to the borrower’s card and as a result of the borrower’s payment of regular payments from his cards in favor of IFC. MFC debits money from the borrower's accounts through its payment system, since when paying the next payment the borrower indicates a three-digit security code on the back of the card in a separate field. This code becomes known to the payment system, and MFC, through the payment system, using this code, writes off the money. The bank that issued the borrower's card does not even send the borrower a confirmation code (acceptance), which usually comes via SMS message if the borrower makes the payment independently. And the IFC justifies these illegal actions by the fact that when concluding the agreement, an agreement was signed to write off funds from any of the borrower’s cards. Will you argue that this complies with the law?

Reply ↓

06/12/2021 at 04:35

Good evening ! Please tell me, who should I contact if I haven’t taken out a loan? I asked for a credit history and saw such a surprise that it was already overdue, because I didn’t know about any loan received.

Reply ↓

- Olga Pikhotskaya

06/13/2021 at 12:48

Good afternoon. It is necessary to contact law enforcement agencies with a statement and the microfinance organization that issued the loan to a third party.

Reply ↓

05/03/2021 at 23:23

I took out a loan from the microfinance organization bear money contract and they didn’t send me how much I owe, I don’t know, they require payment every 10 days, I took out 20 tr, I already paid 70,000 and there is no end to the family’s harm with reprisals, I wrote a statement to the police, it doesn’t scare them, what should I do?

Reply ↓

- Anna Popovich

05/04/2021 at 21:05

Dear Tatyana, write a statement to the Central Bank of the Russian Federation. They will check the actions of the MFO.

Reply ↓

05/02/2021 at 00:57

Hello, this situation is complicated. I contacted the microfinance organization Terem for a loan. I filled out an application for 14,000. In fact, 5,500 arrived. I don’t have any contracts or anything. I log into my personal account; the debt is already 30,000 rubles. And to pay off the debt, I still need to pay 4,500. and then pay off the debt I can’t get through to you by phone or write to you, I don’t know what to do. I read reviews about their company, it’s still the same situation. They threaten me and promise to pour acid on me. etc. I can sue or write to the prosecutor’s office. Please tell me what to do .

Reply ↓

- Anna Popovich

05/03/2021 at 16:28

Dear Albert, you can complain about the actions of the microfinance organization to the SRO, the Central Bank, the prosecutor's office and the police. Detailed justification - where and how to file a complaint - is given in the article.

Reply ↓

03/24/2021 at 23:47

Good evening. Due to very sad circumstances, I was forced to contact a microfinance organization to get a loan. There is such an organization on the internet, MishkaManey. So I fell for their bait like a sucker. In order for the application to be considered out of turn and a large amount approved, I had to transfer 2600, which I did under hypnosis. Then I was approved for only 1100, which was transferred to the card and immediately, by canceling the purchase, they took it back. Pure fraud. Now on this page I have an open loan, which I must pay tomorrow in the amount of 1498. and there are all my passport and card details. I'm not going to pay, because I only spent my own money. How to punish scammers? and won’t it turn out that my non-payment will be attributed to the debt and it will increase exponentially and end up in the MSP? Not a single phone number listed on the site answers.

Reply ↓

- Anna Popovich

03/25/2021 at 01:55

Dear Tatyana, if you do not pay the debt, the amount will increase due to penalties. Further, the unpaid debt can be collected by the creditor both on the basis of a court order and as part of standard lawsuit proceedings, including with the involvement of the FSSP. You can send a complaint about the actions of the microfinance organization to the financial ombudsman or the Central Bank.

Reply ↓

03/17/2021 at 11:03

Hello! I took 30,000 rubles for a week of overdue debt, gave back 78,000 rubles. In my personal account there is neither an agreement nor the loan amount, only the debt is due to me for the overdue payment. . Robotmani. t. https://moikabinet.site/Please tell me where to go with a complaint so that they can check it. Was the money taken from me correctly? I paid the loan and interest on the overdue payment. For a week they called and wrote with threats and insults. Sincerely, Tatyana Kiselev.

Reply ↓

- Anna Popovich

03/17/2021 at 13:36

Dear Tatyana, if you have a complaint about the actions of an MFO, if a company violates your rights, we recommend that you file a complaint directly with the MFO, then through the hierarchy to the SRO and only then the Central Bank of the Russian Federation (preliminary consultation can be obtained by calling 8800 300-30-00).

Reply ↓

Tatyana

03/25/2021 at 01:11

Good evening. Why was my question deleted and I did not receive an answer?

Reply ↓

Consumer rights Protection

It is possible to resolve a controversial situation with a bank without filing an application to the regulatory authorities. Every bank has a customer service department, and contacting such employees is often sufficient to resolve the conflict.

A complaint against banks can be filed with Rospotrebnadzor if a financial institution maliciously violates customer rights and laws. The borrower has the right to submit an application if the bank fails to comply with the terms of the agreement or conceals partial conditions, for example, lending or opening a deposit.

The main task of Rospotrebnadzor is to protect consumer rights at any level of service provision: in a store, restaurant or bank. The agency may conduct an investigation into a complaint from a bank client to ensure compliance with consumer rights. If violations are identified, punitive measures (fines and orders) will be applied to the organization.

If serious offenses are detected on the part of the bank, Rospotrebnadzor may initiate an appeal to the court or the central bank for a more detailed review of the activities of the financial institution.